Global Online Clothing Rental Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.61 Billion

USD

39.93 Billion

2024

2032

USD

2.61 Billion

USD

39.93 Billion

2024

2032

| 2025 –2032 | |

| USD 2.61 Billion | |

| USD 39.93 Billion | |

|

|

|

|

Segmentación del mercado global de alquiler de ropa en línea, por tipo de producto (prendas de punto, pantalones y vaqueros, monos, trajes y blazers, abrigos y chaquetas, faldas y pantalones cortos, y ropa étnica), modelo de negocio (modelo independiente y modelo de suscripción), orientación al consumidor (hombres, mujeres y niños), usuario final (empresa a empresa [B2B], empresa a consumidor [B2C] y consumidor a consumidor [C2C]): tendencias de la industria y pronóstico hasta 2032.

¿Cuál es el tamaño y la tasa de crecimiento del mercado global de alquiler de ropa en línea?

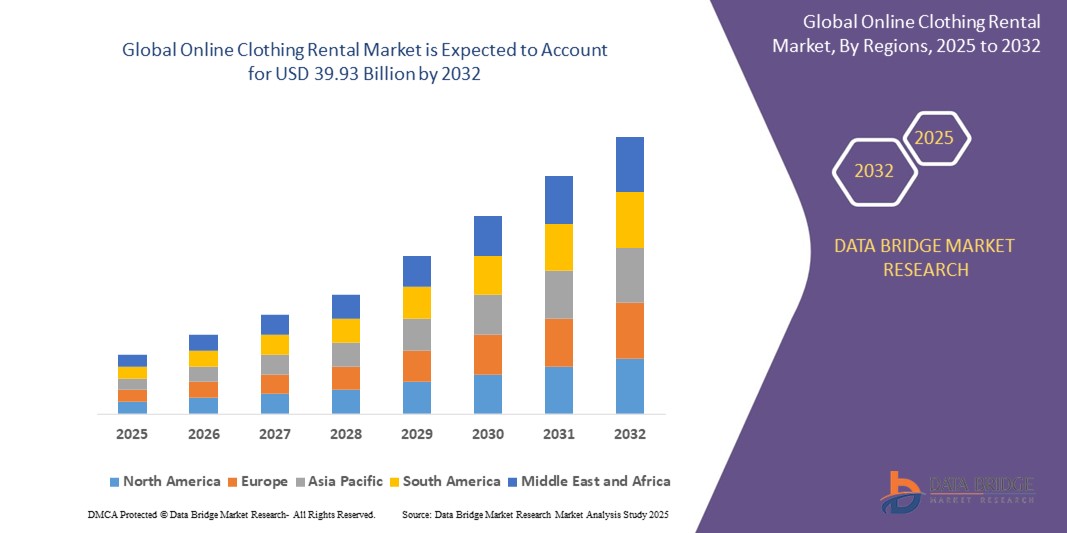

- El tamaño del mercado global de alquiler de ropa en línea se valoró en USD 2.61 mil millones en 2024 y se espera que alcance los USD 39.93 mil millones para 2032 , con una CAGR del 40,60% durante el período de pronóstico.

- El mercado de alquiler de ropa en línea prospera gracias a la comodidad y la sostenibilidad, ofreciendo prendas de diseño sin restricciones de propiedad. Esto fomenta una economía circular, reduciendo el desperdicio de moda y ahorrando dinero y espacio a los clientes. Sus ventajas, como la asequibilidad, la variedad y la responsabilidad ambiental, lo convierten en una opción predilecta para los consumidores modernos, incluyendo la ropa de alquiler para hombres.

¿Cuáles son las principales conclusiones del mercado de alquiler de ropa en línea?

- El alquiler de ropa ofrece a los consumidores con presupuesto ajustado acceso a artículos de diseño premium a una fracción de su precio de venta. Por ejemplo, alquilar un vestido de diseñador para una ocasión especial puede costar solo una fracción de su precio de venta, lo que permite disfrutar de la moda de lujo sin gastar una fortuna.

- Esta solución rentable permite a los compradores mantener un guardarropa elegante sin el compromiso financiero de comprar prendas caras directamente.

- América del Norte dominó el mercado global de alquiler de ropa en línea en 2024, capturando la mayor participación en los ingresos del 38,7%, impulsada por el creciente enfoque del consumidor en la moda sostenible, la creciente popularidad de los modelos de economía compartida y la rápida expansión de las plataformas digitales que ofrecen servicios de alquiler.

- Se proyecta que el mercado de alquiler de ropa en línea de Asia-Pacífico crecerá a la CAGR más rápida del 25,6 % entre 2025 y 2032, impulsado por la rápida urbanización, el crecimiento de la población de clase media y la creciente conciencia de la moda entre los grupos demográficos más jóvenes.

- El segmento de pantalones y jeans dominó el mercado de alquiler de ropa en línea con la mayor participación en los ingresos del 27,4% en 2024, atribuido a la alta demanda de opciones de moda versátiles y cotidianas adecuadas tanto para ocasiones casuales como formales.

Alcance del informe y segmentación del mercado de alquiler de ropa en línea

|

Atributos |

Información clave del mercado de alquiler de ropa en línea |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Norteamérica

Europa

Asia-Pacífico

Oriente Medio y África

Sudamérica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de alquiler de ropa en línea?

Creciente popularidad de la moda asequible con enfoque en la sostenibilidad

- Una tendencia importante que está transformando el mercado global de alquiler de ropa en línea es el creciente cambio de los consumidores hacia una moda asequible que se alinee con la sostenibilidad ambiental y el consumo consciente.

- Los consumidores millennials y de la generación Z, en particular, están adoptando la moda de alquiler como una solución para reducir los desechos, disminuir la huella de carbono y combatir el impacto ambiental de la moda rápida.

- Las principales plataformas de alquiler están ampliando sus ofertas ecológicas mediante la introducción de modelos comerciales circulares, asociaciones de reciclaje de prendas y servicios de suscripción que promueven la variedad de vestuarios sin necesidad de ser propietario.

- Por ejemplo, varios proveedores ahora ofrecen colecciones de alquiler seleccionadas hechas de telas orgánicas, materiales reciclados o textiles de origen sostenible , que atienden tanto las necesidades de la moda como la conciencia ambiental.

- Los movimientos globales que promueven la moda circular, la reducción de residuos y la neutralidad de carbono están reforzando la adopción del alquiler de ropa en línea como una alternativa práctica a las compras de ropa tradicionales.

- Se espera que esta tendencia impulsada por la sostenibilidad revolucione la forma en que los consumidores acceden a la moda, creando oportunidades a largo plazo para las plataformas de alquiler centradas en soluciones de vestuario ecológicas, asequibles y flexibles.

¿Cuáles son los impulsores clave del mercado de alquiler de ropa en línea?

- La creciente demanda de soluciones de moda rentables, flexibles y sostenibles es un impulsor principal del mercado de alquiler de ropa en línea en todo el mundo, ya que los consumidores buscan cada vez más variedad sin comprometerse con la propiedad.

- Por ejemplo, en febrero de 2024, Rent the Runway anunció una expansión de sus colecciones de alquiler de diseñadores, integrando marcas más sostenibles y ofreciendo tallas inclusivas para satisfacer las diversas preferencias de los consumidores.

- La creciente influencia de las tendencias de las redes sociales, la cultura de los influencers y el deseo de actualizaciones frecuentes de vestuario para eventos, viajes y uso diario están acelerando la adopción de plataformas de alquiler de ropa a nivel mundial.

- La creciente conciencia sobre el impacto ambiental de la moda, sumada a las preocupaciones sobre la asequibilidad ante la incertidumbre económica, está impulsando los servicios de alquiler como una alternativa a las compras de moda rápida.

- Además, los avances digitales en herramientas de dimensionamiento basadas en IA , recomendaciones personalizadas y modelos de suscripción están mejorando la experiencia y la retención del usuario, lo que impulsa el crecimiento del mercado.

- El crecimiento del comercio electrónico , la urbanización y la demanda de conveniencia de los consumidores continúan expandiendo el alcance de las plataformas de alquiler de ropa en línea en áreas metropolitanas y grupos demográficos más jóvenes.

¿Qué factor está desafiando el crecimiento del mercado de alquiler de ropa en línea?

- Las complejidades logísticas y los costos operativos asociados con la gestión de inventario, el mantenimiento de prendas y la logística inversa presentan desafíos importantes para el mercado de alquiler de ropa en línea.

- Por ejemplo, los altos gastos de limpieza, reparación y transporte pueden reducir la rentabilidad de las plataformas de alquiler, especialmente para prendas de alta gama o delicadas que requieren un manejo cuidadoso.

- Además, las preocupaciones en torno a la higiene, la calidad de las prendas y la entrega oportuna pueden disuadir a ciertos segmentos de consumidores, particularmente en regiones con infraestructura limitada o menor penetración digital.

- El mercado también enfrenta la competencia del creciente mercado de reventa (ropa usada), que ofrece a los consumidores alternativas sostenibles con plena propiedad a precios competitivos.

- Además, la conciencia limitada y las barreras culturales en torno al alquiler de moda en ciertas regiones en desarrollo restringen la expansión del mercado más allá de los grupos de consumidores urbanos conocedores de la tecnología.

- Para abordar estos desafíos se necesitarán inversiones estratégicas en logística avanzada, asociaciones para el cuidado ecológico de las prendas, educación del consumidor y tecnología escalable para garantizar experiencias de alquiler fluidas y de alta calidad.

¿Cómo está segmentado el mercado de alquiler de ropa online?

El mercado está segmentado según el tipo de producto, modelo de negocio, orientación al consumidor y usuario final.

- Por tipo de producto

Según el tipo de producto, el mercado de alquiler de ropa online se segmenta en prendas de punto, pantalones y vaqueros, monos, trajes y blazers, abrigos y chaquetas, faldas y pantalones cortos, y ropa étnica. El segmento de pantalones y vaqueros dominó el mercado de alquiler de ropa online con la mayor cuota de ingresos, un 27,4 %, en 2024, gracias a la alta demanda de opciones de moda versátiles y para el día a día, tanto para ocasiones informales como formales. El alquiler de pantalones y vaqueros es popular entre los consumidores que buscan asequibilidad y flexibilidad en su guardarropa sin necesidad de tenerlos a largo plazo.

Se espera que el segmento de abrigos y chaquetas sea testigo de la tasa de crecimiento más rápida entre 2025 y 2032, impulsado por la creciente demanda de alquileres de ropa exterior de primera calidad, particularmente para necesidades estacionales, eventos especiales y consumidores urbanos conscientes de la moda.

- Por modelo de negocio

Según el modelo de negocio, el mercado de alquiler de ropa en línea se segmenta en un modelo independiente y un modelo de suscripción. El segmento del modelo de suscripción representó la mayor cuota de mercado en ingresos, con un 61,8 %, en 2024, gracias a la creciente preferencia de los consumidores por un acceso flexible y rentable a la moda y opciones de vestuario seleccionadas. Los modelos de suscripción permiten a los usuarios rotar sus conjuntos con regularidad, lo que mejora la variedad y reduce el impacto ambiental de la moda rápida

Se anticipa que el segmento de modelos independientes registrará la CAGR más rápida entre 2025 y 2032, impulsada por la creciente demanda de alquileres únicos para eventos como bodas, fiestas y funciones comerciales, donde los consumidores priorizan la vestimenta específica para la ocasión sin el compromiso de suscripciones continuas.

- Por orientación al consumidor

Según la orientación al consumidor, el mercado de alquiler de ropa en línea se segmenta en hombres, mujeres y niños. El segmento femenino dominó el mercado con la mayor participación en los ingresos, un 62.5 %, en 2024, impulsado por mayores tasas de participación en el alquiler de ropa de moda, la diversa disponibilidad de productos y un mayor enfoque en la sostenibilidad y la experimentación con el vestuario entre las consumidoras

Se proyecta que el segmento masculino experimentará la tasa de crecimiento más rápida entre 2025 y 2032, debido a la creciente conciencia de la moda masculina, la expansión de los servicios de alquiler de ropa formal y la creciente tendencia de opciones de vestuario sostenibles y asequibles para hombres en áreas urbanas.

- Por usuario final

En función del usuario final, el mercado de alquiler de ropa en línea se segmenta en empresa a empresa (B2B), empresa a consumidor (B2C) y consumidor a consumidor (C2C). El segmento de empresa a consumidor (B2C) dominó el mercado con la mayor cuota de ingresos del 69,4 % en 2024, atribuido al rápido crecimiento de las plataformas de alquiler que ofrecen servicios directos al consumidor, aplicaciones móviles fáciles de usar y condiciones de alquiler flexibles que satisfacen las necesidades individuales de la moda

Se prevé que el segmento de consumidor a consumidor (C2C) experimente la CAGR más rápida entre 2025 y 2032, respaldado por la creciente popularidad de las plataformas de alquiler de ropa entre pares, que permiten a los usuarios alquilar, prestar y monetizar sus guardarropas personales al tiempo que promueven el consumo de moda sostenible.

¿Qué región posee la mayor participación en el mercado de alquiler de ropa en línea?

- Norteamérica dominó el mercado global de alquiler de ropa en línea en 2024, captando la mayor cuota de ingresos con un 38,7 %, impulsada por el creciente interés de los consumidores en la moda sostenible, la creciente popularidad de los modelos de economía colaborativa y la rápida expansión de las plataformas digitales que ofrecen servicios de alquiler. El sólido poder adquisitivo de la región y su énfasis en la asequibilidad, la comodidad y la reducción del desperdicio de moda impulsan su adopción generalizada en el mercado.

- Países como Estados Unidos y Canadá están a la vanguardia, respaldados por plataformas de alquiler bien establecidas, una creciente aceptación de los modelos de suscripción y una mayor conciencia sobre la moda circular y el impacto ambiental.

- Además, la evolución de las preferencias de los consumidores por opciones de vestuario flexibles, alquileres de ropa específicos para eventos y prendas de diseñadores de alta gama sin cargas de propiedad sigue impulsando un crecimiento significativo en el mercado de alquiler de ropa en línea de América del Norte.

Análisis del mercado de alquiler de ropa en línea en EE. UU.

El mercado estadounidense de alquiler de ropa en línea obtuvo la mayor cuota de ingresos en Norteamérica en 2024, gracias a la base de consumidores con gran conocimiento tecnológico, la gran población urbana y la sólida cultura de consumo de moda orientada a la comodidad. Las principales plataformas ofrecen una amplia variedad de productos, desde ropa formal hasta ropa de diario, con planes de alquiler flexibles, entregas rápidas y devoluciones fáciles. La creciente conciencia ambiental, sumada a la demanda de ropa premium, para ocasiones especiales y sostenible, continúa impulsando la expansión del mercado en todo Estados Unidos.

Análisis del mercado de alquiler de ropa en línea de Canadá

Se prevé un crecimiento constante del mercado canadiense de alquiler de ropa en línea, impulsado por la creciente demanda de alternativas de moda asequibles y de alta calidad, la creciente concienciación sobre la sostenibilidad y la creciente adopción de plataformas de economía colaborativa. Los consumidores canadienses están adoptando opciones de alquiler, tanto por suscripción como por única vez, para eventos, ropa de trabajo y moda informal, impulsados por la comodidad, el ahorro y los beneficios ambientales.

¿Cuál es la región de mayor crecimiento en el mercado de alquiler de ropa en línea?

Se proyecta que el mercado de alquiler de ropa en línea de Asia-Pacífico crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta, del 25,6 %, entre 2025 y 2032, impulsado por la rápida urbanización, el crecimiento de la clase media y la creciente conciencia de la moda entre los jóvenes. La creciente penetración de internet, la expansión de las plataformas de comercio electrónico y la creciente influencia de las tendencias de moda occidentales están acelerando el crecimiento del mercado en países clave como China, India y Japón. Además, las preocupaciones ambientales, los desafíos de asequibilidad y la creciente aceptación de la cultura del alquiler entre los millennials y la generación Z están impulsando la adopción del alquiler de ropa, tanto informal como para ocasiones especiales.

Análisis del mercado de alquiler de ropa en línea en China

China lideró el mercado de alquiler de ropa en línea en Asia-Pacífico en 2024, impulsada por el aumento de la renta disponible, el auge de la población urbana y la creciente popularidad de las plataformas para compartir moda. Los consumidores chinos están adoptando la flexibilidad y la sostenibilidad de los servicios de alquiler, especialmente para la moda de alta gama y de diseño, así como para la ropa para eventos. La integración de la personalización basada en IA, las aplicaciones móviles fluidas y las prácticas ecológicas está impulsando aún más la expansión del mercado.

Análisis del mercado de alquiler de ropa en línea en India

El mercado indio de alquiler de ropa en línea está experimentando un rápido crecimiento, impulsado por una población joven y preocupada por la moda, la creciente penetración de los teléfonos inteligentes y la creciente conciencia ambiental. El acceso asequible a moda premium para bodas, fiestas y entornos profesionales está impulsando la demanda de modelos de alquiler tanto por suscripción como por pago por uso. El mercado se beneficia de la expansión de los ecosistemas de startups y la creciente aceptación de alternativas de moda sostenible entre los consumidores urbanos.

Análisis del mercado de alquiler de ropa en línea en Japón

El mercado japonés de alquiler de ropa online experimenta un crecimiento constante, impulsado por la cultura de la moda minimalista, la demanda de ropa premium de alta calidad y el creciente énfasis en el consumo sostenible. Los consumidores japoneses optan cada vez más por los servicios de alquiler para acceder a moda de temporada, ropa formal y marcas de lujo, y cada vez más prefieren las plataformas digitales que ofrecen comodidad y soluciones de vestuario personalizadas.

¿Cuáles son las principales empresas en el mercado de alquiler de ropa online?

La industria de alquiler de ropa en línea está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Rent the Runway (EE. UU.)

- Omapal Technologies Private Limited (India)

- GlamCorner (Australia)

- UNION STATION KANSAS CITY (EE. UU.)

- Etiquette Formal Hire Ltd. (Reino Unido)

- Le Tote, Inc. (EE. UU.)

- Flyrobe (India)

- Chic by Choice (Portugal)

- La Reina (EE. UU.)

- STYLE LEND (EE. UU.)

- Gwynnie Bee Inc. (EE. UU.)

- AEO Management Co. (EE. UU.)

- Poshmark, Inc. (EE. UU.)

- Envoged (India)

- Secoo Holding (China)

- Share Wardrobe (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado global de alquiler de ropa en línea?

- En mayo de 2023, ASOS, la tienda británica de moda online, lanzó su primera colección de alquiler, con más de 180 estilos enfocados en ropa de fiesta femenina. La gama incluye vestidos para invitadas de boda, novias y damas de honor, que se adaptan a diversos tipos de cuerpo, con opciones en tallas curvilíneas, petite y altas.

- En abril de 2022, Flyrobe se asoció con Franchise Mart para expandir su franquicia bajo RENT IT BAE, un servicio de alquiler premium en línea. Esta colaboración busca acercar las últimas tendencias de moda directamente a la puerta de los clientes, mejorando la comodidad y el acceso a la moda de alta gama.

- En diciembre de 2021, Flyrobe, empresa de alquiler de ropa, superó el millón de clientes tras su recuperación de la pandemia. Con presencia actual en 30 ciudades de la India, este hito pone de manifiesto la resiliencia de la industria del alquiler de ropa y su atractivo para los consumidores que buscan soluciones de estilo rentables.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.