Global Extrusion Machinery Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

11.70 Billion

USD

16.20 Billion

2024

2032

USD

11.70 Billion

USD

16.20 Billion

2024

2032

| 2025 –2032 | |

| USD 11.70 Billion | |

| USD 16.20 Billion | |

|

|

|

|

Segmentación del mercado global de maquinaria de extrusión por tipo (extrusión directa, extrusión indirecta y extrusión hidrostática), tipo de producto (extrusoras de un solo tornillo, extrusoras de doble tornillo, etc.), resultado del proceso (plástico, metal, caucho, etc.), uso final (construcción, bienes de consumo, automoción, alimentación y bebidas, salud, aeroespacial y defensa, etc.): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de maquinaria de extrusión

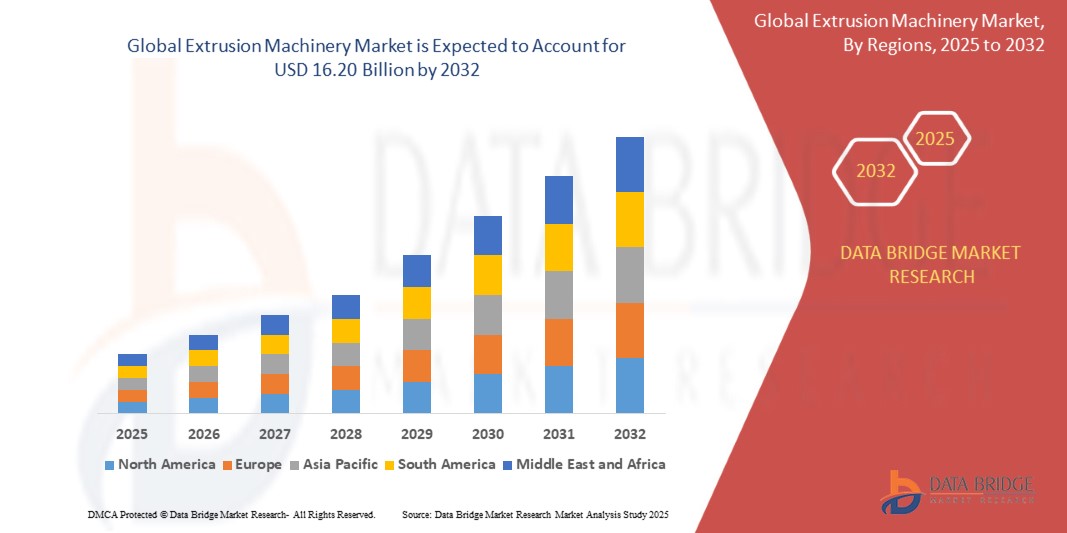

- El tamaño del mercado global de maquinaria de extrusión se valoró en USD 11,70 mil millones en 2024 y se espera que alcance los USD 16,26 mil millones para 2032 , con una CAGR del 4,2% durante el período de pronóstico.

- Este crecimiento está impulsado por factores como la creciente demanda de productos de plástico y metal, los avances tecnológicos, el crecimiento de la fabricación y el desarrollo de infraestructura.

Análisis del mercado de maquinaria de extrusión

- La maquinaria de extrusión se refiere a los equipos utilizados para dar forma a materiales como plásticos, metales o alimentos, forzándolos a través de una matriz para producir perfiles continuos, láminas o formas complejas. Estas máquinas se utilizan ampliamente en industrias como el embalaje, la construcción, la automoción y el procesamiento de alimentos, ofreciendo capacidades de producción eficientes y de alto volumen para una variedad de productos finales.

- El mercado está experimentando un crecimiento constante, impulsado por la creciente demanda de materiales personalizados y de alto rendimiento, avances en automatización y la expansión de aplicaciones industriales a nivel mundial.

- Se espera que Asia-Pacífico domine el mercado de maquinaria de extrusión debido a la rápida industrialización, el crecimiento de los sectores de procesamiento de alimentos, la creciente demanda de productos innovadores y las fuertes inversiones en capacidades de fabricación.

- Se espera que América del Norte sea la región de más rápido crecimiento en el mercado de maquinaria de extrusión durante el período de pronóstico debido a la adopción de tecnologías de fabricación avanzadas, la creciente demanda de soluciones personalizadas y las fuertes inversiones en iniciativas de automatización y sostenibilidad.

- Se espera que el segmento de plástico domine el mercado con una participación de mercado del 77,7% debido al uso generalizado de los plásticos en industrias como el embalaje, la automoción y la construcción, así como a la rentabilidad y versatilidad de los procesos de extrusión de plástico.

Alcance del informe y segmentación del mercado de maquinaria de extrusión

|

Atributos |

Perspectivas clave del mercado de maquinaria de extrusión |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de maquinaria de extrusión

Creciente demanda de alimentos procesados

- Una tendencia destacada en el mercado mundial de maquinaria de extrusión es la creciente demanda de alimentos procesados.

- Esta tendencia está impulsada por los cambios en los estilos de vida de los consumidores, la creciente urbanización y la creciente preferencia por opciones de alimentos convenientes y listos para comer.

- Por ejemplo, empresas como Nestlé y Kellogg's están invirtiendo en maquinaria avanzada de extrusión de alimentos para ampliar sus líneas de productos de snacks y cereales, garantizando al mismo tiempo una calidad y eficiencia constantes.

- El aumento de productos alimenticios de origen vegetal y fortificados también está impulsando la innovación en la tecnología de extrusión de grado alimenticio, mejorando la versatilidad y la eficiencia.

- A medida que el consumo de alimentos procesados continúa aumentando a nivel mundial, especialmente en los mercados emergentes, se espera que la demanda de maquinaria de extrusión especializada se acelere, lo que determinará el crecimiento futuro del mercado.

Dinámica del mercado de maquinaria de extrusión

Conductor

Industrias de la construcción y la automoción en rápido crecimiento

- Las industrias de la construcción y la automoción, en rápido crecimiento, son impulsores clave del mercado de maquinaria de extrusión, ya que ambos sectores requieren cada vez más componentes extruidos de alto rendimiento para aplicaciones estructurales y funcionales.

- Esta demanda es particularmente fuerte en las regiones en desarrollo de Asia-Pacífico y Medio Oriente, donde el desarrollo de infraestructura y la producción de vehículos se están expandiendo a un ritmo rápido.

- Ante la necesidad de materiales como perfiles de aluminio y plástico en marcos de ventanas, tuberías, parachoques y componentes de molduras, los fabricantes están invirtiendo en equipos de extrusión avanzados para garantizar precisión, resistencia y escalabilidad.

- La innovación continua en el diseño de maquinaria, la eficiencia energética y la automatización está ayudando a los fabricantes a satisfacer las demandas cambiantes de estos sectores al tiempo que mantienen la rentabilidad y un alto rendimiento.

- Los principales proveedores de sistemas de extrusión están mejorando sus carteras de productos para alinearse con las crecientes expectativas de estas industrias.

Por ejemplo,

- Bausano y KraussMaffei han presentado líneas de extrusión de alta eficiencia diseñadas para producir perfiles para la industria automotriz y de construcción.

- Davis-Standard se centra en ofrecer sistemas modulares y personalizables que cumplan con estrictos estándares de rendimiento y seguridad.

- A medida que las actividades mundiales de construcción y automoción continúan aumentando, se espera que esta demanda sea un motor de crecimiento a largo plazo para el mercado de maquinaria de extrusión.

Oportunidad

Integración de la fabricación aditiva con la extrusión

- La integración de la fabricación aditiva ( impresión 3D ) con los procesos de extrusión tradicionales presenta una oportunidad significativa para el mercado de maquinaria de extrusión, permitiendo soluciones de producción más complejas, personalizadas y eficientes.

- Los fabricantes están explorando cada vez más sistemas híbridos que combinan la velocidad y la escalabilidad de la extrusión con la flexibilidad de diseño de la fabricación aditiva, lo que permite reducir el desperdicio de material y mejorar la innovación de productos.

- Esta oportunidad se alinea con el cambio más amplio de la industria hacia la fabricación ágil y la creación de prototipos rentables, particularmente en sectores como el aeroespacial, el automotriz y los dispositivos médicos.

Por ejemplo,

- CEAD y JuggerBot 3D han desarrollado plataformas híbridas de extrusión-aditiva capaces de producir componentes de gran formato y alta resistencia utilizando compuestos termoplásticos.

- Arburg ha introducido sistemas que combinan la impresión 3D con la extrusión para crear geometrías complejas y prototipos funcionales directamente a partir de modelos CAD.

- A medida que los fabricantes buscan una mayor personalización, plazos de entrega más bajos y métodos de producción sostenibles, se espera que la integración de la fabricación aditiva con la extrusión abra nuevas vías de crecimiento y redefina las capacidades de la maquinaria en el mercado.

Restricción/Desafío

Aumento de la presión regulatoria y las preocupaciones ambientales

- La creciente presión regulatoria y las crecientes preocupaciones ambientales representan un desafío significativo en el mercado de maquinaria de extrusión. A medida que los gobiernos imponen regulaciones de emisiones y estándares de sostenibilidad más estrictos, los fabricantes se ven presionados a actualizar o rediseñar su maquinaria para cumplir con las normas.

- Las regulaciones destinadas a reducir los desechos plásticos, controlar las emisiones industriales y mejorar la eficiencia energética pueden aumentar los costos de cumplimiento y requerir inversiones sustanciales en tecnologías más limpias.

- Este desafío es especialmente apremiante para los fabricantes que utilizan materiales y procesos tradicionales que pueden no cumplir con los nuevos estándares ambientales, lo que afecta la eficiencia de la producción y la competitividad del mercado.

Por ejemplo,

- Los fabricantes de maquinaria como KraussMaffei y Davis-Standard se enfrentan a la presión de adaptar sus equipos de extrusión para dar cabida a materiales biodegradables e integrar tecnologías de eficiencia energética.

- A medida que las políticas ambientales se endurecen a nivel mundial, la industria de maquinaria de extrusión debe afrontar una mayor complejidad operativa y necesidades de inversión de capital, lo que puede suponer obstáculos para los fabricantes de equipos más pequeños o tradicionales.

Alcance del mercado de maquinaria de extrusión

El mercado está segmentado según tipo, tipo de producto, resultado del proceso y uso final.

|

Segmentación |

Subsegmentación |

|

Por tipo |

|

|

Por tipo de producto |

|

|

Por salida del proceso |

|

|

Por uso final

|

|

Se proyecta que en 2025 el plástico dominará el mercado con la mayor participación en el segmento de salida del proceso.

Se espera que el segmento de plástico domine el mercado de maquinaria de extrusión con la mayor participación del 77,7% en 2025 debido al uso generalizado de los plásticos en industrias como el embalaje, la automoción y la construcción, así como la rentabilidad y la versatilidad de los procesos de extrusión de plástico.

Se espera que las extrusoras de un solo tornillo representen la mayor participación durante el período de pronóstico en el mercado de tipos de productos.

En 2025, se prevé que el segmento de extrusoras de un solo tornillo domine el mercado con la mayor cuota de mercado, un 63,2 %, gracias a su simplicidad, rentabilidad y fiabilidad en el procesamiento de una amplia gama de materiales. Las extrusoras de un solo tornillo se utilizan habitualmente para la producción en masa de productos plásticos y ofrecen una alta eficiencia, lo que las hace ideales para industrias como la del embalaje, la automoción y la construcción.

Análisis regional del mercado de maquinaria de extrusión

Asia-Pacífico posee la mayor participación en el mercado de maquinaria de extrusión

- Asia-Pacífico domina el mercado de maquinaria de extrusión , impulsado por la rápida industrialización, el crecimiento de los sectores de procesamiento de alimentos, la creciente demanda de productos innovadores y las fuertes inversiones en capacidades de fabricación.

- China tiene una participación significativa debido a su enorme base manufacturera, su sector de alimentos y bebidas en expansión y un fuerte énfasis en la innovación y la tecnología en los procesos de producción.

- La región se beneficia de los avances continuos en automatización, integración tecnológica y la creciente necesidad de soluciones de producción personalizadas en múltiples industrias, incluidos alimentos, plásticos y productos farmacéuticos.

- A medida que Asia-Pacífico continúa impulsando el crecimiento industrial y el desarrollo tecnológico, se espera que la región mantenga su posición de liderazgo en el mercado de maquinaria de extrusión durante el período de pronóstico de 2025 a 2032.

Se proyecta que América del Norte registre la CAGR más alta en el mercado de maquinaria de extrusión

- Se espera que América del Norte sea testigo de la mayor tasa de crecimiento en el mercado de maquinaria de extrusión , impulsada por la adopción de tecnologías de fabricación avanzadas, la creciente demanda de soluciones personalizadas y fuertes inversiones en iniciativas de automatización y sostenibilidad.

- Estados Unidos tiene una participación significativa debido a su infraestructura de fabricación bien establecida, sus empresas líderes en procesamiento de alimentos y su énfasis en métodos de producción sostenibles y soluciones energéticamente eficientes.

- Las inversiones en investigación y desarrollo, junto con la necesidad de soluciones personalizadas y de alta calidad, están impulsando la demanda del mercado en la región.

- A medida que América del Norte continúa enfocándose en prácticas sustentables y automatización avanzada, se espera que el mercado de maquinaria de extrusión en la región experimente un crecimiento constante e innovación entre 2025 y 2032.

Cuota de mercado de maquinaria de extrusión

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Davis Standard (EE. UU.)

- Coperion GmbH (Alemania)

- Milacron, LLC (EE. UU.)

- Leistritz Extrusionstechnik GmbH (Alemania)

- NFM/Ingenieros de soldadura, Inc. (EE. UU.)

- Gneuß Kunststofftechnik GmbH (Alemania)

- Reifenhauser (Alemania)

- TECNOMATIC SRL (Italia)

- KraussMaffei (Alemania)

- Kabra ExtrusionTechnik Ltd. (India)

- Nordson Corporation (EE. UU.)

Últimos avances en el mercado mundial de maquinaria de extrusión

- En agosto de 2024, Nordson Corporation completó la adquisición de Atrion Corporation, líder en la administración de fluidos de infusión médica y soluciones cardiovasculares. Esta adquisición amplía la cartera médica de Nordson, explorando nuevos mercados y terapias con un fuerte potencial de crecimiento.

- En enero de 2024, Davis Standard adquirió con éxito Extrusion Technology Group (ETG), ampliando así su capacidad en sistemas de extrusión avanzados. Esta adquisición fortalece la cartera de productos de Davis-Standard y consolida su posición en mercados clave como el del embalaje, la automoción y el sector médico. La fusión impulsará la innovación, mejorará el servicio al cliente y aportará una mayor experiencia tecnológica, lo que permitirá a Davis-Standard ofrecer soluciones más integrales y eficientes a su cartera global de clientes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.