Global Corporate Learning Management System Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

12.92 Billion

USD

83.65 Billion

2024

2032

USD

12.92 Billion

USD

83.65 Billion

2024

2032

| 2025 –2032 | |

| USD 12.92 Billion | |

| USD 83.65 Billion | |

|

|

|

|

Segmentación del mercado global de sistemas de gestión del aprendizaje corporativo por componente (soluciones y servicios), tipo de implementación (local y en la nube), modalidad de impartición (aprendizaje a distancia, formación presencial y aprendizaje combinado), tamaño de la organización (grandes y medianas empresas), sector vertical (software y tecnología, salud, comercio minorista, banca, servicios financieros y seguros, manufactura, gobierno, defensa y telecomunicaciones): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de sistemas de gestión del aprendizaje corporativo

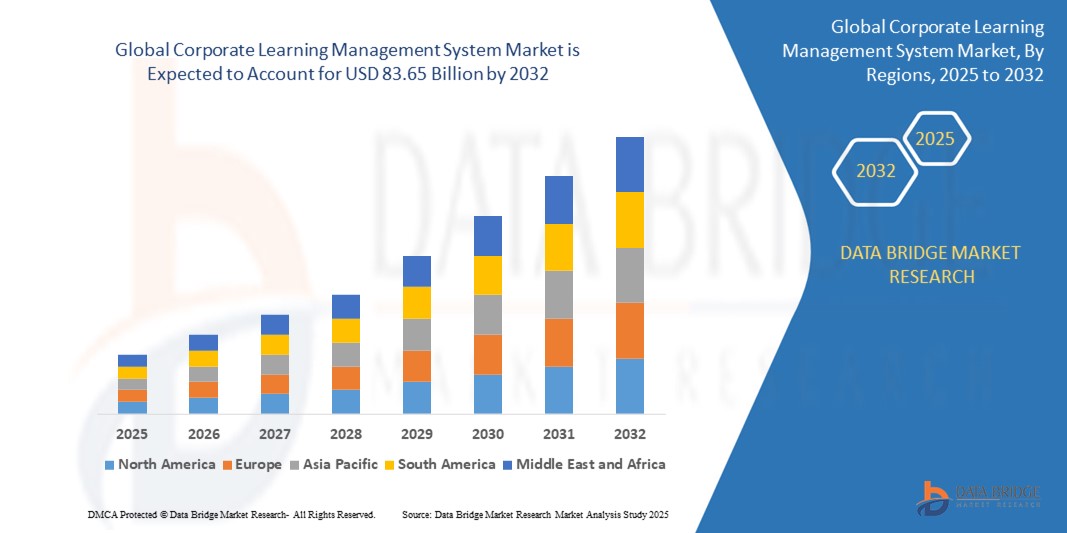

- El tamaño del mercado global del sistema de gestión del aprendizaje corporativo se valoró en USD 12,92 mil millones en 2024 y se espera que alcance los USD 83,65 mil millones para 2032 , con una CAGR del 26,30% durante el período de pronóstico.

- El crecimiento del mercado se ve impulsado en gran medida por la creciente necesidad de mejorar y volver a capacitar a los empleados, la demanda de capacitación escalable y flexible, la necesidad de gestión del cumplimiento, el enfoque en mejorar el compromiso y la retención de los empleados y la creciente dependencia de los conocimientos de aprendizaje basados en datos.

- Los avances tecnológicos como la IA, el microaprendizaje, el aprendizaje móvil y la tecnología inmersiva mejoran la eficacia de los LMS. El auge del teletrabajo exige un aprendizaje digital centralizado. Las soluciones en la nube ofrecen escalabilidad e integración con otros sistemas. La creciente concienciación sobre los beneficios del aprendizaje estratégico también impulsa su adopción.

Análisis del mercado de sistemas de gestión del aprendizaje corporativo

- Los sistemas de gestión del aprendizaje corporativo son plataformas cada vez más vitales para el desarrollo organizacional moderno y la gestión del talento, tanto en entornos corporativos como educativos. Esto se debe a su mayor eficiencia en la impartición de formación, sus sólidas capacidades de seguimiento y generación de informes, y su integración fluida con otros sistemas empresariales.

- La creciente demanda de LMS corporativos se ve impulsada principalmente por el creciente énfasis en el aprendizaje y el desarrollo continuo de los empleados, la creciente necesidad de soluciones de capacitación escalables y flexibles para fuerzas de trabajo diversas y una creciente preferencia organizacional por información basada en datos sobre los resultados del aprendizaje.

- Se espera que América del Norte domine el mercado de sistemas de gestión de aprendizaje corporativo con una participación del 36,5% debido a la importante presencia de corporaciones globales líderes y un fuerte enfoque organizacional en el desarrollo continuo de los empleados y las iniciativas de mejora de las habilidades.

- Se espera que Asia-Pacífico sea la región de más rápido crecimiento en el mercado de sistemas de gestión de aprendizaje corporativo con una participación durante el período de pronóstico debido a la creciente digitalización, un énfasis creciente en el desarrollo de habilidades y avances tecnológicos en países como China, Japón e India.

- Se espera que el segmento de servicios domine el mercado con una participación de mercado del 67,5% debido a la demanda persistente de servicios de implementación personalizados adaptados a las necesidades organizacionales y al requisito crítico de soporte técnico continuo y mantenimiento del sistema.

Alcance del informe y segmentación del mercado del sistema de gestión del aprendizaje corporativo

|

Atributos |

Perspectivas clave del mercado del sistema de gestión del aprendizaje corporativo |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de sistemas de gestión del aprendizaje corporativo

Creciente adopción del aprendizaje personalizado impulsado por IA

- Una tendencia significativa y en auge en el mercado global de Sistemas de Gestión del Aprendizaje (LMS) Corporativo es la creciente integración con la inteligencia artificial (IA) para ofrecer experiencias de aprendizaje personalizadas. Esta fusión de tecnologías está mejorando significativamente la participación del alumnado y el desarrollo de habilidades dentro de las organizaciones.

- Por ejemplo, plataformas como Cornerstone OnDemand y TalentLMS incorporan cada vez más funciones basadas en IA para analizar los estilos de aprendizaje individuales y recomendar itinerarios de contenido personalizados. De igual forma, Degreed utiliza la IA para seleccionar recursos de aprendizaje de diversas fuentes en función de las carencias de habilidades y los objetivos profesionales de cada empleado.

- La integración de IA en LMS corporativos permite funciones como la recomendación de contenido de aprendizaje relevante según el rol de cada persona, su desempeño previo y las deficiencias de habilidades identificadas, lo que resulta en iniciativas de capacitación y reciclaje profesional más efectivas. Además, los chatbots con IA, como los que se encuentran en plataformas como Lattice, ofrecen a los estudiantes apoyo y orientación instantáneos, mejorando así la experiencia de aprendizaje general.

- La integración fluida del aprendizaje personalizado con ecosistemas más amplios de gestión del talento facilita un enfoque más estratégico para el desarrollo de los empleados. A través de una única interfaz, los profesionales de RR. HH. y formación pueden gestionar los programas de formación junto con la gestión del rendimiento, el desarrollo profesional y la planificación de la sucesión, creando un enfoque unificado y basado en datos para el crecimiento del talento.

- Esta tendencia hacia plataformas de aprendizaje más inteligentes, adaptativas y centradas en el alumno está transformando radicalmente las expectativas de los usuarios respecto a la formación corporativa. En consecuencia, empresas como EdCast están desarrollando plataformas de experiencia de aprendizaje (LXP) basadas en IA con funciones como la selección de contenido impulsada por IA y rutas de aprendizaje personalizadas según las necesidades individuales y los objetivos de la organización.

- La demanda de LMS corporativos que ofrezcan un aprendizaje personalizado y sin interrupciones impulsado por IA está creciendo rápidamente en diversas industrias, a medida que las organizaciones priorizan cada vez más la mejora de las habilidades, la capacitación y el desarrollo continuo de los empleados para seguir siendo competitivas en el cambiante panorama empresarial.

Dinámica del mercado de sistemas de gestión del aprendizaje corporativo

Conductor

“Mayor demanda de aprendizaje remoto”

- La creciente prevalencia de acuerdos de trabajo remoto y la creciente necesidad de soluciones de aprendizaje flexibles entre las organizaciones son impulsores importantes de la mayor demanda de sistemas de gestión del aprendizaje corporativo (LMS).

- Por ejemplo, durante y después de la pandemia de COVID-19, empresas como Zoom y Microsoft Teams, aunque principalmente plataformas de comunicación, experimentaron un aumento en el uso de sesiones de capacitación virtual, lo que pone de relieve la necesidad de una infraestructura de aprendizaje digital sólida. Se espera que estos cambios en los paradigmas de trabajo y aprendizaje de las organizaciones impulsen el crecimiento del mercado de LMS corporativos durante el período de pronóstico.

- A medida que las organizaciones adoptan modelos de trabajo remotos e híbridos, y los empleados buscan un desarrollo profesional continuo independientemente de la ubicación, Corporate LMS ofrece funciones avanzadas como acceso a pedido a materiales de aprendizaje, aulas virtuales y herramientas de aprendizaje colaborativo, lo que proporciona una solución convincente sobre los métodos tradicionales de capacitación en persona.

- Además, el creciente reconocimiento de la importancia del aprendizaje continuo y la mejora de las habilidades en un panorama empresarial en rápida evolución está convirtiendo al LMS corporativo en un componente integral de las estrategias de desarrollo organizacional, ofreciendo una integración perfecta con otros sistemas de gestión de talento y recursos humanos.

- La comodidad de acceder a la formación en cualquier momento y lugar, la posibilidad de seguir el progreso de los empleados a distancia y la escalabilidad de las plataformas de aprendizaje online son factores clave que impulsan la adopción de LMS corporativos tanto en grandes empresas como en pymes. La tendencia hacia soluciones LMS en la nube y la creciente disponibilidad de plataformas intuitivas y con numerosas funciones contribuyen aún más al crecimiento del mercado.

Restricción/Desafío

“Altos costos de implementación”

- La preocupación por los costos potencialmente elevados asociados con la implementación y el mantenimiento de un Sistema de Gestión del Aprendizaje (LMS) Corporativo supone un reto importante para una mayor penetración en el mercado. Dado que los LMS corporativos suelen implicar el pago de licencias de software, actualizaciones de infraestructura, migración de datos y soporte continuo, pueden representar una inversión sustancial para las organizaciones.

- Por ejemplo, las empresas más pequeñas o aquellas con presupuestos limitados pueden encontrar prohibitiva la inversión inicial en plataformas integrales como Workday Learning u Oracle Talent Management Cloud.

- Abordar estas preocupaciones sobre los costos mediante modelos de precios flexibles, soluciones escalables y demostrar un claro retorno de la inversión es crucial para una adopción más amplia. Empresas como Gomo Learning y Articulate 360 ofrecen estructuras de precios más accesibles y se centran en la facilidad de uso para atraer a una gama más amplia de organizaciones.

- Si bien los beneficios a largo plazo de un LMS eficaz, como un mejor desempeño de los empleados y menores costos de capacitación, pueden superar la inversión inicial, la prima percibida por una tecnología de aprendizaje sofisticada aún puede obstaculizar su adopción generalizada, especialmente para las organizaciones que no están seguras del impacto inmediato o tienen limitaciones presupuestarias.

- Superar estos desafíos mediante precios transparentes, demostrando un ROI claro, ofreciendo soluciones flexibles y escalables y brindando soporte y capacitación sólidos serán vitales para el crecimiento sostenido del mercado en el sector de LMS corporativo.

Alcance del mercado de los sistemas de gestión del aprendizaje corporativo

El mercado está segmentado en función del componente, el tipo de implementación, el modo de entrega, el tamaño de la organización y la vertical.

- Por componente

Según los componentes, el mercado se segmenta en soluciones y servicios. El segmento de servicios domina la mayor cuota de mercado en ingresos, con un 67,5 % en 2025, impulsado por la constante demanda de servicios de implementación a medida, adaptados a las necesidades de la organización, y la necesidad crítica de soporte técnico y mantenimiento continuos del sistema. Esto también incluye la provisión esencial de programas integrales de capacitación para administradores y usuarios finales, lo que garantiza la adopción y el uso eficaz de la plataforma.

Se espera que el segmento de soluciones sea testigo de la CAGR más rápida entre 2025 y 2032, impulsada por la rápida incorporación de IA de vanguardia, capacidades de personalización mejoradas, experiencias de aprendizaje móvil mejoradas y el creciente requisito de tecnologías de aprendizaje corporativo innovadoras y adaptables.

- Por tipo de implementación

Según el tipo de implementación, el mercado se segmenta en local y en la nube. El segmento de la nube domina la mayor cuota de mercado en ingresos en 2025, impulsado por la escalabilidad y flexibilidad inherentes que ofrece a organizaciones de todos los tamaños, junto con la reducción de los costos iniciales de infraestructura y la simplificación de la gestión de TI. Su accesibilidad desde cualquier lugar con conexión a internet y la facilidad de actualización contribuyen aún más a su adopción generalizada.

Se prevé que el segmento local experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por la creciente demanda de organizaciones con estrictos requisitos de seguridad de datos y cumplimiento normativo, lo que les ofrece un mayor control sobre sus datos e infraestructura. Los avances en soluciones locales que ofrecen funciones de seguridad mejoradas y capacidades de integración también impulsan este crecimiento.

- Por modo de entrega

Según la modalidad de impartición, el mercado se segmenta en educación a distancia, formación impartida por un instructor y aprendizaje combinado. El segmento de educación a distancia domina la mayor cuota de mercado en ingresos en 2025, impulsado por la creciente adopción de plataformas de aprendizaje en línea por su escalabilidad, accesibilidad y rentabilidad para impartir formación a una fuerza laboral dispersa. La flexibilidad y la comodidad que ofrecen las opciones de aprendizaje asincrónico también contribuyen significativamente a su dominio.

Se prevé que el segmento de formación impartida por instructores experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsada por el creciente reconocimiento del valor de las experiencias de aprendizaje interactivas y personalizadas impartidas por instructores presenciales en formatos virtuales o semipresenciales. La necesidad de retroalimentación inmediata, aprendizaje colaborativo y la capacidad de abordar temas complejos de forma eficaz impulsan este rápido crecimiento.

- Por tamaño de la organización

Según el tamaño de la organización, el mercado se segmenta en grandes empresas y pequeñas y medianas empresas. El segmento de grandes empresas domina la mayor cuota de mercado en ingresos en 2025, impulsado por la gran necesidad de sistemas de gestión del aprendizaje robustos y escalables para satisfacer las necesidades de su amplia y diversa plantilla de empleados, junto con los complejos requisitos de formación y cumplimiento normativo. Sus mayores presupuestos suelen permitir la inversión en plataformas integrales y con numerosas funciones.

Se espera que el segmento de pequeñas y medianas empresas sea testigo de la CAGR más rápida entre 2025 y 2032, impulsada por el creciente reconocimiento de la importancia de la capacitación de los empleados para su crecimiento y competitividad, junto con la creciente disponibilidad de soluciones LMS basadas en la nube asequibles y fáciles de usar, adaptadas a sus necesidades y limitaciones presupuestarias.

- Por Vertical

Según el sector vertical, el mercado se segmenta en software y tecnología, salud, comercio minorista, banca, servicios financieros y seguros, manufactura, gobierno, defensa y telecomunicaciones. El segmento de software y tecnología dominará la mayor cuota de mercado en ingresos en 2025, impulsado por la continua necesidad de una rápida capacitación y reciclaje profesional en este sector dinámico, junto con la adopción temprana de tecnologías de aprendizaje sofisticadas para mantener una ventaja competitiva. La naturaleza compleja y cambiante de su trabajo requiere plataformas de formación sólidas.

Se espera que el segmento minorista sea testigo de la CAGR más rápida entre 2025 y 2032, impulsada por la creciente necesidad de capacitar a una fuerza laboral grande, a menudo geográficamente dispersa, en conocimiento de productos, servicio al cliente y cumplimiento, aprovechando soluciones de aprendizaje electrónico escalables y rentables.

Análisis regional del mercado de sistemas de gestión del aprendizaje corporativo

- América del Norte domina el mercado de sistemas de gestión de aprendizaje corporativo con la mayor participación en los ingresos del 36,5 % en 2025, impulsada por la importante presencia de corporaciones globales líderes y un fuerte enfoque organizacional en el desarrollo continuo de los empleados y las iniciativas de mejora de las habilidades.

- Las empresas de la región priorizan la inversión en tecnologías de aprendizaje avanzadas para mejorar las capacidades de la fuerza laboral y mantener una ventaja competitiva.

- Esta adopción generalizada está respaldada además por una infraestructura tecnológica sólida, una fuerza laboral competente digitalmente y el énfasis creciente en estrategias de gestión de talento basadas en datos.

Perspectiva del mercado de sistemas de gestión del aprendizaje corporativo de EE. UU.

El mercado estadounidense de sistemas de gestión del aprendizaje corporativo (LMS) capturó la mayor cuota de ingresos en Norteamérica en 2025, impulsado por la rápida adopción de plataformas de aprendizaje digital y el creciente énfasis en el desarrollo continuo de los empleados. Las organizaciones priorizan cada vez más la mejora de las competencias de sus empleados mediante soluciones de aprendizaje inteligentes y accesibles. La creciente preferencia por la formación online flexible, sumada a la sólida demanda de itinerarios de aprendizaje personalizados e integración del aprendizaje móvil, impulsa aún más la industria de los LMS corporativos. Además, la creciente integración de las plataformas de aprendizaje con otros sistemas empresariales, como las suites de RR. HH. y gestión del talento, contribuye significativamente a la expansión del mercado.

Perspectiva del mercado de sistemas de gestión del aprendizaje corporativo en Europa

Se prevé que el mercado europeo de sistemas de gestión del aprendizaje corporativo se expanda a una tasa de crecimiento anual compuesta (TCAC) sustancial durante el período de pronóstico. Este crecimiento del mercado regional se debe en gran medida al mayor énfasis de la Unión Europea en el fomento de las competencias digitales y la incorporación de la tecnología en la educación, como se describe en el Plan de Acción de Educación Digital. En consecuencia, las instituciones educativas de toda Europa están adoptando cada vez más sistemas LMS. Además, la creciente atención de los gobiernos y los organismos educativos a la mejora de las competencias y el aprendizaje de la fuerza laboral está impulsando la necesidad de soluciones de formación adaptables y de fácil acceso, lo que convierte a las plataformas LMS en recursos esenciales para la formación continua y el reciclaje profesional de la fuerza laboral.

Perspectivas del mercado de sistemas de gestión del aprendizaje corporativo del Reino Unido

Se prevé que el mercado británico de sistemas de gestión del aprendizaje corporativo crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la creciente adopción del aprendizaje digital y el deseo de mejorar las habilidades y el desarrollo de los empleados. Además, la creciente necesidad de una incorporación eficaz y formación continua anima tanto a grandes empresas como a pymes a optar por soluciones integrales de gestión del aprendizaje. Se espera que la adopción de las tecnologías digitales en el Reino Unido, junto con su sólida infraestructura empresarial y educativa, siga impulsando el crecimiento del mercado.

Análisis del mercado de sistemas de gestión del aprendizaje corporativo en Alemania

Se prevé que el mercado alemán de sistemas de gestión del aprendizaje corporativo crezca a una tasa de crecimiento anual compuesta (TCAC) considerable durante el período de pronóstico, impulsado por la creciente concienciación sobre la importancia del aprendizaje digital y la demanda de soluciones tecnológicamente avanzadas y con visión de futuro. La consolidada infraestructura industrial y educativa de Alemania, sumada a su énfasis en la innovación y el desarrollo de la fuerza laboral, promueve la adopción de plataformas LMS sofisticadas en diversos sectores. La integración de sistemas de gestión del aprendizaje con otro software empresarial también es cada vez más frecuente, con una marcada preferencia por soluciones seguras, centradas en la privacidad de los datos y alineadas con los estándares empresariales locales.

Perspectiva del mercado de sistemas de gestión del aprendizaje corporativo en Asia-Pacífico

Se prevé que el mercado de Sistemas de Gestión del Aprendizaje Corporativo (LMS) de Asia-Pacífico crezca a su tasa de crecimiento anual compuesta (TCAC) más alta en 2025, impulsado por la creciente digitalización, un mayor énfasis en el desarrollo de habilidades y los avances tecnológicos en países como China, Japón e India. El creciente enfoque de la región en el aprendizaje continuo y la capacitación de la fuerza laboral, respaldado por iniciativas gubernamentales que promueven la educación y la capacitación digitales, está impulsando la adopción de plataformas LMS robustas. Además, a medida que Asia-Pacífico se consolida como un centro de innovación tecnológica y transformación digital, la accesibilidad e implementación de sistemas avanzados de gestión del aprendizaje se están expandiendo a un mayor número de organizaciones.

Análisis del mercado del sistema de gestión del aprendizaje corporativo en Japón

El mercado japonés de sistemas de gestión del aprendizaje corporativo está cobrando impulso gracias al avanzado panorama tecnológico del país, la creciente adopción del aprendizaje digital y la demanda de soluciones de formación eficientes. El mercado japonés prioriza la calidad y la mejora continua, y la adopción de plataformas LMS sofisticadas se ve impulsada por la creciente necesidad de un desarrollo eficaz de los empleados y formación en cumplimiento normativo. La integración de los sistemas de gestión del aprendizaje con otras tecnologías de RR. HH. y herramientas de gestión del rendimiento está impulsando el crecimiento. Además, es probable que el enfoque de Japón en el aprendizaje permanente y la reducción de la brecha de habilidades en su plantilla impulse la demanda de soluciones de aprendizaje intuitivas, seguras e integrales tanto en el sector empresarial como en el educativo.

Análisis del mercado del sistema de gestión del aprendizaje corporativo en China

El mercado chino de sistemas de gestión del aprendizaje corporativo (LMS) representó la mayor cuota de mercado en ingresos en Asia Pacífico en 2025, gracias a la expansión del sector corporativo del país, la rápida digitalización de las empresas y la alta integración de tecnología en los procesos de formación. China se posiciona como uno de los mercados más grandes para soluciones de aprendizaje digital, y las plataformas LMS corporativas son cada vez más populares en empresas de todos los tamaños y sectores. El sólido apoyo gubernamental a la transformación digital y la disponibilidad de una oferta diversa y competitiva de LMS por parte de proveedores nacionales son factores clave que impulsan el mercado chino.

Cuota de mercado del sistema de gestión del aprendizaje corporativo

La industria de sistemas de gestión del aprendizaje corporativo está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Absorb Software Inc. (Canadá)

- Adobe Inc. (EE. UU.)

- Anthology Inc. (EE. UU.)

- Cornerstone OnDemand (EE. UU.)

- CrossKnowledge (Francia)

- Corporación D2L (Canadá)

- Docebo (Italia)

- Epignosis (Grecia)

- G-Cube Webwide Software Pvt Ltd (India)

- Ingeniería de crecimiento (Reino Unido)

- IBM Corporation (EE. UU.)

- Instructure Inc. (EE. UU.)

- LearnUpon (Irlanda)

- Mindflash (EE. UU.)

- Oracle Corporation (EE. UU.)

- SAP SE (Alemania)

- PowerSchool (EE. UU.)

Últimos avances en el mercado global de sistemas de gestión del aprendizaje corporativo

- En enero de 2024, Google Cloud presentó una nueva solución de comercio conversacional que integra agentes virtuales basados en IA en los sitios web y aplicaciones móviles de los minoristas. Estos agentes interactúan con los clientes mediante lenguaje natural, ofreciendo recomendaciones de productos personalizadas y adaptadas a sus preferencias. Esta innovación busca mejorar la experiencia de compra, haciéndola más interactiva y ágil, lo que aumenta la satisfacción del cliente y, potencialmente, impulsa mayores tasas de conversión para los minoristas.

- En agosto de 2023, Inbenta adquirió Horizn, una empresa de software con sede en Toronto especializada en demostraciones interactivas de productos. Esta adquisición integrará la innovadora tecnología de Horizn en la plataforma de experiencia del cliente basada en IA de Inbenta. Al optimizar su oferta con las capacidades de Horizn, Inbenta busca brindar a sus clientes experiencias atractivas e inmersivas que faciliten la comprensión del producto y la satisfacción del cliente, reforzando así su compromiso con la transformación de las interacciones digitales en el mercado.

- En agosto de 2023, Kore.ai introdujo la integración de su Plataforma de Optimización de Experiencia con Zoom Contact Center, ofreciendo a los usuarios un asistente virtual inteligente impulsado por la plataforma Kore.ai XO. Esta integración permite a los clientes de Zoom aprovechar la IA conversacional avanzada, mejorando la eficiencia y la capacidad de respuesta del servicio al cliente. Al automatizar las interacciones, permite a las empresas optimizar las operaciones y mejorar la interacción del usuario, lo que, en última instancia, genera mejores experiencias y satisfacción del cliente.

- En septiembre de 2021, se anunció el robot Astro, un dispositivo único diseñado para ayudar a los usuarios con diversas tareas, como la monitorización del hogar y la comunicación con sus seres queridos. Esta innovadora tecnología representa una nueva frontera en la robótica personal, con el objetivo de mejorar la vida diaria mediante la automatización y el apoyo. Al combinar la practicidad con una IA avanzada, Astro busca convertirse en un compañero útil en el día a día.

- En abril de 2021, Microsoft anunció la adquisición de Nuance Communications por 19.700 millones de dólares en una operación íntegramente en efectivo, con el objetivo de fortalecer sus capacidades tecnológicas de reconocimiento y transcripción de voz. Nuance, líder en soluciones basadas en IA, aporta una amplia experiencia que enriquecerá la oferta de Microsoft en el sector sanitario y otros sectores. Esta adquisición refleja el compromiso de Microsoft con el avance de las tecnologías de IA y su integración en su ecosistema de productos para ofrecer un mejor servicio a sus clientes.

- En marzo de 2021, Google Cloud anunció la disponibilidad general de Vertex AI, una plataforma de aprendizaje automático gestionado diseñada para optimizar el desarrollo y el mantenimiento de modelos de IA. Vertex AI proporciona a las empresas herramientas e infraestructura robustas, lo que permite una implementación más rápida de aplicaciones de aprendizaje automático. Al facilitar el acceso a capacidades avanzadas de IA, Google Cloud busca empoderar a las organizaciones para que aprovechen las tecnologías de IA de forma más eficaz y eficiente.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.