Global Electronic Data Capture Edc Systems Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.88 Billion

USD

4.20 Billion

2024

2032

USD

1.88 Billion

USD

4.20 Billion

2024

2032

| 2025 –2032 | |

| USD 1.88 Billion | |

| USD 4.20 Billion | |

|

|

|

|

Segmentación del mercado global de sistemas de captura electrónica de datos (EDC), por modo de entrega (alojado en la web, basado en la nube y empresa con licencia), fase de ensayo clínico (fase I, fase II, fase III y fase IV), usuario final (organizaciones de investigación por contrato [CRO], empresas farmacéuticas y biotecnológicas, empresas de dispositivos médicos y hospitales): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado de sistemas de captura electrónica de datos (EDC)

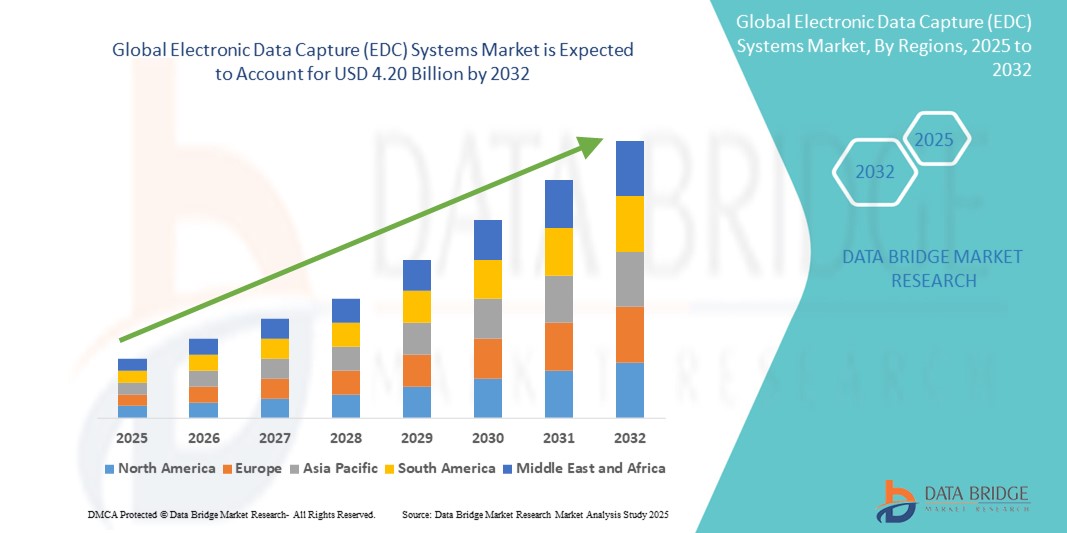

- El tamaño del mercado global de sistemas de captura electrónica de datos (EDC) se valoró en USD 1.88 mil millones en 2024 y se espera que alcance los USD 4.20 mil millones para 2032 , con una CAGR del 10,60% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente digitalización de los ensayos clínicos, la demanda de acceso a datos en tiempo real y la necesidad de un cumplimiento normativo eficiente dentro de las industrias de las ciencias biológicas y la atención médica.

- Además, la creciente adopción de plataformas en la nube, la integración de IA para una gestión de datos más inteligente y el creciente énfasis en los ensayos clínicos descentralizados están posicionando a los sistemas EDC como un componente central de la infraestructura de investigación clínica moderna. Estos desarrollos coordinados están acelerando significativamente la expansión del mercado y aumentando la importancia de soluciones EDC robustas en todo el ecosistema de investigación.

Análisis del mercado de sistemas de captura electrónica de datos (EDC)

- Los sistemas EDC, diseñados para recopilar y gestionar electrónicamente datos de ensayos clínicos, se están convirtiendo en herramientas indispensables en la investigación clínica moderna debido a su acceso a datos en tiempo real, precisión de datos mejorada y compatibilidad con modelos de ensayos remotos y descentralizados tanto en entornos académicos como comerciales.

- La creciente demanda de sistemas EDC se debe principalmente al aumento de las actividades de ensayos clínicos, la necesidad de un cumplimiento normativo simplificado y el cambio en toda la industria hacia operaciones de ensayos sin papel y centradas en el paciente.

- América del Norte dominó el mercado de sistemas de captura electrónica de datos (EDC) con la mayor participación en los ingresos del 41,8 % en 2024, respaldada por una sólida infraestructura de atención médica, altas inversiones en I+D y una adopción temprana de tecnologías digitales, con EE. UU. liderando la tendencia a través de importantes empresas farmacéuticas y biotecnológicas que adoptan plataformas basadas en la nube e integradas con IA.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de sistemas de captura electrónica de datos (EDC) durante el período de pronóstico debido a la expansión de las operaciones de ensayos clínicos, la modernización regulatoria y la creciente presencia de organizaciones de investigación por contrato (CRO).

- El segmento alojado en la web dominó el mercado de sistemas de captura electrónica de datos (EDC) con una participación de mercado del 52,9 % en 2024, impulsado por su facilidad de implementación, rentabilidad y amplia accesibilidad para ensayos clínicos en múltiples sitios.

Alcance del informe y segmentación del mercado de sistemas de captura electrónica de datos (EDC)

|

Atributos |

Perspectivas clave del mercado de los sistemas de captura electrónica de datos (EDC) |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de sistemas de captura electrónica de datos (EDC)

Optimización basada en IA e integración en la nube para la gestión de datos clínicos

- Una tendencia significativa y en auge en el mercado global de sistemas de captura electrónica de datos (EDC) es la integración de inteligencia artificial (IA) y tecnologías avanzadas en la nube para optimizar la recopilación de datos, la monitorización y el cumplimiento normativo en ensayos clínicos. Estas tecnologías mejoran la precisión de los datos, reducen los plazos de los ensayos y facilitan la toma de decisiones en tiempo real.

- Por ejemplo, empresas como Medidata y Veeva Systems han incorporado IA en sus plataformas para automatizar la gestión de consultas, identificar anomalías en los datos y optimizar el diseño de protocolos. Estas funciones basadas en IA permiten a los patrocinadores de ensayos clínicos abordar de forma proactiva los problemas de cumplimiento y mejorar la eficiencia general de los ensayos.

- La integración de IA en los sistemas EDC también permite el análisis predictivo para identificar el riesgo de abandono del paciente y optimizar el rendimiento del centro. Las plataformas alojadas en la nube facilitan el acceso remoto y la sincronización de datos entre centros de ensayos globales, lo que facilita una colaboración fluida y la ejecución descentralizada de los ensayos.

- La fusión de IA y tecnologías de la nube no solo mejora la escalabilidad y la flexibilidad, sino que también mejora la seguridad de los datos a través del control centralizado y registros de auditoría automatizados.

- Esta creciente preferencia por plataformas EDC inteligentes, interoperables y basadas en la nube está transformando la gestión de datos clínicos. Proveedores como Oracle Health Sciences y Castor EDC están lanzando soluciones con paneles de control basados en IA y análisis de datos en tiempo real, diseñados para ensayos complejos multifase.

- La demanda de estos sistemas avanzados está aumentando en las organizaciones farmacéuticas, biotecnológicas y de investigación por contrato (CRO), impulsada por la necesidad de obtener información más rápida, agilidad regulatoria y flujos de trabajo digitales integrados en el desarrollo clínico.

Dinámica del mercado de sistemas de captura electrónica de datos (EDC)

Conductor

Aumento de la complejidad de los ensayos clínicos y transformación digital en la investigación

- La creciente complejidad de los ensayos clínicos y la transición de la industria hacia la transformación digital son factores clave que impulsan la demanda de sistemas EDC. Con el auge de los ensayos descentralizados, los diseños adaptativos y la necesidad de datos en tiempo real, los métodos tradicionales basados en papel ya no son sostenibles.

- Por ejemplo, en febrero de 2024, Veeva Systems introdujo herramientas mejoradas basadas en la nube en su plataforma Vault CDMS, lo que facilita cambios rápidos a mitad del estudio y ajustes de protocolo sin problemas. Estas innovaciones son cruciales a medida que los ensayos crecen en tamaño y diversidad.

- Los sistemas EDC ofrecen acceso en tiempo real a los datos de los pacientes, procesos optimizados de captura de datos y una mejor preparación para auditorías, lo que ayuda a los patrocinadores de ensayos a garantizar el cumplimiento normativo y, al mismo tiempo, reducir los costos y los tiempos de ciclo.

- La creciente necesidad de transparencia, toma de decisiones más rápida y acceso a sitios remotos está haciendo que los sistemas EDC sean indispensables en el desarrollo de fármacos modernos, particularmente en la era posterior a la COVID, donde los ensayos híbridos y descentralizados han ganado terreno.

- Además, el aumento de las inversiones en I+D, el apoyo gubernamental a las tecnologías de salud digital y las crecientes asociaciones entre proveedores de tecnología y CRO están acelerando la adopción del sistema EDC en entornos de investigación clínica.

Restricción/Desafío

Preocupaciones sobre la privacidad de datos y complejidad regulatoria

- La privacidad de los datos y el cumplimiento normativo siguen siendo desafíos importantes para el mercado de sistemas EDC. Dado que los sistemas gestionan datos sensibles de salud de los pacientes, la preocupación por las filtraciones de datos, los ciberataques y las transferencias transfronterizas de datos puede limitar su adopción, especialmente en regiones con leyes de protección de datos estrictas, como el RGPD en Europa o la HIPAA en EE. UU.

- Por ejemplo, las inconsistencias en las políticas de intercambio y retención de datos entre países crean cargas de cumplimiento adicionales para los ensayos globales, lo que requiere que los proveedores de EDC adapten sus sistemas a entornos multiregulatorios.

- Generar confianza mediante cifrado seguro, control de acceso basado en roles y auditorías periódicas de cumplimiento es fundamental. Proveedores líderes como Medrio y OpenClinica están invirtiendo en infraestructura de ciberseguridad mejorada y certificaciones como la ISO 27001 para garantizar la seguridad de los clientes.

- Además, el costo y la complejidad de implementar plataformas EDC sofisticadas, en particular para organizaciones de investigación más pequeñas o aquellas que operan en entornos de bajos recursos, pueden obstaculizar una penetración más amplia en el mercado.

- Abordar estas barreras a través de modelos de precios flexibles, interfaces fáciles de usar y soluciones escalables será fundamental para ampliar el acceso a tecnologías EDC avanzadas a nivel mundial.

Alcance del mercado de sistemas de captura electrónica de datos (EDC)

El mercado está segmentado según el modo de entrega, la fase del ensayo clínico y el usuario final.

- Por modo de entrega

Según el modo de entrega, el mercado de sistemas de captura electrónica de datos (EDC) se segmenta en sistemas alojados en web, en la nube y con licencia empresarial. El segmento alojado en web dominó el mercado con la mayor participación en ingresos, con un 52,9%, en 2024, gracias a su rentabilidad, facilidad de implementación y amplia accesibilidad para las organizaciones de investigación clínica. Estos sistemas ofrecen acceso centralizado a los datos, mantenimiento simplificado y compatibilidad con la monitorización remota, lo que los convierte en la opción preferida tanto para patrocinadores como para CRO que realizan ensayos multicéntricos.

Se prevé que el segmento basado en la nube experimente el mayor crecimiento entre 2025 y 2032, debido a la creciente demanda de plataformas de captura de datos flexibles, escalables y en tiempo real. Las soluciones EDC basadas en la nube facilitan modelos de ensayo descentralizados y la colaboración global, especialmente valiosas en la transformación digital de los ensayos clínicos tras la pandemia. La creciente integración de la IA y la analítica en sistemas basados en la nube también facilita el diseño adaptativo de ensayos y la generación de información predictiva.

- Por fase de ensayo clínico

Según la fase de los ensayos clínicos, el mercado de sistemas de captura electrónica de datos (EDC) se segmenta en Fase I, Fase II, Fase III y Fase IV. El segmento de Fase III tuvo la mayor cuota de mercado, con un 48,1 %, en 2024, debido principalmente a la complejidad, la escala y las exigencias regulatorias de esta fase. Con miles de pacientes y múltiples centros de ensayo, la captura eficiente de datos y la monitorización en tiempo real se vuelven cruciales, lo que hace que los sistemas EDC robustos sean esenciales para la precisión y el cumplimiento normativo.

Se prevé que el segmento de Fase I crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsado por un auge en la investigación en etapas tempranas, especialmente en oncología, enfermedades raras y terapias génicas. Las poblaciones de ensayo más pequeñas y los ciclos de iteración rápidos en los estudios de Fase I se benefician significativamente de plataformas EDC flexibles y ágiles que optimizan la recopilación de datos y las modificaciones de protocolos.

- Por el usuario final

En función del usuario final, el mercado de sistemas de captura electrónica de datos (EDC) se segmenta en Organizaciones de Investigación por Contrato (CRO), empresas farmacéuticas y biotecnológicas, empresas de dispositivos médicos y hospitales. Las Organizaciones de Investigación por Contrato (CRO) dominaron el mercado de sistemas EDC con una participación del 39,7 % en 2024, impulsadas por la creciente externalización de las operaciones de ensayos clínicos y la demanda de soluciones de gestión de datos rentables y escalables. Las CRO se benefician de los sistemas EDC que mejoran la velocidad, la precisión y la preparación regulatoria de los ensayos, especialmente en estudios globales multicéntricos.

Se prevé que el segmento de empresas farmacéuticas y biotecnológicas presente la tasa de crecimiento más rápida hasta 2032, impulsado por la expansión de las líneas de I+D, el auge de los productos biológicos y la medicina personalizada, y la necesidad de plataformas integradas que respalden ensayos a gran escala con uso intensivo de datos. Estas empresas están adoptando cada vez más herramientas EDC basadas en la nube y optimizadas con IA para acelerar la comercialización y garantizar el cumplimiento de las cambiantes regulaciones globales.

Análisis regional del mercado de sistemas de captura electrónica de datos (EDC)

- América del Norte dominó el mercado de sistemas de captura electrónica de datos (EDC) con la mayor participación en los ingresos del 41,8 % en 2024, respaldada por una sólida infraestructura de atención médica, altas inversiones en I+D y una adopción temprana de tecnologías digitales.

- Los patrocinadores y las organizaciones de investigación de la región priorizan el acceso a datos en tiempo real, el cumplimiento normativo y la eficiencia operativa, lo que lleva a una implementación generalizada de plataformas EDC integradas con sistemas eClinical y análisis impulsados por IA.

- Este crecimiento se ve respaldado además por la fuerte presencia de importantes empresas farmacéuticas y biotecnológicas, marcos regulatorios favorables y una creciente demanda de modelos de prueba descentralizados e híbridos, lo que consolida la posición de América del Norte como líder mundial en la adopción de sistemas EDC.

Perspectiva del mercado de sistemas de captura electrónica de datos (EDC) de EE. UU.

El mercado estadounidense de sistemas de captura electrónica de datos (EDC) captó la mayor cuota de ingresos, con un 78,5 %, en 2024 en Norteamérica, impulsado por la robusta industria farmacéutica del país, el alto volumen de ensayos clínicos y la firme apuesta por el cumplimiento normativo. La creciente adopción de ensayos descentralizados e híbridos, junto con la integración de la IA y las tecnologías en la nube en la investigación clínica, está acelerando la demanda de soluciones avanzadas de EDC. Además, las CRO y los patrocinadores estadounidenses están priorizando plataformas que ofrecen análisis en tiempo real, interoperabilidad y acceso remoto seguro a los datos para mejorar la eficiencia de los ensayos y los resultados de los pacientes.

Perspectiva del mercado europeo de sistemas de captura electrónica de datos (EDC)

Se proyecta que el mercado europeo de sistemas de captura electrónica de datos (EDC) se expanda a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico, impulsado principalmente por la creciente actividad de ensayos clínicos en la región, las estrictas regulaciones de protección de datos (como el RGPD) y el impulso a la transformación digital en el sector sanitario. El aumento de la inversión en ciencias de la vida, especialmente en países como Alemania y el Reino Unido, está contribuyendo a la adopción de EDC. Los patrocinadores utilizan cada vez más los sistemas EDC para garantizar la precisión de los datos, la seguridad del paciente y el cumplimiento de los protocolos en ensayos complejos multinacionales.

Perspectiva del mercado de sistemas de captura electrónica de datos (EDC) del Reino Unido

Se prevé que el mercado británico de sistemas de captura electrónica de datos (EDC) crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la fuerte presencia de organizaciones de investigación clínica, instituciones académicas y empresas biotecnológicas en fase inicial. La reestructuración regulatoria posterior al Brexit y el impulso a la innovación en el desarrollo de fármacos están propiciando un mayor despliegue de plataformas EDC basadas en la nube y con IA. Además, se espera que el apoyo gubernamental a la investigación en salud digital y la monitorización de pacientes en tiempo real impulse el crecimiento.

Análisis del mercado de sistemas de captura electrónica de datos (EDC) en Alemania

Se prevé que el mercado alemán de sistemas de captura electrónica de datos (EDC) crezca a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la reputación del país en materia de innovación en tecnología médica, la sólida industria farmacéutica y la importancia de la calidad de los datos clínicos. Con el creciente número de ensayos clínicos en fase inicial y oncológicos, la demanda de plataformas EDC escalables, compatibles y seguras está en aumento. La integración de EDC con las historias clínicas electrónicas (HCE) y otras herramientas digitales para ensayos clínicos está mejorando aún más la eficiencia operativa en los entornos de investigación clínica alemanes.

Análisis del mercado de sistemas de captura electrónica de datos (EDC) en Asia-Pacífico

Se prevé que el mercado de sistemas de captura electrónica de datos (EDC) en Asia-Pacífico crezca a la tasa de crecimiento anual compuesta (TCAC) más rápida, del 23,6 %, entre 2025 y 2032, impulsado por el aumento de los ensayos clínicos externalizados, la expansión de la infraestructura sanitaria y los esfuerzos de digitalización en países clave como China, India y Japón. El apoyo gubernamental al desarrollo de fármacos, las regulaciones favorables y el creciente panorama de las CRO están impulsando la adopción de sistemas EDC. La asequibilidad y la escalabilidad de las plataformas EDC basadas en la nube las hacen accesibles a una gama más amplia de patrocinadores y centros de investigación en toda la región.

Análisis del mercado de sistemas de captura electrónica de datos (EDC) en Japón

El mercado japonés de sistemas de captura electrónica de datos (EDC) está cobrando impulso gracias a los altos estándares de precisión de los datos clínicos, la sólida consolidación del sector farmacéutico y las iniciativas gubernamentales que promueven la transformación digital de la salud. El creciente número de ensayos oncológicos y de enfermedades raras, junto con la necesidad de una monitorización precisa de los datos de los pacientes, está acelerando su adopción. Las plataformas EDC se integran cada vez más con las herramientas eConsent y ePRO, en consonancia con la apuesta de Japón por modelos de investigación tecnológicamente avanzados y centrados en el paciente.

Análisis del mercado de sistemas de captura electrónica de datos (EDC) en India

El mercado indio de sistemas de captura electrónica de datos (EDC) representó la mayor cuota de mercado en ingresos en Asia-Pacífico en 2024, gracias al rápido crecimiento de su panorama de ensayos clínicos, su amplia cartera de pacientes y la rentabilidad de los servicios de las CRO. A medida que el país se convierte en un centro global para la investigación clínica externalizada, los patrocinadores nacionales e internacionales están adoptando plataformas EDC para optimizar la captura de datos, garantizar el cumplimiento normativo y respaldar estudios multilingües y multicéntricos. El auge de las startups de salud digital y las iniciativas de atención médica inteligente respaldadas por el gobierno impulsan aún más la adopción de EDC en la investigación clínica y los ensayos de salud pública.

Cuota de mercado de los sistemas de captura electrónica de datos (EDC)

La industria de sistemas de captura electrónica de datos (EDC) está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Medidata Solutions, Inc. (EE. UU.)

- Veeva Systems Inc. (EE. UU.)

- Oracle Health Sciences (EE. UU.)

- Parexel International Corporation (EE. UU.)

- Clario (EE. UU.)

- Castor EDC (Países Bajos)

- OpenClinica, LLC (EE. UU.)

- Medrio, Inc. (EE. UU.)

- Datos MATRIX (Rusia)

- eClinicalWorks, LLC (EE. UU.)

- Bio-Optronics, Inc. (EE. UU.)

- IQVIA Inc. (EE. UU.)

- Calyx (Reino Unido)

- ClinCapture, Inc. (EE. UU.)

- ArisGlobal LLC (EE. UU.)

- Kayentis (Francia)

- DATATRAK International, Inc. (EE. UU.)

- XClinical GmbH (Alemania)

- Ennov (Francia)

¿Cuáles son los desarrollos recientes en el mercado global de sistemas de captura electrónica de datos (EDC)?

- En abril de 2023, Medidata Solutions, una empresa de Dassault Systèmes, lanzó una mejora de última generación impulsada por IA para su plataforma Rave EDC, con el objetivo de optimizar el cumplimiento de los protocolos y la monitorización de pacientes en tiempo real. Esta actualización aprovecha el análisis predictivo para optimizar la calidad de los datos y el rendimiento del centro, lo que subraya el compromiso de Medidata con la transformación digital en los ensayos clínicos mediante la automatización avanzada y la información inteligente.

- En marzo de 2023, Veeva Systems Inc. introdujo funciones mejoradas de actualización a mitad de estudio en su plataforma Vault CDMS, lo que permite modificar los protocolos con mayor rapidez sin interrumpir los ensayos en curso. Esta innovación refleja el enfoque de Veeva en la agilidad y la eficiencia operativa en la gestión de ensayos, ofreciendo a los patrocinadores mayor flexibilidad y plazos más cortos en estudios clínicos complejos.

- En febrero de 2023, Oracle Health Sciences anunció la expansión global de su plataforma Clinical One Data Collection, diseñada para unificar la captura de datos en todas las fases de los ensayos clínicos. Con una mayor adopción global, Oracle busca optimizar los estudios multirregionales y respaldar modelos de ensayos descentralizados, reforzando así su papel en el avance de las tecnologías EDC basadas en la nube que facilitan la colaboración en tiempo real y el cumplimiento normativo.

- En enero de 2023, Castor EDC obtuvo una inversión estratégica de Two Sigma Ventures para impulsar la innovación de productos y su expansión global. Esta financiación respalda la misión de Castor de democratizar la investigación clínica mediante soluciones EDC intuitivas, asequibles y escalables, especialmente para patrocinadores de tamaño pequeño y mediano e instituciones de investigación académica que buscan la transición de la captura de datos en papel a la digital.

- En enero de 2023, ClinOne se asoció con varias CRO para integrar su plataforma EDC con herramientas de consentimiento electrónico y monitorización remota, lo que facilita un ecosistema de ensayos clínicos descentralizado y sin interrupciones. Este desarrollo demuestra el compromiso de ClinOne con la simplificación de la ejecución de ensayos clínicos mediante soluciones digitales interoperables, garantizando una mayor participación del paciente, la integridad de los datos y la accesibilidad a los ensayos en todo el mundo.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.