Global Mass Spectrometry Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

6.76 Billion

USD

13.06 Billion

2024

2032

USD

6.76 Billion

USD

13.06 Billion

2024

2032

| 2025 –2032 | |

| USD 6.76 Billion | |

| USD 13.06 Billion | |

|

|

|

|

Segmentación del mercado global de espectrometría de masas por tecnología (espectrometría de masas híbrida, espectrometría de masas simple y otras), modalidad (de sobremesa y autónoma), aplicación (investigación en ciencias biológicas, descubrimiento de fármacos, pruebas ambientales, pruebas de alimentos, industrias aplicadas, diagnósticos clínicos y otras), usuario final (industria farmacéutica, institutos de investigación y académicos, industria de alimentos y bebidas, industria petroquímica y otras), canal de distribución (licitaciones directas, ventas minoristas y otras): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de espectrometría de masas

El mercado global de espectrometría de masas se refiere a la industria centrada en el desarrollo, producción y aplicación de tecnologías de espectrometría de masas, que son herramientas analíticas utilizadas para identificar la composición, estructura y cantidad de sustancias químicas en función de su relación masa-carga. El mercado está impulsado por la creciente demanda de herramientas analíticas avanzadas en las industrias farmacéutica y biotecnológica para el desarrollo de medicamentos y el control de calidad, y el enfoque creciente en las pruebas ambientales y las regulaciones de seguridad alimentaria. Sin embargo, el alto costo de los instrumentos de espectrometría de masas sigue siendo una restricción importante, que limita la adopción, particularmente entre los laboratorios más pequeños. Una oportunidad radica en los avances tecnológicos como los espectrómetros de masas híbridos y portátiles, que están expandiendo el alcance del mercado a nuevas aplicaciones como el diagnóstico clínico. Un desafío clave es la necesidad de profesionales capacitados para operar y mantener sistemas complejos, lo que puede obstaculizar el uso eficiente y el crecimiento del mercado.

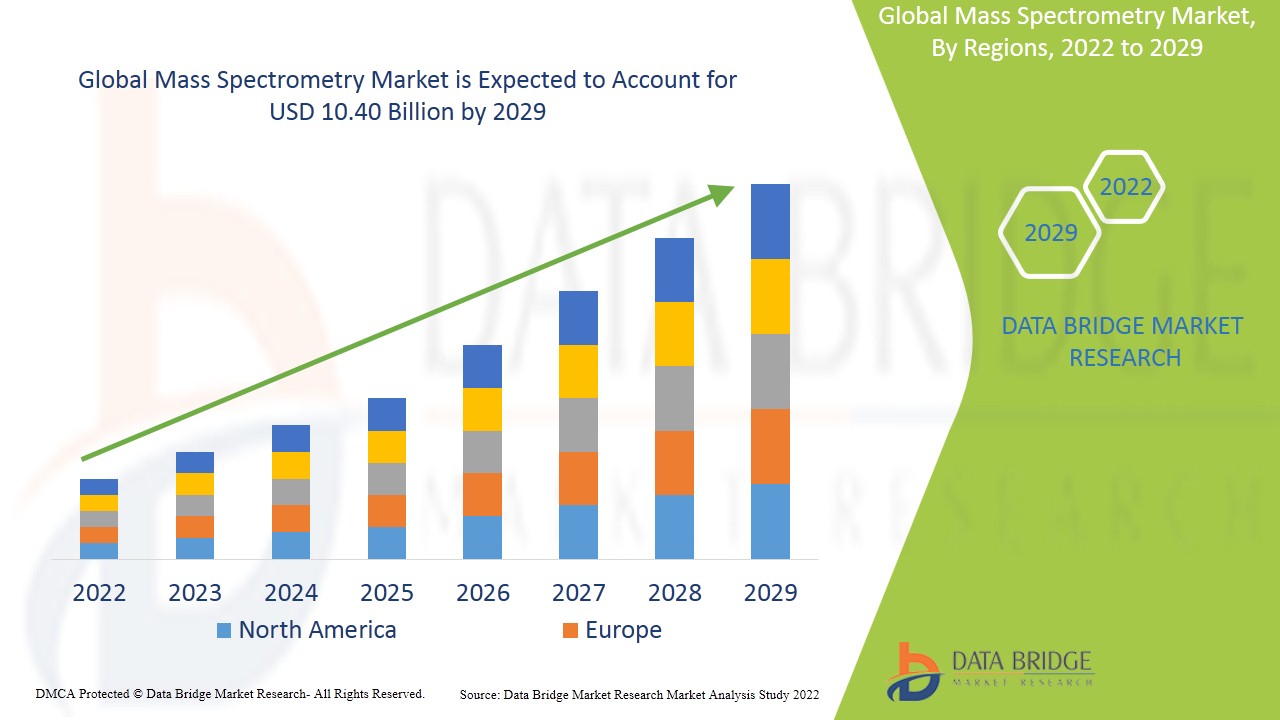

Tamaño del mercado de espectrometría de masas

El tamaño del mercado mundial de espectrometría de masas se valoró en USD 6,76 mil millones en 2024 y se proyecta que alcance los USD 13,06 mil millones para 2032, con una CAGR del 8,58% durante el período de pronóstico de 2025 a 2032. Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio.

Tendencias del mercado de espectrometría de masas

“Aumento de la adopción en el diagnóstico clínico”

La creciente adopción de la espectrometría de masas en el diagnóstico clínico se debe a su capacidad para analizar muestras biológicas complejas, lo que hace avanzar la medicina personalizada y el diagnóstico de enfermedades. En proteómica, identifica y cuantifica proteínas vinculadas a enfermedades como el cáncer, mientras que en metabolómica, perfila los cambios metabólicos asociados a enfermedades como la diabetes y los trastornos neurodegenerativos. La espectrometría de masas también desempeña un papel clave en el descubrimiento de biomarcadores, ya que permite la identificación de moléculas que señalan la presencia o progresión de enfermedades, lo que respalda un diagnóstico temprano y preciso. Esta tecnología mejora el tratamiento personalizado al ayudar a adaptar las terapias al perfil biológico único de cada paciente y está avanzando en el diagnóstico no invasivo mediante el análisis de fluidos como el aliento, la orina o la saliva, lo que mejora la comodidad y el cumplimiento del paciente.

Alcance del informe y segmentación del mercado de espectrometría de masas

|

Atributos |

Perspectivas clave del mercado de la espectrometría de masas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Estados Unidos, Canadá y México, Alemania, Reino Unido, Francia, Italia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos y resto de Europa, China, India, Japón, Corea del Sur, Indonesia, Tailandia, Malasia, Filipinas, Singapur, Australia y Nueva Zelanda y resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y resto de Oriente Medio y África. |

|

Actores clave del mercado |

Thermo Fisher Scientific, Inc. (EE. UU.), Shimadzu Corporation (Japón), Agilent Technologies, Inc. (EE. UU.), Bruker Corp (EE. UU.), Waters Corporation (EE. UU.), Danaher Corporation (EE. UU.), PerkinElmer, Inc. (EE. UU.), Rigaku Corporation (Japón), JEOL Ltd. (EE. UU.), LECO Corporation (EE. UU.), Hiden Analytical (Reino Unido), Hitachi Ltd. (Japón), Kore Technology (Reino Unido), Ametek. Inc. (EE. UU.) |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Definición del mercado de espectrometría de masas

La espectrometría de masas (a menudo abreviada como MS) es una técnica analítica que se utiliza para medir la relación masa-carga de los iones, lo que permite la identificación y cuantificación de compuestos dentro de una muestra. El proceso implica ionizar la muestra, normalmente a través de métodos como el impacto electrónico o la ionización por electropulverización, y luego acelerar los iones en un analizador de masas. Este analizador separa los iones en función de sus relaciones masa-carga, y los datos resultantes se utilizan para construir un espectro de masas que revela la composición, la estructura y la concentración de las moléculas presentes en la muestra. La espectrometría de masas se utiliza ampliamente en varios campos, incluidos la química, la bioquímica y la ciencia ambiental, para aplicaciones como el análisis de fármacos, la proteómica y la metabolómica.

Dinámica del mercado de la espectrometría de masas

Conductores

- Avances tecnológicos en espectrometría de masas

Los avances tecnológicos en espectrometría de masas han impulsado significativamente el crecimiento del mercado global de espectrometría de masas al mejorar la precisión, la velocidad y la gama de aplicaciones en varias industrias. Innovaciones como el desarrollo de sistemas híbridos de espectrometría de masas, técnicas de ionización mejoradas y la integración de inteligencia artificial (IA) y aprendizaje automático han ampliado el alcance de la espectrometría de masas en campos como los productos farmacéuticos, la biotecnología, el análisis ambiental y la seguridad alimentaria. Estos avances permiten una detección más rápida y precisa de moléculas, lo que permite a los investigadores realizar análisis complejos con mayor sensibilidad y confiabilidad. Además, la miniaturización de los dispositivos de espectrometría de masas ha facilitado el uso de sistemas portátiles en diagnósticos en el punto de atención y pruebas de campo, ampliando su alcance de mercado. Las mejoras continuas en el software y las capacidades de análisis de datos también han hecho que la tecnología sea más accesible, lo que permite el procesamiento y la automatización de datos en tiempo real, lo que reduce el error humano y mejora el rendimiento en los laboratorios, lo que impulsa aún más la demanda.

Por ejemplo,

- En junio de 2023, según el artículo publicado por Bioanalysis zone, innovaciones como el espectrómetro de masas Orbitrap Astral han dado lugar a una mayor sensibilidad y rendimiento, lo que beneficia especialmente a campos como la proteómica, el diagnóstico y la medicina personalizada. Además, el análisis de datos mejorado con IA, los métodos mejorados para los estudios de interacción de proteínas y los avances en la cuantificación de biomarcadores. Estos avances están impulsando el progreso en el descubrimiento de fármacos, los ensayos clínicos y el diagnóstico de enfermedades, lo que hace que la espectrometría de masas sea más eficiente y escalable. Estos avances tecnológicos actúan como un motor en el crecimiento del mercado.

- En julio de 2023, según el artículo publicado en Elsevier, los avances recientes en la espectrometría de masas nativa (nMS) han mejorado su capacidad para analizar biomoléculas. Las técnicas de ionización mejoradas, como la ionización por electrospray, preservan el estado nativo de las proteínas, mientras que los analizadores de masas de alta resolución, como Orbitrap y FT-ICR, permiten mediciones precisas de la masa de biomoléculas más grandes. La espectrometría de masas ambiental permite el análisis in situ sin una preparación extensa de la muestra, lo que amplía las aplicaciones en diagnósticos clínicos y estudios ambientales. La integración de la nMS con técnicas como la cromatografía mejora las capacidades de análisis de datos, mientras que el software avanzado facilita la interpretación de datos complejos. Estos avances impulsan el progreso en campos como la proteómica y el descubrimiento de fármacos, lo que permite un análisis detallado de las estructuras e interacciones biomoleculares.

- En agosto de 2023, según el artículo publicado en Academic Research, los avances tecnológicos de la espectrometría de masas (MS) en las tecnologías ómicas, enfatizando su impacto en la genómica, la proteómica, la metabolómica y la lipidómica. Los desarrollos clave incluyen analizadores de masas de alta resolución, como Orbitrap y FT-ICR, que mejoran la sensibilidad y la precisión en el análisis molecular. Las técnicas de ionización mejoradas, como MALDI y la ionización por electrospray, facilitan el análisis de diversas biomoléculas en sus estados nativos. La adquisición independiente de datos (DIA) permite una recopilación integral de datos, mejorando la reproducibilidad y la cuantificación en mezclas complejas. La integración de MS con otras tecnologías ómicas, junto con los avances en microfluídica y automatización, agiliza la preparación de muestras y mejora la eficiencia. El software sofisticado para el análisis de datos ayuda a interpretar conjuntos de datos complejos, lo que convierte a MS en una herramienta fundamental en la investigación ómica e impulsa innovaciones en el descubrimiento de biomarcadores y la medicina personalizada.

Los avances en espectrometría de masas han impulsado significativamente su mercado al mejorar la precisión, la velocidad y la versatilidad en múltiples industrias. Las capacidades de detección mejoradas, los sistemas portátiles y el procesamiento de datos más inteligente han hecho que la tecnología sea más accesible y eficiente, expandiendo su uso en investigación, diagnóstico y aplicaciones industriales, lo que en última instancia impulsa el crecimiento del mercado.

- Aplicaciones crecientes de la espectrometría de masas (MS) en productos farmacéuticos y biotecnológicos

Las crecientes aplicaciones de la espectrometría de masas (MS) en productos farmacéuticos y biotecnológicos son impulsores clave de la expansión del mercado global de espectrometría de masas. A medida que la industria farmacéutica se centra cada vez más en el descubrimiento y desarrollo de fármacos, la demanda de técnicas analíticas avanzadas ha aumentado. La MS desempeña un papel vital en varias etapas del proceso de desarrollo de fármacos, incluido el análisis de moléculas pequeñas, productos biofarmacéuticos y matrices biológicas complejas, lo que permite a los investigadores identificar y cuantificar fármacos, metabolitos e impurezas con alta sensibilidad y especificidad. Además, los avances en la tecnología de MS, como la integración de la espectrometría de masas de alta resolución y las técnicas de ionización innovadoras, han facilitado los estudios de metabolómica y detección de alto rendimiento, agilizando así los flujos de trabajo y acelerando el tiempo de comercialización de nuevas terapias. Los organismos reguladores también han reconocido la confiabilidad de la espectrometría de masas, lo que ha llevado a su aceptación en cumplimiento de estrictos estándares de seguridad y eficacia. El auge de la medicina personalizada, que requiere un análisis detallado de biomarcadores y la elaboración de perfiles farmacológicos específicos para cada paciente, ha aumentado aún más la demanda de espectrometría de masas en el sector biotecnológico. Esta convergencia de avances tecnológicos, apoyo regulatorio y necesidades de atención médica en constante evolución sigue impulsando el crecimiento del mercado mundial de espectrometría de masas, posicionándolo como una herramienta indispensable para la innovación en productos farmacéuticos y biotecnológicos.

Por ejemplo,

- En marzo de 2023, según el artículo publicado en Technology Networks, la espectrometría de masas (MS) adquiere cada vez más importancia en las aplicaciones farmacéuticas y biotecnológicas. La espectrometría de masas tiene un papel esencial en el desarrollo de fármacos, el control de calidad y el análisis de productos biofarmacéuticos. La tecnología proporciona información detallada sobre la estructura y la composición molecular, que son cruciales para garantizar la eficacia y la seguridad del producto. La demanda de métodos analíticos más sofisticados impulsa la innovación en la espectrometría de masas, lo que contribuye a su uso cada vez mayor para caracterizar biomoléculas y bioproductos.

- En septiembre de 2023, según el artículo publicado en Elsevier, la espectrometría de masas cuantitativa permite la medición precisa de biomoléculas, mejorando la caracterización de proteínas, péptidos y metabolitos. Optimiza procesos como la purificación y la formulación, asegurando mayores rendimientos y consistencia. El creciente reconocimiento de las agencias reguladoras respalda aún más su uso para la validación de métodos. Las aplicaciones de la tecnología de espectrometría de masas, como las capacidades de alta resolución y el software de análisis de datos, mejoran la sensibilidad y el rendimiento, mientras que la integración con otras técnicas analíticas amplía su alcance de aplicación. En general, la espectrometría de masas cuantitativa está transformando el desarrollo y la fabricación de productos biofarmacéuticos.

- En julio de 2023, según el artículo publicado en NCBI, la espectrometría de masas (MS) es crucial en el análisis farmacéutico, ya que mejora la sensibilidad y la especificidad para detectar compuestos de baja abundancia en muestras biológicas complejas. Se utiliza en todas las etapas del desarrollo de fármacos y respalda aplicaciones como la metabolómica y la proteómica. La espectrometría de masas (MS) tiene una importancia cada vez mayor en las aplicaciones farmacéuticas y biotecnológicas, en particular en el descubrimiento, desarrollo y control de calidad de fármacos. Destaca la capacidad de la tecnología para analizar biomoléculas complejas, proporcionando datos precisos y sensibles esenciales para los biofarmacéuticos modernos. Además, los avances en las técnicas e instrumentación de MS están acelerando la investigación y mejorando la productividad, lo que la convierte en una herramienta fundamental para garantizar la seguridad y la eficacia de los medicamentos.

El creciente uso de la espectrometría de masas (EM) en productos farmacéuticos y biotecnológicos es un factor clave que impulsa el mercado mundial de la espectrometría de masas. Su capacidad para identificar y cuantificar con precisión fármacos y metabolitos, junto con los avances en la tecnología para el cribado de alto rendimiento, ha agilizado el desarrollo de fármacos. El apoyo normativo y el cambio hacia la medicina personalizada aumentan aún más la demanda de EM, lo que pone de relieve su papel crucial en la innovación dentro de estos sectores.

Oportunidades

- Avances en automatización e inteligencia artificial (IA) en espectrometría de masas

La integración de la automatización y la inteligencia artificial (IA) en la espectrometría de masas presenta una oportunidad transformadora para el mercado global. Los avances en la automatización agilizan el procesamiento y el análisis de muestras, mejorando el rendimiento y la eficiencia en los laboratorios. Esto permite a los investigadores manejar mayores volúmenes de muestras y obtener resultados más rápidamente, acelerando así los plazos de investigación. Las herramientas de análisis de datos impulsadas por IA pueden mejorar significativamente la precisión y la velocidad de interpretación, lo que permite procesar conjuntos de datos más complejos con mayor precisión. Además, los algoritmos de aprendizaje automático pueden optimizar las condiciones experimentales, lo que conduce a un mejor rendimiento del instrumento y a una reducción de los costos operativos. A medida que los laboratorios adopten cada vez más estas tecnologías, aumentará la demanda de sistemas avanzados de espectrometría de masas que incorporen automatización e IA, lo que impulsará la innovación y la expansión del mercado en diversos campos, como los productos farmacéuticos, las pruebas ambientales y los diagnósticos clínicos.

Por ejemplo,

- En julio de 2024, según el artículo publicado en Science Direct, la aplicación de la IA en la interpretación de datos espectroscópicos está evolucionando rápidamente, lo que permite la extracción de información valiosa de conjuntos de datos complejos. Este avance tecnológico crea una oportunidad importante para el mercado global de espectrometría de masas al mejorar las capacidades de análisis de datos. La mejora de la eficiencia y la precisión de los resultados impulsarán la demanda de sistemas avanzados de espectrometría de masas, lo que respaldará la innovación en varios sectores, incluidos los productos farmacéuticos y las pruebas ambientales.

- En junio de 2024, según el artículo publicado en Separation Science, la espectrometría de masas presenta una oportunidad única para que el aprendizaje automático y la IA mejoren la interpretación de los datos. Debido a la complejidad de los espectros de masas, a menudo se requiere un análisis experto para extraer información significativa, ya que muchos detalles siguen sin estar claros. Sin embargo, la IA se destaca en la identificación de patrones en estos datos. Herramientas como Prosit han demostrado el potencial de la IA para predecir y detectar péptidos, lo que destaca importantes oportunidades de mercado.

En febrero de 2024, según el artículo publicado en NCBI, la integración del aprendizaje automático (ML) en el análisis de espectrometría de masas (MS) ha cobrado impulso, con enfoques innovadores que surgen en todo el campo. A medida que se utilizan cada vez más el aprendizaje profundo y las redes neuronales artificiales (ANN), se vuelve crucial evaluar y comparar estos métodos de ML. Esta convergencia presenta una oportunidad significativa para el mercado global de espectrometría de masas, fomentando avances y mejorando las capacidades analíticas.

En enero de 2024, según el artículo publicado en Science Direct, el aprendizaje automático aprovecha los modelos computacionales para extraer información directamente de los datos, transformando los datos sin procesar en información procesable sin depender de ecuaciones predefinidas. La aplicación de varios modelos de IA a los datos de espectrometría de masas produce resultados precisos en un corto período de tiempo, lo que es particularmente valioso para el futuro procesamiento en vuelo de los datos de espectrometría de masas. Este avance representa una oportunidad importante para el mercado global de espectrometría de masas.

El auge de la automatización y la inteligencia artificial (IA) en la espectrometría de masas ofrece importantes oportunidades de crecimiento del mercado. La automatización mejora el procesamiento y el análisis de muestras, aumentando la eficiencia y el rendimiento en los laboratorios. Esta capacidad permite obtener resultados más rápidos y manejar muestras de mayor tamaño, acelerando así los esfuerzos de investigación. El análisis de datos impulsado por IA mejora la precisión y la velocidad de interpretación, lo que permite a los investigadores trabajar con conjuntos de datos complejos de manera más eficaz. Además, el aprendizaje automático puede optimizar las condiciones experimentales, mejorando el rendimiento de los instrumentos y reduciendo los costos. A medida que más laboratorios adopten estas tecnologías, aumentará la demanda de sistemas avanzados de espectrometría de masas que incorporen automatización e IA, lo que impulsará la innovación en sectores como el farmacéutico, las pruebas ambientales y el diagnóstico clínico.

- Creciente adopción de espectrómetros de masas compactos y portátiles

La creciente adopción de espectrómetros de masas compactos y portátiles presenta una oportunidad significativa para el mercado global de espectrometría de masas. Estos dispositivos avanzados facilitan el análisis in situ en diversas aplicaciones, como el control medioambiental, las pruebas de seguridad alimentaria y el diagnóstico clínico. Su pequeño tamaño y su diseño fácil de usar los hacen ideales para su uso en el campo o en ubicaciones remotas, lo que permite obtener resultados inmediatos sin la necesidad de una gran infraestructura de laboratorio. A medida que las industrias buscan una mayor eficiencia y una adquisición rápida de datos, se espera que aumente la demanda de soluciones de espectrometría de masas portátiles. Esta tendencia no solo mejora las capacidades de diagnóstico, sino que también promueve la innovación en las técnicas analíticas. Al satisfacer la creciente necesidad de métodos de prueba accesibles y eficientes, los espectrómetros de masas compactos están preparados para desempeñar un papel crucial en el futuro del mercado de la espectrometría de masas.

Por ejemplo,

- En noviembre de 2022, según el artículo publicado en NCBI, la espectrometría de masas (MS) es un método analítico muy informativo esencial para diversos estudios 'ómicos. Sin embargo, los espectrómetros de masas tradicionales suelen ser voluminosos y requieren condiciones de alto vacío, lo que limita su accesibilidad y uso en campo. El desarrollo de espectrómetros de masas portátiles puede ampliar en gran medida el rango de aplicación y la base de usuarios para el análisis MS, lo que representa una oportunidad significativa para el mercado global de espectrometría de masas.

- En mayo de 2022, según el artículo publicado en Research Gate, el rápido avance de la ciencia y la tecnología ha convertido a los espectrómetros de masas portátiles en instrumentos analíticos esenciales para la investigación. La miniaturización y las aplicaciones de cuatro tipos (espectrómetros de masas de sector magnético, de tiempo de vuelo, cuadrupolo y de trampa de iones) muestran su diseño compacto y facilidad de uso. Esta tendencia destaca una oportunidad importante para el mercado mundial de espectrometría de masas.

El creciente uso de espectrómetros de masas compactos y portátiles crea una valiosa oportunidad para el mercado global de espectrometría de masas. Estos dispositivos innovadores permiten el análisis in situ en diversos campos, incluidos el control medioambiental, la seguridad alimentaria y el diagnóstico clínico. Su pequeño tamaño y facilidad de uso los hacen perfectos para ubicaciones remotas, ya que proporcionan resultados rápidos sin necesidad de grandes instalaciones de laboratorio. A medida que las industrias priorizan la eficiencia y la recopilación rápida de datos, es probable que aumente la demanda de estas soluciones portátiles. Esta tendencia mejora las capacidades de diagnóstico e impulsa la innovación en los métodos analíticos, lo que posiciona a los espectrómetros de masas compactos como herramientas vitales para el futuro del mercado de la espectrometría de masas.

Restricciones/Desafíos

- Alto costo de la espectrometría de masas

El alto costo de los sistemas de espectrometría de masas y sus gastos operativos asociados actúan como una restricción importante en el mercado global de espectrometría de masas, limitando la accesibilidad para muchos laboratorios, especialmente en economías emergentes e instituciones de investigación más pequeñas. La inversión inicial requerida para los instrumentos avanzados de espectrometría de masas es sustancial, abarcando no solo el precio de compra sino también los gastos relacionados con la instalación, el mantenimiento y la necesidad de personal especializado para operar e interpretar los resultados. Además, los costos continuos de los consumibles, como reactivos y estándares de calibración, pueden tensar aún más los presupuestos, lo que dificulta que las organizaciones con recursos limitados adopten o actualicen sus capacidades de espectrometría de masas. Esta barrera financiera puede obstaculizar la adopción de tecnologías de espectrometría de masas, particularmente en campos que requieren soluciones analíticas rentables, lo que frena los avances en la investigación y las aplicaciones clínicas. En consecuencia, a pesar de la creciente demanda de espectrometría de masas en varias industrias, el alto costo asociado con estas tecnologías sigue planteando un desafío importante, que potencialmente limita el crecimiento del mercado y la utilización general de la espectrometría de masas en aplicaciones críticas.

Por ejemplo,

- En agosto de 2019, según el artículo publicado en la American Chemical Society, un espectrómetro de masas de triple cuadrupolo suele costar alrededor de 350.000 dólares, aunque este precio puede variar en función de sus características. Un instrumento de tiempo de vuelo de alta resolución suele oscilar entre 350.000 y 400.000 dólares, mientras que un modelo Orbitrap de rango de masas extendido puede tener un precio de entre 400.000 y 800.000 dólares aproximadamente. El alto coste de la espectrometría de masas moderna actúa como un freno al crecimiento del mercado.

- En julio de 2019, según el artículo publicado en Journal of Infectiology & Epidemiology, la espectrometría de masas MALDI-TOF ofrece ventajas significativas en la identificación rápida y precisa de microorganismos, pero su alto costo sigue siendo una limitación sustancial. El gasto de adquisición y mantenimiento de equipos de espectrometría de masas, junto con la necesidad de capacitación e infraestructura especializadas, plantea una barrera para su adopción generalizada, en particular en entornos con recursos limitados.

Los costos prohibitivos de los sistemas de espectrometría de masas y sus gastos operativos continuos constituyen un obstáculo importante en el mercado mundial de espectrometría de masas. La importante inversión inicial que se requiere para los instrumentos avanzados, junto con el alto costo de mantenimiento, los consumibles y la necesidad de personal calificado, limitan el acceso a muchos institutos de investigación y laboratorios pequeños, en particular en las regiones en desarrollo. Esta carga financiera puede disuadir a las organizaciones de adoptar o mejorar sus capacidades de espectrometría de masas, lo que en última instancia frena el progreso en la investigación y las aplicaciones clínicas.

- Escasez de mano de obra calificada

El mercado de la espectrometría de masas se enfrenta a un desafío importante debido a la escasez de profesionales capacitados capaces de operar sistemas avanzados de espectrometría de masas e interpretar datos complejos. La naturaleza intrincada de la espectrometría de masas exige capacitación y experiencia especializadas, que pueden ser difíciles de encontrar. Esta escasez no solo limita la adopción de la tecnología de espectrometría de masas, ya que las organizaciones pueden dudar en invertir sin personal calificado, sino que también puede generar resultados inconsistentes debido a la variabilidad en la calidad e interpretación de los datos. Además, las empresas pueden incurrir en mayores costos de capacitación para mejorar las habilidades del personal existente, lo que presiona aún más los presupuestos operativos. La falta de trabajadores capacitados puede sofocar la innovación, ya que las nuevas técnicas y aplicaciones pueden quedar sin explorar, mientras que la experiencia limitada crea cuellos de botella en los flujos de trabajo, lo que ralentiza los procesos de investigación y análisis. Abordar esta escasez de mano de obra es crucial para el crecimiento y el avance continuos del mercado de la espectrometría de masas.

Por ejemplo,

- En febrero de 2023, según el artículo publicado en Biomedical Research Network, el sector sanitario se enfrenta a una grave escasez de profesionales esenciales de laboratorio médico que trabajan entre bastidores. Esta falta de técnicos cualificados limita la eficacia operativa y las capacidades de análisis de los sistemas de espectrometría de masas. Como resultado, esta escasez actúa como un desafío importante, que obstaculiza el crecimiento y la adopción generalizada de la espectrometría de masas en los entornos sanitarios.

- En octubre de 2022, según el artículo publicado por THG PUBLISHING PVT LTD, el Laboratorio Regional de Examinadores Químicos de Kakkanad está experimentando desafíos operativos debido a la escasez de personal y equipos modernos inadecuados. Esta situación refleja un problema más amplio que afecta al mercado mundial de espectrometría de masas, donde limitaciones similares pueden obstaculizar la eficiencia y la eficacia del laboratorio. Como resultado, esta deficiencia de personal y equipo actúa como un desafío importante para el crecimiento del mercado.

El mercado de la espectrometría de masas se ve obstaculizado significativamente por la escasez de profesionales cualificados capaces de operar sistemas avanzados y analizar datos complejos. Esta falta de experiencia restringe la adopción de tecnología, ya que las organizaciones pueden ser reacias a invertir sin personal cualificado. Además, pueden surgir resultados inconsistentes a partir de interpretaciones de datos variables, y las empresas se enfrentan a mayores costes de formación para desarrollar al personal existente. Esta falta de habilidades puede sofocar la innovación y crear cuellos de botella en el flujo de trabajo, lo que en última instancia ralentiza la investigación y el análisis. Abordar la escasez de trabajadores cualificados es esencial para el crecimiento continuo del mercado de la espectrometría de masas.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de la espectrometría de masas

El mercado está segmentado en función de la tecnología, la modalidad, la aplicación, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tecnología

- Espectrometría de masas híbrida

- Orbitrap-MS

- EM-FT

- Otros

- Espectrometría de masas única

- Tiempo de vuelo

- Cuadrupolo

- Otros

- Otros

Modalidad

- Mesa de trabajo

- Autónomo

Solicitud

- Industria farmacéutica

- Institutos de investigación y académicos

- Industria de alimentos y bebidas

- Industria petroquímica

- Otros

Canal de distribución

- Licitaciones directas

- Ventas al por menor

- Otros

Análisis regional del mercado de espectrometría de masas

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, tecnología, modalidad, aplicación, usuario final y canal de distribución como se mencionó anteriormente.

Los países cubiertos en el mercado son EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Italia, España, Rusia, Países Bajos, Suiza, Turquía, resto de Europa, China, Japón, India, Australia, Corea del Sur, Tailandia, Indonesia, Malasia, Singapur, Vietnam, Filipinas, resto de APAC, Brasil, Argentina, resto de Sudamérica, Arabia Saudita, Sudáfrica, Egipto, Emiratos Árabes Unidos, Israel, resto de MEA.

Se espera que América del Norte domine el mercado debido a su infraestructura de investigación avanzada, sus inversiones significativas en atención médica y ciencias biológicas y su alta adopción de tecnologías de vanguardia como la espectrometría de masas híbrida y en tándem. El fuerte apoyo de las iniciativas gubernamentales y de las agencias reguladoras fomenta la innovación e impulsa el crecimiento del mercado en la región.

Se espera que Asia-Pacífico sea la región de más rápido crecimiento debido a los rápidos avances en la infraestructura de atención médica y al aumento de las inversiones en investigación y desarrollo en toda la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de la espectrometría de masas

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de espectrometría de masas que operan en el mercado son:

- Thermo Fisher Scientific, Inc. (Estados Unidos)

- Corporación Shimadzu (Japón)

- Agilent Technologies, Inc. (Estados Unidos)

- Bruker Corp (Estados Unidos)

- Corporación Waters (Estados Unidos)

- Corporación Danaher (Estados Unidos)

- PerkinElmer, Inc.

- Corporación Rigaku

- JEOL Ltd. (Japón)

- Corporación LECO

- Hiden Analytical (Inglaterra)

- Hitachi Ltd. (Japón)

- Tecnología Kore (Reino Unido)

- Ametek Inc. (Estados Unidos)

Últimos avances en el mercado de la espectrometría de masas

- En octubre de 2024, Waters Corporation lanzó nuevos reactivos, enzimas y software de grado LC-MS para mejorar el análisis de ARN para vacunas y terapias de ARNm. Las herramientas simplifican la confirmación de secuencias y mejoran la sensibilidad, acelerando el desarrollo y garantizando al mismo tiempo la seguridad y eficacia de los productos farmacéuticos basados en ARN.

- En junio de 2024, Agilent Technologies presentó el sistema GC/MS de triple cuadrupolo 7010D y la celda ExD para el LC/Q-TOF AdvanceBio 6545XT en ASMS 2024, mejorando la sensibilidad, la caracterización estructural y la eficiencia analítica en seguridad alimentaria, pruebas ambientales e investigación biofarmacéutica.

- En mayo de 2024, The Bruker Corp completó la adquisición de NanoString Technologies y adquirió activos clave, incluidas las líneas de productos nCounter, GeoMx, CosMx y AtoMx™, por aproximadamente USD 392,6 millones. Esta medida estratégica mejoró las capacidades de Bruker en la elaboración de perfiles de expresión genética y la transcriptómica espacial para la investigación.

- En octubre de 2023, Waters Corporation se ha asociado con la Universidad de San Agustín para establecer el primer centro de imágenes por espectrometría de masas de Filipinas. Equipado con el sistema SYNAPT HDMS, el centro tiene como objetivo promover el descubrimiento de fármacos de medicina natural para el cáncer y las enfermedades infecciosas.

- En junio de 2023, Agilent Technologies presentó los sistemas de espectrometría de masas LC/TQ 6495D y LC/Q-TOF Revident en ASMS 2023, mejorando la sensibilidad y la eficiencia para análisis específicos. El nuevo software MassHunter Explorer y ChemVista agiliza la exploración e identificación de datos, revolucionando los flujos de trabajo en varios campos científicos

- En mayo de 2023, Thermo Fisher y BRIN se asociaron para mejorar las capacidades de investigación en Indonesia, centrándose en promover la innovación científica y la colaboración en ciencias de la vida, biotecnología y estudios ambientales para investigadores locales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.