Global Pharmaceutical Packaging Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

118.43 Billion

USD

206.52 Billion

2024

2032

USD

118.43 Billion

USD

206.52 Billion

2024

2032

| 2025 –2032 | |

| USD 118.43 Billion | |

| USD 206.52 Billion | |

|

|

|

|

Segmentación global de envases farmacéuticos por producto (envase primario, secundario y terciario), material (plásticos y polímeros, papel y cartón, vidrio, metales y otros), modo de administración de medicamentos (envase de administración de medicamentos por vía oral, envase de administración de medicamentos por vía parenteral, envase de administración de medicamentos por vía tópica, envase de administración de medicamentos por inhalación, envase de administración de medicamentos por vía nasal, envase de administración de medicamentos por vía ocular, envase de administración de otros medicamentos), usuario final (empresas de fabricación de productos farmacéuticos, empresas de envasado por contrato, farmacias y otras): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de envases farmacéuticos

La externalización de los servicios de envasado por contrato se ha convertido en algo crucial para las empresas farmacéuticas, ya que les permite centrarse en sus competencias básicas y cumplir con los estándares más exigentes. Prespack ofrece asociaciones multidimensionales que liberan a los fabricantes de medicamentos o dispositivos médicos de muchos procesos. Esta tendencia refleja el creciente sector de la externalización farmacéutica, lo que en última instancia contribuye a la expansión del mercado de envasado farmacéutico.

Tamaño del mercado de envases farmacéuticos

El tamaño global de los envases farmacéuticos se valoró en USD 118,43 mil millones en 2024 y se proyecta que alcance los USD 206,52 mil millones para 2032, con una CAGR del 7,20 % durante el período de pronóstico de 2025 a 2032. Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología del paciente, análisis de la cartera de productos, análisis de precios y marco regulatorio.

Alcance del informe y segmentación del mercado de envases farmacéuticos

|

Atributos |

Perspectivas clave del mercado de envases farmacéuticos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur |

|

Actores clave del mercado |

Las empresas WestRock Company, Amcor plc, BD, AptarGroup, Inc., West Pharmaceutical Services, Inc., Berry Global, Inc., CCL Industries, Gerresheimer AG, Schott AG, UFlex Limited, SGD Pharma, EPL Limited, Drug Plastics Group, Comar y Daikyo Seiko Co., Ltd. |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Definición del mercado de envases farmacéuticos

El envasado farmacéutico implica el proceso de envolver medicamentos y otros productos farmacéuticos en materiales de envasado que aseguren su protección, identificación y difusión de información. Estos materiales incluyen plásticos, vidrio, aluminio, papel y cartón, cada uno elegido por sus propiedades y aplicaciones específicas. Estos materiales se seleccionan cuidadosamente en función de su compatibilidad con el producto farmacéutico, su capacidad de protección contra factores externos y los requisitos reglamentarios.

Dinámica del mercado de envases farmacéuticos

Conductores

- Aumento de la subcontratación farmacéutica

Las empresas farmacéuticas optan cada vez más por externalizar los procesos de fabricación a envasadores especializados. Este cambio estratégico les permite concentrarse en sus competencias básicas, como la investigación, el desarrollo y el marketing, y dejar las complejidades del envasado en manos de expertos. Los envasadores ofrecen una gama de servicios que incluyen el diseño de envases, la selección de materiales y la garantía del cumplimiento de los estrictos requisitos normativos. Esto resulta especialmente ventajoso para las empresas farmacéuticas que buscan soluciones de envasado innovadoras y personalizadas para sus productos.

- El papel evolutivo del embalaje farmacéutico en la diferenciación del mercado

El embalaje ha evolucionado más allá de su función tradicional de contener simplemente productos farmacéuticos; ahora es un elemento clave para diferenciar estos productos en el mercado. Este cambio está impulsado por la intensificación de la competencia en la industria farmacéutica, donde las empresas están aprovechando el embalaje como una herramienta para diferenciar sus productos de los competidores. El embalaje sirve como una plataforma visual e informativa que comunica detalles vitales sobre el producto, incluida su calidad, seguridad y eficacia. Además, el embalaje actúa como un medio de marketing, ayudando a atraer a los consumidores e influir en sus decisiones de compra. En respuesta a esta tendencia, ha habido un aumento de soluciones de embalaje innovadoras. Por ejemplo, el embalaje inteligente incorpora características digitales como etiquetas RFID o códigos QR, lo que permite a los consumidores acceder a información adicional del producto o rastrear su autenticidad.

El uso de materiales ecológicos en los envases está ganando terreno, lo que refleja la creciente conciencia ambiental de los consumidores. Estos enfoques innovadores no solo diferencian los productos, sino que también contribuyen a las prácticas sostenibles y mejoran aún más la reputación de la marca.

El enfoque en la diferenciación de productos a través del embalaje está impulsando avances significativos en la industria del embalaje farmacéutico, fomentando un entorno de mercado propicio para la innovación y la mejora continuas.

Oportunidades

- Innovaciones en envases inteligentes

Las innovaciones en el ámbito de los envases inteligentes, como las etiquetas sensibles a la temperatura y el seguimiento RFID, están revolucionando el mercado mundial de los envases farmacéuticos. Estos avances ofrecen una gran cantidad de beneficios, empezando por una mayor visibilidad en toda la cadena de suministro. Las etiquetas sensibles a la temperatura, por ejemplo, permiten un seguimiento en tiempo real, lo que garantiza que los medicamentos se almacenen y transporten en condiciones óptimas. Esta capacidad es especialmente crucial para los productos farmacéuticos, ya que mantener la temperatura adecuada es fundamental para preservar su eficacia y seguridad. Además, el seguimiento RFID permite a las empresas rastrear unidades de productos individuales, lo que garantiza la autenticidad y evita la manipulación. Este nivel de trazabilidad no solo ayuda a cumplir con las normas reglamentarias, sino que también aumenta la confianza de los consumidores. Además, los envases inteligentes facilitan procesos de retirada eficientes, ya que las empresas pueden identificar y recuperar rápidamente los productos afectados.

Restricciones/Desafíos

- Falsificación y seguridad de los productos

La falsificación en el sector farmacéutico plantea un desafío multifacético a pesar de los avances en las tecnologías de envasado. La proliferación de medicamentos falsificados no solo pone en peligro la salud de los pacientes, sino que también erosiona la confianza en los productos farmacéuticos y en la industria. Estas actividades ilícitas a menudo implican tácticas sofisticadas, incluida la reproducción de envases y etiquetas para imitar productos genuinos. A medida que los falsificadores desarrollan continuamente sus métodos para evadir la detección, las empresas farmacéuticas deben permanecer alertas y adaptar sus estrategias de envasado para mantenerse a la vanguardia de estas amenazas. Esta batalla en curso contra los medicamentos falsificados subraya la importancia crítica de las soluciones de envasado innovadoras y los esfuerzos de colaboración dentro de la industria y los organismos reguladores para garantizar la seguridad e integridad de los productos farmacéuticos.

- Limitaciones de costos para la implementación de tecnologías avanzadas de envasado

El desarrollo y la implementación de tecnologías avanzadas de envasado, como los envases inteligentes y las medidas contra la falsificación, a menudo requieren una inversión sustancial en investigación, desarrollo e infraestructura tecnológica. Para las empresas más pequeñas con recursos limitados, estos costos pueden ser prohibitivos, lo que les impide adoptar soluciones de envasado innovadoras. Como resultado, estas empresas pueden estar en desventaja en comparación con competidores más grandes que pueden permitirse invertir en tecnologías de envasado avanzadas. Esta restricción obstaculiza el crecimiento general y el potencial de innovación del mercado de envases farmacéuticos, lo que limita la disponibilidad de soluciones de envasado avanzadas y potencialmente obstaculiza la competitividad en el mercado.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de envases farmacéuticos

El mercado está segmentado en función del producto, el material, el modo de administración del fármaco y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Producto

- Embalaje primario

- Embalaje secundario y terciario

Material

- Plásticos y polímeros

- Papel y cartón

- Vaso

- Rieles

- Otros

Modo de administración de fármacos

- Envases para administración oral de medicamentos

- Envases para administración parenteral de medicamentos

- Envases para administración tópica de medicamentos

- Envases para administración de medicamentos por inhalación

- Envases para administración nasal de medicamentos

- Envases para administración de fármacos oculares

- Embalaje para entrega de otros medicamentos

Usuario final

- Empresas de fabricación de productos farmacéuticos

- Empresas de embalaje por contrato

- Farmacias

- Otros

Análisis regional del mercado de envases farmacéuticos

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, producto, material, modo de administración del medicamento y usuario final como se mencionó anteriormente.

Los países cubiertos en el informe de mercado son EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur.

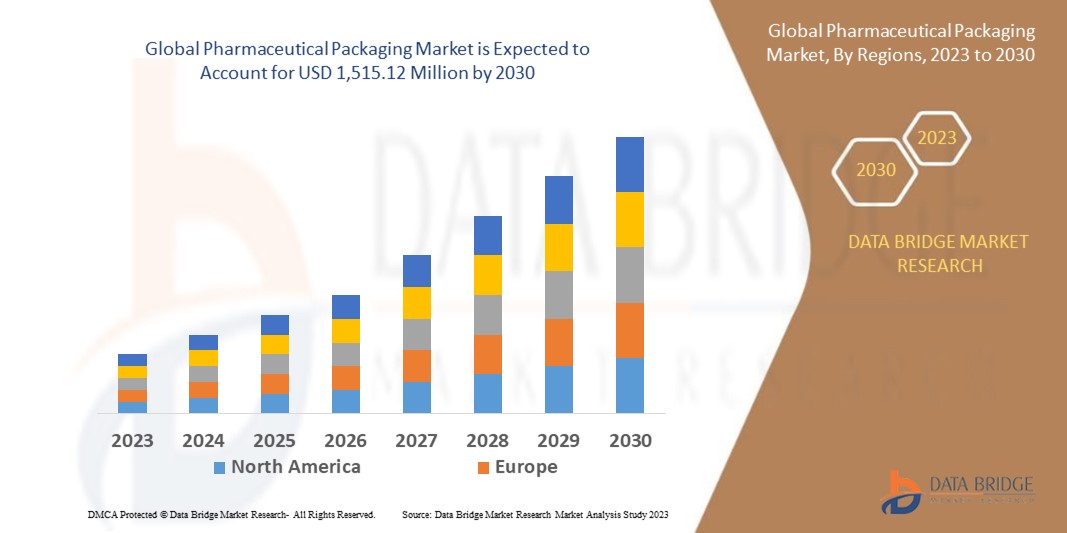

Se espera que América del Norte domine el mercado mundial de envases farmacéuticos debido a su infraestructura sanitaria avanzada, su sólido marco regulatorio y su importante inversión en investigación y desarrollo. Se espera que Estados Unidos domine América del Norte debido a su infraestructura sanitaria avanzada, su gran industria farmacéutica y su alta demanda de soluciones de envasado innovadoras. Se espera que China domine en la región de Asia y el Pacífico debido a su industria farmacéutica en rápida expansión, su gran base de consumidores y el aumento de las inversiones en infraestructura sanitaria y tecnologías de envasado. Se espera que Alemania domine en la región de Europa debido a su sólido sector de fabricación farmacéutica, su sólido entorno regulatorio y su énfasis en los estándares de envasado de alta calidad.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de envases farmacéuticos

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de envases farmacéuticos que operan en el mercado son:

- Compañía WestRock

- Amcor plc

- BD

- Grupo Aptar, Inc.

- Servicios Farmacéuticos del Oeste, Inc.

- Compañía global de bayas, Inc.

- Industrias CCL

- Gerresheimer AG

- Schott AG

- UFlex limitada

- SGD Farmacéutica

- EPL limitada

- Grupo de plásticos para fármacos

- Comar

- Compañía Daikyo Seiko, Ltd.

Últimos avances en el mercado de envases farmacéuticos

- En septiembre de 2023, WestRock Company WRK y Smurfit Kappa Group Plc SMFKY acordaron fusionarse y crear Smurfit WestRock, que se espera que sea una de las empresas de papel y embalajes más grandes del mundo con un valor de alrededor de 20 mil millones de dólares.

- En julio de 2023, Constantia Flexibles anunció su última solución de envasado farmacéutico, la lámina de termoconformado en frío REGULA CIRC, una tecnología de vanguardia que establece un nuevo estándar de sostenibilidad en el envasado en blíster. Diseñada teniendo en cuenta la circularidad, REGULA CIRC cumple con las futuras regulaciones y legislaciones, ofreciendo una solución de barrera total que cumple con los más altos estándares de envasado sostenible.

- En junio de 2022, Berlin Packaging, uno de los proveedores de envases híbridos más grandes del mundo, anunció la adquisición de Andler Packaging Group, un distribuidor de valor agregado de envases y cierres de plástico, vidrio y metal.

- En diciembre de 2021, Comar, un proveedor líder de dispositivos y conjuntos médicos personalizados y soluciones de envasado especiales, anunció hoy que adquirió Omega Packaging, un fabricante de productos moldeados por inyección y soplado que atiende a los mercados farmacéutico, nutracéutico, de nutrición deportiva y de cuidado de la piel.

- En abril de 2022, Amcor, líder en el diseño y producción de soluciones de embalaje éticas, reveló recientemente la incorporación de un nuevo laminado High Shield más ecológico a su línea de embalajes farmacéuticos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.