Global Glass Substrate Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

7.01 Billion

USD

12.33 Billion

2024

2032

USD

7.01 Billion

USD

12.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.01 Billion | |

| USD 12.33 Billion | |

|

|

|

|

Segmentación del mercado global de sustratos de vidrio, por tipo (de borosilicato, de sílice fundida/cuarzo, de silicio y otros), diámetro de oblea (300 mm, 200 mm, 150 mm, 125 mm, superior a 300 mm y hasta 100 mm), aplicación (envasado de oblea, soporte de sustrato e intercalador TGV), uso final (electrónica, aplicaciones ópticas, aeroespacial y defensa, automoción y solar, y medicina): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de sustratos de vidrio

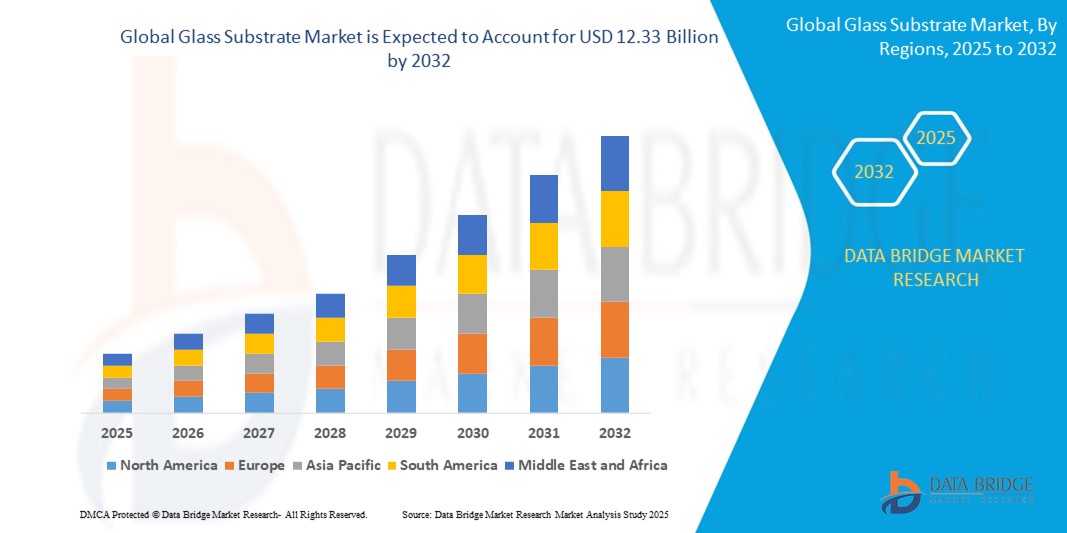

- El tamaño del mercado global de sustrato de vidrio se valoró en USD 7.01 mil millones en 2024 y se espera que alcance los USD 12.33 mil millones para 2032 , con una CAGR del 7,30% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de tecnologías de visualización avanzadas en productos electrónicos de consumo, como teléfonos inteligentes, tabletas y televisores, así como por las crecientes aplicaciones en paneles solares y electrónica flexible.

- Además, la creciente adopción de pantallas OLED y AMOLED, que requieren sustratos de vidrio de alta calidad para un mejor rendimiento y durabilidad, está impulsando aún más la expansión del mercado a nivel mundial.

Análisis del mercado de sustratos de vidrio

- El mercado de sustrato de vidrio se está expandiendo debido a la creciente demanda de pantallas de alto rendimiento en la electrónica de consumo, que ofrecen mayor durabilidad y claridad para dispositivos como teléfonos inteligentes y televisores.

- Los fabricantes se están centrando en el desarrollo de sustratos de vidrio más delgados y flexibles para satisfacer las necesidades cambiantes de las tecnologías de visualización flexibles y plegables.

- América del Norte dominó el mercado de sustrato de vidrio con la mayor participación en los ingresos en 2024, impulsada por una sólida industria electrónica, una creciente demanda de tecnologías de visualización avanzadas y la presencia de fabricantes líderes de semiconductores.

- Se espera que la región de Asia y el Pacífico sea testigo de la mayor tasa de crecimiento en el mercado mundial de sustratos de vidrio, impulsada por la rápida industrialización, la expansión de la fabricación de productos electrónicos y la creciente demanda de semiconductores y paneles de visualización en países como China, Japón, Corea del Sur e India.

- El segmento de borosilicato dominó el mercado con la mayor cuota de mercado en 2024, gracias a su alta resistencia térmica y química, lo que lo hace adecuado para diversas aplicaciones microelectrónicas y fotónicas. La demanda de sustratos de borosilicato es alta en el encapsulado de semiconductores debido a su estabilidad dimensional y rentabilidad.

Alcance del informe y segmentación del mercado de sustratos de vidrio

|

Atributos |

Perspectivas clave del mercado de sustratos de vidrio |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de sustratos de vidrio

El auge de los sustratos de vidrio flexibles y plegables para pantallas

- El mercado de sustratos de vidrio está experimentando una tendencia significativa hacia el desarrollo y la adopción de sustratos de vidrio flexibles y plegables, impulsada por la creciente popularidad de los teléfonos inteligentes plegables y los dispositivos portátiles.

- Los fabricantes están innovando materiales de vidrio ultradelgados y flexibles que pueden soportar plegados repetidos sin comprometer la durabilidad ni la claridad de la pantalla.

- Por ejemplo, los teléfonos inteligentes plegables de Samsung y el Surface Duo de Microsoft utilizan sustratos de vidrio flexible, lo que resalta la viabilidad comercial y la demanda de los consumidores de dichas tecnologías.

- Esta tendencia está impulsando a los productores de vidrio a mejorar la dureza y elasticidad del vidrio mediante técnicas avanzadas de recubrimiento y fortalecimiento químico.

- Además, la tendencia apoya el crecimiento de nuevas categorías de productos en electrónica de consumo, como pantallas enrollables y tabletas flexibles, lo que abre nuevas oportunidades para aplicaciones de sustrato de vidrio más allá de las pantallas rígidas tradicionales.

Dinámica del mercado de sustratos de vidrio

Conductor

Creciente demanda de tecnologías de visualización avanzadas

- La creciente demanda de tecnologías de visualización avanzadas está impulsando el mercado de sustrato de vidrio, ya que los consumidores buscan dispositivos de alta resolución, duraderos y fáciles de usar.

- Los sustratos de vidrio son esenciales para pantallas como pantallas de cristal líquido, diodos orgánicos emisores de luz y pantallas flexibles y plegables emergentes, proporcionando una superficie lisa y plana para capas electrónicas uniformes.

- Innovaciones como el vidrio ultrafino y reforzado químicamente permiten pantallas más livianas y robustas, satisfaciendo las necesidades de los consumidores de dispositivos elegantes pero duraderos.

- La adopción generalizada de teléfonos inteligentes, tabletas, computadoras portátiles y televisores con pantallas avanzadas está acelerando el crecimiento del mercado; por ejemplo, las principales marcas de teléfonos inteligentes utilizan vidrio reforzado químicamente para mejorar la resistencia a los rayones y la durabilidad.

- Los nuevos formatos de pantalla, incluidas las pantallas flexibles y enrollables, dependen de sustratos de vidrio especializados que mantienen la flexibilidad sin sacrificar la transparencia ni la resistencia, lo que amplía su uso en tableros de automóviles y dispositivos portátiles.

- Por ejemplo, los últimos teléfonos inteligentes plegables de Samsung utilizan sustratos de vidrio ultradelgados y reforzados químicamente que permiten que la pantalla se doble suavemente manteniendo la durabilidad y la claridad.

Restricción/Desafío

“Altos costos de producción y complejidades de fabricación”

- El mercado de sustratos de vidrio enfrenta desafíos debido a los altos costos involucrados en la producción de materiales de vidrio avanzados, especialmente aquellos que son ultradelgados o tratados químicamente.

- La fabricación requiere múltiples etapas precisas, como la fusión, el conformado, el recocido y el fortalecimiento químico, cada una de las cuales necesita estrictos controles de calidad y equipos especializados.

- La producción de sustratos de vidrio flexibles implica mantener la flexibilidad y la claridad óptica, lo que es técnicamente exigente y aumenta los costos operativos.

- Por ejemplo, el desarrollo de vidrio flexible ultrafino para pantallas plegables requiere un control del espesor a nivel nanométrico para evitar roturas y garantizar al mismo tiempo el rendimiento visual.

- Los materiales alternativos como los sustratos plásticos, aunque menos duraderos, están ganando popularidad para las pantallas flexibles debido a los menores costos de producción y al procesamiento más fácil.

Alcance del mercado de sustratos de vidrio

El mercado está segmentado según el tipo, el diámetro de la oblea, la aplicación y el uso final.

- Por tipo

Según el tipo, el mercado de sustratos de vidrio de alta densidad se segmenta en sustratos de borosilicato, de sílice fundida/cuarzo, de silicio y otros. El segmento de borosilicato dominó el mercado con la mayor cuota de mercado en 2024, gracias a su alta resistencia térmica y química, lo que lo hace adecuado para diversas aplicaciones de microelectrónica y fotónica. La demanda de sustratos de borosilicato es alta en el encapsulado de semiconductores debido a su estabilidad dimensional y rentabilidad.

Se prevé que el segmento de sílice fundida/cuarzo experimente el mayor crecimiento entre 2025 y 2032, impulsado por su excepcional transparencia óptica y bajo coeficiente de expansión térmica. Estas propiedades lo hacen ideal para la electrónica de alta frecuencia, los componentes ópticos y la litografía avanzada, especialmente en aplicaciones de semiconductores y aeroespaciales.

- Por diámetro de oblea

Según el diámetro de la oblea, el mercado de sustratos de vidrio de alta densidad se segmenta en 300 mm, 200 mm, 150 mm, 125 mm, más de 300 mm y hasta 100 mm. El segmento de 200 mm registró la mayor cuota de mercado en 2024, gracias a su amplio uso en plantas de fabricación de semiconductores tradicionales y a su rentabilidad en la producción de MEMS y dispositivos analógicos.

Se prevé que el segmento de 300 mm experimente el mayor crecimiento entre 2025 y 2032, impulsado por los avances continuos en la fabricación de semiconductores, incluyendo el empaquetado 3D y la producción de circuitos integrados (CI) a gran escala. A medida que las fundiciones optan por obleas más grandes para mejorar el rendimiento y reducir el coste por chip, la demanda de sustratos de vidrio de 300 mm aumenta rápidamente.

- Por aplicación

Según su aplicación, el mercado de sustratos de vidrio de alta densidad se segmenta en empaquetado de obleas, soporte de sustrato e intercalador TGV. El segmento de empaquetado de obleas representó la mayor cuota de mercado en 2024, impulsado por la creciente demanda de soluciones de empaquetado de alta densidad y miniaturizadas en electrónica de consumo y dispositivos de comunicación. Los sustratos de vidrio ofrecen excelentes superficies planas y un rendimiento térmico ideal para el empaquetado a nivel de oblea.

Se prevé que el segmento de interpositores TGV experimente el mayor crecimiento entre 2025 y 2032, debido a la creciente adopción de la tecnología Through Glass Via en la integración avanzada de chips y el encapsulado heterogéneo. Sus características de alta precisión y baja pérdida dieléctrica resultan atractivas para aplicaciones de computación de alto rendimiento y RF.

- Por uso final

Según el uso final, el mercado de sustratos de alto contenido de vidrio se segmenta en electrónica, aplicaciones ópticas, aeroespacial y defensa, automoción y energía solar, y medicina. El segmento de la electrónica dominó el mercado en 2024, impulsado por la creciente demanda de smartphones, wearables y dispositivos semiconductores que requieren soluciones de sustrato compactas y eficientes.

Se prevé que el segmento médico experimente la tasa de crecimiento más rápida entre 2025 y 2032, debido a la creciente adopción de biosensores, chips microfluídicos y tecnologías de laboratorio en un chip que utilizan sustratos de vidrio por su biocompatibilidad, estabilidad química y transparencia.

Análisis regional del mercado de sustratos de vidrio

- América del Norte dominó el mercado de sustrato de vidrio con la mayor participación en los ingresos en 2024, impulsada por una sólida industria electrónica, una creciente demanda de tecnologías de visualización avanzadas y la presencia de fabricantes líderes de semiconductores.

- La región se beneficia de las crecientes inversiones en I+D para aplicaciones microelectrónicas y optoelectrónicas, lo que impulsa la demanda de sustratos de vidrio de alto rendimiento.

- Además, las iniciativas gubernamentales de apoyo y la expansión de las instalaciones de fabricación en los EE. UU. y Canadá están acelerando la adopción en el mercado en industrias de uso final como la automotriz, la aeroespacial y la atención médica.

Perspectiva del mercado de sustratos de vidrio de EE. UU.

El mercado estadounidense de sustratos de vidrio captó la mayor participación en los ingresos de Norteamérica en 2024, impulsado por la sólida presencia de empresas líderes en electrónica y semiconductores. El avanzado ecosistema tecnológico del país, sumado a la alta demanda de componentes miniaturizados y de alta precisión en electrónica de consumo, impulsa el mercado. El aumento de las aplicaciones en dispositivos de imagen médica y módulos fotovoltaicos también contribuye al crecimiento. La continua innovación en técnicas de fabricación de vidrio y ciencia de materiales mejora aún más las perspectivas del mercado.

Perspectiva del mercado europeo de sustratos de vidrio

Se prevé que el mercado europeo de sustratos de vidrio experimente el mayor crecimiento entre 2025 y 2032, impulsado por el aumento de las inversiones en fotónica, MEMS y tecnologías de visualización. La sólida presencia de la región en electrónica automotriz, sumada a la creciente adopción de pantallas inteligentes y componentes ópticos, sustenta una demanda sostenida del mercado. Las estrictas normativas ambientales y de calidad también están fomentando el uso de sustratos de vidrio sostenibles y de alta pureza en múltiples aplicaciones en Alemania, Francia y el Reino Unido.

Perspectiva del mercado de sustratos de vidrio del Reino Unido

Se prevé que el mercado británico de sustratos de vidrio experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente demanda de materiales avanzados en las industrias médica, aeroespacial y optoelectrónica. Las innovaciones en electrónica flexible y sensores ópticos, así como el apoyo gubernamental a la fabricación nacional, están mejorando las perspectivas del mercado. Además, el énfasis del país en la sostenibilidad y la fabricación de precisión está impulsando su adopción en los sectores emergentes de alta tecnología.

Perspectiva del mercado de sustratos de vidrio en Alemania

Se prevé que el mercado alemán de sustratos de vidrio experimente el mayor crecimiento entre 2025 y 2032, impulsado por el liderazgo del país en tecnología automotriz, óptica y automatización industrial. Con un fuerte enfoque en la ingeniería de precisión y los materiales de alto rendimiento, Alemania está invirtiendo fuertemente en microfabricación y materiales de sustrato avanzados. El auge de la Industria 4.0 y las fábricas inteligentes está incrementando aún más la demanda de sustratos de vidrio para la integración de sensores y pantallas.

Perspectiva del mercado de sustratos de vidrio en Asia-Pacífico

Se prevé que el mercado de sustratos de vidrio de Asia-Pacífico experimente su mayor crecimiento entre 2025 y 2032, gracias al auge de la producción de electrónica de consumo, las políticas gubernamentales favorables y la rápida industrialización. Países como China, Japón, Corea del Sur y Taiwán están a la vanguardia de la innovación en paneles de visualización, semiconductores y tecnología solar. La disponibilidad de fabricación a bajo costo, mano de obra cualificada e inversiones estratégicas en salas blancas está acelerando significativamente el crecimiento regional.

Perspectiva del mercado de sustratos de vidrio en Japón

Se prevé que el mercado japonés de sustratos de vidrio experimente el mayor crecimiento entre 2025 y 2032, gracias a su sólida experiencia en materiales de precisión, microelectrónica y tecnologías ópticas de vanguardia. Las consolidadas industrias japonesas de electrónica de consumo y paneles de visualización son impulsores clave de la demanda. Además, las aplicaciones en HUD para automóviles, fotomáscaras y equipos médicos avanzados están impulsando su adopción. El énfasis en la miniaturización y la durabilidad de los productos consolida aún más la posición del mercado en aplicaciones de alto valor.

Perspectiva del mercado de sustratos de vidrio en China

El mercado chino de sustratos de vidrio representó la mayor participación en los ingresos de Asia-Pacífico en 2024, impulsado por la producción en masa de teléfonos inteligentes, tabletas y dispositivos de visualización. El decidido impulso del país hacia la autosuficiencia en semiconductores y la expansión de la fabricación fotovoltaica impulsan la demanda de sustratos de vidrio de calidad. Gracias a la solidez de sus proveedores nacionales y a los incentivos gubernamentales que impulsan el desarrollo tecnológico, China continúa liderando el crecimiento regional tanto en volumen como en capacidad.

Cuota de mercado de sustratos de vidrio

La industria de sustratos de vidrio está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- AGC Inc. (Japón)

- SCHOTT (Alemania)

- AvanStrate Inc. (Japón)

- Dongxu Group Co., Ltd. (China)

- Irico Group New Energy Company Limited (China)

- TECNISCO, LTD. (Japón)

- Corning Incorporated (EE. UU.)

- Nippon Electric Glass Co., Ltd. (Japón)

- Corporación HOYA (Japón)

- Plan Optik AG (Alemania)

- Ohara Inc. (Japón)

Últimos avances en el mercado mundial de sustratos de vidrio

- En abril de 2024, AGC Inc. obtuvo una Declaración Ambiental de Producto (DAP) para su vidrio flotado arquitectónico de la planta de Kashima, validada por SuMPO. Esta iniciativa busca ayudar a los compradores a evaluar los impactos ambientales de forma más transparente y respalda el cumplimiento de estándares de construcción sostenible como LEED. Al alinearse con su objetivo a medio plazo de reducir el impacto ambiental, AGC fortalece su estrategia de abastecimiento sostenible, impulsando las oportunidades de crecimiento en el sector de la construcción.

- En enero de 2024, SCHOTT amplió su colaboración con Lumus para satisfacer la creciente demanda de gafas de realidad aumentada (RA). La expansión de la planta de SCHOTT en Malasia impulsará la producción de la tecnología de guía de ondas Z-Lens de Lumus. Esta colaboración optimizará el desarrollo de la RA desde el prototipo hasta la producción en masa, haciendo las gafas de RA más accesibles y consolidando la presencia de SCHOTT en el sector de la electrónica de consumo.

- En mayo de 2023, Corning Incorporated implementó un aumento del 20 % en el precio de los sustratos de vidrio para pantallas a nivel mundial para abordar el aumento de los costos de energía y materias primas. Esta estrategia de precios busca mantener la rentabilidad en un contexto inflacionario, aprovechando al mismo tiempo la creciente demanda de vidrio para pantallas. Este ajuste posiciona a Corning para mantener su liderazgo en el mercado y aumentar sus ingresos en una industria electrónica en recuperación.

- En abril de 2023, SCHOTT presentó soluciones innovadoras para cocinas en la feria AWE 2023 de Shanghái, con características como el revestimiento CleanPlus para un fácil mantenimiento y CERAN Luminoir para diseños avanzados de placas de cocción. Estos productos, reconocidos por la industria, reflejan la dedicación de SCHOTT a la innovación en cocinas inteligentes y refuerzan su competitividad en el mercado de electrodomésticos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.