Global Automation Testing Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

33.50 Billion

USD

125.56 Billion

2025

2033

USD

33.50 Billion

USD

125.56 Billion

2025

2033

| 2026 –2033 | |

| USD 33.50 Billion | |

| USD 125.56 Billion | |

|

|

|

|

Segmentación del mercado global de pruebas de automatización por componente (tipos y servicios de prueba), interfaz de punto final (móvil, web, de escritorio y software integrado), tamaño de la organización (pequeñas y medianas empresas y grandes empresas), sector vertical (banca, servicios financieros, seguros, automoción, defensa y aeroespacial, salud y ciencias de la vida, comercio minorista, telecomunicaciones y TI, fabricación, logística y transporte, energía y servicios públicos, medios de comunicación y entretenimiento, gobierno y sector público, entre otros): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de pruebas de automatización

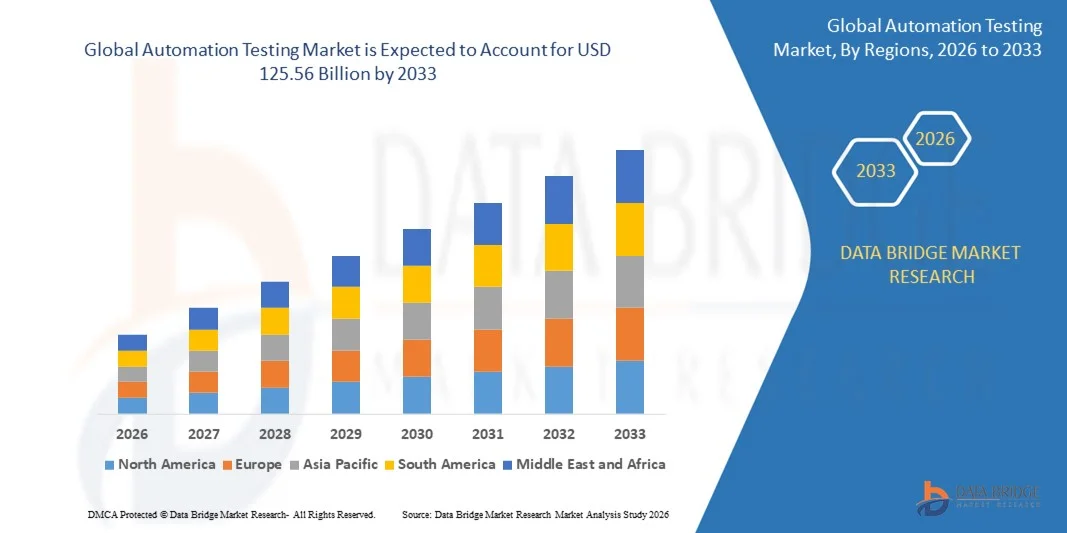

- El tamaño del mercado global de pruebas de automatización se valoró en USD 33,50 mil millones en 2025 y se espera que alcance los USD 125,56 mil millones para 2033 , con una CAGR del 17,60% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de lanzamientos de software más rápidos, una mayor adopción de metodologías ágiles y DevOps y la necesidad de soluciones de prueba rentables, confiables y escalables.

- El creciente énfasis en mejorar la calidad del software, reducir el error humano y garantizar el cumplimiento de los estándares de la industria está impulsando aún más la adopción de herramientas de pruebas de automatización.

Análisis del mercado de pruebas de automatización

- El mercado está siendo testigo de un aumento de las inversiones en herramientas de pruebas de automatización inteligentes impulsadas por IA que mejoran la cobertura de las pruebas, optimizan los ciclos de pruebas y reducen el tiempo general de comercialización.

- Empresas de todos los sectores, incluidos BFSI, atención médica, TI y telecomunicaciones, y comercio minorista, están integrando rápidamente soluciones de pruebas de automatización para lograr eficiencia operativa, minimizar defectos y acelerar las iniciativas de transformación digital.

- América del Norte dominó el mercado de pruebas de automatización con la mayor participación en los ingresos del 36,25 % en 2025, impulsada por la adopción generalizada de prácticas ágiles y DevOps, el aumento de las iniciativas de transformación digital y la creciente demanda de ciclos de lanzamiento de software más rápidos.

- Se espera que la región de Asia y el Pacífico sea testigo de la mayor tasa de crecimiento en el mercado global de pruebas de automatización , impulsada por la expansión de los servicios de TI, la creciente penetración de teléfonos inteligentes e Internet, y las iniciativas gubernamentales que apoyan la digitalización y el desarrollo de infraestructura inteligente.

- El segmento de tipos de pruebas registró la mayor participación en ingresos del mercado en 2025, impulsado por la creciente adopción de pruebas funcionales, de rendimiento y de seguridad en aplicaciones de software complejas. Las soluciones de tipos de pruebas ofrecen una cobertura integral para plataformas web, móviles y empresariales, lo que permite una identificación más rápida de defectos, una mayor confiabilidad y una mejor calidad del software.

Alcance del informe y segmentación del mercado de pruebas de automatización

|

Atributos |

Perspectivas clave del mercado de las pruebas de automatización |

|

Segmentos cubiertos |

|

|

Países cubiertos |

América del norte

Europa

Asia-Pacífico

Oriente Medio y África

Sudamerica

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de pruebas de automatización

El auge de las soluciones de pruebas inteligentes y continuas

- La creciente adopción de pruebas de automatización inteligente está transformando el panorama del control de calidad del software al permitir pruebas más rápidas, precisas y repetibles en aplicaciones complejas. Las herramientas basadas en IA y aprendizaje automático permiten la detección de defectos en tiempo real y el análisis predictivo, lo que mejora la fiabilidad del software y acelera los ciclos de lanzamiento. Las organizaciones aprovechan cada vez más la información predictiva para optimizar la cobertura de las pruebas, reducir errores y gestionar proactivamente los riesgos potenciales, mejorando así la calidad general del producto.

- La creciente demanda de integración y entrega continuas (CI/CD) en entornos ágiles y DevOps está impulsando la adopción de marcos de pruebas automatizadas. Estas soluciones facilitan las pruebas rápidas, reducen la intervención manual y mejoran la colaboración entre los equipos de desarrollo y control de calidad. Las pruebas continuas permiten a los equipos identificar y corregir defectos con mayor rapidez, mantener la estabilidad del software y acelerar los ciclos de lanzamiento en múltiples entornos.

- La asequibilidad y la escalabilidad de las plataformas de pruebas de automatización basadas en la nube las hacen atractivas para empresas de todos los tamaños. Las organizaciones se benefician de entornos de prueba flexibles, menores costos de infraestructura y una comercialización más rápida, lo que en última instancia mejora la eficiencia operativa. Las pruebas basadas en la nube también permiten que equipos globales colaboren fluidamente, realicen pruebas paralelas y adapten recursos según la demanda para proyectos complejos.

- Por ejemplo, en 2023, Infosys implementó soluciones de pruebas automatizadas basadas en IA en sus clientes bancarios y minoristas de EE. UU. y Europa, lo que resultó en una detección más rápida de defectos, una mejor calidad del software y una reducción de los retrasos en la implementación. De igual manera, Capgemini implementó la automatización inteligente de pruebas para un operador de telecomunicaciones europeo, lo que mejoró la cobertura de las pruebas, redujo los errores manuales y aceleró los plazos de lanzamiento. Estas implementaciones también mejoraron la productividad del equipo, redujeron la dependencia de los evaluadores manuales y proporcionaron análisis prácticos para la mejora continua.

- Si bien la adopción de las pruebas de automatización está en aumento, el impacto sostenido depende de la innovación continua, la integración con tecnologías emergentes y la capacitación de la fuerza laboral. Los proveedores deben centrarse en la interoperabilidad de las herramientas, las mejoras de la IA y los programas de capacitación para aprovechar al máximo el crecimiento del mercado. La inversión estratégica en I+D, los programas de certificación y las alianzas con el ecosistema también impulsarán la adopción a largo plazo y el avance del sector.

Dinámica del mercado de pruebas de automatización

Conductor

Creciente complejidad de las aplicaciones de software y demanda de lanzamientos más rápidos

- La creciente complejidad de las aplicaciones empresariales y el software multiplataforma está impulsando a las organizaciones a adoptar las pruebas automatizadas como una solución clave para garantizar la calidad y el rendimiento. Las pruebas manuales ya no son suficientes para gestionar sistemas integrados a gran escala. La automatización permite realizar pruebas de regresión eficientes, comprobar la compatibilidad entre plataformas y mantener la coherencia entre versiones, lo que reduce el riesgo operativo.

- Las empresas adoptan cada vez más metodologías ágiles y DevOps, que priorizan las pruebas continuas y ciclos de lanzamiento más rápidos. Las pruebas automatizadas permiten realizar pruebas de regresión frecuentes, detectar errores de forma temprana y ofrecer software más fiable. Este enfoque también facilita la iteración rápida, promueve ciclos de retroalimentación más rápidos y alinea las pruebas con los cambios de desarrollo en tiempo real para mejorar la estabilidad del producto.

- Los avances en IA, ML y herramientas de prueba basadas en la nube están mejorando la precisión, la escalabilidad y la eficiencia de las pruebas, lo que anima a las empresas a invertir en soluciones de automatización. Estas innovaciones reducen el error humano, optimizan los costos de las pruebas y facilitan una implementación rápida. Las capacidades predictivas mejoradas también permiten a las organizaciones anticipar fallos, optimizar las suites de pruebas y mantener altos estándares de calidad del software.

- Por ejemplo, en 2022, una importante entidad bancaria europea implementó la automatización de pruebas basada en IA en sus plataformas móviles y web, lo que resultó en una reducción del 40 % en el tiempo de prueba y una mayor fiabilidad en los lanzamientos. En 2023, Cognizant implementó una solución de automatización de pruebas basada en la nube para un cliente global de comercio electrónico, lo que permitió realizar pruebas paralelas en múltiples regiones, reducir el tiempo de lanzamiento en un 35 % y mejorar la detección de defectos. Estas iniciativas ayudaron a estandarizar las prácticas de prueba y a mejorar la satisfacción del cliente.

- Si bien la creciente demanda y el progreso tecnológico impulsan el mercado, las organizaciones deben abordar los desafíos relacionados con la selección de herramientas, la integración con sistemas heredados y las habilidades de la fuerza laboral para maximizar la adopción y los beneficios a largo plazo. La inversión continua en la capacitación, la modernización de la infraestructura y la selección estratégica de herramientas es crucial para lograr ventajas sostenibles en las pruebas de automatización.

Restricción/Desafío

Altos costos de implementación y complejidad de integración

- La inversión inicial necesaria para implementar soluciones integrales de pruebas de automatización, que incluyen herramientas basadas en IA, marcos de prueba y personal cualificado, puede resultar prohibitiva para las pequeñas y medianas empresas. Este factor de coste limita su adopción generalizada. Las elevadas tasas de licencia, los costes de configuración de la infraestructura y los gastos de mantenimiento continuo pueden hacer que las pruebas de automatización sean menos accesibles para las organizaciones más pequeñas.

- La integración de pruebas de automatización en la infraestructura de TI existente y los sistemas heredados suele presentar desafíos técnicos. Las arquitecturas de aplicaciones complejas, los entornos heterogéneos y las múltiples plataformas de desarrollo pueden complicar la implementación y la gestión de herramientas. Los problemas de integración pueden generar resultados inconsistentes, ciclos de implementación prolongados y una mayor sobrecarga operativa si no se gestionan con cuidado.

- La disponibilidad limitada de probadores de automatización cualificados y especialistas en IA puede ralentizar la implementación y reducir la eficiencia de los programas de pruebas. Las organizaciones suelen enfrentarse a dificultades de formación y contratación para mantener equipos de control de calidad altamente cualificados. La escasez de personal puede dificultar la adopción de herramientas avanzadas, retrasar la implementación y aumentar la dependencia de consultores externos, lo que afecta a los costes y los plazos.

- Por ejemplo, en 2023, las pymes del Sudeste Asiático, incluidas startups de software de Singapur e Indonesia, informaron retrasos en la adopción de pruebas automatizadas debido al alto coste de las herramientas y la falta de evaluadores cualificados, lo que afectó los plazos de lanzamiento de productos y el control de calidad. De igual forma, una empresa mediana de TI en Alemania enfrentó problemas de integración con sistemas ERP heredados, lo que retrasó la implementación de las pruebas automatizadas y afectó los plazos de entrega. Estos retrasos también afectaron la satisfacción del cliente, limitaron la competitividad en mercados dinámicos y ralentizaron las iniciativas internas de transformación digital.

- Mientras el mercado continúa evolucionando con soluciones innovadoras, es fundamental abordar las brechas de costos, integración y habilidades. Los proveedores y las empresas deben centrarse en soluciones escalables y fáciles de usar, programas de capacitación y opciones basadas en la nube para aprovechar todo el potencial del mercado. Las alianzas estratégicas, la implementación modular y los modelos de precios flexibles también pueden mitigar las barreras y acelerar la adopción en todos los sectores.

Alcance del mercado de pruebas de automatización

El mercado está segmentado en función del componente, la interfaz del punto final, el tamaño de la organización y la vertical.

- Por componente

Según los componentes, el mercado de pruebas de automatización se segmenta en tipos y servicios de prueba. Este segmento obtuvo la mayor cuota de mercado en ingresos en 2025, impulsado por la creciente adopción de pruebas funcionales, de rendimiento y de seguridad en aplicaciones de software complejas. Las soluciones de prueba ofrecen una cobertura integral para plataformas web, móviles y empresariales, lo que permite una identificación más rápida de defectos, una mayor fiabilidad y una mejor calidad del software.

Se prevé que el segmento de servicios experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente demanda de pruebas de automatización externalizadas, consultoría y servicios gestionados. Los proveedores de servicios ofrecen experiencia en pruebas basadas en IA/ML, integración de CI/CD y gestión de pruebas, lo que ayuda a las organizaciones a reducir la carga operativa, optimizar costes y acelerar los ciclos de entrega de software.

- Por interfaz de punto final

Según la interfaz de punto final, el mercado se segmenta en software móvil, web, de escritorio y embebido. El segmento web registró la mayor cuota de mercado en 2025, impulsado por la adopción generalizada de aplicaciones en la nube y portales empresariales que requieren rigurosas pruebas automatizadas. Las pruebas web garantizan la compatibilidad, la funcionalidad y la seguridad entre navegadores en todas las plataformas en línea, lo que facilita una experiencia de usuario fluida.

Se prevé que el segmento móvil experimente el mayor crecimiento entre 2026 y 2033, impulsado por la proliferación de smartphones, tablets y aplicaciones móviles. Las pruebas móviles automatizadas permiten una implementación rápida, la detección de defectos en tiempo real y un rendimiento consistente en todos los dispositivos y sistemas operativos, lo que las hace cruciales para los ecosistemas digitales modernos.

- Por tamaño de la organización

Según el tamaño de la organización, el mercado se segmenta en pequeñas y medianas empresas (PYME) y grandes empresas. Las grandes empresas obtuvieron la mayor cuota de mercado en 2025, gracias a su compleja infraestructura de TI, software multiplataforma y requisitos de aplicaciones de alto volumen que requieren pruebas automatizadas. Las grandes organizaciones utilizan herramientas de nivel empresarial para optimizar la cobertura de las pruebas, garantizar el cumplimiento normativo y mejorar la fiabilidad de las versiones.

Se prevé que el segmento de las pymes experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente disponibilidad de soluciones de pruebas automatizadas rentables, basadas en la nube y basadas en IA. Las pymes están adoptando las pruebas automatizadas para acelerar la transformación digital, reducir los costes de las pruebas manuales y mantenerse competitivas en mercados en constante evolución.

- Por Vertical

Por sector vertical, el mercado se segmenta en banca, servicios financieros, seguros, automoción, defensa y aeroespacial, salud y ciencias de la vida, comercio minorista, telecomunicaciones y TI, manufactura, logística y transporte, energía y servicios públicos, medios de comunicación y entretenimiento, gobierno y sector público, entre otros. El segmento de banca, servicios financieros y seguros (BFSI) obtuvo la mayor participación en los ingresos del mercado en 2025, impulsado por un estricto cumplimiento normativo, un alto volumen de transacciones y la necesidad de aplicaciones seguras y sin errores.

Se prevé que el segmento de salud y ciencias de la vida experimente el mayor crecimiento entre 2026 y 2033, impulsado por la adopción de plataformas de salud digital, telemedicina y software médico. Las pruebas de automatización en este sector vertical garantizan la integridad de los datos, la fiabilidad del sistema y el cumplimiento normativo, lo que contribuye a la seguridad del paciente y la eficiencia operativa.

Análisis regional del mercado de pruebas de automatización

- América del Norte dominó el mercado de pruebas de automatización con la mayor participación en los ingresos del 36,25 % en 2025, impulsada por la adopción generalizada de prácticas ágiles y DevOps, el aumento de las iniciativas de transformación digital y la creciente demanda de ciclos de lanzamiento de software más rápidos.

- Las empresas de la región valoran mucho las soluciones de pruebas de automatización inteligentes impulsadas por IA que mejoran la calidad del software, reducen la intervención manual y permiten pruebas continuas en aplicaciones complejas.

- Esta adopción generalizada se ve respaldada además por la presencia de importantes proveedores de servicios de TI, la alta penetración de la tecnología y la creciente inversión en plataformas de pruebas basadas en la nube, lo que establece las pruebas de automatización como un componente crítico del desarrollo de software empresarial.

Perspectiva del mercado de pruebas de automatización en EE. UU.

El mercado estadounidense de pruebas de automatización captó la mayor participación en los ingresos en 2025 en Norteamérica, impulsado por la creciente complejidad de las aplicaciones empresariales y el fuerte énfasis en las metodologías CI/CD y DevOps. Las organizaciones priorizan la implementación de herramientas de prueba basadas en IA y ML para mejorar la fiabilidad del software y acelerar los ciclos de lanzamiento. Además, la integración de plataformas de pruebas en la nube y la demanda de análisis predictivo contribuyen significativamente al crecimiento del mercado.

Perspectivas del mercado europeo de pruebas de automatización

Se prevé que el mercado europeo de pruebas de automatización experimente el mayor crecimiento entre 2026 y 2033, impulsado principalmente por el aumento de las iniciativas de modernización de software y los estrictos estándares de calidad. La demanda de pruebas eficientes de aplicaciones web y móviles, sumada a la creciente transformación digital en los sectores bancario, sanitario y manufacturero, está impulsando la adopción de pruebas de automatización. Las empresas europeas también se centran en la optimización de pruebas, la reducción del tiempo de comercialización y la entrega de software de alta calidad.

Análisis del mercado de pruebas de automatización en el Reino Unido

Se prevé que el mercado de pruebas de automatización del Reino Unido experimente su mayor crecimiento entre 2026 y 2033, impulsado por la transformación digital en los sectores de servicios financieros, TI y comercio minorista. Las empresas adoptan cada vez más marcos de pruebas basados en IA para reducir el trabajo manual y garantizar un rendimiento de alta calidad de las aplicaciones. Además, los requisitos de cumplimiento normativo y el creciente énfasis en la seguridad y la fiabilidad impulsan aún más la expansión del mercado.

Análisis del mercado de pruebas de automatización en Alemania

Se prevé que el mercado alemán de pruebas de automatización experimente su mayor crecimiento entre 2026 y 2033, impulsado por la adopción de prácticas de la Industria 4.0, los avances tecnológicos en software integrado y la creciente demanda de pruebas automatizadas en los sectores automotriz y manufacturero. La sólida infraestructura de TI de Alemania, su énfasis en la innovación y su enfoque en la digitalización están impulsando su adopción en el mercado. Las empresas integran cada vez más soluciones de pruebas inteligentes en sus procesos de desarrollo para mejorar la eficiencia y la calidad del software.

Análisis del mercado de pruebas de automatización en Asia-Pacífico

Se prevé que el mercado de pruebas de automatización en Asia-Pacífico experimente el mayor crecimiento entre 2026 y 2033, impulsado por la rápida digitalización, el aumento de la externalización de TI y la creciente adopción de aplicaciones móviles y en la nube en países como India, China y Japón. Las iniciativas gubernamentales que promueven las ciudades inteligentes y la infraestructura digital, junto con la disponibilidad de soluciones de automatización rentables, están acelerando la adopción. La región también se está consolidando como un centro para el desarrollo e implementación de soluciones de pruebas basadas en IA.

Análisis del mercado de pruebas de automatización en Japón

Se prevé que el mercado japonés de pruebas de automatización experimente un crecimiento significativo entre 2026 y 2033 debido al creciente enfoque en la entrega de software de alta calidad, la demanda de aplicaciones móviles y web avanzadas y la adopción de soluciones de pruebas basadas en IA. Las empresas japonesas están aprovechando la automatización inteligente para mejorar la fiabilidad del software, reducir el tiempo de prueba y optimizar los costes. Además, la creciente demanda de dispositivos conectados y aplicaciones del IoT impulsa aún más el crecimiento del mercado.

Análisis del mercado de pruebas de automatización en China

El mercado chino de pruebas de automatización representó la mayor cuota de mercado en ingresos en Asia Pacífico en 2025, gracias al rápido crecimiento de la infraestructura de TI, la alta actividad de desarrollo de software y la sólida adopción de soluciones de pruebas basadas en la nube e IA. China está experimentando una creciente adopción de pruebas automatizadas en sectores como finanzas, telecomunicaciones y manufactura, impulsada por la necesidad de ciclos de lanzamiento más rápidos, una mejor calidad del software y las iniciativas de transformación digital. El creciente ecosistema nacional de pruebas de automatización también está impulsando una adopción generalizada en el mercado.

Cuota de mercado de las pruebas de automatización

La industria de pruebas de automatización está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Verizon (EE. UU.)

- IBM (EE.UU.)

- Aemulus Corporation Sdn. Bhd. (Malasia)

- Chroma ATE Inc. (Taiwán)

- AEROFLEX (EE. UU.)

- Astronics Corporation (EE. UU.)

- ADVANTEST CORPORATION (Japón)

- Cohu, Inc. (EE. UU.)

- Teradyne Inc. (EE. UU.)

- Star Infomatic Pvt. Ltd. (India)

- TESEC, Inc (Japón)

- ROOS INSTRUMENTS, INC. (EE. UU.)

- Marvin Test Solutions, Inc. (EE. UU.)

- Danaher (Estados Unidos)

- Capgemini (Francia)

- Wipro (India)

- Accenture (Irlanda)

- Servicios de consultoría TATA Limited (India)

- La empresa Qt (Finlandia)

- Worksoft, Inc. (EE. UU.)

Últimos avances en el mercado global de pruebas de automatización

- En marzo de 2024, Sauce Labs anunció una alianza estratégica con GitHub Actions para optimizar los flujos de trabajo de pruebas continuas para los desarrolladores. Esta colaboración permite ejecutar pruebas directamente desde los repositorios de GitHub utilizando la infraestructura en la nube de Sauce Labs, lo que permite a los equipos automatizar las pruebas web y móviles de forma eficiente. Esta integración mejora la eficiencia del flujo de trabajo de CI/CD, acelera los ciclos de desarrollo y mejora la calidad general del software, lo que fortalece la adopción en el mercado de soluciones de pruebas basadas en la nube.

- En febrero de 2024, Micro Focus lanzó UFT One 17.5, la última versión de su plataforma de pruebas de automatización. Esta versión incorpora automatización sin scripts para simplificar las pruebas, mantenimiento de pruebas basado en IA para actualizaciones adaptativas e informes mejorados para obtener información más detallada sobre el flujo de trabajo. La plataforma ayuda a las organizaciones a mejorar la precisión de las pruebas, acelerar los ciclos de lanzamiento y mantener un software de alta calidad, lo que consolida la posición de Micro Focus en la automatización empresarial.

- En enero de 2024, Eggplant presentó Eggplant AI 2.0, una plataforma mejorada de pruebas de automatización inteligente. La nueva versión aprovecha el aprendizaje automático para la creación autónoma de pruebas y el análisis predictivo para anticipar los resultados. Estas características permiten procesos de prueba más rápidos y fiables, reducen la intervención manual y contribuyen a una mayor calidad del software, impulsando una mayor adopción en el mercado de herramientas de automatización basadas en IA.

- En junio de 2023, ESCRIBA AG firmó una alianza estratégica con Software AG para ofrecer soluciones digitales integrales y avanzadas. Esta colaboración proporciona herramientas para optimizar procesos y promover la transformación digital en todos los sectores, mejorando así la eficiencia operativa. Al aprovechar la plataforma de Software AG, ESCRIBA AG fortalece su presencia en el mercado y apoya a las empresas en la adopción de estrategias integrales de automatización.

- En mayo de 2023, UiPath se asoció con Peraton para ofrecer su plataforma de automatización empresarial como servicio gestionado para entornos de alta seguridad del gobierno y defensa de EE. UU. La iniciativa permite la implementación segura, tanto en la nube como local, de automatización basada en IA, lo que mejora la eficiencia operativa, el cumplimiento normativo y la automatización del flujo de trabajo. Esta iniciativa amplía la presencia de UiPath en sectores sensibles y refuerza la adopción de soluciones de automatización empresarial.

- En abril de 2023, Emerson adquirió NI por 8200 millones de dólares para mejorar sus capacidades de automatización y pruebas. La adquisición integra las soluciones avanzadas de pruebas y medición de NI, lo que permite a Emerson expandirse a sectores de alto crecimiento como el transporte, los vehículos eléctricos, los semiconductores y el sector aeroespacial. Esta estrategia fortalece la posición de Emerson en el mercado y apoya el crecimiento a largo plazo en industrias que requieren soluciones de automatización sofisticadas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.