Global Activated Carbon Filters Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

69.06 Billion

USD

133.62 Billion

2022

2030

USD

69.06 Billion

USD

133.62 Billion

2022

2030

| 2023 –2030 | |

| USD 69.06 Billion | |

| USD 133.62 Billion | |

|

|

|

|

Mercado mundial de filtros de carbón activado, por tipo (carcasa de acero inoxidable, carcasa de acero al carbono, otros), aplicación (tratamiento de la contaminación del agua industrial, purificación de agua potable, alimentos y bebidas, farmacéutica, otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y tamaño del mercado de filtros de carbón activado

Una forma de carbón procesado conocida como "carbón activado" se crea con orificios más pequeños y de menor volumen que ayudan a aumentar el área de superficie en aplicaciones de filtración. Como resultado, estos poros se utilizan en el proceso de purificación en una variedad de sectores de procesamiento, incluidos alimentos y bebidas, petróleo y gas, control de la contaminación y tratamiento de agua y aguas residuales, entre otros. También ayudan a aumentar la capacidad de absorción. El agua se puede hacer apropiada para su descarga o uso en operaciones de fabricación mediante el uso de filtros de carbón activado, que son el tipo de filtros que se utilizan normalmente en el proceso de eliminación de compuestos orgánicos o extracción de cloro libre del agua.

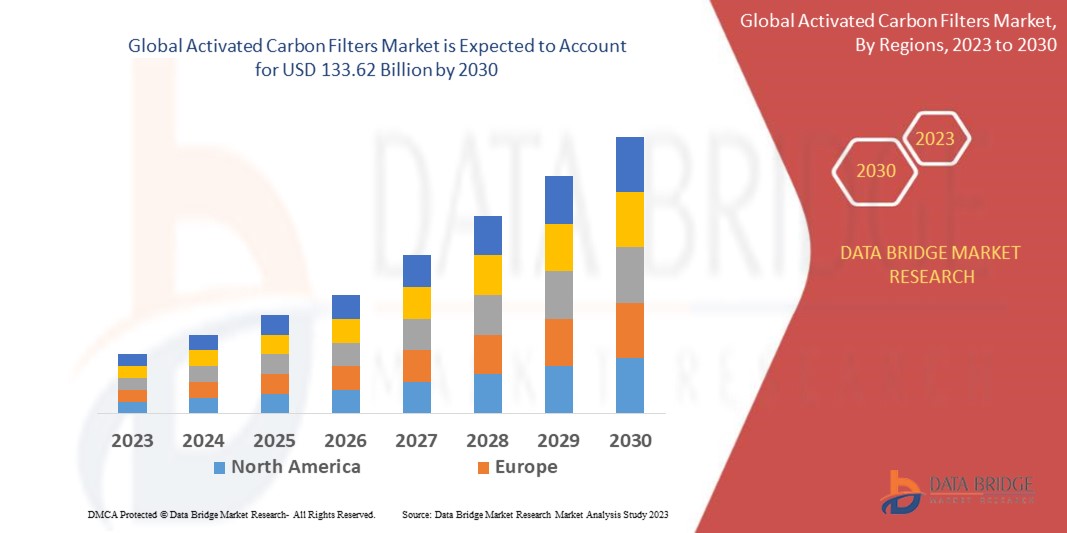

Data Bridge Market Research analiza que el mercado mundial de filtros de carbón activado, que ascendía a 69.060 millones de dólares en 2022, se disparará hasta los 133.620 millones de dólares en 2030 y se espera que experimente una CAGR del 8,6 % durante el período de pronóstico. Se espera que la "carcasa de acero inoxidable" domine el segmento de tipos del mercado de filtros de carbón activado debido a su durabilidad y propiedades menos corrosivas.

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representada geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis de déficit de la cadena de suministro y la demanda.

Alcance y segmentación del mercado de filtros de carbón activado

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2023 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Tipo (carcasa de acero inoxidable, carcasa de acero al carbono, otras), aplicación (tratamiento de contaminación del agua industrial, purificación de agua potable, alimentos y bebidas, farmacéutica, otras) |

|

Países cubiertos |

EE. UU., Canadá, México, Brasil, Argentina, Resto de Sudamérica, Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Sudáfrica, Israel, Resto de Medio Oriente y África |

|

Actores del mercado cubiertos |

TIGG LLC (EE. UU.), PURAGEN ACTIVATED CARBONS (EE. UU.), Cabot Corporation (EE. UU.), WesTech Engineering, Inc. (EE. UU.), HAYCARB (PVT) LTD.; KUREHA CORPORATION (Japón), Silcarbon Aktivkohle GmbH (Alemania), Prominent Systems, Inc. (EE. UU.), OXBOW ACTIVATED CARBON (EE. UU.), Advanced Emissions Solutions Inc. (EE. UU.), Albemarle Corporation (EE. UU.), KURARAY CO., LTD (Japón), Lenntech BV (Países Bajos), Donau Carbon GmbH (Alemania), General Carbon Corporation (EE. UU.), Sereco Srl (Italia) y Carbtrol Corp (EE. UU.), entre otros. |

|

Oportunidades de mercado |

|

Definición de mercado

El carbón activado granular es el componente principal de los filtros. La naturaleza porosa de estos filtros de carbón afecta directamente la absorción de contaminantes. Los sistemas de filtración, como los filtros de aire HEPA y los purificadores de agua, emplean pequeños paquetes de carbón activado. Los filtros de carbón reaccionan químicamente con los compuestos orgánicos durante el proceso de absorción para absorberlos. En comparación con los filtros de carbón convencionales, estos filtros de carbón activado absorben más contaminantes. La cantidad de carbón activado en un filtro de carbón afecta su capacidad para absorber contaminantes; los filtros con más carbón activado tienen una mejor capacidad para hacerlo. Debido a sus numerosas aplicaciones en la purificación de gases industriales, caña de azúcar, agua y aire, los filtros de carbón activado han experimentado una expansión sustancial en los últimos años. El bambú , la cáscara de coco, la turba de sauce, la madera, la fibra de coco, el lignito, el carbón y la brea de petróleo son algunos ejemplos de fuentes orgánicas de carbón activado.

Dinámica del mercado mundial de filtros de carbón activado

Conductores

- El producto tiene mayor demanda para aplicaciones de tratamiento de agua.

A medida que aumenta la necesidad de agua potable limpia y segura, también aumenta la demanda del producto. La gran superficie accesible del producto para la adsorción, que elimina contaminantes como aceites, microorganismos, compuestos que imparten sabor y olor, y productos químicos, es responsable de la expansión del mercado. La fuerte demanda de agua dulce por parte de los consumidores está siendo impulsada por una población en crecimiento exponencial, y esto ha aumentado la necesidad de filtración de agua. Los funcionarios gubernamentales se han visto obligados a promulgar leyes estrictas sobre el manejo de aguas residuales industriales debido al aumento de los niveles de contaminación del agua. Para satisfacer la necesidad de carbón para eliminar contaminantes, numerosas empresas, incluidas las de papel y pulpa, productos químicos y pinturas y tintes, se han visto obligadas a hacerlo.

- Un aumento en el uso de filtros de carbón activado en la industria de bienes de consumo masivo para procedimientos de purificación

Debido al aumento del uso de filtros de carbón activado en procedimientos de purificación y filtración como la eliminación de colores de jugos de frutas, alteración de sabores de alcohol, tratamiento de caña de azúcar y purificación de aceites comestibles , ha habido un aumento en la demanda de estos filtros en las industrias de alimentos y bebidas.

- Los cigarrillos se fabrican utilizando filtros de carbón activado.

La demanda de filtros de carbón activado se debe a su uso en la industria tabacalera. Los filtros de cigarrillos se fabrican principalmente con carbón activado. Los jóvenes fuman cada vez más cigarrillos, lo que aumenta el consumo de cigarrillos y la expansión del mercado.

- Compañía farmacéutica emplea filtros de carbón activado

Una empresa farmacéutica típica utiliza filtros de carbón activado en la síntesis, purificación y filtrado de componentes farmacéuticos activos durante el proceso de producción estéril. En casos de intoxicación grave, el carbón activado se utiliza como medicamento de venta con receta para salvar vidas. Debido a la enorme expansión del sector farmacéutico durante el período de proyección, el mercado de filtros de carbón activado muestra un potencial significativo.

Oportunidades

- Aumento de la separación de gases en aplicaciones de filtros de carbón activado de reciente desarrollo

Además, el desarrollo de la tecnología y el aumento de la demanda de filtros de carbón activado para satisfacer la creciente demanda del mercado, un aumento en los esfuerzos de investigación y desarrollo de mercado y ampliar las oportunidades rentables para los actores del mercado de 2023 a 2030. Además, el aumento de los niveles de investigación y desarrollo y la expansión de las instalaciones, y la introducción de nuevos productos expandirán aún más el crecimiento futuro del mercado de filtros de carbón activado.

Restricciones/Desafíos

- Aumentos de precios provocados por la falta de materias primas

Un peligro para la expansión del mercado es la falta de disponibilidad de distintas materias primas necesarias para la fabricación, como el carbón vegetal elaborado a partir de cáscaras de coco. Como resultado, el precio de las materias primas ha aumentado, siendo el carbón vegetal elaborado a partir de cáscaras de coco el que ha experimentado el mayor aumento. Los precios de los productos elaborados a partir de carbón han subido como resultado de la creciente demanda de energía. El carbón se utiliza ampliamente en los principales sectores industriales de China, incluidos los que producen acero, cemento y energía. Como resultado, no hay suficiente cantidad de determinados tipos de carbón disponible para fabricar el producto. Sin embargo, la disminución de la demanda de cocos ha tenido un impacto en la producción operativa de los productores. Como resultado, los fabricantes se vieron obligados a aumentar la capacidad de producción entre un 50% y un 60%, lo que aumentó los precios de los productos.

Este informe de mercado de filtros de carbón activado proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de filtros de carbón activado, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Acontecimientos recientes

- En marzo de 2022, en un comunicado, Cabot Corporation afirmó que había adquirido con éxito Tokai Carbon (Tianjin) Co., Ltd. de Tokai Carbon Group. Si bien sigue prestando servicios a los clientes actuales de negro de carbono, la compra aumenta la capacidad de fabricación de Cabot para respaldar la expansión de su línea de productos de materiales para baterías. Actualmente, la instalación puede generar 50.000 toneladas métricas de negro de carbono al año.

- En octubre de 2020, WesTech Engineering, Inc. se complace en informar que el estado de California ha aprobado condicionalmente el WWETCO FlexFilter como tecnología de filtrado alternativa según sus Criterios de reciclaje de agua (Título 22), Sección 60320.5.

Alcance del mercado mundial de filtros de carbón activado

El mercado de filtros de carbón activado está segmentado en función del tipo y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Carcasa de acero inoxidable

- Carcasa de acero al carbono

- Otros

Solicitud

- Tratamiento de la contaminación del agua industrial

- Purificación de agua potable

- Alimentos y bebidas

- Farmacéutico

- Otros

Análisis y perspectivas regionales del mercado de filtros de carbón activado

Se analiza el mercado de filtros de carbón activado y se proporcionan información y tendencias del tamaño del mercado por país, tipo y aplicación como se menciona anteriormente.

Los países cubiertos en el informe de mercado de filtros de carbón activado son EE. UU., Canadá, México, Brasil, Argentina, Resto de América del Sur, Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza, Resto de Europa, Japón, China, India, Corea del Sur, Australia, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico, Emiratos Árabes Unidos, Arabia Saudita, Egipto, Sudáfrica, Israel, Resto de Medio Oriente y África.

Se espera que Asia-Pacífico domine el mercado en términos de participación de mercado e ingresos de mercado y que continúe fortaleciendo su dominio durante el período de pronóstico de 2023 a 2030. Esto se debe a las crecientes regulaciones gubernamentales estrictas sobre la purificación del agua, los mayores niveles de demanda de las industrias de procesamiento de agua y aguas residuales, las crecientes preocupaciones por el medio ambiente que resultan en una mayor demanda de medios de purificación y filtrado, y el aumento de los niveles de investigación y desarrollo en la producción de carbono en esta región.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, y estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los filtros de carbón activado

El panorama competitivo del mercado de filtros de carbón activado proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de filtros de carbón activado.

Algunos de los principales actores que operan en el mercado de filtros de carbón activado son:

- TIGG LLC (Estados Unidos)

- CARBONES ACTIVADOS PURAGEN (EE. UU.)

- Corporación Cabot (Estados Unidos)

- WesTech Engineering, Inc. (Estados Unidos)

- HAYCARB (PVT) LTD., (Sri Lanka)

- CORPORACIÓN KUREHA (Japón)

- Silcarbon Aktivkohle GmbH (Alemania)

- Prominent Systems, Inc. (Estados Unidos)

- CARBÓN ACTIVADO OXBOW (EE. UU.)

- Soluciones avanzadas de emisiones Inc. (Estados Unidos)

- Corporación Albemarle (Estados Unidos)

- KURARAY CO., LTD (Japón)

- Lenntech BV (Países Bajos)

- Donau Carbon GmbH (Alemania)

- Corporación General del Carbono (Estados Unidos)

- Sereco Srl (Italia)

- Carbtrol Corp (Estados Unidos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.