Mercado europeo de molienda húmeda por equipo (equipo de molienda, equipo de remojo, sistema de centrifugación, sistema de lavado y filtración, otros), tamaño de procesamiento (línea de procesamiento mediana, línea de procesamiento grande), fuente (maíz, trigo, mandioca, papa, otros), producto final (almidón, edulcorante, etanol, harina de gluten de maíz y alimento para gluten, aceite de maíz, licor de remojo de maíz, proteínas, otros), aplicación (pienso, alimentos, agua de remojo, procesamiento de aceite, fermentación/bioprocesamiento, tratamiento de residuos, molino, refinería, producción de etanol, modificación de almidón, otros) – Tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado de molienda húmeda en Europa

Según la Oficina del Censo de los Estados Unidos, la producción de piensos húmedos a base de gluten de maíz ha aumentado en los últimos años, mientras que otros subproductos han disminuido. Entre 2007 y 2009, la producción mensual media de harina de gluten fue de 165 millones de libras. Las refinerías de maíz fabrican una variedad de productos alimenticios, entre ellos harina de gluten de maíz, harina de germen de maíz y piensos húmedos a base de gluten de maíz.

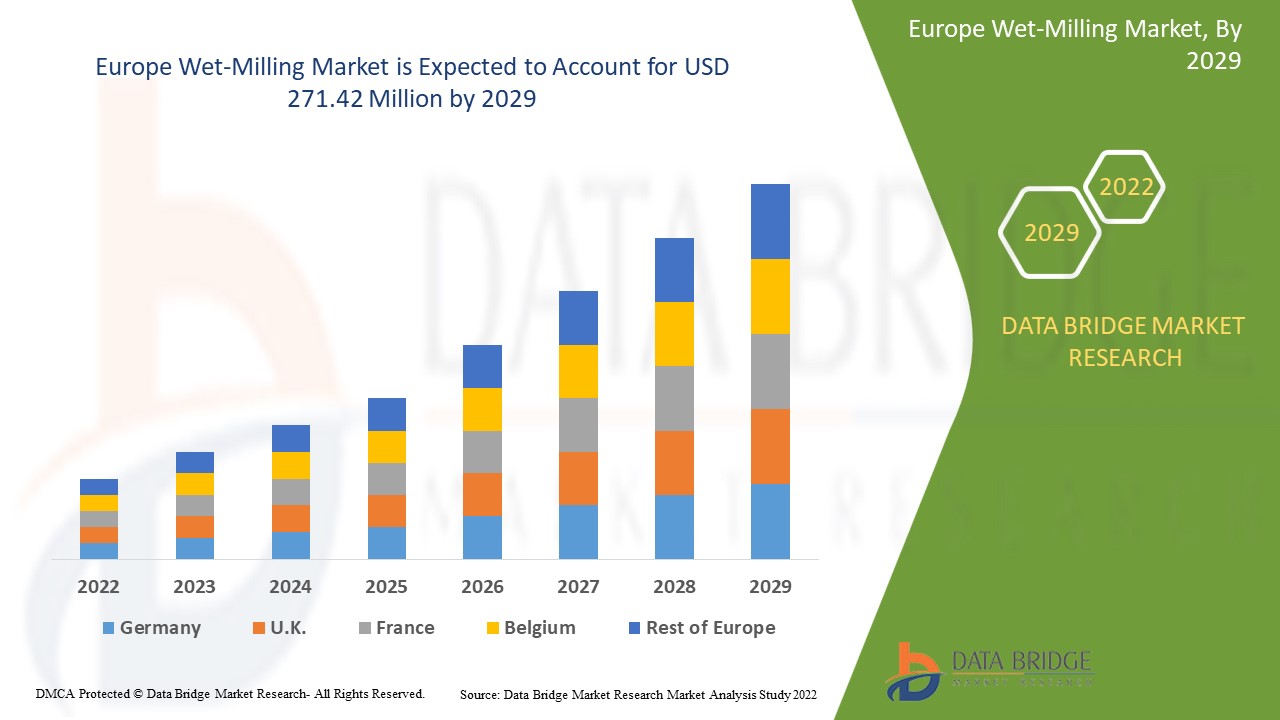

Data Bridge Market Research analiza que el mercado de molienda húmeda creció a un valor de 266,39 millones en 2021 y se espera que alcance el valor de USD 271,42 millones para 2029, a una CAGR de 0,234% durante el período de pronóstico de 2022 a 2029. El informe de mercado curado por el equipo de Data Bridge Market Research incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción, análisis de patentes y comportamiento del consumidor.

Definición de mercado

La molienda húmeda es una cadena de procesos costosa pero eficiente en la que se sumergen materiales como el maíz y el trigo para lograr el objetivo de ablandar el grano y separar todos los componentes de esa fuente de modo que se pueda obtener el máximo uso de todos los componentes. En el caso del maíz, por ejemplo, el proceso de molienda húmeda produce almidón de maíz, aceite de maíz, glucosa y una variedad de otros componentes. La molienda húmeda es una parte importante de muchas industrias, incluidas las farmacéuticas, de alimentos y bebidas, de belleza y cosméticos, y otras, porque proporciona ingredientes como almidón y proteínas.

Alcance y segmentación del mercado de molienda húmeda en Europa

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Equipo (equipo de molienda, equipo de remojo, sistema de centrifugado, sistema de lavado y filtración, y otros), tamaño de procesamiento (línea de procesamiento mediana y línea de procesamiento grande), fuente (maíz, trigo, mandioca, papa y otros), producto final (almidón, edulcorante, etanol, harina de gluten de maíz y alimento de gluten, aceite de maíz, licor de remojo de maíz, proteínas y otros), aplicación (pienso, alimento, agua de remojo, procesamiento de aceite, fermentación/bioprocesamiento, tratamiento de desechos, molino, refinería, producción de etanol, modificación de almidón, otros) |

|

Países cubiertos |

Alemania, Reino Unido, Italia, Francia, España, Suiza, Países Bajos, Bélgica, Rusia, Dinamarca, Suecia, Polonia, Turquía, Resto de Europa |

|

Actores del mercado cubiertos |

Tate & Lyle PLC (Reino Unido), ADM (Estados Unidos), Cargill, Incorporated (Estados Unidos), Ingredion Incorporated (Estados Unidos), Agrana Beteiligungs-AG (Austria), The Roquette Freres (Francia), Bunge Limited (Estados Unidos), China Agri-Industries Holding Limited (China), Global Bio-Chem Technology Group Company Limited (Hong Kong) y Grain Processing Corporation (Estados Unidos). |

|

Oportunidades |

|

Dinámica del mercado de molienda húmeda

Conductores

- Alta demanda de jarabes con alto contenido de fructosa en la industria de alimentos y bebidas

La creciente demanda de jarabes de maíz con alto contenido de fructosa en la industria de bebidas carbonatadas, debido a que su contenido de fructosa del 55 por ciento los hace más dulces que la sacarosa y da como resultado menores costos de fabricación para los fabricantes. Como los jarabes de maíz con alto contenido de fructosa son el producto principal producido en el proceso de molienda húmeda, se espera que un aumento en su demanda impulse el mercado de molienda húmeda de maíz en el futuro cercano. Independientemente de la crisis económica europea, se espera que la industria de bebidas en Europa crezca significativamente. El aumento en las ventas de bebidas listas para beber, que incluyen bebidas carbonatadas y lácteas, té, bebidas de frutas y bebidas alcohólicas como cerveza, sidras y bebidas malteadas, es el principal impulsor del aumento en la demanda de jarabes de maíz con alto contenido de fructosa.

- Creciente importancia de la molienda húmeda en las industrias de alimentos para animales

Otros factores que se espera que impulsen el crecimiento del mercado europeo de molienda húmeda de maíz son la creciente demanda de etanol de maíz, productos de molienda húmeda con alto contenido de fibra digerible, aminoácidos y energía, proteínas, cisteína y metionina. La creciente demanda de biocombustibles beneficiará a la industria de molienda húmeda y aumentará la demanda de molienda húmeda.

Oportunidad

Además, la creciente demanda de carne y productos cárnicos en las regiones en crecimiento brindará oportunidades de crecimiento lucrativas para el mercado en los próximos años. Además, la tendencia europea hacia el consumo de dietas con proteínas animales contribuirá al crecimiento del mercado.

Restricciones

Sin embargo, los estrictos controles regulatorios gubernamentales sobre salud y seguridad, así como los crecientes estándares de calidad, pueden obstaculizar el crecimiento del mercado de molienda húmeda de maíz. Además, el costo de mantenimiento y servicio de los equipos de molienda húmeda es alto. Como resultado, el mercado de molienda húmeda está limitado.

Este informe sobre el mercado de molienda húmeda proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de molienda húmeda, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de COVID-19 en el mercado de molienda húmeda

Varios países impusieron confinamientos estrictos para contener la infección, lo que provocó el cierre de plantas de procesamiento de alimentos y bebidas y la interrupción de la cadena de suministro de alimentos y bebidas por un tiempo limitado. La escasez de productos de alimentos y bebidas y artículos esenciales, las compras compulsivas de los consumidores de todo el mundo, la interrupción de las cadenas de suministro debido a las restricciones de viaje y la escasez de mano de obra han afectado significativamente a la cadena de suministro de alimentos y bebidas. Las principales empresas de fabricación de robots en todo el mundo informaron una disminución en la generación de ingresos durante el primer y segundo trimestre de 2020 debido a las menores ventas causadas por una desaceleración económica causada por el confinamiento y las restricciones de cuarentena impuestas por los gobiernos de todo el mundo, así como una caída temporal en la demanda de automatización.

Desarrollo reciente

- Tate & Lyle PLC (Tate & Lyle), un proveedor líder europeo de ingredientes y soluciones para alimentos y bebidas, duplicó la capacidad de su línea de producción de maltodextrina MALTOSWEET sin OGM en Boleraz, Eslovaquia, en octubre de 2019. La maltodextrina MALTOSWEET es un edulcorante especial a base de maíz de alto valor nutricional. Esto aumenta la capacidad de producción para satisfacer la creciente demanda.

- En enero de 2019, ADM introdujo una nueva línea de productos denominada Almidones de tapioca, que amplió la cartera de productos de la compañía y le permitirá satisfacer mejor las necesidades de sus clientes en el mercado europeo.

- Tate & Lyle presentó la línea CLARIAEVERLAST® de almidones de etiqueta limpia en febrero de 2020, que extiende la vida útil del producto e incluso preserva la calidad de los alimentos en condiciones de almacenamiento extremas. Esto amplía su cartera de productos, lo que a su vez amplía su oferta para los consumidores.

Alcance del mercado de molienda húmeda en Europa

El mercado de molienda húmeda está segmentado en función del equipo, el tamaño del procesamiento, la fuente, el producto final y la aplicación. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Equipo

- Equipos de fresado

- Equipo de remojo

- Sistema de centrifugación

- Sistema de lavado y filtración

- Otros

Solicitud

- Alimentar

- Alimento

- Aguas empinadas

- Procesamiento de petróleo

- Fermentación/Bioprocesamiento

- Tratamiento de residuos

- Molino

- Refinería

- Producción de etanol

- Modificación del almidón

- Otros

Tamaño de procesamiento

- Procesamiento de línea media

- Procesamiento de líneas grandes

Fuente

- Maíz

- Trigo

- Mandioca

- Papa

- Otros

Usuario final

- Almidón

- Edulcorante

- Etanol

- Harina de gluten de maíz y pienso con gluten

- Aceite de maíz

- Licor de maíz macerado

- Proteínas

- Otros

Análisis y perspectivas regionales del mercado de molienda húmeda

Se analiza el mercado de molienda húmeda y se proporcionan información y tendencias del tamaño del mercado por país, equipo, tamaño de procesamiento, fuente, producto final y aplicación como se menciona anteriormente.

Los países cubiertos en el informe del mercado de molienda húmeda son Alemania, Reino Unido, Italia, Francia, España, Suiza, Países Bajos, Bélgica, Rusia, Dinamarca, Suecia, Polonia, Turquía y el resto de Europa.

Alemania cuenta con un mercado de molienda húmeda en auge debido a la creciente demanda de molienda húmeda en la industria alimentaria. A medida que la gente se vuelve más consciente de los avances tecnológicos, que han dado como resultado un aumento de los productos y subproductos de molienda húmeda en Alemania y los Países Bajos, estos últimos están creciendo en el mercado europeo de molienda húmeda.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la molienda húmeda

El panorama competitivo del mercado de molienda húmeda ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de molienda húmeda.

Algunos de los principales actores que operan en el mercado de molienda húmeda son:

- Tate & Lyle PLC (Reino Unido)

- ADM (Estados Unidos)

- Cargill, Incorporated (Estados Unidos)

- Ingredion Incorporated (Estados Unidos)

- Agrana Beteiligungs-AG (Austria)

- Roquette Freres (Francia)

- Bunge Limited (Estados Unidos)

- China Agri-Industries Holding Limited (China)

- Compañía Global Bio-Chem Technology Group Limited (Hong Kong)

- Corporación de procesamiento de granos (EE. UU.)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE WET-MILLING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 EQUIPMENT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MULTI-FUNCTIONALITY OF starch in food and feed applications

5.1.2 risingdemand for fruit sugars in food & beverage industry

5.1.3 Technological advancement in the milling equipment

5.2 RESTRAINTS

5.2.1 HIGH CAPITAL INVESTMENT

5.2.2 lack of skilled labours in developing and underdeveloped countries

5.3 OPPORTUNITIES

5.3.1 INCREASED DEMAND FOR BIOFUEL

5.3.2 Scope of strategic development in the developing regions

5.3.3 Integrated Solutions for wet-milling process

5.4 CHALLENGES

5.4.1 Stringent government regulations

5.4.2 Market disruption by domestic players

6 IMPACT OF COVID-19

6.1 SUPPLY SIDE IMPACT:

6.2 DEMAND SIDE IMPACT:

7 EUROPE WET-MILLING MARKET, BY EQUIPMENT

7.1 OVERVIEW

7.2 MILLING EQUIPMENT

7.3 STEEPING EQUIPMENT

7.4 CENTRIFUGE SYSTEM

7.5 WASHING & FILTRATION SYSTEM

7.6 OTHERS

8 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE

8.1 OVERVIEW

8.2 LARGE LINE PROCESSING

8.3 MEDIUM LINE PROCESSING

9 EUROPE WET-MILLING MARKET, BY SOURCE

9.1 OVERVIEW

9.2 CORN

9.2.1 Dent Corn

9.2.2 Waxy Corn

9.3 WHEAT

9.4 CASSAVA

9.5 POTATO

9.6 OTHERS

10 EUROPE WET-MILLING MARKET, BY END-PRODUCT

10.1 OVERVIEW

10.2 STARCH

10.3 SWEETENER

10.4 ETHANOL

10.5 CORN GLUTEN MEAL& GLUTEN FEED

10.6 CORN OIL

10.7 CORN STEEP LIQUOR

10.8 PROTEINS

10.9 OTHERS

11 EUROPE WET-MILLING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FEED

11.3 FOOD

11.4 STEEP WATER

11.5 OIL PROCESSING

11.6 FERMENTATION/BIOPROCESSING

11.7 WASTE TREATMENT

11.8 MILL

11.9 REFINERY

11.1 ETHANOL PRODUCTION

11.11 STARCH MODIFICATION

11.12 OTHERS

12 EUROPE WET-MILLING MARKET, BY REGION

12.1 EUROPE

12.1.1 gERMANY

12.1.2 U.K.

12.1.3 ITALY

12.1.4 france

12.1.5 SPAIN

12.1.6 SWITZERLAND

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 RUSSIA

12.1.10 DENMARK

12.1.11 SWEDEN

12.1.12 POLAND

12.1.13 TURKEY

12.1.14 REST OF EUROPE

13 EUROPE WET-MILLING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE WET-MILLING STARCH EQUIPMENT MANUFACTURERS

15.1 GEA GROUP AKTIENGESELLSCHAFT

15.1.1 COMPANY snapshot

15.1.2 Company share analysis

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 recent DEVELOPMENT

15.2 ALFA LAVAL

15.2.1 COMPANY snapshot

15.2.2 Company share analysis

15.2.3 REVENUE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 recent DEVELOPMENT

15.3 BÜHLER AG

15.3.1 COMPANY snapshot

15.3.2 Company share analysis

15.3.3 REVENUE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 recent DEVELOPMENT

15.4 ANDRITZ

15.4.1 COMPANY snapshot

15.4.2 Company share analysis

15.4.3 REVENUE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 recent DEVELOPMENTS

15.5 HANNINGFIELD PROCESS SYSTEMS LTD

15.5.1 COMPANY snapshot

15.5.2 PRODUCT PORTFOLIO

15.5.3 recent DEVELOPMENT

15.6 HENAN YONGHAN MACHINERY EQUIPMENT CO., LTD.

15.6.1 COMPANY snapshot

15.6.2 PRODUCT PORTFOLIO

15.6.3 recent DEVELOPMENT

15.7 INGETECSA

15.7.1 COMPANY snapshot

15.7.2 PRODUCT PORTFOLIO

15.7.3 recent DEVELOPMENT

15.8 THAI GERMAN PROCESSING CO., LTD.

15.8.1 COMPANY snapshot

15.8.2 PRODUCT PORTFOLIO

15.8.3 recent DEVELOPMENT

15.9 NETZSCH-FEINMAHLTECHNIK GMBH

15.9.1 COMPANY snapshot

15.9.2 PRODUCT PORTFOLIO

15.9.3 recent DEVELOPMENTs

15.1 UNIVERSAL ENGINEERS

15.10.1 COMPANY snapshot

15.10.2 PRODUCT PORTFOLIO

15.10.3 recent DEVELOPMENT

15.11 WILLY A. BACHOFEN AG

15.11.1 COMPANY snapshot

15.11.2 PRODUCT PORTFOLIO

15.11.3 recent DEVELOPMENT

16 COMPANY PROFILE WET-MILLING STARCH MANUFACTURERS

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 Revenue Analysis

16.1.3 product PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 AGRANA BETEILIGUNGS-AG

16.2.1 COMPANY SNAPSHOT

16.2.2 Revenue Analysis

16.2.3 product PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 CARGILL, INCORPORATED.

16.3.1 COMPANY SNAPSHOT

16.3.2 product PORTFOLIO

16.3.3 RECENT DEVELOPMENTs

16.4 EUROPE BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED.

16.4.1 COMPANY SNAPSHOT

16.4.2 Revenue Analysis

16.4.3 product PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 GRAIN PROCESSING CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 product PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 INGREDION INCORPORATED

16.6.1 COMPANY SNAPSHOT

16.6.2 Revenue analysis

16.6.3 product PORTFOLIO

16.6.4 RECENT DEVELOPMENTs

16.7 ROQUETTE FRÈRES

16.7.1 COMPANY SNAPSHOT

16.7.2 Product portfolio

16.7.3 RECENT DEVELOPMENT

16.8 TATE & LYLE

16.8.1 COMPANY SNAPSHOT

16.8.2 Revenue Analysis

16.8.3 Product portfolio

16.8.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

LIST OF TABLES

TABLE 1 EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 2 EUROPE MILLING EQUIPMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 EUROPE STEEPING EQUIPMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 EUROPE CENTRIFUGE SYSTEM IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 EUROPE WASHING & FILTRATION SYSTEM IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 8 EUROPE LARGE LINE PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 EUROPE MEDIUM LINE PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 EUROPE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 11 EUROPE CORN IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 EUROPE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 13 EUROPE WHEAT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 EUROPE CASSAVA IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 EUROPE POTATO IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 EUROPE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 18 EUROPE STARCH IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 19 EUROPE SWEETENER IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 EUROPE ETHANOL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 EUROPE CORN GLUTEN MEAL & CORN GLUTEN FEED IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 EUROPE CORN OIL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 EUROPE CORN STEEP LIQUOR IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 EUROPE PROTEINS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 EUROPE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 27 EUROPE FEED IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 EUROPE FOOD IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 EUROPE STEEP WATER IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 EUROPE OIL PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 EUROPE FERMENTATION/BIOPROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 EUROPE WASTE TREATMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 EUROPE MILL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 EUROPE REFINERY IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 EUROPE ETHANOL PRODUCTION IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 EUROPE STARCH MODIFICATION IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 37 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 38 EUROPE WET-MILLING MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 39 EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 40 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 41 EUROPE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 42 EUROPE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 43 EUROPE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 44 EUROPE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 45 GERMANY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 46 GERMANY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 47 GERMANY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 48 GERMANY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 49 GERMANY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 50 GERMANY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 U.K. WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 52 U.K. WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 53 U.K. WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 54 U.K. CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 55 U.K. WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 56 U.K. WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 ITALY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 58 ITALY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 59 ITALY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 60 ITALY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 61 ITALY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 62 ITALY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 63 FRANCE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 64 FRANCE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 65 FRANCE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 66 FRANCE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 67 FRANCE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 68 FRANCE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 69 SPAIN WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 70 SPAIN WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 71 SPAIN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 72 SPAIN CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 73 SPAIN WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 74 SPAIN WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 75 SWITZERLAND WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 76 SWITZERLAND WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 77 SWITZERLAND WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 78 SWITZERLAND CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 79 SWITZERLAND WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 80 SWITZERLAND WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 81 NETHERLANDS WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 82 NETHERLANDS WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 83 NETHERLANDS WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 84 NETHERLANDS CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 85 NETHERLANDS WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 86 NETHERLANDS WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 87 BELGIUM WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 88 BELGIUM WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 89 BELGIUM WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 90 BELGIUM CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 91 BELGIUM WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 92 BELGIUM WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 93 RUSSIA WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 94 RUSSIA WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 95 RUSSIA WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 96 RUSSIA CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 97 RUSSIA WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 98 RUSSIA WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 99 DENMARK WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 100 DENMARK WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 101 DENMARK WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 102 DENMARK CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 103 DENMARK WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 104 DENMARK WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 105 SWEDEN WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 106 SWEDEN WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 107 SWEDEN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 108 SWEDEN CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 109 SWEDEN WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 110 SWEDEN WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 111 POLAND WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 112 POLAND WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 113 POLAND WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 114 POLAND CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 115 POLAND WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 116 POLAND WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 117 TURKEY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 118 TURKEY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 119 TURKEY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 120 TURKEY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 121 TURKEY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 122 TURKEY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 123 REST OF EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

Lista de figuras

LIST OF FIGURES

FIGURE 1 EUROPE WET-MILLING MARKET: SEGMENTATION

FIGURE 2 EUROPE WET-MILLING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE WET-MILLING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE WET-MILLING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE WET-MILLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE WET-MILLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE WET-MILLING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE WET-MILLING MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE WET-MILLING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE WET-MILLING MARKET: SEGMENTATION

FIGURE 11 THE GROWING MULTI-FUNCTIONALITY OF STARCH IN FOOD AND FEED APPLICATIONS AND THE RISING DEMAND FOR FRUIT SUGARS IN FOOD & BEVERAGE INDUSTRY ARE EXPECTED TO DRIVE THE EUROPE WET-MILLING MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 MILLING EQUIPMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE WET-MILLING MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE WET-MILLING MARKET

FIGURE 14 EUROPE WET-MILLING MARKET: BY EQUIPMENT, 2019

FIGURE 15 EUROPE WET-MILLING MARKET: BY PROCESSING SIZE, 2019

FIGURE 16 EUROPE WET-MILLING MARKET: BY SOURCE, 2019

FIGURE 17 EUROPE WET-MILLING MARKET: BY END-PRODUCT, 2019

FIGURE 18 EUROPE WET-MILLING MARKET: BY APPLICATION, 2019

FIGURE 19 EUROPE WET-MILLING MARKET: SNAPSHOT (2019)

FIGURE 20 EUROPE WET-MILLING MARKET: BY COUNTRY (2019)

FIGURE 21 EUROPE WET-MILLING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 22 EUROPE WET-MILLING MARKET: BY COUNTRY (2019 & 2027)

FIGURE 23 EUROPE WET-MILLING MARKET: BY EQUIPMENT (2020-2027)

FIGURE 24 EUROPE WET-MILLING MARKET: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.