Global Halogenated Agrochemicals Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

172.90 Million

USD

224.18 Million

2024

2032

USD

172.90 Million

USD

224.18 Million

2024

2032

| 2025 –2032 | |

| USD 172.90 Million | |

| USD 224.18 Million | |

|

|

|

|

Mercado global de agroquímicos halogenados, por tipo (herbicidas, insecticidas, fungicidas), tipo de halógeno (agroquímicos a base de cloro, a base de bromo, a base de flúor, a base de yodo), método de aplicación (pulverización foliar, tratamiento de suelos, tratamiento de semillas), usuario final (agricultores y trabajadores agrícolas, empresas agrícolas): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de agroquímicos halogenados

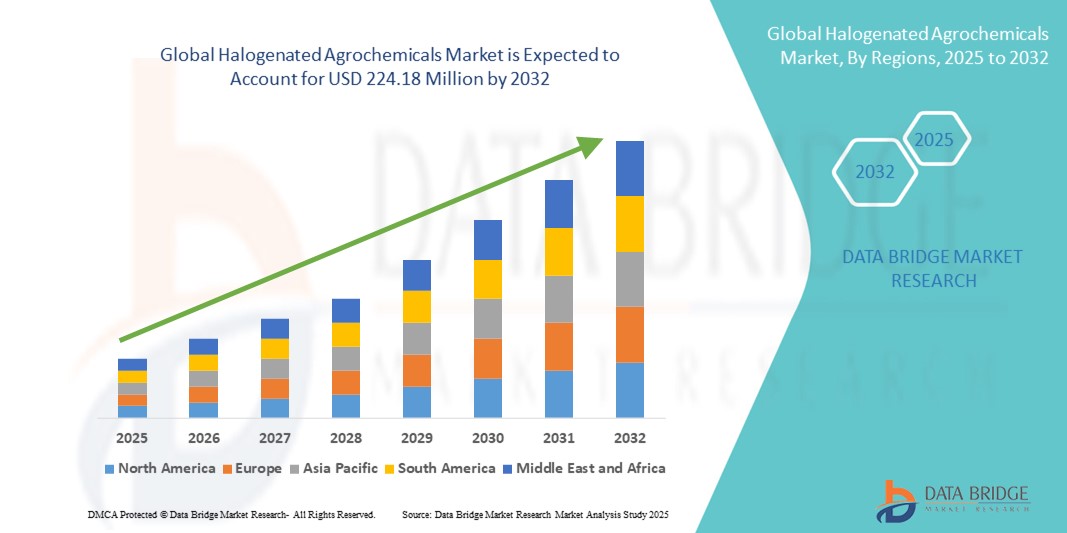

- El tamaño del mercado global de agroquímicos halogenados se valoró en USD 172,90 millones en 2024 y se espera que alcance los USD 224,18 millones para 2032 , con una CAGR del 3,3% durante el período de pronóstico.

- El crecimiento del mercado está impulsado por la creciente demanda de prácticas agrícolas de alto rendimiento, la creciente necesidad de protección de los cultivos contra plagas y enfermedades y la creciente adopción de agroquímicos avanzados para garantizar la seguridad alimentaria.

- La creciente conciencia entre los agricultores sobre los beneficios de los agroquímicos halogenados, como la mayor eficacia y el control específico de plagas, está impulsando aún más la demanda del mercado en las operaciones agrícolas tanto a pequeña como a gran escala.

Análisis del mercado de agroquímicos halogenados

- El mercado de agroquímicos halogenados está experimentando un sólido crecimiento debido a la creciente necesidad de soluciones eficaces de protección de cultivos para abordar la demanda mundial de alimentos y los desafíos relacionados con el clima.

- La creciente adopción tanto en la agricultura convencional como en la de precisión está animando a los fabricantes a innovar con formulaciones halogenadas más seguras, eficientes y respetuosas con el medio ambiente.

- Asia-Pacífico dominó el mercado de agroquímicos halogenados con la mayor participación en los ingresos del 30,2 % en 2024, impulsada por actividades agrícolas extensivas, agricultura a gran escala y apoyo gubernamental a técnicas agrícolas modernas en países como China, India y naciones del sudeste asiático.

- Se espera que América del Norte sea la región de más rápido crecimiento durante el período de pronóstico, impulsada por los avances en tecnología agrícola, la creciente adopción de agricultura de precisión y la creciente demanda de soluciones agroquímicas sostenibles.

- El segmento de herbicidas dominó la mayor participación en los ingresos del mercado con un 48,7 % en 2024, impulsado por el uso generalizado de herbicidas halogenados, como el glifosato y la atrazina, para el control eficaz de malezas en cultivos importantes como el arroz, el trigo y el maíz.

Alcance del informe y segmentación del mercado de agroquímicos halogenados

|

Atributos |

Perspectivas clave del mercado de agroquímicos halogenados |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de agroquímicos halogenados

Creciente adopción de formulaciones avanzadas y agricultura de precisión

- El mercado mundial de agroquímicos halogenados está experimentando una tendencia significativa hacia la adopción de formulaciones avanzadas que incorporan halógenos como cloro, bromo, flúor y yodo.

- Estas formulaciones avanzadas mejoran la eficacia y selectividad de los agroquímicos, lo que permite un control específico de plagas y malezas y, al mismo tiempo, minimiza el impacto ambiental.

- Las técnicas de agricultura de precisión, habilitadas por tecnologías como IoT y análisis de datos, se integran cada vez más con agroquímicos halogenados para optimizar los métodos de aplicación, garantizar una entrega precisa y reducir el desperdicio.

- Por ejemplo, las empresas están desarrollando herbicidas a base de flúor e insecticidas a base de cloro que funcionan sinérgicamente con sistemas de pulverización de precisión para atacar especies específicas de malezas o plagas, mejorando el rendimiento y la sostenibilidad de los cultivos.

- Esta tendencia mejora la propuesta de valor de los agroquímicos halogenados, haciéndolos más atractivos para los agricultores y las empresas agrícolas que buscan soluciones eficientes y ecológicas.

- Las formulaciones avanzadas pueden abordar una amplia gama de desafíos agrícolas, incluidas las poblaciones de malezas y plagas resistentes, al aprovechar las propiedades químicas únicas de los halógenos para mejorar el rendimiento.

Dinámica del mercado de agroquímicos halogenados

Conductor

Creciente demanda de soluciones de protección de cultivos de alto rendimiento

- La creciente población mundial y la creciente demanda de alimentos están impulsando la necesidad de prácticas agrícolas de alto rendimiento, lo que impulsa la adopción de agroquímicos halogenados como herbicidas, insecticidas y fungicidas.

- Los agroquímicos halogenados mejoran la protección de los cultivos al controlar eficazmente las malezas, las plagas y las enfermedades fúngicas, lo que garantiza mayores rendimientos y una mejor calidad de los cultivos.

- Las iniciativas gubernamentales, particularmente en Asia y el Pacífico, que promueven prácticas agrícolas modernas y la seguridad alimentaria, están contribuyendo al uso generalizado de estos agroquímicos.

- El desarrollo de las tecnologías 5G e IoT está permitiendo el monitoreo y la aplicación en tiempo real de agroquímicos halogenados, mejorando la eficiencia y reduciendo el impacto ambiental a través de métodos de administración precisos como la pulverización foliar y el tratamiento de semillas.

- Las empresas agrícolas están incorporando cada vez más agroquímicos halogenados en las estrategias de manejo integrado de plagas para satisfacer la demanda de los consumidores de productos sostenibles y de alta calidad.

Restricción/Desafío

Preocupaciones ambientales y restricciones regulatorias

- El alto costo de desarrollar e implementar agroquímicos halogenados, incluida la investigación, la producción y la infraestructura de aplicación, puede ser una barrera importante, en particular para los pequeños agricultores en los mercados emergentes.

- La integración de agroquímicos halogenados en los sistemas agrícolas existentes a menudo requiere equipo y capacitación especializados, lo que aumenta el costo general.

- Las preocupaciones ambientales y sanitarias relacionadas con el uso de agroquímicos halogenados, en particular los compuestos a base de cloro y bromo, plantean desafíos significativos. Estos productos químicos pueden persistir en el suelo y el agua, lo que puede provocar contaminación y daños ecológicos.

- Los marcos regulatorios estrictos en regiones como Europa y América del Norte, centrados en reducir el impacto ambiental de los agroquímicos, crean desafíos de cumplimiento para los fabricantes y limitan el uso de ciertos compuestos halogenados.

- Estos factores pueden disuadir la adopción en mercados sensibles a los costos o conscientes del medio ambiente, lo que podría desacelerar el crecimiento del mercado en regiones con regulaciones estrictas o alta conciencia de las cuestiones de sostenibilidad.

Alcance del mercado de agroquímicos halogenados

El mercado está segmentado según el tipo, tipo de halógeno, método de aplicación y usuario final.

- Por tipo

Según el tipo, el mercado global de agroquímicos halogenados se segmenta en herbicidas, insecticidas y fungicidas. El segmento de herbicidas dominó la mayor cuota de mercado, con un 48,7%, en 2024, impulsado por el uso generalizado de herbicidas halogenados, como el glifosato y la atrazina, para el control eficaz de malezas en cultivos importantes como el arroz, el trigo y el maíz. La creciente demanda mundial de cultivos de alto rendimiento y la escasez de mano de obra en los países en desarrollo refuerzan aún más el dominio de este segmento, especialmente en Asia-Pacífico.

Se prevé que el segmento de insecticidas experimente la tasa de crecimiento más rápida, del 6,2 %, entre 2025 y 2032. Este crecimiento se ve impulsado por la creciente presión de las plagas debido al cambio climático y a la necesidad de un manejo eficaz de las mismas para proteger el rendimiento de los cultivos. Los insecticidas halogenados, como el clorantraniliprol, están ganando terreno por su eficacia y acción específica, especialmente en Norteamérica, donde la agricultura de precisión está impulsando su adopción.

- Por tipo de halógeno

Según el tipo de halógeno, el mercado se segmenta en agroquímicos a base de cloro, bromo, flúor y yodo. Se prevé que el segmento de agroquímicos a base de flúor alcance la mayor cuota de mercado, con un 52,3%, en 2024, gracias a su óptima eficacia, seguridad ambiental y versatilidad en las formulaciones agroquímicas modernas. Los compuestos a base de flúor, como los desarrollados por Bayer CropScience, se utilizan ampliamente gracias a los avances en los métodos de síntesis, que han reducido los costos y mejorado el rendimiento.

Se prevé que el segmento de agroquímicos a base de bromo experimente la tasa de crecimiento más rápida del 7,1 % entre 2025 y 2032. Esto se debe a su creciente uso en aplicaciones especializadas, como la fumigación del suelo y el control de plagas en cultivos de alto valor, particularmente en América del Norte, donde los cambios regulatorios y la demanda de soluciones sostenibles están fomentando la innovación en productos a base de bromo.

- Por método de aplicación

Según el método de aplicación, el mercado se segmenta en pulverización foliar, tratamiento del suelo y tratamiento de semillas. Se prevé que el segmento de pulverización foliar alcance la mayor cuota de mercado, con un 46,8%, en 2024, gracias a su uso generalizado para la aplicación directa de herbicidas e insecticidas halogenados a las hojas de las plantas. Este método es muy eficaz para el control rápido de plagas y malezas, especialmente en Asia-Pacífico, donde predomina el cultivo de cereales.

Se proyecta que el segmento de tratamiento de semillas experimentará un crecimiento significativo entre 2025 y 2032, con una tasa de crecimiento anual compuesta (TCAC) del 6,8 %. La adopción de agroquímicos halogenados en el tratamiento de semillas está en aumento debido a su rentabilidad, su perfil de seguridad y su capacidad para proteger los cultivos de plagas y enfermedades en sus etapas iniciales. Esta tendencia es especialmente fuerte en Norteamérica, donde la agricultura de precisión y la integración de biopesticidas impulsan la demanda.

- Por el usuario final

En función del usuario final, el mercado se segmenta en agricultores, trabajadores agrícolas y empresas agrícolas. El segmento de empresas agrícolas dominó el mercado con una participación en los ingresos del 62,4 % en 2024, impulsado por sus operaciones a gran escala y su capacidad para invertir en soluciones agroquímicas halogenadas avanzadas para la agricultura de alto rendimiento. Empresas como BASF, Bayer y Syngenta están aprovechando estos productos químicos para mejorar la protección y la productividad de los cultivos, especialmente en Asia-Pacífico.

Se prevé que el segmento de agricultores y trabajadores agrícolas experimente un rápido crecimiento del 6,5 % entre 2025 y 2032. Este crecimiento se ve impulsado por la creciente concienciación sobre los beneficios de los agroquímicos halogenados, los subsidios gubernamentales y la adopción de técnicas agrícolas modernas en Norteamérica. Los pequeños y medianos agricultores utilizan cada vez más estos productos para mejorar el rendimiento de sus cultivos y combatir la resistencia a las plagas, con el apoyo de plataformas digitales de gestión agrícola.

Análisis regional del mercado de agroquímicos halogenados

- Asia-Pacífico dominó el mercado de agroquímicos halogenados con la mayor participación en los ingresos del 30,2 % en 2024, impulsada por actividades agrícolas extensivas, agricultura a gran escala y apoyo gubernamental a técnicas agrícolas modernas en países como China, India y naciones del sudeste asiático.

- Los consumidores priorizan los agroquímicos halogenados por su eficacia en el control de plagas y malezas, mejorando el rendimiento de los cultivos y protegiéndolos de enfermedades, particularmente en regiones con alta actividad agrícola.

- El crecimiento está respaldado por los avances en las formulaciones de compuestos halogenados, incluidos los agroquímicos a base de flúor y cloro, junto con una creciente adopción tanto en la agricultura a pequeña escala como en las grandes empresas agrícolas.

Perspectiva del mercado japonés de agroquímicos halogenados

Se prevé un rápido crecimiento del mercado japonés de agroquímicos halogenados debido a la fuerte preferencia de los consumidores por agroquímicos de alta eficacia y tecnología avanzada que mejoran la productividad y la seguridad de los cultivos. La presencia de importantes empresas agrícolas y la integración de insecticidas y fungicidas halogenados en la agricultura comercial aceleran su penetración en el mercado. El creciente interés en prácticas agrícolas sostenibles y métodos de aplicación avanzados, como la pulverización foliar, también contribuye a este crecimiento.

Análisis del mercado de agroquímicos halogenados en China

China posee la mayor participación en el mercado de agroquímicos halogenados de Asia-Pacífico, impulsada por la rápida urbanización, el aumento de la producción agrícola y la creciente demanda de soluciones eficaces para la protección de cultivos. El creciente sector agrícola del país y su enfoque en la seguridad alimentaria impulsan la adopción de agroquímicos a base de cloro y flúor. La sólida capacidad de fabricación nacional y los precios competitivos mejoran la accesibilidad al mercado, impulsando la demanda en aplicaciones de pulverización foliar, tratamiento de suelos y tratamiento de semillas.

Perspectiva del mercado estadounidense de agroquímicos halogenados

Se prevé un crecimiento significativo del mercado estadounidense de agroquímicos halogenados, impulsado por la fuerte demanda de la agricultura a gran escala y la creciente concienciación sobre los beneficios de la protección de cultivos. La tendencia hacia la agricultura de precisión y la necesidad de cultivos de alto rendimiento impulsan la adopción de herbicidas, insecticidas y fungicidas halogenados. El apoyo regulatorio a formulaciones más seguras e innovadoras complementa el crecimiento del mercado, con la inversión de empresas agrícolas y agricultores en soluciones avanzadas.

Perspectiva del mercado europeo de agroquímicos halogenados

Se prevé un crecimiento significativo del mercado europeo de agroquímicos halogenados, impulsado por una normativa rigurosa en materia de protección de cultivos y un enfoque en prácticas agrícolas sostenibles. Los consumidores buscan agroquímicos halogenados que equilibren la eficacia con la seguridad ambiental, especialmente en países como Alemania y Francia, donde predominan las prácticas agrícolas avanzadas. La adopción de métodos de pulverización foliar y tratamiento de semillas impulsa la expansión del mercado tanto en la agricultura comercial como en la de pequeña escala.

Perspectiva del mercado de agroquímicos halogenados del Reino Unido

Se prevé un rápido crecimiento del mercado británico de agroquímicos halogenados, impulsado por la creciente demanda de cultivos de alto rendimiento y un manejo eficaz de plagas en diversas condiciones climáticas. Los agricultores y las empresas agrícolas priorizan los agroquímicos a base de cloro y flúor por su versatilidad y eficacia. La evolución de las normativas que promueven un uso más seguro de plaguicidas y la creciente concienciación sobre la sostenibilidad ambiental influyen en su adopción, impulsando las aplicaciones foliares y de tratamiento del suelo.

Análisis del mercado alemán de agroquímicos halogenados

Se prevé que Alemania experimente un rápido crecimiento del mercado de agroquímicos halogenados, gracias a su avanzado sector agrícola y a su énfasis en soluciones sostenibles para la protección de cultivos. Los agricultores y las empresas alemanas prefieren los agroquímicos a base de flúor por su alta eficacia y compatibilidad ambiental. La integración de estos agroquímicos en la agricultura de precisión y su uso en el tratamiento de semillas y aplicaciones edáficas impulsa el crecimiento del mercado, especialmente en la producción de cultivos de alto valor.

Análisis del mercado de agroquímicos halogenados en China

China posee la mayor participación en el mercado de agroquímicos halogenados de Asia-Pacífico, impulsada por la rápida urbanización, el aumento de la propiedad de vehículos y la creciente demanda de soluciones para vehículos conectados e inteligentes. La creciente clase media del país y su enfoque en la movilidad inteligente impulsan la adopción de sistemas telemáticos avanzados. La sólida capacidad de fabricación nacional y los precios competitivos mejoran la accesibilidad al mercado.

Cuota de mercado de agroquímicos halogenados

La industria de agroquímicos halogenados está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Grupo Syngenta (Suiza)

- BASF SE (Alemania)

- Bayer AG (Alemania)

- Corteva Agriscience (EE. UU.)

- Corporación FMC (EE. UU.)

- ADAMA Ltd. (Israel)

- Sumitomo Chemical Company, Limited (Japón)

- Nufarm Limited (Australia)

- UPL Limited (India)

- LANXESS (Alemania)

- MITSUI CHEMICALS, INC. (Japón)

- Isagro SpA. (Italia)

- Wynca Chemical (China)

- Rotam Global AgroSciences (China)

¿Cuáles son los desarrollos recientes en el mercado global de agroquímicos halogenados?

- En mayo de 2024, Aarti Industries Limited y UPL Limited, dos importantes empresas químicas indias, anunciaron una empresa conjunta al 50% para fabricar y comercializar productos químicos especializados, en particular derivados de aminas utilizados en agroquímicos y pinturas. Esta alianza estratégica se basa en su relación de dos décadas y busca fortalecer la autosuficiencia de la India en la producción de productos químicos especializados para los mercados globales. Se espera que la empresa conjunta inicie los suministros comerciales en el primer trimestre del año fiscal 2026-27, con una proyección de ingresos anuales de 400 a 500 millones de rupias en un plazo de 2 a 3 años.

- En marzo de 2024, Best Agrolife Ltd., un fabricante líder de agroquímicos en la India, adquirió Sudarshan Farm Chemicals India Pvt Ltd (SFCL) por 139 millones de rupias. Esta adquisición estratégica permite a Best Agrolife aprovechar las sólidas capacidades de I+D de SFCL, su cartera de propiedad intelectual (incluidas 10 patentes solicitadas) y su experiencia en la fabricación de moléculas sin patente. El legado de 40 años de SFCL y su extensa red de distribuidores de más de 2500 puntos de venta fortalecerán la presencia de Best Agrolife en el mercado, especialmente en el centro y sur de la India, y respaldarán su objetivo de crecimiento sostenible en el sector agroquímico.

- En diciembre de 2023, Crystal Crop Protection Limited, empresa líder en agroquímicos de la India, adquirió la marca registrada del herbicida Gramoxone® del Grupo Syngenta para su uso en el mercado indio. Esta estrategia permite a Crystal fortalecer su posición en la categoría de herbicidas de amplio espectro, aprovechando el reconocimiento de marca consolidado de Gramoxone. Se espera que la adquisición amplíe el alcance de Crystal a más agricultores de la India y contribuya significativamente a su crecimiento en el segmento de herbicidas no selectivos, en línea con la iniciativa del país de implementar prácticas agrícolas modernizadas y eficientes.

- En septiembre de 2023, ADAMA Ltd., empresa global de protección de cultivos con sede en Israel, lanzó sus primeras formulaciones genéricas de clorantraniliprol (CTPR) en India con la introducción de Cosayr® y Lapidos®. Estos insecticidas, diseñados para cultivos como el arroz y la caña de azúcar, ofrecen una protección eficaz contra plagas como los barrenadores del tallo y los plegadores de las hojas, responsables de importantes pérdidas de cultivos. Este lanzamiento forma parte de la estrategia Core Leap de ADAMA, cuyo objetivo es ampliar su cartera con ingredientes activos sin patente y abordar el creciente desafío de la resistencia a las plagas en la agricultura.

- En septiembre de 2023, Croda International Plc, empresa química con sede en el Reino Unido, lanzó Atlox™ BS-50, su primer producto diseñado específicamente para el mercado de biopesticidas. Atlox BS-50 es un sistema de administración de polvo listo para usar, diseñado específicamente para microorganismos formadores de esporas, que aborda desafíos de formulación como la estabilidad, la viabilidad y la facilidad de uso. Esta innovación refleja el compromiso de Croda con la agricultura sostenible, ofreciendo una solución versátil que simplifica el desarrollo de productos y satisface la creciente demanda de productos fitosanitarios naturales y ecológicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.