Global Beverage Processing Equipment Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

8.77 Billion

USD

13.72 Billion

2024

2032

USD

8.77 Billion

USD

13.72 Billion

2024

2032

| 2025 –2032 | |

| USD 8.77 Billion | |

| USD 13.72 Billion | |

|

|

|

|

Segmentación del mercado global de equipos de procesamiento de bebidas, por tipo de equipo (equipo de filtración, intercambiadores de calor, equipo de cervecería, licuadoras y mezcladoras, equipo de carbonatación, disolventes de azúcar y otros), tipo de automatización (automático, semiautomático y manual), aplicación (bebidas no alcohólicas y bebidas alcohólicas): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado de equipos de procesamiento de bebidas

Se espera que la expansión de la industria de bebidas impulse el crecimiento del mercado. Se espera que los altos costos iniciales de inversión y mantenimiento obstaculicen el mercado. Se espera que la adaptación de tecnologías innovadoras en la industria de procesamiento de bebidas brinde oportunidades para el crecimiento del mercado. Se espera que el cambio en las preferencias de los consumidores hacia alimentos y bebidas frescos y no procesados suponga un desafío para el mercado.

Tamaño del mercado de equipos de procesamiento de bebidas

El tamaño del mercado global de equipos de procesamiento de bebidas se valoró en USD 8,77 mil millones en 2024 y se proyecta que alcance los USD 13,72 mil millones para 2032, con una CAGR del 5,74% durante el período de pronóstico de 2025 a 2032. Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis experto en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas / consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

Alcance del informe y segmentación del mercado de equipos de procesamiento de bebidas

|

Atributos |

Perspectivas clave del mercado de equipos de procesamiento de bebidas |

|

Segmentos cubiertos |

|

|

Países cubiertos |

EE. UU., Canadá y México en América del Norte, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA), Brasil, Argentina y Resto de América del Sur como parte de América del Sur |

|

Actores clave del mercado |

Grupo Tetra Pak, GEA Group Aktiengesellschaft, Krones AG, SPX Flow, Pentair, Grupo KHS, ALFA LAVAL, JBT., Bühler AG, Paul Mueller Company, Bucher Unipektin AG, Praj Industries, HRS Process Systems Ltd., TechniBlend, Inc., Fristam, Omnia Della Toffola SpA, PROXES GMBH, Caloris Engineering, LLC., FME Food Machinery Europe Sp. z oo y Bigtem Makine AS |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de equipos de procesamiento de bebidas

El procesamiento de bebidas implica la transformación de ingredientes crudos en bebidas mediante diversas técnicas. Abarca pasos como la mezcla, el calentamiento, el enfriamiento y la filtración para lograr los sabores y las texturas deseados. El procesamiento garantiza que las bebidas cumplan con los estándares de calidad y las normas de seguridad antes del envasado. Desempeña un papel crucial en el mantenimiento de la consistencia y la vida útil, optimizando la eficiencia de la producción durante todo el proceso de fabricación.

Dinámica del mercado de equipos de procesamiento de bebidas

Conductores

- El sector de las bebidas en crecimiento

El creciente sector de las bebidas es un importante impulsor del mercado mundial de equipos de procesamiento de bebidas. Este crecimiento se ve impulsado por la creciente demanda de los consumidores de una variedad de bebidas, incluidas las gaseosas, los jugos, las bebidas alcohólicas y las bebidas funcionales, como las bebidas deportivas y energéticas. El aumento de la población mundial, la urbanización y los cambios en el estilo de vida de los consumidores han llevado a un mayor consumo de productos listos para beber, lo que hace necesario contar con equipos avanzados de procesamiento de bebidas para satisfacer las demandas de producción de manera eficiente y mantener la calidad del producto.

A medida que el sector de las bebidas se expande, los fabricantes invierten cada vez más en tecnologías de procesamiento avanzadas para mejorar la eficiencia de la producción y la consistencia del producto. Esto incluye equipos de filtración, homogeneización, pasteurización y envasado. La necesidad de cumplir con estrictas normas de seguridad alimentaria y estándares de calidad impulsa la adopción de maquinaria de procesamiento sofisticada. Esta tendencia se ve impulsada aún más por la necesidad de producir bebidas con una vida útil más prolongada y perfiles de seguridad mejorados, lo que garantiza la confianza y la satisfacción del consumidor.

La globalización de la industria de las bebidas ha abierto nuevos mercados y ha aumentado la competencia entre los productores. Para seguir siendo competitivos y cumplir con los estándares internacionales, los fabricantes de bebidas están invirtiendo en equipos de procesamiento de última generación que garantizan la uniformidad del producto y el cumplimiento de las normas de calidad globales. Esta necesidad de cumplir con los diversos requisitos regulatorios y las preferencias de los consumidores en todo el mundo es un factor clave para el crecimiento y la evolución continuos del mercado de equipos de procesamiento de bebidas.

La creciente demanda de los consumidores, la demanda de tecnología avanzada, la tendencia hacia opciones más saludables, la globalización y las políticas gubernamentales de apoyo contribuyen en conjunto a la creciente necesidad de equipos sofisticados para el procesamiento de bebidas. Esta inversión e innovación continuas en tecnologías de procesamiento fomentan el crecimiento y el desarrollo del mercado, lo que garantiza que los fabricantes puedan cumplir con las preferencias cambiantes de los consumidores y las normas regulatorias. Por lo tanto, el creciente sector de las bebidas está impulsando significativamente el mercado mundial de equipos para el procesamiento de bebidas.

- El consumo de bebidas aumenta en todo el mundo

El aumento del consumo de bebidas se debe a diversos factores, entre ellos, los cambios en el estilo de vida de los consumidores, la urbanización y el aumento de los ingresos disponibles. A medida que más personas buscan opciones de conveniencia y listas para beber, la demanda de bebidas procesadas como jugos, refrescos y bebidas alcohólicas se ha disparado. Esta tendencia requiere la expansión y modernización de las instalaciones de procesamiento de bebidas para satisfacer las preferencias de los consumidores.

Un factor importante que contribuye al aumento del consumo de bebidas es el cambio en los hábitos alimentarios, ya que los consumidores optan por bebidas más saludables y funcionales. Las bebidas enriquecidas con vitaminas, minerales y otros nutrientes están ganando popularidad, lo que impulsa a los fabricantes de bebidas a invertir en equipos de procesamiento avanzados para mantener el valor nutricional y la calidad de estos productos. Este cambio hacia un consumo consciente de la salud impulsa directamente la demanda de tecnologías sofisticadas de procesamiento de bebidas. Además, la creciente popularidad de las bebidas premium y artesanales, como los refrescos artesanales, los cafés especiales y las cervezas artesanales, está impulsando el crecimiento del mercado de equipos de procesamiento de bebidas. Estos productos de alta calidad, a menudo de lotes pequeños, requieren equipos de procesamiento precisos y confiables para garantizar la consistencia y cumplir con los altos estándares esperados por los consumidores exigentes. Como resultado, los productores de bebidas se ven obligados a adoptar equipos avanzados que puedan manejar las complejidades de producir bebidas tan especializadas.

La rápida expansión de la industria mundial de bebidas también pone de relieve la necesidad de contar con soluciones de procesamiento eficientes y escalables. Los mercados emergentes de Asia, América Latina y África muestran un sólido crecimiento en el consumo de bebidas, por lo que los fabricantes se ven presionados a mejorar sus capacidades de producción. Las inversiones en equipos modernos de procesamiento de bebidas permiten a estas empresas ampliar sus operaciones, mejorar la eficiencia de la producción y satisfacer la creciente demanda en estos mercados en expansión.

Oportunidades

- Adopción de tecnologías innovadoras en la industria de procesamiento de bebidas

Los avances tecnológicos han revolucionado diversos aspectos del procesamiento de bebidas, mejorando la eficiencia, la productividad y la calidad del producto. La automatización y la robótica, por ejemplo, han permitido optimizar los procesos de fabricación, reducir los costos laborales y mejorar la eficiencia operativa general. Esta integración de tecnologías avanzadas permite a los fabricantes de equipos de procesamiento de bebidas desarrollar y ofrecer maquinaria sofisticada que satisface las necesidades cambiantes de los procesadores de bebidas.

La adopción de la digitalización y la Internet de las cosas (IoT) en los equipos de procesamiento de bebidas ha facilitado el monitoreo en tiempo real y el análisis de datos. Los sensores integrados en los equipos pueden rastrear parámetros como la temperatura, la humedad y los tiempos de procesamiento, lo que garantiza un control preciso de los procesos de producción. Este enfoque basado en datos no solo mejora la consistencia y la calidad del producto, sino que también permite el mantenimiento predictivo, minimizando el tiempo de inactividad de los equipos y optimizando el tiempo de actividad operativa.

Las tecnologías innovadoras también contribuyen a mejorar los estándares de seguridad e higiene de las bebidas. Los avances en las técnicas de saneamiento, como los sistemas de limpieza automatizados y los recubrimientos antimicrobianos, ayudan a mitigar los riesgos de contaminación durante el procesamiento. Estas tecnologías son cruciales para el cumplimiento de las estrictas normas de seguridad de las bebidas, lo que refuerza la confianza de los consumidores y la competitividad en el mercado de los procesadores de bebidas. Además, la aparición de conceptos de fabricación inteligente, incluida la inteligencia artificial (IA) y el aprendizaje automático, permite que los equipos se optimicen por sí solos y se adapten a las cambiantes demandas de producción en tiempo real.

Los algoritmos de análisis predictivo pueden predecir los patrones de demanda y los requisitos de producción, lo que permite a los fabricantes ajustar los cronogramas de producción y optimizar la utilización de los recursos de manera proactiva. Esta agilidad es particularmente valiosa en un entorno de mercado dinámico en el que las preferencias de los consumidores y los requisitos regulatorios evolucionan rápidamente.

Restricciones/Desafíos

- Complejidad operativa asociada con los equipos de procesamiento de bebidas

La complejidad operativa es un factor importante que actúa como una limitación para el mercado global de equipos de procesamiento de bebidas. La naturaleza intrincada de la producción moderna de bebidas, que involucra múltiples etapas y procesos especializados, presenta numerosos desafíos para los fabricantes. Estas complejidades pueden disuadir a las empresas de invertir en equipos de procesamiento avanzados, lo que limita el crecimiento del mercado. Comprender los factores específicos que contribuyen a la complejidad operativa ayuda a identificar por qué esto es una barrera importante.

Un aspecto clave de la complejidad operativa es la integración de tecnologías avanzadas en las líneas de producción existentes. Los equipos modernos de procesamiento de bebidas suelen incluir sofisticados sistemas de automatización y control que requieren conocimientos y capacitación especializados para funcionar de manera eficiente. La necesidad de personal capacitado para gestionar y mantener estos sistemas puede ser un obstáculo importante, especialmente para los fabricantes más pequeños con recursos limitados. Esta necesidad de habilidades especializadas puede generar mayores costos operativos y posibles interrupciones durante el período de transición, lo que hace que las empresas duden en adoptar nuevas tecnologías.

Otro factor que contribuye es el mantenimiento y el tiempo de inactividad asociados con los equipos de procesamiento avanzados. La maquinaria de alta tecnología suele tener requisitos de mantenimiento estrictos para garantizar un rendimiento óptimo y una larga vida útil. El mantenimiento frecuente y la necesidad de actualizaciones o reemplazos regulares de piezas pueden generar mayores gastos operativos. Además, los tiempos de inactividad no planificados debido a fallas en los equipos pueden alterar los cronogramas de producción, lo que genera pérdidas financieras y demoras en las entregas de productos. La posibilidad de que se produzcan tales interrupciones hace que algunos fabricantes se muestren cautelosos a la hora de realizar grandes inversiones en nuevas tecnologías de procesamiento.

El cumplimiento normativo añade otra capa de complejidad a las operaciones de procesamiento de bebidas. Los fabricantes deben cumplir con estrictos estándares de calidad y seguridad alimentaria, que pueden variar significativamente en las distintas regiones. Garantizar que los equipos de procesamiento avanzados cumplan con estos diversos requisitos normativos puede ser un desafío y costoso. El proceso de obtención de las certificaciones y aprobaciones necesarias puede llevar mucho tiempo, lo que retrasa aún más la implementación de nuevos equipos. Esta carga normativa puede disuadir a las empresas de actualizar sus capacidades de procesamiento, lo que limita el crecimiento del mercado.

Este informe de mercado proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Además del informe estándar, también ofrecemos un análisis en profundidad del nivel de adquisiciones a partir de retrasos de envío previstos, mapeo de distribuidores por región, análisis de productos básicos, análisis de producción, tendencias de mapeo de precios, abastecimiento, análisis del desempeño de categorías, soluciones de gestión de riesgos de la cadena de suministro, evaluación comparativa avanzada y otros servicios para adquisiciones y soporte estratégico.

Impacto esperado de la desaceleración económica en los precios y la disponibilidad de los productos

Cuando la actividad económica se desacelera, las industrias comienzan a sufrir. Los efectos previstos de la crisis económica sobre los precios y la accesibilidad de los productos se tienen en cuenta en los informes de conocimiento del mercado y los servicios de inteligencia que ofrece DBMR. Con esto, nuestros clientes pueden normalmente mantenerse un paso por delante de sus competidores, proyectar sus ventas e ingresos y estimar sus gastos de ganancias y pérdidas.

Alcance del mercado de equipos de procesamiento de bebidas

El mercado está segmentado en función del tipo de equipo, el tipo de automatización y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de equipo

- Equipos de filtración

- Intercambiadores de calor

- Equipos para cervecerías

- Licuadoras y batidoras

- Equipo de carbonatación

- Disolventes de azúcar

- Otros

Tipo de automatización

- Automático

- Semiautomático

- Manual

Solicitud

- Bebidas no alcohólicas

- Bebidas alcohólicas

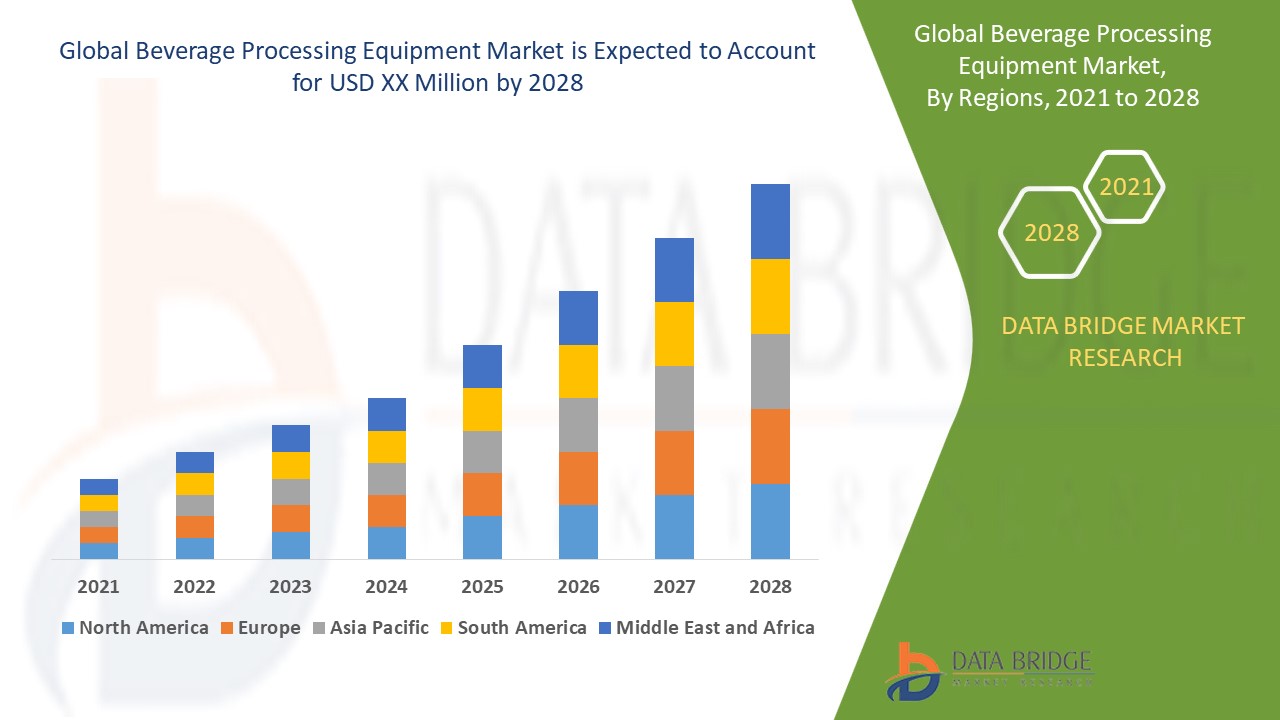

Análisis regional del mercado de equipos de procesamiento de bebidas

Se analiza el mercado y se proporcionan información y tendencias del tamaño del mercado por país, tipo de equipo, tipo de automatización y aplicación como se menciona anteriormente.

Los países cubiertos en el informe de mercado son EE. UU., Canadá, México en América del Norte, Alemania, Suecia, Polonia, Dinamarca, Italia, Reino Unido, Francia, España, Países Bajos, Bélgica, Suiza, Turquía, Rusia, Resto de Europa en Europa, Japón, China, India, Corea del Sur, Nueva Zelanda, Vietnam, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico (APAC) en Asia-Pacífico (APAC), Brasil, Argentina, Resto de América del Sur como parte de América del Sur, Emiratos Árabes Unidos, Arabia Saudita, Omán, Qatar, Kuwait, Sudáfrica, Resto de Medio Oriente y África (MEA) como parte de Medio Oriente y África (MEA)

Se espera que la región de Asia y el Pacífico domine el mercado mundial de equipos de procesamiento de bebidas debido al aumento de las inversiones gubernamentales y las políticas de apoyo en el sector de procesamiento de bebidas. Se espera que China domine la región de Asia y el Pacífico debido al aumento del consumo de bebidas en todo el país. Se espera que Alemania domine la región de Europa debido a sus vastas capacidades de fabricación, bajos costos de producción y amplia red de exportación. Se espera que Estados Unidos domine la región de América del Norte debido a la adaptación de tecnologías innovadoras en la industria de procesamiento de bebidas.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor aguas arriba y aguas abajo, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado de equipos para el procesamiento de bebidas

El panorama competitivo del mercado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado.

Los líderes del mercado de equipos de procesamiento de bebidas que operan en el mercado son:

- Grupo Tetra Pak

- Sociedad Anónima del Grupo GEA

- Krones AG

- Flujo del SPX

- Pentair

- Grupo KHS

- Alfa Laval

- JBT

- Bühler AG

- Compañía Paul Mueller

- Bucher Unipektin AG

- Industrias Praj

- Sistemas de procesos HRS Ltd.

- Fabricante: TechniBlend, Inc.

- Fristam

- Omnia Della Toffola SpA

- PROXES GMBH

- Ingeniería Caloris, LLC.

- Maquinaria alimentaria FME Europe Sp. z oo

- Bigtem Machine AS

Últimos avances en el mercado de equipos de procesamiento de bebidas

- En 2024, el Grupo Tetra Pak presentó su oferta de "Soluciones sustentables para fábricas", un nuevo enfoque integral para optimizar los procesos de energía, agua y limpieza in situ (CIP) en las fábricas. Esta iniciativa, parte de la cartera de sustentabilidad más amplia de Tetra Pak, brindará a los productores de alimentos y bebidas (F&B) una combinación personalizada de tecnologías avanzadas y capacidades superiores de integración en planta. El objetivo es ayudar a los productores de alimentos y bebidas a mejorar su eficiencia energética y de recursos, ayudándolos a lograr sus objetivos de sustentabilidad y, al mismo tiempo, reducir los costos operativos.

- En 2024, GEA Group Aktiengesellschaft lanzó en Anuga FoodTec Insight Partner, una nueva aplicación basada en la nube para el procesamiento y envasado de alimentos. La solución proporcionaba monitorización y análisis en tiempo real, optimizando el rendimiento de las máquinas y ampliando la vida útil de los equipos. Su objetivo era mejorar la eficiencia, reducir el tiempo de inactividad y disminuir el coste total de propiedad de las plantas alimentarias. Insight Partner ofrecía interfaces fáciles de usar, acceso a datos en directo y alertas de mantenimiento proactivas, lo que respaldaba la productividad operativa y la planificación del mantenimiento.

- En mayo, el sistema de recuperación rápida aséptica (ARRS) APV de SPX FLOW ganó el premio al producto sostenible en los premios SEAL Business Sustainability Awards de 2024 por reducir el desperdicio de productos en un 87 %. La tecnología redujo la pérdida de productos lácteos del 4 % al 0,5 % al recuperar los restos en las tuberías de proceso. También minimizó el uso de agua y el tiempo de limpieza, lo que mejoró la sostenibilidad en la producción de lácteos y bebidas. La innovación tiene como objetivo establecer un nuevo estándar en el procesamiento aséptico para mejorar el impacto ambiental y la seguridad del consumidor.

- En mayo de 2024, Alfa Laval presentó un nuevo intercambiador de calor, el Hygienic WideGap, con el objetivo de revolucionar las prácticas sostenibles en el procesamiento de alimentos. Reduce a la mitad las emisiones en la producción de alimentos líquidos como jugos y bebidas de origen vegetal. La nueva tecnología mejora la eficiencia energética en un 50 por ciento y reduce significativamente el consumo de vapor y energía. Esta innovación respalda el cambio de la industria alimentaria hacia el abandono de los combustibles fósiles, abordando tanto el uso de energía como las emisiones de gases de efecto invernadero. Ofrece una solución sostenible para la producción de alimentos en un momento en el que la demanda mundial de alimentos está aumentando drásticamente.

- En abril de 2024, Alfa Laval presentó el Alfa Laval Foodec Hygiene Plus, un decantador altamente higiénico diseñado específicamente para la industria alimentaria. Cuenta con funciones de limpieza avanzadas y superficies lisas para evitar la acumulación de residuos y mejorar la limpieza. Los extras opcionales como TrueStainlessTM y SaniRibs mejoran aún más la higiene al utilizar acero inoxidable para las piezas clave y reducir los puntos críticos de patógenos. Esta innovación tiene como objetivo cumplir con los estándares de higiene en evolución en la producción de alimentos, lo que garantiza una mejor productividad y calidad del producto.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.