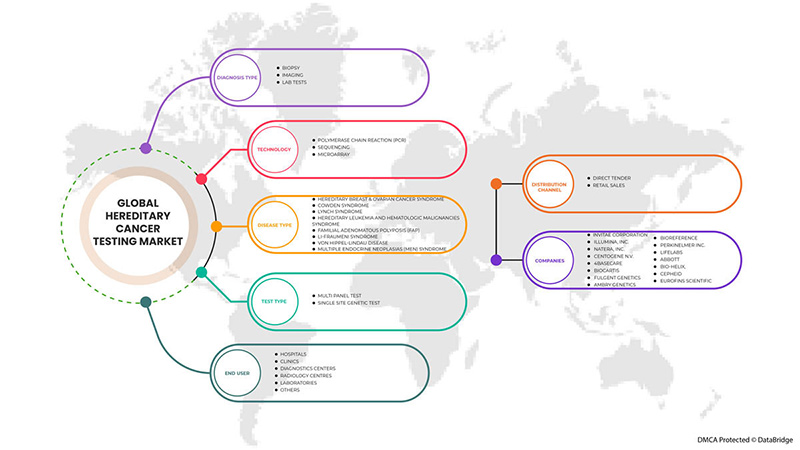

Mercado mundial de pruebas de cáncer hereditario, por tipo de prueba (conjunto de paneles múltiples y prueba genética de sitio único), tipo de diagnóstico (biopsia, imágenes, pruebas de laboratorio), tecnología (secuenciación, reacción en cadena de la polimerasa (PCR), microarray), tipo de enfermedad (síndrome de cáncer de mama y ovario hereditario, síndrome de Cowden, síndrome de Lynch, síndromes de leucemia hereditaria y neoplasias hematológicas, poliposis adenomatosa familiar (FAP), síndrome de Li-Fraumeni, enfermedad de von Hippel-Lindau, síndromes de neoplasias endocrinas múltiples (MEN)), usuario final (hospitales, clínicas, laboratorios, centros de radiología, centros de diagnóstico, otros), canal de distribución (licitación directa, ventas minoristas), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de pruebas de cáncer hereditario

El cáncer es una enfermedad genética causada por ciertas mutaciones en los genes que controlan la función de las células, afectando particularmente su crecimiento y reproducción. Las mutaciones genéticas hereditarias son responsables de aproximadamente el 5-10% de todos los cánceres. Los investigadores han vinculado las mutaciones en genes específicos a más de 50 síndromes de cáncer hereditario que afectan a las personas a través del desarrollo de ciertos cánceres. Además, alrededor del 5-10% de los casos de cáncer de mama están asociados con mutaciones genéticas heredadas de los padres. Por lo tanto, la creciente prevalencia del cáncer está impulsando el crecimiento constante de los cánceres hereditarios y, por lo tanto, impulsando el crecimiento del mercado de pruebas de cáncer hereditario. Además, el aumento de la demanda de métodos de prueba no invasivos y la creciente demanda de atención médica de mejor calidad y diagnóstico temprano son las principales oportunidades para el crecimiento del mercado. Además, los desafíos éticos a los que se enfrenta durante las pruebas de cáncer hereditario y la creciente competencia entre los actores del mercado son los desafíos clave para el crecimiento del mercado.

Sin embargo, las estrictas regulaciones para el diagnóstico del cáncer y el alto costo asociado con las pruebas pueden obstaculizar el crecimiento del mercado.

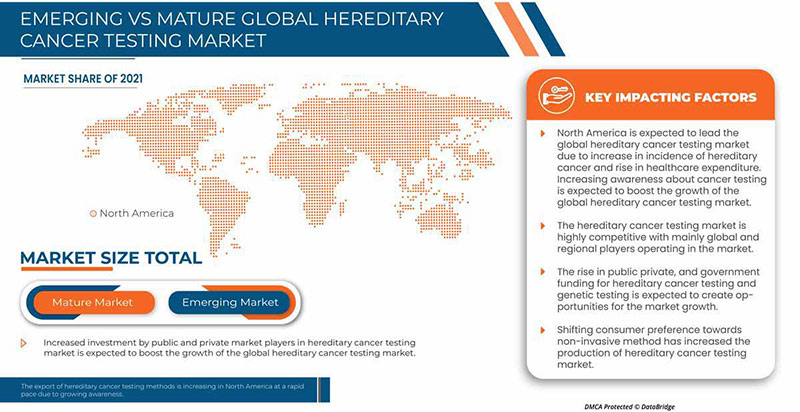

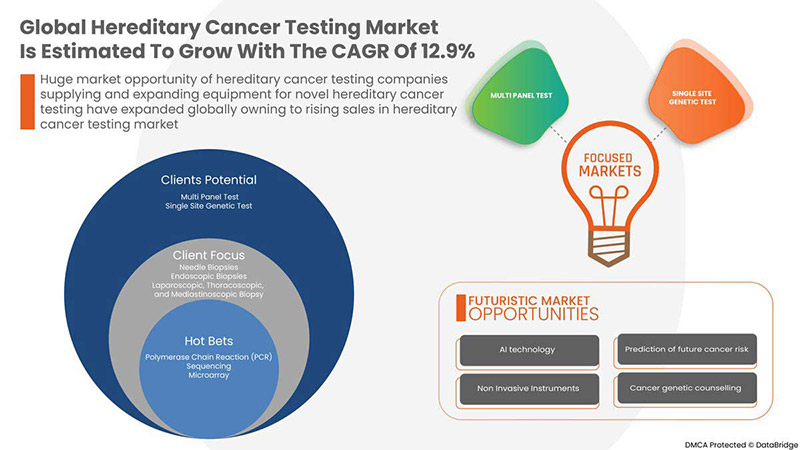

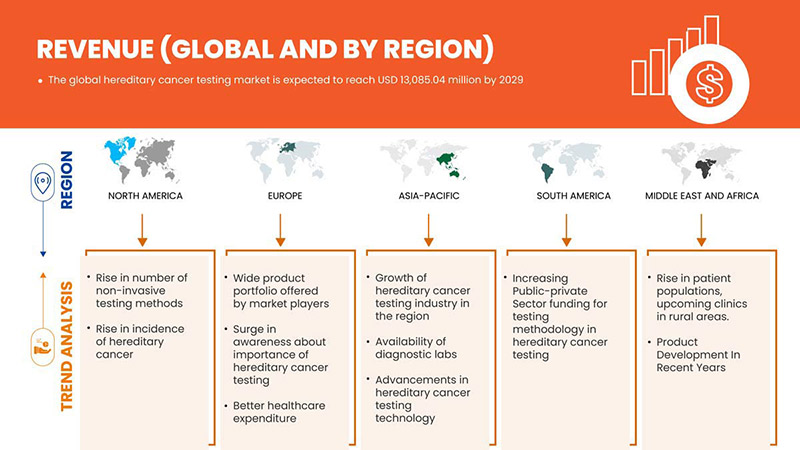

Data Bridge Market Research analiza que se espera que el mercado mundial de pruebas de cáncer hereditario alcance un valor de USD 13.085,04 millones para 2029, con una CAGR del 12,9 % durante el período de pronóstico. Este informe de mercado también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2015) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por tipo de prueba (conjunto de paneles múltiples y prueba genética de sitio único), tipo de diagnóstico (biopsia, imágenes, pruebas de laboratorio), tecnología (secuenciación, reacción en cadena de la polimerasa (PCR), microarray), tipo de enfermedad (síndrome hereditario de cáncer de mama y ovario, síndrome de Cowden, síndrome de Lynch, síndromes hereditarios de leucemia y neoplasias hematológicas, poliposis adenomatosa familiar (FAP), síndrome de Li-Fraumeni, enfermedad de von Hippel-Lindau, síndromes de neoplasias endocrinas múltiples (MEN)), usuario final (hospitales, clínicas, laboratorios, centros de radiología, centros de diagnóstico, otros), canal de distribución (licitación directa, ventas minoristas). |

|

Países cubiertos |

Estados Unidos, Canadá, México, Alemania, Francia, Reino Unido, Italia, España, Rusia, Turquía, Bélgica, Países Bajos, Suiza y el resto de Europa, China, Japón, India, Corea del Sur, Singapur, Tailandia, Malasia, Australia, Filipinas, Indonesia y el resto de Asia-Pacífico, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y el resto de Oriente Medio y África, Brasil, Argentina y el resto de Sudamérica. |

|

Actores del mercado cubiertos |

Invitae Corporation, Illumina, Inc., Natera, Inc., CENTOGENE NV, 4baseCare, Biocartis, Fulgent Genetics, Ambry Genetics, BioReference, PerkinElmer Inc., LifeLabs, Abbott, BIO-HELIX, Cepheid, Eurofins Scientific, entre otros. |

Definición del mercado mundial de pruebas de detección del cáncer hereditario

El cáncer hereditario es cualquier cáncer causado por una mutación genética hereditaria. Las variantes dañinas en ciertos genes están asociadas con un mayor riesgo de cáncer. Las pruebas genéticas pueden estimar el riesgo de una persona de desarrollar cáncer a lo largo de su vida. Esto se puede hacer buscando mutaciones en sus genes, cromosomas o proteínas. Las pruebas genéticas están disponibles para varios tipos de cáncer. Estos incluyen cáncer de mama, ovario, colon, tiroides, próstata, páncreas, cáncer de piel, sarcoma y cáncer de riñón y estómago. Numerosos estudios médicos muestran que entre el 5% y el 10% de los cánceres comunes se consideran hereditarios. Las pruebas genéticas se realizan para determinar si una persona es portadora de una variante genética dañina. Estas pruebas también ayudan a determinar si un miembro de la familia que aún no ha tenido cáncer ha heredado la misma variante que un miembro de la familia que se sabe que tiene una alternativa de susceptibilidad al cáncer.

Dinámica del mercado mundial de pruebas de detección del cáncer hereditario

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la incidencia del cáncer hereditario

El cáncer surge del crecimiento descontrolado de las células. El cáncer es causado por cambios dañinos (mutaciones) en los mensajes genéticos (genes) que controlan el crecimiento y la división de las células, impidiéndoles realizar su trabajo de manera eficaz.

En los casos de cáncer hereditario, el individuo hereda una copia del gen regulador del crecimiento mutado de uno de sus padres y una copia funcional del mismo gen del otro padre. El gen mutado también se denomina "gen de susceptibilidad al cáncer". Como este gen de susceptibilidad al cáncer se hereda, se encuentra en todas las células del cuerpo, pero una copia funcional del gen mantiene el correcto funcionamiento de cada célula. Sin embargo, si una mutación daña una copia funcional de un gen en una célula, la célula puede perder el control de su crecimiento y volverse cancerosa. Por lo tanto, las personas que heredan un gen del cáncer tienen muchas más probabilidades de desarrollar ciertos tipos de cáncer durante su vida.

Por lo tanto, la creciente incidencia del cáncer hereditario incrementa la demanda de pruebas de cáncer hereditario y puede actuar como motor del crecimiento del mercado mundial de pruebas de cáncer hereditario.

- Aumento de la población geriátrica

El cáncer puede ser una enfermedad de pacientes mayores. En todo el mundo, la población geriátrica está aumentando. El riesgo de cáncer hereditario entre los geriátricos es mucho mayor. El aumento de la población geriátrica puede dar lugar a una mejor oferta del mercado mundial de pruebas de cáncer hereditario. Se anticipó un aumento de la demanda en el mercado mundial de pruebas de cáncer hereditario. El envejecimiento de la población está provocando una redistribución de la estructura demográfica que afectará al futuro de la atención sanitaria. Sin duda, el riesgo de cáncer aumenta exponencialmente con la edad.

El cáncer hereditario, incluida su incidencia y riesgo asociado, según la base de datos de cáncer confirmado médicamente y estructura familiar completa más grande del mundo, fue aproximadamente el doble en la población de 8 a 20 años nacida de padres afectados o hermanos de personas que no tienen familiares. El riesgo de cáncer de intestino delgado, testículo, tiroides y huesos fue de cinco a ocho veces mayor.

Por lo tanto, se espera que el aumento de la incidencia de cáncer entre la población geriátrica sea un factor impulsor del crecimiento del mercado mundial de pruebas de cáncer hereditario.

Restricción

- El alto costo de las pruebas de detección del cáncer hereditario

Las pruebas de detección del cáncer hereditario emplean productos de tecnología muy avanzada. El desarrollo de estos productos implica una investigación y un desarrollo rigurosos por parte de la empresa desarrolladora. Por lo tanto, los procedimientos y el costo del producto siguen siendo altos, lo que aumenta proporcionalmente el costo de las pruebas. Los kits de prueba son caros porque requieren una gran cantidad de recursos e implican médicos bien pagados, transporte y medicamentos costosos.

- Además, también se han utilizado procedimientos de análisis para detectar el cáncer. Sin embargo, estos procedimientos son muy costosos y pueden estar asociados con complicaciones y peores resultados a largo plazo.

Por lo tanto, el alto costo de las pruebas de cáncer que utilizan modalidades y productos tecnológicos avanzados puede ser un factor restrictivo importante para el crecimiento del mercado mundial de pruebas de cáncer hereditario.

Oportunidad

-

Iniciativas estratégicas de los actores del mercado

El aumento del mercado mundial de pruebas de cáncer hereditario aumenta la necesidad de ideas comerciales estratégicas. Incluye una asociación, expansión comercial y otros desarrollos. El aumento de la demanda de tratamiento del cáncer hereditario está aumentando significativamente la demanda de métodos de pruebas de diagnóstico. Las estrategias planificadas permiten que los actores del mercado se alineen con las actividades funcionales de la organización para lograr los objetivos establecidos. Orienta las discusiones y la toma de decisiones de la empresa para determinar los requisitos de recursos y presupuesto para lograr los objetivos, aumentando así la eficiencia operativa.

Estas iniciativas estratégicas, como lanzamientos de productos, acuerdos y expansión comercial por parte de los principales actores del mercado, impulsarán el crecimiento del mercado y se espera que actúen como una oportunidad para el mercado global de pruebas de cáncer hereditario. Se espera que las iniciativas estratégicas ayuden al crecimiento y mejoren la cartera de productos de la empresa, lo que en última instancia conducirá a una mayor generación de ingresos. Por lo tanto, se espera que estas iniciativas estratégicas de los actores del mercado actúen como una oportunidad para el crecimiento en el mercado global de pruebas de cáncer hereditario.

Desafío

- Desafíos éticos que se enfrentan durante las pruebas de detección del cáncer hereditario

Durante las pruebas genéticas de cáncer hereditario, uno de los obstáculos éticos más importantes es la falta de conocimientos básicos de los profesionales de la salud sobre las pruebas genéticas y su falta de confianza a la hora de interpretar los patrones de enfermedades familiares. El desafío para los profesionales de la salud es proporcionar información suficiente para respaldar la toma de decisiones del paciente y pruebas para respaldar el razonamiento que sustenta cualquier sugerencia que puedan hacer.

La falta de reembolso crea barreras económicas para la atención. El proceso de evaluación del riesgo de cáncer hereditario y el asesoramiento requieren mucho tiempo y no está claro cuál es la mejor manera de documentar y facturar este servicio. Los oncólogos a menudo se ven obligados a navegar en un entorno de reembolso potencialmente incierto para las pruebas genéticas, con diversas políticas de reembolso entre los pagadores externos.

Las pruebas genéticas para el cáncer hereditario plantean cuestiones éticas que no pueden resolverse con los pacientes o sus familiares. Los diversos aspectos de naturaleza ética, cultural y religiosa no deberían ser un obstáculo para el acto de realizar pruebas de cáncer hereditario. Todas estas son cuestiones que deben resolverse. Por lo tanto, se espera que los desafíos éticos durante las pruebas de cáncer hereditario desafíen el crecimiento del mercado.

Impacto posterior a la COVID-19 en el mercado mundial de pruebas de detección del cáncer hereditario

Muchas industrias de todo el mundo se han visto perjudicadas en los últimos 18 meses. Esto podría deberse a las importantes interrupciones que están experimentando sus procesos industriales y de cadena de suministro debido a diversas medidas de precaución, como cierres y otras restricciones que han estado siguiendo las instalaciones de todo el mundo. Lo mismo ocurre con el mercado mundial de pruebas de cáncer hereditario. Además, la demanda de consumo ha disminuido posteriormente, ya que las personas ahora tienen más oportunidades de excluir los gastos no esenciales de sus presupuestos, ya que las finanzas generales de la mayoría de las personas se han visto gravemente afectadas por el auge. Se puede esperar que estos factores mencionados anteriormente afecten el margen de ingresos del mercado mundial de pruebas de cáncer hereditario durante el período de pronóstico.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de I+D y lanzamiento de productos y asociaciones estratégicas para mejorar la tecnología y los resultados de las pruebas involucradas en el mercado de diagnóstico de trasplantes.

Acontecimientos recientes

- En julio de 2022, Helio Genomics y su socio comercial, Fulgent Genetics (FLGT), anunciaron que la Asociación Médica Estadounidense (AMA) emitió un nuevo código de análisis de laboratorio patentado de terminología de procedimiento actual (CPT) de categoría I para HelioLiver y una adopción más amplia de pruebas de vigilancia innovadoras y avanzadas para el cáncer de hígado en los EE. UU. Esto ha ayudado a la empresa a ampliar su cartera de productos.

- En marzo de 2022, Illumina, Inc. presentó el kit de diagnóstico in vitro (IVD), un secuenciador de ARN del cáncer. El lanzamiento dio como resultado la expansión de la línea de productos de secuenciación, seguida de la aprobación posterior a la comercialización. Se muestra un crecimiento lineal del mercado.

Alcance del mercado mundial de pruebas de cáncer hereditario

El mercado mundial de pruebas de cáncer hereditario está segmentado en tipo de prueba, tipo de diagnóstico, tecnología, tipo de enfermedad, usuario final y canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

POR TIPO DE PRUEBA

- PRUEBA MULTIPANEL

- PRUEBA GENÉTICA DE SITIO ÚNICO

Sobre la base del tipo de prueba, el mercado global de pruebas de cáncer hereditario está segmentado en pruebas de paneles múltiples y pruebas genéticas de sitio único.

POR TIPO DE DIAGNÓSTICO

- BIOPSIA

- IMÁGENES

- PRUEBAS DE LABORATORIO

Según el tipo de diagnóstico, el mercado mundial de pruebas de cáncer hereditario se segmenta en biopsia, imágenes y pruebas de laboratorio.

POR TECNOLOGÍA

- SECUENCIACIÓN

- REACCIÓN EN CADENA DE LA POLIMERASA (PCR)

- MICROARREGLA

Sobre la base de la tecnología, el mercado mundial de pruebas de cáncer hereditario está segmentado en secuenciación, reacción en cadena de la polimerasa (PCR) y microarrays.

POR TIPO DE ENFERMEDAD

- SÍNDROME HEREDITARIO DE CÁNCER DE MAMA Y OVARIO

- SÍNDROME DE COWDEN

- SÍNDROME DE LYNCH

- SÍNDROMES DE LEUCEMIA HEREDITARIA Y NEOPRENO HEMATOLÓGICO

- POLIPOSIS ADENOMATOSA FAMILIAR (PAF)

- SÍNDROME DE LI-FRAUMENI

- ENFERMEDAD DE VON HIPPEL-LINDAU

- SÍNDROMES DE NEOPLASIAS ENDOCRINAS MÚLTIPLES (HOMBRES)

On the basis of disease type, the global hereditary cancer testing market is segmented into hereditary breast & ovarian cancer syndrome, cowden syndrome, lynch syndrome, hereditary leukemia and hematologic malignancies syndromes, familial adenomatous polyposis (FAP), li-fraumeni syndrome, vol-hippel lindau disease, multiple endocrine neoplasias (MEN) syndrome.

BY END USER

- HOSPITALS

- CLINICS

- LABORATORIES

- RADIOLOGY CENTERS

- DIAGNOSTIC CENTERS

- OTHERS

On the basis of end user, the global hereditary cancer testing market is segmented into hospitals, clinics, laboratories, radiology centers, diagnostic centers, and others.

BY DISTRIBUTION CHANNEL

- DIRECT TENDER

- RETAIL SALES

On the basis of distribution channel, the global hereditary cancer testing market is segmented into direct tender, retail sales.

Global Hereditary Cancer Testing Market Regional Analysis/Insights

The global hereditary cancer testing market is analyzed and market size information is provided by country, test type, diagnosis type, technology, disease type, end user, and distribution channel.

The countries covered in this market report U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, and the rest of Europe, China, Japan, India, South Korea, Singapore, Thailand, Malaysia, Australia, Philippines, Indonesia, and the rest of Asia-Pacific, South Africa, Saudi Arabia, UAE, Egypt, Israel, and the rest of the Middle East and Africa, Brazil, Argentina, and the rest of South America.

North America is dominating the market due to the increasing investment in R&D is expected to boost the market growth. The U.S. dominates North America region due to strong presence of key players Invitae Corporation, Illumina, Inc., Natera, Inc. and others. U.K. dominates Europe region due to the mass production of hereditary cancer tests and increasing demand from emerging markets and expansion of healthcare industries. China dominates Asia-Pacific region due to rise in cancer related diagnostic tests.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Hereditary Cancer Testing Market Share Analysis

El panorama competitivo del mercado mundial de pruebas de cáncer hereditario proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y amplitud de los productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en el mercado mundial de pruebas de cáncer hereditario.

Algunos de los principales actores que operan en el mercado global de pruebas de cáncer hereditario son Invitae Corporation, Illumina, Inc., Natera, Inc., CENTOGENE NV, 4baseCare, Biocartis, Fulgent Genetics, Ambry Genetics, BioReference, PerkinElmer Inc., LifeLabs, Abbott, BIO-HELIX, Cepheid, Eurofins Scientific, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL HEREDITARY CANCER TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 GLOBAL HEREDITARY CANCER TESTING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING INCIDENCE OF HEREDITARY CANCER

6.1.2 INCREASE IN THE GERIATRIC POPULATION

6.1.3 RISING HEALTHCARE SPENDING

6.1.4 INCREASE IN AWARENESS ABOUT CANCER TESTING

6.2 RESTRAINTS

6.2.1 HIGH COST OF HEREDITARY CANCER TESTING

6.2.2 LACK OF SKILLED PROFESSIONALS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.2 INCREASED DEMAND FOR NON-INVASIVE TESTING METHODS

6.3.3 GROWING DEMAND FOR BETTER QUALITY HEALTHCARE AND EARLY DIAGNOSIS

6.3.4 TECHNOLOGICAL DEVELOPMENTS IN HEREDITARY CANCER TESTING PROCEDURES

6.4 CHALLENGES

6.4.1 ETHICAL CHALLENGES FACED DURING HEREDITARY CANCER TESTING

6.4.2 RISING COMPETITION AMONG MARKET PLAYERS

7 GLOBAL HEREDITARY CANCER TESTING MARKET, BY TEST TYPE

7.1 OVERVIEW

7.2 MULTI PANEL TEST

7.3 SINGLE-SITE GENETIC TEST

8 GLOBAL HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE

8.1 OVERVIEW

8.2 BIOPSY

8.2.1 NEEDLE BIOPSIES

8.2.2 ENDOSCOPIC BIOPSIES

8.2.3 LAPAROSCOPIC, THORACOSCOPIC, AND MEDIASTINOSCOPIC BIOPSY

8.2.4 LAPAROTOMY AND THORACOTOMY

8.2.5 OTHERS

8.3 IMAGING

8.3.1 MAGNETIC RESONANCE IMAGING (MRI)

8.3.2 COMPUTED TOMOGRAPHY (CT) SCAN

8.3.3 POSITRON EMISSION TOMOGRAPHY (PET) SCAN

8.3.4 NUCLEAR SCAN

8.3.5 ULTRASOUND

8.3.6 X-RAYS

8.4 LAB TESTS

8.4.1 BLOOD

8.4.2 URINE

8.4.3 OTHERS

9 GLOBAL HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 POLYMERASE CHAIN REACTION (PCR)

9.3 SEQUENCING

9.4 MICRO ARRAY

10 GLOBAL HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE

10.1 OVERVIEW

10.2 HEREDITARY BREAST & OVARIAN CANCER SYNDROME

10.3 COWDEN SYNDROME

10.4 LYNCH SYNDROME

10.5 HEREDITARY LEUKEMIA AND HEMATOLOGIC MALIGNANCIES SYNDROME

10.6 FAMILIAL ADENOMATOUS POLYPOSIS (FAP)

10.7 LI-FRAUMENI SYNDROME

10.8 VON HIPPEL-LINDAU DISEASE

10.9 MULTIPLE ENDOCRINE NEOPLASIAS (MEN) SYNDROME

11 GLOBAL HEREDITARY CANCER TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 CLINICS

11.4 DIAGNOSTIC CENTERS

11.5 RADIOLOGY CENTERS

11.6 LABORATORIES

11.7 OTHERS

12 GLOBAL HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 GLOBAL HEREDITARY CANCER TESTING MARKET, BY REGION

13.1 OVERVIEW

13.2 ASIA-PACIFIC

13.2.1 CHINA

13.2.2 JAPAN

13.2.3 SOUTH KOREA

13.2.4 INDIA

13.2.5 AUSTRALIA

13.2.6 SINGAPORE

13.2.7 THAILAND

13.2.8 MALAYSIA

13.2.9 INDONESIA

13.2.10 PHILIPPINES

13.2.11 REST OF ASIA-PACIFIC

13.3 NORTH AMERICA

13.3.1 U.S.

13.3.2 CANADA

13.3.3 MEXICO

13.4 EUROPE

13.4.1 GERMANY

13.4.2 FRANCE

13.4.3 U.K.

13.4.4 RUSSIA

13.4.5 ITALY

13.4.6 SPAIN

13.4.7 TURKEY

13.4.8 NETHERLANDS

13.4.9 SWITZERLAND

13.4.10 BELGIUM

13.4.11 REST OF EUROPE

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 SAUDI ARABIA

13.6.3 U.A.E.

13.6.4 EGYPT

13.6.5 ISRAEL

13.6.6 REST OF THE MIDDLE EAST AND AFRICA

14 GLOBAL HEREDITARY CANCER TESTING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ABBOTT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 ILLUMINA, INC. (2021)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 PERKINELMER INC. (2021)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 LIFELABS GENETICS

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 EUROFINS SCIENTIFIC (2021)

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 AMBRY GENETICS

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 BIOCARTIS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIO-HELIX

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOREFERENCE (A SUBSIDIARY OF OPKO HEALTH, INC.) (2021)

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENT

16.1 CENTOGENE N.V. (2021)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENT

16.11 CEPHEID

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 FULGENT GENETICS

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 INVITAE CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENT

16.14 NATERA, INC. (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 4BASECARE.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 GLOBAL HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL MULTI PANEL TEST IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL SINGLE-SITE GENETIC TEST IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL IMAGING IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL IMAGING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL POLYMERASE CHAIN REACTION (PCR) IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL SEQUENCING IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL MICROARRAY IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL HEREDITARY BREAST & OVARIAN CANCER SYNDROME IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL COWDEN SYNDROME IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL LYNCH SYNDROME IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL HEREDITARY LEUKEMIA AND HEMATOLOGIC MALIGNANCIES SYNDROME IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL FAMILIAL ADENOMATOUS POLYPOSIS (FAP) IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL LI-FRAUMENI SYNDROME IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL VON HIPPEL-LINDAU DISEASE IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL MULTIPLE ENDOCRINE NEOPLASIAS (MEN) SYNDROME IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL HEREDITARY CANCER TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL HOSPITALS CENTERS IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL CLINICS IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL DIAGNOSTIC CENTERS IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL RADIOLOGY CENTERS IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL LABORATORIES IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL OTHERS IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL DIRECT TENDER IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL RETAIL SALES IN HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL HEREDITARY CANCER TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 CHINA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 46 CHINA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 47 CHINA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 48 CHINA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 49 CHINA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 50 CHINA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 52 CHINA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 CHINA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 55 CHINA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 JAPAN HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 58 JAPAN HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 59 JAPAN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 60 JAPAN BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 62 JAPAN LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 63 JAPAN HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 JAPAN HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 65 JAPAN HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 66 JAPAN HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 69 SOUTH KOREA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 70 SOUTH KOREA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH KOREA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH KOREA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH KOREA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 INDIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 79 INDIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 80 INDIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 81 INDIA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 82 INDIA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 83 INDIA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 84 INDIA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 85 INDIA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 INDIA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 87 INDIA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 88 INDIA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 91 AUSTRALIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 92 AUSTRALIA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 96 AUSTRALIA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 97 AUSTRALIA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 98 AUSTRALIA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 99 AUSTRALIA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 102 SINGAPORE HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 103 SINGAPORE HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 104 SINGAPORE BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 105 SINGAPORE IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 106 SINGAPORE LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 107 SINGAPORE HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 108 SINGAPORE HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 109 SINGAPORE HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 110 SINGAPORE HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 111 THAILAND HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 112 THAILAND HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 113 THAILAND HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 114 THAILAND HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 115 THAILAND BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 116 THAILAND IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 117 THAILAND LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 118 THAILAND HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 119 THAILAND HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 120 THAILAND HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 121 THAILAND HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 MALAYSIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 123 MALAYSIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 124 MALAYSIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 125 MALAYSIA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 126 MALAYSIA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 127 MALAYSIA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 128 MALAYSIA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 129 MALAYSIA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 MALAYSIA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 131 MALAYSIA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 132 MALAYSIA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 135 INDONESIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 136 INDONESIA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 139 INDONESIA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 140 INDONESIA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 141 INDONESIA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 142 INDONESIA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 143 INDONESIA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 146 PHILIPPINES HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 147 PHILIPPINES HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 149 PHILIPPINES IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 150 PHILIPPINES LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 151 PHILIPPINES HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 152 PHILIPPINES HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 153 PHILIPPINES HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 154 PHILIPPINES HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 155 REST OF ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 156 NORTH AMERICA HEREDITARY CANCER TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 157 NORTH AMERICA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 158 NORTH AMERICA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 159 NORTH AMERICA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 160 NORTH AMERICA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 161 NORTH AMERICA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 162 NORTH AMERICA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 NORTH AMERICA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 164 NORTH AMERICA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 165 NORTH AMERICA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 U.S. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 167 U.S. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 168 U.S. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 169 U.S. HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 170 U.S. BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 171 U.S. IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 172 U.S. LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 173 U.S. HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 174 U.S. HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 175 U.S. HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 176 U.S. HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 177 CANADA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 178 CANADA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 179 CANADA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 180 CANADA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 181 CANADA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 182 CANADA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 183 CANADA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 184 CANADA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 CANADA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 186 CANADA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 187 CANADA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 188 MEXICO HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 189 MEXICO HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 190 MEXICO HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 191 MEXICO HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 192 MEXICO BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 193 MEXICO IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 194 MEXICO LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 195 MEXICO HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 196 MEXICO HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 197 MEXICO HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 198 MEXICO HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 199 EUROPE HEREDITARY CANCER TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 200 EUROPE HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 201 EUROPE HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 202 EUROPE BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 203 EUROPE IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 204 EUROPE LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 205 EUROPE HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 206 EUROPE HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 207 EUROPE HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 208 EUROPE HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 209 GERMANY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 210 GERMANY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 211 GERMANY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 212 GERMANY HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 213 GERMANY BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 214 GERMANY IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 215 GERMANY LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 216 GERMANY HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 217 GERMANY HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 218 GERMANY HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 219 GERMANY HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 220 FRANCE HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 221 FRANCE HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 222 FRANCE HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 223 FRANCE HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 224 FRANCE BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 225 FRANCE IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 226 FRANCE LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 227 FRANCE HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 228 FRANCE HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 229 FRANCE HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 230 FRANCE HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 231 U.K. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 232 U.K. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 233 U.K. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 234 U.K. HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 235 U.K. BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 236 U.K. IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 237 U.K. LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 238 U.K. HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 239 U.K. HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 240 U.K. HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 241 U.K. HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 242 RUSSIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 243 RUSSIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 244 RUSSIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 245 RUSSIA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 246 RUSSIA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 247 RUSSIA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 248 RUSSIA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 249 RUSSIA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 250 RUSSIA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 251 RUSSIA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 252 RUSSIA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 253 ITALY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 254 ITALY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 255 ITALY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 256 ITALY HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 257 ITALY BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 258 ITALY IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 259 ITALY LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 260 ITALY HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 261 ITALY HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 262 ITALY HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 263 ITALY HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 264 SPAIN HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 265 SPAIN HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 266 SPAIN HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 267 SPAIN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 268 SPAIN BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 269 SPAIN IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 270 SPAIN LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 271 SPAIN HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 272 SPAIN HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 273 SPAIN HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 274 SPAIN HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 275 TURKEY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 276 TURKEY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 277 TURKEY HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 278 TURKEY HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 279 TURKEY BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 280 TURKEY IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 281 TURKEY LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 282 TURKEY HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 283 TURKEY HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 284 TURKEY HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 285 TURKEY HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 286 NETHERLANDS HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 287 NETHERLANDS HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 288 NETHERLANDS HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 289 NETHERLANDS HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 290 NETHERLANDS BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 291 NETHERLANDS IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 292 NETHERLANDS LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 293 NETHERLANDS HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 294 NETHERLANDS HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 295 NETHERLANDS HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 296 NETHERLANDS HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 297 SWITZERLAND HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 298 SWITZERLAND HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 299 SWITZERLAND HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 300 SWITZERLAND HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 301 SWITZERLAND BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 302 SWITZERLAND IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 303 SWITZERLAND LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 304 SWITZERLAND HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 305 SWITZERLAND HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 306 SWITZERLAND HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 307 SWITZERLAND HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 308 BELGIUM HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 309 BELGIUM HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 310 BELGIUM HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 311 BELGIUM HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 312 BELGIUM BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 313 BELGIUM IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 314 BELGIUM LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 315 BELGIUM HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 316 BELGIUM HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 317 BELGIUM HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 318 BELGIUM HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 319 REST OF EUROPE HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 320 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 321 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 322 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 323 SOUTH AMERICA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 324 SOUTH AMERICA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 325 SOUTH AMERICA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 326 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 327 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 328 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 329 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 330 BRAZIL HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 331 BRAZIL HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 332 BRAZIL HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 333 BRAZIL HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 334 BRAZIL BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 335 BRAZIL IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 336 BRAZIL LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 337 BRAZIL HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 338 BRAZIL HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 339 BRAZIL HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 340 BRAZIL HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 341 ARGENTINA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 342 ARGENTINA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 343 ARGENTINA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 344 ARGENTINA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 345 ARGENTINA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 346 ARGENTINA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 347 ARGENTINA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 348 ARGENTINA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 349 ARGENTINA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 350 ARGENTINA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 351 ARGENTINA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 352 REST OF THE SOUTH AMERICA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 353 MIDDLE EAST AND AFRICA HEREDITARY CANCER TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 354 MIDDLE EAST AND AFRICA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 355 MIDDLE EAST AND AFRICA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 356 MIDDLE EAST AND AFRICA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 357 MIDDLE EAST AND AFRICA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 358 MIDDLE EAST AND AFRICA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 359 MIDDLE EAST AND AFRICA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 360 MIDDLE EAST AND AFRICA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 361 MIDDLE EAST AND AFRICA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 362 MIDDLE EAST AND AFRICA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 363 SOUTH AFRICA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 364 SOUTH AFRICA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 365 SOUTH AFRICA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 366 SOUTH AFRICA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 367 SOUTH AFRICA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 368 SOUTH AFRICA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 369 SOUTH AFRICA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 370 SOUTH AFRICA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 371 SOUTH AFRICA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 372 SOUTH AFRICA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 373 SOUTH AFRICA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 374 SAUDI ARABIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 375 SAUDI ARABIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 376 SAUDI ARABIA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 377 SAUDI ARABIA HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 378 SAUDI ARABIA BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 379 SAUDI ARABIA IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 380 SAUDI ARABIA LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 381 SAUDI ARABIA HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 382 SAUDI ARABIA HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 383 SAUDI ARABIA HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 384 SAUDI ARABIA HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 385 U.A.E. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 386 U.A.E. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 387 U.A.E. HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 388 U.A.E. HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 389 U.A.E. BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 390 U.A.E. IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 391 U.A.E. LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 392 U.A.E. HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 393 U.A.E. HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 394 U.A.E. HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 395 U.A.E. HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 396 EGYPT HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 397 EGYPT HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 398 EGYPT HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 399 EGYPT HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 400 EGYPT BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 401 EGYPT IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 402 EGYPT LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 403 EGYPT HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 404 EGYPT HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 405 EGYPT HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 406 EGYPT HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 407 ISRAEL HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 408 ISRAEL HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 409 ISRAEL HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 ASP (USD)

TABLE 410 ISRAEL HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 411 ISRAEL BIOPSY IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 412 ISRAEL IMAGINING IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 413 ISRAEL LAB TESTS IN HEREDITARY CANCER TESTING MARKET, BY DIAGNOSIS TYPE, 2020-2029 (USD MILLION)

TABLE 414 ISRAEL HEREDITARY CANCER TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 415 ISRAEL HEREDITARY CANCER TESTING MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 416 ISRAEL HEREDITARY CANCER TESTING MARKET, BY END USERS, 2020-2029 (USD MILLION)

TABLE 417 ISRAEL HEREDITARY CANCER TESTING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 418 REST OF MIDDLE EAST AND AFRICA HEREDITARY CANCER TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 GLOBAL HEREDITARY CANCER TESTING MARKET: SEGMENTATION

FIGURE 2 GLOBAL HEREDITARY CANCER TESTING MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL HEREDITARY CANCER TESTING MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL HEREDITARY CANCER TESTING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL HEREDITARY CANCER TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL HEREDITARY CANCER TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL HEREDITARY CANCER TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 GLOBAL HEREDITARY CANCER TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 GLOBAL HEREDITARY CANCER TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL HEREDITARY CANCER TESTING MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE GLOBAL HEREDITARY CANCER TESTING MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 12 EXPANDING REPRODUCTIVE GENETIC HEALTH SPACE IS EXPECTED TO DRIVE THE GLOBAL HEREDITARY CANCER TESTING MARKET IN THE FORECAST PERIOD

FIGURE 13 MULTI PANEL TEST SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL HEREDITARY CANCER TESTING MARKET IN 2022 & 2029

FIGURE 14 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR HEREDITARY CANCER TESTING MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL HEREDITARY CANCER TESTING MARKET

FIGURE 16 GLOBAL HEREDITARY CANCER TESTING MARKET: BY TEST TYPE, 2021

FIGURE 17 GLOBAL HEREDITARY CANCER TESTING MARKET: BY TEST TYPE, 2022-2029 (USD MILLION)

FIGURE 18 GLOBAL HEREDITARY CANCER TESTING MARKET: BY TEST TYPE, CAGR (2022-2029)

FIGURE 19 GLOBAL HEREDITARY CANCER TESTING MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 20 GLOBAL HEREDITARY CANCER TESTING MARKET: BY DIAGNOSIS TYPE, 2021

FIGURE 21 GLOBAL HEREDITARY CANCER TESTING MARKET: BY DIAGNOSIS TYPE, 2022-2029 (USD MILLION)

FIGURE 22 GLOBAL HEREDITARY CANCER TESTING MARKET: BY DIAGNOSIS TYPE, CAGR (2022-2029)

FIGURE 23 GLOBAL HEREDITARY CANCER TESTING MARKET: BY DIAGNOSIS TYPE, LIFELINE CURVE

FIGURE 24 GLOBAL HEREDITARY CANCER TESTING MARKET : BY TECHNOLOGY, 2021

FIGURE 25 GLOBAL HEREDITARY CANCER TESTING MARKET : BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 26 GLOBAL HEREDITARY CANCER TESTING MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 27 GLOBAL HEREDITARY CANCER TESTING MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 28 GLOBAL HEREDITARY CANCER TESTING MARKET: BY DISEASE TYPE, 2021

FIGURE 29 GLOBAL HEREDITARY CANCER TESTING MARKET: BY DISEASE TYPE, 2022-2029 (USD MILLION)

FIGURE 30 GLOBAL HEREDITARY CANCER TESTING MARKET: BY DISEASE TYPE, CAGR (2022-2029)

FIGURE 31 GLOBAL HEREDITARY CANCER TESTING MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 32 GLOBAL HEREDITARY CANCER TESTING MARKET : BY END USER, 2021

FIGURE 33 GLOBAL HEREDITARY CANCER TESTING MARKET : BY END USER, 2020-2029 (USD MILLION)

FIGURE 34 GLOBAL HEREDITARY CANCER TESTING MARKET : BY END USER, CAGR (2022-2029)

FIGURE 35 GLOBAL HEREDITARY CANCER TESTING MARKET : BY END USER, LIFELINE CURVE

FIGURE 36 GLOBAL HEREDITARY CANCER TESTING MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 37 GLOBAL HEREDITARY CANCER TESTING MARKET : BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 38 GLOBAL HEREDITARY CANCER TESTING MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 39 GLOBAL HEREDITARY CANCER TESTING MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 GLOBAL HEREDITARY CANCER TESTING MARKET: SNAPSHOT (2021)

FIGURE 41 GLOBAL HEREDITARY CANCER TESTING MARKET: BY REGION (2021)

FIGURE 42 GLOBAL HEREDITARY CANCER TESTING MARKET: BY REGION (2022 & 2029)

FIGURE 43 GLOBAL HEREDITARY CANCER TESTING MARKET: BY REGION (2021 & 2029)

FIGURE 44 GLOBAL HEREDITARY CANCER TESTING MARKET: BY TEST TYPE (2022-2029)

FIGURE 45 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET: SNAPSHOT (2021)

FIGURE 46 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021)

FIGURE 47 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET: BY TEST TYPE (2022-2029)

FIGURE 50 NORTH AMERICA HEREDITARY CANCER TESTING MARKET: SNAPSHOT (2021)

FIGURE 51 NORTH AMERICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021)

FIGURE 52 NORTH AMERICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 53 NORTH AMERICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 54 NORTH AMERICA HEREDITARY CANCER TESTING MARKET: BY TEST TYPE (2022-2029)

FIGURE 55 EUROPE HEREDITARY CANCER TESTING MARKET: SNAPSHOT (2021)

FIGURE 56 EUROPE HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021)

FIGURE 57 EUROPE HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 58 EUROPE HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 59 EUROPE HEREDITARY CANCER TESTING MARKET: BY TEST TYPE (2022-2029)

FIGURE 60 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET: SNAPSHOT (2021)

FIGURE 61 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021)

FIGURE 62 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 63 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 64 SOUTH AMERICA HEREDITARY CANCER TESTING MARKET: BY TEST TYPE (2022-2029)

FIGURE 65 MIDDLE EAST & AFRICA HEREDITARY CANCER TESTING MARKET: SNAPSHOT (2021)

FIGURE 66 MIDDLE EAST & AFRICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021)

FIGURE 67 MIDDLE EAST & AFRICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 68 MIDDLE EAST & AFRICA HEREDITARY CANCER TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 69 MIDDLE EAST & AFRICA HEREDITARY CANCER TESTING MARKET: BY TEST TYPE (2022-2029)

FIGURE 70 GLOBAL HEREDITARY CANCER TESTING MARKET: COMPANY SHARE 2021 (%)

FIGURE 71 NORTH AMERICA HEREDITARY CANCER TESTING MARKET: COMPANY SHARE 2021 (%)

FIGURE 72 EUROPE HEREDITARY CANCER TESTING MARKET: COMPANY SHARE 2021 (%)

FIGURE 73 ASIA-PACIFIC HEREDITARY CANCER TESTING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible