Global Ion Implanter Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

945.00 Million

USD

1,396.20 Million

2021

2029

USD

945.00 Million

USD

1,396.20 Million

2021

2029

| 2022 –2029 | |

| USD 945.00 Million | |

| USD 1,396.20 Million | |

|

|

|

|

Mercado mundial de implantadores de iones, por tecnología (implantadores de baja energía, implantadores de energía media, implantadores de alta energía), aplicación (fabricación de semiconductores, acabado de metales, otros): tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado

En los últimos años, la demanda de dispositivos electrónicos como teléfonos inteligentes, computadoras portátiles y otros dispositivos electrónicos ha aumentado considerablemente. El mercado de implantadores de iones ha estado creciendo rápidamente. Según la Asociación de Electrónica de Consumo (CEA), el mercado de dispositivos electrónicos de consumo tendrá un valor de $ 415,897 millones en 2021, un 13,9 por ciento más que el año anterior. Además, las nuevas tecnologías como la inteligencia artificial y el reconocimiento de voz están animando a los usuarios finales a comprar dispositivos electrónicos avanzados. Como resultado, se espera que el mercado de implantadores de iones crezca significativamente durante el período de pronóstico.

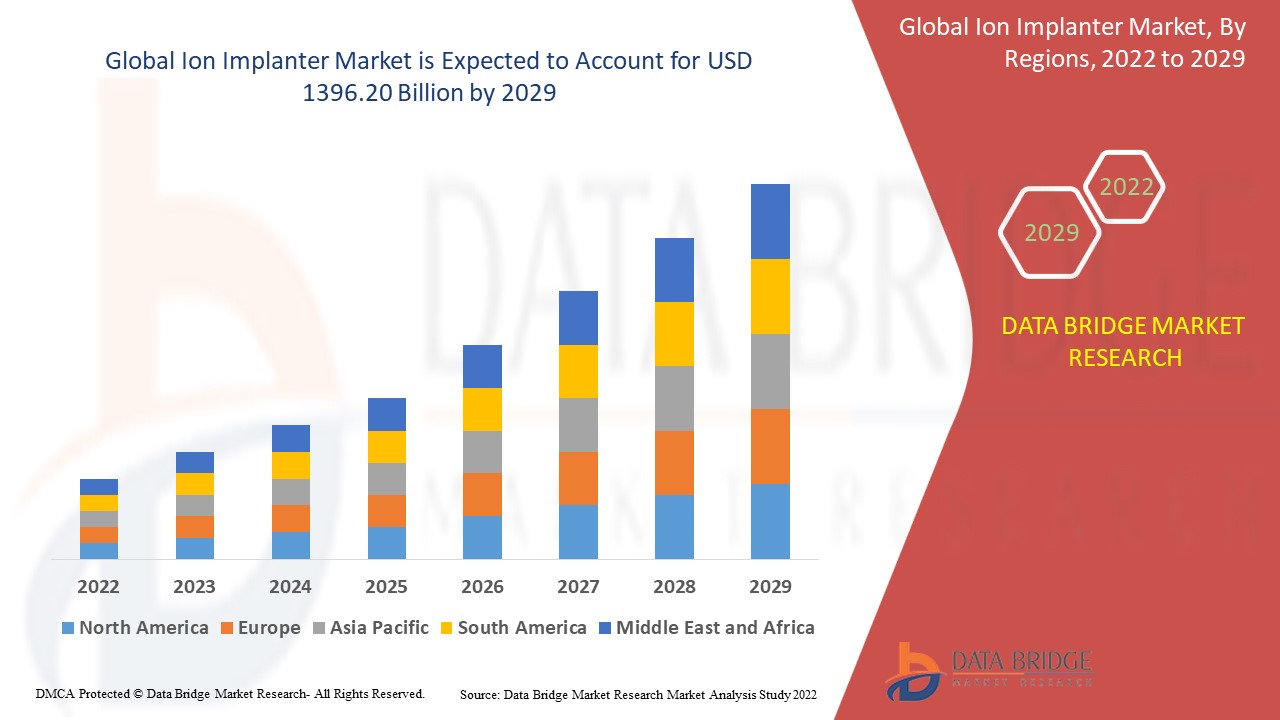

El mercado global de implantadores de iones se valoró en USD 945,00 millones en 2021 y se espera que alcance los USD 1396,20 millones para 2029, registrando una CAGR del 5,00% durante el período de pronóstico de 2022 a 2029. Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado curado por el equipo de investigación de mercado de Data Bridge también incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y escenario de la cadena climática.

Alcance del informe y segmentación del mercado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por tecnología (implantador de baja energía, implantador de energía media, implantador de alta energía), aplicación (fabricación de semiconductores, acabado de metales, otros) |

|

Países cubiertos |

EE. UU., Canadá, México, Brasil, Argentina, Resto de Sudamérica, Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Sudáfrica, Israel, Resto de Medio Oriente y África |

|

Actores del mercado cubiertos |

Applied Materials, Inc. (EE. UU.), Axcelis Technologies (EE. UU.), Varian Inc. (EE. UU.), Nissin Ion Equipment Co. Ltd. (EE. UU.), Sumitomo Heavy Industries Ltd. (Japón), Amtech Systems Inc. (EE. UU.), Intevac Inc. (EE. UU.), ULVAC Inc. (Japón), Ion beam services SA (Francia), Nissin Electric Co. Ltd. (Japón), High Voltage Engineering Europa BV (Países Bajos), II-VI Incorporated (EE. UU.), CuttingEdge Ions (EE. UU.), Phoenix (EE. UU.), MKS Instruments (EE. UU.) y Kingstone Semiconductor Joint Stock Company Ltd (China) |

|

Oportunidades de mercado |

|

Definición de mercado

La implantación de iones es un proceso de baja temperatura que hace que los iones de un elemento penetren en un objetivo sólido, modificando las propiedades físicas, químicas o eléctricas del mismo. La implantación de iones se utiliza habitualmente en el dopaje de semiconductores con boro, fósforo o arsénico. Cada átomo dopante implantado en un semiconductor puede generar un portador de carga en el semiconductor. La implantación de iones es un proceso fundamental en la fabricación de microchips de silicio. También se utiliza para endurecer el acero inyectándole moléculas de nitrógeno y reforzando los materiales utilizados para fabricar dispositivos protésicos para evitar que se erosionen.

Dinámica del mercado de implantes iónicos

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Alta demanda de fabricación de semiconductores

En la actualidad, los implantadores de iones se utilizan ampliamente en la fabricación de semiconductores. Debido a la alta demanda de teléfonos inteligentes, computadoras portátiles y otros dispositivos electrónicos, el mercado de dispositivos electrónicos ha crecido rápidamente. Además, los tamaños de las obleas de silicio están pasando de 100 mm a 300 mm en la industria de los semiconductores. En los últimos años, los tamaños de las obleas han aumentado entre un 25 % y un 50 % en la industria de los semiconductores debido a los avances tecnológicos en las máquinas de implantes de iones. Se espera que el crecimiento de la demanda de semiconductores impulse la demanda de implantadores de iones. Como resultado, se estima que la demanda de implantadores de iones aumentará durante el período de pronóstico.

- Implantadores de iones de última generación que ofrecen

El Internet de las cosas (IoT), los coches autónomos y los hogares inteligentes están generando crecimiento para los fabricantes de implantadores de iones. Las empresas están ampliando su experiencia en una amplia gama de tipos y modelos de equipos para ofrecer actualizaciones y servicios de modernización rentables. Los implantadores de iones de última generación ayudan en el mantenimiento y modernización de los equipos. Las partes interesadas están apoyando las innovaciones en componentes eléctricos, paneles solares y baterías como parte del campo de la eficiencia energética. Las empresas ahora pueden ofrecer servicios tanto subcontratados como de fabricación gracias a los implantadores de iones de última generación. Como resultado, se estima que el mercado de implantadores de iones ha acelerado su crecimiento.

- Mayor utilización de implantadores de iones para diversas aplicaciones

La implantación de iones se utiliza con mayor frecuencia para crear microchips de silicio. La creciente demanda de dispositivos electrónicos y la dependencia de la industria de semiconductores de los sustratos de silicio han impulsado la expansión del mercado global de implantadores de iones. La implantación de iones es necesaria para la producción de nanocompuestos plasmáticos con aplicaciones de gestión de la luz, como la captura de luz de células fotovoltaicas y la detección del índice de refracción local. El proceso de implantación de iones se utiliza para producir nanopartículas de metales nobles con alta estabilidad, que tienen una gran demanda. También se espera que esto aumente la demanda de varios tipos de procesos de implantación de iones en el futuro cercano. Además, se espera que el uso de la implantación de iones en aplicaciones industriales para reforzar el acero utilizado en diversas maquinarias y en la industria de TI para la producción de placas de circuitos impulse el mercado de implantadores de iones.

Además, la creciente demanda de implantes iónicos para la fabricación de nanocompuestos plasmáticos también acelera el crecimiento del mercado. Asimismo, durante el período de pronóstico, se espera que la creciente demanda de nanopartículas de metales nobles a través del proceso de implantación iónica catalice la creciente demanda de diversas formas de implantación iónica.

Oportunidades

- Desarrollos e Inversiones

Además, el desarrollo de módulos fotovoltaicos de alto rendimiento basados en células solares de silicio cristalino delgadas es el resultado de los avances en la implantación de iones para células solares, lo que amplía aún más las oportunidades rentables para los actores del mercado en el período de pronóstico de 2022 a 2029. Además, los fabricantes están invirtiendo más en procesos de autoalineación para la fabricación de células solares de contacto posterior interdigitado (IBC) basadas en implantación de iones, lo que ampliará aún más el crecimiento futuro del mercado de implantadores de iones.

Restricciones/Desafíos

- Costos iniciales elevados

Por otra parte, se espera que la elevada inversión inicial asociada con la adquisición y los servicios posventa de las máquinas de implantación de iones limite el crecimiento del mercado. Las máquinas de implantación de iones son costosas y tienen un ciclo de vida largo, por lo que rara vez se las reemplaza. El mercado mundial de máquinas de implantación de iones se ve obstaculizado en gran medida por este factor.

- Limitaciones dentro del mercado

Sin embargo, la creciente demanda de implantadores de iones reacondicionados y usados, la gran dependencia de un pequeño grupo de clientes y la recesión y la naturaleza altamente cíclica de la industria electrónica podrían limitar el crecimiento de la industria de implantadores de iones durante el período de pronóstico. Por lo tanto, estas limitaciones desafiarán la tasa de crecimiento del mercado de implantadores de iones.

Este informe de mercado de implantadores de iones proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de implantadores de iones, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de COVID-19 en el mercado de implantadores de iones

El reciente brote de coronavirus tuvo un impacto significativo en el mercado de implantadores de iones. El gobierno impuso diversas restricciones, como cierres y distanciamiento social, que resultaron en una caída significativa en la producción de las principales industrias. La demanda de productos electrónicos ha caído drásticamente como resultado de la desaceleración económica de la pandemia. La industria electrónica ha restringido el mercado mundial de implantadores de iones, que es una importante industria de usuarios finales. Además, las interrupciones de la cadena de suministro causadas por las restricciones de transporte nacionales e internacionales han tenido un impacto en las operaciones del mercado de implantadores de iones. Además, la demanda de los consumidores ha disminuido, ya que las personas ahora están más enfocadas en eliminar los gastos no esenciales de sus presupuestos, ya que la situación económica general de la mayoría de las personas se ha visto gravemente afectada por el brote.

En el lado positivo, se ha descubierto que el brote de COVID-19 ha tenido un menor impacto en industrias como la de semiconductores, acabado de metales e investigación en ciencia de materiales. La 23.ª Conferencia Internacional sobre Tecnología de Implantación de Iones, por ejemplo, se ha reprogramado para el 25 al 29 de septiembre de 2022 en San Diego. Como resultado, las partes interesadas están redoblando sus esfuerzos en proyectos de misión crítica en las industrias de semiconductores y acabado de metales para mantener la continuidad del negocio incluso durante la pandemia.

Alcance del mercado global de implantadores de iones

El mercado de implantadores de iones está segmentado en función de la tecnología y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tecnología

- Implantador de bajo consumo energético

- Implantador de energía media

- Implantador de alta energía

Solicitud

- Fabricación de semiconductores

- Acabado de metales

- Otros

Análisis y perspectivas regionales del mercado de implantadores de iones

Se analiza el mercado de implantadores de iones y se proporcionan información y tendencias del tamaño del mercado por país, tecnología y aplicación como se menciona anteriormente.

Los países cubiertos en el informe de mercado de implantadores de iones son EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto, Sudáfrica, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur.

América del Norte domina el mercado de implantadores de iones en términos de participación de mercado e ingresos de mercado y seguirá fortaleciendo su dominio durante el período de pronóstico de 2022 a 2029. El crecimiento del mercado en esta región se atribuye al uso generalizado de la fabricación de semiconductores y al aumento de los desarrollos dentro de la región.

Por otra parte, se estima que Asia-Pacífico mostrará un crecimiento lucrativo durante el período de pronóstico de 2022 a 2029, debido a las altas demandas de microelectrónica y la creciente demanda de implantes de iones para la fabricación de nanocompuestos plasmáticos en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los implantadores de iones

El panorama competitivo del mercado de implantadores de iones proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento del producto, la amplitud y la variedad del producto, el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de implantadores de iones.

Algunos de los principales actores que operan en el mercado de implantadores de iones son

- Applied Materials, Inc., (Estados Unidos)

- Axcelis Technologies (Estados Unidos)

- Varian Inc. (Estados Unidos)

- Nissin Ion Equipment Co. Ltd. (Estados Unidos)

- Sumitomo Heavy Industries Ltd., (Japón)

- Amtech Systems Inc. (Estados Unidos)

- Intevac Inc. (Estados Unidos)

- ULVAC Inc., (Japón)

- Servicios de haz de iones SA (Francia)

- Nissin Electric Co. Ltd. (Japón)

- High Voltage Engineering Europa BV (Países Bajos)

- II-VI Incorporated (EE.UU.)

- Iones de vanguardia (EE. UU.)

- Phoenix (Estados Unidos)

- MKS Instruments (Estados Unidos)

- Kingstone Semiconductor Sociedad Anónima Ltda. (China)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.