Global Endpoint Detection Response Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

4.22 Billion

USD

23.83 Billion

2024

2032

USD

4.22 Billion

USD

23.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.22 Billion | |

| USD 23.83 Billion | |

|

|

|

|

Global Endpoint Detection and Response Market Segmentation, By Solution (Software and Service), Endpoint Device (Network devices & Servers, Mobile Devices, Point of Sale (POS) devices, and Others), Deployment (Cloud-based and On-premise), Enterprise Size (Small and medium-sized enterprises and Large enterprises), Vertical (Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Government and Defense, Retail and eCommerce, IT and Telecom, Energy and Utilities, Manufacturing, and Others) - Industry Trends and Forecast to 2032

Endpoint Detection and Response Market Size

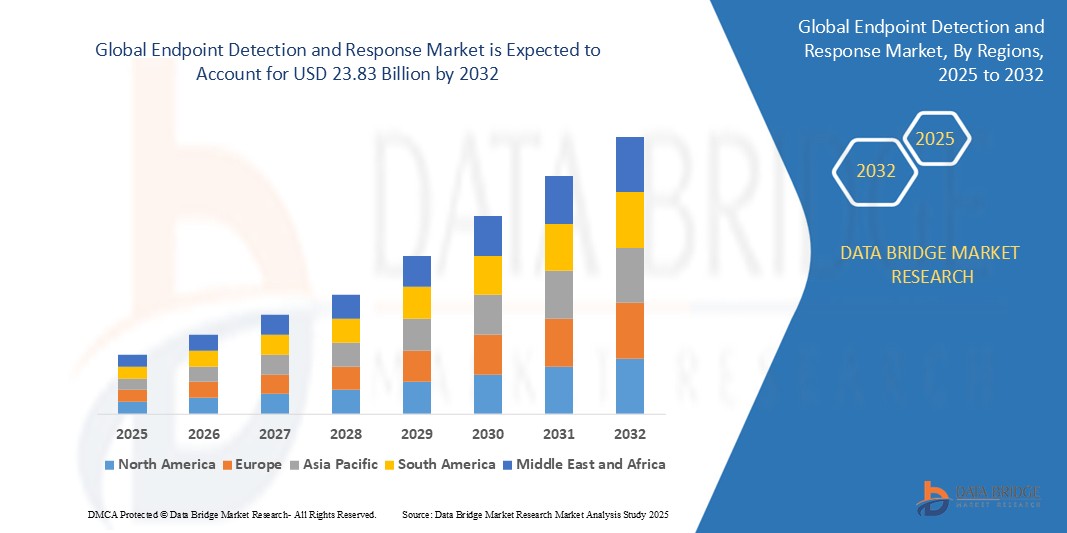

- The global endpoint detection and response market size was valued at USD 4.22 billion in 2024 and is expected to reach USD 23.83 billion by 2032, at a CAGR of 24.16% during the forecast period

- This growth is driven by factors such as rising frequency of cyber threats, growth in remote work, and increasing regulatory compliance needs

Endpoint Detection and Response Market Analysis

- Endpoint detection and response (EDR) refers to a cybersecurity solution that continuously monitors endpoint devices to detect, investigate, and respond to potential threats in real time. It integrates threat intelligence, behavioral analysis, and automated response to protect against evolving cyberattacks across desktops, laptops, mobile devices, and servers

- The EDR market is experiencing strong growth driven by the surge in sophisticated cyber threats, rising adoption of remote and hybrid work models, increasing regulatory pressures for data protection, rapid cloud adoption, and growing enterprise focus on real-time threat detection and mitigation across diverse endpoints

- North America is expected to dominate the endpoint detection and response market with a share of 32.9%, due to the early technology adoption across industries and a strong presence of cybersecurity solution providers

- Asia-Pacific is expected to be the fastest growing region in the endpoint detection and response market during the forecast period due to rapid digital transformation and growing awareness of cybersecurity risks across various sectors

- Software segment is expected to dominate the market with a market share of 65% due to the growing demand for scalable, cloud-based EDR solutions that offer real-time threat detection, investigation, and automated response capabilities. This shift is driven by the increasing sophistication of cyberattacks and the need for agile, easily deployable security tools across diverse endpoints

Report Scope and Endpoint Detection and Response Market Segmentation

|

Attributes |

Endpoint Detection and Response Key Market Insights |

|

Segments Covered |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de detección y respuesta en endpoints

“Aumento de la adopción de soluciones basadas en la nube”

- Una tendencia destacada en el mercado global de detección y respuesta de puntos finales es la creciente adopción de soluciones basadas en la nube.

- Esta tendencia está impulsada por la creciente necesidad de herramientas de ciberseguridad escalables y rentables , el aumento de las fuerzas de trabajo remotas y la demanda de monitoreo centralizado de amenazas en entornos distribuidos.

- Por ejemplo, proveedores líderes como CrowdStrike, Microsoft y SentinelOne ofrecen plataformas EDR nativas de la nube que permiten análisis en tiempo real, detección automatizada de amenazas y respuesta rápida a incidentes en puntos finales globales.

- La implementación basada en la nube está ganando terreno tanto entre las grandes empresas como entre las pequeñas y medianas empresas debido a una integración más sencilla, menores costos de infraestructura y una mejor accesibilidad.

- A medida que la transformación digital se acelera y las organizaciones priorizan la agilidad y la resiliencia, se espera que las soluciones EDR basadas en la nube desempeñen un papel central en la configuración de la trayectoria de crecimiento futuro del mercado.

Endpoint Detection and Response Market Dynamics

Driver

“Rise of Managed Security Service Providers (MSSPs)”

- The rise of managed security service providers (MSSPs) is a major driver of growth in the endpoint detection and response (EDR) market, as organizations seek cost-effective, expert-driven solutions to handle complex cybersecurity challenges

- This shift is particularly evident among small and mid-sized enterprises that lack in-house cybersecurity teams and require continuous threat monitoring and response capabilities

- As cyberattacks grow in frequency and sophistication, businesses are increasingly outsourcing EDR functions to MSSPs for real-time protection, faster incident response, and regulatory compliance

- Service providers are enhancing their offerings with advanced analytics, AI-driven threat detection, and cloud-based EDR platforms to meet evolving enterprise needs

- The growing reliance on MSSPs is expanding the reach of EDR solutions across industries such as healthcare, finance, and manufacturing

For instance,

- Secureworks offers managed EDR with behavioral analytics and real-time detection; AT&T Cybersecurity integrates EDR with its unified security management platform for enhanced threat response

- IBM Security provides managed EDR as part of its X-Force Threat Management services, helping enterprises detect advanced threats across global endpoints

- As businesses prioritize operational efficiency and threat resilience, the demand for MSSP-led EDR solutions is expected to be a key force driving market growth through 2032

Opportunity

“Integration with Security Tools”

- Integration with broader security tools presents a significant opportunity for the endpoint detection and response (EDR) market, enabling enhanced threat visibility, faster incident response, and more cohesive cybersecurity operations

- EDR vendors are increasingly aligning with SIEM, SOAR, and XDR platforms to offer seamless data sharing, automated workflows, and centralized threat management across diverse security environments

- This opportunity supports the growing need for unified cybersecurity solutions that reduce alert fatigue, streamline remediation, and enable faster decision-making across enterprise security teams

For instance,

- CrowdStrike Falcon integrates with SIEM tools such as Splunk and IBM QRadar to deliver real-time endpoint telemetry and contextual threat insights across security layers

- Microsoft Defender for Endpoint works with Azure Sentinel and Microsoft 365 Defender to enable automated detection and response using preconfigured playbooks

- As organizations prioritize unified and scalable security architectures, integration with existing tools is expected to be a key factor driving EDR solution adoption and long-term market expansion through 2032

Restraint/Challenge

“High Implementation Costs”

- Los altos costos de implementación representan un desafío significativo para el mercado de detección y respuesta de puntos finales (EDR), ya que el gasto en software avanzado, personal capacitado e integración con la infraestructura de TI existente crea barreras financieras sustanciales.

- Estos costos son particularmente prohibitivos para las pequeñas y medianas empresas (PYME) que carecen de presupuestos dedicados a la ciberseguridad y de la experiencia interna para gestionar implementaciones complejas de EDR.

- El desafío se ve agravado por la necesidad de actualizaciones continuas, ajustes del sistema y capacitación de analistas de seguridad, lo que aumenta aún más el costo total de propiedad y limita una adopción más amplia.

Por ejemplo,

- Las plataformas EDR de nivel empresarial de proveedores como CrowdStrike, Palo Alto Networks y VMware Carbon Black a menudo requieren tarifas de licencia iniciales, suscripciones anuales y gastos adicionales en servicios de integración y monitoreo.

- Sin modelos de precios más asequibles u opciones de implementación simplificadas, los altos costos de implementación pueden obstaculizar la adopción en industrias con limitaciones presupuestarias y mercados en desarrollo, lo que podría desacelerar el crecimiento general del mercado de EDR hasta 2032.

Alcance del mercado de detección y respuesta en endpoints

El mercado está segmentado en función de la solución, el dispositivo terminal, la implementación, el tamaño de la empresa y la vertical.

|

Segmentación |

Subsegmentación |

|

Por solución |

|

|

Por dispositivo de punto final |

|

|

Por implementación |

|

|

Por tamaño de empresa

|

|

|

Por Vertical |

|

En 2025, se proyecta que el software domine el mercado con la mayor participación en el segmento de soluciones.

Se prevé que el segmento de software domine el mercado de detección y respuesta en endpoints, con una cuota del 65% en 2025, debido a la creciente demanda de soluciones EDR escalables y basadas en la nube que ofrezcan detección de amenazas en tiempo real, investigación y capacidad de respuesta automatizada. Este cambio se debe a la creciente sofisticación de los ciberataques y a la necesidad de herramientas de seguridad ágiles y fáciles de implementar en diversos endpoints.

Se espera que la nube represente la mayor participación durante el período de pronóstico en el segmento de implementación.

En 2025, se prevé que el segmento basado en la nube domine el mercado con la mayor cuota de mercado, un 55,3 %, gracias a su rentabilidad, facilidad de implementación y capacidad para proporcionar inteligencia de amenazas en tiempo real y gestión centralizada en endpoints dispersos geográficamente. La creciente adopción del teletrabajo y los entornos híbridos impulsa aún más la demanda de soluciones EDR flexibles y escalables basadas en la nube.

Análisis regional del mercado de detección y respuesta en endpoints

Norteamérica posee la mayor participación en el mercado de detección y respuesta de endpoints.

- América del Norte domina el mercado de detección y respuesta de endpoints con una participación del 32,9% , impulsada por la adopción temprana de tecnología en todas las industrias y una fuerte presencia de proveedores de soluciones de ciberseguridad.

- Estados Unidos tiene una participación significativa debido a la alta adopción entre las pequeñas y medianas empresas (PYME), inversiones sustanciales en infraestructura de ciberseguridad y un entorno regulatorio proactivo centrado en la protección de datos.

- El crecimiento del mercado está respaldado además por amplias actividades de investigación y desarrollo, asociaciones público-privadas y un ecosistema bien establecido de proveedores de servicios de seguridad administrados.

- Con la innovación continua, las crecientes amenazas cibernéticas y la fuerte demanda empresarial de protección avanzada de puntos finales, se espera que América del Norte mantenga su posición de liderazgo en el mercado global de EDR hasta 2032.

Se proyecta que Asia-Pacífico registre la mayor tasa de crecimiento anual compuesta (TCAC) en el mercado de detección y respuesta de endpoints.

- Se espera que Asia-Pacífico sea testigo de la mayor tasa de crecimiento en el mercado de detección y respuesta de puntos finales , impulsada por la rápida transformación digital y la creciente conciencia de los riesgos de ciberseguridad en varios sectores.

- China tiene una participación significativa debido a las iniciativas lideradas por el gobierno en seguridad digital, la expansión de la infraestructura en la nube y el aumento del gasto empresarial en tecnologías de detección de amenazas.

- El impulso regional se ve impulsado aún más por la creciente penetración de Internet, la creciente adopción de dispositivos móviles y de IoT y un aumento de los ciberataques dirigidos a empresas y entidades gubernamentales.

- Con la creciente demanda de soluciones de seguridad escalables y de última generación, Asia-Pacífico está preparada para convertirse en la región de más rápido crecimiento en el mercado global de detección y respuesta de endpoints hasta 2032.

Cuota de mercado de detección y respuesta en endpoints

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia global, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Cisco Systems, Inc. (EE. UU.)

- Broadcom (EE. UU.)

- Belden Inc. (EE. UU.)

- Sophos Ltd. (Reino Unido)

- F-Secure (Finlandia)

- McAfee, LLC (EE. UU.)

- Trend Micro Incorporated (Japón)

- NortonLifeLock Inc. (EE. UU.)

- Symantec Corporation (EE. UU.)

- VMware, Inc. (EE. UU.)

- CrowdStrike (EE. UU.)

- Palo Alto Networks (EE. UU.)

- Forcepoint (EE. UU.)

- InfraRed Integrated Systems Ltd (Reino Unido)

- Digital Guardian (EE. UU.)

- Cybereason (EE. UU.)

- Open Text Corporation (Canadá)

- FireEye, Inc. (EE. UU.)

- RSA Security LLC (EE. UU.)

- Intel Corporation (EE. UU.)

Latest Developments in Global Endpoint Detection and Response Market

- In October 2023, HarfangLab, a French cybersecurity firm specializing in endpoint detection and response, secured EUR 25 million in Series A funding. This investment will facilitate the company’s expansion in Europe, enabling it to enhance its capabilities in identifying and neutralizing cyberattacks. HarfangLab’s growth reflects the increasing demand for robust cybersecurity solutions in a rapidly evolving threat landscape

- In August 2023, Fortinet was recognized as the Google Cloud Technology Partner of the Year for Security, particularly for its FortiEDR solution. This accolade acknowledges Fortinet’s effectiveness in real-time breach identification and prevention, which is crucial for organizational resilience against cyber threats. The recognition strengthens Fortinet’s reputation and also supports its future growth in the security market through enhanced integration capabilities

- In October 2022, SyncDog, Inc. partnered with 3Eye Technologies to enhance its mobility and cloud strategy, focusing on a more secure solution for mobile device usage. Their Secure Systems Workspace aims to address the complexities of enabling employee access on mobile platforms. This collaboration seeks to bolster sales targets by offering enterprises and government agencies a scalable and secure environment for mobile operations

- In July 2022, Raytheon Intelligence & Space teamed up with CrowdStrike to bolster its managed detection and response (MDR) services. By integrating CrowdStrike’s advanced endpoint security technologies, the collaboration aims to enhance threat detection and response capabilities. This partnership highlights the importance of combining resources to provide comprehensive security solutions, positioning Raytheon as a stronger contender in the cybersecurity landscape

- In June 2021, Cisco acquired Kenna Security, Inc. to enhance its endpoint security capabilities significantly. This strategic acquisition aims to consolidate Cisco's security portfolio, creating a comprehensive endpoint security framework. By integrating Kenna's technologies, Cisco seeks to offer more robust solutions against cyber threats, strengthening its position as a leader in the cybersecurity industry while improving overall organizational protection

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.