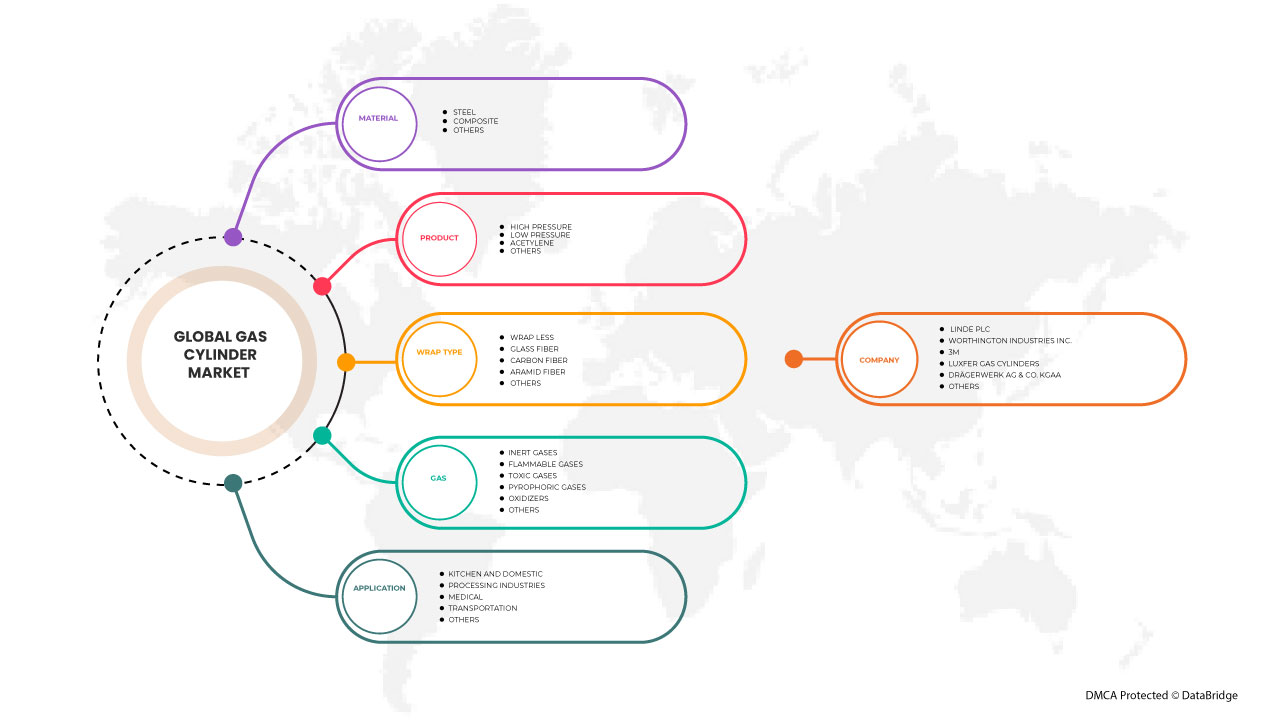

Mercado mundial de cilindros de gas, por tipo de material (acero, compuesto y otros), producto (baja presión, alta presión, acetileno y otros), tipo de envoltura (sin envoltura, fibra de vidrio, fibra de aramida , fibra de carbono y otros), gas (gases inertes, gases inflamables, gases tóxicos, gases pirofóricos, oxidantes y otros), aplicación (cocina y doméstico, industrias de procesamiento, médica, transporte y otros) - Tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de cilindros de gas

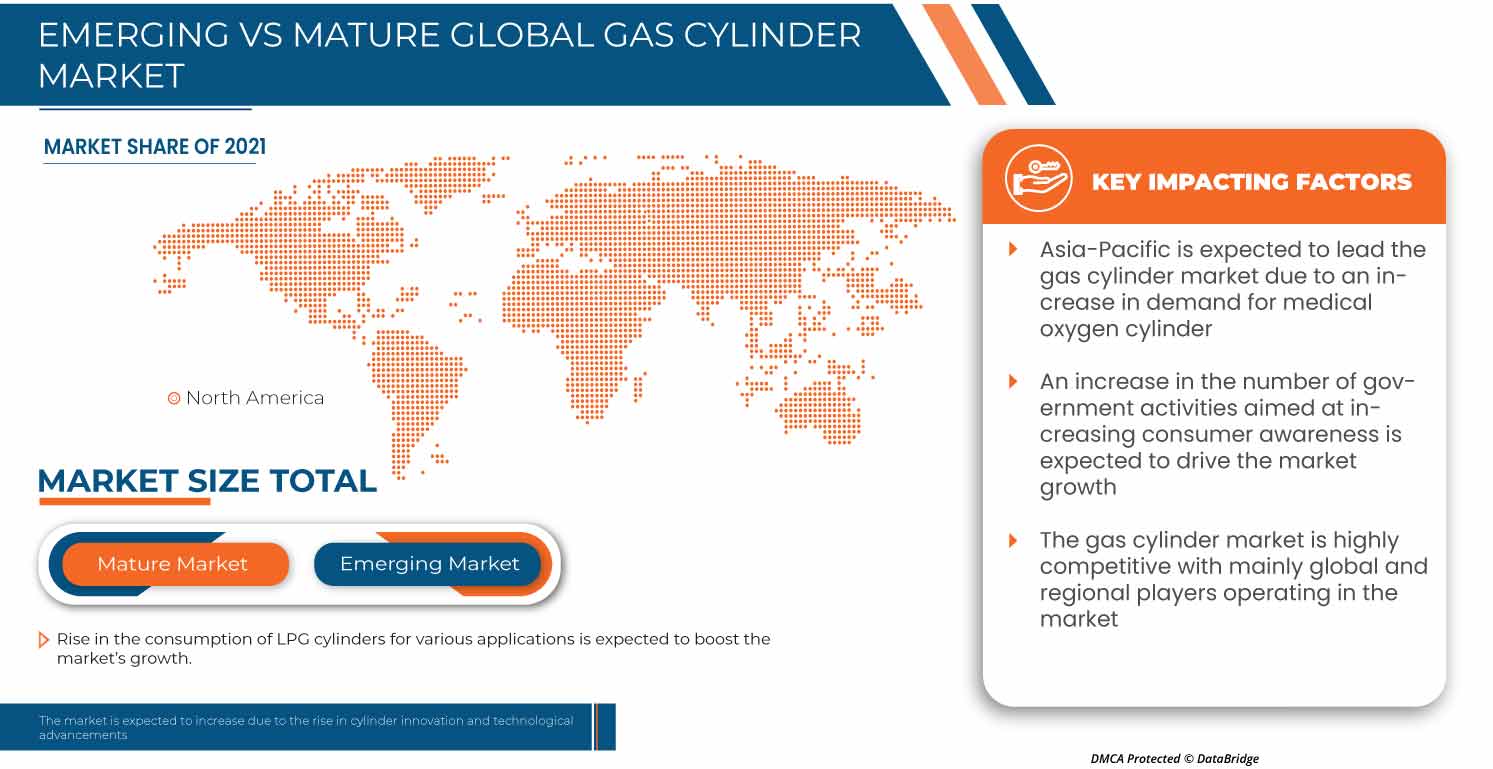

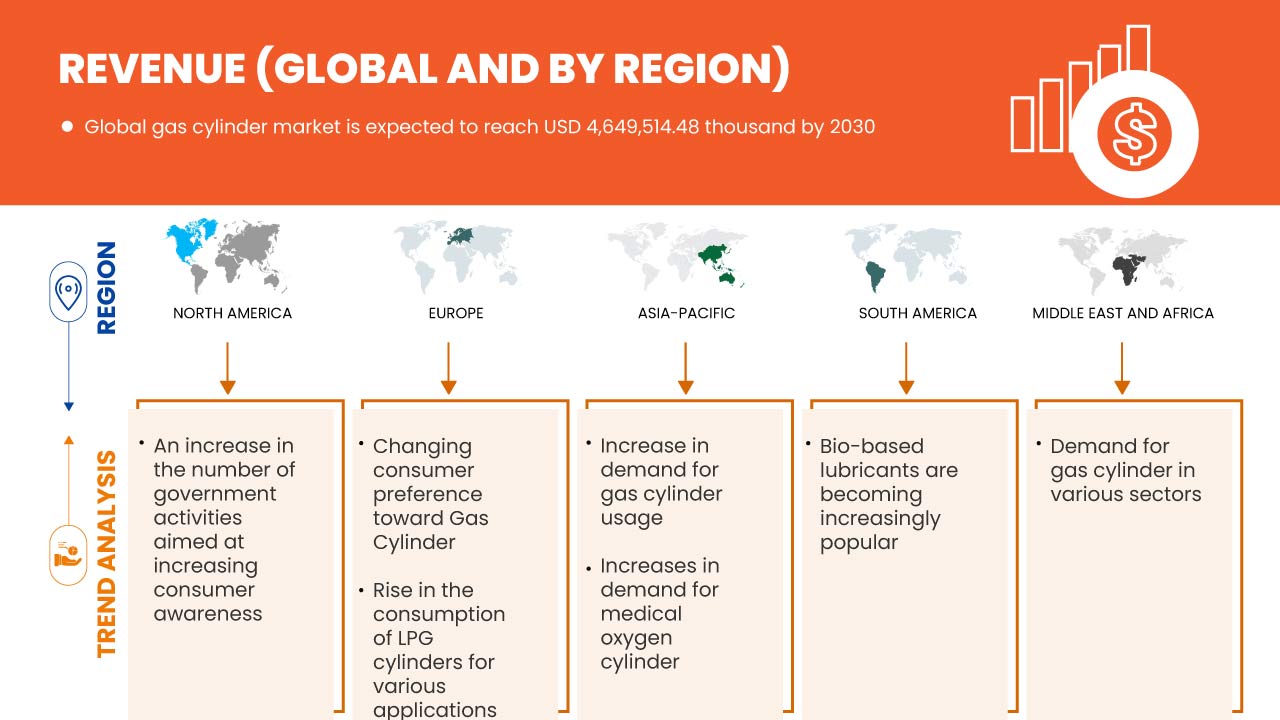

El aumento de la demanda de cilindros de oxígeno médico es un factor importante para el mercado mundial de cilindros de gas. El aumento del consumo de cilindros de GLP para diversas aplicaciones está ganando importancia. Se espera que el aumento de la cantidad de actividades gubernamentales destinadas a aumentar la conciencia de los consumidores y la demanda de cilindros de gas en varios sectores impulse el crecimiento del mercado mundial de cilindros de gas.

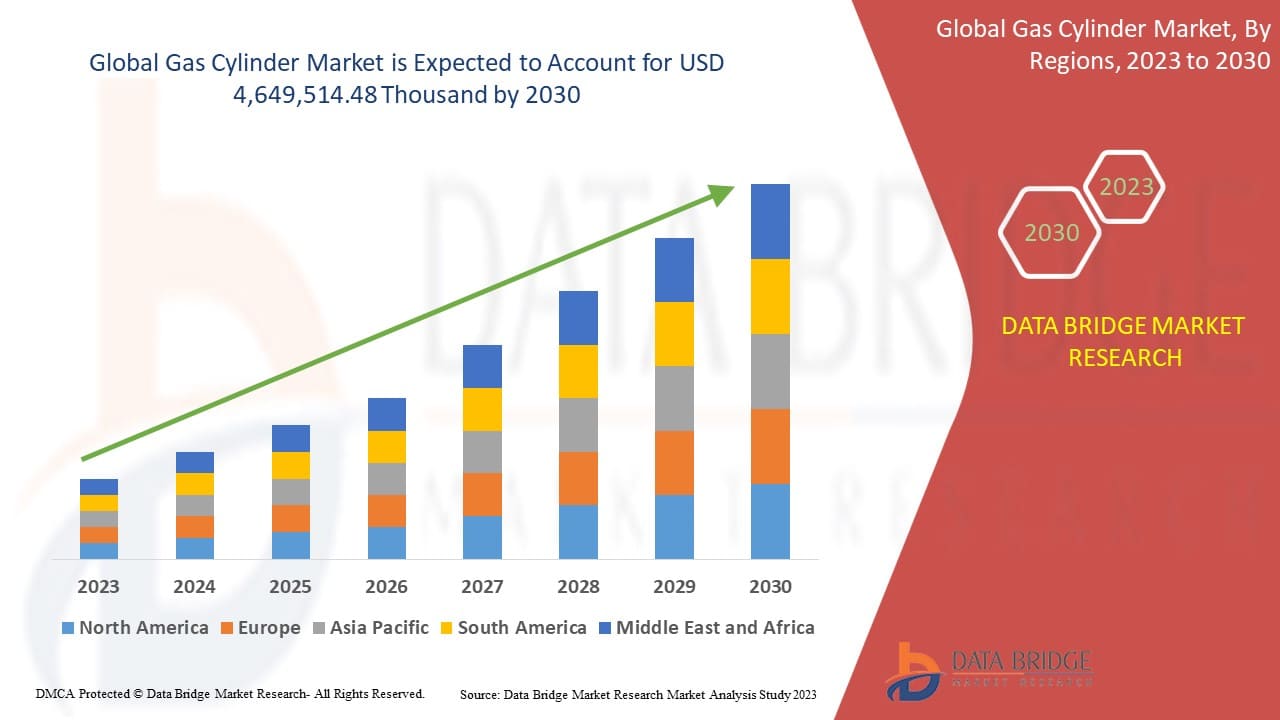

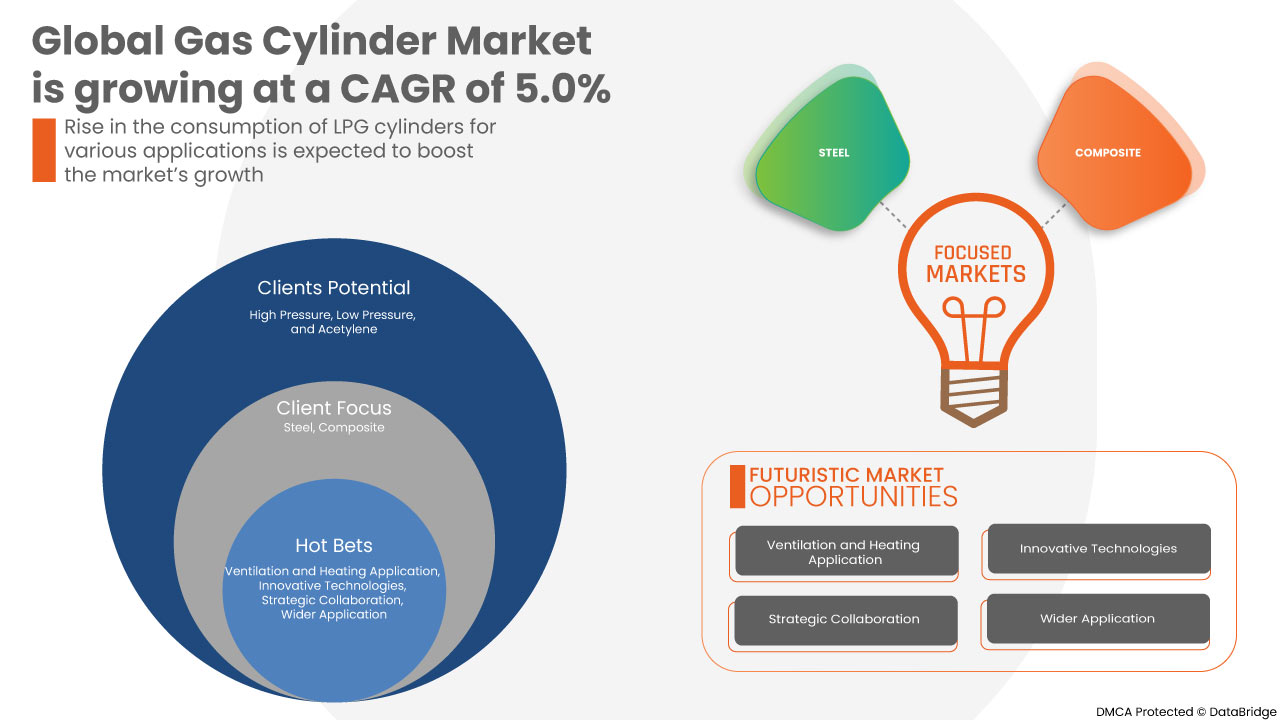

Se espera que el mercado de cilindros de gas gane un crecimiento significativo en el período de pronóstico de 2023 a 2030. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 5,0% en el período de pronóstico de 2023 a 2030 y se espera que alcance los USD 4.649.514,48 mil para 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2020-2015) |

|

Unidades cuantitativas |

Ingresos en miles de USD |

|

Segmentos cubiertos |

Por tipo de material (acero, compuesto y otros), producto (baja presión, alta presión, acetileno y otros), tipo de envoltura (sin envoltura, fibra de vidrio, fibra de aramida, fibra de carbono y otros), gas (gases inertes, gases inflamables, gases tóxicos, gases pirofóricos, oxidantes y otros), aplicación (cocina y hogar, industrias de procesamiento, médica, transporte y otros) |

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia y Nueva Zelanda, Tailandia, Indonesia, Hong Kong, Filipinas, Taiwán, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de Sudamérica como parte de Sudamérica |

|

Actores del mercado cubiertos |

3M, Aygaz A.Ş., FABER INDUSTRIE SPA, Hexagon Ragasco AS, Luxfer Gas Cylinders, Worthington Industries Inc, Beijing Tianhai Industry Co., Ltd., Drägerwerk AG & Co. KGaA, EKC, Linde plc, Time Technoplast Ltd., MS GROUP, Welz Gas Cylinder GmbH y Zhejiang Tianlong Cylinder Co., LTD |

Definición de mercado

Un cilindro de gas es un recipiente a presión que almacena gases a presiones superiores a la atmosférica. Cilindros de gas de alta presión, también conocidos como botellas. Dependiendo de las cualidades físicas del artículo, los componentes almacenados dentro del cilindro pueden estar en un fluido supercrítico, gas comprimido, vapor sobre líquido o disueltos en un material de sustrato. La válvula y la conexión de conexión están ubicadas en la parte superior de un diseño de cilindro de gas normal, extendiéndose y permaneciendo en posición vertical sobre un extremo inferior aplanado. Se prevé que el creciente enfoque de fabricantes de renombre en el desarrollo de diseños de cilindros únicos que sean capaces de mejorar las medidas de seguridad, optimizar las capacidades de manipulación y almacenamiento y que sean livianos impulse el mercado. Se espera que el mayor uso de cilindros de gas en diversas aplicaciones, como tratamiento de agua, soldadura, dispensación de bebidas, fines médicos, calefacción y cocina y extinción de incendios, aumente la demanda en todo el mundo.

Dinámica del mercado de cilindros de gas

Conductores

- Aumento de la demanda de cilindros de oxígeno medicinal

Los proveedores de atención médica utilizan con frecuencia cilindros de oxígeno con fines terapéuticos y de diagnóstico. Los sistemas de oxígeno médico, como los concentradores y los cilindros de oxígeno comprimido, se utilizan ampliamente en los entornos de atención domiciliaria y suelen ser elegidos por pacientes de edad avanzada con problemas de movilidad y que requieren un suministro constante de oxígeno.

El aumento global de la industrialización ha tenido un impacto negativo en la calidad general del aire respirable. Debido al rápido crecimiento y al aumento de la contaminación, el índice de calidad del aire (ICA) ha aumentado, aumentando la prevalencia de trastornos respiratorios. Los pacientes que padecen enfermedades respiratorias crónicas (ERC), como la enfermedad pulmonar obstructiva crónica (EPOC), necesitan suplementos de oxígeno para mejorar su calidad de vida. La contaminación, el humo del cigarrillo, los productos químicos y el polvo ocupacionales y otros factores pueden contribuir a las enfermedades respiratorias crónicas (ERC). En los últimos años, ha habido un aumento de la población de personas mayores con enfermedades crónicas que requieren asistencia respiratoria continua.

- Aumento del consumo de cilindros de GLP para diversas aplicaciones

El gas licuado de petróleo (GLP) es un combustible que se quema de forma limpia, es sostenible y eficiente. Porque es una fuente de energía sostenible, baja en carbono, eficiente e innovadora. Proporciona ventajas a los clientes. Industria y medio ambiente El GLP es menos costoso que otros combustibles tradicionales, ya que la mayor parte de su energía se convierte en calor, y se puede transportar, almacenar y utilizar en una amplia gama de aplicaciones, incluidas las residenciales, comerciales, agrícolas, industriales y de automoción.

El GLP es un gas, pero se mantiene frecuentemente bajo presión, lo que lo convierte en líquido. Una de las principales ventajas del GLP sobre otras fuentes de energía es su facilidad de transporte. Tiene un mejor poder calorífico y no contiene azufre. Debido a que el GLP se quema regularmente, es más confiable que otros tipos de energía. El GLP es más ecológico que otras fuentes de energía. Aunque todas las fuentes de energía emiten dióxido de carbono, en comparación con el petróleo, el GLP emite solo el 81% del dióxido de carbono que produce el petróleo. En comparación con el carbón, otra fuente de energía, el GLP emite solo el 70% del dióxido de carbono.

Oportunidades

- Aumento de la innovación en cilindros y avances tecnológicos

Los fabricantes de cilindros de gas mejoran constantemente sus paquetes de cilindros para satisfacer las cambiantes demandas del mercado. Las presiones más altas, las pantallas digitales y los protectores y válvulas de nuevo diseño permiten una mayor inteligencia del gas y del cilindro, y un transporte más sencillo sin comprometer la seguridad. El transporte de gases de alto valor es crucial, lo que aumenta la demanda de cilindros de gas seguros y controlados. Los avances en la compresión de gases volátiles y no reactivos han afectado a la producción de cilindros de gas. La seguridad mejorada y los diseños innovadores de cilindros han mejorado las capacidades de manipulación y almacenamiento de cilindros de gas. Como resultado de este aumento en la innovación de cilindros y los avances tecnológicos, se espera que proporcionen una oportunidad de crecimiento del mercado para el mercado de cilindros de gas. Como resultado de este aumento en la innovación de cilindros y los avances tecnológicos, se espera que proporcionen una oportunidad de crecimiento del mercado para el mercado de cilindros de gas.

Restricciones/Desafíos

- Las fluctuaciones de los precios de las bombonas de gas

Los cilindros de gas están hechos de materiales como acero, materiales compuestos y otros. Los materiales de acero se utilizan principalmente en la fabricación de cilindros de gas debido a su mejor capacidad antiestrés, lo que ahorra energía durante la producción, aumenta la resistencia y es 100% reciclable al final de la vida útil del producto. El cilindro compuesto está hecho de aleación de aluminio y es un cilindro de tres capas compuesto por un revestimiento interior de HDPE moldeado por soplado, cubierto con una capa compuesta de fibra de vidrio envuelta en polímero y equipado con una cubierta exterior de HDPE. Los precios de estos materiales han fluctuado en los últimos años, lo que hace que los precios de los cilindros de gas también fluctúen.

El mineral de hierro y la chatarra son las dos principales materias primas que se utilizan en el proceso de fabricación de acero. Es decir, el coste de producción del acero está directamente relacionado con los precios y la disponibilidad del mineral de hierro y la chatarra. Por ejemplo, durante los últimos meses, el aumento continuo de los precios del mineral de hierro de Australia (el mayor proveedor de mineral de hierro en el comercio mundial) se ha reflejado directamente en el reciente aumento del mercado del acero. Mientras tanto, la disponibilidad de chatarra utilizada para la producción de acero reciclado también puede afectar a los costes.

- Debido a la creciente demanda de diferentes gases, el sistema de la cadena de suministro está bajo una intensa presión.

El mundo está sumido en una crisis de la cadena de suministro, y las empresas de todos los sectores se enfrentan a obstáculos importantes. La epidemia y su reacción global han provocado un problema de transporte marítimo global. La demanda supera a la oferta, los precios del transporte marítimo están en su nivel más alto y la capacidad de contenedores es extremadamente limitada. Lamentablemente, no hay una respuesta rápida y parece que los elevados costes de envío, los plazos de entrega más largos y los cuellos de botella en la capacidad seguirán existiendo en la primera mitad de 2022. Las empresas navieras han pronosticado que las cosas empezarán a mejorar en la segunda parte del año.

Las principales materias primas necesarias para fabricar cilindros de gas plantearon otro obstáculo a la cadena de suministro global. La epidemia ha causado importantes trastornos en todo el mundo en la minería y la industria, lo que ha dado lugar a una escasez global de aluminio. Como resultado, los precios del aluminio se han duplicado y los fabricantes de cilindros no pueden adquirir suficiente aluminio para aumentar la capacidad de fabricación, mientras que la creciente demanda y las restricciones de la oferta han llevado los costos de la fibra de carbono a máximos históricos. La invasión rusa de Ucrania tiene consecuencias no deseadas, como el aumento de los precios de la gasolina y el desvío de vuelos para evitar el espacio aéreo ruso.

Desarrollo reciente

- En septiembre de 2022, la nueva planta de Worthington Industries que atiende al mercado de la movilidad con hidrógeno se completó en menos de dos años. La nueva planta producirá cilindros de presión compuestos de tipo III y IV. Los cilindros son livianos y están hechos de revestimientos metálicos o poliméricos con refuerzo de fibra de carbono que pueden soportar altas presiones. Las aplicaciones incluyen sistemas de abastecimiento de combustible a bordo para automóviles, camiones, autobuses, trenes y barcos, así como contenedores de almacenamiento y transporte para hidrógeno comprimido y gas natural comprimido (GNC).

- En marzo de 2021, Luxfer Gas Cylinders anunció la adquisición de Structural Composites Industries, un fabricante norteamericano de cilindros compuestos. La adquisición fortalece la oferta de cilindros compuestos de Luxfer y se alinea con las inversiones recientes para mejorar aún más su capacidad de combustibles alternativos para abordar las oportunidades de crecimiento del mercado de GNC e hidrógeno, además de ampliar nuestra cartera en los mercados aeroespacial, de soporte vital y otros.

Alcance del mercado de cilindros de gas

El mercado de cilindros de gas se clasifica en función del material, el producto, el tipo de envoltura, el gas y la aplicación. El crecimiento en cinco segmentos le ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Material

- Acero

- Compuesto

- Otros

Según el material, el mercado de cilindros de gas se segmenta en acero, compuestos y otros.

Producto

- Presión alta

- Baja presión

- Acetileno

Sobre la base del producto, el mercado de cilindros de gas está segmentado en alta presión, baja presión y acetileno.

Envolturas

- Envolver menos

- Fibra de vidrio

- Fibra de aramida

- Fibra de carbono

- Otros

Sobre la base del tipo de envoltura, el mercado de cilindros de gas se segmenta en sin envoltura, fibra de vidrio, fibra de aramida, fibra de carbono y otros.

Gas

- Gases inflamables

- Gases inertes

- Gases tóxicos

- Gases pirofóricos

- Oxidantes

- Otros

En función del gas, el mercado de cilindros de gas se segmenta en gases inertes, gases inflamables, gases tóxicos, gases pirofóricos, oxidantes y otros.

Solicitud

- Cocina y hogar

- Industrias de procesamiento

- Médico

- Transporte

- Otros

Sobre la base de la aplicación, el mercado de cilindros de gas se segmenta en cocina y hogar, industrias de procesamiento, medicina, transporte y otros.

Análisis y perspectivas regionales del mercado de cilindros de gas

El mercado de cilindros de gas está segmentado según el material, el producto, el tipo de envoltura, el gas y la aplicación.

Los principales países cubiertos en el informe del mercado de cilindros de gas son EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia y Nueva Zelanda, Tailandia, Indonesia, Hong Kong, Filipinas, Taiwán, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de Sudamérica como parte de Sudamérica.

En Asia-Pacífico, se espera que China domine el mercado debido al aumento de la demanda de cilindros de oxígeno médico en la región. Se espera que Estados Unidos domine el mercado de cilindros de gas de América del Norte debido al aumento de la cantidad de actividades gubernamentales destinadas a aumentar la concienciación de los consumidores.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, el análisis de las cinco fuerzas de Porter de las tendencias técnicas y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para cada país. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los cilindros de gas

El panorama competitivo del mercado de cilindros de gas proporciona detalles por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de cilindros de gas.

Algunos de los principales actores del mercado que participan en el mercado global de cilindros de gas son 3M, Aygaz A.Ş., FABER INDUSTRIE SPA, Hexagon Ragasco AS, Luxfer Gas Cylinders, Worthington Industries Inc, Beijing Tianhai Industry Co., Ltd., Drägerwerk AG & Co. KGaA, EKC, Linde plc, Time Technoplast Ltd., MS GROUP, Welz Gas Cylinder GmbH y Zhejiang Tianlong Cylinder Co., LTD, entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL GAS CYLINDER MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE DEMAND FOR MEDICAL OXYGEN CYLINDER

5.1.2 RISE IN THE CONSUMPTION OF LPG CYLINDERS FOR VARIOUS APPLICATIONS

5.1.3 AN INCREASE IN THE NUMBER OF GOVERNMENT ACTIVITIES AIMED AT INCREASING CONSUMER AWARENESS

5.1.4 DEMAND FOR GAS CYLINDERS IN VARIOUS SECTORS

5.2 RESTRAINTS

5.2.1 THE FLUCTUATIONS IN GAS CYLINDER PRICES

5.2.2 DUE TO THE RISING DEMAND FOR DIFFERENT GASES, THE SUPPLY CHAIN SYSTEM IS UNDER INTENSE STRAIN

5.3 OPPORTUNITIES

5.3.1 RISE IN CYLINDER INNOVATION AND TECHNOLOGICAL ADVANCEMENTS

5.3.2 INCREASING USE IN VENTILATION AND HEATING APPLICATIONS

5.3.3 INCREASE IN STRATEGIC COLLABORATIONS

5.4 CHALLENGES

5.4.1 AVAILABLE ALTERNATIVES FOR GAS CYLINDERS

5.4.2 RISK OF EXPLOSION AND FIRE, IF GASES SUPPORT COMBUSTION

6 GLOBAL GAS CYLINDER MARKET, BY MATERIAL

6.1 OVERVIEW

6.2 STEEL

6.3 COMPOSITE

6.4 OTHERS

7 GLOBAL GAS CYLINDER MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 HIGH PRESSURE

7.3 LOW PRESSURE

7.4 ACETYLENE

7.5 OTHERS

8 GLOBAL GAS CYLINDER MARKET, BY WRAP TYPE

8.1 OVERVIEW

8.2 WRAP LESS

8.3 GLASS FIBER

8.4 ARAMID FIBER

8.5 CARBON FIBER

8.6 OTHERS

9 GLOBAL GAS CYLINDER MARKET, BY GAS

9.1 OVERVIEW

9.2 INERT GASES

9.3 FLAMMABLE GASES

9.4 TOXIC GASES

9.5 PYROPHORIC GASES

9.6 OXIDIZERS

9.7 OTHERS

10 GLOBAL GAS CYLINDER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 PROCESSING INDUSTRIES

10.3 TRANSPORTATION

10.4 KITCHEN AND DOMESTIC

10.5 MEDICALS

10.6 OTHERS

11 GLOBAL GAS CYLINDER MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 JAPAN

11.2.4 SOUTH KOREA

11.2.5 THAILAND

11.2.6 SINGAPORE

11.2.7 INDONESIA

11.2.8 AUSTRALIA & NEW ZEALAND

11.2.9 PHILIPPINES

11.2.10 MALAYSIA

11.2.11 HONG KONG

11.2.12 TAIWAN

11.2.13 REST OF ASIA PACIFIC

11.3 EUROPE

11.3.1 GERMANY

11.3.2 U.K.

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 RUSSIA

11.3.7 SWITZERLAND

11.3.8 TURKEY

11.3.9 BELGIUM

11.3.10 NETHERLANDS

11.3.11 REST OF EUROPE

11.4 NORTH AMERICA

11.4.1 U.S.

11.4.2 CANADA

11.4.3 MEXICO

11.5 MIDDLE EAST AND AFRICA

11.5.1 SAUDI ARABIA

11.5.2 UNITED ARAB EMIRATES

11.5.3 SOUTH AFRICA

11.5.4 EGYPT

11.5.5 ISRAEL

11.5.6 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL GAS CYLINDER MARKET COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS:

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.5 COLLABORATION

12.6 NEW UNIT

12.7 NEW PLANT

12.8 PARTNERSHIP

12.9 ACQUISITIONS

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LINDE PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 WORTHINGTON INDUSTRIES INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 3M

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 LUXFER GAS CYLINDERS

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATE

14.5 DRÄGERWERK AG & CO. KGAA (2022)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 BEIJING TIANHAI INDUSTRY CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 AYGAZ A.Ş.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPEMNTS

14.8 FABER INDUSTRIE SPA

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 WELZ GAS CYLINDER GMBH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 EKC

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 HEXAGON RAGASCO AS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MS GROUP

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 TIME TECHNOPLAST LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 ZHEJIANG TIANLONG CYLINDER CO., LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 GLOBAL GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 2 GLOBAL GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 3 GLOBAL STEEL IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 GLOBAL STEEL IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 5 GLOBAL COMPOSITE IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 GLOBAL COMPOSITE IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 7 GLOBAL OTHERS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 GLOBAL OTHERS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 9 GLOBAL GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 10 GLOBAL HIGH PRESSURE IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 GLOBAL LOW PRESSURE IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 GLOBAL ACETYLENE IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 GLOBAL OTHERS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 GLOBAL GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 GLOBAL WRAP LESS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 GLOBAL GLASS FIBER IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 GLOBAL ARAMID FIBER IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 GLOBAL CARBON FIBER IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 GLOBAL OTHERS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 GLOBAL GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 21 GLOBAL INERT GASES IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 GLOBAL FLAMMABLE GASES IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 GLOBAL TOXIC GASES IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 GLOBAL PYROPHORIC GASES IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 GLOBAL OXIDIZERS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 GLOBAL OTHERS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 GLOBAL GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 28 GLOBAL PROCESSING INDUSTRIES IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 GLOBAL TRANSPORTATION IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 GLOBAL KITCHEN AND DOMESTIC IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 GLOBAL MEDICALS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 GLOBAL OTHERS IN GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 GLOBAL GAS CYLINDER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 GLOBAL GAS CYLINDER MARKET, BY REGION, 2021-2030 (THOUSAND UNITS)

TABLE 35 ASIA-PACIFIC GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 37 ASIA-PACIFIC GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 39 ASIA-PACIFIC GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 43 CHINA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 44 CHINA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 45 CHINA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 CHINA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 CHINA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 48 CHINA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 49 INDIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 50 INDIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 51 INDIA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 INDIA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 INDIA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 54 INDIA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 55 JAPAN GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 56 JAPAN GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 57 JAPAN GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 JAPAN GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 JAPAN GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 60 JAPAN GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH KOREA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH KOREA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 63 SOUTH KOREA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH KOREA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH KOREA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 66 SOUTH KOREA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 67 THAILAND GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 THAILAND GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 69 THAILAND GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 70 THAILAND GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 THAILAND GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 72 THAILAND GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 73 SINGAPORE GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 74 SINGAPORE GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 75 SINGAPORE GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 SINGAPORE GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 SINGAPORE GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 78 SINGAPORE GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 79 INDONESIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 80 INDONESIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 81 INDONESIA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 82 INDONESIA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 INDONESIA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 84 INDONESIA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 85 AUSTRALIA & NEW ZEALAND GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 86 AUSTRALIA & NEW ZEALAND GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 87 AUSTRALIA & NEW ZEALAND GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 88 AUSTRALIA & NEW ZEALAND GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 AUSTRALIA & NEW ZEALAND GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 90 AUSTRALIA & NEW ZEALAND GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 91 PHILIPPINES GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 92 PHILIPPINES GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 93 PHILIPPINES GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 94 PHILIPPINES GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 PHILIPPINES GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 96 PHILIPPINES GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 97 MALAYSIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 98 MALAYSIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 99 MALAYSIA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 100 MALAYSIA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 MALAYSIA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 102 MALAYSIA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 103 HONG KONG GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 104 HONG KONG GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 105 HONG KONG GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 106 HONG KONG GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 HONG KONG GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 108 HONG KONG GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 109 TAIWAN GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 110 TAIWAN GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 111 TAIWAN GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 112 TAIWAN GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 TAIWAN GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 114 TAIWAN GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 115 REST OF ASIA PACIFIC GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 116 REST OF ASIA PACIFIC GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 117 EUROPE GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 118 EUROPE GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 119 EUROPE GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 120 EUROPE GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 121 EUROPE GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 122 EUROPE GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 EUROPE GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 124 EUROPE GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 125 GERMANY GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 126 GERMANY GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 127 GERMANY GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 128 GERMANY GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 129 GERMANY GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 130 GERMANY GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 131 U.K. GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 132 U.K. GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 133 U.K. GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 134 U.K. GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 135 U.K. GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 136 U.K. GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 137 FRANCE GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 138 FRANCE GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 139 FRANCE GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 140 FRANCE GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 141 FRANCE GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 142 FRANCE GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 143 ITALY GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 144 ITALY GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 145 ITALY GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 146 ITALY GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 147 ITALY GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 148 ITALY GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 149 SPAIN GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 150 SPAIN GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 151 SPAIN GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 152 SPAIN GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 SPAIN GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 154 SPAIN GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 155 RUSSIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 156 RUSSIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 157 RUSSIA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 158 RUSSIA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 RUSSIA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 160 RUSSIA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 161 SWITZERLAND GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 162 SWITZERLAND GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 163 SWITZERLAND GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 164 SWITZERLAND GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 165 SWITZERLAND GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 166 SWITZERLAND GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 167 TURKEY GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 168 TURKEY GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 169 TURKEY GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 170 TURKEY GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 171 TURKEY GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 172 TURKEY GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 173 BELGIUM GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 174 BELGIUM GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 175 BELGIUM GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 176 BELGIUM GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 BELGIUM GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 178 BELGIUM GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 179 NETHERLANDS GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 180 NETHERLANDS GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 181 NETHERLANDS GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 182 NETHERLANDS GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 NETHERLANDS GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 184 NETHERLANDS GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 185 REST OF EUROPE GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 186 REST OF EUROPE GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 187 NORTH AMERICA GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 188 NORTH AMERICA GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 189 NORTH AMERICA CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 190 NORTH AMERICA CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 191 NORTH AMERICA CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 192 NORTH AMERICA CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 NORTH AMERICA CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 194 NORTH AMERICA CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 195 U.S. GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 196 U.S. GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 197 U.S. GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 198 U.S. GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 U.S. GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 200 U.S. GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 201 CANADA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 202 CANADA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 203 CANADA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 204 CANADA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 205 CANADA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 206 CANADA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 207 MEXICO GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 208 MEXICO GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 209 MEXICO GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 210 MEXICO GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 MEXICO GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 212 MEXICO GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 213 MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 214 MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 215 MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 216 MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 217 MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 218 MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 219 MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 220 MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 221 SAUDI ARABIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 222 SAUDI ARABIA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 223 SAUDI ARABIA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 224 SAUDI ARABIA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 225 SAUDI ARABIA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 226 SAUDI ARABIA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 227 UNITED ARAB EMIRATES GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 228 UNITED ARAB EMIRATES GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 229 UNITED ARAB EMIRATES GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 230 UNITED ARAB EMIRATES GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 231 UNITED ARAB EMIRATES GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 232 UNITED ARAB EMIRATES GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 233 SOUTH AFRICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 234 SOUTH AFRICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 235 SOUTH AFRICA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 236 SOUTH AFRICA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 SOUTH AFRICA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 238 SOUTH AFRICA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 239 EGYPT GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 240 EGYPT GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 241 EGYPT GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 242 EGYPT GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 243 EGYPT GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 244 EGYPT GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 245 ISRAEL GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 246 ISRAEL GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 247 ISRAEL GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 248 ISRAEL GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 249 ISRAEL GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 250 ISRAEL GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 251 REST OF MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 252 REST OF MIDDLE EAST & AFRICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 253 SOUTH AMERICA GLOBAL GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 254 SOUTH AMERICA GAS CYLINDER MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 255 SOUTH AMERICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 256 SOUTH AMERICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 257 SOUTH AMERICA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 258 SOUTH AMERICA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 259 SOUTH AMERICA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 260 SOUTH AMERICA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 261 BRAZIL GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 262 BRAZIL GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 263 BRAZIL GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 264 BRAZIL GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 265 BRAZIL GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 266 BRAZIL GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 267 ARGENTINA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 268 ARGENTINA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

TABLE 269 ARGENTINA GAS CYLINDER MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 270 ARGENTINA GAS CYLINDER MARKET, BY WRAP TYPE, 2021-2030 (USD THOUSAND)

TABLE 271 ARGENTINA GAS CYLINDER MARKET, BY GAS, 2021-2030 (USD THOUSAND)

TABLE 272 ARGENTINA GAS CYLINDER MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 273 REST OF SOUTH AMERICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 274 REST OF SOUTH AMERICA GAS CYLINDER MARKET, BY MATERIAL, 2021-2030 (THOUSAND UNITS)

Lista de figuras

FIGURE 1 GLOBAL GAS CYLINDER MARKET

FIGURE 2 GLOBAL GAS CYLINDER MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL GAS CYLINDER MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL GAS CYLINDER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL GAS CYLINDER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL GAS CYLINDER MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 GLOBAL GAS CYLINDER MARKET: MULTIVARIATE MODELLING

FIGURE 8 GLOBAL GAS CYLINDER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GLOBAL GAS CYLINDER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GLOBAL GAS CYLINDER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 GLOBAL GAS CYLINDER MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 GLOBAL GAS CYLINDER MARKET: SEGMENTATION

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE GLOBAL GAS CYLINDER MARKET, WHILE EUROPE IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 RISE IN THE CONSUMPTION OF LPG CYLINDERS FOR VARIOUS APPLICATIONS IS EXPECTED TO DRIVE GLOBAL GAS CYLINDER MARKET IN THE FORECAST PERIOD

FIGURE 15 STEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL GAS CYLINDER MARKET IN 2023 & 2030

FIGURE 16 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR GAS CYLINDER MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL GAS CYLINDERS MARKET

FIGURE 18 GLOBAL GAS CYLINDER MARKET: BY MATERIAL, 2022

FIGURE 19 GLOBAL GAS CYLINDER MARKET: BY PRODUCT, 2022

FIGURE 20 GLOBAL GAS CYLINDER MARKET: BY WRAP TYPE, 2022

FIGURE 21 GLOBAL GAS CYLINDER MARKET: BY GAS, 2022

FIGURE 22 GLOBAL GAS CYLINDER MARKET: BY APPLICATION, 2022

FIGURE 23 GLOBAL GAS CYLINDER MARKET: SNAPSHOT (2022)

FIGURE 24 GLOBAL GAS CYLINDER MARKET: BY REGION (2022)

FIGURE 25 GLOBAL GAS CYLINDER MARKET: BY REGION (2023 & 2030)

FIGURE 26 GLOBAL GAS CYLINDER MARKET: BY REGION (2022 & 2030)

FIGURE 27 GLOBAL GAS CYLINDER MARKET: BY MATERIAL (2023-2030)

FIGURE 28 ASIA-PACIFIC GAS CYLINDER MARKET: SNAPSHOT (2022)

FIGURE 29 ASIA-PACIFIC GAS CYLINDER MARKET: BY COUNTRY (2022)

FIGURE 30 ASIA-PACIFIC GAS CYLINDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 31 ASIA-PACIFIC GAS CYLINDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 32 ASIA-PACIFIC GAS CYLINDER MARKET: BY MATERIAL (2023-2030)

FIGURE 33 EUROPE GAS CYLINDER MARKET: SNAPSHOT (2022)

FIGURE 34 EUROPE GAS CYLINDER MARKET: BY COUNTRY (2022)

FIGURE 35 EUROPE GAS CYLINDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 36 EUROPE GAS CYLINDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 37 EUROPE GAS CYLINDER MARKET: BY MATERIAL (2023-2030)

FIGURE 38 NORTH AMERICA GAS CYLINDER MARKET: SNAPSHOT (2022)

FIGURE 39 NORTH AMERICA GAS CYLINDER MARKET: BY COUNTRY (2022)

FIGURE 40 NORTH AMERICA GAS CYLINDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 NORTH AMERICA GAS CYLINDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 NORTH AMERICA GAS CYLINDER MARKET: BY MATERIAL (2023-2030)

FIGURE 43 MIDDLE EAST AND AFRICA GAS CYLINDER MARKET: SNAPSHOT (2022)

FIGURE 44 MIDDLE EAST AND AFRICA GAS CYLINDER MARKET: BY COUNTRY (2022)

FIGURE 45 MIDDLE EAST AND AFRICA GAS CYLINDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 46 MIDDLE EAST AND AFRICA GAS CYLINDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 47 MIDDLE EAST AND AFRICA GAS CYLINDER MARKET: BY MATERIAL (2023-2030)

FIGURE 48 SOUTH AMERICA GAS CYLINDER MARKET: SNAPSHOT (2022)

FIGURE 49 SOUTH AMERICA GAS CYLINDER MARKET: BY COUNTRY (2022)

FIGURE 50 SOUTH AMERICA GAS CYLINDER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 51 SOUTH AMERICA GAS CYLINDER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 52 SOUTH AMERICA GAS CYLINDER MARKET: BY MATERIAL (2023-2030)

FIGURE 53 GLOBAL GAS CYLINDER MARKET: COMPANY SHARE 2022 (%)

FIGURE 54 NORTH AMERICA GAS CYLINDER MARKET: COMPANY SHARE 2022 (%)

FIGURE 55 EUROPE GAS CYLINDER MARKET: COMPANY SHARE 2022 (%)

FIGURE 56 ASIA-PACIFIC GAS CYLINDER MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.