Global E Series Glycol Ether Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.45 Billion

USD

3.57 Billion

2024

2032

USD

2.45 Billion

USD

3.57 Billion

2024

2032

| 2025 –2032 | |

| USD 2.45 Billion | |

| USD 3.57 Billion | |

|

|

|

Segmentación del mercado global de éter de glicol de la serie E, por tipo (éter de propileno de etilenglicol (EGPE), éter de butilo de etilenglicol (EGBE), acetato de éter de butilo de etilenglicol (EGBEA), otros), aplicación (pinturas y recubrimientos, tinta de impresión, limpiadores, cosméticos y cuidado personal, productos farmacéuticos, automoción, productos químicos intermedios, otros), peso molecular (éter de glicol de la serie E de bajo peso molecular, éter de glicol de la serie E de alto peso molecular): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de éter de glicol de la serie E

El crecimiento global de la industria cosmética aumentó un 8,2 por ciento en 2021 después de mostrar una pérdida del 8,1 por ciento en 2020, según el informe anual de L'OREAL para 2021. La demanda de éter de glicol de serie e está aumentando como resultado del crecimiento del sector de la cosmética y el cuidado personal, que está impulsando el mercado de esta sustancia y creando importantes oportunidades potenciales para el mercado durante el período de pronóstico.

Tamaño del mercado de éter de glicol de la serie E

El tamaño del mercado global de éter de glicol de la serie E se valoró en USD 2,45 mil millones en 2024 y se proyecta que alcance los USD 3,57 mil millones para 2032, con una CAGR del 4,8% durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Perspectivas clave del mercado del éter de glicol de la serie E |

|

Segmentación |

|

|

Países cubiertos |

EE. UU., Canadá, México, Brasil, Argentina, Resto de Sudamérica, Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Sudáfrica, Israel, Resto de Medio Oriente y África |

|

Actores clave del mercado |

Dow (EE. UU.), LyondellBasell Industries NV (Países Bajos), BASF SE (Alemania), ADM (EE. UU.), Global Bio-chem Technology Group Company Limited. (China), DuPont (EE. UU.), SKC (Corea del Sur), Temix Oleo (Italia), INEOS Oxide (Suiza), Huntsman International Ll.C (EE. UU.), ADEKA CORPORATION (Japón), Chaoyang Chemicals, Inc. (EE. UU.), Manali Petrochemicals Limited (India), Haike Chemical Group Co., Ltd. (China), Arch Chemicals Inc. (EE. UU.), Repsol (España), Midland Company (EE. UU.), Helm AG (Alemania), Shell Plc (Reino Unido) |

|

Oportunidades de mercado |

|

Definición del mercado de éter de glicol de la serie E

Los éteres de alquilo de propileno o etilenglicol sirven como base para la familia de disolventes conocidos como éteres de glicol. El óxido de etileno es la materia prima para los éteres de glicol de la serie e, de ahí el nombre. Los éteres de mono, di y trietilenglicol son posibles mediante la unión de unidades repetidas de la serie e del grupo de óxido de etileno.

Dinámica del mercado del éter de glicol de la serie E

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Alto uso en la industria cosmética y del cuidado personal

La demanda de éter de glicol de la serie e está en auge en el negocio de la cosmética y el cuidado personal para diversos usos en el cuidado de la piel, el cabello, el cuerpo y otras áreas. La necesidad mundial de cosméticos de color, las crecientes tendencias de higiene y belleza y los estilos de vida cambiantes contribuyen al éxito de la industria de la cosmética y el cuidado personal. Por ejemplo, la Administración de Comercio Internacional estima que la industria de la belleza y el cuidado personal de Tailandia generará 4.200 millones de dólares en ingresos en 2021 y se expandirá a una tasa del 5,5 por ciento hasta 2025. La mayor parte de esta industria está compuesta por el 42 por ciento del cuidado de la piel, el 12 por ciento del cuidado dental, el 14 por ciento de los jabones y productos de higiene y el 15 por ciento del cuidado del cabello. La demanda de éter de glicol de la serie e está aumentando como resultado del crecimiento de la industria de la cosmética y el cuidado personal, que está impulsando el mercado de esta sustancia y creando importantes oportunidades de crecimiento.

- Aumento de las aplicaciones en el sector farmacéutico

En el sector farmacéutico, los éteres de glicol de la serie e, como el éter propílico de etilenglicol (EGPE), el éter butílico de etilenglicol (EGBE) y otros, tienen una gran demanda para su uso en medicamentos, laxantes, ungüentos, gotas para los ojos y otros productos. Debido a las nuevas enfermedades médicas, la creación de nuevos medicamentos y las mejoras en la infraestructura del sistema médico, el sector farmacéutico se está expandiendo rápidamente. Por ejemplo, la industria farmacéutica en la India estaba valorada en 42 mil millones de dólares en 2021 y se espera que alcance los 120-130 mil millones de dólares en 2030, según la Federación de Valor de Marca de la India (IBEF). Las aplicaciones del éter de glicol de la serie e en cremas, medicamentos y otros tratamientos se están expandiendo a medida que aumenta la producción y la expansión farmacéuticas. Por lo tanto, la industria del éter de glicol de la serie e está siendo impulsada y promete un crecimiento significativo debido a la creciente demanda de medicamentos.

Además, el creciente uso de éter en varias industrias, la adopción de éter para la producción de extracción de medicamentos en la industria farmacéutica y la creciente demanda de productos debido a su fuerza solvente, baja volatilidad y otras propiedades son algunos de los factores que probablemente impulsarán el crecimiento del mercado de éter de glicol de la serie e en el período de pronóstico.

Oportunidades

- Avances, investigación y desarrollo y concientización

Además, los avances de los fabricantes y las inversiones significativas en actividades de investigación y desarrollo que mejoran aún más las aplicaciones de los productos, amplían las oportunidades rentables para los actores del mercado en el período de pronóstico de 2025 a 2032. Además, la creciente conciencia sobre los beneficios del éter de glicol de la serie e expandirá aún más el crecimiento futuro del mercado del éter de glicol de la serie e.

Restricciones/Desafíos

- Menor adopción debido a efectos tóxicos

Los éteres de etilenglicol de la serie E son venenosos y afectan negativamente a la salud humana y al medio ambiente. Los éteres de etilenglicol de bajo peso molecular, como el etil éter de etilenglicol (EGEE), el etil cellosolve y el metil éter de etilenglicol (EGME), liberan gases tóxicos a la atmósfera. Esto generará una menor adopción para el crecimiento del mercado de éteres de glicol de la serie E.

- Regulaciones estrictas

Existen varias organizaciones que han promulgado una serie de limitaciones y leyes para limitar el uso de estos peligrosos éteres de glicol. Además, la Unión Europea y Canadá han implementado leyes que prohíben el uso de éteres de glicol de la serie e en bienes de consumo. Por ejemplo, el Anexo XVII de REACH impone restricciones a los materiales nocivos que se pueden encontrar en los bienes de consumo, como los diferentes éteres de glicol. Como resultado de estas limitaciones, el mercado se enfrenta a un dilema, ya que la demanda y las aplicaciones de los éteres de glicol de la serie e se ven significativamente afectadas y se ralentizan. Por lo tanto, estas restricciones plantean un desafío para la tasa de crecimiento del mercado de éteres de glicol de la serie e.

Este informe de mercado de éter de glicol de serie e proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis de crecimiento estratégico del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de éter de glicol de serie e, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado del éter de glicol de la serie E

El mercado de éter de glicol de la serie E está segmentado en función del tipo, la aplicación y el peso molecular. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Éter propílico de etilenglicol (EGPE)

- Éter butílico de etilenglicol (EGBE)

- Acetato de éter butílico de etilenglicol (EGBEA)

- Otros

Solicitud

- Pinturas y recubrimientos

- Tinta de impresión

- Limpiadores

- Cosmética y cuidado personal

- Productos farmacéuticos

- Automotor

- Intermedios químicos

- Otros

Peso molecular

- Éter de glicol de serie E de bajo peso molecular

- Éter de glicol de serie E de alto peso molecular

Análisis regional del mercado de éter de glicol de la serie E

Se analiza el mercado de éter de glicol de la serie e y se proporcionan información y tendencias del tamaño del mercado por país, tipo, aplicación y peso molecular como se menciona anteriormente.

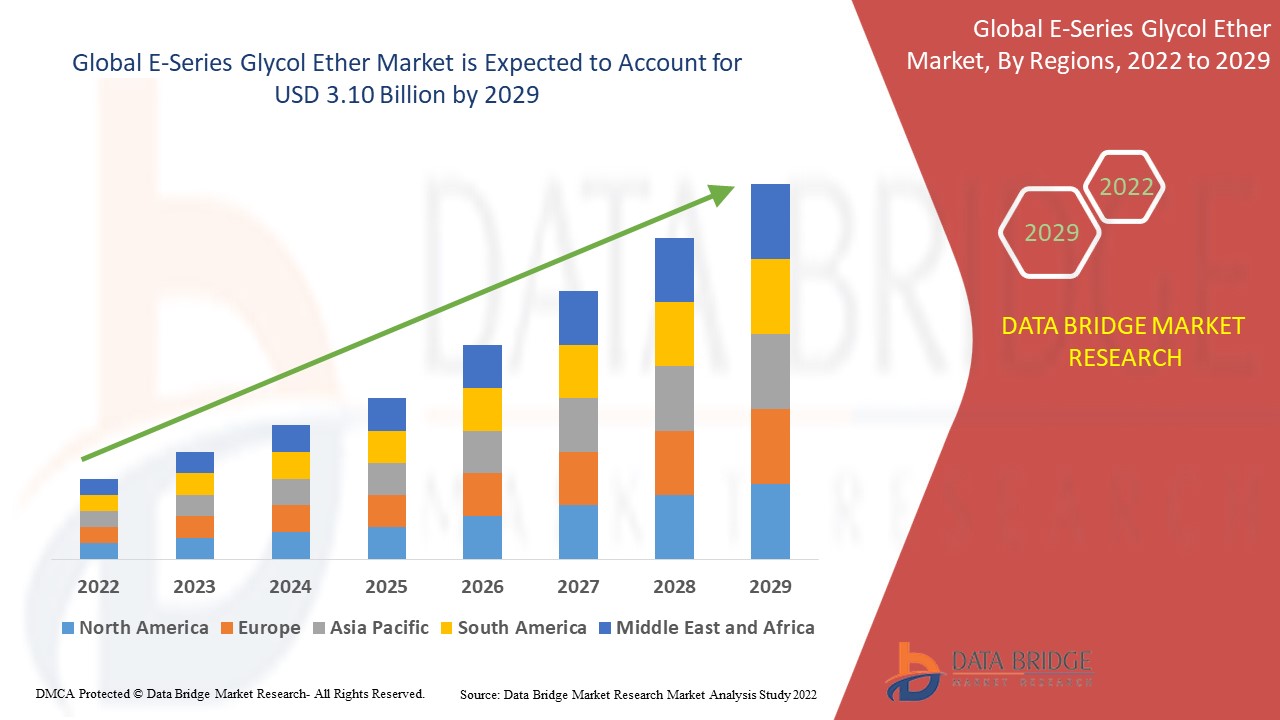

Los países cubiertos en el informe de mercado de éter de glicol de la serie e son EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto, Sudáfrica, Resto de Medio Oriente y África (MEA como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur.

América del Norte domina el mercado en términos de participación de mercado e ingresos de mercado y seguirá manteniendo su dominio durante el período de pronóstico de 2025 a 2032. El crecimiento del mercado en esta región se atribuye a la creciente inversión de varias empresas para el desarrollo de productos en la región.

Por otra parte, se estima que Asia-Pacífico mostrará un crecimiento lucrativo durante el período previsto de 2025 a 2032, debido al aumento de las aplicaciones de limpiadores, pinturas y recubrimientos y productos farmacéuticos en la región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado del éter de glicol de la serie E

El panorama competitivo del mercado de éter de glicol de la serie e proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento del producto, la amplitud y la variedad del producto, el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de éter de glicol de la serie e.

Los líderes del mercado de éter de glicol de la serie E que operan en el mercado son:

- Dow (Estados Unidos)

- LyondellBasell Industries NV (Países Bajos)

- BASF SE (Alemania)

- ADM (Estados Unidos)

- Compañía Global Bio-chem Technology Group Limited (China)

- DuPont (Estados Unidos)

- SKC (Corea del Sur)

- Temix Oleo (Italia)

- Óxido de INEOS (Suiza)

- Huntsman International LLC (Estados Unidos)

- CORPORACIÓN ADEKA (Japón)

- Chaoyang Chemicals, Inc. (Estados Unidos)

- Petroquímica Manali Limitada (India)

- Grupo químico Haike Co., Ltd. (China)

- Arch Chemicals Inc., (Estados Unidos)

- Repsol (España)

- Helm AG (Alemania)

- Shell Plc (Reino Unido)

Últimos avances en el mercado de éter de glicol de serie E

- En julio de 2021, India Glycols y Clariant establecieron una nueva empresa conjunta, en la que IGL posee una participación del 49 por ciento y Clariant una del 51 por ciento. El proyecto tenía como objetivo aumentar la producción de derivados de óxido de etileno ecológicos y otros, abriendo nuevas oportunidades de mercado.

- En noviembre de 2021, la planta de etilenglicol 3 de The Jubail United Petrochemical Company comenzó a producir, según un anuncio de SABIC. La nueva instalación emplea tecnología de vanguardia, reduce las emisiones y brinda sostenibilidad en el mercado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.