Global Automotive Engine Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

95.95 Billion

USD

115.10 Billion

2024

2032

USD

95.95 Billion

USD

115.10 Billion

2024

2032

| 2025 –2032 | |

| USD 95.95 Billion | |

| USD 115.10 Billion | |

|

|

|

|

Segmentación del mercado global de motores automotrices por tipo de motor (motores de combustión interna (MCI), motores eléctricos y motores de combustibles alternativos), tipo de vehículo (turismos, vehículos comerciales ligeros (VCL), vehículos comerciales pesados (VCP), vehículos de dos ruedas y autobuses), cilindrada (menos de 1,0 l, de 1,0 l a 2,0 l, de 2,0 l a 3,0 l y más de 3,0 l), tipo de combustible (gasolina, diésel, eléctrico, híbrido y combustibles alternativos): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de motores automotrices

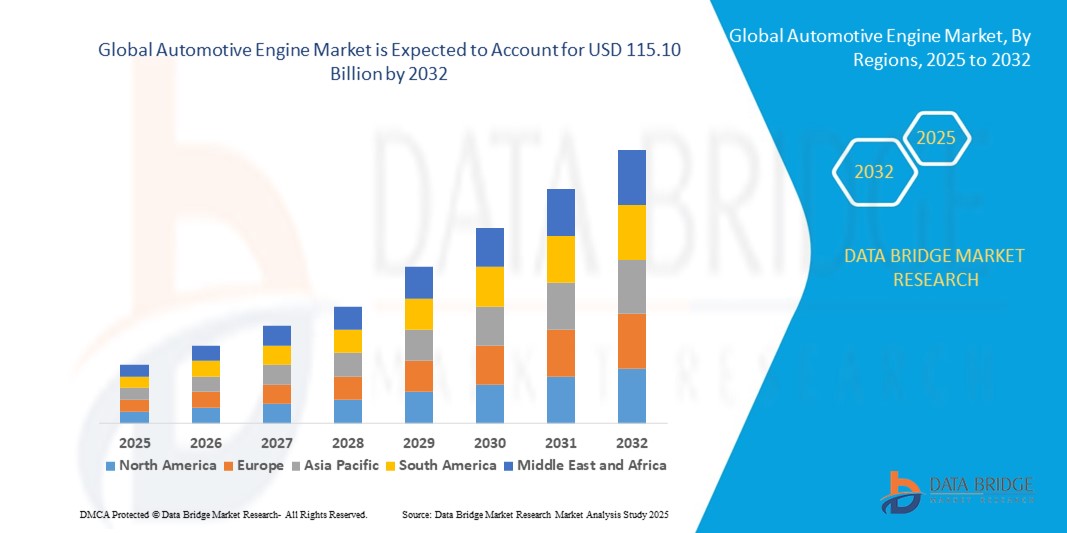

- El tamaño del mercado mundial de motores automotrices se valoró en USD 95,95 mil millones en 2024 y se espera que alcance los USD 115,10 mil millones para 2032 , con una CAGR de 2,30% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de motores de bajo consumo de combustible y bajas emisiones, respaldados por regulaciones ambientales más estrictas en todo el mundo.

- La innovación continua en tecnologías de motores híbridos y compatibles con electricidad está acelerando aún más su adopción, a medida que los fabricantes de automóviles avanzan hacia el cumplimiento de los objetivos de sostenibilidad y rendimiento.

Análisis del mercado de motores automotrices

- El mercado está siendo testigo de un cambio transformador a medida que los fabricantes invierten en motores turboalimentados de tamaño reducido que ofrecen una mayor potencia y al mismo tiempo reducen el consumo de combustible.

- Las estrategias de hibridación, donde los motores convencionales se combinan con sistemas de propulsión eléctricos, están creando nuevas oportunidades tanto en los segmentos de vehículos de pasajeros como comerciales.

- América del Norte dominó el mercado de motores automotrices con la mayor participación en los ingresos del 36,5 % en 2024, impulsada por una fuerte demanda de vehículos de alto rendimiento, estrictas regulaciones de emisiones y continuos avances tecnológicos en el diseño de motores.

- Se espera que la región de Asia y el Pacífico sea testigo de la mayor tasa de crecimiento en el mercado mundial de motores automotrices , impulsada por la expansión de la producción de automóviles, el aumento de los ingresos disponibles y la creciente demanda de automóviles de pasajeros y vehículos comerciales en las economías emergentes.

- El segmento de motores de combustión interna (ICE) registró la mayor participación en ingresos del mercado en 2024, impulsado por su uso generalizado en turismos y vehículos comerciales. La tecnología ICE sigue siendo la columna vertebral del transporte mundial, respaldada por una infraestructura consolidada y continuos avances en eficiencia de combustible y control de emisiones.

Alcance del informe y segmentación del mercado de motores automotrices

|

Atributos |

Perspectivas clave del mercado de motores automotrices |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de motores automotrices

Cambio hacia motores híbridos y compatibles con la electricidad

- La industria automotriz está experimentando una transición constante hacia motores híbridos y compatibles con la electricidad, transformando el panorama global de los motores. Los fabricantes de automóviles invierten cada vez más en sistemas de propulsión flexibles que combinan eficiencia de combustible con reducción de emisiones, cumpliendo con las regulaciones ambientales más estrictas. Este cambio apoya los objetivos de sostenibilidad, manteniendo al mismo tiempo los estándares de rendimiento.

- La creciente demanda de vehículos más ecológicos por parte de los consumidores está acelerando la adopción de motores diseñados para integrarse a la perfección con sistemas de propulsión eléctricos. Los fabricantes priorizan las plataformas modulares que pueden adaptarse tanto a los segmentos convencionales como a los híbridos, garantizando así la adaptabilidad en diferentes mercados.

- Los motores compatibles con híbridos también permiten a los fabricantes de automóviles ampliar la autonomía de los vehículos y reducir la dependencia del combustible, lo que los convierte en un puente estratégico hacia la electrificación total. Este enfoque beneficia a los consumidores al equilibrar la eficiencia, la rentabilidad y la fiabilidad.

- Por ejemplo, en 2023, varios fabricantes de automóviles líderes en Europa lanzaron plataformas con motores híbridos que ofrecieron un mayor ahorro de combustible y el cumplimiento de la normativa de emisiones Euro 7. Estas innovaciones no solo redujeron la huella de CO₂, sino que también posicionaron a los fabricantes de forma competitiva en los mercados globales.

- Si bien la tendencia hacia los motores híbridos y eléctricos se está acelerando, los avances continuos en materiales, tecnología de integración y asequibilidad son cruciales. Las empresas deben centrarse en soluciones escalables para garantizar una adopción generalizada y la sostenibilidad a largo plazo.

Dinámica del mercado de motores automotrices

Conductor

Creciente demanda de vehículos de bajo consumo de combustible y bajas emisiones

- Las regulaciones de emisiones más estrictas a nivel mundial están impulsando a los fabricantes a diseñar motores que cumplan con altos estándares de eficiencia y sostenibilidad. Los gobiernos de las principales economías están implementando planes de neutralidad de carbono, lo que crea fuertes incentivos para que los fabricantes de automóviles prioricen las tecnologías de bajo consumo de combustible. Estas políticas están acelerando la adopción de sistemas de combustión avanzados y plataformas híbridas en los mercados globales.

- Los consumidores también muestran una creciente conciencia sobre el impacto ambiental, lo que genera una mayor demanda de vehículos con menores costos de combustible y emisiones. Esto ha fortalecido la inversión en motores de nueva generación que generen beneficios tanto ambientales como económicos. La creciente conciencia ecológica entre los compradores más jóvenes presiona aún más a los fabricantes de automóviles para ampliar sus carteras de vehículos ecológicos.

- Los fabricantes de automóviles están invirtiendo fuertemente en I+D para motores turboalimentados, de menor tamaño y compatibles con sistemas híbridos. Las alianzas con proveedores de tecnología también impulsan la innovación, garantizando que los motores satisfagan las futuras demandas de movilidad. Las alianzas estratégicas con desarrolladores de baterías y software permiten la integración de funciones inteligentes y de bajo consumo en los sistemas de propulsión de nueva generación.

- Por ejemplo, en 2022, Japón implementó normas de emisiones avanzadas para turismos, lo que impulsó la demanda de motores más pequeños y eficientes con características de rendimiento mejoradas. Este marco regulatorio impulsó la innovación en diseños ligeros y la integración de híbridos. Esta medida también influyó en los mercados asiáticos vecinos para que reforzaran sus propias políticas de eficiencia y emisiones.

- Si bien la adopción orientada a la eficiencia está transformando el mercado, lograr la escalabilidad requiere una colaboración continua entre reguladores, fabricantes de automóviles y proveedores de tecnología para equilibrar el rendimiento con la asequibilidad. La coordinación de políticas, incentivos y desarrollo de infraestructura será esencial para alcanzar los futuros objetivos de movilidad global. Sin una alineación, la adopción podría seguir fragmentada entre regiones.

Restricción/Desafío

Altos costos de desarrollo y complejidad de los motores de próxima generación

- El alto coste asociado al desarrollo de motores híbridos avanzados y compatibles con la electricidad supone un gran reto para los fabricantes de automóviles, en particular para las empresas más pequeñas. Los gastos de I+D, los requisitos de pruebas y el cumplimiento de la normativa en constante evolución incrementan los costes generales de producción. Estas barreras financieras suelen retrasar la implantación en el mercado de masas y limitar el acceso a la innovación.

- La complejidad en la integración de sistemas electrónicos, gestión de baterías y plataformas de software añade obstáculos adicionales. Los fabricantes de automóviles requieren conocimientos especializados e instalaciones avanzadas, que no son igualmente accesibles en todas las regiones. La curva de aprendizaje para la integración híbrido-eléctrica también prolonga los ciclos de desarrollo de productos, lo que ralentiza el tiempo de comercialización.

- Los problemas en la cadena de suministro, como la escasez de semiconductores y las limitaciones de materias primas, limitan aún más la escalabilidad de la producción. Esto afecta la disponibilidad y retrasa la expansión del mercado en algunas economías. La dependencia de las tierras raras también genera vulnerabilidades geopolíticas, lo que aumenta la exposición al riesgo para los fabricantes.

- Por ejemplo, en 2023, varios fabricantes norteamericanos informaron retrasos en el lanzamiento de nuevos modelos de motores híbridos debido al aumento de los costos de las tierras raras y a la escasez de semiconductores, lo que afectó la producción general. Estos desafíos obligaron a las empresas a reconsiderar los plazos de producción y a adoptar estrategias de abastecimiento alternativas.

- Mientras la innovación continúa, será vital abordar los desafíos de costos y complejidad. Los actores de la industria deben centrarse en el desarrollo colaborativo, los diseños escalables y las estrategias de producción localizadas para garantizar una mayor penetración en el mercado. Construir cadenas de suministro resilientes e invertir en la capacitación de la fuerza laboral serán clave para superar estos obstáculos.

Alcance del mercado de motores automotrices

El mercado está segmentado según el tipo de motor, tipo de vehículo, capacidad de desplazamiento y tipo de combustible.

- Por tipo de motor

Según el tipo de motor, el mercado de motores automotrices se segmenta en motores de combustión interna (MCI), motores eléctricos y motores de combustibles alternativos. El segmento de motores de combustión interna (MCI) obtuvo la mayor participación en los ingresos del mercado en 2024, gracias a su uso generalizado en turismos y vehículos comerciales. La tecnología de MCI sigue siendo la columna vertebral del transporte mundial, respaldada por una infraestructura consolidada y continuos avances en eficiencia de combustible y control de emisiones.

Se prevé que el segmento de motores eléctricos experimente el mayor crecimiento entre 2025 y 2032, impulsado por la transición global hacia la movilidad sostenible y la rápida expansión de la infraestructura de vehículos eléctricos. El aumento de los incentivos gubernamentales, la demanda de vehículos de cero emisiones por parte de los consumidores y las innovaciones en las tecnologías de baterías están acelerando la adopción de motores eléctricos en todo el mundo.

- Por tipo de vehículo

Según el tipo de vehículo, el mercado se segmenta en turismos, vehículos comerciales ligeros (LCV), vehículos comerciales pesados (HCV), vehículos de dos ruedas y autobuses y autocares. Los turismos representaron la mayor cuota de ingresos en 2024, impulsados por la alta demanda mundial, la innovación continua en tecnologías de propulsión y la presión regulatoria para motores más limpios y eficientes. Los fabricantes de automóviles se están centrando en motores compactos e híbridos para satisfacer las diversas preferencias de los consumidores.

Se prevé que el segmento de vehículos comerciales ligeros (LCV) experimente el mayor crecimiento entre 2025 y 2032, impulsado por el rápido crecimiento del comercio electrónico, los servicios de entrega de última milla y la logística urbana. Los fabricantes de LCV están adoptando motores de combustión interna e híbridos eficientes para equilibrar el rendimiento con el ahorro de combustible en entornos urbanos cada vez más congestionados.

- Por capacidad de desplazamiento

Según la cilindrada, el mercado de motores automotrices se clasifica en: Menos de 1.0 L, De 1.0 L a 2.0 L, De 2.0 L a 3.0 L y Más de 3.0 L. El segmento de 1.0 L a 2.0 L obtuvo la mayor participación en ingresos en 2024, impulsado por su dominio en turismos y SUV compactos. Esta gama ofrece el equilibrio óptimo entre eficiencia de combustible y potencia, lo que la convierte en la opción preferida tanto para conducción urbana como en carretera.

Se prevé que el segmento de vehículos de menos de 1.0L experimente el mayor crecimiento entre 2025 y 2032, debido principalmente a la creciente demanda de vehículos pequeños, ligeros y de bajo consumo en las economías emergentes. Esta categoría está ganando terreno en vehículos de dos ruedas, coches de gama básica y soluciones de micromovilidad, donde la asequibilidad y la eficiencia son factores clave de compra.

- Por tipo de combustible

Según el tipo de combustible, el mercado de motores automotrices se segmenta en gasolina, diésel, eléctrico, híbrido y combustibles alternativos. El segmento de gasolina representó la mayor participación en los ingresos en 2024, gracias a su fuerte adopción en turismos y a la amplia disponibilidad de infraestructura de repostaje. La continua innovación en el diseño de motores de gasolina ha mejorado aún más la eficiencia y reducido las emisiones, manteniendo su liderazgo en el mercado.

Se prevé que el segmento híbrido experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente preocupación por el medio ambiente y la demanda de vehículos que ofrezcan eficiencia y mayor autonomía. Los sistemas de propulsión híbridos se perfilan como una tecnología de transición clave, que combina el rendimiento de los motores de combustión interna con la eficiencia eléctrica para apoyar los objetivos globales de descarbonización.

Análisis regional del mercado de motores automotrices

- América del Norte dominó el mercado de motores automotrices con la mayor participación en los ingresos del 36,5 % en 2024, impulsada por una fuerte demanda de vehículos de alto rendimiento, estrictas regulaciones de emisiones y continuos avances tecnológicos en el diseño de motores.

- Los consumidores de la región priorizan los vehículos que ofrecen eficiencia, durabilidad y cumplimiento de los estándares ecológicos, lo que crea oportunidades para motores híbridos y turboalimentados.

- Esta adopción generalizada se ve respaldada además por altos ingresos disponibles, una infraestructura bien desarrollada y bases de fabricación de automóviles sólidas, lo que posiciona a América del Norte como un mercado líder tanto para motores tradicionales como de próxima generación.

Perspectivas del mercado de motores automotrices de EE. UU.

El mercado estadounidense de motores automotrices captó la mayor participación en los ingresos en 2024 en Norteamérica, impulsado por la creciente demanda de turismos y vehículos comerciales ligeros de bajo consumo. Los fabricantes de automóviles invierten cada vez más en motores de tamaño reducido, turboalimentados y compatibles con sistemas híbridos para satisfacer las expectativas de los consumidores y los requisitos regulatorios. El mercado se ve impulsado aún más por una fuerte inversión en I+D, las alianzas con proveedores de tecnología y la creciente tendencia hacia soluciones de movilidad sostenible. Además, la creciente popularidad de los sistemas de propulsión eléctricos e híbridos está transformando la competencia, impulsando su adopción en múltiples categorías de vehículos.

Perspectivas del mercado europeo de motores de automoción

Se prevé que el mercado europeo de motores de automoción experimente el mayor crecimiento entre 2025 y 2032, impulsado principalmente por los ambiciosos objetivos de reducción de emisiones de la región y la adopción de motores híbridos y compatibles con sistemas eléctricos. La creciente urbanización y la demanda de vehículos de bajo consumo impulsan a los fabricantes a innovar. Europa también se mantiene a la vanguardia en tecnología de motores, respaldada por sólidos marcos normativos y fabricantes de equipos originales (OEM) de automoción consolidados. El mercado está experimentando una expansión tanto en vehículos de pasajeros como comerciales, con la integración de sistemas híbridos convirtiéndose en un estándar en las nuevas líneas de modelos.

Análisis del mercado de motores de automoción del Reino Unido

Se prevé que el mercado británico de motores de automoción experimente su mayor crecimiento entre 2025 y 2032, impulsado por las iniciativas gubernamentales para reducir las emisiones y la creciente adopción de vehículos híbridos y eléctricos. Los fabricantes de automóviles del Reino Unido se están centrando en plataformas de motores más limpias, compactas y tecnológicamente avanzadas. El creciente interés de los consumidores por el transporte sostenible y el sólido desarrollo de los servicios posventa del país impulsan aún más la demanda. Además, la transición del Reino Unido hacia planes de neutralidad de carbono está acelerando las inversiones en motores de combustión interna compatibles con híbridos y de combustibles alternativos.

Análisis del mercado de motores de automoción en Alemania

Se prevé que el mercado alemán de motores automotrices experimente su mayor crecimiento entre 2025 y 2032, impulsado por la sólida base de ingeniería del país y su compromiso con la innovación en la eficiencia de los motores. El liderazgo de Alemania en la industria automotriz, sumado a su enfoque en la sostenibilidad, impulsa la demanda de motores avanzados turboalimentados, híbridos y compatibles con sistemas eléctricos. Los fabricantes de automóviles están invirtiendo fuertemente en diseños ligeros e integración inteligente con sistemas de propulsión híbridos. La creciente adopción de vehículos ecológicos en los segmentos residencial y comercial consolida aún más la posición de Alemania como un actor clave en el mercado europeo.

Análisis del mercado de motores automotrices de Asia-Pacífico

Se prevé que Asia-Pacífico experimente la tasa de crecimiento más rápida entre 2025 y 2032, impulsada por la rápida urbanización, el aumento de la renta disponible y el aumento de la propiedad de vehículos en países como China, India y Japón. Las políticas gubernamentales que apoyan los vehículos de bajo consumo y la adopción de híbridos están acelerando la expansión del mercado. Dado que Asia-Pacífico también es un importante centro de fabricación de motores y componentes, la asequibilidad y la accesibilidad siguen en aumento. El mercado está experimentando un impulso significativo en turismos, vehículos de dos ruedas y vehículos comerciales, gracias a las continuas inversiones en diseños híbridos y compatibles con sistemas eléctricos.

Análisis del mercado de motores automotrices en Japón

Se prevé que el mercado japonés de motores automotrices experimente su mayor crecimiento entre 2025 y 2032 gracias al liderazgo tecnológico del país, la rápida urbanización y la preferencia de los consumidores por los vehículos ecológicos. Japón ha priorizado desde hace tiempo la adopción de sistemas híbridos y de combustibles alternativos, impulsando el crecimiento de soluciones innovadoras de motores. El mercado se sustenta en la integración con sistemas de vehículos eléctricos, motores compactos turboalimentados y diseños ligeros. Además, es probable que el envejecimiento de la población japonesa aumente la demanda de vehículos eficientes y de bajo mantenimiento, lo que impulsará aún más la adopción de motores híbridos y de baja cilindrada en todo el país.

Análisis del mercado de motores automotrices de China

El mercado chino de motores automotrices representó la mayor participación en ingresos de mercado en Asia-Pacífico en 2024, impulsado por la producción automotriz a gran escala del país, la expansión de la clase media y la fuerte demanda tanto de turismos como de vehículos comerciales. China sigue siendo uno de los mayores consumidores de vehículos híbridos y de bajo consumo, con iniciativas gubernamentales que impulsan la reducción de emisiones y la electrificación. Los fabricantes nacionales están innovando rápidamente, produciendo plataformas de motores asequibles y a la vez avanzadas. La combinación de proyectos de ciudades inteligentes, el crecimiento de la infraestructura urbana y la creciente adopción de vehículos de nuevas energías continúa impulsando el dominio de China en el mercado regional.

Cuota de mercado de motores automotrices

La industria de motores automotrices está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- TOYOTA MOTOR CORPORATION (Japón)

- Ford Motor Company (EE. UU.)

- Volkswagen AG (Alemania)

- General Motors Company (EE. UU.)

- Honda Motor Co., Ltd. (Japón)

- BMW AG (Alemania)

- Daimler AG (Alemania)

- Nissan Motor Corporation (Japón)

- Hyundai Motor Company (Corea del Sur)

- Fiat Chrysler Automobiles (ahora parte de Stellantis) (Países Bajos)

- Subaru Corporation (Japón)

- Mazda Motor Corporation (Japón)

- Renault SA (Francia)

- Tata Motors Limited (India)

Últimos avances en el mercado mundial de motores automotrices

- En mayo de 2024, Toyota Motor North America (TMNA) designó oficialmente su oficina de I+D en California como la Sede Norteamericana del Hidrógeno (H2HQ) para impulsar sus iniciativas de pilas de combustible de hidrógeno. Las instalaciones renovadas apoyarán la investigación, el desarrollo y la comercialización de productos relacionados con el hidrógeno, con planes futuros para una microrred flexible y un centro de formación para clientes. El presidente y director ejecutivo, Ted Ogawa, enfatizó el compromiso de Toyota con la tecnología de cero emisiones.

- En mayo de 2021, Ford Motor Company anunció un plan integral para invertir 22 000 millones de dólares en electrificación para 2025, centrándose en la electrificación de modelos icónicos como el Mustang, la F-150 y la Transit. La compañía busca mejorar el rendimiento y la capacidad, a la vez que ofrece versiones cero emisiones de sus populares vehículos. Ford también está ampliando su infraestructura de vehículos eléctricos, con la red de carga pública más grande de Norteamérica y un centro global de baterías dedicado en Michigan. Esta estrategia se alinea con el compromiso de Ford de lograr la neutralidad de carbono para 2050 y apoyar la transición hacia la propiedad de vehículos eléctricos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.