Global Food Robotics In Processed Food Application Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

6.40 Billion

USD

16.42 Billion

2024

2032

USD

6.40 Billion

USD

16.42 Billion

2024

2032

| 2025 –2032 | |

| USD 6.40 Billion | |

| USD 16.42 Billion | |

|

|

|

|

Segmentación del mercado global de aplicaciones de robótica alimentaria en alimentos procesados, por tipo (articulado, cartesiano, SCARA, paralelo, cilíndrico, colaborativo y otros tipos), carga útil (baja, media y pesada) y aplicación (empaquetado, reempaquetado, paletizado, picking, procesamiento y otros) – Tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de aplicaciones de robótica alimentaria en alimentos procesados

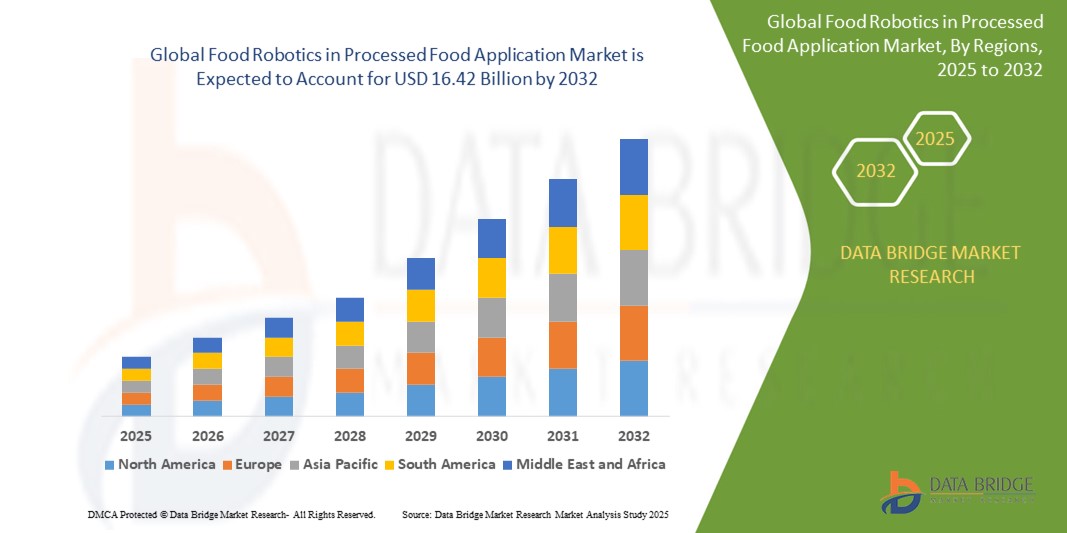

- El tamaño del mercado global de aplicaciones de robótica alimentaria en alimentos procesados se valoró en USD 6.40 mil millones en 2024 y se espera que alcance los USD 16.42 mil millones para 2032 , con una CAGR del 12,50% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente adopción de la automatización en el procesamiento de alimentos para mejorar la eficiencia, reducir los costos laborales y mejorar la consistencia del producto, impulsada por los avances en las tecnologías robóticas y la creciente demanda de alimentos procesados y envasados.

- Además, la creciente demanda de los consumidores de productos alimenticios de alta calidad, seguros e higiénicos, junto con estrictos estándares regulatorios, está posicionando a la robótica alimentaria como una solución crítica para las operaciones modernas de procesamiento de alimentos, impulsando significativamente el crecimiento de la industria.

Análisis del mercado de aplicaciones de robótica alimentaria en alimentos procesados

- La robótica alimentaria, que abarca sistemas automatizados para tareas como el envasado, la paletización y el procesamiento, es cada vez más fundamental en la industria de alimentos y bebidas debido a su precisión, velocidad y capacidad para cumplir con estrictos estándares de higiene en aplicaciones de alimentos procesados.

- El aumento de la demanda de robótica alimentaria está impulsado por la necesidad de eficiencia operativa, el aumento de los costos laborales y la creciente tendencia a la automatización en la fabricación de alimentos, particularmente en entornos de producción de alto volumen.

- Europa dominó el mercado de la robótica alimentaria en aplicaciones de alimentos procesados, con la mayor cuota de ingresos, un 38,5 % en 2024, gracias a una infraestructura de fabricación avanzada, una alta adopción de tecnologías de automatización y sólidos marcos regulatorios que garantizan la seguridad alimentaria. Alemania y el Reino Unido son contribuyentes clave, con importantes inversiones en soluciones robóticas por parte de importantes empresas de procesamiento de alimentos.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento durante el período de pronóstico, impulsada por la rápida industrialización, la creciente demanda de alimentos procesados y las crecientes inversiones en automatización en países como China, Japón e India.

- El segmento articulado dominó la mayor cuota de mercado con un 42,3%, gracias a su flexibilidad y capacidad para imitar los movimientos del brazo humano, lo que lo hace ideal para tareas complejas como el corte, el deshuesado, el envasado y la paletización en el procesamiento de alimentos. Su precisión y versatilidad en espacios reducidos refuerzan aún más su dominio.

Alcance del informe y segmentación del mercado de aplicaciones de robótica alimentaria en alimentos procesados

|

Atributos |

Perspectivas clave del mercado de la robótica alimentaria en aplicaciones de alimentos procesados |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de aplicaciones de robótica alimentaria en alimentos procesados

“Aumento de la integración de la IA y el análisis de macrodatos”

- El mercado global de robótica alimentaria en aplicaciones de alimentos procesados está experimentando una tendencia notable hacia la integración de la Inteligencia Artificial (IA) y el análisis de Big Data.

- Estas tecnologías facilitan el procesamiento avanzado de datos, lo que permite obtener información detallada sobre la eficiencia de la producción, el rendimiento del equipo y las métricas de control de calidad.

- Las soluciones robóticas impulsadas por IA respaldan el mantenimiento proactivo al predecir fallas de los equipos antes de que interrumpan las operaciones, lo que reduce el tiempo de inactividad y los costos de mantenimiento.

- Por ejemplo, las empresas están aprovechando las plataformas de IA para optimizar las operaciones robóticas, como ajustar las velocidades de envasado según la demanda en tiempo real o analizar patrones de clasificación para minimizar el desperdicio de alimentos.

- Esta tendencia aumenta el atractivo de los sistemas de robótica alimentaria para los fabricantes, mejorando la eficiencia operativa y el cumplimiento de estrictos estándares de seguridad alimentaria.

- Los algoritmos de IA pueden procesar datos de tareas robóticas, como la precisión de selección, la consistencia del empaquetado y la precisión del procesamiento, para optimizar el rendimiento y garantizar resultados de alta calidad.

Dinámica del mercado de aplicaciones de robótica alimentaria en alimentos procesados

Conductor

Creciente demanda de automatización y cumplimiento de la seguridad alimentaria

- La creciente demanda de los consumidores de alimentos procesados y envasados, incluidas las comidas listas para comer y los productos de conveniencia, es un impulsor clave del mercado de la robótica alimentaria.

- Los sistemas robóticos mejoran la seguridad alimentaria al automatizar tareas como el envasado, la selección y el procesamiento, reduciendo el contacto humano y los riesgos de contaminación.

- Las estrictas regulaciones gubernamentales, particularmente en Europa con estándares como HACCP e ISO 22000, están acelerando la adopción de la robótica para garantizar el cumplimiento de los requisitos de seguridad e higiene alimentaria.

- Los avances en IoT y la conectividad 5G permiten una transferencia de datos más rápida y un monitoreo en tiempo real, lo que respalda aplicaciones robóticas sofisticadas en el procesamiento de alimentos.

- Los fabricantes de alimentos están integrando cada vez más la robótica como solución estándar para satisfacer las crecientes demandas de producción y mantener una calidad constante del producto.

Restricción/Desafío

Altos costos de implementación y preocupaciones sobre la seguridad de los datos

- Los altos costos iniciales del hardware, software y la integración de sistemas robóticos plantean una barrera importante, en particular para las pequeñas y medianas empresas en los mercados emergentes.

- Modernizar las líneas de producción existentes con sistemas robóticos puede ser complejo y costoso, y requiere conocimientos especializados y actualizaciones de infraestructura.

- Las cuestiones de seguridad y privacidad de los datos son un desafío importante, ya que los sistemas robóticos recopilan datos operativos confidenciales, lo que genera inquietudes sobre ciberataques, uso indebido de datos y cumplimiento de regulaciones como el RGPD en Europa.

- La falta de regulaciones globales estandarizadas para el manejo de datos en la robótica alimentaria complica las operaciones de los fabricantes que operan en múltiples regiones.

- Estos factores pueden desacelerar el crecimiento del mercado en regiones sensibles a los costos o áreas con mayor conciencia de la privacidad de los datos.

Alcance del mercado de aplicaciones de la robótica alimentaria en alimentos procesados

El mercado está segmentado según el tipo, la carga útil y la aplicación.

- Por tipo

Según el tipo, el mercado global de robótica alimentaria en aplicaciones de alimentos procesados se segmenta en articulada, cartesiana, Scara, paralela, cilíndrica, colaborativa, entre otros. El segmento articulado dominó la mayor cuota de mercado con un 42,3%, gracias a su flexibilidad y capacidad para imitar los movimientos del brazo humano, lo que la hace ideal para tareas complejas como cortar, deshuesar, envasar y paletizar en el procesamiento de alimentos. Su precisión y versatilidad en espacios reducidos refuerzan aún más su dominio.

Se espera que el segmento de robots colaborativos (cobots) experimente la tasa de crecimiento más rápida entre 2025 y 2032. Este crecimiento está impulsado por un enfoque creciente en la seguridad de los trabajadores, la facilidad de programación e implementación, y la creciente demanda de soluciones de automatización flexibles en instalaciones de procesamiento de alimentos donde la colaboración entre humanos y robots es beneficiosa.

- Por carga útil

En función de la carga útil, el mercado global de robótica alimentaria en aplicaciones de alimentos procesados se segmenta en baja, media y pesada. Se espera que el segmento de carga media ocupe la mayor cuota de mercado, principalmente gracias a su equilibrada capacidad y flexibilidad, lo que lo hace muy versátil para diversas aplicaciones en la industria alimentaria.

Se prevé que el segmento de carga pesada experimente un crecimiento significativo, impulsado por los avances tecnológicos y la mejora de la I+D en el manejo eficiente de grandes volúmenes y productos alimenticios más pesados en aplicaciones de alimentos procesados.

- Por aplicación

En función de su aplicación, el mercado global de robótica alimentaria en aplicaciones de alimentos procesados se segmenta en envasado, reenvasado, paletizado, picking, procesamiento, etc. El segmento de envasado representa la mayor cuota de mercado, impulsado por la creciente demanda de alimentos envasados y la necesidad de procesos de envasado rápidos, consistentes e higiénicos que los robots puedan gestionar eficientemente, reduciendo el desperdicio y aumentando la capacidad de producción.

Se prevé que el segmento de procesamiento experimente un sólido crecimiento entre 2025 y 2032. Esto está impulsado por la necesidad crítica de precisión, consistencia e higiene en diversas tareas de procesamiento de alimentos, como cortar, mezclar y clasificar, donde las soluciones robóticas ofrecen un rendimiento superior y ayudan a mantener estrictos estándares de seguridad alimentaria.

Análisis regional del mercado de aplicaciones de robótica alimentaria en alimentos procesados

- Europa dominó el mercado de la robótica alimentaria en aplicaciones de alimentos procesados, con la mayor cuota de ingresos, un 38,5 % en 2024, gracias a una infraestructura de fabricación avanzada, una alta adopción de tecnologías de automatización y sólidos marcos regulatorios que garantizan la seguridad alimentaria. Alemania y el Reino Unido son contribuyentes clave, con importantes inversiones en soluciones robóticas por parte de importantes empresas de procesamiento de alimentos.

- Los consumidores y fabricantes priorizan las soluciones robóticas para mejorar la precisión de la producción, reducir los costos laborales y garantizar el cumplimiento de estrictos estándares de seguridad alimentaria, particularmente en regiones con ecosistemas industriales avanzados.

- El crecimiento está respaldado por los avances en tecnologías robóticas, incluidos los robots articulados, SCARA y colaborativos, junto con una creciente adopción tanto en plantas de procesamiento de alimentos a gran escala como en instalaciones más pequeñas.

Análisis del mercado de aplicaciones de robótica alimentaria en alimentos procesados del Reino Unido

Se prevé un crecimiento significativo del mercado británico de robótica alimentaria, impulsado por la demanda de automatización para mejorar la eficiencia operativa y la consistencia de los productos en las instalaciones de procesamiento de alimentos urbanas y suburbanas. El creciente interés en la fabricación inteligente y la creciente concienciación sobre el papel de la robótica en la reducción de los costes laborales fomentan su adopción. La evolución de las normativas de seguridad alimentaria también influye en las tendencias del mercado, buscando un equilibrio entre las necesidades de automatización y el cumplimiento normativo.

Análisis del mercado alemán de aplicaciones de robótica alimentaria en alimentos procesados

Se espera que Alemania experimente un sólido crecimiento en el mercado de la robótica alimentaria, gracias a su avanzado sector de procesamiento y fabricación de alimentos y a su gran enfoque en la eficiencia operativa y la sostenibilidad. Los fabricantes alemanes prefieren robots tecnológicamente avanzados, como los articulados y colaborativos, que mejoran la productividad y contribuyen a la eficiencia energética. La integración de estos sistemas en instalaciones de procesamiento de alimentos de alta gama y las mejoras posventa impulsan el crecimiento sostenido del mercado.

Perspectiva del mercado de aplicaciones de robótica alimentaria en alimentos procesados en América del Norte

Norteamérica posee una participación significativa en el mercado mundial de robótica alimentaria, impulsada por una sólida industria de procesamiento de alimentos y la creciente adopción de la automatización para mejorar la eficiencia operativa y cumplir con los estrictos estándares de seguridad. La demanda de robótica en aplicaciones como el envasado, la paletización y el procesamiento se ve impulsada por la necesidad de precisión, escalabilidad e higiene en la producción de alimentos. Estados Unidos lidera la región, con crecientes inversiones en fabricación inteligente y avances tecnológicos en robótica que impulsan la expansión del mercado.

Análisis del mercado estadounidense de aplicaciones de robótica alimentaria en alimentos procesados

Se prevé un crecimiento significativo del mercado estadounidense de robótica alimentaria aplicada a alimentos procesados, impulsado por la fuerte demanda de automatización en el procesamiento y envasado de alimentos. La creciente concienciación sobre los beneficios de la robótica para mejorar el rendimiento y mantener los estándares de higiene impulsa la expansión del mercado. La tendencia hacia las fábricas inteligentes y el aumento de las regulaciones que promueven la seguridad alimentaria impulsan aún más su adopción. La integración de la robótica tanto en nuevas instalaciones como en la modernización de las existentes crea un sólido ecosistema de mercado.

Análisis del mercado de aplicaciones de robótica alimentaria en alimentos procesados en Asia-Pacífico

Se prevé que la región Asia-Pacífico experimente la tasa de crecimiento más rápida, impulsada por la expansión de las industrias de procesamiento de alimentos y el aumento de las inversiones en automatización en países como China, India y Japón. La creciente conciencia sobre los beneficios de la robótica para mejorar la eficiencia de la producción, garantizar la seguridad alimentaria y mejorar la calidad de los productos impulsa la demanda. Las iniciativas gubernamentales que promueven la fabricación inteligente y las normas de seguridad alimentaria impulsan aún más la adopción de sistemas robóticos avanzados.

Análisis del mercado japonés de aplicaciones de robótica alimentaria en alimentos procesados

Se prevé un rápido crecimiento del mercado japonés de robótica alimentaria debido a la fuerte preferencia de consumidores y fabricantes por sistemas robóticos de alta calidad y tecnología avanzada que mejoran la eficiencia y la seguridad de la producción. La presencia de importantes fabricantes de equipos de procesamiento de alimentos y la integración de la robótica en grandes instalaciones aceleran la penetración en el mercado. El creciente interés en soluciones de automatización personalizadas también contribuye a este crecimiento.

Análisis del mercado de aplicaciones de robótica alimentaria en alimentos procesados de China

China posee la mayor participación en el mercado de robótica alimentaria de Asia-Pacífico, impulsada por la rápida urbanización, el aumento del consumo de alimentos y la creciente demanda de automatización en el procesamiento de alimentos. La creciente clase media del país y su enfoque en la fabricación inteligente impulsan la adopción de sistemas robóticos avanzados. La sólida capacidad de fabricación nacional y los precios competitivos mejoran el acceso al mercado.

Cuota de mercado de la robótica alimentaria en aplicaciones de alimentos procesados

La industria de la robótica alimentaria en aplicaciones de alimentos procesados está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- ABB (Suiza)

- Kawasaki Heavy Industries, Ltd. (Japón)

- CORPORACIÓN ELÉCTRICA YASKAWA (Japón)

- Rockwell Automation, Inc. (EE. UU.)

- FANUC CORPORATION (Japón)

- Mitsubishi Electric Corporation (Japón)

- Universal Robots A/S (Dinamarca)

- KUKA AG (Alemania)

- Seiko Epson Corporation (Japón)

- Stäubli International AG (Suiza)

- MAYEKAWA MFG. CO., LTD. (Japón)

- Bastian Solutions, Inc. (EE. UU.)

- MYCOM OSI (EE. UU.)

- DENSO CORPORATION (Japón)

- Toshiba Corporation (Japón)

- Stryker (EE. UU.)

- Adept Technologies Inc. (EE. UU.)

- Panasonic Corporation (Japón)

- Comau (Italia)

- Nachi Robotic Systems, Inc. (EE. UU.)

¿Cuáles son los últimos avances en el mercado global de aplicaciones de robótica alimentaria en alimentos procesados?

- En febrero de 2025, LBX Food Robotics anunció la expansión de sus quioscos de comida caliente Bake Xpress a Canadá, tras obtener la certificación de la Asociación Canadiense de Normas (CSA). Este hito permite una rápida implementación en diversos sectores, como la hostelería, el comercio minorista, la sanidad y la educación, sin necesidad de inspecciones individuales. Si bien no se trata de una aplicación tradicional para alimentos procesados, Bake Xpress representa un avance significativo en la preparación y dispensación automatizada de alimentos, ofreciendo comidas recién horneadas y pasteles a pedido a través de un quiosco robótico compacto. Esta iniciativa subraya la creciente relevancia de la robótica alimentaria para la entrega de comidas prácticas y de alta calidad en entornos sin personal.

- En julio de 2024, Chef Robotics presentó un robot de alimentos flexible, pionero en su tipo, impulsado por IA, diseñado para abordar la escasez de mano de obra e impulsar la producción en el sector alimentario. Impulsado por ChefOS, el software de manipulación de alimentos patentado por la compañía, el robot se adapta a entornos de producción con alta diversidad de ingredientes y tamaños de porciones con precisión. A diferencia de la automatización tradicional, el sistema de Chef ofrece una automatización parcial que se integra a la perfección en los flujos de trabajo existentes. Clientes destacados como Amy's Kitchen, Sunbasket y Chef Bombay ya han adoptado la tecnología, reportando mejoras en la consistencia, la productividad laboral y el rendimiento.

- En agosto de 2023, Wootzano, empresa innovadora en robótica con sede en el Reino Unido, lanzó oficialmente sus operaciones en Estados Unidos con la introducción al mercado de su robot insignia, Avarai. Diseñado para aplicaciones poscosecha, Avarai utiliza una piel electrónica integrada y visión artificial impulsada por IA para manipular con cuidado productos frescos delicados, como uvas y tomates, sin magulladuras ni daños. Esta precisión reduce la pérdida de alimentos y aumenta la eficiencia del envasado, solucionando así la escasez de mano de obra en las plantas de envasado de productos agrícolas. La expansión, con el apoyo de socios como la Corporación de Desarrollo Económico del Condado de Fresno y el Consulado General Británico en San Francisco, marca un hito importante en la estrategia de crecimiento global de Wootzano.

- En abril de 2023, Doosan Robotics presentó su E-SERIES, una innovadora línea de robots colaborativos con certificación NSF, diseñados para la industria de alimentos y bebidas. Diseñados con espacios sellados entre los ejes de conexión y una estructura delgada e higiénica, estos cobots cumplen con estrictos estándares de seguridad, a la vez que ofrecen una flexibilidad excepcional en las tareas de preparación de alimentos. Con una carga útil de 5 kg y un alcance de casi 90 cm, la E-SERIES puede gestionar diversas aplicaciones, desde freír pollo hasta preparar café, ya implementadas en conceptos como Robert Chicken y Dr. Presso. Este lanzamiento marca un paso significativo en la automatización de la producción de alimentos con soluciones robóticas eficientes, higiénicas y adaptables.

- En abril de 2023, ABB Robotics inició una colaboración con Pulmuone, empresa coreana líder en procesamiento de alimentos, para desarrollar soluciones robóticas basadas en IA para el cultivo de mariscos en laboratorio. La colaboración se centra en la automatización de la manipulación y el análisis de cultivos celulares, con el objetivo de aumentar la eficiencia de la producción, reducir los riesgos de contaminación y liberar a los trabajadores de laboratorio cualificados de las tareas repetitivas. La cartera de robots colaborativos (cobots) de ABB desempeñará un papel clave en el apoyo seguro a los operadores humanos, mientras que Pulmuone planea aprovechar esta tecnología para establecer la producción en masa para 2026, convirtiéndose potencialmente en la primera empresa en aplicar la robótica con IA a los alimentos cultivados en células.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.