Mercado mundial de intercambiadores de calor automotrices, por aplicación (intercambiador de calor, radiador, aire acondicionado, enfriador de aceite y otros), tipo de diseño (aleta de tubo, barra de placa y otros), material (aluminio, cobre y otros), tipo de propulsión ( motor de combustión interna (ICE) y vehículo eléctrico (EV)), tipo de vehículo (automóvil de pasajeros, vehículo comercial ligero y vehículo comercial pesado) Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado de intercambiadores de calor para automóviles

En el análisis de intercambiadores de calor, suele ser conveniente trabajar con un coeficiente de transferencia de calor global, conocido como factor U. Los intercambiadores de calor se clasifican normalmente según la disposición del flujo y el tipo de construcción. Los diferentes tipos de intercambiadores de calor son disposiciones de flujo paralelo y disposiciones de contraflujo.

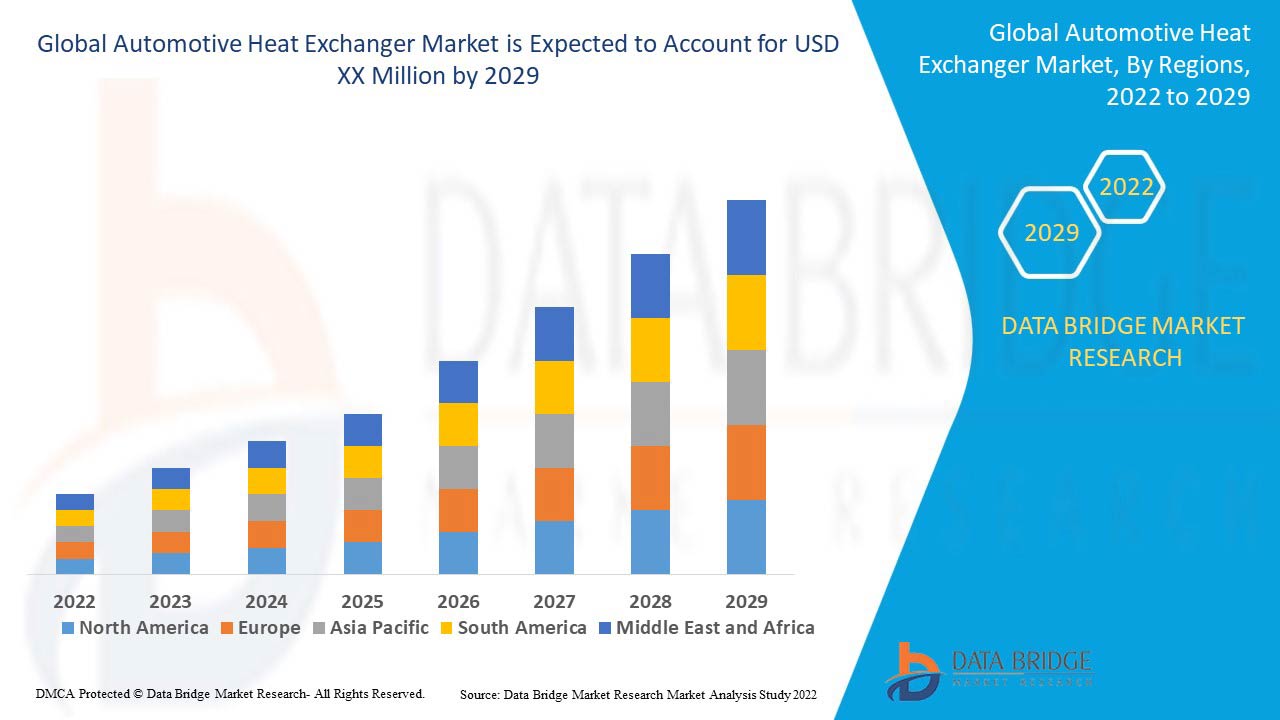

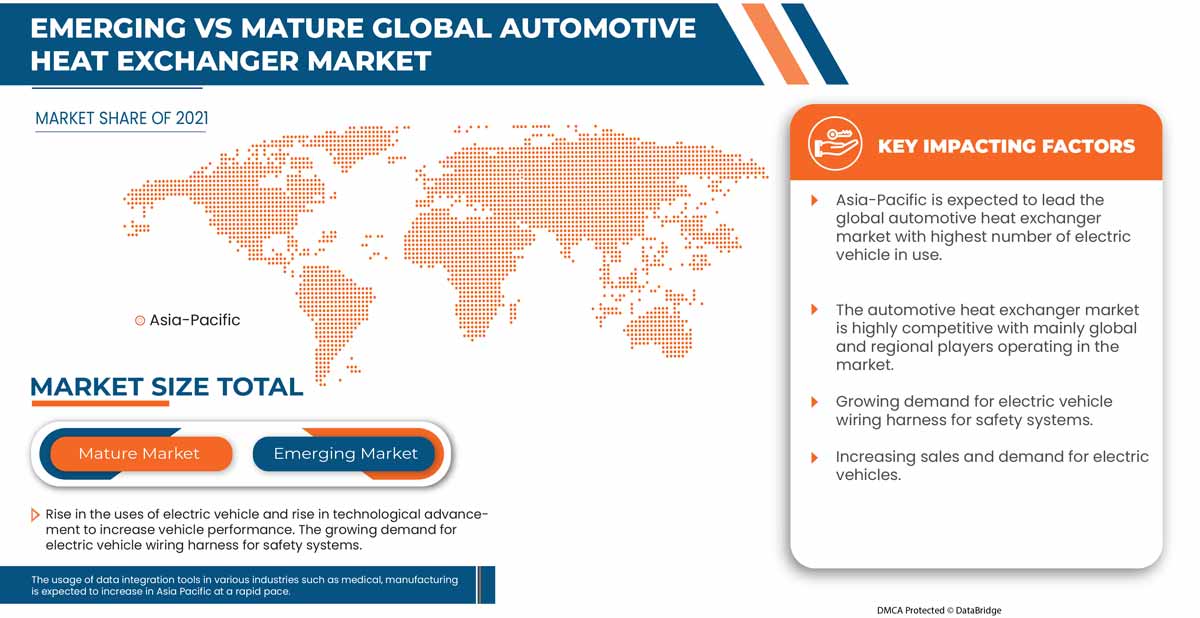

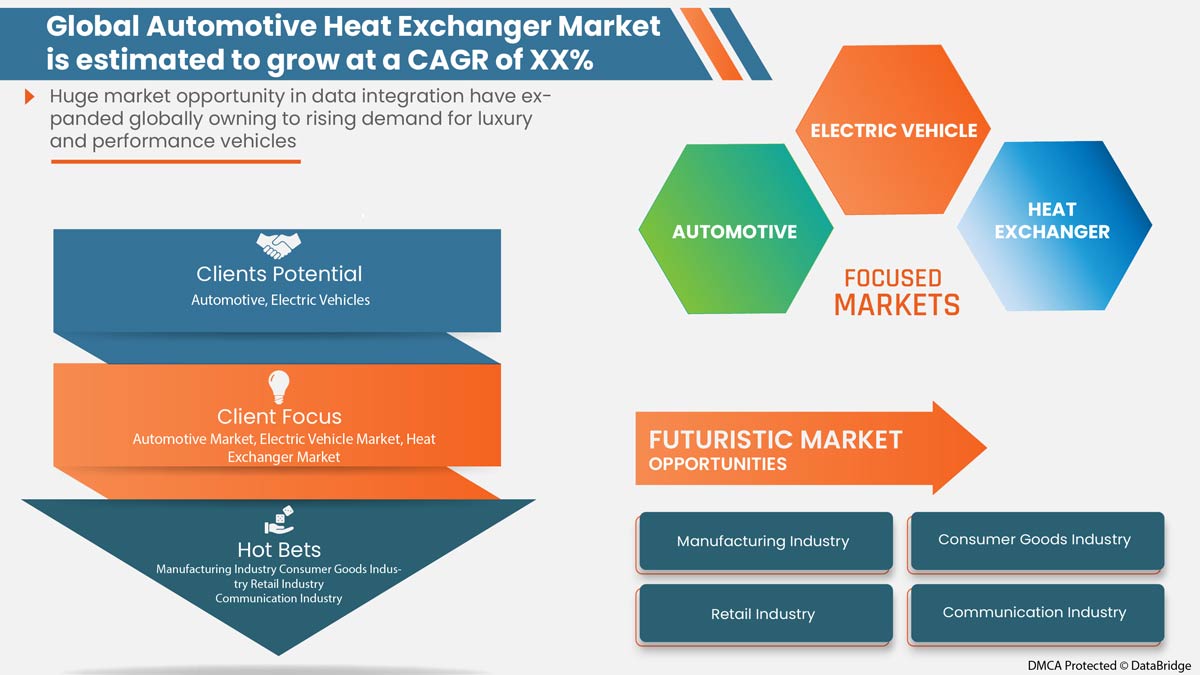

El aumento de la población, la rápida urbanización y la industrialización tienen un impacto proposicional en el crecimiento y la adopción del intercambiador de calor automotriz, ya que los sistemas actuales de intercambiador de calor automotriz se utilizan ampliamente para mejorar la dinámica del vehículo y las características de seguridad. Data Bridge Market Research analiza que el mercado global de intercambiadores de calor automotriz crecerá a una CAGR del 6,3% entre 2022 y 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Por aplicación (intercambiador de calor, radiador, aire acondicionado, enfriador de aceite y otros), tipo de diseño (aleta de tubo, barra de placa y otros), material (aluminio, cobre y otros), tipo de propulsión (motor de combustión interna (ICE) y vehículo eléctrico (EV)), tipo de vehículo (automóvil de pasajeros, vehículo comercial ligero y vehículo comercial pesado). |

|

Países cubiertos |

EE. UU., Canadá, México, Reino Unido, Alemania, Francia, España, Italia, Países Bajos, Suiza, Rusia, Bélgica, Turquía, Resto de Europa, China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas, Resto de Asia-Pacífico, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto, Resto de Medio Oriente y África, Brasil, Argentina y Resto de Sudamérica. |

|

Actores del mercado cubiertos |

Español: Fabricantes y proveedores de componentes de refrigeración y aire acondicionado de vehículos. |

Definición de mercado

Un intercambiador de calor es un dispositivo de transferencia de calor que intercambia calor entre dos o más fluidos de proceso. Los intercambiadores de calor tienen aplicaciones industriales y domésticas generalizadas. Se han desarrollado muchos intercambiadores de calor en plantas de energía a vapor, plantas de procesamiento químico, sistemas de calefacción y aire acondicionado de edificios, sistemas de energía de transporte y unidades de refrigeración. La transferencia de calor en un intercambiador de calor generalmente implica convección en cada fluido y conducción térmica a través de la pared que separa los dos fluidos.

Dinámica del mercado mundial de intercambiadores de calor para automóviles

En esta sección se aborda la comprensión de los factores impulsores, las ventajas, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

-

AUMENTO DE LA POBLACIÓN, RÁPIDA URBANIZACIÓN E INDUSTRIALIZACIÓN

Durante más de una década, la industrialización y la urbanización han desempeñado un papel importante en el surgimiento y el crecimiento de la industria automotriz. Con una población en aumento en todo el mundo y la mayoría de la población desplazándose hacia áreas urbanas en busca de mejores oportunidades y niveles de vida, desempeña un papel vital en la configuración del sector de la industria automotriz.

-

APARICIÓN DE LOS VEHÍCULOS ELÉCTRICOS (VE)

La industria automotriz ha crecido enormemente debido a la creciente demanda de vehículos eléctricos de lujo. Los vehículos totalmente eléctricos (VE) se denominan vehículos eléctricos de batería y utilizan una batería para almacenar la energía eléctrica que alimenta los vehículos. Algunos de los factores que impulsan las ventas de vehículos eléctricos incluyen las estrictas regulaciones gubernamentales sobre las emisiones de los vehículos y la creciente demanda de vehículos de bajo consumo de combustible, alto rendimiento y bajas emisiones. Esto se suma a la adopción de vehículos totalmente eléctricos como vehículos de cero emisiones, lo que minimiza de manera efectiva las emisiones de carbono.

-

CRECIMIENTO DE LA DEMANDA DE VEHÍCULOS ADAS Y SU MODELO DE SUSCRIPCIÓN

Los sistemas avanzados de asistencia al conductor (ADAS) son sistemas electrónicos implantados en los automóviles para ayudar a la conducción de vehículos o coches autónomos. Este sistema utiliza sensores como radares y cámaras para el análisis y toma medidas automáticas en función del entorno del vehículo. Este sistema implementado en automóviles permite mejorar los sistemas de seguridad en cuanto a la conducción mediante la evitación de colisiones, la adopción de control de crucero, antibloqueo de frenos, automatización de la iluminación, mitigación de colisiones con peatones (PCAM) y muchos otros.

-

AUMENTO DE LA DEMANDA DE VEHÍCULOS DE LUJO Y DE ALTO RENDIMIENTO

Un vehículo de lujo es aquel que cuenta con características de lujo avanzadas, como materiales interiores de mayor calidad, motores eficientes, transmisiones, sistemas de sonido, telemática y funciones de seguridad. Estos vehículos tienen características que no están disponibles en modelos de vehículos de menor precio.

Oportunidad

-

SURGIMIENTO DE LA AUTOMOCIÓN INTELIGENTE CONECTADA

Un vehículo conectado es capaz de conectar redes inalámbricas a dispositivos cercanos. El concepto de vehículos conectados es posible gracias a avances tecnológicos como la IA, el Big Data, la conectividad de red avanzada y la IoT. El vehículo conectado se está volviendo popular entre los consumidores por diversas aplicaciones y casos de uso. Uno de esos casos de uso puede ser el de los sistemas de entretenimiento conectados, que permiten que los teléfonos móviles de los consumidores se conecten a Internet en vehículos con comunicación bidireccional con otros vehículos y dispositivos móviles.

Restricción/Desafío

-

ALTA HUELLA DE CARBONO DEL SECTOR AUTOMOTRIZ Y COMPLEJIDADES DE DISEÑO, Y ALTO COSTO INICIAL

Sin embargo, la elevada huella de carbono del sector automotor obligará a los organismos gubernamentales a adoptar medidas y reglamentaciones estrictas para controlar los niveles de emisiones, lo que puede reducir la adopción de soluciones de intercambiadores de calor para automóviles. Además, las complejidades del diseño y los elevados costes iniciales se correlacionan directamente con las ventas y la disponibilidad de nuevos sistemas de intercambiadores de calor para automóviles.

Impacto de la COVID-19 en el mercado mundial de intercambiadores de calor para automóviles

El COVID-19 ha afectado negativamente al mercado. Como los sistemas de intercambiadores de calor para automóviles tienen una gran demanda a nivel mundial, empresas como Marelli Holdings Co., Ltd., Hanon Systems, Nissens, Griffin Thermal Products, TYC Brother Industrial Co., Ltd., Dana Limited y otras en todo el mundo enfrentan una absoluta dificultad para proporcionar sistemas avanzados para vehículos nuevos y antiguos debido a la escasez de chips y controladores de control de semiconductores, esto se debió a las estrictas regulaciones impuestas por el gobierno. Una oferta limitada de chips y dispositivos semiconductores ha afectado significativamente la oferta de vehículos en el mercado.

Desarrollo reciente

- En marzo de 2022, T.RAD Co., Ltd. lanzó equipos de refrigeración y ventilación no domésticos (NACE2 2825) en América del Norte. La característica clave de dichos productos en la región fue el lanzamiento de sus múltiples productos, por ejemplo, radiadores, enfriadores de aceite, intercoolers, enfriadores de EGR, evaporadores, condensadores, serpentines de agua y recuperadores. A través de esto, la empresa amplió sus ingresos y sus ventas en la región.

Alcance del mercado mundial de intercambiadores de calor para automóviles

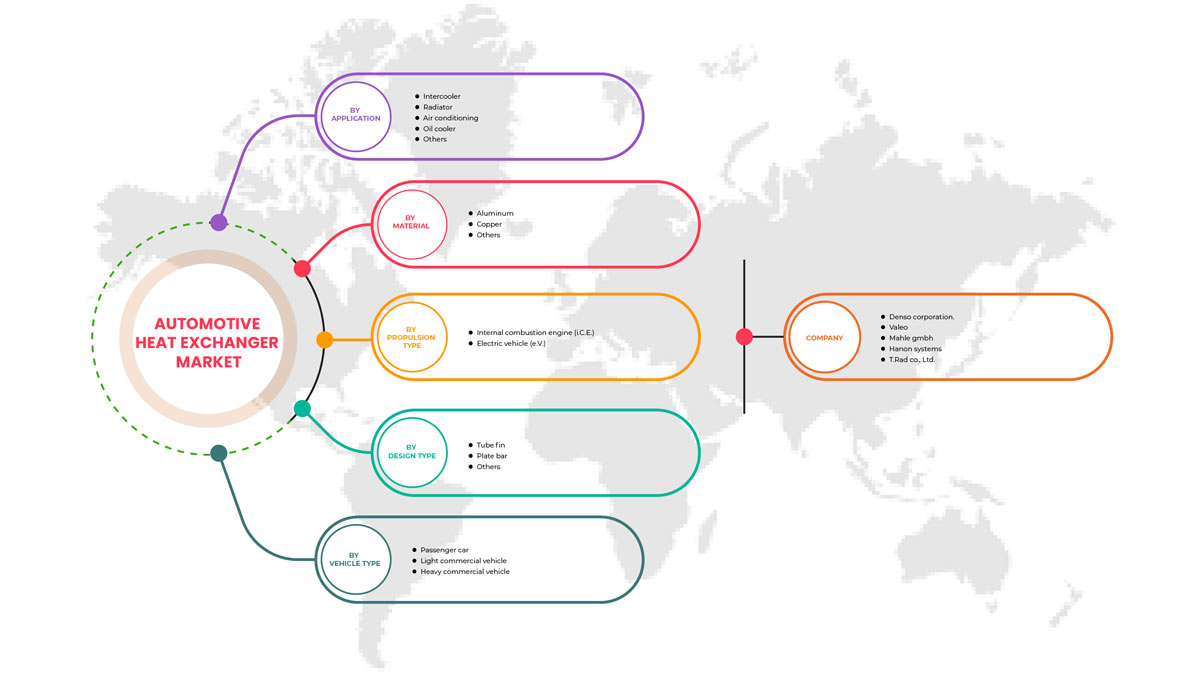

El mercado mundial de intercambiadores de calor para automóviles está segmentado por aplicación, tipo de diseño, tipo de material del vehículo y tipo de propulsión. El crecimiento entre estos segmentos le ayudará a analizar los escasos segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Solicitud

- Intercambiador de calor

- Radiador

- Aire acondicionado

- Enfriador de aceite

- Otros

Sobre la base de la aplicación, el mercado global de intercambiadores de calor automotrices se segmenta en intercooler, radiador, aire acondicionado, enfriador de aceite y otros.

Tipo de diseño

- Aleta de tubo

- Barra de placa

- Otros

Sobre la base del tipo de diseño, el mercado global de intercambiadores de calor automotrices se segmenta en aletas de tubo, barras de placa y otros.

Material

- Aluminio

- Cobre

- Otros

Sobre la base del material, el mercado global de intercambiadores de calor automotrices está segmentado en aluminio, cobre y otros.

Tipo de propulsión

- Motor de combustión interna (ICE)

- Vehículo eléctrico (VE)

Sobre la base del tipo de propulsión, el mercado global de intercambiadores de calor automotrices está segmentado en motores de combustión interna (ICE) y vehículos eléctricos (EV).

Tipo de vehículo

- Coche de pasajeros

- Vehículo comercial ligero

- Vehículo comercial pesado

Según el tipo de vehículo, el mercado global de intercambiadores de calor automotrices se segmenta en automóviles de pasajeros, vehículos comerciales ligeros y vehículos comerciales pesados.

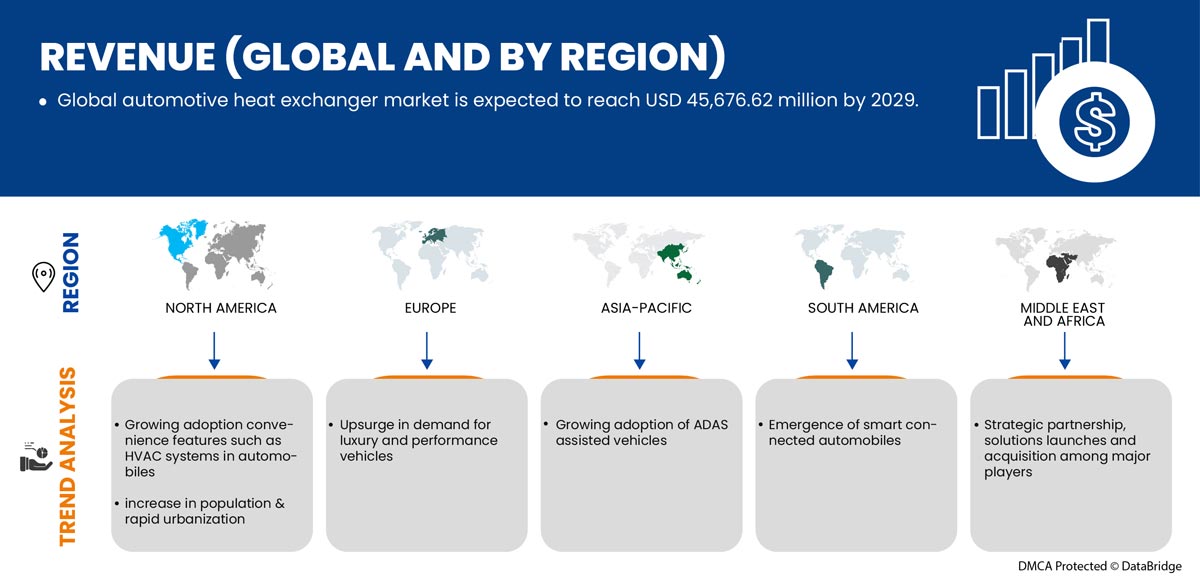

Análisis y perspectivas regionales del mercado mundial de intercambiadores de calor para automóviles

Se analiza el mercado global de intercambiadores de calor automotrices y se proporcionan información y tendencias sobre el tamaño del mercado por región, aplicación, tipo de diseño, material, tipo de propulsión y tipo de vehículo, como se menciona anteriormente.

Las regiones cubiertas en el informe global del mercado de intercambiadores de calor automotrices son Asia-Pacífico, Europa, América del Norte, Medio Oriente y África, y América del Sur. El mercado de intercambiadores de calor automotrices de América del Norte está subsegmentado en EE. UU., Canadá y México. El mercado de intercambiadores de calor automotrices de Europa está subsegmentado en Reino Unido, Alemania, Francia, España, Italia, Países Bajos, Suiza, Rusia, Bélgica, Turquía y el resto de Europa. El mercado de intercambiadores de calor automotrices de Asia-Pacífico está subsegmentado en China, Corea del Sur, Japón, India, Australia, Singapur, Malasia, Indonesia, Tailandia, Filipinas y el resto de Asia-Pacífico. El mercado de intercambiadores de calor automotrices de Oriente Medio y África está subsegmentado en Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Israel, Egipto y el resto de Oriente Medio y África. El mercado de intercambiadores de calor automotrices de América del Sur está subsegmentado en Brasil, Argentina y el resto de América del Sur.

En 2022, la región de Asia y el Pacífico dominará el mercado de intercambiadores de calor automotrices a nivel mundial, ya que es una región tecnológicamente avanzada con una gran cantidad de actores importantes del mercado, lo que posteriormente aumenta la adopción de productos de intercambiadores de calor automotrices y sus servicios.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en las regulaciones en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, epidemiología de enfermedades y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado global de intercambiadores de calor para automóviles

El panorama competitivo del mercado mundial de intercambiadores de calor para automóviles proporciona detalles de un competidor. Los detalles incluyen una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de soluciones, la amplitud y variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado mundial de intercambiadores de calor para automóviles.

Algunos de los principales actores del mercado mundial de intercambiadores de calor automotrices son DENSO CORPORATION, MAHLE GmbH, VALEO, Hanon Systems y T.RAD Co., Ltd., entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 APPLICATION TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF ELECTRIC VEHICLES (EVS)

5.1.3 GROWING ADOPTION OF ADAS ASSISTED VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH CARBON FOOTPRINT OF AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 STRATEGIC PARTNERSHIP, SOLUTIONS LAUNCHES, AND ACQUISITIONS AMONG MAJOR PLAYERS

5.3.2 EMERGENCE OF SMART CONNECTED AUTOMOTIVE

5.3.3 GROWING ADOPTION OF CONVENIENCE FEATURES SUCH AS HVAC SYSTEMS IN AUTOMOTIVES

5.4 CHALLENGES

5.4.1 UPCOMING EMISSION NORMS COULD POSE A CHALLENGE FOR AUTOMOTIVE HEAT EXCHANGERS

5.4.2 DESIGN COMPLEXITIES AND HIGH UPFRONT COST

6 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 INTERCOOLER

6.3 RADIATOR

6.4 AIR CONDITIONING

6.5 OIL COOLER

6.6 OTHERS

7 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 TUBE FIN

7.3 PLATE BAR

7.4 OTHERS

8 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 ALUMINUM

8.3 COPPER

8.4 OTHERS

9 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE

9.1 OVERVIEW

9.2 INTERNAL COMBUSTION ENGINE (ICE)

9.3 ELECTRIC VEHICLE (EV)

10 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CAR

10.3 LIGHT COMMERCIAL VEHICLE

10.4 HEAVY COMMERCIAL VEHICLE

10.4.1 ON-HIGHWAY VEHICLE

10.4.2 OFF-HIGHWAY VEHICLE

10.4.2.1 CONSTRUCTION

10.4.2.2 AGRICULTURE

10.4.2.3 OTHERS

11 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 JAPAN

11.2.3 SOUTH KOREA

11.2.4 INDIA

11.2.5 AUSTRALIA

11.2.6 THAILAND

11.2.7 INDONESIA

11.2.8 MALAYSIA

11.2.9 PHILIPPINES

11.2.10 SINGAPORE

11.2.11 REST OF ASIA-PACIFIC

11.3 EUROPE

11.3.1 GERMANY

11.3.2 U.K.

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 RUSSIA

11.3.7 SWITZERLAND

11.3.8 NETHERLANDS

11.3.9 BELGIUM

11.3.10 TURKEY

11.3.11 REST OF EUROPE

11.4 NORTH AMERICA

11.4.1 U.S.

11.4.2 CANADA

11.4.3 MEXICO

11.5 MIDDLE EAST AND AFRICA

11.5.1 U.A.E.

11.5.2 SAUDI ARABIA

11.5.3 ISRAEL

11.5.4 SOUTH AFRICA

11.5.5 EGYPT

11.5.6 REST OF MIDDLE EAST AND AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DENSO CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 VALEO

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 BUSINESS PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 MAHLE GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HANON SYSTEMS

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 BUSINESS PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 T.RAD CO., LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCTS PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AKG GROUP

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT0

14.7 BANCO PRODUCTS (I) LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CLIZEN INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSTELLIUM

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 DANA LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 BUSINESS PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 G&M RADIATOR

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GRIFFIN THERMAL PRODUCTS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCTS PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MARELLI HOLDINGS CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCTS PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 MISHIMOTO AUTOMOTIVE

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MODINE MANUFACTURING COMPANY

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 NISSENS AUTOMOTIVE A/S

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCTS PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PWR CORPORATE

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SANDEN CORPORATION.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 TYC BROTHER INDUSTRIAL CO., LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 BUSINESS PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS, SUVS &TRUCK

TABLE 2 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 3 GLOBAL INTERCOOLER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 GLOBAL RADIATOR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 GLOBAL AIR CONDITIONING IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 GLOBAL OIL COOLER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 GLOBAL OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 9 GLOBAL TUBE FIN IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 GLOBAL PLATE BAR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 GLOBAL OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 GLOBAL ALUMINUM IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 GLOBAL COPPER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 GLOBAL OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 17 GLOBAL INTERNAL COMBUSTION ENGINE (ICE) IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 GLOBAL ELECTRIC VEHICLE (EV) IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 20 GLOBAL PASSENGER CAR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 GLOBAL LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 GLOBAL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 GLOBAL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 GLOBAL OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 36 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 37 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 38 CHINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 39 CHINA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 43 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 44 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 45 JAPAN AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 46 JAPAN HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 JAPAN OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 51 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH KOREA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 53 SOUTH KOREA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SOUTH KOREA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 57 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 58 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 59 INDIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 60 INDIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 INDIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 64 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 65 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 66 AUSTRALIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 67 AUSTRALIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 AUSTRALIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 71 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 72 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 73 THAILAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 74 THAILAND HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 THAILAND OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 78 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 79 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 80 INDONESIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 81 INDONESIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 INDONESIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 85 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 86 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 87 MALAYSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 88 MALAYSIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 MALAYSIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 91 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 92 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 93 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 94 PHILIPPINES AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 95 PHILIPPINES HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 PHILIPPINES OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 99 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 100 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 101 SINGAPORE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 102 SINGAPORE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SINGAPORE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 REST OF ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 106 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 107 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 108 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 109 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 110 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 111 EUROPE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 EUROPE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 115 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 116 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 117 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 118 GERMANY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 GERMANY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 120 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 122 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 123 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 124 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 125 U.K. HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.K. OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 129 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 130 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 131 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 132 FRANCE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 FRANCE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 136 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 137 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 138 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 139 ITALY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 ITALY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 142 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 146 SPAIN HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 148 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 150 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 152 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 157 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 158 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 159 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 160 SWITZERLAND HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 SWITZERLAND OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 162 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 164 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 165 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 166 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 167 NETHERLANDS HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 168 NETHERLANDS OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 171 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 172 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 173 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 174 BELGIUM HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 BELGIUM OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 177 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 178 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 179 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 180 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 181 TURKEY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 TURKEY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 REST OF EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 184 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 185 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 187 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 188 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 189 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 190 NORTH AMERICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 NORTH AMERICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 194 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 195 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 196 U.S. AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 197 U.S. HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 U.S. OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 201 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 202 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 203 CANADA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 204 CANADA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 CANADA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 206 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 207 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 208 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 209 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 210 MEXICO AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 211 MEXICO HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 MEXICO OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 213 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 214 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 215 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 216 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 217 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 219 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 221 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 222 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 223 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 224 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 225 U.A.E. AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 226 U.A.E. HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 U.A.E. OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 228 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 229 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 230 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 231 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 232 SAUDI ARABIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 233 SAUDI ARABIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 SAUDI ARABIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 235 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 236 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 237 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 238 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 239 ISRAEL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 240 ISRAEL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 241 ISRAEL OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 243 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 244 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 245 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 246 SOUTH AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 247 SOUTH AFRICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 248 SOUTH AFRICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 249 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 250 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 251 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 252 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 253 EGYPT AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 254 EGYPT HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 EGYPT OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 256 REST OF MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 257 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 258 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 259 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 260 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 261 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 262 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 263 SOUTH AMERICA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 264 SOUTH AMERICA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 265 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 266 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 267 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 268 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 269 BRAZIL AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 270 BRAZIL HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 271 BRAZIL OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 272 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 273 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 274 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 275 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 276 ARGENTINA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 277 ARGENTINA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 ARGENTINA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 279 REST OF SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: SEGMENTATION

FIGURE 2 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: SEGMENTATION

FIGURE 10 GROWING ADOPTION OF ADAS ASSISTED VEHICLES IS EXPECTED TO DRIVE GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INTERCOOLER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET FROM 2022 TO 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IT IS THE FASTEST GROWING REGION IN THE GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR AUTOMOTIVE HEAT EXCHANGER MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET

FIGURE 15 URBANIZED REGIONS IN THE GLOBE

FIGURE 16 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 17 ROAD TRANSPORT EMISSIONS

FIGURE 18 BENEFITS OF SMART TELEMATICS FOR FLEET MANAGEMENT

FIGURE 19 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION, 2021

FIGURE 20 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY DESIGN TYPE, 2021

FIGURE 21 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY MATERIAL, 2021

FIGURE 22 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY PROPULSION TYPE, 2021

FIGURE 23 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY VEHICLE TYPE, 2021

FIGURE 24 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 25 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY REGION (2021)

FIGURE 26 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY REGION (2022 & 2029)

FIGURE 27 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY REGION (2021 & 2029)

FIGURE 28 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 29 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 30 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 31 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 34 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 35 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 36 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 39 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 44 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 45 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 46 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 MIDDLE EAST AND AFRICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 49 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 50 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 51 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 52 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 53 SOUTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 54 GLOBAL AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

FIGURE 55 NORTH AMERICA AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

FIGURE 56 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

FIGURE 57 ASIA-PACIFIC AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.