Global Extruder And Compounding Machine Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

74.37 Billion

USD

102.57 Billion

2024

2032

USD

74.37 Billion

USD

102.57 Billion

2024

2032

| 2025 –2032 | |

| USD 74.37 Billion | |

| USD 102.57 Billion | |

|

|

|

|

Segmentación del mercado global de extrusoras y máquinas de compuestos, por tipo de producto (extrusoras de un solo tornillo, extrusoras de doble tornillo, extrusoras de ariete), aplicación (plásticos especializados, cables de PVC, producción de masterbatch, láminas para pisos, etc.), usuario final (industria alimentaria, química, plástica, médica/farmacéutica, etc.): tendencias y pronóstico de la industria hasta 2032.

Tamaño del mercado de máquinas extrusoras y de compuestos

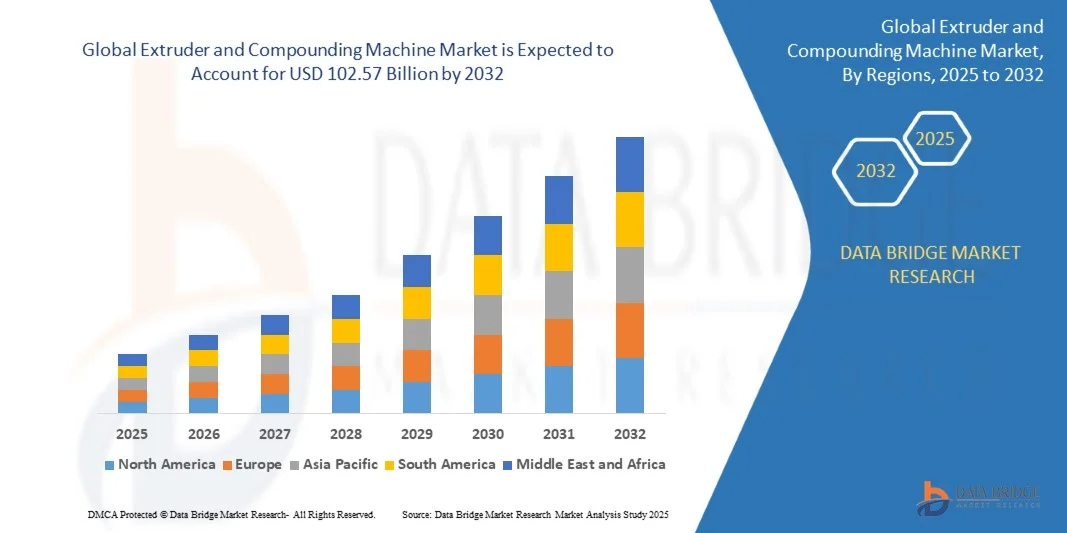

- El tamaño del mercado de máquinas extrusoras y de compuestos se valoró en USD 74,37 mil millones en 2024 y se proyecta que alcance los USD 102,57 mil millones para 2032, creciendo a una CAGR del 4,10% durante el período de pronóstico.

- La expansión del mercado está impulsada principalmente por el aumento de la demanda en las industrias automotriz, de embalaje y de construcción, donde se requieren cada vez más soluciones de procesamiento de polímeros personalizadas y de alto rendimiento.

- Además, los avances tecnológicos en extrusoras de doble tornillo y corrotativas, junto con la creciente adopción de maquinaria automatizada y de bajo consumo, están impulsando el mercado. Estas innovaciones mejoran la productividad y la flexibilidad, acelerando así la adopción global y apoyando un sólido crecimiento del sector.

Análisis del mercado de máquinas extrusoras y de compuestos

- Las máquinas extrusoras y de compuesto, esenciales para procesar plásticos, caucho y otros materiales, desempeñan un papel fundamental en numerosas industrias, incluidas la automotriz, el embalaje, la construcción y la electrónica, debido a su capacidad para producir materiales uniformes de alta calidad con mayor eficiencia y personalización.

- La creciente demanda de máquinas extrusoras y de compuestos está impulsada principalmente por la creciente industrialización, la creciente demanda de productos plásticos, los rápidos avances en las tecnologías de procesamiento de polímeros y la necesidad de maquinaria de alto rendimiento y energéticamente eficiente en las operaciones de fabricación.

- América del Norte dominó el mercado de máquinas extrusoras y de compuestos con la mayor participación en los ingresos del 38,05 % en 2024, impulsada por la presencia de fabricantes líderes, una base industrial madura y un fuerte enfoque en la automatización y la innovación tecnológica, especialmente en los Estados Unidos, donde la adopción de líneas de compuestos de alto rendimiento se está acelerando en los sectores automotriz y médico.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de máquinas extrusoras y de compuestos durante el período de pronóstico, impulsada por la rápida urbanización, la expansión de las industrias de usuarios finales como el embalaje y la construcción, y el aumento de las inversiones en el desarrollo de infraestructura, especialmente en China e India.

- El segmento de doble tornillo dominó el mercado de extrusoras y máquinas de compuesto con una participación de mercado del 44,4 % en 2024, impulsado por su capacidad de mezcla superior, alto rendimiento y versatilidad en el manejo de una amplia gama de materiales, lo que lo convierte en una opción preferida en varias aplicaciones de alto rendimiento.

Alcance del informe y segmentación del mercado de máquinas extrusoras y de composición

|

Atributos |

Información sobre extrusoras y máquinas de compuestos |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de máquinas extrusoras y de compuestos

Mayor eficiencia mediante la integración de IA y automatización inteligente

- Una tendencia significativa y en auge en el mercado de máquinas extrusoras y de compuestos es la creciente integración de la inteligencia artificial (IA) y las tecnologías de automatización inteligente en los sistemas de extrusión y compuestos. Esta convergencia está mejorando significativamente la eficiencia operativa, el mantenimiento predictivo y la optimización de procesos en todos los sectores manufactureros.

- Por ejemplo, las extrusoras avanzadas de doble tornillo de Coperion ahora incorporan sistemas de monitorización de procesos con IA que analizan datos en tiempo real para ajustar automáticamente los parámetros de procesamiento, garantizando así una calidad constante del producto y minimizando el desperdicio de material. De igual forma, Leistritz AG integra sistemas de control inteligente que permiten la monitorización remota y la autocalibración para optimizar el rendimiento del tornillo durante la producción de gran volumen.

- La integración de IA en máquinas de extrusión y compuestos permite el mantenimiento predictivo mediante el análisis de patrones de desgaste, el rendimiento del motor y el flujo de material en tiempo real. Por ejemplo, Steer Engineering utiliza algoritmos de IA para detectar indicios tempranos de degradación de componentes, lo que ayuda a reducir las paradas imprevistas y a prolongar la vida útil de la máquina. Estos sistemas inteligentes también pueden ajustar dinámicamente el par y la temperatura en función de las características del polímero procesado.

- La integración de los sistemas de extrusión con plataformas de control industrial centralizadas, como SCADA o MES (Sistemas de Ejecución de Manufactura), permite a los fabricantes supervisar y gestionar múltiples líneas de producción desde una única interfaz. Esto facilita la coordinación de las operaciones en toda la planta de producción, incluyendo la automatización de los sistemas de alimentación, el cambio de matrices y las secuencias de enfriamiento.

- Esta tendencia hacia máquinas más inteligentes, conectadas y autooptimizables está transformando la forma en que los fabricantes abordan el procesamiento de polímeros. Empresas como Davis-Standard y Milacron están a la vanguardia, integrando unidades de control basadas en IA que permiten el ajuste en tiempo real y la optimización basada en aprendizaje automático, basándose en datos históricos y comportamientos específicos de los materiales.

- La demanda de extrusoras y máquinas de compuestos con integración avanzada de IA y compatibilidad con fábricas inteligentes está aumentando rápidamente, particularmente en sectores de alta demanda como la automoción, la electrónica, los dispositivos médicos y los envases sostenibles, donde la precisión, la consistencia y la eficiencia no son negociables.

Dinámica del mercado de máquinas extrusoras y de compuestos

Conductor

Creciente necesidad debido a la expansión industrial y la demanda de materiales de alto rendimiento

- La creciente demanda de materiales plásticos y poliméricos de alto rendimiento en sectores como la automoción, la construcción, la electrónica, los dispositivos médicos y el envasado es un factor clave para la creciente adopción de extrusoras y máquinas de compuestos. Esta tendencia se ve impulsada por la expansión industrial global, especialmente en las economías emergentes, donde la capacidad de fabricación se está expandiendo rápidamente.

- Por ejemplo, en marzo de 2024, Coperion GmbH anunció la expansión de su línea de compuestos de alto rendimiento, diseñada para el procesamiento de materiales de baterías, una decisión estratégica que refleja el auge de la demanda en la producción de vehículos eléctricos (VE). Se espera que este tipo de innovación acelere significativamente el crecimiento del mercado durante el período de pronóstico.

- A medida que las industrias se orientan hacia materiales avanzados con propiedades térmicas, mecánicas o de barrera específicas, se ha intensificado la necesidad de soluciones de compuestos personalizados. Las extrusoras y mezcladoras, equipadas para manejar polímeros reforzados, plásticos biodegradables y mezclas multimaterial, se están convirtiendo en componentes esenciales de la fabricación moderna.

- Además, la tendencia hacia procesos de fabricación automatizados y continuos impulsa la demanda de extrusoras y máquinas de compuestos que permitan operaciones de alto volumen, energéticamente eficientes y con bajos residuos. Estos sistemas permiten a los fabricantes mantener la consistencia y precisión en la producción, a la vez que reducen los costos operativos generales.

- La integración de sistemas de control inteligentes, diseños modulares y adaptabilidad a diversos materiales hacen que estas máquinas sean especialmente atractivas para las industrias que buscan asegurar el futuro de sus líneas de producción. Ante la creciente demanda de sostenibilidad e innovación en materiales, estas máquinas desempeñan un papel fundamental en el cumplimiento de las normas regulatorias, de calidad y de rendimiento.

Restricción/Desafío: Alta inversión de capital y complejidad técnica

- A pesar de la creciente demanda, la elevada inversión de capital inicial requerida para comprar e instalar máquinas extrusoras y de composición avanzadas representa una barrera importante, en particular para las pequeñas y medianas empresas (PYME) y los fabricantes en los mercados en desarrollo.

- Por ejemplo, una línea completa de extrusión de doble tornillo de alto rendimiento integrada con sistemas de control avanzados puede representar un costo inicial considerable, lo que a menudo la hace inaccesible para empresas emergentes o para operaciones con presupuestos ajustados. La necesidad de infraestructura especializada (p. ej., sistemas de energía de alto voltaje, control de climatización y optimización del espacio) agrava aún más este problema.

- Además, la complejidad técnica asociada a los sistemas modernos de extrusión y composición, incluyendo diseños de tornillos específicos para cada material, calibración de temperatura y presión, y procesamiento multietapa, puede resultar abrumadora para instalaciones que carecen de personal capacitado. Una operación inadecuada puede provocar desperdicio de material, daños en los equipos o paradas de producción.

- La escasez de mano de obra calificada, particularmente en los mercados emergentes, crea un cuello de botella adicional, ya que la operación y el mantenimiento exitosos de estas máquinas requieren capacitación especializada y conocimiento del proceso.

- Para afrontar estos desafíos, fabricantes líderes como Davis-Standard y Leistritz AG invierten en programas de formación, maquinaria modular y sistemas básicos diseñados para ofrecer flexibilidad y facilidad de uso. No obstante, superar las barreras del coste y la complejidad sigue siendo crucial para ampliar el alcance del mercado, especialmente en regiones de rápido crecimiento pero con recursos limitados.

Alcance del mercado de máquinas extrusoras y de compuestos

El mercado está segmentado según el producto, la aplicación y el usuario final.

- Por producto

Según el producto, el mercado de extrusoras y máquinas de compuestos se segmenta en extrusoras de un solo tornillo, de doble tornillo y de ariete. El segmento de doble tornillo dominó el mercado con la mayor participación en los ingresos, con un 44,4 % en 2024, gracias a su superior eficiencia de mezcla, alta capacidad de producción y versatilidad para procesar una amplia gama de polímeros y aditivos. Las extrusoras de doble tornillo se utilizan ampliamente en aplicaciones que requieren un control preciso de la temperatura, la presión y las fuerzas de corte, lo que las hace ideales para industrias como la automotriz, la médica y la del embalaje.

Se espera que el segmento de extrusoras de ariete registre la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, principalmente debido a la creciente demanda de aplicaciones especializadas como PTFE y materiales de alta viscosidad. Estas extrusoras ofrecen una alta fuerza de compactación, lo que las hace adecuadas para materiales difíciles de procesar con mecanismos de tornillo convencionales. Se espera que las innovaciones en la ciencia de los materiales y el mayor uso de plásticos de alto rendimiento impulsen aún más el crecimiento de este segmento.

- Por aplicación

Según la aplicación, el mercado se segmenta en plásticos especializados, cables de PVC, producción de masterbatch, láminas para suelos y otros. El segmento de plásticos especializados registró la mayor cuota de mercado en 2024, con un 38,7 %, debido a la creciente demanda de compuestos plásticos avanzados con propiedades personalizadas en sectores como el aeroespacial, el automotriz, el electrónico y el sanitario. Las máquinas de extrusión y preparación de compuestos son cruciales para procesar plásticos de alto rendimiento como PEEK, PPS y fluoropolímeros, que requieren un control preciso de la temperatura y la presión.

Se prevé que el segmento de producción de masterbatches experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el creciente uso de masterbatches en aplicaciones de color, rellenos y aditivos. A medida que las industrias buscan una dispersión más eficiente y uniforme del color y los aditivos en los productos plásticos, los sistemas de compuestos diseñados para la producción de masterbatches están ganando terreno. La demanda es especialmente alta en los sectores del embalaje, la agricultura y la construcción, donde la producción a gran escala y con una calidad constante es esencial.

- Por el usuario final

Según el usuario final, el mercado de máquinas extrusoras y de composición se segmenta en la industria del plástico, la industria alimentaria, la industria química, la industria médica/farmacéutica y otras. El segmento de la industria del plástico dominó el mercado en 2024, con la mayor participación en los ingresos (46,5 %), gracias a la sólida demanda mundial de productos plásticos en componentes de automoción, materiales de embalaje y bienes de consumo. La industria del plástico utiliza ampliamente sistemas de extrusión y composición para mejorar las características de los materiales y permitir el uso de polímeros reciclados, contribuyendo así a los objetivos de rendimiento y sostenibilidad.

Se proyecta que el segmento médico/farmacéutico crecerá a la tasa de crecimiento anual compuesta (TCAC) más alta entre 2025 y 2032, debido a la creciente adopción de sistemas de extrusión de precisión para tubos médicos, implantes y dispositivos de administración de fármacos. Los requisitos regulatorios y la necesidad de una producción estéril y de alta calidad impulsan a los fabricantes a invertir en máquinas de preparación de compuestos avanzadas con sistemas de control de circuito cerrado. La demanda de polímeros biocompatibles y especializados impulsa aún más la expansión de este segmento.

Análisis regional del mercado de máquinas extrusoras y de compuestos

- América del Norte dominó el mercado de máquinas extrusoras y de compuestos con la mayor participación en los ingresos del 38,05 % en 2024, impulsada por una sólida infraestructura industrial, capacidades de fabricación avanzadas e inversiones significativas en tecnologías de procesamiento de polímeros.

- Los fabricantes de la región priorizan los sistemas de extrusión y composición de alto rendimiento y eficiencia energética para satisfacer la creciente demanda de materiales avanzados en sectores como la automoción, la aeroespacial, el embalaje y los dispositivos médicos. La implementación generalizada de las tecnologías de la Industria 4.0 y la automatización está mejorando aún más la productividad y la eficiencia operativa.

- Este dominio también se ve respaldado por la presencia de actores líderes del mercado, una fuerza laboral cualificada y un alto nivel de actividad de I+D centrada en la optimización de procesos y la innovación de materiales. El creciente uso de plásticos de ingeniería y compuestos personalizados en diversas aplicaciones continúa impulsando la adopción de sofisticados equipos de extrusión y preparación de compuestos, lo que posiciona a Norteamérica como un centro clave en el panorama del mercado global.

Análisis del mercado estadounidense de máquinas extrusoras y de compuestos

El mercado estadounidense de máquinas extrusoras y de composición captó la mayor participación en los ingresos, con un 82%, en 2024 en Norteamérica, impulsado por la avanzada infraestructura de fabricación del país, las importantes inversiones en investigación de polímeros y la rápida adopción de las tecnologías de la Industria 4.0. Los fabricantes estadounidenses recurren cada vez más a equipos de extrusión y composición de alto rendimiento para satisfacer la creciente demanda de plásticos especiales y materiales sostenibles en sectores como el automotriz, el médico y el del embalaje. La presencia de empresas líderes a nivel mundial, como Milacron y Davis-Standard, refuerza la sólida posición de mercado de Estados Unidos. Además, la tendencia hacia la automatización, la eficiencia energética y el control digital de procesos continúa moldeando el futuro de la implementación de extrusoras en entornos de fabricación tanto a gran como a mediano escala.

Análisis del mercado europeo de máquinas extrusoras y de compuestos

Se proyecta que el mercado europeo de extrusoras y máquinas de compuestos se expandirá a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado por el creciente enfoque regulatorio en materiales sostenibles y reciclaje, junto con la creciente demanda de plásticos avanzados en los sectores de la automoción, la construcción y la electrónica de consumo. La región se beneficia de sólidas capacidades de I+D y una sólida base de empresas de ingeniería de alta precisión. Países como Alemania, Italia y Francia están experimentando un aumento de la inversión en iniciativas de economía circular, lo que impulsa la demanda de soluciones de compuestos que facilitan el reprocesamiento de polímeros reciclados. Además, el énfasis de Europa en la eficiencia energética y las estrictas normas sobre emisiones está impulsando a los fabricantes a modernizar sus líneas de extrusión existentes con alternativas inteligentes y ecológicas.

Análisis del mercado de extrusoras y máquinas de compuestos del Reino Unido

Se prevé que el mercado británico de extrusoras y máquinas de compuestos crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la demanda de los sectores del embalaje, la medicina y la electrónica. Los fabricantes británicos están adoptando máquinas de compuestos avanzadas para desarrollar mezclas de polímeros personalizadas con funcionalidades mejoradas, como resistencia al fuego, conductividad y biodegradabilidad. El enfoque del país en la innovación y la sostenibilidad está impulsando la adopción de maquinaria que facilita la producción de materiales reciclables y de origen biológico. Además, la integración de tecnologías de gemelos digitales y sensores inteligentes está ganando popularidad, lo que permite la monitorización y optimización de procesos en tiempo real en las plantas de extrusión del Reino Unido.

Análisis del mercado alemán de máquinas extrusoras y de compuestos

Se espera que el mercado alemán de máquinas extrusoras y de compuestos crezca a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la excelencia en ingeniería del país, su liderazgo en automatización y la sólida presencia de las industrias automotriz y química. Alemania es un centro global para la fabricación de compuestos de alto rendimiento, con especial atención a los elastómeros termoplásticos, los plásticos de ingeniería y los compuestos especiales. El mercado también se beneficia de la creciente adopción de prácticas de fabricación inteligente y sistemas de extrusión modulares diseñados para una rápida adaptación y un menor tiempo de inactividad. Las normativas ambientales y el énfasis en los sistemas de reciclaje de circuito cerrado contribuyen aún más a la demanda de máquinas de alta precisión y eficiencia energética.

Análisis del mercado de máquinas extrusoras y de compuestos de Asia-Pacífico

Se prevé que el mercado de extrusoras y máquinas de compuestos de Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más alta, del 24 %, durante el período de pronóstico de 2025 a 2032, impulsado por la rápida industrialización, el desarrollo de infraestructura y la creciente demanda de productos plásticos en todos los sectores. Países como China, India, Japón y Corea del Sur están invirtiendo fuertemente en mejoras de fabricación e iniciativas de fábricas inteligentes, lo que genera una demanda significativa de tecnologías avanzadas de extrusión y compuestos. El creciente papel de la región como centro de fabricación global, junto con las iniciativas gubernamentales de apoyo y una sólida base de maquinaria nacional, está acelerando el crecimiento del mercado. El creciente uso de plásticos de ingeniería en los sectores de la automoción, la electrónica y la construcción también impulsa la necesidad de soluciones de compuestos a medida.

Análisis del mercado de extrusoras y máquinas de compuestos de Japón

El mercado japonés de extrusoras y máquinas de compuestos está cobrando impulso a medida que los fabricantes buscan maquinaria avanzada capaz de producir componentes de alta precisión para dispositivos electrónicos, automotrices y médicos. La reputación de Japón por sus altos estándares de producción e innovación impulsa la adopción de sistemas de extrusión de vanguardia, en particular los modelos de doble tornillo que satisfacen requisitos complejos de compuestos. El enfoque del país en el ahorro de energía, la automatización y la maquinaria eficiente en el espacio está influyendo en la dinámica del mercado. Además, el envejecimiento de la población y la escasez de mano de obra están impulsando la transición hacia extrusoras automatizadas y de bajo mantenimiento, diseñadas para una producción continua y de alta eficiencia con mínima intervención manual.

Análisis del mercado de extrusoras y máquinas de compuestos de China

El mercado chino de máquinas extrusoras y de compuestos representó la mayor cuota de mercado en ingresos en Asia Pacífico en 2024, impulsado por la posición dominante del país en la fabricación y exportación mundial de plástico. Ante la creciente demanda de bienes de consumo, autopartes, productos electrónicos y envases, los fabricantes chinos están adoptando rápidamente equipos de extrusión y compuestos de alto rendimiento. Las iniciativas gubernamentales que apoyan la modernización industrial y la sostenibilidad promueven aún más el uso de máquinas energéticamente eficientes y líneas de procesamiento de materiales reciclados. Los fabricantes locales también están ganando terreno gracias a ofertas competitivas en costos y capacidades tecnológicas mejoradas, mientras que las empresas internacionales continúan expandiendo su presencia mediante empresas conjuntas y producción local.

Cuota de mercado de máquinas extrusoras y de compuestos

La industria de las máquinas extrusoras y de compuestos está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Coperion GmbH (Alemania)

- The Japan Steel Works, Ltd. (Japón)

- Leistritz AG (Alemania

- KraussMaffei Group GmbH (Alemania)

- Toshiba Machine Co., Ltd. (Japón)

- Battenfeld-Cincinnati (Austria)

- JSW Plastics Machinery Inc. (Japón)

- Grupo de extrusión CPM (EE. UU.)

- Brabender GmbH & Co. KG (Alemania)

- Steer Engineering Pvt. Ltd. (India)

- Milacron LLC (EE. UU.)

- Davis-Standard, LLC (EE. UU.)

- ENTEK Manufacturing LLC (EE. UU.)

- USEON Extrusion Machinery Co., Ltd. (China)

- Nanjing Haisi Extrusion Equipment Co., Ltd. (China)

- Mitsubishi Heavy Industries, Ltd. (Japón)

- Thermo Fisher Scientific Inc. (EE. UU.)

- Euro Machinery ApS (Dinamarca)

- Buss AG (Suiza)

- BC Extrusion Holding GmbH (Alemania)

¿Cuáles son los desarrollos recientes en el mercado de máquinas extrusoras y compuestas?

- En abril de 2023, Coperion GmbH, líder mundial en tecnologías de compuestos y extrusión, anunció la expansión de su planta de fabricación en Stuttgart, Alemania. Esta iniciativa estratégica busca aumentar la capacidad de producción de extrusoras de doble tornillo de alto rendimiento, satisfaciendo así la creciente demanda global en sectores como el automotriz, el del embalaje y el farmacéutico. Al mejorar su infraestructura de fabricación y sus capacidades de I+D, Coperion consolida su liderazgo en el mercado de extrusoras y máquinas de compuestos, a la vez que impulsa la innovación en soluciones de procesamiento de polímeros de alta precisión.

- En marzo de 2023, Leistritz Extrusionstechnik GmbH, empresa clave en sistemas avanzados de compuestos, lanzó su serie de extrusoras de doble tornillo ZSE MAXX-HD de nueva generación, diseñada específicamente para aplicaciones de alto rendimiento y el procesamiento sostenible de materiales. La nueva línea integra sistemas de control inteligentes para la monitorización en tiempo real y ofrece configuraciones modulares para facilitar la personalización. Esta introducción de producto refleja el compromiso de Leistritz de ofrecer soluciones versátiles y energéticamente eficientes para satisfacer las cambiantes necesidades de los procesadores de polímeros en diversas industrias.

- En marzo de 2023, Davis-Standard LLC completó la adquisición de Extrusion Technology Group (ETG), fortaleciendo así su cartera global de equipos y servicios de extrusión. Esta adquisición fortalece las capacidades de Davis-Standard en los mercados de extrusión médica, de película soplada y de perfiles, a la vez que amplía su presencia geográfica en Europa y Asia. Esta operación se alinea con la estrategia de crecimiento de la compañía, centrada en el liderazgo tecnológico, el soporte posventa y la accesibilidad global al servicio en el mercado de extrusoras y máquinas de compuestos.

- En febrero de 2023, Milacron Holdings Corp., líder en tecnologías de procesamiento de plásticos, anunció la introducción de su nueva serie de compuestos de doble tornillo TCM, diseñada específicamente para resinas de ingeniería de alto rendimiento. Diseñadas con mayor capacidad de torque, mayor resistencia al desgaste y controles táctiles intuitivos, las nuevas máquinas satisfacen la creciente demanda de soluciones especializadas de compuestos para la reducción de peso en automoción, electrónica y componentes médicos. Este lanzamiento subraya el compromiso de Milacron de ofrecer soluciones innovadoras para el procesamiento de materiales de última generación.

- En enero de 2023, KraussMaffei Berstorff, una empresa líder en tecnología de extrusión, presentó su plataforma iCOM Digital Twin para máquinas de compuestos en la feria Interplastica de Moscú. Esta plataforma de vanguardia permite la simulación en tiempo real, el mantenimiento predictivo y la optimización de procesos mediante análisis basados en IA. Esta iniciativa refleja la dedicación de KraussMaffei a la digitalización del proceso de extrusión y la promoción de prácticas de fabricación inteligentes. Posiciona a la empresa como una empresa innovadora y con visión de futuro en el cambiante mercado de extrusoras y máquinas de compuestos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.