Global Nasal Spray Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

25.76 Billion

USD

43.29 Billion

2024

2032

USD

25.76 Billion

USD

43.29 Billion

2024

2032

| 2025 –2032 | |

| USD 25.76 Billion | |

| USD 43.29 Billion | |

|

|

|

|

Segmentación del mercado global de aerosoles nasales por tipo de producto (aerosol nasal descongestionante, aerosol nasal con esteroides, aerosol nasal con solución salina/salina y otros), diseño del envase (botellas con dosificador y botes presurizados), presentación farmacéutica (multidosis, dosis unitaria/monodosis y bidosis), clase terapéutica (antihistamínico, esteroide nasal, inhibidor de mastocitos y anticolinérgico), aplicación (congestión nasal, rinitis alérgica y no alérgica, trastornos del sistema nervioso central, vacunación y otros), prescripción/disponibilidad (sin receta y con receta), usuario final (centros de atención domiciliaria, hospitales, clínicas y centros de salud comunitarios): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de aerosoles nasales

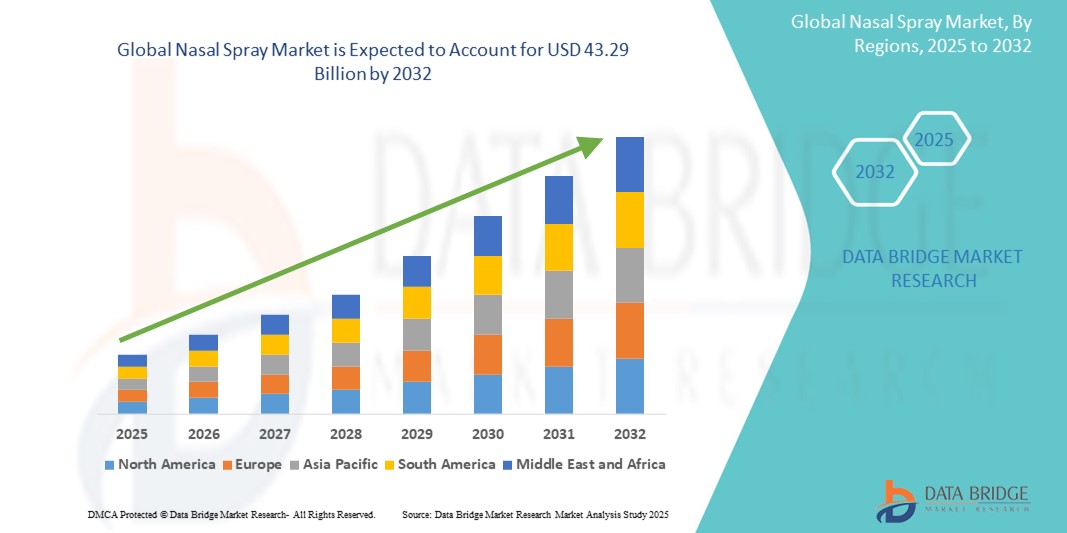

- El mercado mundial de aerosoles nasales se valoró en USD 25,76 mil millones en 2024 y se espera que alcance los USD 43,29 mil millones para 2032.

- Durante el período de pronóstico de 2025 a 2032, es probable que el mercado crezca a una CAGR del 6,70 %, impulsado principalmente por la creciente prevalencia de trastornos respiratorios.

- Este crecimiento está impulsado por factores como la mayor demanda de tratamientos efectivos y convenientes para afecciones como alergias , sinusitis y congestión nasal.

Análisis del mercado de aerosoles nasales

- La creciente incidencia de afecciones como alergias, sinusitis y congestión nasal está impulsando la demanda de aerosoles nasales como forma preferida de medicación debido a su acción rápida y específica.

- Las empresas están innovando continuamente para mejorar las formulaciones de aerosoles nasales, como la introducción de aerosoles de acción más rápida y aquellos con beneficios terapéuticos adicionales, ampliando la gama de productos disponibles en el mercado.

- La creciente preferencia por los productos de venta libre, donde los consumidores pueden comprar aerosoles nasales sin receta, está contribuyendo al crecimiento del mercado, ofreciendo conveniencia y accesibilidad a una base de consumidores más amplia.

- El desarrollo de mecanismos de pulverización avanzados para un mejor control de la dosis y una mayor eficacia es una tendencia clave en el mercado, que atrae tanto a fabricantes como a consumidores interesados en soluciones eficientes para el cuidado nasal.

- A medida que más personas conocen la disponibilidad y los beneficios de los aerosoles nasales, especialmente para el manejo de las alergias estacionales, su adopción por parte de los consumidores ha aumentado. Por ejemplo, marcas como Flonase han ganado una cuota de mercado significativa gracias a su reconocida eficacia en el tratamiento de los síntomas nasales asociados a las alergias.

Alcance del informe y segmentación del mercado de aerosoles nasales

|

Atributos |

Análisis clave del mercado de los aerosoles nasales |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis en profundidad de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado de aerosoles nasales

“ Desarrollo de aerosoles nasales avanzados ”

- El desarrollo de aerosoles nasales avanzados ha visto innovaciones significativas destinadas a mejorar la eficacia, la comodidad del usuario y ampliar las aplicaciones terapéuticas.

- Haleon presentó Otrivin Nasal Mist, que utiliza tecnología de microgotas para brindar una suave niebla que cubre uniformemente los conductos nasales, minimizando el goteo y mejorando la comodidad del usuario.

- Para abordar las inquietudes de los pacientes sobre los conservantes, fabricantes como Aptar Pharma han desarrollado sistemas de pulverización intranasal sin conservantes, que incorporan membranas de filtro para evitar la contaminación microbiana sin necesidad de conservantes.

- La FDA aprobó FluMist para uso en el hogar, lo que permite que personas de hasta 49 años se autoadministren la vacuna contra la influenza, aumentando así la accesibilidad y la conveniencia.

- Los investigadores han desarrollado aerosoles nasales como SPL7013, que demuestran una potente actividad antiviral contra el SARS-CoV-2 y ofrecen protección potencial contra la COVID- 19.

- Las innovaciones incluyen aerosoles nasales formulados con ingredientes naturales, como el extracto de Zingiber officinalis, que brindan opciones de tratamiento ecológicas y naturales para la rinitis y la rinosinusitis.

Dinámica del mercado de aerosoles nasales

Conductor

Aumento de casos de rinitis alérgica e infecciones respiratorias

- El aumento global de casos de rinitis alérgica está impulsando significativamente la demanda de aerosoles nasales. Factores como la urbanización, el aumento de la contaminación y los cambios en los estilos de vida contribuyen a este incremento.

- Las infecciones respiratorias frecuentes , especialmente en los países en desarrollo, conducen a un mayor uso de aerosoles nasales para aliviar la congestión nasal y otros síntomas.

- Los aerosoles nasales ofrecen una opción conveniente de automedicación, en línea con la creciente tendencia de los consumidores hacia productos de venta libre para controlar los síntomas leves.

- Los aerosoles nasales brindan un alivio rápido, lo que los convierte en la opción preferida entre los consumidores que buscan un alivio inmediato de los síntomas.

- Por ejemplo, la aprobación del aerosol nasal Spravato (esketamina) por parte de la FDA en marzo de 2019 para la depresión resistente al tratamiento destaca las crecientes aplicaciones terapéuticas de los aerosoles nasales.

Oportunidad

“ Integración de dispositivos inteligentes ”

- Los dispositivos de pulverización nasal modernos están cada vez más equipados con sensores inteligentes que monitorean los patrones de uso y brindan información en tiempo real a los usuarios. Estos dispositivos pueden rastrear la dosis, el tiempo y la frecuencia, lo que garantiza que los pacientes cumplan con los regímenes prescritos.

- Por ejemplo, HeroTracker Sense de Aptar Pharma transforma un inhalador de dosis medida estándar en un dispositivo de atención médica inteligente conectado, que ofrece seguimiento digital y recordatorios.

- Los dispositivos de pulverización nasal inteligentes pueden transmitir datos de uso a los proveedores de atención médica, lo que facilita el monitoreo remoto de las condiciones del paciente. Esta integración admite planes de tratamiento personalizados e intervenciones oportunas.

- Los dispositivos de pulverización nasal inteligentes pueden transmitir datos de uso a los proveedores de atención médica, lo que facilita el monitoreo remoto de las condiciones del paciente.

- Esta integración admite planes de tratamiento personalizados e intervenciones oportunas.

Restricción/Desafío

Obstáculos regulatorios y posibles efectos adversos

- Navegar por marcos regulatorios estrictos para la aprobación de aerosoles nasales puede retrasar los lanzamientos de productos y aumentar los costos de desarrollo, lo que plantea desafíos para los fabricantes.

- Los posibles efectos secundarios, como hemorragias nasales, sequedad o congestión de rebote por el uso excesivo, pueden limitar el uso a largo plazo de los aerosoles nasales, lo que afecta la confianza del consumidor y el crecimiento del mercado.

- La disponibilidad de tratamientos alternativos, incluidos medicamentos orales e inhaladores, presenta competencia y desafía la participación de mercado de los aerosoles nasales.

- El uso excesivo de aerosoles nasales puede generar dependencia y otros problemas de salud, lo que requiere educación del consumidor y puede afectar la dinámica del mercado.

- Por ejemplo , el proceso de aprobación de nuevas formulaciones de aerosol nasal puede ser largo y costoso, como se ve en los plazos de desarrollo de productos como Spravato, lo que resalta el impacto de los desafíos regulatorios en las ofertas

Análisis del mercado de aerosoles nasales

El mercado está segmentado según el tipo de producto, el diseño del envase, la forma de dosificación, la clase terapéutica, la aplicación, la prescripción/disponibilidad y el usuario final.

|

Segmentación |

Subsegmentación |

|

Por tipo de producto |

|

|

Por Container Design |

|

|

Por forma de dosificación |

|

|

Por clase terapéutica |

|

|

Por aplicación |

|

|

Por prescripción/disponibilidad |

|

|

Por el usuario final |

|

Análisis regional del mercado de aerosoles nasales

Norteamérica es la región dominante en el mercado de aerosoles nasales.

- Los sistemas de salud avanzados de la región facilitan la disponibilidad y adopción generalizada de aerosoles nasales.

- América del Norte alberga importantes empresas farmacéuticas, lo que garantiza un suministro constante de diversos productos en aerosol nasal.

- Los altos niveles de concienciación sobre la salud entre los consumidores contribuyen al uso frecuente de aerosoles nasales para diversas afecciones.

- Las regulaciones favorables y las políticas de reembolso mejoran la accesibilidad al mercado, consolidando la posición de liderazgo de América del Norte

Se proyecta que Asia-Pacífico registre la mayor tasa de crecimiento.

- Se proyecta que la región de Asia y el Pacífico experimente la tasa de crecimiento anual compuesta (CAGR) más alta en el mercado de aerosoles nasales durante el período de pronóstico.

- El aumento de casos de infecciones respiratorias y afecciones alérgicas está impulsando la demanda de tratamientos nasales efectivos en países como China, India y Japón.

- La rápida urbanización y los estilos de vida cambiantes están contribuyendo a una mayor incidencia de afecciones tratadas con aerosoles nasales, como la rinitis alérgica y la sinusitis.

- Las mejoras en la infraestructura de atención médica y el aumento del gasto en salud están mejorando la disponibilidad y accesibilidad de los productos de aerosol nasal en toda la región.

- La creciente conciencia y aceptación de los aerosoles nasales como una opción de tratamiento conveniente y eficaz están impulsando el crecimiento del mercado en la región de Asia y el Pacífico.

Cuota de mercado de aerosoles nasales

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- EMERGENTE (EE. UU.)

- Cipla Inc. (India)

- Sandoz International GmbH (parte de Novartis) (Suiza)

- Aytu Health (una subsidiaria de Aytu BioPharma, Inc.) (EE. UU.)

- Bayer AG (Alemania)

- GlaxoSmithKline plc. (Reino Unido)

- Assertio Therapeutics, Inc. (EE. UU.)

- Laboratorios Aurena (Suecia)

- J Pharmaceuticals (EE. UU.)

- San Renato (EE. UU.)

- Ultratech India Limited (India)

- Catalent, Inc. (EE. UU.)

- Teva Pharmaceuticals USA, Inc. (EE. UU.)

- Pfizer Inc. (EE. UU.)

- Viatris Inc. (EE. UU.)

- LEEFORD HEALTHCARE LTD (India)

- Grupo Aishwarya (India)

Últimos avances en el mercado mundial de aerosoles nasales

- En agosto de 2024, ARS Pharmaceuticals lanzó Neffy, un aerosol nasal de epinefrina aprobado por la FDA para el tratamiento de la anafilaxia. Neffy ofrece una alternativa sin agujas para personas con riesgo de reacciones alérgicas graves, lo que facilita la atención de emergencia.

- En octubre de 2023, se lanzó Otrivin Nasal Mist, un producto con tecnología de microgotas que alivia eficazmente la congestión nasal. Este producto ofrece una suave bruma para una mejor cobertura de las fosas nasales, mejorando la comodidad del paciente y su facilidad de uso.

- En agosto de 2023, Padagis LLC, un proveedor líder de productos farmacéuticos especializados, presentó el primer aerosol nasal de clorhidrato de naloxona de venta libre (OTC) en los EE. UU. Este producto innovador está diseñado para revertir rápidamente los efectos potencialmente mortales de las sobredosis de opioides, haciéndolo más accesible al público.

- En marzo de 2023, Teva Pharmaceuticals, la filial estadounidense de Teva Pharmaceutical Industries Ltd, lanzó concentraciones adicionales de la versión genérica de Revlimid® (cápsulas de lenalidomida) en dosis de 2,5 mg y 20 mg en EE. UU., con el objetivo de ampliar la cartera de productos de la empresa.

- En enero de 2023, Viatris Inc., compañía global de atención médica, anunció la finalización de las adquisiciones de Oyster Point Pharma y Famy Life Sciences, lo que marca la creación de su nueva División Viatris Eye Care. Se espera que esta adquisición impulse la expansión comercial de la compañía.

- En noviembre de 2021, Amcyte Pharma, una innovadora compañía farmacéutica con sede en Seattle, anunció el lanzamiento en EE. UU. del aerosol nasal Nasitrol, específicamente formulado para la irrigación sinusal. Este producto busca aliviar la congestión sinusal y mejorar la salud nasal mediante su uso regular.

- En octubre de 2021, Cipla, Inc. lanzó Naselin, un aerosol nasal antiviral diseñado para proteger contra las infecciones de las vías respiratorias causadas por coronavirus. Este producto se desarrolló para ofrecer una capa adicional de defensa contra las infecciones virales, especialmente durante la pandemia de COVID-19.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.