Mercado mundial de compuestos de polipropileno, por producto (polipropileno relleno con minerales, compuestos TPO/TPV, concentrados de aditivos, reforzado con vidrio y otros), tipo de polímero (homopolímeros y copolímeros), aplicación (fibra, película y lámina, rafia y otros), uso final (automotriz, embalaje, construcción, electricidad y electrónica, bienes de consumo, médico, textil y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de compuestos de polipropileno

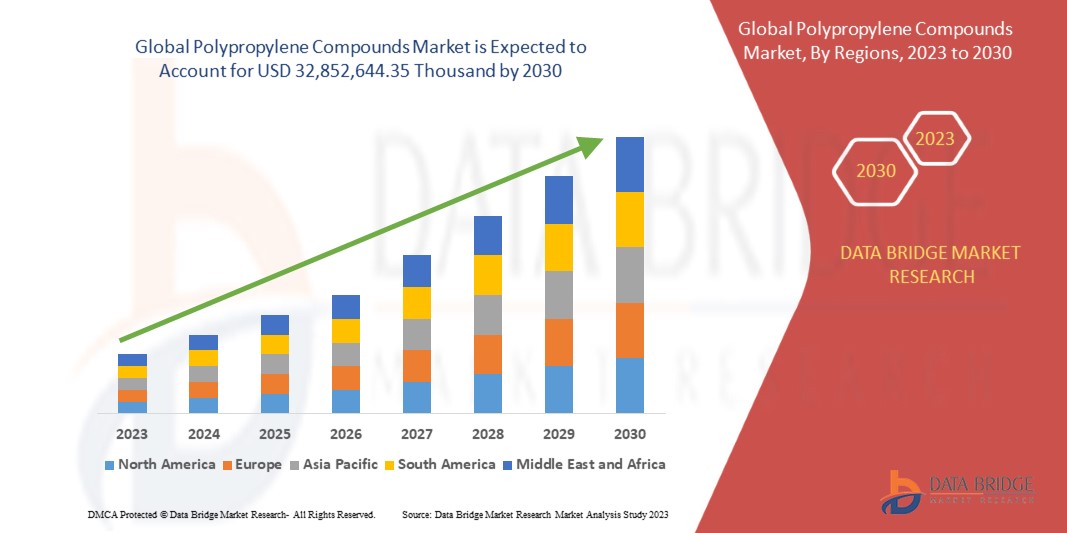

Se espera que el mercado mundial de compuestos de polipropileno crezca significativamente en el período de pronóstico de 2023 a 2030. Los análisis de investigación de mercado de Data Bridge indican que el mercado está creciendo con una CAGR del 4,6 % en el período de pronóstico de 2023 a 2030 y se espera que alcance los 32 852 644,35 mil dólares en 2030. El principal factor que impulsa el crecimiento del mercado mundial de polipropileno es la creciente demanda de las industrias de uso final.

La creciente demanda de compuestos de polipropileno en diversas industrias de uso final es un factor clave para el crecimiento del mercado. Los compuestos de polipropileno son materiales muy versátiles que ofrecen una combinación de propiedades deseables, como alta resistencia, bajo peso, resistencia química y rentabilidad. Estas propiedades los hacen adecuados para una amplia gama de aplicaciones en diferentes sectores, lo que impulsa su adopción en industrias como la automotriz, el embalaje, la construcción y la electrónica.

El informe del mercado global de compuestos de polipropileno proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un informe de analista. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015 - 2020) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Producto (polipropileno con carga mineral, TPO/TPV compuestos, concentrados de aditivos, reforzado con vidrio y otros), tipo de polímero (homopolímeros y copolímeros), aplicación (fibra, película y lámina, rafia y otros), uso final (automoción, embalaje, construcción, electricidad y electrónica, bienes de consumo, medicina, textiles y otros) |

|

Países cubiertos |

EE. UU., Canadá, México, Alemania, Reino Unido, Italia, Francia, España, Suiza, Rusia, Turquía, Bélgica, Países Bajos, Suecia, Dinamarca, Noruega, Finlandia, Resto de Europa, China, India, Japón, Corea del Sur, Australia, Nueva Zelanda, Malasia, Singapur, Tailandia, Taiwán, Indonesia, Filipinas, Hong Kong, Resto de Asia-Pacífico, Brasil, Argentina, Resto de Sudamérica, Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Kuwait, Egipto, Israel, Omán, Qatar, Baréin Resto de Oriente Medio y África |

|

Actores del mercado cubiertos |

Entre otras, Mitsui Chemicals, Inc., Exxon Mobil Corporation, SABIC, Borealis AG, Braskem, China Petrochemical Corporation (SINOPEC), Celanese Corporation, BASF SE, Formosa Plastics Group, LyondellBasell Industries Holdings BV, Avient Corporation, Reliance Industries Limited, Sasol, SCG Chemicals Public Company Limited, Trinseo, TotalEnergies, GS GLOBAL CORP, LG Chem, Repsol e INEOS. |

Definición de mercado

Los compuestos de polipropileno (PP) son resinas termoplásticas fabricadas a partir de una combinación de una o más poliolefinas básicas y componentes adicionales como modificadores de impacto , rellenos y fortalecedores (por ejemplo, rellenos minerales y fibra de vidrio), colores y aditivos. Estos compuestos de polipropileno tienen varias ventajas y se utilizan en una amplia gama de industrias, incluidas la automotriz, el embalaje, los textiles, los productos de consumo y otras. El compuesto de PP es un termoplástico robusto, rígido y cristalino. Para fabricarlo se utiliza monómero de propeno.

Dinámica del mercado mundial de compuestos de polipropileno

Conductores

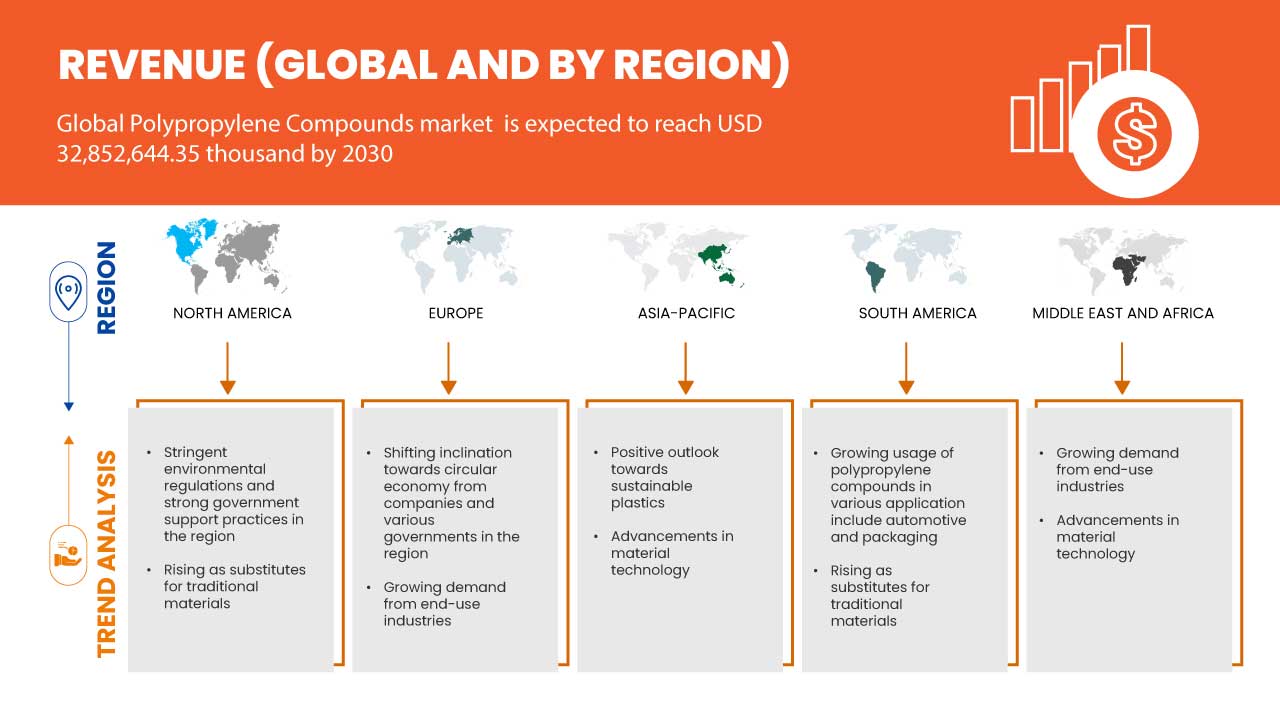

- Demanda creciente de las industrias de uso final

La creciente demanda de compuestos de polipropileno en diversas industrias de uso final es un factor clave para el crecimiento del mercado. Los compuestos de polipropileno son materiales muy versátiles que ofrecen una combinación de propiedades deseables, como alta resistencia, bajo peso, resistencia química y rentabilidad.

En la industria automotriz, los fabricantes están incorporando cada vez más compuestos de polipropileno en la producción de diversos componentes debido a su naturaleza liviana. El sector automotriz se está centrando en la sostenibilidad y la eficiencia del combustible, lo que genera una creciente demanda de materiales livianos que puedan ayudar a reducir el peso del vehículo y mejorar el ahorro de combustible. Los compuestos de polipropileno, con su capacidad para cumplir con los requisitos de rendimiento y al mismo tiempo ser más livianos que los materiales tradicionales, son muy adecuados para este propósito.

- Avances en la tecnología de materiales

Los avances tecnológicos en la formulación de materiales y las técnicas de procesamiento han sido fundamentales para el desarrollo de compuestos de polipropileno de alto rendimiento. Estas innovaciones han permitido a los fabricantes adaptar las propiedades de los compuestos de polipropileno para satisfacer las necesidades y requisitos específicos de la industria.

Los esfuerzos de investigación y desarrollo en el campo de los compuestos de polipropileno han dado como resultado la creación de fórmulas nuevas y mejoradas. Estos compuestos avanzados se adaptan a nichos de mercado y aplicaciones de alto valor, ampliando el potencial del mercado y atrayendo a nuevos clientes. Por ejemplo, la demanda de compuestos de polipropileno con mayor resistencia mecánica y resistencia química está aumentando en industrias como la automotriz y la electrónica.

- En auge como sustitutos de materiales tradicionales

Los compuestos de polipropileno se utilizan cada vez más como sustitutos de materiales tradicionales como metales, vidrio y otros plásticos en diversas aplicaciones. El cambio hacia materiales livianos en industrias como la automotriz, la aeroespacial y los bienes de consumo está impulsado por la necesidad de mejorar la eficiencia del combustible, reducir las emisiones y mejorar el rendimiento general.

En la industria automotriz, la sustitución de piezas metálicas por compuestos de polipropileno se ha vuelto más común debido a su menor peso y resistencia comparable. Los componentes más livianos contribuyen a reducir el consumo de combustible y las emisiones, en línea con los esfuerzos de la industria por lograr la sostenibilidad.

En conclusión, las propiedades versátiles de los compuestos de polipropileno, junto con los continuos avances tecnológicos, los hacen cada vez más atractivos para diversas industrias que buscan soluciones livianas, duraderas y rentables. A medida que la demanda continúa aumentando y la innovación impulsa el desarrollo de variantes de alto rendimiento, se espera que los compuestos de polipropileno desempeñen un papel aún más importante en la configuración del futuro de los materiales utilizados en diversas aplicaciones y en la promoción de la sostenibilidad en varios sectores. Se espera que el uso creciente de compuestos de polipropileno como sustituto impulse el crecimiento del mercado.

OPORTUNIDADES

- Demanda creciente de materiales ecológicos y sostenibles

La creciente demanda de materiales ecológicos y sostenibles se ha convertido en un importante motor de innovación y desarrollo de productos en todas las industrias. A medida que aumentan las preocupaciones ambientales, los consumidores, las empresas y los gobiernos muestran una mayor preferencia por productos con un impacto ambiental reducido. En respuesta a esta demanda, el desarrollo y la comercialización de compuestos de polipropileno sostenibles y de origen biológico presentan importantes oportunidades para el mercado.

Los compuestos de polipropileno de origen biológico se derivan de recursos renovables, como materias primas de origen vegetal. A diferencia del polipropileno convencional, que depende del propileno derivado de combustibles fósiles, el polipropileno de origen biológico se fabrica utilizando fuentes de biomasa renovables. Al reemplazar una parte de las materias primas derivadas del petróleo con alternativas renovables, el polipropileno de origen biológico puede reducir significativamente la huella de carbono y la dependencia de recursos fósiles finitos.

- Sectores industriales en expansión

La expansión de los sectores industriales en las economías en desarrollo presenta interesantes oportunidades de crecimiento para el mercado mundial de compuestos de polipropileno. A medida que estas economías experimentan una rápida urbanización e industrialización, aumenta la demanda de materiales avanzados, incluidos los compuestos de polipropileno.

En los países en desarrollo, la industria de la construcción es un importante consumidor de compuestos de polipropileno debido al continuo desarrollo de infraestructuras y la expansión urbana. La demanda de tuberías, accesorios y materiales de aislamiento de alta calidad ha crecido significativamente, lo que ofrece amplias oportunidades para que los actores del mercado atiendan a estos mercados emergentes.

En la agricultura, los compuestos de polipropileno se están empleando de formas innovadoras. Se utilizan en aplicaciones como películas para invernaderos , materiales de protección de cultivos y sistemas de riego. A medida que el sector agrícola busca soluciones más eficientes y sostenibles para abordar los desafíos de la seguridad alimentaria, se espera que aumente la demanda de materiales avanzados como los compuestos de polipropileno, lo que se espera que cree oportunidades para el crecimiento del mercado.

Restricciones/Desafíos

- Volatilidad en los precios de las materias primas

El costo de los compuestos de polipropileno está muy influenciado por los precios de las materias primas, en particular del monómero de propileno. El propileno es una materia prima clave para la producción de polipropileno, y su disponibilidad y precio pueden afectar significativamente el costo total de producción de los compuestos de polipropileno.

Las fluctuaciones de los precios de las materias primas pueden deberse a diversos factores, como los cambios en la dinámica de la oferta y la demanda a nivel mundial, las tensiones geopolíticas, los desastres naturales que afectan a las instalaciones de producción y las fluctuaciones monetarias. Esta volatilidad de los precios plantea desafíos a los fabricantes y a los usuarios finales, ya que afecta a las estructuras de costos, la gestión de inventarios y los márgenes de ganancia.

En conclusión, las fluctuaciones de precios y la disponibilidad de materias primas pueden afectar la disponibilidad de productos de reemplazo. Los cambios de precios o las interrupciones en el suministro de productos sustitutos pueden afectar la demanda de polipropileno y obstaculizar su expansión en el mercado.

- Mercado de materiales competitivo

Los compuestos de polipropileno se enfrentan a la competencia de una amplia gama de plásticos de ingeniería y materiales avanzados que ofrecen propiedades similares o incluso mejoradas. A medida que las industrias buscan materiales con características de rendimiento específicas, los fabricantes de compuestos de polipropileno deben innovar y mejorar continuamente sus productos para seguir siendo competitivos en el mercado.

Uno de los principales competidores de los compuestos de polipropileno es el polietileno (PE), otro polímero termoplástico popular. Si bien los compuestos de polipropileno ofrecen una mejor resistencia mecánica, el polietileno es conocido por su mayor resistencia al impacto y flexibilidad. Según la aplicación, los usuarios finales pueden optar por el polietileno en lugar de los compuestos de polipropileno.

Además, los fabricantes pueden aprovechar la versatilidad de los compuestos de polipropileno para desarrollar fórmulas personalizadas que se adapten a aplicaciones específicas. Al colaborar estrechamente con los clientes y comprender sus necesidades específicas, los fabricantes pueden crear soluciones a medida, fortaleciendo su posición competitiva en el mercado, que se espera que suponga un desafío para el crecimiento del mercado.

Desarrollo reciente

- En mayo de 2023, LyondellBasell anunció que Alujain National Industrial Company (Alujain) había elegido la tecnología de proceso de polipropileno de LyondellBasell para una nueva línea de tecnología de proceso Spherizone. National Petrochemical Industrial Co. (NatPet), que opera una línea de tecnología de proceso Spheripol, es propiedad de Alujain. Este liderazgo tecnológico es un facilitador fundamental del crecimiento.

- En junio de 2023, Borealis acordó adquirir Rialti, uno de los principales fabricantes europeos de compuestos de polipropileno (PP) recuperado mecánicamente para moldeo por inyección y extrusión. El proyecto ampliará la gama circular de Borealis añadiendo 50.000 toneladas de capacidad de compuestos reciclados y satisfaciendo la creciente demanda de los clientes de soluciones respetuosas con el medio ambiente.

Alcance del mercado mundial de compuestos de polipropileno

El mercado global de compuestos de polipropileno se clasifica en función del producto, el tipo de polímero, la aplicación y el uso final. El crecimiento entre estos segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Polipropileno relleno de minerales

- TPOS/TPVS compuesto

- Concentrados de aditivos

- Reforzado con vidrio

- Otros

Sobre la base del producto, el mercado está segmentado en polipropileno cargado de minerales, compuestos tpos/tpvs, concentrados de aditivos reforzados con vidrio y otros.

Tipo de polímero

- Homopolímeros

- Copolímeros

Según el tipo de polímero, el mercado se segmenta en homopolímeros y copolímeros .

Solicitud

- Fibra

- Película y partituras

- Rafia

- Otros

Según la aplicación, el mercado está segmentado en fibra, película y láminas, rafia y otros.

Uso final

- Automotor

- Embalaje

- Construcción y edificación

- Electricidad y electrónica

- Bienes de consumo

- Médico

- Textil

- Otros

En función del usuario final, el mercado está segmentado en automoción, embalaje, construcción, electricidad y electrónica, bienes de consumo, médicos, textiles y otros.

Análisis y perspectivas regionales del mercado mundial de compuestos de polipropileno

El mercado mundial de compuestos de polipropileno está segmentado según el producto, el tipo de polímero, la aplicación y el uso final.

Los países del mercado global de compuestos de polipropileno son EE. UU., Canadá, México, Alemania, Reino Unido, Italia, Francia, España, Suiza, Rusia, Turquía, Bélgica, Países Bajos, Suecia, Dinamarca, Noruega, Finlandia, Resto de Europa, China, India, Japón, Corea del Sur, Australia, Nueva Zelanda, Malasia, Singapur, Tailandia, Taiwán, Indonesia, Filipinas, Hong Kong, Resto de Asia-Pacífico, Brasil, Argentina, Resto de Sudamérica, Sudáfrica, Emiratos Árabes Unidos, Arabia Saudita, Kuwait, Egipto, Israel, Omán, Qatar, Bahréin, Resto de Medio Oriente y África.

China domina el mercado de compuestos de polipropileno de Asia-Pacífico en términos de participación de mercado e ingresos de mercado debido a la creciente demanda de las industrias de uso final en esta región. La creciente demanda de las industrias de uso final también contribuye al crecimiento del mercado.

Alemania está dominando el mercado de compuestos de polipropileno en los países europeos debido a la creciente demanda en los sectores de la automoción, el embalaje y la electrónica. Estados Unidos está dominando en América del Norte debido a la expansión de los sectores industriales. La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, el análisis de las cinco fuerzas de Porter de las tendencias técnicas y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para los países individuales. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado global de compuestos de polipropileno

El panorama competitivo del mercado global de compuestos de polipropileno proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado global de compuestos de polipropileno.

Algunos de los participantes destacados que operan en el mercado global de compuestos de polipropileno son Mitsui Chemicals, Inc., Exxon Mobil Corporation, SABIC, Borealis AG, Braskem, China Petrochemical Corporation (SINOPEC), Celanese Corporation, BASF SE, Formosa Plastics Group, LyondellBasell Industries Holdings BV, Avient Corporation, Reliance Industries Limited, Sasol, SCG Chemicals Public Company Limited, Trinseo, TotalEnergies, GS GLOBAL CORP, LG Chem, Repsol e INEOS, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 IMPORT-EXPORT SCENARIO

4.4 ESTIMATED PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATION

4.7 PRICING ANALYSIS

4.8 RAW MATERIAL COVERAGE

4.8.1 PROPYLENE

4.8.2 ADDITIVES

4.8.3 FILLERS

4.8.4 LUBRICANTS

4.8.5 FLAME RETARDANTS

4.8.6 ANTISTATIC AGENTS

4.9 SUPPLY CHAIN OF THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET

4.9.1 OVERVIEW:

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS:

4.1 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FROM END-USE INDUSTRIES

6.1.2 ADVANCEMENTS IN MATERIAL TECHNOLOGY

6.1.3 RISING AS SUBSTITUTES FOR TRADITIONAL MATERIALS

6.2 RESTRAINTS

6.2.1 VOLATILITY IN RAW MATERIAL PRICES

6.2.2 ENVIRONMENTAL CONCERNS AND REGULATIONS

6.3 OPPORTUNITIES

6.3.1 RISING DEMAND FOR ECO-FRIENDLY AND SUSTAINABLE MATERIALS

6.3.2 EXPANDING INDUSTRIAL SECTORS

6.4 CHALLENGES

6.4.1 COMPETITIVE MATERIAL MARKET

6.4.2 RECYCLING CHALLENGES

7 GLOBAL POLYPROPYLENE COMPOUNDS MARKET BY GEOGRAPHY

7.1 OVERVIEW

7.2 NORTH AMERICA

7.3 EUROPE

7.4 ASIA-PACIFIC

7.5 SOUTH AMERICA

7.6 MIDDLE EAST & AFRICA

8 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: COMPANY LANDSCAPE

8.1 COMPANY SHARE ANALYSIS: GLOBAL

8.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

8.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

8.4 COMPANY SHARE ANALYSIS: EUROPE

8.5 PRODUCT LAUNCH

8.6 INVESTMENT

8.7 AWARD

8.8 EXPANSION

8.9 NEW FACILITY

8.1 COLLABORATION

8.11 ACQUISITION

9 SWOT ANALYSIS

10 COMPANY PROFILES

10.1 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

10.1.1 COMPANY SNAPSHOT

10.1.2 REVENUE ANALYSIS

10.1.3 COPANY SHARE ANALYSIS

10.1.4 PRODUCT PORTFOLIO

10.1.5 RECENT DEVELOPMENT

10.2 SABIC

10.2.1 COMPANY SNAPSHOT

10.2.2 REVENUE ANALYSIS

10.2.3 COPANY SHARE ANALYSIS

10.2.4 PRODUCT PORTFOLIO

10.2.5 RECENT DEVELOPMENT

10.3 BOREALIS AG

10.3.1 COMPANY SNAPSHOT

10.3.2 REVENUE ANALYSIS

10.3.3 COPANY SHARE ANALYSIS

10.3.4 PRODUCT PORTFOLIO

10.3.5 RECENT DEVELOPMENT

10.4 TOTALENERGIES

10.4.1 COMPANY SNAPSHOT

10.4.2 REVENUE ANALYSIS

10.4.3 COPANY SHARE ANALYSIS

10.4.4 PRODUCT PORTFOLIO

10.4.5 RECENT DEVELOPMENT

10.5 EXXON MOBIL CORPORATION

10.5.1 COMPANY SNAPSHOT

10.5.2 REVENUE ANALYSIS

10.5.3 COPANY SHARE ANALYSIS

10.5.4 PRODUCT PORTFOLIO

10.5.5 RECENT DEVELOPMENT

10.6 AVIENT CORPORATION

10.6.1 COMPANY SNAPSHOT

10.6.2 REVENUE ANALYSIS

10.6.3 PRODUCT PORTFOLIO

10.6.4 RECENT DEVELOPMENT

10.7 BASF SE

10.7.1 COMPANY SNAPSHOT

10.7.2 REVENUE ANALYSIS

10.7.3 PRODUCT PORTFOLIO

10.7.4 RECENT DEVELOPMENT

10.8 BRASKEM

10.8.1 COMPANY SNAPSHOT

10.8.2 REVENUE ANALYSIS

10.8.3 PRODUCT PORTFOLIO

10.8.4 RECENT DEVELOPMENT

10.9 CELANESE CORPORATION

10.9.1 COMPANY SNAPSHOT

10.9.2 REVENUE ANALYSIS

10.9.3 PRODUCT PORTFOLIO

10.9.4 RECENT DEVELOPMENT

10.1 CHINA PETROCHEMICAL CORPORATION (SINOPEC)

10.10.1 COMPANY SNAPSHOT

10.10.2 REVENUE ANALYSIS

10.10.3 PRODUCT PORTFOLIO

10.10.4 RECENT DEVELOPMENT

10.11 FORMOSA PLASTICS GROUP

10.11.1 COMPANY SNAPSHOT

10.11.2 REVENUE ANALYSIS

10.11.3 PRODUCT PORTFOLIO

10.11.4 RECENT DEVELOPMENT

10.12 GS GLOBAL CORP

10.12.1 COMPANY SNAPSHOT

10.12.2 REVENUE ANALYSIS

10.12.3 PRODUCT PORTFOLIO

10.12.4 RECENT DEVELOPMENT

10.13 INEOS

10.13.1 COMPANY SNAPSHOT

10.13.2 REVENUE ANALYSIS

10.13.3 PRODUCT PORTFOLIO

10.13.4 RECENT DEVELOPMENT

10.14 LG CHEM

10.14.1 COMPANY SNAPSHOT

10.14.2 REVENUE ANALYSIS

10.14.3 PRODUCT PORTFOLIO

10.14.4 RECENT DEVELOPMENT

10.15 MITSUI CHEMICALS, INC.

10.15.1 COMPANY SNAPSHOT

10.15.2 REVENUE ANALYSIS

10.15.3 PRODUCT PORTFOLIO

10.15.4 RECENT DEVELOPMENTS

10.16 RELIANCE INDUSTRIES LIMITED

10.16.1 COMPANY SNAPSHOT

10.16.2 REVENUE ANALYSIS

10.16.3 PRODUCT PORTFOLIO

10.16.4 RECENT DEVELOPMENT

10.17 REPSOL

10.17.1 COMPANY SNAPSHOT

10.17.2 REVENUE ANALYSIS

10.17.3 PRODUCT PORTFOLIO

10.17.4 RECENT DEVELOPMENT

10.18 SASOL

10.18.1 COMPANY SNAPSHOT

10.18.2 REVENUE ANALYSIS

10.18.3 PRODUCT PORTFOLIO

10.18.4 RECENT DEVELOPMENT

10.19 SCG CHEMICALS PUBLIC COMPANY LIMITED

10.19.1 COMPANY SNAPSHOT

10.19.2 REVENUE ANALYSIS

10.19.3 PRODUCT PORTFOLIO

10.19.4 RECENT DEVELOPMENT

10.2 TRINSEO

10.20.1 COMPANY SNAPSHOT

10.20.2 REVENUE ANALYSIS

10.20.3 PRODUCT PORTFOLIO

10.20.4 RECENT DEVELOPMENT

11 QUESTIONNAIRE

12 RELATED REPORTS

Lista de figuras

FIGURE 1 GLOBAL POLYPROPYLENE COMPOUNDS MARKET

FIGURE 2 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: THE PRODUCT LIFELINE CURVE

FIGURE 7 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 GROWING DEMAND FROM END-USE INDUSTRIES IS EXPECTED TO DRIVE THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE MINERAL FILLED POLYPROPYLENE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET IN 2023 AND 2030

FIGURE 17 MIDDLE EAST AND AFRICA IS THE FASTEST-GROWING MARKET FOR POLYPROPYLENE COMPOUNDS MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 18 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL POLYPROPYLENE COMPOUNDS MARKET

FIGURE 21 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 22 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY REGION (2022)

FIGURE 23 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY REGION (2023 & 2030)

FIGURE 24 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY REGION (2022 & 2030)

FIGURE 25 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 26 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 31 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 32 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 33 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 36 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 37 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 38 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 39 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 40 EUROPE POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 41 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 42 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 43 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 44 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 45 SOUTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: BY PRODUCT (2023 - 2030)

FIGURE 46 MIDDLE EAST AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY SNAPSHOT (2022)

FIGURE 47 MIDDLE EAST AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022)

FIGURE 48 MIDDLE EAST AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 49 MIDDLE EASE AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 50 MIDDLE EAST AND AFRICA POLYPROPYLENE COMPOUNDS MARKET: BY COUNTRY (2023 - 2030)

FIGURE 51 GLOBAL POLYPROPYLENE COMPOUNDS MARKET: COMPANY SHARE 2022 (%)

FIGURE 52 NORTH AMERICA POLYPROPYLENE COMPOUNDS MARKET: COMPANY SHARE 2022 (%)

FIGURE 53 ASIA-PACIFIC POLYPROPYLENE COMPOUNDS MARKET: COMPANY SHARE 2022 (%)

FIGURE 54 EUROPE POLYPROPYLENE COMPOUNDS MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.