Mercado global de disolventes, por categoría (disolventes oxigenados, disolventes de hidrocarburos, disolventes halogenados, otros), fuente (convencional, de base biológica), aplicación (pinturas y recubrimientos, productos farmacéuticos, adhesivos, tintas de impresión , cuidado personal, fabricación de polímeros, productos químicos agrícolas, limpieza de metales, otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de disolventes

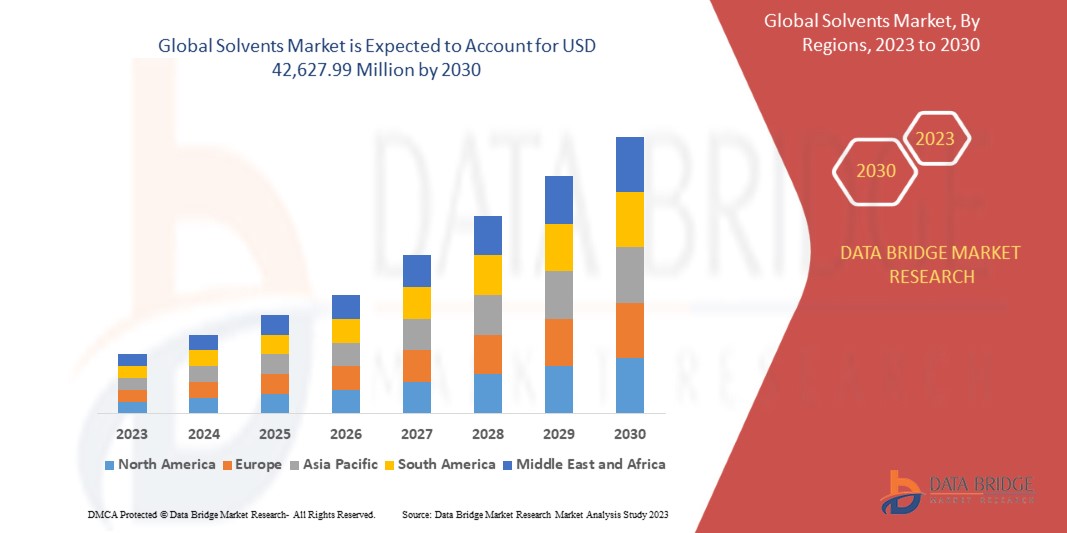

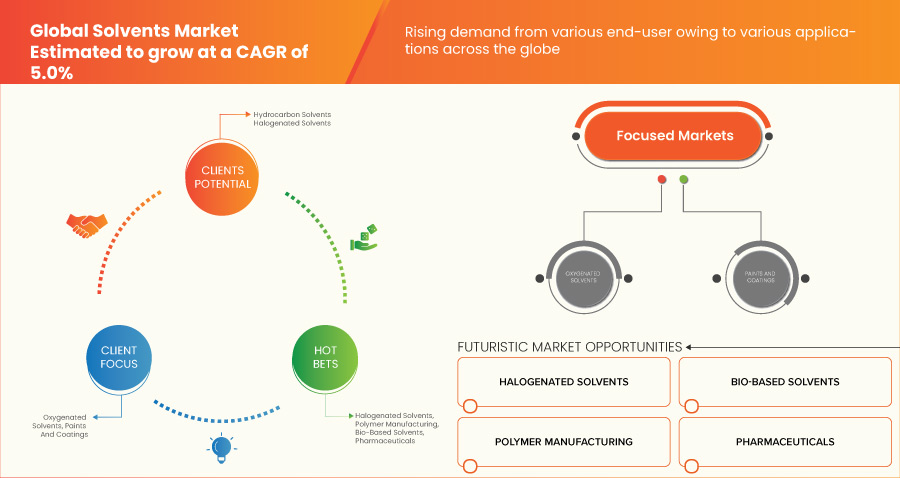

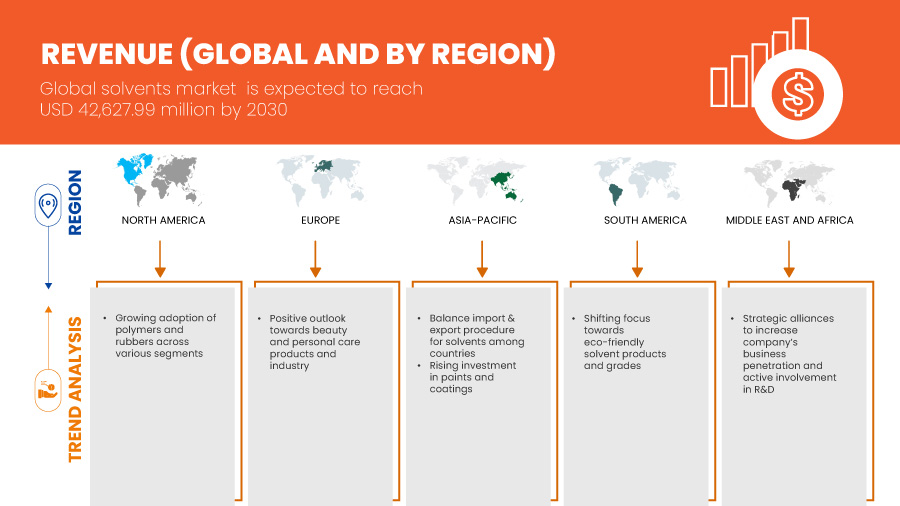

Se espera que el mercado mundial de disolventes crezca significativamente en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,0% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 42.627,99 millones para 2030. El principal factor que impulsa el crecimiento del mercado de disolventes es el creciente uso de tintas de impresión para diferentes aplicaciones industriales y las perspectivas positivas hacia la industria de productos de belleza y cuidado personal.

Los disolventes son fluidos sintéticos fluorados de bajo peso molecular. No son tóxicos ni inflamables en su estado natural. Se pueden utilizar en temperaturas extremas que van desde los 80 °C hasta los 200 °C. Su estructura molecular puede ser lineal, ramificada o una combinación de ambas, según la aplicación. Los disolventes tienen diversas propiedades, como resistencia a la temperatura, lubricidad, resistencia al desgaste y volatilidad del fluido.

El informe del mercado global de solventes proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado local y nacional, analiza las oportunidades en términos de segmentos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución que tenga impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en kilotoneladas |

|

Segmentos cubiertos |

Categoría (disolventes oxigenados, disolventes de hidrocarburos, disolventes halogenados, otros), origen (convencional, de base biológica), aplicación ( pinturas y recubrimientos , productos farmacéuticos, adhesivos, tintas de impresión, cuidado personal, fabricación de polímeros, productos químicos agrícolas, limpieza de metales, otros) |

|

Países cubiertos |

EE. UU., Canadá, México, Brasil, Argentina, Resto de Sudamérica, Alemania, Francia, Italia, Países Bajos, Reino Unido, Rusia, España, Turquía, Suiza, Bélgica, Resto de Europa, China, India, Japón, Corea del Sur, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, Resto de Asia-Pacífico, Sudáfrica, Arabia Saudita, Egipto, Emiratos Árabes Unidos, Israel, Resto de Medio Oriente y África |

|

Actores del mercado cubiertos |

Arkema (Francia), INVISTA (filial de Koch Industries, Inc.) (EE. UU.), Ashland (EE. UU.), Bharat Petroleum Corporation Limited (India), Huntsman International LLC (EE. UU.), Solvay (Bélgica), ADM (EE. UU.), Shell Global (Países Bajos), BP plc (Reino Unido), Eastman Chemical Company (EE. UU.), INEOS GROUP HOLDINGS SA (Reino Unido), BASF SE (Alemania), Celanese Corporation (EE. UU.), Cargill, Incorporated (EE. UU.), Reliance Industries Limited (India), Honeywell International Inc. (EE. UU.), LyondellBasell Industries Holding BV (Países Bajos), Exxon Mobil Corporation (EE. UU.), Monument Chemical (EE. UU.), Dow (EE. UU.), Olin Corporation (EE. UU.), entre otros. |

Definición de mercado

Los disolventes son sustancias típicamente líquidas con la capacidad de disolver o distribuir una amplia gama de compuestos, incluidas sustancias sólidas, líquidas y gaseosas. Se utilizan ampliamente en una variedad de industrias, incluidas las químicas, farmacéuticas, pinturas y revestimientos, adhesivos, productos de limpieza y muchas más. El mercado de disolventes incluye una variedad de tipos de disolventes, como hidrocarburos , disolventes oxigenados, disolventes halogenados y otros disolventes especializados.

Dinámica del mercado mundial de disolventes

CONDUCTORES

- Creciente demanda de disolventes en la industria de pinturas y recubrimientos

Los disolventes desempeñan un papel importante como portadores de revestimientos de superficies como pinturas, barnices y adhesivos. Los productos químicos utilizados en pinturas y revestimientos dependen de los disolventes, ya que pueden disolver y dispersar los componentes que se emplean en las formulaciones de los revestimientos. Además, garantiza la calidad del producto final obtenido y un rendimiento óptimo. Los disolventes actúan como componentes esenciales en las formulaciones de pinturas y revestimientos en la industria de la construcción, ya que pueden disolver pigmentos, aditivos y aglutinantes para formar revestimientos de alto rendimiento. Se utilizan varios tipos de disolventes según los requisitos de los revestimientos, como el tiempo de secado, la calidad de la película y la compatibilidad con otros componentes. La selección de disolventes, como disolventes de hidrocarburos, cetonas , ésteres, alcoholes y éteres de glicol, depende de factores como la capacidad de solvatación, la polaridad y la compatibilidad con otros componentes de la formulación. El benceno , el tolueno y los xilenos son disolventes de hidrocarburos aromáticos que se utilizan en pinturas a base de esmalte, mientras que las pinturas a base de laca necesitan disolventes más fuertes para un secado más rápido.

Por ejemplo,

- En abril de 2022, según los datos de construcción de Biltrax, se prevé que el sector de la construcción de la India crezca a una tasa de crecimiento anual compuesta (CAGR) del 15,7 por ciento, alcanzando un valor de 738 500 millones de dólares. La expansión del sector de la construcción creará oportunidades para los fabricantes y proveedores solventes a escala mundial.

- En marzo de 2022, según GROUPE BERKEM, Groupe Berkem, una empresa líder en productos químicos de origen biológico, anunció el lanzamiento de su gama de resinas alquídicas 100% de origen biológico destinadas al mercado de pinturas para la construcción. Este desarrollo innovador implica la transformación de productos existentes hacia soluciones sostenibles, utilizando aceites de origen biológico, subproductos de la química orgánica y un disolvente 100% de origen biológico. Esto contribuye al mercado mundial de disolventes al proporcionar soluciones ecológicas en la industria de pinturas para la construcción.

Además de las pinturas y los revestimientos, los disolventes se utilizan en los adhesivos para unir materiales. Los adhesivos son de distintos tipos, como los de policloropreno, poliuretano , acrilato y silicona. Además, los disolventes se utilizan en agentes de limpieza y desengrasantes, decapantes y barnices. El sector de la construcción y la automoción está en auge en todo el mundo debido a la urbanización, el desarrollo de infraestructuras, el aumento de las actividades de construcción y la creciente demanda de automóviles. Este crecimiento de la industria de la construcción y la automoción impulsa aún más la demanda de pinturas, revestimientos y adhesivos y, por tanto, la demanda de disolventes.

- Aumento del uso de tintas de impresión para diferentes aplicaciones industriales

Los disolventes desempeñan un papel crucial en la industria de la impresión, ya que ofrecen solvencia a las tintas para disolver pigmentos y vehículos, como vehículos de glicol solubles en agua, en una solución. Esto se hace para que la tinta se pueda aplicar fácilmente al papel o a cualquier otro sustrato. Las tintas de impresión necesitan disolventes a través de los cuales se pueda lograr una distribución adecuada del color y la consistencia. Los disolventes que tienen un alto poder de disolución pueden producir impresiones vibrantes y duraderas. Los disolventes que tienen un rango de ebullición estrecho se evaporan rápidamente después de la aplicación de la tinta, por lo que hay un secado efectivo y adecuado de la tinta en los sustratos aplicados.

Por ejemplo,

- En marzo de 2022, según Gardner Business Media, Inc., Sun Chemical presentó las tintas a base de solventes SunSpectro SolvaWash, diseñadas para aumentar las tasas de reciclaje de botellas de PET. Estas tintas lavables/desentintables para huecograbado e impresión flexográfica están desarrolladas específicamente para la impresión inversa de fundas retráctiles de PET cristalizables. Las tintas a base de solventes SolvaWash de Sun Chemical respaldarán el mercado global de solventes al permitir mayores tasas de reciclaje de botellas de PET.

- En julio de 2021, según Fint Group, Flint Group Packaging Inks presentó una nueva gama de tintas y recubrimientos a base de solventes llamada ONECode, diseñada específicamente para los convertidores de envases flexibles europeos. Incluye seis nuevas marcas, que ofrecen sistemas de tinta para impresión flexográfica (VertixCode), impresión en huecograbado (MatrixCode), tintas de doble propósito (HelixCode), soluciones sostenibles (ZenCode), barnices e imprimaciones de sobreimpresión (NexisCode) y aditivos (AdmixCode). Beneficiará al mercado global de solventes al simplificar el proceso de impresión para los convertidores de envases flexibles europeos.

La aplicación de disolventes en tintas de impresión se realiza ampliamente en diferentes aplicaciones, como impresión, embalaje, impresión de botellas e impresión de plástico, entre otras. La industria del embalaje juega un papel importante en el impulso de la demanda de disolventes de tinta para aplicaciones de impresión. Ha habido un aumento en la demanda de embalajes flexibles debido a su naturaleza personalizable, bajo costo y propiedades livianas. Este tipo de embalaje flexible se utiliza en varios sectores que van desde bienes de consumo hasta la atención médica, lo que impulsa la demanda de disolventes durante el período de pronóstico. También se espera que el crecimiento de la industria de alimentos y bebidas aumente la demanda de embalajes, lo que impulsará aún más la demanda de tintas de impresión. Los disolventes de tinta ayudan a lograr la calidad de impresión requerida y la durabilidad necesaria para los materiales de embalaje utilizados en el sector de alimentos y bebidas. En el futuro, la demanda de tintas de impresión de alta calidad aumentará para diferentes aplicaciones en una amplia gama de industrias, como soluciones de embalaje para alimentos y bebidas, bienes de consumo y aplicaciones de atención médica, impulsando así el mercado global de disolventes.

- Perspectiva positiva hacia la industria de productos de belleza y cuidado personal

La industria de productos de belleza y cuidado personal está creciendo a un ritmo significativo debido a factores como la creciente conciencia sobre el cuidado personal y la demanda de productos de belleza y bienestar. Además, la evolución de las tendencias de belleza y el cambio de las preferencias de los consumidores debido a la presencia de las redes sociales contribuyen al crecimiento de la industria de la belleza y el cuidado personal.

Por ejemplo,

- Según la Asociación de Cosméticos, Artículos de Tocador y Perfumería, el mercado europeo de cosméticos alcanzó un valor de USD 92,66 millones a precio de venta minorista (RSP) en 2022. Esto supone un impulso para el mercado mundial de disolventes al indicar la continua expansión y fortaleza de la industria cosmética en Europa.

- Según Cosmetics Europe, Europa es un mercado líder en el sector de los cosméticos y productos de cuidado personal, con un valor de ventas minoristas estimado de 92.660 millones de dólares en 2022. Entre los países europeos, Alemania tiene el mayor tamaño de mercado, valorado en 15.060 millones de dólares.

Los disolventes se utilizan principalmente para disolver ingredientes activos que son hidrófobos y se utilizan en fórmulas cosméticas y de cuidado de la piel. Los disolventes mejoran la estabilidad, la textura y la absorción de los productos de belleza y cuidado personal. Los disolventes como el butilenglicol, el propilenglicol , el alcohol isopropílico y el alcohol etílico se utilizan ampliamente en productos de cuidado de la piel, cosméticos, cuidado del cabello y fragancias. Los disolventes también actúan como humectantes, emolientes y controladores de viscosidad. Ayudan a hidratar y humectar la piel, mejorando la textura y estabilizando las fórmulas. Además de eso, los fabricantes también se centran en fabricar disolventes que tengan un mayor rendimiento, una mejor compatibilidad con diferentes ingredientes y perfiles de seguridad. Por lo tanto, se espera que la demanda de disolventes crezca en el período de pronóstico a medida que la industria de la belleza y el cuidado personal continúa expandiéndose, impulsando aún más el mercado global de disolventes.

OPORTUNIDADES

- Cambiando el enfoque de los fabricantes hacia disolventes ecológicos

En los últimos años, se ha producido un cambio significativo entre los usuarios finales hacia los disolventes respetuosos con el medio ambiente, también denominados biodisolventes o disolventes verdes. La mayoría de estos disolventes se derivan del procesamiento de cultivos agrícolas. Como los disolventes derivados de productos petroquímicos contribuyen a las emisiones de compuestos orgánicos volátiles, tienen graves efectos secundarios sobre el medio ambiente. Estos disolventes no son cancerígenos ni corrosivos, lo que hace que su manipulación sea segura y reduce los riesgos para los trabajadores.

Por ejemplo,

- En noviembre de 2021, según Woodcote Media Limited, Celtic Renewables, una empresa innovadora en tecnologías limpias, anunció una asociación con Caldic para poner en marcha la primera planta química sostenible de Escocia en Grangemouth. La tecnología patentada de bajas emisiones de carbono de Celtic Renewables permite la conversión de material biológico no deseado en productos químicos renovables, biocombustibles y otros productos valiosos. Este desarrollo apoyará a los clientes de Caldic en su camino hacia la sostenibilidad proporcionándoles biodisolventes de alta calidad con una huella de carbono significativamente menor.

- En febrero de 2023, según LUMITOS AG, Clariter y TotalEnergies Fluids presentaron los primeros disolventes ultrapuros sostenibles fabricados a partir de residuos plásticos. Esta tecnología revolucionaria, fruto de una colaboración de 18 meses, combina el innovador proceso de reciclaje de Clariter con la tecnología de hidrodesaromatización de TotalEnergies Fluids. Los disolventes resultantes cumplen los más altos estándares de pureza que exigen industrias tan exigentes como la farmacéutica y la cosmética.

El lactato de etilo es uno de los disolventes ecológicos que se deriva del procesamiento del maíz y tiene ventajas como la biodegradabilidad en comparación con los disolventes convencionales. También se utilizan en aplicaciones como decapante de pintura y para la eliminación de grasas, aceites, adhesivos y combustibles sólidos de diversas superficies metálicas. Los fabricantes están realizando más investigaciones y esfuerzos de desarrollo para mejorar el rendimiento y la gama de disolventes ecológicos.

- Inmenso potencial en el sector de las energías renovables

Como ha aumentado la demanda de fuentes de energía más limpias y sostenibles, el sector de las energías renovables ha experimentado un crecimiento significativo en los últimos años. Los sistemas de paneles solares y las turbinas eólicas, componentes esenciales de la generación de energía renovable, requieren semiconductores para una conversión y un control de energía eficaces.

Por ejemplo,

- En abril de 2023, según Cision US Inc., Lowe's realizó un avance reciente en materia de energía renovable al anunciar la instalación de paneles solares en los tejados de 174 de sus tiendas y centros de distribución en todo Estados Unidos. Se espera que los paneles solares, una vez completados, proporcionen aproximadamente el 90 % del consumo energético en cada ubicación. Lowe's se había asociado con DSD Renewables, Greenskies Clean Focus e Infiniti Energy para ejecutar estas instalaciones en California, Illinois y Nueva Jersey.

- En diciembre de 2022, según HT Digital Streams Ltd, Jindal Stainless se asoció con ReNew Power, la empresa de energía renovable más grande de la India, para establecer un proyecto de energía renovable de 300 MW. Este proyecto empleará una combinación de tecnologías solares y eólicas y se estima que generará 700 millones de unidades de electricidad al año.

Los disolventes y las combinaciones de disolventes se utilizan ampliamente en la industria de semiconductores para diversos fines, como la limpieza de equipos, el secado de obleas y la deposición o eliminación de sustratos. Los disolventes de grado semiconductor tienen un papel importante en la fabricación de semiconductores. Están diseñados para la industria de semiconductores y las industrias electrónicas, que requieren un bajo nivel de impurezas. El alcohol isopropílico y la acetona se encuentran entre los disolventes de limpieza más populares en la industria de semiconductores. Por tanto, los fabricantes de disolventes pueden invertir en actividades de investigación y desarrollo para el desarrollo de nuevos disolventes, incluidos disolventes ecológicos que cumplan los requisitos de la fabricación de semiconductores. Estas medidas ayudarán a la expansión de los sistemas de energía renovable en todo el mundo, ofreciendo así una amplia gama de oportunidades para el crecimiento del mercado mundial de disolventes.

RESTRICCIONES/DESAFÍOS

- Preocupaciones de salud y seguridad relacionadas con el uso de disolventes

Los disolventes se utilizan para diversas aplicaciones para disolver o diluir componentes. Los disolventes utilizados en productos de construcción, como pinturas, decapantes y diluyentes, plantean posibles riesgos para la salud de las personas que están expuestas a ellos. Los disolventes como el diclorometano, el tolueno y el acetato de etilo influyen en la salud de las personas de diferentes maneras, como por contacto con la piel, ingestión, inhalación y contacto con los ojos. Mientras se aplica este tipo de productos, se produce una respiración que provoca efectos secundarios como dolores de cabeza, náuseas e irritación de los ojos, la piel y los pulmones. Además, la exposición prolongada a estos disolventes provoca problemas de salud como dermatitis y daños en partes del cuerpo como los ojos, los riñones, los pulmones, el sistema nervioso y la piel. Las dosis altas de disolventes pueden incluso provocar pérdida de conocimiento y muerte, especialmente en el caso de exposición ocupacional.

Por ejemplo,

- En mayo de 2023, según HealthNews, un estudio publicado sugiere un posible vínculo entre el disolvente químico tetracloroetileno (TCE) y la enfermedad de Parkinson. La investigación revisó varios estudios que examinaron los efectos de la exposición prolongada al TCE, que alguna vez se usó ampliamente en industrias como la atención médica, la tintorería y la fabricación. El estudio encontró evidencia de que la exposición al TCE puede causar neuroinflamación, pérdida de neuronas dopaminérgicas y alteraciones en las proteínas cerebrales asociadas con la enfermedad de Parkinson.

Estas preocupaciones en materia de salud y seguridad relacionadas con los disolventes conducirán a una reducción de la demanda de productos que contengan disolventes. Estas industrias, como las de pinturas, revestimientos y adhesivos, también pueden enfrentarse a importantes desafíos que limitarán el crecimiento del mercado mundial de disolventes.

- Problemas en el transporte y almacenamiento de disolventes

Los disolventes se utilizan en diversas industrias, como la farmacéutica, las pinturas, los agroquímicos y muchas más. La mayoría de los disolventes son inflamables y requieren un manejo y almacenamiento cuidadosos. Si no se gestionan adecuadamente, pueden tener consecuencias graves, como accidentes laborales, daños a la propiedad y contaminación ambiental. Debido a estos riesgos, es necesario aplicar normas de seguridad en el transporte y almacenamiento de disolventes. Los disolventes también emiten vapores que pueden causar problemas de salud y riesgos para los trabajadores. El almacenamiento y transporte inadecuados de disolventes pueden tener efectos graves sobre el medio ambiente. Los disolventes, si se derraman, podrían contaminar el suelo y las fuentes de agua, lo que supone una amenaza adicional para los ecosistemas y potencialmente dañar la vida silvestre.

Existen diversas regulaciones, como el etiquetado adecuado, las condiciones de almacenamiento, la segregación, la ventilación y la identificación, con respecto al almacenamiento y transporte de disolventes. Si se pasan por alto dichas regulaciones, se pueden causar muchos daños al lugar donde se produce el derrame de disolventes. El transporte de productos químicos como disolventes conlleva diferentes riesgos y desafíos. Si los disolventes están etiquetados incorrectamente, puede resultar en que se transporten y almacenen los productos químicos incorrectos. Además, factores como prácticas de almacenamiento inadecuadas, trabajadores agotados, mal funcionamiento de los equipos y catástrofes naturales o provocadas por el hombre imprevistas pueden contribuir a los accidentes de transporte que podrían tener efectos perjudiciales. Los desafíos en el transporte y almacenamiento de disolventes tienen un impacto directo en los fabricantes de disolventes. Los incidentes resultantes de un transporte o almacenamiento inadecuados pueden interrumpir la cadena de suministro, lo que genera retrasos, pérdida de confianza de los clientes y posibles pérdidas financieras, lo que supone un desafío para el crecimiento del mercado mundial de disolventes en el período de pronóstico.

Desarrollo reciente

- En junio de 2023, Bharat Petroleum Corporation Limited (BPCL) fue reconocida en los prestigiosos premios FIPI Oil & Gas Awards 2022 al obtener cinco codiciados galardones. Los premios fueron entregados por el Honorable Ministro de Petróleo y Gas Natural y Vivienda y Desarrollo Urbano del Gobierno de la India, Sr. Hardeep Singh Puri, en una gran ceremonia celebrada recientemente.

- En agosto de 2022, Eastman fue nombrada en la lista Forbes de los mejores empleadores del estado de 2022. Este prestigioso premio es otorgado por Forbes y Statista Inc., el portal de estadísticas y proveedor de clasificación de la industria líder a nivel mundial. Esto ayudará a la empresa a crecer como marca y en reconocimiento

Alcance del mercado mundial de disolventes

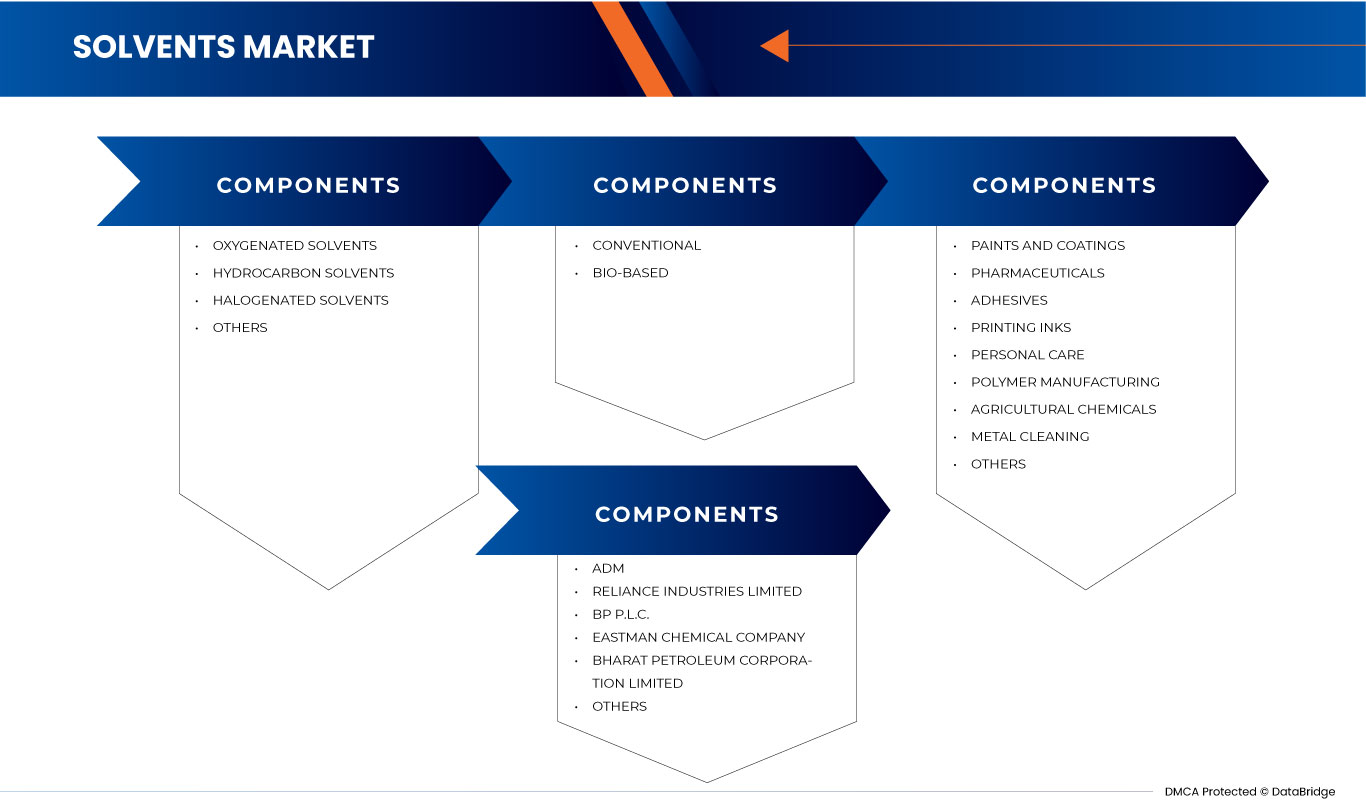

El mercado de disolventes se clasifica en función de la categoría, la fuente y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas a fin de identificar las principales aplicaciones del mercado.

Categoría

- Disolventes oxigenados

- Disolventes de hidrocarburos

- Disolventes halogenados

- Otros

Según la categoría, el mercado está segmentado en disolventes oxigenados, disolventes de hidrocarburos, disolventes halogenados y otros.

Fuente

- Convencional

- De base biológica

En función de la fuente, el mercado se segmenta en convencional y de base biológica.

Solicitud

- Pinturas y recubrimientos

- Productos farmacéuticos

- Adhesivos

- Tintas de impresión

- Cuidado personal

- Fabricación de polímeros

- Productos químicos agrícolas

- Limpieza de metales

- Otros

Sobre la base de la aplicación, el mercado está segmentado en pinturas y recubrimientos, productos farmacéuticos, adhesivos, tintas de impresión, cuidado personal , fabricación de polímeros, productos químicos agrícolas, limpieza de metales, otros.

Análisis y perspectivas regionales del mercado mundial de disolventes

El mercado de disolventes está segmentado según categoría, fuente y aplicación.

Los países del mercado de solventes son EE. UU., Canadá, México, Brasil, Argentina, Resto de Sudamérica, Alemania, Francia, Italia, Países Bajos, Reino Unido, Rusia, España, Turquía, Suiza, Bélgica, Resto de Europa, China, India, Japón, Corea del Sur, Singapur, Tailandia, Indonesia, Malasia, Filipinas, Australia y Nueva Zelanda, Resto de Asia-Pacífico, Sudáfrica, Arabia Saudita, Egipto, Emiratos Árabes Unidos, Israel, Resto de Medio Oriente y África.

La región de Asia-Pacífico domina el mercado mundial de disolventes en términos de participación de mercado e ingresos de mercado. China domina debido a la creciente demanda de disolventes en la industria de pinturas y revestimientos. Además, el aumento del uso de tintas de impresión en diferentes aplicaciones industriales también contribuye al crecimiento del mercado. Estados Unidos domina el mercado debido al aumento del uso de tintas de impresión en diferentes aplicaciones industriales. Alemania domina debido a la creciente conciencia sobre el cuidado personal y la demanda de productos de belleza y bienestar. Además, la evolución de las tendencias de belleza y el cambio de las preferencias de los consumidores también contribuyen al crecimiento del mercado.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, el análisis de las cinco fuerzas de Porter de las tendencias técnicas y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado global de disolventes

El panorama competitivo del mercado global de solventes proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado global de solventes.

Algunos de los participantes destacados que operan en el mercado global de solventes son Arkema (Francia), INVISTA (una subsidiaria de Koch Industries, Inc.) (EE. UU.), Ashland (EE. UU.), Bharat Petroleum Corporation Limited (India), Huntsman International LLC (EE. UU.), Solvay (Bélgica), ADM (EE. UU.), Shell Global (Países Bajos), BP plc (Reino Unido), Eastman Chemical Company (EE. UU.), INEOS GROUP HOLDINGS SA (Reino Unido), BASF SE (Alemania), Celanese Corporation (EE. UU.), Cargill, Incorporated (EE. UU.), Reliance Industries Limited (India), Honeywell International Inc. (EE. UU.), LyondellBasell Industries Holding BV (Países Bajos), Exxon Mobil Corporation (EE. UU.), Monument Chemical (EE. UU.), Dow (EE. UU.), Olin Corporation (EE. UU.) entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 PRODUCTION ANALYSIS

4.4.1 PRODUCTION ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

4.7 LIST OF KEY BUYERS

4.8 RAW MATERIAL COVERAGE

4.9 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR SOLVENTS IN THE PAINTS AND COATINGS INDUSTRY

6.1.2 RISING USAGE OF PRINTING INKS FOR DIFFERENT INDUSTRIAL APPLICATIONS

6.1.3 POSITIVE OUTLOOK TOWARD BEAUTY & PERSONAL CARE PRODUCTS INDUSTRY

6.1.4 GROWING ADOPTION OF POLYMERS AND RUBBERS ACROSS VARIOUS SEGMENTS

6.1.5 POSITIVE OUTLOOK TOWARD THE AGROCHEMICALS INDUSTRY

6.1.6 INCREASING SPENDING IN THE PHARMACEUTICAL SECTOR

6.2 RESTRAINTS

6.2.1 HEALTH AND SAFETY CONCERNS RELATED TO THE USAGE OF SOLVENTS

6.2.2 TECHNICAL COMPLEXITIES IN SOLVENT RECOVERY AND REUSE

6.3 OPPORTUNITIES

6.3.1 SHIFTING THE FOCUS OF MANUFACTURERS TOWARD ECO-FRIENDLY SOLVENTS

6.3.2 IMMENSE POTENTIAL IN THE RENEWABLE ENERGY SECTOR

6.4 CHALLENGES

6.4.1 ISSUES IN TRANSPORTATION AND STORAGE OF SOLVENTS

6.4.2 STRINGENT RULES AND REGULATIONS

7 GLOBAL SOLVENTS MARKET, BY REGION

7.1 OVERVIEW

7.2 ASIA-PACIFIC

7.2.1 CHINA

7.2.2 INDIA

7.2.3 JAPAN

7.2.4 SOUTH KOREA

7.2.5 SINGAPORE

7.2.6 THAILAND

7.2.7 INDONESIA

7.2.8 MALAYSIA

7.2.9 PHILIPPINES

7.2.10 AUSTRALIA & NEW ZEALAND

7.2.11 REST OF ASIA-PACIFIC

7.3 NORTH AMERICA

7.3.1 U.S.

7.3.2 CANADA

7.3.3 MEXICO

7.4 EUROPE

7.4.1 GERMANY

7.4.2 FRANCE

7.4.3 ITALY

7.4.4 NETHERLANDS

7.4.5 U.K.

7.4.6 RUSSIA

7.4.7 SPAIN

7.4.8 TURKEY

7.4.9 SWITZERLAND

7.4.10 BELGIUM

7.4.11 REST OF EUROPE

7.5 MIDDLE EAST AND AFRICA

7.5.1 SOUTH AFRICA

7.5.2 SAUDI ARABIA

7.5.3 EGYPT

7.5.4 UNITED ARAB EMIRATES

7.5.5 ISRAEL

7.5.6 REST OF MIDDLE EAST AND AFRICA

7.6 SOUTH AMERICA

7.6.1 BRAZIL

7.6.2 ARGENTINA

7.6.3 REST OF SOUTH AMERICA

8 GLOBAL SOLVENTS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: GLOBAL

8.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

8.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8.4 COMPANY SHARE ANALYSIS: EUROPE

8.5 PRODUCT LAUNCH

8.6 AGREEMENT

8.7 ACQUISITION

8.8 AWARD

9 SWOT ANALYSIS

10 COMPANY PROFILE

10.1 ADM

10.1.1 COMPANY SNAPSHOT

10.1.2 COMPANY SHARE ANALYSIS

10.1.3 PRODUCT PORTFOLIO

10.1.4 REVENUE ANALYSIS

10.1.5 RECENT DEVELOPMENTS

10.2 RELIANCE INDUSTRIES LIMITED

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COMPANY SHARE ANALYSIS

10.2.4 PRODUCT PORTFOLIO

10.2.5 RECENT DEVELOPMENTS

10.3 BP P.L.C.

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COMPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENTS

10.4 EASTMAN CHEMICAL COMPANY (2022)

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COMPANY SHARE ANALYSIS

10.4.4 PRODUCT PORTFOLIO

10.4.5 RECENT UPDATES

10.5 BHARAT PETROLEUM CORPORATION LIMITED (2022)

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COMPANY SHARE ANALYSIS

10.5.4 PRODUCT PORTFOLIO

10.5.5 RECENT DEVELOPMENT

10.6 OLIN CORPORATION

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENTS

10.7 ARKEMA (2022)

10.7.1 COMPANY SNAPSHOT

10.7.2 REVENUE ANALYSIS

10.7.3 PRODUCT PORTFOLIO

10.7.4 RECENT DEVELOPMENT

10.8 ASHLAND.(2022)

10.8.1 COMPANY SNAPSHOT

10.8.2 REVENUE ANALYSIS

10.8.3 PRODUCT PORTFOLIO

10.8.4 RECENT UPDATE

10.9 BASF SE

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 PRODUCT PORTFOLIO

10.9.4 RECENT UPDATE

10.1 CARGILL, INCORPORATED

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 CELANESE CORPORATON(2022)

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT UPDATE

10.12 DOW

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENTS

10.13 EXXON MOBIL CORPORATION(2022)

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT UPDATES

10.14 HONEYWELL INTERNATIONAL INC. (2022)

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENTS

10.15 HUNTSMAN INTERNATIONAL LLC (2022)

10.15.1 COMPANY SNAPSHOT

10.15.2 REVENUE ANALYSIS

10.15.3 PRODUCT PORTFOLIO

10.15.4 RECENT DEVELOPMENT

10.16 INEOS GROUP HOLDINGS S.A. (2022)

10.16.1 COMPANY SNAPSHOT

10.16.2 REVENUE ANALYSIS

10.16.3 PRODUCT PORTFOLIO

10.16.4 RECENT DEVELOPMENT

10.17 INVISTA (A SUBSIDRIARY OF KOCH INDUSTRIES, INC.)

10.17.1 COMPANY SNAPSHOT

10.17.2 PRODUCT PORTFOLIO

10.17.3 RECENT DEVELOPMENTS

10.18 LYONDELLBASELL INDUSTRIES HOLDING B.V. (2022)

10.18.1 COMPANY SNAPSHOT

10.18.2 REVENUE ANALYSIS

10.18.3 PRODUCT PORTFOLIO

10.18.4 RECENT UPDATE

10.19 MONUMENT CHEMICAL

10.19.1 COMPANY SNAPSHOT

10.19.2 PRODUCT PORTFOLIO

10.19.3 RECENT DEVELOPMENTS

10.2 SHELL GLOBAL (2022)

10.20.1 COMPANY SNAPSHOT

10.20.2 REVENUE ANALYSIS

10.20.3 PRODUCT PORTFOLIO

10.20.4 RECENT UPDATES

10.21 SOLVAY (2022)

10.21.1 COMPANY SNAPSHOT

10.21.2 REVENUE ANALYSIS

10.21.3 PRODUCT PORTFOLIO

10.21.4 RECENT DEVELOPMENTS

11 QUESTIONNAIRE

12 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY COVERAGE

TABLE 2 GLOBAL SOLVENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 GLOBAL SOLVENTS MARKET, BY REGION, 2021-2030 (KILO TONS)

TABLE 4 GLOBAL SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 5 GLOBAL SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 6 GLOBAL OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 7 GLOBAL ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 GLOBAL GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 GLOBAL KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 GLOBAL ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 GLOBAL GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 GLOBAL ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 13 GLOBAL HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 14 GLOBAL AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 GLOBAL XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 GLOBAL HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 17 GLOBAL SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 18 GLOBAL SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 19 GLOBAL SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 GLOBAL SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 21 ASIA-PACIFIC SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 22 ASIA-PACIFIC SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 23 ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 24 ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 25 ASIA-PACIFIC OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 ASIA-PACIFIC ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 ASIA-PACIFIC GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 ASIA-PACIFIC KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 ASIA-PACIFIC ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 ASIA-PACIFIC GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 38 ASIA-PACIFIC SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 40 CHINA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 41 CHINA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 42 CHINA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 43 CHINA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 CHINA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CHINA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 CHINA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CHINA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 CHINA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 CHINA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 CHINA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CHINA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CHINA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 53 CHINA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 54 CHINA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 55 CHINA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 CHINA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 57 INDIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 58 INDIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 59 INDIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 60 INDIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 INDIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 INDIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 INDIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 INDIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 INDIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 INDIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 67 INDIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 INDIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 INDIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 70 INDIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 71 INDIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 72 INDIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 73 INDIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 74 JAPAN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 75 JAPAN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 76 JAPAN OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 77 JAPAN ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 JAPAN GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 JAPAN KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 JAPAN ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 JAPAN GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 JAPAN ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 JAPAN HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 84 JAPAN AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 JAPAN XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 JAPAN HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 87 JAPAN SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 88 JAPAN SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 89 JAPAN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 90 JAPAN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 91 SOUTH KOREA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 92 SOUTH KOREA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 93 SOUTH KOREA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 94 SOUTH KOREA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 SOUTH KOREA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 SOUTH KOREA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 SOUTH KOREA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 SOUTH KOREA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 SOUTH KOREA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 SOUTH KOREA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 101 SOUTH KOREA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 SOUTH KOREA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 SOUTH KOREA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 104 SOUTH KOREA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 105 SOUTH KOREA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 106 SOUTH KOREA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 SOUTH KOREA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 108 SINGAPORE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 109 SINGAPORE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 110 SINGAPORE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 111 SINGAPORE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 SINGAPORE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 SINGAPORE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 117 SINGAPORE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 118 SINGAPORE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 119 SINGAPORE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 SINGAPORE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 121 SINGAPORE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 122 SINGAPORE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 123 SINGAPORE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 124 SINGAPORE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 125 THAILAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 126 THAILAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 127 THAILAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 128 THAILAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 THAILAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 THAILAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 THAILAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 THAILAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 THAILAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 THAILAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 135 THAILAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 THAILAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 THAILAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 138 THAILAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 139 THAILAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 140 THAILAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 141 THAILAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 142 INDONESIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 143 INDONESIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 144 INDONESIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 145 INDONESIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 INDONESIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 INDONESIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 INDONESIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 INDONESIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 INDONESIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 INDONESIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 152 INDONESIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 INDONESIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 INDONESIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 155 INDONESIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 156 INDONESIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 157 INDONESIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 158 INDONESIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 159 MALAYSIA SOLVENTS MARKET

TABLE 160 MALAYSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 161 MALAYSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 162 MALAYSIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 163 MALAYSIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 MALAYSIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 MALAYSIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 MALAYSIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 MALAYSIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 MALAYSIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 MALAYSIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 170 MALAYSIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 MALAYSIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 MALAYSIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 173 MALAYSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 174 MALAYSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 175 MALAYSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 176 MALAYSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 177 PHILIPPINES SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 178 PHILIPPINES SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 179 PHILIPPINES OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 180 PHILIPPINES ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 PHILIPPINES GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 182 PHILIPPINES KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 183 PHILIPPINES ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 184 PHILIPPINES GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 PHILIPPINES ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 PHILIPPINES HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 187 PHILIPPINES AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 188 PHILIPPINES XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 PHILIPPINES HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 190 PHILIPPINES SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 191 PHILIPPINES SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 192 PHILIPPINES SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 193 PHILIPPINES SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 194 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 195 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 196 AUSTRALIA & NEW ZEALAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 197 AUSTRALIA & NEW ZEALAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 AUSTRALIA & NEW ZEALAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 AUSTRALIA & NEW ZEALAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 AUSTRALIA & NEW ZEALAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 AUSTRALIA & NEW ZEALAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 AUSTRALIA & NEW ZEALAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 AUSTRALIA & NEW ZEALAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 204 AUSTRALIA & NEW ZEALAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 AUSTRALIA & NEW ZEALAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 AUSTRALIA & NEW ZEALAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 207 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 209 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 210 AUSTRALIA & NEW ZEALAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 211 REST OF ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 212 REST OF ASIA-PACIFIC SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 213 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 214 NORTH AMERICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 215 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 216 NORTH AMERICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 217 NORTH AMERICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 218 NORTH AMERICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 219 NORTH AMERICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 NORTH AMERICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 NORTH AMERICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 NORTH AMERICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 NORTH AMERICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 225 NORTH AMERICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 NORTH AMERICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 NORTH AMERICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 228 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 229 NORTH AMERICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 230 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 231 NORTH AMERICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 232 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 233 U.S. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 234 U.S. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 235 U.S. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 U.S. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 237 U.S. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 U.S. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 U.S. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 U.S. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 U.S. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 242 U.S. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 U.S. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 U.S. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 245 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 246 U.S. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 247 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 248 U.S. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 249 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 250 CANADA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 251 CANADA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 252 CANADA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 CANADA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 CANADA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 255 CANADA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 CANADA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 CANADA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 CANADA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 259 CANADA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 260 CANADA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 CANADA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 262 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 263 CANADA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 264 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 265 CANADA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 266 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 267 MEXICO SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 268 MEXICO OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 269 MEXICO ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 276 MEXICO AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 279 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 281 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 282 MEXICO SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 283 EUROPE SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 284 EUROPE SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 285 EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 286 EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 287 EUROPE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 288 EUROPE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 289 EUROPE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 EUROPE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 291 EUROPE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 EUROPE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 EUROPE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 EUROPE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 295 EUROPE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 EUROPE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 EUROPE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 298 EUROPE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 299 EUROPE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 300 EUROPE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 301 EUROPE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 302 GERMANY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 303 GERMANY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 304 GERMANY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 305 GERMANY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 306 GERMANY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 307 GERMANY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 308 GERMANY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 309 GERMANY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 310 GERMANY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 311 GERMANY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 312 GERMANY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 313 GERMANY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 314 GERMANY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 315 GERMANY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 316 GERMANY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 317 GERMANY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 318 GERMANY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 319 FRANCE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 320 FRANCE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 321 FRANCE OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 322 FRANCE ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 323 FRANCE GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 324 FRANCE KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 FRANCE ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 326 FRANCE GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 327 FRANCE ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 328 FRANCE HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 329 FRANCE AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 330 FRANCE XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 331 FRANCE HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 332 FRANCE SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 333 FRANCE SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 334 FRANCE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 335 FRANCE SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 336 ITALY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 337 ITALY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 338 ITALY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 339 ITALY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 340 ITALY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 341 ITALY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 342 ITALY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 ITALY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 344 ITALY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 ITALY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 346 ITALY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 ITALY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 348 ITALY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 349 ITALY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 350 ITALY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 351 ITALY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 352 ITALY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 353 NETHERLANDS SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 354 NETHERLANDS SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 355 NETHERLANDS OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 356 NETHERLANDS ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 357 NETHERLANDS GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 358 NETHERLANDS KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 359 NETHERLANDS ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 360 NETHERLANDS GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 361 NETHERLANDS ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 362 NETHERLANDS HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 363 NETHERLANDS AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 364 NETHERLANDS XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 365 NETHERLANDS HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 366 NETHERLANDS SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 367 NETHERLANDS SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 368 NETHERLANDS SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 369 NETHERLANDS SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 370 U.K. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 371 U.K. SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 372 U.K. OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 373 U.K. ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 374 U.K. GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 375 U.K. KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 376 U.K. ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 377 U.K. GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 378 U.K. ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 379 U.K. HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 380 U.K. AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 381 U.K. XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 382 U.K. HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 383 U.K. SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 384 U.K. SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 385 U.K. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 386 U.K. SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 387 RUSSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 388 RUSSIA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 389 RUSSIA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 390 RUSSIA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 391 RUSSIA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 392 RUSSIA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 393 RUSSIA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 394 RUSSIA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 395 RUSSIA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 396 RUSSIA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 397 RUSSIA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 398 RUSSIA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 399 RUSSIA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 400 RUSSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 401 RUSSIA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 402 RUSSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 403 RUSSIA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 404 SPAIN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 405 SPAIN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 406 SPAIN OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 407 SPAIN ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 408 SPAIN GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 409 SPAIN KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 410 SPAIN ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 411 SPAIN GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 412 SPAIN ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 413 SPAIN HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 414 SPAIN AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 415 SPAIN XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 416 SPAIN HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 417 SPAIN SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 418 SPAIN SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 419 SPAIN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 420 SPAIN SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 421 TURKEY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 422 TURKEY SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 423 TURKEY OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 424 TURKEY ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 425 TURKEY GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 426 TURKEY KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 427 TURKEY ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 428 TURKEY GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 429 TURKEY ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 430 TURKEY HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 431 TURKEY AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 432 TURKEY XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 433 TURKEY HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 434 TURKEY SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 435 TURKEY SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 436 TURKEY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 437 TURKEY SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 438 SWITZERLAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 439 SWITZERLAND SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 440 SWITZERLAND OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 441 SWITZERLAND ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 442 SWITZERLAND GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 443 SWITZERLAND KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 444 SWITZERLAND ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 445 SWITZERLAND GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 446 SWITZERLAND ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 447 SWITZERLAND HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 448 SWITZERLAND AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 449 SWITZERLAND XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 450 SWITZERLAND HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 451 SWITZERLAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 452 SWITZERLAND SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 453 SWITZERLAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 454 SWITZERLAND SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 455 BELGIUM SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 456 BELGIUM SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 457 BELGIUM OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 458 BELGIUM ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 459 BELGIUM GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 460 BELGIUM KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 461 BELGIUM ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 462 BELGIUM GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 463 BELGIUM ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 464 BELGIUM HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 465 BELGIUM AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 466 BELGIUM XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 467 BELGIUM HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 468 BELGIUM SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 469 BELGIUM SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 470 BELGIUM SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 471 BELGIUM SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 472 REST OF EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 473 REST OF EUROPE SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 474 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 475 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY COUNTRY, 2021-2030 (KILO TONS)

TABLE 476 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 477 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 478 MIDDLE EAST AND AFRICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 479 MIDDLE EAST AND AFRICA ALCOHOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 480 MIDDLE EAST AND AFRICA GLYCOL ETHERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 481 MIDDLE EAST AND AFRICA KETONES IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 482 MIDDLE EAST AND AFRICA ESTERS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 483 MIDDLE EAST AND AFRICA GLYCOLS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 484 MIDDLE EAST AND AFRICA ETHYLENE GLYCOL IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 485 MIDDLE EAST AND AFRICA HYDROCARBON SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 486 MIDDLE EAST AND AFRICA AROMATIC SOLVENTS IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 487 MIDDLE EAST AND AFRICA XYLENE IN SOLVENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 488 MIDDLE EAST AND AFRICA HALOGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 489 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 490 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY SOURCE, 2021-2030 (KILO TONS)

TABLE 491 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 492 MIDDLE EAST AND AFRICA SOLVENTS MARKET, BY APPLICATION, 2021-2030 (KILO TONS)

TABLE 493 SOUTH AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 494 SOUTH AFRICA SOLVENTS MARKET, BY CATEGORY, 2021-2030 (KILO TONS)

TABLE 495 SOUTH AFRICA OXYGENATED SOLVENTS IN SOLVENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)