Global Compressed Natural Gas Cng Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

92.21 Billion

USD

121.42 Billion

2024

2032

USD

92.21 Billion

USD

121.42 Billion

2024

2032

| 2025 –2032 | |

| USD 92.21 Billion | |

| USD 121.42 Billion | |

|

|

|

|

Segmentación del mercado global de gas natural comprimido (GNC) por fuente (gas asociado y no asociado), kits (secuenciales y Venturi), tipo de distribución (cilindros/tanques, acumuladores, colectores compuestos y otros) y uso final (vehículos ligeros, medianos y pesados): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado del gas natural comprimido (GNC)

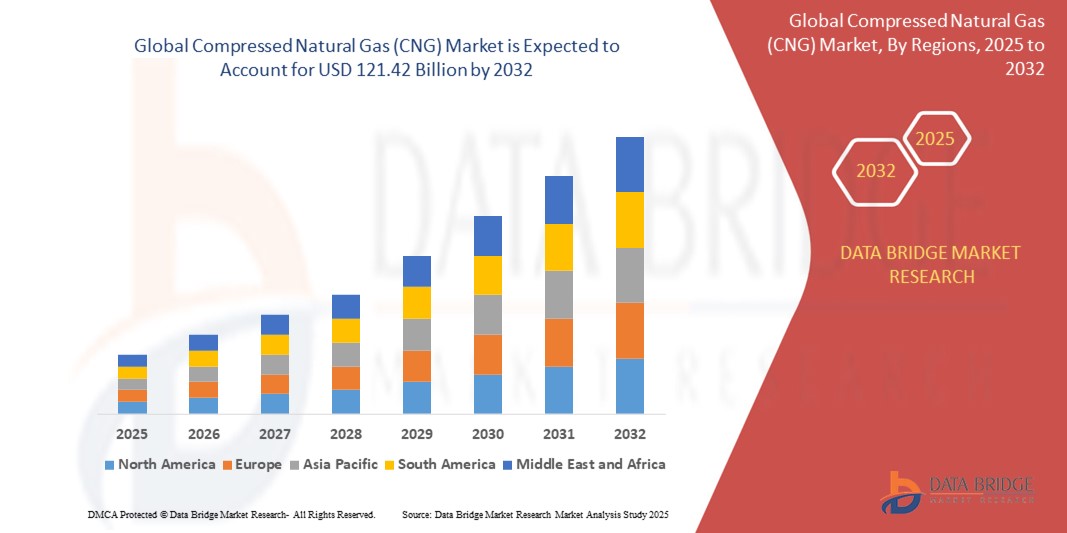

- El tamaño del mercado mundial de gas natural comprimido (GNC) se valoró en USD 92,21 mil millones en 2024 y se espera que alcance los USD 121,42 mil millones para 2032 , con una CAGR de 3,50% durante el período de pronóstico.

- El crecimiento del mercado está impulsado principalmente por la creciente demanda de alternativas de combustible más limpias y sostenibles, políticas gubernamentales de apoyo que promueven vehículos de bajas emisiones y avances en la infraestructura de GNC y tecnologías de reabastecimiento.

- Las crecientes preocupaciones ambientales, junto con la rentabilidad del GNC en comparación con los combustibles tradicionales, están acelerando su adopción en varios segmentos de vehículos, particularmente en las economías emergentes.

Análisis del mercado del gas natural comprimido (GNC)

- El gas natural comprimido (GNC) es un combustible alternativo más limpio utilizado principalmente en el transporte y que ofrece menores emisiones en comparación con la gasolina y el diésel, lo que lo convierte en la opción preferida para los mercados con conciencia ecológica.

- La creciente adopción de GNC está impulsada por el aumento de las regulaciones ambientales, el aumento de los costos del combustible y la expansión de la infraestructura de reabastecimiento de GNC a nivel mundial.

- Asia-Pacífico dominó el mercado de gas natural comprimido (GNC) con la mayor participación en los ingresos del 45,3 % en 2024, impulsada por una adopción generalizada en países como China, India y Pakistán, respaldada por incentivos gubernamentales, combustible de GNC de bajo costo y amplias redes de reabastecimiento.

- Se espera que América del Norte sea la región de más rápido crecimiento durante el período de pronóstico, atribuido al aumento de las inversiones en infraestructura de GNC, la creciente demanda de soluciones de transporte sostenible y las políticas de apoyo que promueven la energía limpia en los EE. UU. y Canadá.

- El segmento de gas asociado dominó el mercado con una participación de mercado del 89,91% en 2024, impulsado por su abundante suministro, eficiencia económica y beneficios ambientales, ya que se produce junto con el petróleo crudo, lo que reduce los desechos y las emisiones.

Alcance del informe y segmentación del mercado de gas natural comprimido (GNC)

|

Atributos |

Perspectivas clave del mercado del gas natural comprimido (GNC) |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado del gas natural comprimido (GNC)

“Aumento de la integración de tecnologías avanzadas de almacenamiento e IoT”

- El mercado global de gas natural comprimido (GNC) está experimentando una tendencia significativa hacia la integración de tecnologías avanzadas de almacenamiento y soluciones de Internet de las cosas (IoT).

- Las innovaciones en materiales compuestos livianos, como fibra de carbono y fibra de vidrio para tanques de GNC Tipo IV, mejoran la eficiencia de almacenamiento y el rendimiento del vehículo al reducir el peso y mejorar la seguridad.

- Los sistemas de GNC habilitados para IoT permiten el monitoreo en tiempo real de la presión del tanque, los niveles de combustible y la integridad del sistema, brindando información útil para los operadores de flotas y los propietarios de vehículos.

- Por ejemplo, las empresas están desarrollando plataformas de IoT que rastrean los patrones de consumo de GNC para optimizar los cronogramas de reabastecimiento y predecir las necesidades de mantenimiento de los sistemas de combustible.

- Esta tendencia mejora la eficiencia y confiabilidad de los sistemas de GNC, haciéndolos más atractivos tanto para los operadores de flotas comerciales como para los consumidores individuales.

- La integración de IoT también respalda la gestión inteligente de flotas al analizar datos sobre rutas de vehículos, eficiencia de combustible y emisiones, lo que contribuye al ahorro de costos y al cumplimiento ambiental.

Dinámica del mercado del gas natural comprimido (GNC)

Conductor

Creciente demanda de combustibles más limpios y regulaciones más estrictas sobre emisiones

- La creciente demanda de los consumidores y la industria de alternativas de combustible respetuosas con el medio ambiente, impulsada por el aumento de los costos del combustible y las preocupaciones ambientales, es un impulsor importante del mercado mundial de GNC.

- Los vehículos propulsados por GNC producen emisiones significativamente menores en comparación con la gasolina o el diésel, con estudios que muestran una reducción de hasta un 25% en las emisiones de CO2 por kilómetro recorrido.

- Los mandatos gubernamentales, particularmente en regiones como Asia-Pacífico con políticas que promueven la energía limpia, están acelerando la adopción del GNC a través de subsidios, incentivos fiscales e inversiones en infraestructura.

- La expansión de las tecnologías 5G e IoT mejora las aplicaciones de GNC al permitir una transmisión de datos más rápida para el monitoreo de combustible en tiempo real y la gestión de flotas.

- Los fabricantes de automóviles están integrando cada vez más sistemas de GNC como características estándar u opcionales en los vehículos para cumplir con los requisitos regulatorios y la demanda de los consumidores de transporte sostenible.

Restricción/Desafío

“Altos costos iniciales e infraestructura de reabastecimiento limitada”

- Los altos costos iniciales para las conversiones de vehículos a GNC, la fabricación avanzada de tanques (por ejemplo, tanques compuestos Tipo IV) y el desarrollo de estaciones de servicio plantean una barrera importante, en particular en los mercados emergentes.

- La modernización de vehículos existentes con kits de GNC, como sistemas secuenciales o venturi, implica procesos de integración complejos y costosos.

- La disponibilidad limitada de estaciones de servicio de GNC, especialmente en regiones rurales o menos desarrolladas, restringe el crecimiento del mercado y desalienta su adopción entre los operadores de vehículos de larga distancia.

- Las preocupaciones sobre la seguridad de los datos relacionadas con los sistemas de GNC habilitados para IoT, incluidos los riesgos de ciberataques a los sistemas de combustible conectados, plantean desafíos de privacidad y cumplimiento con diversas regulaciones globales.

- Estos factores pueden disuadir a posibles adoptantes y desacelerar la expansión del mercado, particularmente en regiones con sensibilidad a los costos o infraestructura subdesarrollada.

Alcance del mercado del gas natural comprimido (GNC)

El mercado está segmentado según la fuente, los kits, el tipo de distribución y el uso final.

- Por fuente

Según su origen, el mercado mundial de gas natural comprimido (GNC) se segmenta en gas asociado y gas no asociado. El segmento de gas asociado dominó el mercado con una participación del 89,91 % en 2024, impulsado por su abundante oferta, eficiencia económica y beneficios ambientales, ya que se produce junto con el petróleo crudo, lo que reduce los residuos y las emisiones.

Se prevé que el segmento de gas no asociado experimente la tasa de crecimiento más rápida del 12,5% entre 2025 y 2032, impulsada por la disminución de la producción mundial de petróleo crudo y el cambio hacia reservas de gas no asociado, particularmente en regiones como Medio Oriente y Rusia, para satisfacer la creciente demanda de GNC.

- Por Kits

En cuanto a los kits, el mercado global de gas natural comprimido (GNC) se segmenta en secuencial y Venturi. Se prevé que el segmento secuencial domine el mercado con una cuota del 59,41 % en 2024, gracias a su mayor rendimiento del motor, eficiencia, reducción de emisiones, rentabilidad y durabilidad, lo que lo convierte en la opción preferida para la conversión de vehículos a GNC.

Se proyecta que el segmento Venturi experimentará un sólido crecimiento entre 2025 y 2032, impulsado por su simplicidad y asequibilidad, que atraen a los mercados conscientes de los costos, particularmente en las regiones en desarrollo que adoptan vehículos de GNC.

- Por tipo de distribución

Según el tipo de distribución, el mercado global de gas natural comprimido (GNC) se segmenta en cilindros/tanques, acumuladores, colectores compuestos y otros. Se prevé que el segmento de cilindros/tanques domine el mercado con una participación del 80,14 % en 2024, impulsado por la importancia crucial de los tanques de GNC para almacenar gas comprimido a altas presiones (hasta 250 bar) y garantizar la operación segura y eficiente de los vehículos. Los tanques Tipo 4, fabricados con materiales compuestos avanzados, son especialmente populares por su ligereza y alta capacidad.

Se prevé que el segmento de acumuladores experimente un crecimiento significativo entre 2025 y 2032, ya que mejoran la eficiencia del almacenamiento y respaldan los sistemas de ductos virtuales en expansión, mejorando la accesibilidad al GNC en áreas sin acceso directo a ductos.

- Por uso final

Según el uso final, el mercado mundial del gas natural comprimido (GNC) se segmenta en vehículos ligeros, vehículos medianos y vehículos pesados. Se prevé que el segmento de vehículos ligeros domine el mercado con una cuota del 63,28 % en 2024, impulsado por el alto volumen de vehículos de pasajeros a nivel mundial, la creciente demanda de combustibles económicos y ecológicos por parte de los consumidores, y la creciente adopción del GNC en zonas urbanas para combatir la contaminación atmosférica.

Se proyecta que el segmento de vehículos pesados experimentará la tasa de crecimiento más rápida del 19,6% entre 2025 y 2032, impulsado por la creciente adopción de GNC en camiones y autobuses de larga distancia para ahorrar costos, reducir emisiones y cumplir con estrictas regulaciones ambientales, respaldado por la expansión de la infraestructura de reabastecimiento de combustible.

Análisis regional del mercado del gas natural comprimido (GNC)

- Asia-Pacífico dominó el mercado de gas natural comprimido (GNC) con la mayor participación en los ingresos del 45,3 % en 2024, impulsada por una adopción generalizada en países como China, India y Pakistán, respaldada por incentivos gubernamentales, combustible de GNC de bajo costo y amplias redes de reabastecimiento.

- Los consumidores priorizan el GNC por su rentabilidad, menores emisiones y menores costos de mantenimiento en comparación con los combustibles tradicionales, particularmente en regiones con altos precios del combustible y preocupaciones ambientales.

- El crecimiento está respaldado por los avances en la tecnología de GNC, incluidos los tanques livianos Tipo 4 y los kits secuenciales, junto con una creciente adopción en los segmentos OEM y de posventa para varios tipos de vehículos.

Perspectivas del mercado del gas natural comprimido (GNC) en Japón

Se prevé un crecimiento significativo del mercado japonés de GNC debido a la fuerte preferencia de los consumidores por sistemas de GNC de alta calidad y tecnología avanzada que mejoran la eficiencia y la seguridad de los vehículos. La presencia de importantes fabricantes de automóviles y la integración de sistemas de GNC en vehículos OEM aceleran la penetración en el mercado. El creciente interés en las conversiones a GNC en el mercado de posventa también contribuye a este crecimiento.

Perspectivas del mercado del gas natural comprimido (GNC) en China

China posee la mayor participación en el mercado de GNC de Asia-Pacífico, impulsada por la rápida urbanización, el aumento de la propiedad de vehículos y la fuerte demanda de combustibles rentables y ecológicos. La creciente clase media del país y su enfoque en la movilidad sostenible impulsan la adopción de tecnologías avanzadas de GNC. La sólida capacidad de fabricación nacional y los precios competitivos mejoran el acceso al mercado.

Mercado de gas natural comprimido (GNC) de América del Norte

Se prevé que el mercado de gas natural comprimido (GNC) en Norteamérica experimente el mayor crecimiento. Este crecimiento se ve impulsado por un fuerte énfasis en la reducción de las emisiones de carbono, la abundancia de recursos de gas natural y la creciente adopción de alternativas de combustibles más limpios por parte de consumidores y empresas. La región se beneficia del creciente apoyo gubernamental mediante incentivos y regulaciones que promueven el uso del GNC en diversos sectores, en particular el transporte.

Perspectiva del mercado de gas natural comprimido (GNC) de EE. UU.

Se prevé un crecimiento significativo del mercado estadounidense de gas natural comprimido (GNC), impulsado por la fuerte demanda de posventa y la creciente concienciación de los consumidores sobre los beneficios ambientales y de ahorro del GNC. La tendencia hacia soluciones de transporte más limpias y la expansión de la infraestructura de repostaje impulsan aún más la expansión del mercado. La integración de sistemas de GNC por parte de los fabricantes de automóviles en sus vehículos de fábrica complementa las ventas de posventa, creando un sólido ecosistema de mercado.

Perspectivas del mercado europeo del gas natural comprimido (GNC)

Se prevé un crecimiento significativo del mercado europeo de GNC, impulsado por estrictas regulaciones ambientales y un enfoque en la reducción de las emisiones de carbono. Los consumidores buscan soluciones de GNC que ofrezcan menores emisiones y eficiencia de combustible, a la vez que cumplen con los estándares de seguridad. El crecimiento es notable tanto en la instalación de vehículos nuevos como en proyectos de modernización, con países como Alemania e Italia mostrando una adopción significativa debido a la preocupación por la calidad del aire urbano y a las políticas de apoyo.

Perspectivas del mercado del gas natural comprimido (GNC) en el Reino Unido

Se prevé un rápido crecimiento del mercado británico de GNC, impulsado por la demanda de alternativas de combustible más limpias y un transporte rentable en entornos urbanos y suburbanos. La mayor concienciación sobre los beneficios ambientales del GNC y la reducción de los costes operativos fomenta su adopción. La evolución de las normativas, que equilibran la reducción de emisiones con las normas de seguridad vehicular, influye en las decisiones de los consumidores y promueve sistemas de GNC que cumplan con las normativas.

Perspectivas del mercado del gas natural comprimido (GNC) en Alemania

Se espera que Alemania experimente un rápido crecimiento del mercado de GNC, gracias a su avanzado sector de fabricación de automóviles y a la gran atención de los consumidores a la eficiencia del combustible y la sostenibilidad. Los consumidores alemanes prefieren tecnologías avanzadas de GNC, como los tanques Tipo 4 y los kits secuenciales, que reducen las emisiones y contribuyen a un menor consumo de combustible. La integración de sistemas de GNC en vehículos premium y opciones de posventa impulsa el crecimiento sostenido del mercado.

Cuota de mercado del gas natural comprimido (GNC)

La industria del gas natural comprimido (GNC) está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- NIS (Serbia)

- KryoGas (Serbia)

- TotalEnergies SE (Francia)

- Chevron Corporation (EE. UU.)

- Shell PLC (Reino Unido)

- Grupo Adani (India)

- JW Power Company (EE. UU.)

- CORPORACIÓN DE PETRÓLEO DE LA INDIA LIMITADA (India)

- JIO-BP (India)

- GRUPO ENGIE (REINO UNIDO)

- INDRAPRASTHA GAS LIMITED (India)

- TRILLIUM ENERGY (EE. UU.)

¿Cuáles son los desarrollos recientes en el mercado global de gas natural comprimido (GNC)?

- En febrero de 2025, Irán inauguró 12 nuevas estaciones de gas natural comprimido (GNC) en seis provincias, lo que marca un paso significativo en sus esfuerzos continuos por expandir la infraestructura de combustibles limpios. La inauguración coincidió con el 46.º aniversario de la Revolución Islámica y fue liderada por la Compañía Nacional Iraní de Distribución de Productos Petrolíferos (NIOPDC). Esta expansión eleva el número total de estaciones de GNC operativas en el país a más de 2600, lo que apoya el objetivo de Irán de reducir el consumo de gasolina y promover el gas natural como una alternativa más limpia y rentable.

- En febrero de 2025, el Aeropuerto Internacional de Noida (NIA) anunció una alianza estratégica con Indraprastha Gas Limited (IGL) para desarrollar la infraestructura de Gas Natural Comprimido (GNC) en el aeropuerto. Como parte de la iniciativa, se construirán dos estaciones de GNC —una en el recinto oeste y otra en la zona de operaciones— para atender a viajeros, personal del aeropuerto y socios logísticos. IGL también construirá una red de Distribución de Gas Urbano (CGD) y suministrará gas natural canalizado (PNG) a patios de comidas, salas VIP y cocinas. Esta colaboración destaca la integración de soluciones de energía limpia en la infraestructura aeronáutica.

- En febrero de 2024, Shell PLC finalizó la adquisición de Nature Energy Biogas A/S, el mayor productor europeo de gas natural renovable (GNR). La empresa danesa, que opera 14 plantas de biometano a escala industrial, ahora funciona como una filial propiedad al 100 % de Shell. Esta estrategia amplía significativamente la cartera de combustibles bajos en carbono de Shell y respalda su ambición de construir una cadena de valor global e integrada de GNR. La adquisición también incluye una cartera de 30 nuevos proyectos de plantas en Europa y Norteamérica, lo que refuerza el compromiso de Shell con las alternativas energéticas sostenibles.

- En julio de 2023, Time Technoplast anunció una importante expansión de su capacidad de fabricación de cascadas de GNC para satisfacer la creciente demanda de soluciones de almacenamiento y transporte de combustibles limpios. En la Fase 1, la compañía añadió capacidad para 300 cascadas anuales. Aprovechando este impulso, la Fase 2 pretende aumentar la capacidad anual total a 480 cascadas, con planes adicionales para alcanzar las 1080 cascadas anuales para finales del año fiscal 2023-24. Esta expansión refleja la creciente adopción de infraestructura de GNC y el liderazgo de la compañía en la tecnología de cilindros compuestos Tipo IV.

- En octubre de 2022, Advik Hi-Tech Private Limited, fabricante líder indio de componentes automotrices, firmó una colaboración tecnológica con NIKKI Co. Ltd., reconocida empresa japonesa de sistemas de combustible, para producir reguladores de gas natural comprimido (GNC) en India. Esta alianza estratégica busca localizar la producción, fortalecer la cadena de suministro nacional y apoyar el impulso de India hacia soluciones de movilidad más limpias. La alianza combina la probada tecnología de reguladores de Nikki con la experiencia en fabricación de Advik para satisfacer la creciente demanda de automóviles, vehículos comerciales y aplicaciones industriales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.