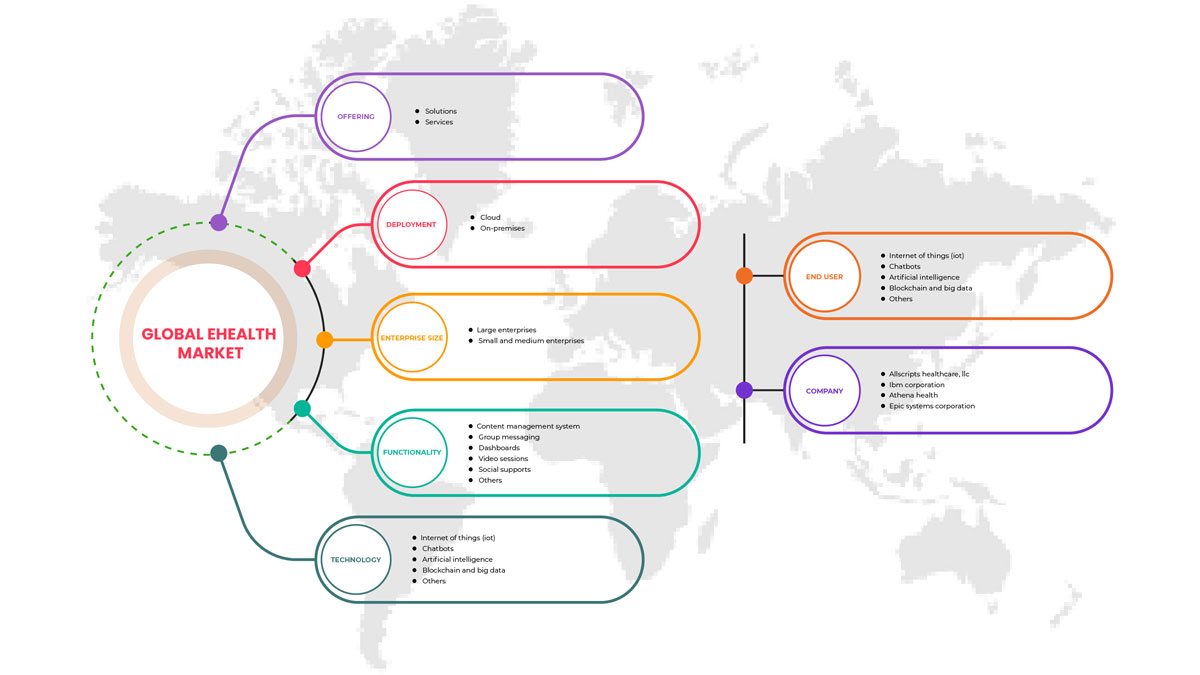

Mercado global de eHealth, por oferta (soluciones y servicios), implementación (nube y local), tamaño de la empresa (grandes empresas y pequeñas y medianas empresas), funcionalidad (sistema de gestión de contenido, mensajería grupal, panel de control, sesiones de video, soporte social y otros), tecnología (Internet de las cosas (IoT), chatbotsinteligencia artificial , blockchain y big data, entre otros), usuario final (proveedores de atención médica, pagadores, consumidores de atención médica , farmacias y otros), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de la salud electrónica

El mercado mundial de la salud electrónica está impulsado por factores como la mayor prevalencia de enfermedades crónicas, el aumento de los avances tecnológicos en materia de salud electrónica, el aumento de la demanda de telesalud y las iniciativas gubernamentales que respaldan las soluciones y los servicios de salud electrónica. El gasto en atención sanitaria ha aumentado en los países desarrollados y emergentes, lo que se espera que genere una ventaja competitiva para que los fabricantes desarrollen productos de salud electrónica nuevos e innovadores.

El informe de mercado global de eHealth proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Contáctenos para obtener un informe de analista para comprender el análisis y el escenario del mercado. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado. La escalabilidad y la expansión comercial de las unidades minoristas en los países en desarrollo de varias regiones y la asociación con proveedores para la distribución segura de productos de máquinas y medicamentos son los principales impulsores que impulsan la demanda del mercado en el período de pronóstico.

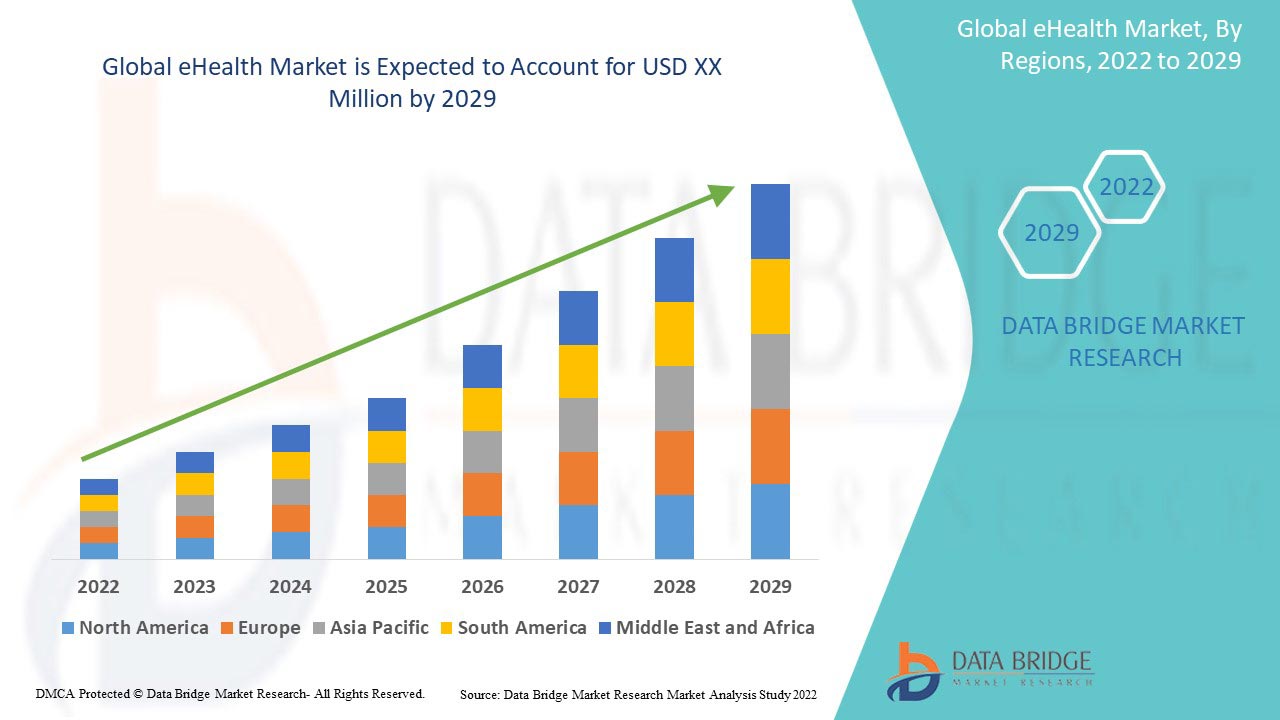

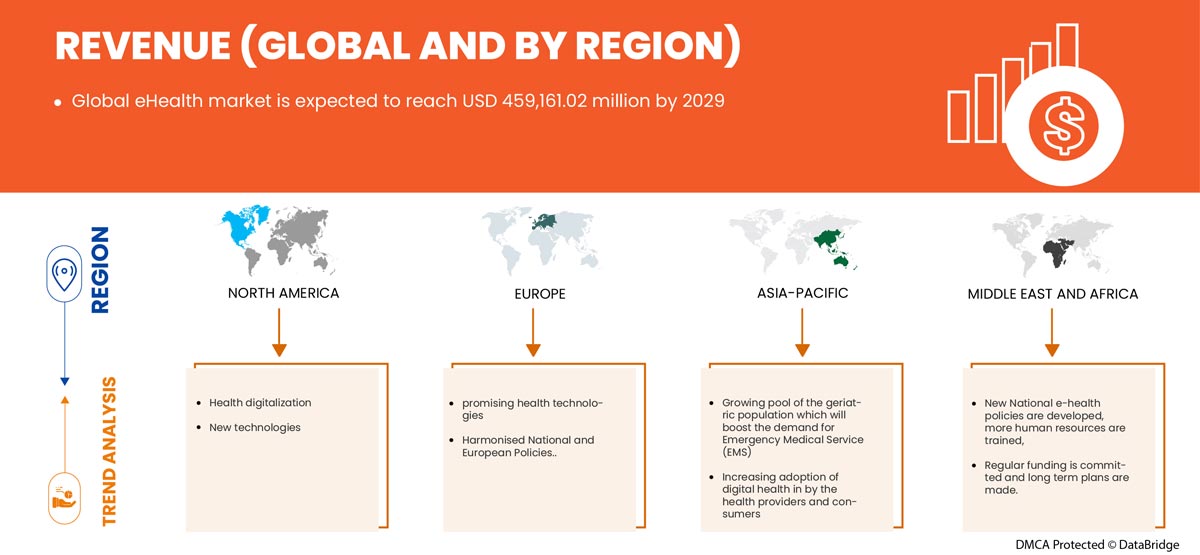

El mercado mundial de la salud electrónica es favorable y tiene como objetivo reducir la progresión de la enfermedad. Data Bridge Market Research analiza que el mercado mundial de la salud electrónica crecerá a una tasa compuesta anual del 24,7 % entre 2022 y 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por oferta (soluciones y servicios), implementación (nube y local), tamaño de la empresa (grandes empresas y pequeñas y medianas empresas), funcionalidad (sistema de gestión de contenido, mensajería grupal, panel de control, sesiones de video, soporte social y otros), tecnología (Internet de las cosas (IoT), chatbots, inteligencia artificial, blockchain y big data, entre otros), usuario final (proveedores de atención médica, pagadores, consumidores de atención médica, farmacias y otros). |

|

Países cubiertos |

(EE. UU., Canadá, México, Alemania, Reino Unido, Francia, Italia, España, Rusia, Países Bajos, Suiza, Bélgica, Turquía y resto de Europa, China, Japón, India, Corea del Sur, Australia, Singapur, Vietnam, Tailandia, Malasia, Indonesia, Filipinas y resto de Asia-Pacífico, Brasil, Argentina y resto de Sudamérica, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y resto de Medio Oriente y África). |

|

Actores del mercado cubiertos |

Entre otros, se encuentran Allscripts Healthcare, LLC, IBM Corporation, Athena health, Epic Systems Corporation, Koninklijke Philips NV, Siemens Healthcare GmbH, Apple Inc., eHealth Technologies, Lifen, SATmed, Kazaam INC., Teladoc Health, Inc., Doximity, Inc., Implantica, Medisafe, iHealth Labs Inc, Medtronic, Boston Scientific Corporation, General Electric Company, Cantata Health Solutions, BioTelemetry, una empresa de Philips, McKesson Corporation, Oracle, Cisco Systems y Optum Inc. |

DEFINICIÓN DE MERCADO

Un tipo relativamente nuevo de prestación de servicios de salud con la ayuda de procedimientos y comunicaciones electrónicos se denomina eHealth (a veces escrito eHealth). La palabra se utiliza de diversas maneras porque abarca "casi todo lo relacionado con las computadoras y la medicina", no solo "medicina de Internet", como se definió originalmente en ese momento. Algunos sostienen que se puede utilizar indistintamente con el término "informática de la salud", que definen como que incluye todos los procesos de salud electrónicos y digitales . En cambio, otros lo definen más específicamente como atención médica basada en Internet. También puede incluir enlaces y aplicaciones de mHealth o m-Health en dispositivos móviles.

Dinámica del mercado mundial de la salud electrónica

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento de la prevalencia de enfermedades crónicas

Con el crecimiento económico en aumento, las personas están más interesadas en la salud y el bienestar a largo plazo. Los pacientes con diabetes necesitan dispositivos para controlar sus niveles de azúcar, controlar el embarazo, aumentar la demanda de tiras reactivas para el embarazo y controlar la presión arterial. Existe una creciente demanda de dispositivos como monitores de glucosa en sangre, esfigmomanómetros y otros. El servicio de gestión de atención médica domiciliaria ayuda a controlar enfermedades crónicas como la diabetes, la insuficiencia cardíaca o la enfermedad pulmonar obstructiva crónica (EPOC) y el cáncer. Su servicio incluye servicio de enfermería, servicio de cuidados paliativos y dispensación de medicamentos.

Diferentes tipos de enfermedades crónicas, incluyendo el cáncer y las enfermedades cardiovasculares, están aumentando a nivel mundial. A continuación, se presentan algunas de las enfermedades crónicas que están aumentando, debido a las cuales la demanda de servicios de atención médica domiciliaria ha aumentado, ya que brindarán tratamiento diario a quienes padecen enfermedades crónicas. Como resultado del estilo de vida sedentario de las personas, la prevalencia de trastornos asociados al estilo de vida, como la hipertensión y la diabetes, muestra un aumento en la actualidad. Por lo tanto, se espera que la creciente prevalencia de enfermedades crónicas con la creciente integración de datos de atención médica con dispositivos portátiles exija una gestión de la salud adecuada, lo que lleva a la creciente demanda anticipada de servicios de salud electrónica en el mercado global de la salud electrónica en el período de pronóstico.

- Aumento de los avances tecnológicos en eSalud

Los dispositivos basados en nuevas tecnologías, como big data, análisis y servicios basados en la nube, ayudan a almacenar los datos de los pacientes. Estos datos son accesibles para pacientes y médicos, donde el paciente puede consultar su historial de tratamiento desde cualquier lugar y en cualquier momento. La aplicación móvil facilita la relación entre médicos y pacientes. Un paciente puede consultar el estado médico del médico y acceder a la información del médico en cualquier momento. Además, los crecientes avances tecnológicos en dispositivos de eSalud con funciones avanzadas han dado como resultado una gestión adecuada para pacientes y médicos, lo que se prevé que impulse el crecimiento del mercado global de eSalud.

Visitar un hospital y someterse a un tratamiento posterior es un procedimiento bastante costoso. Para evitar visitas repetidas a los hospitales, la empresa fabrica dispositivos con tecnología avanzada, lo que ayuda a mejorar la calidad de vida de los pacientes, impulsando así el crecimiento del mercado mundial de la eSalud.

Oportunidad

- Aumento del uso de soluciones de eSalud en centros de atención ambulatoria

La mayoría de las organizaciones de atención sanitaria se están centrando en la introducción de servicios especializados debido a la creciente presión sobre los sistemas de salud para reducir el coste de la atención. El uso de soluciones de eSalud está aumentando debido a la transición a un paradigma de atención ambulatoria, ya que estas soluciones ofrecen un método de atención sanitaria cómodo. Estas soluciones también ayudan a los médicos a atender las necesidades de los pacientes y proporcionan un seguimiento remoto de la salud de los pacientes. Debido a las ventajas de las tecnologías de eSalud, numerosos organismos federales están fomentando su uso en entornos de atención ambulatoria. Los organismos federales toman muchas iniciativas para promover la eSalud en los centros de atención al paciente.

Con las mejoras en la tecnología de la información, la ciencia de la información, la medicina y la biotecnología, la telesalud y la salud electrónica seguirán desarrollándose. La próxima generación de profesionales de la salud y de pacientes estará mucho más acostumbrada a utilizar herramientas, servicios y aplicaciones de vanguardia. Además, cada vez hay más conciencia de que la telesalud y la salud electrónica ofrecen a los proveedores de atención médica la oportunidad de mejorar los sistemas de salud y cambiarlos del modelo de "diagnosticar y tratar" al de "predecir y prevenir".

De esta forma, las iniciativas de soluciones de eSalud están en aumento, incrementando su uso en la atención ambulatoria y se espera que actúen como una oportunidad para el mercado global de eSalud.

Restricciones/Desafíos

- Falta de profesionales capacitados para manejar tecnología eSalud

Uno de los campos de la tecnología de la salud electrónica que se está desarrollando con mayor rapidez es el desarrollo y uso de diversas aplicaciones basadas en la tecnología, como la IA (inteligencia artificial). El avance de la tecnología ha hecho posible que los métodos de atención sanitaria convencionales alcancen el nivel de las instalaciones que brindan atención sanitaria. El avance de la tecnología sanitaria requiere de diversos conjuntos de habilidades para su manejo. Como la atención sanitaria basada en la tecnología está altamente automatizada y tiene un software costoso, el manejo inadecuado de dichos sistemas puede dañarlos y dificultar la obtención de datos precisos y perfectos. La escasez de profesionales capacitados con las habilidades y los conocimientos adecuados para manejar un software basado en una tecnología tan innovadora obstaculiza el crecimiento del mercado.

Los profesionales que carecen de alguna de las habilidades mencionadas anteriormente no son aptos para realizar ninguna actividad basada en la salud electrónica, ya que los resultados son de suma importancia. La necesidad de profesionales sanitarios cualificados ha aumentado. Por tanto, la falta de profesionales cualificados para manejar la tecnología de la salud electrónica puede suponer un reto para el crecimiento del mercado.

Impacto post COVID-19 en el mercado mundial de salud electrónica

Anteriormente, la atención de rutina, la atención de emergencia, la atención de crisis y otros tipos de atención utilizaban atención remota y servicios de telesalud. Su uso en una capacidad más generalizada ha cobrado velocidad a medida que avanzaba la pandemia de COVID-19. Los servicios de telesalud ahora se están utilizando en el cribado a gran escala de pacientes antes de su visita y evaluación de triaje, el monitoreo de rutina de pacientes en el hogar, los encuentros clínicos remotos o la supervisión de la atención al paciente por parte de expertos externos. Los servicios de telesalud también se están utilizando para examinar a los pacientes en el hogar en el Reino Unido. Es probable que una parte significativa de esos servicios continúen basándose en la telesalud después de COVID-19, por ejemplo, el monitoreo y la gestión remotos de un número más significativo de pacientes. Esto se debe a que la telesalud ofrece una mayor comodidad y una mejor atención centrada en el paciente, lo que ayuda a abordar parcialmente los desafíos del caudal y la capacidad dentro del sistema de atención médica.

Desarrollo reciente

- En septiembre de 2022, GE Healthcare (parte de General Electric Company) colaboró con siete empresas emergentes llamadas Alertive (Reino Unido), xWave (Reino Unido), Idoven (España), Nurea (Francia), Metalynx (Reino Unido), Clinithink (Reino Unido) y KOSA AI (Países Bajos) para acelerar e impulsar la transformación de la atención médica digital en asociación con la organización de innovación Wayra UK. Esta colaboración ayudará a GE Healthcare a aumentar el alcance de su audiencia y transformar el sistema de atención médica digital.

Segmentación del mercado mundial de eSalud

El mercado mundial de eHealth se clasifica en seis segmentos notables según la oferta, la implementación, el tamaño de la empresa, la funcionalidad, la tecnología y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Ofrenda

- Soluciones

- Servicios

Sobre la base de la oferta, el mercado global de eSalud se segmenta aún más en soluciones y servicios.

Despliegue

- Nube

- En las instalaciones

En función de la implementación, el mercado global de eSalud se segmenta en nube y local.

Tamaño de la empresa

- Gran empresa

- Pequeña y mediana empresa

En función del tamaño de la empresa, el mercado mundial de eSalud se segmenta en grandes empresas y pequeñas y medianas empresas.

Funcionalidad

- Sistema de mensajería de contenido (CMS)

- Mensajería grupal

- Panel

- Sesiones de video

- Apoyo social

- Otros

Sobre la base de la funcionalidad, el mercado global de eSalud está segmentado en sistema de mensajería de contenido (CMS), mensajería grupal, panel de control, sesiones de video, soporte social y otros.

Tecnología

- Chatbots

- Inteligencia artificial

- Internet de las cosas (IdC)

- Blockchain y big data

- Otro

Sobre la base de la tecnología, el mercado global de eSalud está segmentado en Internet de las cosas, chatbots, inteligencia artificial, Internet de las cosas (IOT), blockchain y big data, entre otros.

Usuario final

- Proveedores de atención médica

- Pagadores

- Consumidores de atención sanitaria

- Farmacias

- Otros

En función del usuario final, el mercado global de eSalud se segmenta en proveedores de atención médica, pagadores, consumidores de atención médica, farmacias y otros.

Análisis y perspectivas regionales del mercado de eHealth

Se analiza el mercado global de eSalud y se proporcionan información y tendencias sobre el tamaño del mercado según la oferta, la implementación, el tamaño de la empresa, la funcionalidad, la tecnología y el usuario final, como se mencionó anteriormente.

Los países cubiertos en el informe de eSalud son: EE. UU., Canadá, México, Alemania, Reino Unido, Francia, Italia, España, Rusia, Países Bajos, Suiza, Bélgica, Turquía, resto de Europa, China, Japón, India, Corea del Sur, Australia, Singapur, Vietnam, Tailandia, Malasia, Indonesia, Filipinas, resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel y resto de Oriente Medio y África.

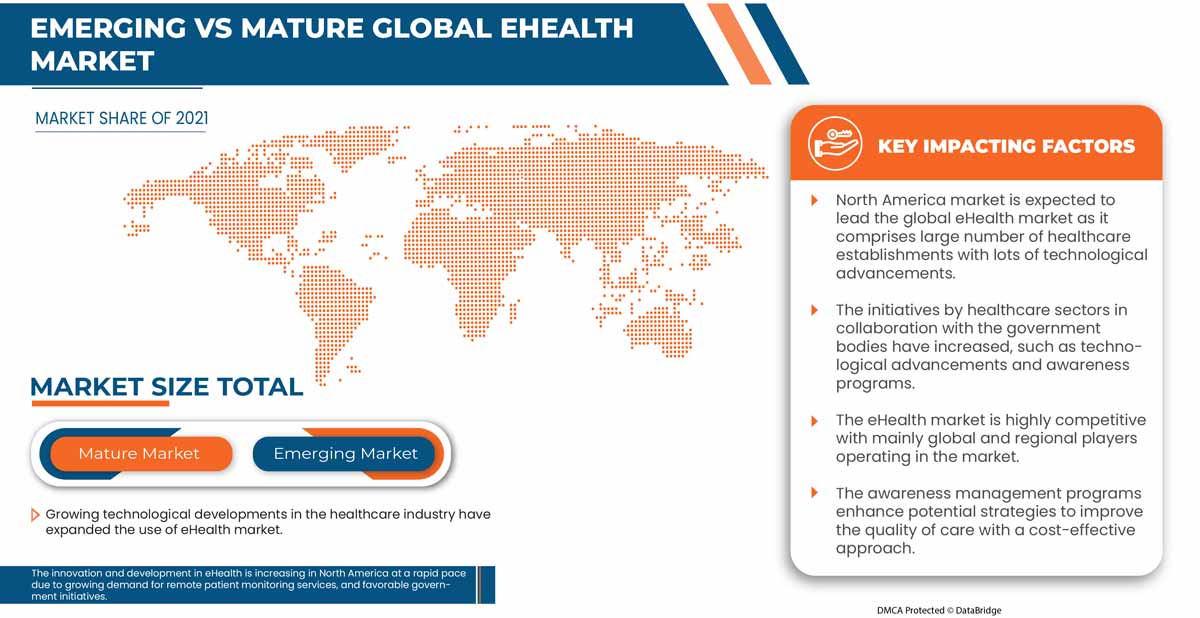

North America dominates the global eHealth market. With significant healthcare spending, the country's broad base of the eHealth industry is set to drive market growth for various devices and equipment used for telehealth, including remote monitoring. To avoid repeated visits to hospitals, the company manufactures devices with advanced technology, which helps in improving the quality of life of patients, thus boosting the growth of the North America eHealth market. The U.S. dominates the North America region due to the country's exponential use of remote monitoring, telehealth, and consultancy services. Germany dominates the Europe eHealth market due to increasing technology and reliability of healthcare services, which are also delivering infotainment services. China dominates the Asia-Pacific eHealth market. The demand in this region is projected to be driven by the rise in chronic diseases with the growing integration of healthcare data with portable devices.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points such as downstream and upstream value chain analysis, technological trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to significant or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and eHealth Market Share Analysis

Global eHealth market competitive landscape provides details of the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on eHealth market.

Some players in the market are Allscripts Healthcare, LLC, IBM Corporation, Athena health, Epic Systems Corporation, Koninklijke Philips N.V., Siemens Healthcare GmbH, Apple Inc., eHealth Technologies, Lifen, SATmed, Kazaam INC., Teladoc Health, Inc., Doximity, Inc., Implantica, Medisafe, iHealth Labs Inc, Medtronic, Boston Scientific Corporation, General Electric Company, Cantata Health Solutions, BioTelemetry, a Philips Company, McKesson Corporation, Oracle, Cisco Systems and Optum Inc.

Research Methodology

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes del mercado. Además, el análisis de la participación de mercado y el análisis de tendencias fundamentales son los principales factores de éxito en el informe de mercado. La metodología de investigación fundamental utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, análisis global frente a regional y análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL EHEALTH MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 DIGITAL FRONT DOOR SOLUTIONS & BENEFITS OF GLOBAL EHEALTH MARKET

4.3 ECOSYSTEM MODEL FOR EHEALTHCARE SYSTEM OF GLOBAL EHEALTH MARKET

4.4 EHEALTH DIGITAL INNOVATION AND PREVENTION OF GLOBAL EHEALTH MARKET

4.5 OPEN DATA PLATFORMS IN EHEALTH OF GLOBAL EHEALTH MARKET

4.6 TRENDS TO SHAPE THE EHEALTH INDUSTRY OF GLOBAL EHEALTH MARKET

4.6.1 APP ON PRESCRIPTION

4.6.2 TELEMEDICINE

4.6.3 SMART MEDICAL THINGS

4.6.4 DATA PROTECTION

4.6.5 MEDICAL DEEP LEARNING

4.7 VALUE CHAIN OF GLOBAL EHEALTH MARKET

4.8 GLOBAL EHEALTH MARKET: REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE PREVALENCE OF CHRONIC DISEASES

5.1.2 RISE IN THE TECHNOLOGICAL ADVANCEMENTS IN EHEALTH

5.1.3 INCREASE IN THE DEMAND FOR TELEHEALTH

5.1.4 INCREASING GOVERNMENT INITIATIVES SUPPORTING THE USE OF EHEALTH SERVICES AND SOLUTIONS

5.2 RESTRAINTS

5.2.1 STRICT REGULATORY FRAMEWORK

5.2.2 INCREASE UNMET HOME CARE NEEDS

5.3 OPPORTUNITIES

5.3.1 RISING USE OF EHEALTH SOLUTIONS IN OUTPATIENT CARE FACILITIES

5.3.2 PROVIDES QUICK ONLINE RESULTS AND QUICK HEALTHCARE CONSULTANCY

5.3.3 STRATEGIC INITIATIVES AND DEVELOPMENTS BY KEY PLAYERS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS TO HANDLE E-HEALTH TECHNOLOGY

5.4.2 PATIENTS DATA SECURITY IN E-HEALTH

6 GLOBAL EHEALTH MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SERVICES

6.2.1 REMOTE MONITORING SERVICES

6.2.2 DATABASE MANAGEMENT SERVICES

6.2.3 DIAGNOSIS AND CONSULTATION SERVICES

6.2.4 HEALTHCARE SYSTEM STRENGTHENING SERVICES

6.2.5 TREATMENT SERVICES

6.3 SOLUTIONS

6.3.1 ELECTRONIC HEALTH RECORDS (HER) / ELECTRONIC MEDICAL RECORDS (EMR)

6.3.2 MEDICAL APPS

6.3.3 PERSONAL HEALTH RECORD AND PATIENT PORTALS

6.3.4 TELEHEALTH SOLUTIONS

6.3.5 CHRONIC CARE MANAGEMENT APPS

6.3.6 PHARMACY INFORMATION SYSTEMS

6.3.7 CLINICAL DECISION SUPPORT SYSTEMS

6.3.8 LABORATORY INFORMATION SYSTEMS RIGID (RIS)

6.3.9 HEALTHCARE INFORMATION EXCHANGE

6.3.10 RADIOLOGY INFORMATION SYSTEMS (RIS) E-PRESCRIBING SOLUTIONS

6.3.11 CARDIOVASCULAR INFORMATION SYSTEMS

6.4 OTHERS

7 GLOBAL EHEALTH MARKET, BY DEPLOYMENT

7.1 OVERVIEW

7.2 CLOUD

7.2.1 PRIVATE CLOUD

7.2.2 PUBLIC CLOUD

7.2.3 HYBRID CLOUD

7.3 ON-PREMISES

8 GLOBAL EHEALTH MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.3 SMALL AND MEDIUM ENTERPRISES

9 GLOBAL EHEALTH MARKET, BY FUNCTIONALITY

9.1 OVERVIEW

9.2 VIDEO SESSIONS

9.3 CONTENT MANAGEMENT SYSTEMS (CMS)

9.4 DASHBOARD

9.5 GROUP MESSAGING

9.6 SOCIAL SUPPORT

9.7 OTHERS

10 GLOBAL EHEALTH MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 CHATBOTS

10.3 ARTIFICIAL INTELLIGENCE

10.4 INTERNET OF THINGS (IOT)

10.5 BLOCK CHAIN AND BIG DATA ANALYTICS

10.6 OTHERS

11 GLOBAL EHEALTH MARKET, BY END USER

11.1 OVERVIEW

11.2 HEALTHCARE PROVIDERS

11.3 HEALTHCARE PROVIDERS, BY TYPE

11.3.1 HOSPITALS

11.3.2 AMBULATORY CARE CENTERS

11.3.3 HOME HEALTHCARE AGENCIES, NURSING HOMES, AND ASSISTED LIVING CENTRES

11.4 HEALTHCARE PROVIDERS, BY ENTERPRISE SIZE

11.4.1 LARGE ENTERPRISES

11.4.2 SMALL AND MEDIUM ENTERPRISES

11.5 PHARMACIES

11.5.1 LARGE ENTERPRISES

11.5.2 SMALL AND MEDIUM ENTERPRISES

11.6 PAYERS

11.6.1 LARGE ENTERPRISES

11.6.2 SMALL AND MEDIUM ENTERPRISES

11.7 HEALTHCARE CONSUMERS

11.7.1 LARGE ENTERPRISES

11.7.2 SMALL AND MEDIUM ENTERPRISES

11.8 OTHERS

12 GLOBAL EHEALTH MARKET, BY REGION

12.1 OVERVIEW

12.2 ASIA-PACIFIC

12.2.1 VIETNAM

13 GLOBAL EHEALTH MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 IBM CORPORATION (2021)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 APPLE INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MCKESSON CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 GENERAL ELECTRIC COMPANY (2021)

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 TELADOC HEALTH, INC (2021)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ALLSCRIPTS HEALTHCARE, LLC (2021)

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 ATHENAHEALTH (2021)

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BIOTELEMETRY, A PHILIPS COMPANY (2021)

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BOSTON SCIENTIFIC CORPORATION (2021)

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 CANTATA HEALTH SOLUTIONS (2021)

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 CISCO SYSTEMS

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 DOXIMITY, INC. (2021)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 EHEALTH TECHNOLOGIES

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 EPIC SYSTEMS CORPORATION (2021)

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 IHEALTH LABS INC (2021)

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 IMPLANTICA (2021)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 KAZAAM INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 KONINKLIJKE PHILIPS N.V. (2021)

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 LIFEN

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 MEDISAFE (2021)

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 MEDTRONIC (2021)

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENT

15.22 OPTUM INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 ORACLE

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENTS

15.24 SATMED

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 SIEMENS HEALTHCARE GMBH

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 GLOBAL EHEALTH MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL SERVICES IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL SERVICES IN EHEALTH MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL SOLUTIONS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL SOLUTIONS IN EHEALTH MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL EHEALTH MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL CLOUD IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL CLOUD IN EHEALTH MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL ON-PREMISES IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL LARGE ENTERPRISES IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL SMALL AND MEDIUM ENTERPRISES IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL EHEALTH MARKET, BY FUNCTIONALITY, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL VIDEO SESSIONS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL CONTENT MANAGEMENT SYSTEMS (CMS) IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL DASHBOARD IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL GROUP MESSAGING IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL SOCIAL SUPPORT IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL OTHERS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL EHEALTH MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL CHATBOTS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL ARTIFICIAL INTELLIGENCE IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL INTERNET OF THINGS (IOT) IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL BLOCK CHAIN AND BIG DATA ANALYTICS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL OTHERS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 GLOBAL EHEALTH MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 27 GLOBAL HEALTHCARE PROVIDERS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 GLOBAL HEALTHCARE PROVIDERS IN EHEALTH MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 GLOBAL HEALTHCARE PROVIDERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 30 GLOBAL PHARMACIES IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 GLOBAL PHARMACIES IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 32 GLOBAL PAYERS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 GLOBAL PAYERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 34 GLOBAL HEALTHCARE CONSUMERS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 GLOBAL HEALTHCARE CONSUMERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 36 GLOBAL OTHERS IN EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 GLOBAL EHEALTH MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC EHEALTH MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC EHEALTH MARKET, BY OFFERING 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC SERVICES IN EHEALTH MARKET, BY OFFERING 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC SOLUTIONS IN EHEALTH MARKET, BY OFFERING 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC EHEALTH MARKET, BY DEPLOYMENT 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC CLOUD IN EHEALTH MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC EHEALTH MARKET, BY FUNCTIONALITY, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC EHEALTH MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC EHEALTH MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC HEALTHCARE PROVIDERS IN EHEALTH MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC HEALTHCARE PROVIDERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC PHARMACIES IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC PAYERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC HEALTHCARE CONSUMERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 53 VIETNAM EHEALTH MARKET, BY OFFERING 2020-2029 (USD MILLION)

TABLE 54 VIETNAM SERVICES IN EHEALTH MARKET, BY OFFERING 2020-2029 (USD MILLION)

TABLE 55 VIETNAM SOLUTIONS IN EHEALTH MARKET, BY OFFERING 2020-2029 (USD MILLION)

TABLE 56 VIETNAM EHEALTH MARKET, BY DEPLOYMENT 2020-2029 (USD MILLION)

TABLE 57 VIETNAM CLOUD IN EHEALTH MARKET, BY DEPLOYMENT, 2020-2029 (USD MILLION)

TABLE 58 VIETNAM EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 59 VIETNAM EHEALTH MARKET, BY FUNCTIONALITY, 2020-2029 (USD MILLION)

TABLE 60 VIETNAM EHEALTH MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 VIETNAM EHEALTH MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 VIETNAM HEALTHCARE PROVIDERS IN EHEALTH MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 VIETNAM HEALTHCARE PROVIDERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 64 VIETNAM PHARMACIES IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 65 VIETNAM PAYERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 66 VIETNAM HEALTHCARE CONSUMERS IN EHEALTH MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 GLOBAL EHEALTH MARKET: SEGMENTATION

FIGURE 2 GLOBAL EHEALTH MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL EHEALTH MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL EHEALTH MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL EHEALTH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL EHEALTH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL EHEALTH MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL EHEALTH MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL EHEALTH MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 GLOBAL EHEALTH MARKET: SEGMENTATION

FIGURE 11 INCREASE IN THE PREVALENCE OF CHRONIC DISEASES AND RISE IN TECHNOLOGICAL ADVANCEMENT IN EHEALTH IS EXPECTED TO DRIVE THE GLOBAL MEZCAL MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL EHEALTH MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE GLOBAL EHEALTH MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR EHEALTH TECHNOLOGY IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL EHEALTH MARKET

FIGURE 16 GLOBAL EHEALTH MARKET: BY OFFERING, 2021

FIGURE 17 GLOBAL EHEALTH MARKET: BY OFFERING, 2022-2029 (USD MILLION)

FIGURE 18 GLOBAL EHEALTH MARKET: BY OFFERING, CAGR (2022-2029)

FIGURE 19 GLOBAL EHEALTH MARKET: BY OFFERING, LIFELINE CURVE

FIGURE 20 GLOBAL EHEALTH MARKET: BY DEPLOYMENT, 2021

FIGURE 21 GLOBAL EHEALTH MARKET: BY DEPLOYMENT, 2022-2029 (USD MILLION)

FIGURE 22 GLOBAL EHEALTH MARKET: BY DEPLOYMENT, CAGR (2022-2029)

FIGURE 23 GLOBAL EHEALTH MARKET: BY DEPLOYMENT, LIFELINE CURVE

FIGURE 24 GLOBAL EHEALTH MARKET: BY ENTERPRISE SIZE, 2021

FIGURE 25 GLOBAL EHEALTH MARKET: BY ENTERPRISE SIZE, 2022-2029 (USD MILLION)

FIGURE 26 GLOBAL EHEALTH MARKET: BY ENTERPRISE SIZE, CAGR (2022-2029)

FIGURE 27 GLOBAL EHEALTH MARKET: BY ENTERPRISE SIZE, LIFELINE CURVE

FIGURE 28 GLOBAL EHEALTH MARKET: BY FUNCTIONALITY, 2021

FIGURE 29 GLOBAL EHEALTH MARKET: BY FUNCTIONALITY, 2020-2029 (USD MILLION)

FIGURE 30 GLOBAL EHEALTH MARKET: BY FUNCTIONALITY, CAGR (2022-2029)

FIGURE 31 GLOBAL EHEALTH MARKET: BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 32 GLOBAL EHEALTH MARKET: BY TECHNOLOGY, 2021

FIGURE 33 GLOBAL EHEALTH MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 34 GLOBAL EHEALTH MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 35 GLOBAL EHEALTH MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 36 GLOBAL EHEALTH MARKET: BY END USER, 2021

FIGURE 37 GLOBAL EHEALTH MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 GLOBAL EHEALTH MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 GLOBAL EHEALTH MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 GLOBAL EHEALTH MARKET: SNAPSHOT (2021)

FIGURE 41 GLOBAL EHEALTH MARKET: BY REGION (2021)

FIGURE 42 GLOBAL EHEALTH MARKET: BY REGION (2022 & 2029)

FIGURE 43 GLOBAL EHEALTH MARKET: BY REGION (2021 & 2029)

FIGURE 44 GLOBAL EHEALTH MARKET: BY OFFERING (2022-2029)

FIGURE 45 ASIA-PACIFIC EHEALTH MARKET: SNAPSHOT (2021)

FIGURE 46 ASIA-PACIFIC EHEALTH MARKET: BY COUNTRY (2021)

FIGURE 47 ASIA-PACIFIC EHEALTH MARKET: BY COUNTRY (2022 & 2029)

FIGURE 48 ASIA-PACIFIC EHEALTH MARKET: BY COUNTRY (2021 & 2029)

FIGURE 49 ASIA-PACIFIC EHEALTH MARKET: BY OFFERING (2022-2029)

FIGURE 50 GLOBAL EHEALTH MARKET: COMPANY SHARE 2021 (%)

FIGURE 51 ASIA-PACIFIC EHEALTH MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.