Global Natural Fibers Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

60.42 Billion

USD

108.57 Billion

2024

2032

USD

60.42 Billion

USD

108.57 Billion

2024

2032

| 2025 –2032 | |

| USD 60.42 Billion | |

| USD 108.57 Billion | |

|

|

|

|

Segmentación del mercado global de fibras naturales, por fibras (algodón, lana, lino, seda, yute, cáñamo, sisal, kenaf y otras), canal de distribución (fabricantes, distribuidores, mayoristas, minoristas y otros), aplicación (moda y ropa, mobiliario y hogar, e industrial y técnica): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de fibras naturales

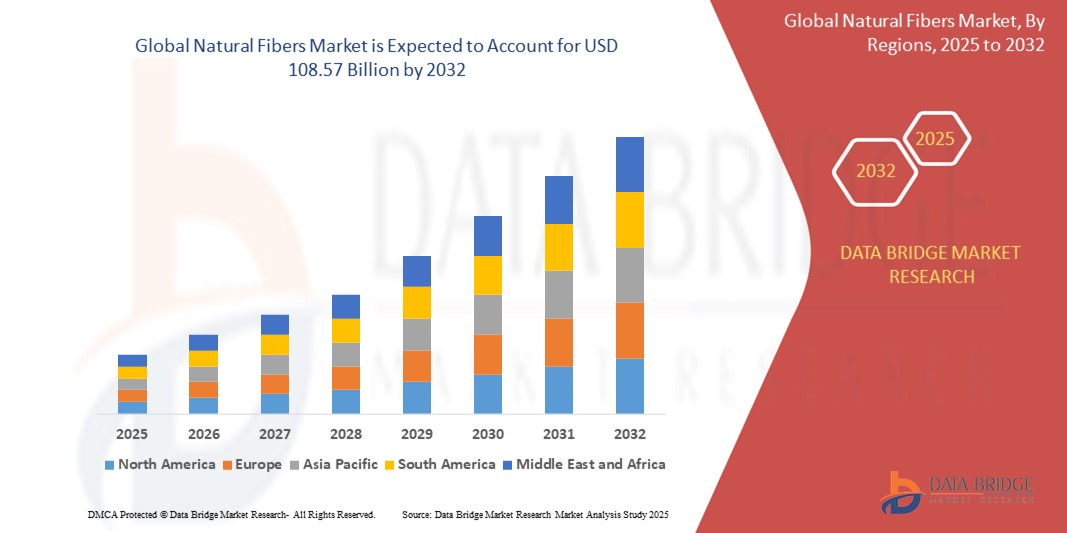

- El tamaño del mercado mundial de fibras naturales se valoró en USD 60,42 mil millones en 2024 y se espera que alcance los USD 108,57 mil millones para 2032 , con una CAGR del 7,60% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de alternativas ecológicas y biodegradables a las fibras sintéticas en industrias como la textil, la automotriz, la construcción y el embalaje.

- La creciente conciencia de los consumidores respecto de la sostenibilidad, junto con las presiones regulatorias para reducir las huellas de plástico y carbono, está acelerando aún más la adopción de fibras naturales tanto en las economías desarrolladas como en las emergentes.

Análisis del mercado de fibras naturales

- El mercado está siendo testigo de un cambio hacia materiales sostenibles como el algodón, el lino, el yute, el cáñamo, el bonote y el sisal, que ofrecen un menor impacto ambiental y aplicaciones versátiles.

- Las industrias están integrando cada vez más fibras naturales en compuestos y textiles para cumplir con los estándares de certificación ecológica y atraer a consumidores conscientes del medio ambiente.

- Asia-Pacífico dominó el mercado de fibras naturales con la mayor participación en los ingresos del 38,74 % en 2024, impulsada por una fuerte presencia de fuentes de materias primas, bajos costos laborales y una creciente demanda de las industrias textiles y de embalaje.

- Se espera que la región de América del Norte sea testigo de la mayor tasa de crecimiento en el mercado mundial de fibras naturales, impulsada por la creciente conciencia de los consumidores hacia los materiales sostenibles y biodegradables, junto con la creciente demanda de productos ecológicos en los sectores de la moda, la automoción y la construcción.

- El segmento del algodón dominó el mercado con la mayor participación en los ingresos, un 34,5%, en 2024, impulsado por su amplio uso en la industria textil y de la confección gracias a su comodidad, transpirabilidad y alta aceptación por parte del consumidor. La naturaleza biodegradable del algodón y su compatibilidad con las prácticas de agricultura orgánica también han fortalecido su atractivo en medio de la creciente preocupación por la sostenibilidad. Los fabricantes prefieren cada vez más el algodón orgánico para cumplir con los requisitos de la etiqueta ecológica y la demanda de los consumidores de un abastecimiento ético.

Alcance del informe y segmentación del mercado de fibras naturales

|

Atributos |

Perspectivas clave del mercado de fibras naturales |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de fibras naturales

“Creciente integración de fibras naturales en compuestos automotrices”

- Las fibras naturales como el yute, el lino y el kenaf se utilizan cada vez más en los interiores de los vehículos, incluidos los paneles de las puertas y los tableros.

- Los fabricantes de automóviles prefieren las fibras naturales por su peso ligero, lo que ayuda a mejorar la eficiencia del combustible.

- La presión regulatoria en Europa está promoviendo materiales de origen biológico y reciclables en la producción automotriz

- Los compuestos de fibra natural ofrecen un menor impacto ambiental en comparación con los materiales sintéticos tradicionales.

- Las inversiones en materiales sostenibles por parte de los fabricantes de equipos originales (OEM) de automóviles están impulsando la adopción de fibras naturales

- Por ejemplo, BMW utiliza fibra de kenaf en los paneles de las puertas de su coche eléctrico i3 para reducir el peso y mejorar la sostenibilidad.

Dinámica del mercado de fibras naturales

Conductor

Creciente demanda de materiales sostenibles y biodegradables

- Las preocupaciones ambientales están impulsando un cambio global hacia materiales biodegradables y renovables.

- Los consumidores prefieren cada vez más alternativas ecológicas en textiles, embalajes y muebles.

- Las prohibiciones gubernamentales sobre plásticos y materiales no biodegradables están apoyando la adopción de fibras naturales

- Las fibras naturales reducen la carga de los vertederos y las emisiones de carbono en comparación con sus contrapartes sintéticas.

- Las marcas están incorporando fibras orgánicas para cumplir con los objetivos de sostenibilidad y atraer a compradores conscientes.

- Por ejemplo, Levi's ha introducido colecciones que utilizan cáñamo y algodón orgánico para apoyar sus iniciativas positivas para el clima.

Restricción/Desafío

Problemas de calidad inconsistente y de la cadena de suministro

- Las fibras naturales a menudo varían en textura, resistencia y durabilidad debido a las condiciones agrícolas y climáticas.

- La disponibilidad estacional genera un suministro impredecible, lo que afecta las aplicaciones a gran escala.

- Una infraestructura deficiente de almacenamiento y transporte puede provocar el deterioro y la degradación de las fibras.

- Los fabricantes luchan por estandarizar la calidad de la fibra para aplicaciones de alto rendimiento

- La volatilidad de los costos debido a rendimientos inconsistentes dificulta la planificación y las adquisiciones a largo plazo

- Por ejemplo, el sector de la construcción ha limitado el uso de yute en compuestos estructurales debido a la resistencia a la tracción variable entre lotes.

Alcance del mercado de fibras naturales

El mercado está segmentado según las fibras, el canal de distribución y la aplicación.

• Por fibras

En cuanto a las fibras, el mercado de fibras naturales se segmenta en algodón, lana, lino, seda, yute, cáñamo, sisal, kenaf y otras. El segmento del algodón dominó el mercado con la mayor participación en los ingresos, un 34,5 %, en 2024, gracias a su amplio uso en la industria textil y de la confección gracias a su comodidad, transpirabilidad y alta aceptación por parte del consumidor. La naturaleza biodegradable del algodón y su compatibilidad con las prácticas de agricultura orgánica también han reforzado su atractivo en medio de la creciente preocupación por la sostenibilidad. Los fabricantes prefieren cada vez más el algodón orgánico para cumplir con los requisitos de la etiqueta ecológica y la demanda de los consumidores de un abastecimiento ético.

Se prevé que el segmento del cáñamo experimente su mayor crecimiento entre 2025 y 2032, impulsado por su rápido ciclo de cultivo, su bajo impacto ambiental y su creciente uso tanto en aplicaciones textiles como industriales. La resistencia y durabilidad del cáñamo, junto con su mínima necesidad de pesticidas, están despertando interés en las industrias de la moda, la automoción y la construcción, especialmente en Europa y Norteamérica.

• Por canal de distribución

Según el canal de distribución, el mercado de fibras naturales se segmenta en fabricantes, distribuidores, mayoristas, minoristas y otros. El segmento de fabricantes obtuvo la mayor cuota de mercado en 2024, gracias al creciente número de empresas integradas verticalmente que se centran en el abastecimiento sostenible y el procesamiento interno para garantizar la calidad y la trazabilidad. La colaboración directa con los productores de fibra también permite a los fabricantes reducir costes y adaptar las características de la fibra a las necesidades del usuario final.

Se prevé que el segmento minorista experimente el mayor crecimiento entre 2025 y 2032, impulsado por el creciente interés de los consumidores en productos ecológicos y la expansión de las plataformas de comercio electrónico y minoristas especializados. Los minoristas están aprovechando la creciente demanda de ropa, decoración del hogar y artículos de estilo de vida sostenibles, ofreciendo alternativas basadas en fibras naturales y promoviendo sus beneficios ambientales mediante el desarrollo de marcas y certificaciones.

• Por aplicación

Según su aplicación, el mercado de fibras naturales se segmenta en moda y confección, mobiliario y hogar, e industrial y técnico. Este segmento captó la mayor cuota de mercado en 2024, impulsado por la creciente preferencia de los consumidores por tejidos transpirables y respetuosos con la piel, y el aumento de la demanda de moda sostenible. Las marcas de moda globales que buscan reducir su huella ambiental están adoptando cada vez más fibras naturales como el algodón, la lana y la seda.

Se prevé que el segmento industrial y técnico experimente el mayor crecimiento entre 2025 y 2032, impulsado por el creciente uso de fibras como el lino, el kenaf y el cáñamo en aplicaciones de automoción, embalaje y construcción. Estas fibras se están integrando en biocompuestos y materiales de aislamiento, proporcionando soluciones duraderas y ligeras, a la vez que cumplen con los estándares regulatorios y de sostenibilidad.

Análisis regional del mercado de fibras naturales

- Asia-Pacífico dominó el mercado de fibras naturales con la mayor participación en los ingresos del 38,74 % en 2024, impulsada por una fuerte presencia de fuentes de materias primas, bajos costos laborales y una creciente demanda de las industrias textiles y de embalaje.

- Los países de la región se benefician de sectores agrícolas de algodón y yute establecidos, así como de una base industrial en rápido crecimiento que utiliza cáñamo y kenaf para aplicaciones técnicas.

- Los incentivos gubernamentales que promueven el uso de materiales biodegradables y ecológicos están acelerando aún más la adopción de fibras naturales en países como India, China y Bangladesh.

Perspectiva del mercado de fibras naturales de China

El mercado chino de fibras naturales representó la mayor participación en los ingresos de la región Asia-Pacífico en 2024, impulsado por su sólida base de producción de algodón, cáñamo y seda, así como por el liderazgo del país en la fabricación textil mundial. La amplia capacidad de la cadena de suministro de China, sumada a las iniciativas gubernamentales que promueven la agricultura sostenible y los materiales biodegradables, está impulsando el uso de fibras naturales en la confección, el mobiliario y aplicaciones industriales. Las marcas y los exportadores nacionales incorporan cada vez más materiales ecológicos para cumplir con las normas regulatorias globales y las expectativas de los consumidores, especialmente de los mercados norteamericano y europeo.

Perspectiva del mercado de fibras naturales de Japón

Se prevé un crecimiento sostenido del mercado japonés de fibras naturales durante el período de pronóstico, impulsado por la creciente preferencia de los consumidores por materiales de alta calidad, naturales y ecológicos en la moda y los artículos para el hogar. La larga tradición japonesa en el uso de la seda y el algodón, sumada a la innovación en la mezcla y el acabado de textiles, está impulsando la adopción de fibras naturales en los segmentos de ropa y estilo de vida de alta gama. Además, el énfasis del país en la arquitectura sostenible y los envases ecológicos está impulsando la demanda de compuestos y materiales a base de fibras naturales en aplicaciones industriales especializadas.

Perspectiva del mercado de fibras naturales de América del Norte

Se prevé que el mercado norteamericano de fibras naturales experimente su mayor crecimiento entre 2025 y 2032, impulsado por una mayor concienciación de los consumidores sobre el impacto ambiental, una transición hacia los textiles orgánicos y una creciente demanda en las industrias de muebles y embalajes para el hogar. Grandes marcas estadounidenses están incorporando fibras naturales como el algodón y la lana orgánicos en sus líneas de productos para cumplir con los objetivos de sostenibilidad y atender al segmento de consumidores con conciencia ecológica.

Perspectiva del mercado de fibras naturales de EE. UU.

Se prevé que el mercado estadounidense de fibras naturales experimente su mayor crecimiento entre 2025 y 2032, debido al creciente interés en estilos de vida sostenibles, la expansión del cultivo de algodón orgánico y los avances tecnológicos en el procesamiento de fibras. Las industrias de la moda, el mueble y la automoción recurren cada vez más a las fibras naturales para aplicaciones que abarcan desde tapicería hasta biocompuestos. La presencia de marcas líderes de ropa y una sólida infraestructura minorista también contribuyen al crecimiento del mercado, especialmente a través de canales de eco-compra tanto físicos como en línea.

Perspectiva del mercado europeo de fibras naturales

Se prevé que Europa experimente la tasa de crecimiento más rápida entre 2025 y 2032, impulsada por estrictas regulaciones ambientales, la preferencia de los consumidores por productos sostenibles y la integración de fibras naturales en aplicaciones industriales. Las políticas de la Unión Europea que apoyan las prácticas de economía circular están fomentando el uso de lino, cáñamo y lana en los sectores de la moda, la automoción y la construcción. Francia, Alemania y el Reino Unido lideran la innovación y la adopción en la región.

Análisis del mercado de fibras naturales en Alemania

Se prevé que Alemania experimente la tasa de crecimiento más rápida entre 2025 y 2032, gracias a sus robustos sectores textil y automotriz, que están adoptando activamente fibras naturales como el lino y el cáñamo en interiores y componentes técnicos. El énfasis del país en una vida ecológica y una construcción energéticamente eficiente también está creando un entorno favorable para el uso de soluciones de aislamiento y embalaje biodegradables basadas en fibras naturales.

Perspectiva del mercado de fibras naturales del Reino Unido

Se prevé que el mercado británico de fibras naturales experimente su mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de moda de origen ético, el apoyo a los objetivos de sostenibilidad de los gobiernos y la creciente popularidad de los materiales naturales para la decoración y el mobiliario del hogar. La presencia de cadenas minoristas responsables y marcas de moda que promueven colecciones ecológicas está impulsando el interés del consumidor, mientras que las innovaciones en textiles de origen vegetal también están atrayendo inversiones en investigación y desarrollo.

Cuota de mercado de las fibras naturales

La industria de fibras naturales está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Vardhman Textiles Limited (India)

- Grasim Industries Limited (India)

- ESTILOS TEXTILES ANANDHI (India)

- Bcomp (Suiza)

- The Natural Fibre Company (Reino Unido)

- Procotex (Bélgica)

- FlexForm Technologies (EE. UU.)

- Bast Fibre Technologies Inc. (Canadá)

- Lenzing AG (Austria)

- Fibras naturales Barnhardt (EE. UU.)

Últimos avances en el mercado mundial de fibras naturales

- En octubre de 2022, Bast Fibre Technologies Inc. firmó un acuerdo de financiación estratégica con Ahlstrom Capital Group, en virtud del cual Ahlstrom adquirió una participación del 20 % en Bast. Esta inversión acelerará la expansión de las operaciones de producción de fibra de Bast, mejorando su capacidad de fabricación y consolidando su posición en el mercado de fibras naturales.

- En febrero de 2022, Bast Fibre Technologies Inc. completó la adquisición de Lumberton Cellulose de Georgia-Pacific, rebautizando la planta como BFT Lumberton. Se espera que esta operación aumente la capacidad de producción anual de la empresa a más de 30.000 toneladas, lo que la consolidará como un centro clave de procesamiento de fibras naturales en Norteamérica y fortalecerá la resiliencia de su cadena de suministro.

- En enero de 2022, Reality Paskov sro se fusionó con Lenzing Biocel Paskov as, ambas con sede en la República Checa. Esta consolidación corporativa tiene como objetivo optimizar las operaciones e impulsar el crecimiento futuro, permitiendo a Lenzing satisfacer mejor la creciente demanda de fibras naturales y sostenibles en los mercados globales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL NATURAL FIBERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MULTIVARIATE MODELLING

2.9 TYPE LIFELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 IMPORT-EXPORT ANALYSIS

4.4 SUPPLY CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING APPLICATION OF NATURAL FIBERS IN FASHION INDUSTRY

5.1.2 EXTENDED APPLICATION OF NATURAL FIBERS IN THE AUTOMOTIVE INDUSTRY

5.1.3 ADVANCEMENT IN THE APPLICATION OF NATURAL FIBERS IN THE PACKAGING INDUSTRY

5.1.4 TECHNOLOGICAL ADVANCEMENTS IN NATURAL FIBER PROCESSING

5.2 RESTRAINTS

5.2.1 REGIONAL CROP VARIABILITY

5.2.2 LIMITATIONS ASSOCIATED WITH NATURAL FIBERS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR SILK

5.3.2 RISING SUSTAINABLE AGRICULTURE INITIATIVES

5.3.3 GROWING E-COMMERCE AND DIRECT-TO-CONSUMER MODELS

5.4 CHALLENGES

5.4.1 PRESENCE OF ALTERNATIVES SUCH AS SYNTHETIC POLYESTERS

5.4.2 INCREASING AWARENESS REGARDING VEGANISM CAN AFFECT THE ANIMAL DERIVED FIBERS

6 GLOBAL NATURAL FIBERS MARKET, BY FIBERS

6.1 OVERVIEW

6.2 COTTON

6.3 JUTE

6.4 FLAX

6.5 HEMP

6.6 WOOL

6.7 SILK

6.8 SISAL

6.9 KENAF

6.1 OTHERS

7 GLOBAL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL

7.1 OVERVIEW

7.2 MANUFACTURERS

7.3 DISTRIBUTORS

7.4 WHOLESALERS

7.5 RETAILERS

7.6 OTHERS

8 GLOBAL NATURAL FIBERS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 INDUSTRIAL & TECHNICAL

8.2.1 AUTOMOTIVE TEXTILES

8.2.1.1 CHAIR CUSHIONS

8.2.1.2 HEADLINERS

8.2.1.3 CAR COVERS

8.2.1.4 OTHERS

8.2.2 SMART TEXTILES

8.2.3 ROPES AND NETTINGS

8.2.4 MEDICAL TEXTILES

8.2.5 SUN BLINDS

8.2.6 OTHERS

8.3 FURNISHING & HOME

8.3.1 BED LINEN

8.3.2 CARPETS

8.3.3 CURTAINS

8.3.4 UPHOLSTERY

8.3.5 OTHERS

8.4 FASHION & CLOTHING

8.4.1 SUITS

8.4.2 COAT

8.4.3 DRESSES

8.4.4 SHIRTS

8.4.5 OTHERS

9 GLOBAL NATURAL FIBERS MARKET, BY REGION

9.1 OVERVIEW

9.2 ASIA-PACIFIC

9.2.1 CHINA

9.2.2 INDIA

9.2.3 HONG KONG

9.2.4 AUSTRALIA

9.2.5 JAPAN

9.2.6 THAILAND

9.2.7 INDONESIA

9.2.8 SINGAPORE

9.2.9 MALAYSIA

9.2.10 TAIWAN

9.2.11 SOUTH KOREA

9.2.12 PHILIPPINES

9.2.13 REST OF ASIA-PACIFIC

9.3 NORTH AMERICA

9.3.1 U.S.

9.3.2 MEXICO

9.3.3 CANADA

9.4 EUROPE

9.4.1 GERMANY

9.4.2 ITALY

9.4.3 U.K.

9.4.4 FRANCE

9.4.5 SPAIN

9.4.6 RUSSIA

9.4.7 BELGIUM

9.4.8 NETHERLANDS

9.4.9 TURKEY

9.4.10 SWITZERLAND

9.4.11 REST OF EUROPE

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 MIDDLE EAST AND AFRICA

9.6.1 SOUTH AFRICA

9.6.2 EGYPT

9.6.3 SAUDI ARABIA

9.6.4 U.A.E

9.6.5 ISRAEL

9.6.6 REST OF AFRICA

10 GLOBAL NATURAL FIBERS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

11 NORTH AMERICA NATURAL FIBERS MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 EUROPE NATURAL FIBERS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 ASIA-PACIFIC NATURAL FIBERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 LENZING AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 GRASIM INDUSTRIES LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 VARDHMAN TEXTILES LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 BCOMP

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 BARNHARDT NATURAL FIBERS

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ANANDHI TEXSTYLES

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BAST FIBRE TECHNOLOGIES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT (PRESS RELEASE)

15.8 FLEXFORM TECHNOLOGIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 PROCOTEX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 THE NATURAL FIBRE COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF WORLD AND TOP 10 COUNTRIES (2022) FOR " FLAX YARN "; HS CODE OF PRODUCT: 5306

TABLE 2 EXPORT DATA OF WORLD AND TOP 10 COUNTRIES (2022) FOR " FLAX YARN "; HS CODE OF PRODUCT: 5306

TABLE 3 GLOBAL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 4 GLOBAL COTTON IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 5 GLOBAL JUTE IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 6 GLOBAL FLAX IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 7 GLOBAL HEMP IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 8 GLOBAL WOOL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 9 GLOBAL SILK IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 10 GLOBAL SISAL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 11 GLOBAL KENAF IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 12 GLOBAL OTHERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 13 GLOBAL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 14 GLOBAL MANUFACTURERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 15 GLOBAL DISTRIBUTORS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 16 GLOBAL WHOLESALERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 17 GLOBAL RETAILERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 18 GLOBAL OTHERS IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 19 GLOBAL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 20 GLOBAL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 21 GLOBAL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 22 GLOBAL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 23 GLOBAL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 24 GLOBAL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 25 GLOBAL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 26 GLOBAL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 27 GLOBAL NATURAL FIBERS MARKET, BY REGION, 2022-2031 (USD MILLION)

TABLE 28 ASIA-PACIFIC NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 29 ASIA-PACIFIC NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 30 ASIA-PACIFIC NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 31 ASIA-PACIFIC NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 32 ASIA-PACIFIC INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 33 ASIA-PACIFIC AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 34 ASIA-PACIFIC FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 35 ASIA-PACIFIC FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 36 CHINA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 37 CHINA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 38 CHINA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 39 CHINA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 40 CHINA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 41 CHINA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 42 CHINA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 43 INDIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 44 INDIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 45 INDIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 46 INDIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 47 INDIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 48 INDIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 49 INDIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 50 HONG KONG NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 51 HONG KONG NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 52 HONG KONG NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 53 HONG KONG INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 54 HONG KONG AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 55 HONG KONG FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 56 HONG KONG FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 57 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 58 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 59 AUSTRALIA AND NEW ZEALAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 60 AUSTRALIA AND NEW ZEALAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 61 AUSTRALIA AND NEW ZEALAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 62 AUSTRALIA AND NEW ZEALAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 63 AUSTRALIA AND NEW ZEALAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 64 JAPAN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 65 JAPAN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 66 JAPAN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 67 JAPAN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 68 JAPAN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 69 JAPAN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 70 JAPAN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 71 THAILAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 72 THAILAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 73 THAILAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 74 THAILAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 75 THAILAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 76 THAILAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 77 THAILAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 78 INDONESIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 79 INDONESIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 80 INDONESIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 81 INDONESIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 82 INDONESIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 83 INDONESIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 84 INDONESIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 85 SINGAPORE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 86 SINGAPORE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 87 SINGAPORE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 88 SINGAPORE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 89 SINGAPORE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 90 SINGAPORE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 91 SINGAPORE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 92 MALAYSIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 93 MALAYSIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 94 MALAYSIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 95 MALAYSIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 96 MALAYSIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 97 MALAYSIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 98 MALAYSIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 99 TAIWAN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 100 TAIWAN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 101 TAIWAN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 102 TAIWAN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 103 TAIWAN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 104 TAIWAN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 105 TAIWAN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 106 SOUTH KOREA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 107 SOUTH KOREA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 108 SOUTH KOREA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 109 SOUTH KOREA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 110 SOUTH KOREA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 111 SOUTH KOREA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 112 SOUTH KOREA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 113 PHILIPPINES NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 114 PHILIPPINES NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 115 PHILIPPINES NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 116 PHILIPPINES INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 117 PHILIPPINES AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 118 PHILIPPINES FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 119 PHILIPPINES FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 120 REST OF ASIA-PACIFIC NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 121 NORTH AMERICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 122 NORTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 123 NORTH AMERICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 124 NORTH AMERICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 125 NORTH AMERICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 126 NORTH AMERICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 127 NORTH AMERICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 128 NORTH AMERICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 129 U.S. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 130 U.S. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 131 U.S. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 132 U.S. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 133 U.S. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 134 U.S. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 135 U.S. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 136 MEXICO NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 137 MEXICO NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 138 MEXICO NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 139 MEXICO INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 140 MEXICO AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 141 MEXICO FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 142 MEXICO FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 143 CANADA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 144 CANADA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 145 CANADA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 146 CANADA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 147 CANADA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 148 CANADA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 149 CANADA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 150 EUROPE NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 151 EUROPE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 152 EUROPE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 153 EUROPE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 154 EUROPE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 155 EUROPE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 156 EUROPE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 157 EUROPE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 158 GERMANY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 159 GERMANY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 160 GERMANY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 161 GERMANY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 162 GERMANY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 163 GERMANY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 164 GERMANY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 165 ITALY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 166 ITALY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 167 ITALY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 168 ITALY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 169 ITALY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 170 ITALY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 171 ITALY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 172 U.K. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 173 U.K. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 174 U.K. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 175 U.K. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 176 U.K. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 177 U.K. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 178 U.K. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 179 FRANCE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 180 FRANCE NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 181 FRANCE NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 182 FRANCE INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 183 FRANCE AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 184 FRANCE FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 185 FRANCE FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 186 SPAIN NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 187 SPAIN NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 188 SPAIN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 189 SPAIN INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 190 SPAIN AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 191 SPAIN FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 192 SPAIN FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 193 RUSSIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 194 RUSSIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 195 RUSSIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 196 RUSSIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 197 RUSSIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 198 RUSSIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 199 RUSSIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 200 BELGIUM NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 201 BELGIUM NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 202 BELGIUM NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 203 BELGIUM INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 204 BELGIUM AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 205 BELGIUM FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 206 BELGIUM FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 207 NETHERLANDS NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 208 NETHERLANDS NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 209 NETHERLANDS NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 210 NETHERLANDS INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 211 NETHERLANDS AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 212 NETHERLANDS FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 213 NETHERLANDS FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 214 TURKEY NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 215 TURKEY NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 216 TURKEY NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 217 TURKEY INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 218 TURKEY AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 219 TURKEY FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 220 TURKEY FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 221 SWITZERLAND NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 222 SWITZERLAND NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 223 SWITZERLAND NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 224 SWITZERLAND INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 225 SWITZERLAND AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 226 SWITZERLAND FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 227 SWITZERLAND FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 228 REST OF EUROPE NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 229 SOUTH AMERICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 230 SOUTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 231 SOUTH AMERICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 232 SOUTH AMERICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 233 SOUTH AMERICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 234 SOUTH AMERICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 235 SOUTH AMERICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 236 SOUTH AMERICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 237 BRAZIL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 238 BRAZIL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 239 BRAZIL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 240 BRAZIL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 241 BRAZIL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 242 BRAZIL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 243 BRAZIL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 244 ARGENTINA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 245 ARGENTINA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 246 ARGENTINA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 247 ARGENTINA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 248 ARGENTINA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 249 ARGENTINA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 250 ARGENTINA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 251 REST OF SOUTH AMERICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 252 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 253 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 254 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 255 MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 256 MIDDLE EAST AND AFRICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 257 MIDDLE EAST AND AFRICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 258 MIDDLE EAST AND AFRICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 259 MIDDLE EAST AND AFRICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 260 SOUTH AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 261 SOUTH AFRICA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 262 SOUTH AFRICA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 263 SOUTH AFRICA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 264 SOUTH AFRICA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 265 SOUTH AFRICA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 266 SOUTH AFRICA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 267 EGYPT NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 268 EGYPT NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 269 EGYPT NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 270 EGYPT INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 271 EGYPT AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 272 EGYPT FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 273 EGYPT FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 274 SAUDI ARABIA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 275 SAUDI ARABIA NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 276 SAUDI ARABIA NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 277 SAUDI ARABIA INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 278 SAUDI ARABIA AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 279 SAUDI ARABIA FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 280 SAUDI ARABIA FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 281 U.A.E. NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 282 U.A.E. NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 283 U.A.E. NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 284 U.A.E. INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 285 U.A.E. AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 286 U.A.E. FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 287 U.A.E. FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 288 ISRAEL NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

TABLE 289 ISRAEL NATURAL FIBERS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

TABLE 290 ISRAEL NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 291 ISRAEL INDUSTRIAL & TECHNICAL IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 292 ISRAEL AUTOMOTIVE TEXTILES IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 293 ISRAEL FURNISHING & HOME IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 294 ISRAEL FASHION & CLOTHING IN NATURAL FIBERS MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 295 REST OF MIDDLE EAST AND AFRICA NATURAL FIBERS MARKET, BY FIBERS, 2022-2031 (USD MILLION)

Lista de figuras

FIGURE 1 GLOBAL NATURAL FIBERS MARKET: SEGMENTATION

FIGURE 2 GLOBAL NATURAL FIBERS MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL NATURAL FIBERS MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL NATURAL FIBERS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL NATURAL FIBERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL NATURAL FIBERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL NATURAL FIBERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL NATURAL FIBERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 GLOBAL NATURAL FIBERS MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE GLOBAL NATURAL FIBERS MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 11 EXTENDED APPLICATION OF NATURAL FIBERS IN AUTOMOTIVE INDUSTRY IS DRIVING THE GROWTH OF THE GLOBAL NATURAL FIBERS MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 12 COTTON SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL NATURAL FIBERS MARKET IN 2024 & 2031

FIGURE 13 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR NATURAL FIBERS MANUFACTURERS IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 14 SUPPLY CHAIN ANALYSIS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF GLOBAL NATURAL FIBERS MARKET

FIGURE 16 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, 2023

FIGURE 17 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, 2024-2031 (USD MILLION)

FIGURE 18 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, CAGR (2024-2031)

FIGURE 19 GLOBAL NATURAL FIBERS MARKET: BY FIBERS, LIFELINE CURVE

FIGURE 20 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 21 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, 2024-2031 (USD MILLION)

FIGURE 22 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 23 GLOBAL NATURAL FIBERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 24 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, 2023

FIGURE 25 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, 2024-2031 (USD MILLION)

FIGURE 26 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, CAGR (2024-2031)

FIGURE 27 GLOBAL NATURAL FIBERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 GLOBAL NATURAL FIBERS MARKET: SNAPSHOT (2023)

FIGURE 29 GLOBAL NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 30 NORTH AMERICA NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 EUROPE NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 AISA-PACIFIC NATURAL FIBERS MARKET: COMPANY SHARE 2023 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.