Global Packaging Films Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

107.97 Billion

USD

165.57 Billion

2024

2032

USD

107.97 Billion

USD

165.57 Billion

2024

2032

| 2025 –2032 | |

| USD 107.97 Billion | |

| USD 165.57 Billion | |

|

|

|

|

Segmentación del mercado global de películas de embalaje, por tipo (polietileno (PE), polipropileno (PP), tereftalato de polietileno (PET), cloruro de polivinilo (PVC), ácido poliláctico (PLA), celulosa, alcohol vinílico de etileno (EVOH) y otros), flexibilidad (flexible y rígido), naturaleza (sintético y de base biológica), aplicación (alimentos y bebidas, productos farmacéuticos, cuidado personal y cosméticos, electricidad y electrónica, hogar y decoración, alimentos para mascotas y otros) – Tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de películas para embalaje

El informe del mercado global de películas de embalaje proporciona detalles de la participación de mercado, los nuevos desarrollos y el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado.

Tamaño del mercado de películas para embalaje

El tamaño del mercado de películas de embalaje se valoró en USD 107,97 mil millones en 2024 y se proyecta que alcance los USD 165,57 mil millones para 2032, con una CAGR del 5,49% durante el período de pronóstico de 2025 a 2032. Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas / consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Alcance del informe y segmentación de películas para embalaje

|

Atributos |

Perspectivas clave del mercado de películas para embalaje |

|

Segmentos cubiertos |

|

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur |

|

Actores clave del mercado |

Las empresas que participan son: Novolex, Amcor plc, Sigma Plastics Group, Interplast Group, Papier-Mettler, Berry Global Group, Inc., Mondi, Uflex Limited, ProAmpac, Taghleef Industries, Parkside, DACO Corporation, Klöckner Pentaplast, AEP GROUP y TIPA LTD. |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis de consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de películas para embalaje

Las películas de embalaje son principalmente películas delgadas de plástico o de polímero que se utilizan para envolver, proteger y conservar productos, proporcionando protección de barrera contra la humedad, los gases y los contaminantes, junto con resistencia mecánica, flexibilidad y transparencia. Estas películas, fabricadas con diferentes materiales como polietileno, polipropileno, PVC y PET, se utilizan en el envasado de alimentos, bebidas, productos farmacéuticos y bienes de consumo. Prolongan la vida útil, garantizan la seguridad del producto y mejoran su apariencia, con funcionalidades como termosellado, capacidad de impresión y resistencia a la perforación. Las películas de embalaje avanzadas también pueden incluir tecnologías inteligentes como recubrimientos antimicrobianos, eliminadores de oxígeno y propiedades biodegradables para satisfacer las demandas del mercado y los objetivos de sostenibilidad.

Dinámica del mercado de películas para embalaje

Conductores

- Aumentar la concienciación de los consumidores sobre los envases sostenibles y ecológicos

La creciente tendencia hacia opciones de embalaje respetuosas con el medio ambiente y sostenibles impulsa la expansión del mercado de los embalajes de película a nivel mundial. Con la creciente preocupación por los efectos de los residuos plásticos y la importancia de la sostenibilidad, las cuestiones medioambientales están adquiriendo cada vez más importancia a escala mundial. Los consumidores son cada vez más conscientes del impacto medioambiental de los residuos plásticos y la contaminación. Esta concienciación está impulsada por la cobertura mediática, las campañas educativas y la mayor visibilidad de las cuestiones medioambientales. Esta mayor concienciación está impulsando la demanda de soluciones de embalaje que no solo sean eficientes sino también respetuosas con el medio ambiente. El embalaje sostenible se considera un medio para preservar los recursos naturales, reducir los residuos y reducir las emisiones de carbono, todo lo cual está en consonancia con los objetivos más generales de sostenibilidad y preservación del medio ambiente.

- Aumento de la adopción de películas de embalaje en la industria farmacéutica y agrícola

El uso cada vez mayor de películas de embalaje en las industrias agrícola y farmacéutica está impulsando un aumento significativo de la demanda del producto en el mercado mundial de películas de embalaje. Esta tendencia refleja una creciente conciencia entre una amplia gama de industrias de las muchas ventajas que ofrecen las películas de embalaje en términos de protección, conservación y conveniencia del producto. En la industria farmacéutica, la adopción de películas de embalaje ha experimentado un aumento significativo debido a varios factores clave. En primer lugar, los estrictos requisitos regulatorios requieren soluciones de embalaje que garanticen la seguridad, integridad y eficacia de los productos farmacéuticos durante todo su ciclo de vida. Las películas de embalaje desempeñan un papel crucial en el cumplimiento de estos requisitos al proporcionar propiedades de barrera que protegen a los medicamentos de la humedad, el oxígeno, la luz y otros factores ambientales que podrían comprometer su estabilidad y vida útil. Además, los avances en la tecnología de películas han llevado al desarrollo de películas farmacéuticas especializadas con características como sellos a prueba de manipulaciones, cierres a prueba de niños y medidas contra la falsificación, que son esenciales para garantizar la seguridad del producto y el cumplimiento normativo. Además, a medida que la población mundial envejece y las enfermedades crónicas se vuelven más comunes, existe una mayor necesidad de productos farmacéuticos, lo que a su vez aumenta la necesidad de soluciones de envasado confiables y efectivas. Las películas de envasado son ideales para una variedad de aplicaciones farmacéuticas, como blísters, sobres, bolsas y paquetes en tiras, ya que son flexibles, adaptables y tienen un precio razonable.

Oportunidades

- Innovaciones en tecnologías que mejoran las cualidades protectoras de las películas de embalaje

El mercado mundial de películas para embalaje está experimentando una fase de transformación impulsada por innovaciones tecnológicas destinadas a mejorar las cualidades protectoras de los materiales de embalaje. Estas innovaciones abordan la necesidad crítica de garantizar la integridad, la seguridad y la vida útil prolongada del producto en diversas industrias. Las nuevas tecnologías están llevando al desarrollo de películas con propiedades superiores de barrera contra el oxígeno y la humedad, como las tecnologías de barrera avanzadas. Uno de los aspectos más críticos de las películas para embalaje es su capacidad para proteger los productos de factores externos como la humedad, el oxígeno, la luz y los contaminantes. Se han desarrollado películas de alto rendimiento con cualidades protectoras excepcionales como resultado de los avances recientes en la tecnología de barrera. Por ejemplo, las películas multicapa brindan una protección de barrera mejorada sin sacrificar la resistencia o la flexibilidad, ya que combinan varios materiales en una sola estructura. Para productos alimenticios y farmacéuticos delicados que necesitan una vida útil prolongada y una protección fuerte, estas películas son especialmente útiles.

- Innovaciones en materiales de embalaje, como películas biodegradables y sostenibles

El mercado mundial de películas para embalaje está experimentando una transformación significativa impulsada por el aumento de la demanda de alternativas biodegradables y sostenibles. Tanto los consumidores como los organismos reguladores están priorizando cada vez más las soluciones respetuosas con el medio ambiente, lo que crea una gran oportunidad para los fabricantes que pueden innovar y adaptarse a la necesidad de embalajes de película ecológicos. Hoy en día, la conciencia de los consumidores con respecto a los problemas ambientales ha alcanzado niveles sin precedentes, y muchas personas buscan activamente productos que minimicen su huella ecológica. Este cambio en el comportamiento del consumidor está impulsando la demanda de películas para embalaje fabricadas con materiales biodegradables y sostenibles. Estas películas ofrecen una alternativa ecológica a los plásticos tradicionales, que son conocidos por su impacto nocivo en el medio ambiente. Por otro lado, las películas biodegradables, generalmente fabricadas a partir de recursos renovables como el ácido poliláctico (PLA), los polihidroxialcanoatos (PHA) y los materiales a base de almidón, se descomponen naturalmente con el tiempo, lo que reduce la acumulación de desechos plásticos en vertederos y océanos. Las películas sostenibles, por otro lado, están diseñadas para la reciclabilidad y la reutilización, lo que promueve una economía circular que minimiza el agotamiento de los recursos y la generación de desechos. Además, los avances en la investigación de bioplásticos y biopolímeros también están conduciendo al desarrollo de películas biodegradables de alto rendimiento.

Restricciones/Desafíos

- Disponibilidad de materiales de embalaje alternativos

El mercado mundial de películas de embalaje, si bien experimenta un crecimiento en algunos sectores, enfrenta un desafío significativo en forma de una creciente disponibilidad y popularidad de materiales de embalaje alternativos. Estas alternativas, incluidas las bolsas de papel y los embalajes de papel, están ganando terreno debido a las preocupaciones ambientales y las preferencias de los consumidores, lo que potencialmente afecta la demanda de películas de plástico. Una de las principales razones detrás del cambio a los embalajes de papel es la creciente conciencia y preocupación de los consumidores por la contaminación plástica. Los plásticos, en particular los plásticos de un solo uso, han sido objeto de escrutinio por su impacto ambiental, principalmente debido a su persistencia en el medio ambiente y la contaminación microplástica resultante. Por el contrario, el papel se percibe como un material más ecológico, al ser biodegradable y reciclable. Esta percepción ha llevado a una mayor preferencia por los embalajes a base de papel entre los consumidores conscientes del medio ambiente. Los consumidores de hoy toman cada vez más decisiones conscientes del medio ambiente al comprar productos. La disponibilidad de bolsas y embalajes de papel les permite elegir opciones que se alinean con sus valores y contribuyen a un futuro más sostenible. Nuevamente, el papel es un recurso renovable y se puede reciclar varias veces, lo que minimiza su huella ambiental en comparación con las películas de plástico. Además, los envases de papel suelen biodegradarse fácilmente si se compostan correctamente, lo que atrae a los clientes preocupados por el medio ambiente hacia los envases de papel reciclables en lugar de los envases de film.

- Fluctuación de los precios de las materias primas

Se fabrican diversas películas de embalaje utilizando una variedad de materias primas. Estas materias primas son materiales plásticos como el polietileno y el polipropileno que se derivan del petróleo crudo. Estos materiales no son biodegradables, son difíciles de reciclar y son perjudiciales para el medio ambiente, incluido el agua y la tierra. La selección de la materia prima se basa principalmente en el uso final de las películas de barrera y las películas de embalaje normales. Algunas de las principales materias primas utilizadas en las películas de embalaje incluyen PE, PP, EVOH, PLA, PVDC y PP.

La mayor parte de las materias primas utilizadas en la producción de estos materiales son recursos no renovables y, por lo tanto, existen grandes fluctuaciones en el precio de estas materias primas. Además, el aumento de la demanda y la disponibilidad de una cantidad insuficiente de materias primas disponibles, y por lo tanto el aumento inusual de los precios, provocan volatilidad en el mercado de películas para embalaje. También la volatilidad de los precios de las materias primas tradicionales como el polietileno y el polipropileno, que se derivan del petróleo, a menudo conduce a un aumento de los costos de producción y márgenes de beneficio impredecibles. Esta inestabilidad incentiva a los fabricantes de películas para embalaje a diversificar sus fuentes de materias primas. Además, con la llegada de la pandemia de COVID-19, los precios de estas materias primas experimentaron una tendencia al alza debido a las restricciones en el transporte y la escasez de materias primas.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analistas, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias comienzan a sufrir. Los efectos previstos de la crisis económica sobre los precios y la accesibilidad de los productos se tienen en cuenta en los informes de conocimiento del mercado y los servicios de inteligencia que ofrece DBMR. Con esto, nuestros clientes pueden normalmente mantenerse un paso por delante de sus competidores, proyectar sus ventas e ingresos y estimar sus gastos de ganancias y pérdidas.

Alcance del mercado de películas para embalaje

El mercado está segmentado en función del tipo, la flexibilidad, la naturaleza y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Polietileno (PE)

- Polipropileno (PP)

- Tereftalato de polietileno (PET)

- Cloruro de polivinilo (PVC)

- Ácido poliláctico (PLA)

- Celulosa

- Alcohol vinílico de etileno (EVOH)

- Otros

Flexibilidad

- Flexible

- Rígido

Naturaleza

- Sintético

- De base biológica

Solicitud

- Alimentos y bebidas

- Productos farmacéuticos

- Cuidado Personal y Cosmética

- Electricidad y electrónica

- Decoración del hogar y del hogar

- Comida para mascotas

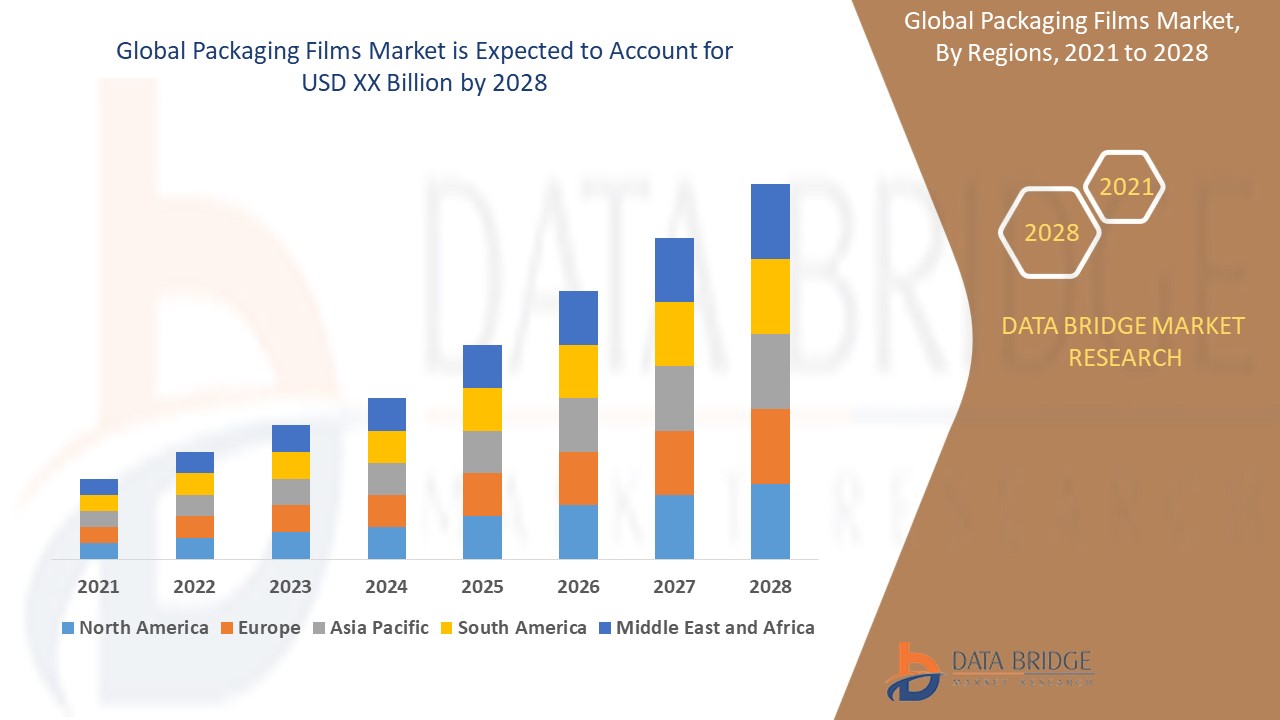

Análisis regional del mercado de películas de embalaje para otros productos

Se analiza el mercado y se proporcionan información sobre el tamaño y las tendencias del mercado por país, tipo, flexibilidad, naturaleza y aplicación como se mencionó anteriormente.

Los países cubiertos en el informe de mercado son EE. UU., Canadá, México, Brasil, Argentina, Resto de América del Sur, Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza, Resto de Europa, Japón, China, India, Corea del Sur, Australia y Nueva Zelanda, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Israel, Sudáfrica, Resto de Medio Oriente y África.

Se espera que el segmento de Asia-Pacífico domine el mercado mundial de películas para embalaje. Se espera que China domine en Asia-Pacífico debido a la creciente demanda de alimentos congelados y refrigerados. Se espera que Estados Unidos domine en América del Norte debido al crecimiento del comercio electrónico, la mensajería y el servicio de entrega. Se espera que Alemania domine en Europa debido al aumento en la adopción de películas para embalaje en la industria farmacéutica y agrícola.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de películas para embalaje

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de películas de embalaje que operan en el mercado son:

- Novolex

- Amcor plc

- Grupo de plásticos Sigma

- Grupo Interplast

- Papel Mettler

- Grupo Berry Global, Inc.

- Mundo

- Uflex limitada

- ProAmpac

- Industrias Taghleef

- Junto al parque

- Corporación DACO

- Llave Pentaplast

- GRUPO AEP

- TIPA LTDA.

Últimos avances en el mercado de películas para embalaje

- En octubre de 2022, Novolex obtuvo una certificación compostable de referencia de BPI, concretamente las etiquetas duales How2Compost y How2Recycle para productos de bolsas y sacos de papel, denominadas "Dubl Life". Esta certificación ayudará a la empresa a ganar el reconocimiento de los clientes y a mejorar su alcance en el mercado.

- En marzo de 2024, Amcor plc, líder mundial en el desarrollo y producción de soluciones de envasado responsables, recibió ocho premios Flexible Packaging Achievement Awards por sus contribuciones innovadoras y sostenibles a la industria. Entre todos los premios, los revestimientos para IBC McCoy Dunnage Free para productos asépticos a granel recibieron tres premios: Oro por sostenibilidad y Plata por ampliar el uso de envases flexibles e innovación técnica. Esto fortalecerá el objetivo de la empresa de lograr sus objetivos de sostenibilidad y lograr soluciones más innovadoras.

- En marzo de 2021, AEP Group obtuvo con éxito la certificación ISCC PLUS. Esta certificación subraya el compromiso con la economía circular y la adhesión a los estándares globales de sostenibilidad. Valida el cumplimiento de los criterios ecológicos y sociales por parte de la empresa y sus esfuerzos por reducir las emisiones de gases de efecto invernadero, así como nuestro compromiso con la trazabilidad de la cadena de suministro.

- En octubre de 2023, Forbes reconoció a Berry Global Inc. (NYSE: BERY) como uno de los mejores empleadores de Estados Unidos en Indiana. Este reconocimiento se basó en los comentarios de los empleados, incluidos los aportes directos y las recomendaciones. Ayudó a generar confianza entre empleadores y empleados y tuvo un impacto positivo para sus clientes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.