Global Digital Oilfield Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

23,580.66

36,298.83

2021

2029

23,580.66

36,298.83

2021

2029

| 2022 –2029 | |

| USD 23,580.66 | |

| USD 36,298.83 | |

|

|

|

|

Mercado mundial de yacimientos petrolíferos digitales, por oferta (software, hardware y servicios), proceso (optimización de la producción, optimización de yacimientos, optimización de la perforación, gestión de la seguridad y otros), tecnología (IoT y dispositivos móviles, IA y análisis avanzados, computación en la nube , robótica y otros), aplicación (en tierra y en alta mar): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado de yacimientos petrolíferos digitales

Si bien el creciente avance continuo hacia tecnologías inalámbricas, análisis de datos, movilidad y plataformas de recolección, las crecientes actividades de E&P en los sectores terrestres y marinos impulsadas por la continua recuperación del precio del petróleo, la continua disminución de la producción de los pozos convencionales junto con una creciente inclinación hacia el diseño de un proceso económico de recuperación de pozos, la creciente implementación de sistemas mejorados de recuperación de petróleo junto con el creciente número de campos de gas maduros en todo el Medio Oriente son los principales factores, entre otros, que se espera que impulsen el mercado mundial de campos petrolíferos digitales.

Sin embargo, los crecientes retrasos en el proceso de toma de decisiones mediante la implementación de diversas herramientas analíticas y las crecientes amenazas a la seguridad cibernética son los principales factores que pueden restringir la incorporación de nuevos talentos digitales y la creciente interoperabilidad de múltiples componentes del sistema de diferentes proveedores de soluciones.

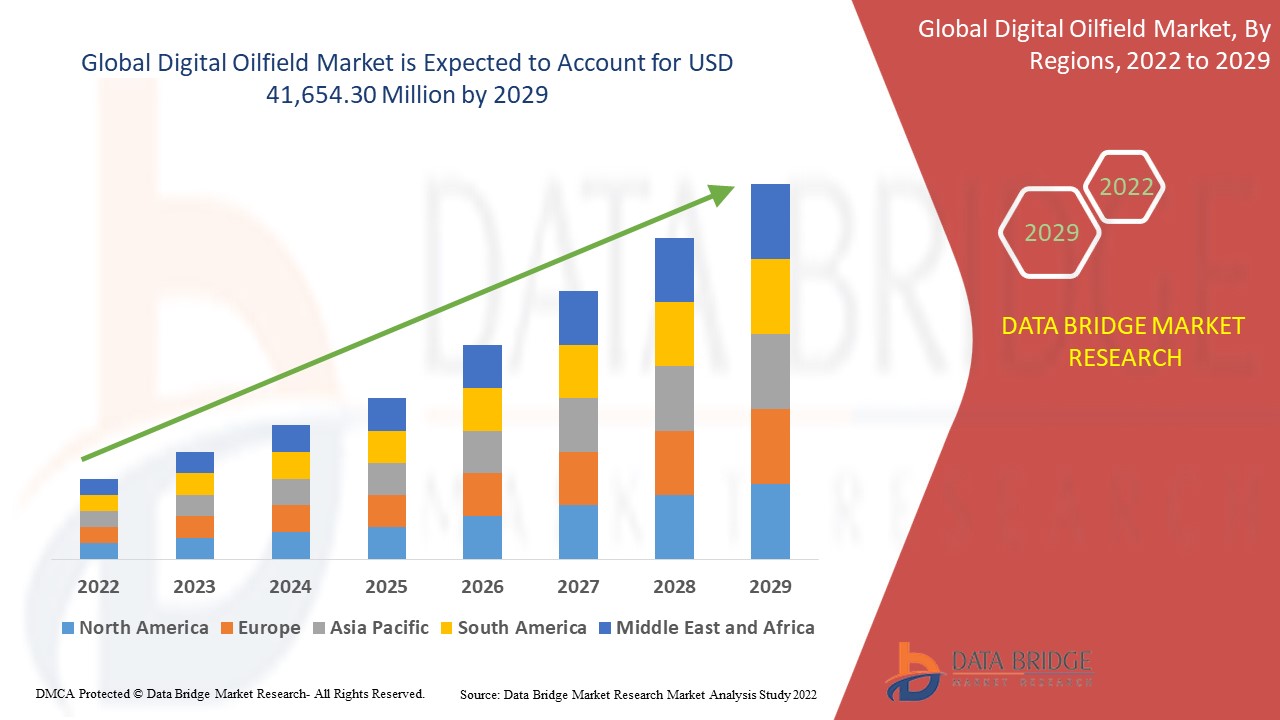

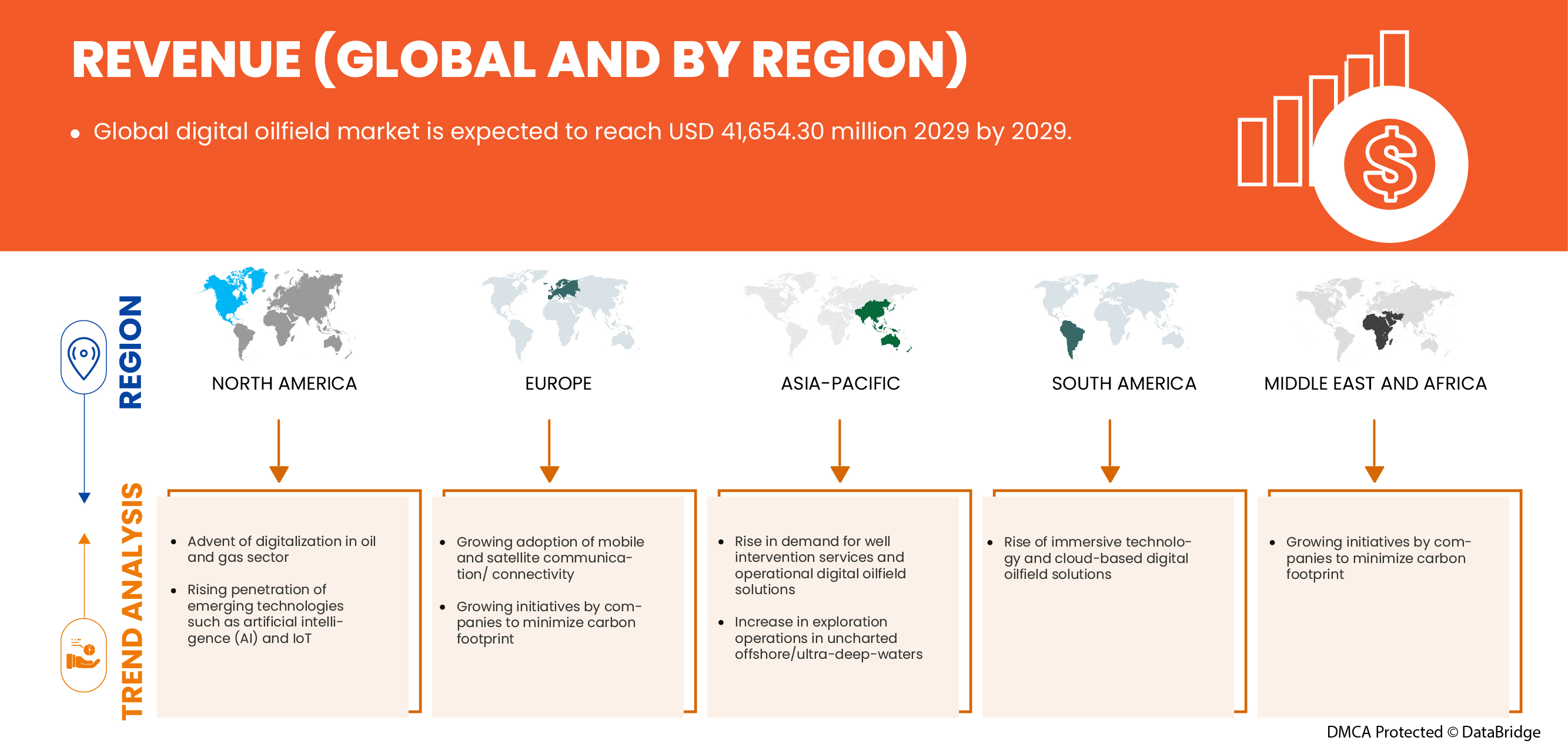

Data Bridge Market Research analiza que se espera que el mercado mundial de yacimientos petrolíferos digitales alcance un valor de 41.654,30 millones de dólares en 2029, con una tasa compuesta anual del 7,2 % durante el período de pronóstico. El informe sobre el mercado mundial de yacimientos petrolíferos digitales también cubre de forma exhaustiva los precios, las patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por oferta (software, hardware y servicios), proceso (optimización de producción, optimización de yacimientos, optimización de perforación, gestión de seguridad y otros), tecnología (IoT y dispositivos móviles, inteligencia artificial y análisis avanzados, computación en la nube, robótica y otros), aplicación (en tierra y en alta mar) |

|

Países cubiertos |

Estados Unidos, Canadá, México, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, resto de Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, resto de Asia-Pacífico, Arabia Saudita, Sudáfrica, Egipto, Israel, Emiratos Árabes Unidos y resto de Oriente Medio y África. |

|

Actores del mercado cubiertos |

Baker Hughes Company, IBM Corporation, Microsoft, Rockwell Automation, Inc., Halliburton Energy Services, Inc., CGG, Schlumberger Limited, Redline Communications, Osperity, Emerson Electric Co., Siemens AG., ABB, Honeywell International Inc., OleumTech, NOV Inc., Petrolink., Weatherford, Katalyst Data Management, Digi International Inc., Kongsberg Digital (una subsidiaria de KONGSBERG), entre otros. |

Definición de mercado

El campo petrolífero digital se define como la automatización de las actividades de exploración, producción y producción de petróleo. Es una parte de la industria energética que ha incorporado software avanzado y técnicas de análisis de datos en sus operaciones para proporcionar mejores resultados y mejorar la rentabilidad del proceso de producción. Ofrecen ventajas como una tasa de producción optimizada de hidrocarburos, mayor seguridad, protección del medio ambiente y facilidad para encontrar reservas y explotarlas al máximo. El campo petrolífero digital se trata de sensores y pantallas instaladas en un campo de petróleo y gas. La integración de procesos comerciales con tecnologías digitales y la automatización de flujos de trabajo es un concepto que permite a una empresa reducir la interferencia humana y minimizar los riesgos asociados con las operaciones de petróleo y gas. El flujo de datos e información se integra rápidamente con la interfaz de análisis, lo que permite tomar decisiones oportunas y mejores para la operación.

Dinámica del mercado mundial de yacimientos petrolíferos digitales

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

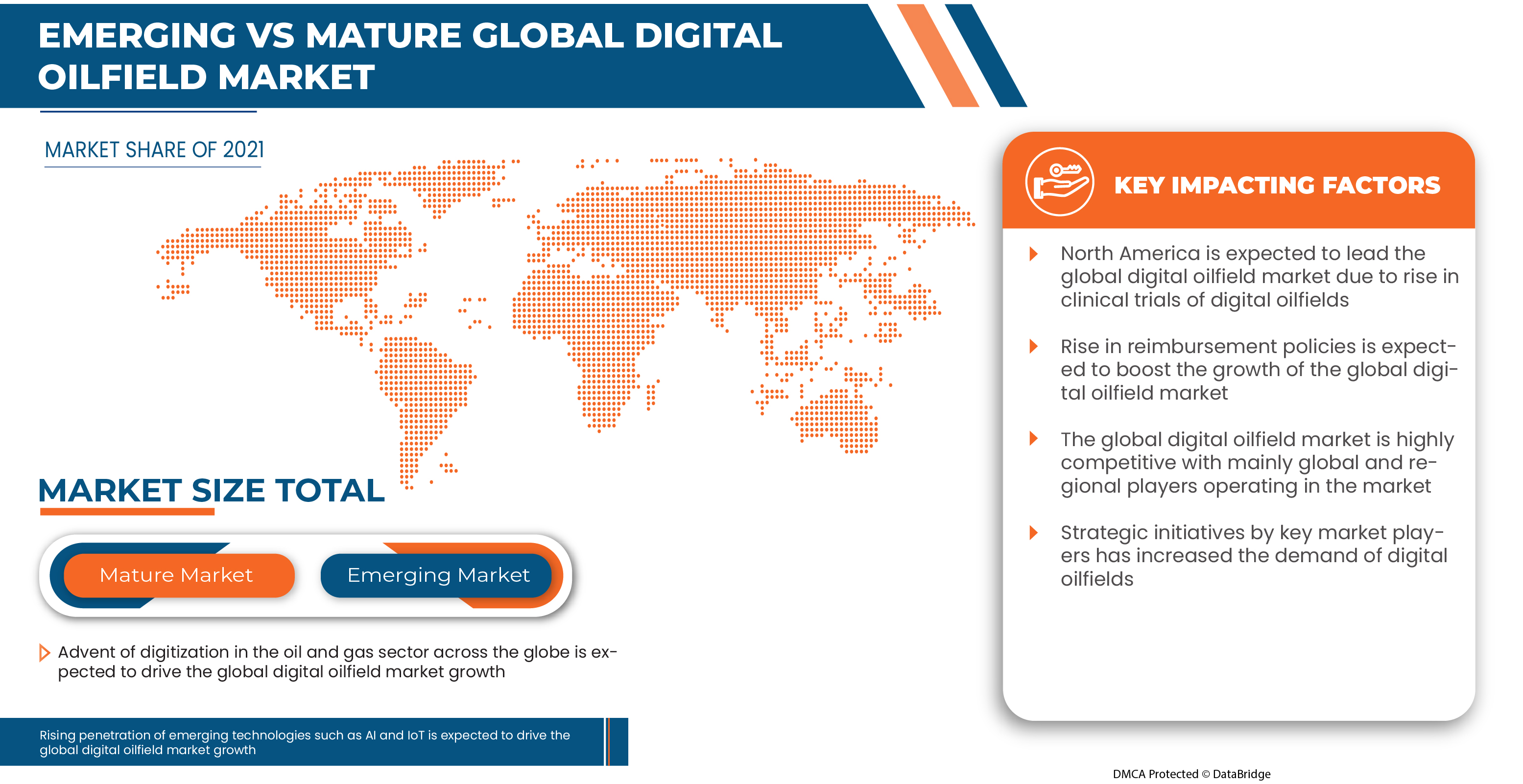

- La llegada de la digitalización al sector del petróleo y el gas en toda la región

La digitalización es cada vez más evidente y la tecnología digital está transformando el sector del petróleo y el gas, impulsada aún más por los datos en tiempo real, la computación en la nube y los mundos digitales. Los yacimientos petrolíferos digitales se han diseñado para revisar los sistemas de petróleo y gas y permitir la optimización total en toda la cadena de suministro mediante la combinación de la gestión de procesos con tecnologías digitales. Además, la adopción de yacimientos petrolíferos digitales ayuda a las empresas de petróleo y gas a realizar la transición hacia prácticas más ecológicas. Por ejemplo, la inteligencia artificial y el análisis predictivo pueden ayudar a identificar derrames de petróleo después o incluso antes de que ocurran, lo que ayuda a las empresas a minimizar diversos daños. Al invertir en tecnologías de yacimientos petrolíferos digitales, los operadores de petróleo y gas pueden automatizar el mantenimiento y gestionar los equipos de forma más eficiente mientras siguen impulsando la innovación.

- Creciente penetración de tecnologías emergentes como la inteligencia artificial (IA) y la IoT

La tecnología juega un papel importante en el crecimiento de cada negocio y también ayuda a las organizaciones a mejorar la calidad y la velocidad de trabajo al respaldar y mejorar las operaciones. Las empresas están adoptando técnicas de análisis de big data en sus negocios para mejorar las operaciones y facilitar el rendimiento de las instalaciones. Las tecnologías disruptivas como la inteligencia artificial (IA) y la Internet de las cosas (IdC) están impulsando la transformación digital en todo el mercado global de automatización del petróleo y el gas, aumentando así la eficiencia, la seguridad y la sostenibilidad.

Oportunidades

- Aumento de las operaciones de exploración en zonas marinas desconocidas y aguas ultraprofundas

El aumento del consumo de petróleo y productos derivados del petróleo en todo el mundo ha sido muy incierto en las últimas dos décadas. La incertidumbre refleja la demanda y la oferta de petróleo y productos derivados del petróleo, que impulsa la producción de petróleo y gas o la extracción de nuevos pozos petrolíferos a nivel mundial. Además, las compañías petroleras están investigando los yacimientos petrolíferos para comprender la adopción de soluciones digitales para aumentar la capacidad de producción. Algunas empresas, como ABB y CGG, participan en la exploración de nuevos yacimientos petrolíferos en tierra y en alta mar. Hoy en día, el 70% del petróleo y el gas del mundo se extrae de sitios en tierra, y el 30% restante se extrae de yacimientos petrolíferos en alta mar. Por lo tanto, la exploración del yacimiento petrolífero en tierra es cada vez mayor y ha sido muy común, y la mayoría de las empresas han explorado la mayoría de los yacimientos petrolíferos en tierra.

Restricciones/Desafíos

- Aumento de las amenazas a la ciberseguridad debido a las iniciativas digitales

Las compañías de petróleo y gas dependen de sistemas de control y datos altamente conectados para facilitar la exploración, la perforación y el monitoreo de sistemas, y para optimizar la producción de recursos terrestres y marinos. A medida que su dependencia de la tecnología de TI ha aumentado, la vulnerabilidad a los ciberataques también ha aumentado en los últimos años.

El auge de los yacimientos petrolíferos digitales ha hecho que las empresas de petróleo y gas dependan cada vez más de los datos para mantener la producción. A medida que estas tecnologías se generalizan, el riesgo cibernético para la industria del petróleo y el gas ha seguido aumentando.

- Interoperabilidad de múltiples componentes del sistema de diferentes proveedores de soluciones

Los sistemas digitales para yacimientos petrolíferos están ganando importancia en la industria del petróleo y el gas debido a su eficaz monitoreo, capacidades de supervisión y control remoto. Este sistema o tecnología digital integra activos de petróleo y gas como tuberías, pozos, maquinaria y muchos otros. Diferentes proveedores ofrecen una amplia gama de soluciones digitales para yacimientos petrolíferos, que incluyen software SCADA, computadoras, sensores inalámbricos, robótica, computación en la nube, software de configuración y muchos otros.

Las empresas de la industria del petróleo y el gas suelen considerar las mejores y más rentables soluciones digitales, independientemente de los vendedores y proveedores. Sin embargo, estas decisiones se toman especialmente en función de los requisitos, lo que domina la estandarización de productos en función de los requisitos, lo que parece muy desafiante. Se adoptan numerosas soluciones digitales en la industria, lo que crea la necesidad de técnicas de integración adecuadas y fáciles. Además, las soluciones orientadas al cliente serán una limitación para agregar cualquier oferta de hardware o software.

Impacto posterior al COVID-19 en el mercado petrolero digital global

La COVID-19 generó un impacto negativo en el mercado petrolero digital global debido a las regulaciones y reglas de bloqueo en las instalaciones petroleras.

La pandemia de COVID-19 ha afectado al mercado mundial de yacimientos petrolíferos digitales de manera negativa. Sin embargo, el aumento de la demanda de servicios de intervención de pozos y soluciones operativas digitales para yacimientos petrolíferos ha ayudado al mercado a crecer después de la pandemia. Además, el crecimiento ha sido alto desde que se abrió el mercado después de COVID-19, y se espera que haya un crecimiento considerable en el sector debido al auge de la tecnología inmersiva y las soluciones digitales para yacimientos petrolíferos basadas en la nube.

Los proveedores de soluciones están tomando diversas decisiones estratégicas para recuperarse después de la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el campo petrolífero digital. Con esto, las empresas traerán tecnologías avanzadas al mercado. Además, las iniciativas gubernamentales para el uso de tecnología de automatización han llevado al crecimiento del mercado.

Acontecimientos recientes

- En septiembre de 2022, IBM Corporation se asoció con Saudi Data, la Autoridad de Inteligencia Artificial (SDAIA) y el Ministerio de Energía para acelerar las iniciativas de sostenibilidad en Arabia Saudita mediante el uso de inteligencia artificial. Esta asociación ayudará a la empresa a impulsar la digitalización en la industria del petróleo y el gas y acelerar el crecimiento de los ingresos.

- En abril de 2021, Microsoft anunció la asociación con Ambyint para brindar soluciones de exploración y producción de petróleo y gas para optimizar los pozos de elevación por varilla y por émbolo. Esta asociación ayudará a la empresa a aprovechar las soluciones y el software para transformar los yacimientos petrolíferos, atraer clientes hacia la digitalización y acelerar el crecimiento de los ingresos.

Alcance del mercado mundial de yacimientos petrolíferos digitales

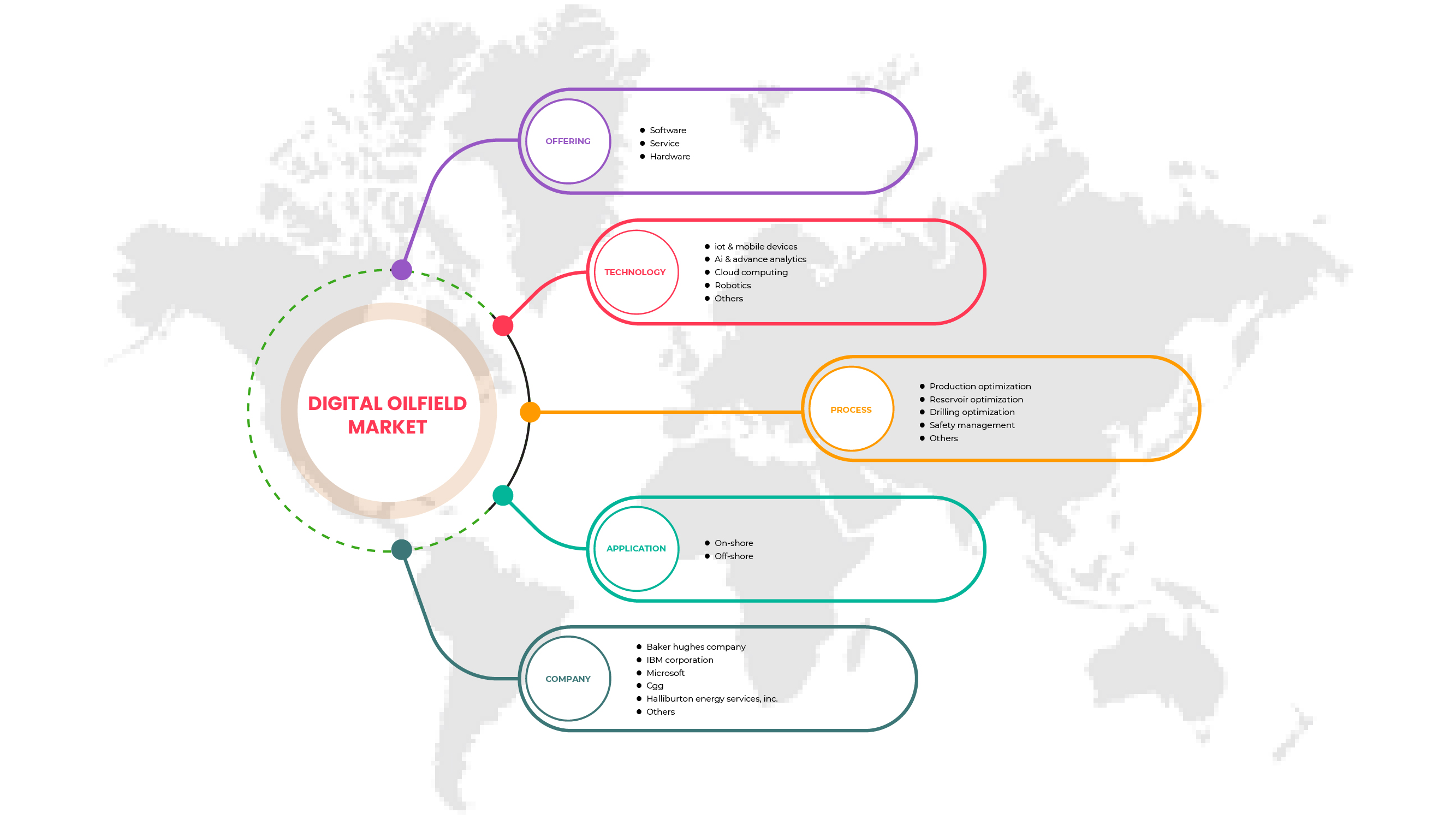

El mercado mundial de yacimientos petrolíferos digitales está segmentado en función de la oferta, el proceso, la tecnología y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los escasos segmentos de crecimiento de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Ofrenda

- Software

- Servicios

- Hardware

Sobre la base de la oferta, el mercado petrolero digital global se segmenta en software, servicios y hardware.

Proceso

- Optimización de la producción

- Optimización de yacimientos

- Optimización de la perforación

- Gestión de la seguridad

- Otros

Sobre la base del proceso, el mercado petrolero digital global se ha segmentado en optimización de la producción, optimización de yacimientos, optimización de la perforación, gestión de la seguridad y otros.

Tecnología

- IoT y dispositivos móviles

- Inteligencia artificial y análisis avanzados

- Computación en la nube

- Robótica

- Otros

Sobre la base de la tecnología, el mercado petrolero digital global se ha segmentado en IoT y dispositivos móviles, IA y análisis avanzado, computación en la nube, robótica y otros.

Solicitud

- En tierra

- Costa afuera

Sobre la base de la aplicación, el mercado petrolero digital global se segmenta en tierra y mar adentro.

Análisis y perspectivas regionales del mercado mundial de yacimientos petrolíferos digitales

Se analiza el mercado petrolero digital global y se proporcionan información y tendencias del tamaño del mercado por país, oferta, proceso, tecnología y aplicación, como se menciona anteriormente.

Algunos de los países cubiertos en el informe global sobre el mercado petrolero digital son EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, el resto de Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, el resto de Asia-Pacífico, Arabia Saudita, Sudáfrica, Egipto, Israel, Emiratos Árabes Unidos y el resto de Medio Oriente y África.

Se espera que América del Norte domine el mercado petrolero digital global debido a la creciente adopción de la IoT industrial, especialmente en el sector del petróleo y el gas. Se anticipa que Estados Unidos domine en la región de América del Norte, ya que es el hogar de muchos gigantes tecnológicos en todo el mundo. Alemania puede dominar en la región de Europa debido a la creciente demanda de petróleo y la automatización en la industria. Se espera que China domine en la región de Asia y el Pacífico debido a la fuerte inversión en la digitalización marina de la industria del petróleo y el gas.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado global de los yacimientos petrolíferos digitales

El panorama competitivo del mercado mundial de yacimientos petrolíferos digitales proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado mundial de yacimientos petrolíferos digitales.

Algunos de los principales actores que operan en el mercado petrolero digital global son Baker Hughes Company, IBM Corporation, Microsoft, Rockwell Automation, Inc., Halliburton Energy Services, Inc., CGG, Schlumberger Limited, Redline Communications, Osperity, Emerson Electric Co., Siemens AG., ABB, Honeywell International Inc., OleumTech, NOV Inc., Petrolink., Weatherford, Katalyst Data Management, Digi International Inc., Kongsberg Digital (una subsidiaria de KONGSBERG), entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL DIGITAL OILFIELD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 PRICE TREND ANALYSIS

4.6 LIST OF BUYERS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATIONS AND STANDARDS COVERAGE

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT'S ROLE

4.10.4 ANALYST RECOMMENDATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF DIGITIZATION IN THE OIL AND GAS SECTOR ACROSS THE REGION

5.1.2 RISING PENETRATION OF EMERGING TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE (AI) AND IOT

5.1.3 GROWING ADOPTION OF MOBILE AND SATELLITE COMMUNICATION/ CONNECTIVITY

5.1.4 GROWING INITIATIVES BY COMPANIES TO MINIMIZE CARBON FOOTPRINT

5.2 RESTRAINT

5.2.1 INCREASE IN CYBER SECURITY THREATS DUE TO DIGITAL INITIATIVES

5.3 OPPORTUNITIES

5.3.1 RISE IN DEMAND FOR WELL INTERVENTION SERVICES AND OPERATIONAL DIGITAL OILFIELD SOLUTIONS

5.3.2 INCREASE IN EXPLORATION OPERATIONS IN UNCHARTED OFFSHORE/ULTRA-DEEP-WATERS

5.3.3 RISE OF IMMERSIVE TECHNOLOGY AND CLOUD-BASED DIGITAL OILFIELDS SOLUTION

5.4 CHALLENGES

5.4.1 INTEROPERABILITY OF MULTIPLE SYSTEM COMPONENTS FROM DIFFERENT SOLUTION PROVIDERS

5.4.2 TRADE BARRIERS, LOW PRODUCTION, AND RESTRICTIONS IN LOGISTICS

6 GLOBAL DIGITAL OILFIELD MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 HOSTED

6.2.2 ON-PREMISE

6.3 SERVICES

6.4 HARDWARE

6.4.1 DISTRIBUTED CONTROL SYSTEMS

6.4.2 SUPERVISORY CONTROL AND DATA ACQUISITION

6.4.3 COMPUTER EQUIPMENT AND APPLICATION HARDWARE

6.4.4 SMART-WELLS

6.4.5 WIRELESS SENSORS

6.4.6 PROCESS AUTOMATION

6.4.7 SAFETY SYSTEMS

6.4.8 OTHERS

7 GLOBAL DIGITAL OILFIELD MARKET, BY PROCESS

7.1 OVERVIEW

7.2 PRODUCTION OPTIMIZATION

7.3 RESERVOIR OPTIMIZATION

7.4 DRILLING OPTIMIZATION

7.5 SAFETY MANAGEMENT

7.6 OTHERS

8 GLOBAL DIGITAL OILFIELD MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 IOT & MOBILE DEVICES

8.3 AI & ADVANCE ANALYTICS

8.4 CLOUD COMPUTING

8.5 ROBOTICS

8.6 OTHERS

9 GLOBAL DIGITAL OILFIELD MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ON-SHORE

9.3 OFF-SHORE

10 GLOBAL DIGITAL OILFIELD MARKET, BY REGION

10.1 OVERVIEW

10.2 NORTH AMERICA

10.2.1 U.S.

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 U.K.

10.3.4 TURKEY

10.3.5 RUSSIA

10.3.6 ITALY

10.3.7 SPAIN

10.3.8 SWITZERLAND

10.3.9 BELGIUM

10.3.10 NETHERLANDS

10.3.11 REST OF EUROPE

10.4 ASIA-PACIFIC

10.4.1 CHINA

10.4.2 INDIA

10.4.3 INDONESIA

10.4.4 AUSTRALIA

10.4.5 MALAYSIA

10.4.6 THAILAND

10.4.7 JAPAN

10.4.8 SOUTH KOREA

10.4.9 SINGAPORE

10.4.10 PHILIPPINES

10.4.11 REST OF ASIA-PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 SAUDI ARABIA

10.5.2 U.A.E.

10.5.3 EGYPT

10.5.4 SOUTH AFRICA

10.5.5 ISRAEL

10.5.6 REST OF MIDDLE EAST AND AFRICA

10.6 SOUTH AMERICA

10.6.1 BRAZIL

10.6.2 ARGENTINA

10.6.3 REST OF SOUTH AMERICA

11 GLOBAL DIGITAL OILFIELD MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 BAKER HUGHES COMPANY

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SOLUTION PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 IBM CORPORATION

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MICROSOFT

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 CGG

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 HALLIBURTON ENERGY SERVICES, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCTS PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 SOLUTIONS PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 DIGI INTERNATIONAL INC.

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENT

13.8 EMERSON ELECTRIC CO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 SOLUTION PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 HONEYWELL INTERNATIONAL INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCTS PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 KATALYST DATA MANAGEMENT

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KONGSBERG DIGITAL (A SUBSIDIARY OF KONGSBERG)

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCTS PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 NOV INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCTS PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 OLEUMTECH

13.13.1 COMPANY SNAPSHOT

13.13.2 SOLUTION PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 OSPERITY

13.14.1 COMPANY SNAPSHOT

13.14.2 SOLUTION PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PETROLINK.

13.15.1 COMPANY SNAPSHOT

13.15.2 TECHNOLOGY PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 REDLINE COMMUNICATIONS

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 SERVICE PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 ROCKWELL AUTOMATION, INC.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 SOLUTION PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SCHLUMBERGER LIMITED

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCTS PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SIEMENS AG.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 SOLUTION PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 WEATHERFORD

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 GLOBAL DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 GLOBAL SOFTWARE IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL SERVICES IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL HARDWARE IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL HARDWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL PRODUCTION OPTIMIZATION IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL RESERVOIR OPTIMIZATION IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL DRILLING OPTIMIZATION IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL SAFETY MANAGEMENT IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL OTHERS IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL IOT & MOBILE DEVICES IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL AI & ADVANCE ANALYTICS IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL CLOUD COMPUTING IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL ROBOTICS IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL OTHERS IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL DIGITAL OILFIELD MARKET, BY APPLICATION 2020-2029 (USD MILLION)

TABLE 20 GLOBAL ON-SHORE IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL OFF-SHORE IN DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL DIGITAL OILFIELD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA DIGITAL OILFIELD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 30 U.S. DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 31 U.S. SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 32 U.S. HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 34 U.S. DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 35 U.S. DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 CANADA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 37 CANADA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 38 CANADA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 CANADA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 40 CANADA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 41 CANADA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 MEXICO DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 MEXICO SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 44 MEXICO HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 MEXICO DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 46 MEXICO DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 47 MEXICO DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE DIGITAL OILFIELD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 49 EUROPE DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 50 EUROPE SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 53 EUROPE DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 54 EUROPE DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 GERMANY DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 56 GERMANY SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 GERMANY DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 59 GERMANY DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 GERMANY DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 FRANCE DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 FRANCE SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 63 FRANCE HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 65 FRANCE DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 FRANCE DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.K. DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 68 U.K. SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 69 U.K. HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.K. DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 71 U.K. DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 72 U.K. DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 TURKEY DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 TURKEY SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 75 TURKEY HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 TURKEY DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 77 TURKEY DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 78 TURKEY DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 RUSSIA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 80 RUSSIA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 81 RUSSIA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 RUSSIA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 ITALY DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 86 ITALY SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 87 ITALY HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 89 ITALY DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 ITALY DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 SPAIN DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 92 SPAIN SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 93 SPAIN HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 SPAIN DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 95 SPAIN DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 96 SPAIN DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SWITZERLAND DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 98 SWITZERLAND SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 99 SWITZERLAND HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SWITZERLAND DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 101 SWITZERLAND DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 SWITZERLAND DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 BELGIUM DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 104 BELGIUM SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 105 BELGIUM HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 BELGIUM DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 107 BELGIUM DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 108 BELGIUM DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 NETHERLANDS DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 NETHERLANDS SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 111 NETHERLANDS DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 REST OF EUROPE DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 115 ASIA-PACIFIC DIGITAL OILFIELD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 116 ASIA-PACIFIC DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 117 ASIA-PACIFIC SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 118 ASIA-PACIFIC HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 ASIA-PACIFIC DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 120 ASIA-PACIFIC DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 ASIA-PACIFIC DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 CHINA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 123 CHINA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 124 CHINA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CHINA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 126 CHINA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 127 CHINA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 INDIA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 129 INDIA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 130 INDIA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 INDIA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 132 INDIA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 133 INDIA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 INDONESIA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 138 INDONESIA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 139 INDONESIA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 AUSTRALIA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 141 AUSTRALIA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 142 AUSTRALIA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 AUSTRALIA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 144 AUSTRALIA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 145 AUSTRALIA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 THAILAND DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 153 THAILAND SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 154 THAILAND HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 THAILAND DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 156 THAILAND DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 157 THAILAND DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 JAPAN DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 159 JAPAN SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 160 JAPAN HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 JAPAN DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 162 JAPAN DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 JAPAN DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 SOUTH KOREA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 165 SOUTH KOREA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 166 SOUTH KOREA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 SOUTH KOREA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 168 SOUTH KOREA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 169 SOUTH KOREA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 SINGAPORE DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 171 SINGAPORE SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 172 SINGAPORE HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 SINGAPORE DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 174 SINGAPORE DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 175 SINGAPORE DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 PHILIPPINES DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 177 PHILIPPINES SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 178 PHILIPPINES HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 PHILIPPINES DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 180 PHILIPPINES DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 181 PHILIPPINES DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 REST OF ASIA-PACIFIC DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 SAUDI ARABIA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 191 SAUDI ARABIA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 192 SAUDI ARABIA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 SAUDI ARABIA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 194 SAUDI ARABIA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 195 SAUDI ARABIA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 U.A.E DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 197 U.A.E SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 198 U.A.E HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 199 U.A.E DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 200 U.A.E DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 201 U.A.E DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 EGYPT DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 203 EGYPT SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 204 EGYPT HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 EGYPT DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 206 EGYPT DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 207 EGYPT DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 208 SOUTH AFRICA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 209 SOUTH AFRICA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 210 SOUTH AFRICA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 SOUTH AFRICA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 212 SOUTH AFRICA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 213 SOUTH AFRICA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 214 ISRAEL DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 215 ISRAEL SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 216 ISRAEL HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 ISRAEL DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 218 ISRAEL DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 219 ISRAEL DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 220 REST OF MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 221 SOUTH AMERICA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 222 SOUTH AMERICA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 223 SOUTH AMERICA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 224 SOUTH AMERICA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 225 SOUTH AMERICA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 226 SOUTH AMERICA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 227 BRAZIL DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 228 BRAZIL SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 229 BRAZIL HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 BRAZIL DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 231 BRAZIL DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 232 BRAZIL DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 233 ARGENTINA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 234 ARGENTINA SOFTWARE IN DIGITAL OILFIELD MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 235 ARGENTINA HARDWARE IN DIGITAL OILFIELD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 ARGENTINA DIGITAL OILFIELD MARKET, BY PROCESS, 2020-2029 (USD MILLION)

TABLE 237 ARGENTINA DIGITAL OILFIELD MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 238 ARGENTINA DIGITAL OILFIELD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 239 REST OF SOUTH AMERICA DIGITAL OILFIELD MARKET, BY OFFERING, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 GLOBAL DIGITAL OILFIELD MARKET: SEGMENTATION

FIGURE 2 GLOBAL DIGITAL OILFIELD MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL DIGITAL OILFIELD MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL DIGITAL OILFIELD MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL DIGITAL OILFIELD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL DIGITAL OILFIELD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL DIGITAL OILFIELD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL DIGITAL OILFIELD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL DIGITAL OILFIELD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 GLOBAL DIGITAL OILFIELD MARKET: SEGMENTATION

FIGURE 11 RISING PENETRATION OF EMERGING TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE (AI) AND IOT IS EXPECTED TO BE KEY DRIVERS FOR THE GLOBAL DIGITAL OILFIELD MARKET IN THE FORECAST PERIOD

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL DIGITAL OILFIELD MARKET FROM 2022 TO 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE, AND MIDDLE EAST AND AFRICA IS THE FASTEST GROWING REGION IN THE GLOBAL DIGITAL OILFIELD MARKET IN THE FORECAST PERIOD

FIGURE 14 MIDDLE EAST AND AFRICA IS THE FASTEST GROWING MARKET FOR DIGITAL OILFIELD IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL DIGITAL OILFIELD MARKET

FIGURE 16 INCREASING NUMBER OF RESEARCH AND PATENT FILLING IN THE LAST FEW YEARS

FIGURE 17 ESTIMATED INVESTMENTS IN DIGITAL TECHNOLOGIES IN THE OIL AND GAS INDUSTRY (%) (2021-2025)

FIGURE 18 GLOBAL OIL CONSUMPTION IN EXAJOULE (EJ) FROM THE YEAR 2000 TO 2021:

FIGURE 19 GLOBAL DIGITAL OILFIELD MARKET: BY PRODUCT, 2021

FIGURE 20 GLOBAL DIGITAL OILFIELD MARKET : BY PROCESS, 2021

FIGURE 21 GLOBAL DIGITAL OILFIELD MARKET : BY TECHNOLOGY, 2021

FIGURE 22 GLOBAL DIGITAL OILFIELD MARKET : BY APPLICATION, 2021

FIGURE 23 GLOBAL DIGITAL OILFIELD MARKET: SNAPSHOT (2021)

FIGURE 24 GLOBAL DIGITAL OILFIELD MARKET: BY REGION (2021)

FIGURE 25 GLOBAL DIGITAL OILFIELD MARKET BY REGION (2022 & 2029)

FIGURE 26 GLOBAL DIGITAL OILFIELD MARKET: BY REGION (2021 & 2029)

FIGURE 27 GLOBAL DIGITAL OILFIELD MARKET: BY OFFERING (2022-2029)

FIGURE 28 NORTH AMERICA DIGITAL OILFIELD MARKET: SNAPSHOT (2021)

FIGURE 29 NORTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2021)

FIGURE 30 NORTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 31 NORTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 NORTH AMERICA DIGITAL OILFIELD MARKET: BY OFFERING (2022-2029)

FIGURE 33 EUROPE DIGITAL OILFIELD MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE DIGITAL OILFIELD MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE DIGITAL OILFIELD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE DIGITAL OILFIELD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE DIGITAL OILFIELD MARKET: BY OFFERING (2022-2029)

FIGURE 38 ASIA-PACIFIC DIGITAL OILFIELD MARKET: SNAPSHOT (2021)

FIGURE 39 ASIA-PACIFIC DIGITAL OILFIELD MARKET: BY COUNTRY (2021)

FIGURE 40 ASIA-PACIFIC DIGITAL OILFIELD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 ASIA-PACIFIC DIGITAL OILFIELD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 ASIA-PACIFIC DIGITAL OILFIELD MARKET: BY OFFERING (2022 & 2029)

FIGURE 43 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET: SNAPSHOT (2021)

FIGURE 44 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET: BY COUNTRY (2021)

FIGURE 45 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET: BY OFFERING (2022 & 2029)

FIGURE 48 SOUTH AMERICA DIGITAL OILFIELD MARKET: SNAPSHOT (2021)

FIGURE 49 SOUTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2021)

FIGURE 50 SOUTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 SOUTH AMERICA DIGITAL OILFIELD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 SOUTH AMERICA DIGITAL OILFIELD MARKET: BY OFFERING (2022 & 2029)

FIGURE 53 GLOBAL DIGITAL OILFIELD MARKET: COMPANY SHARE 2021 (%)

FIGURE 54 NORTH AMERICA DIGITAL OILFIELD MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 EUROPE DIGITAL OILFIELD MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 ASIA-PACIFIC DIGITAL OILFIELD MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.