Europe Warehouse Management System Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

854.47 Million

USD

2,859.79 Million

2021

2029

USD

854.47 Million

USD

2,859.79 Million

2021

2029

| 2022 –2029 | |

| USD 854.47 Million | |

| USD 2,859.79 Million | |

|

|

|

Mercado de sistemas de gestión de almacenes en Europa, por componente (hardware, software, servicios), implementación (basada en la nube, local), tipo de nivel (avanzado, intermedio, básico), función (sistema de gestión de mano de obra, análisis y optimización, facturación y gestión de patios, integración y mantenimiento de sistemas, servicios de consultoría), canal de distribución (en línea, fuera de línea), usuario final (alimentos y bebidas, comercio electrónico, automoción, logística de terceros, atención médica, electricidad y electrónica, metales y maquinaria, productos químicos, otros): tendencias de la industria y pronóstico hasta 2029

Análisis y tamaño del mercado de sistemas de gestión de almacenes en Europa

El comercio electrónico ha experimentado un enorme crecimiento, lo que ha provocado que la demanda de sistemas de gestión de almacenes (WMS) se esté expandiendo. Además, la introducción de tecnologías modernas, como la computación en la nube y el software como servicio (SaaS), entre otras, ha impulsado a los operadores de la cadena de suministro a adoptar sistemas de gestión de almacenes, que proporcionan una operación de extremo a extremo con mayor eficiencia y transparencia. Estos factores determinantes ayudarán en gran medida a que el mercado gane impulso durante el período previsto.

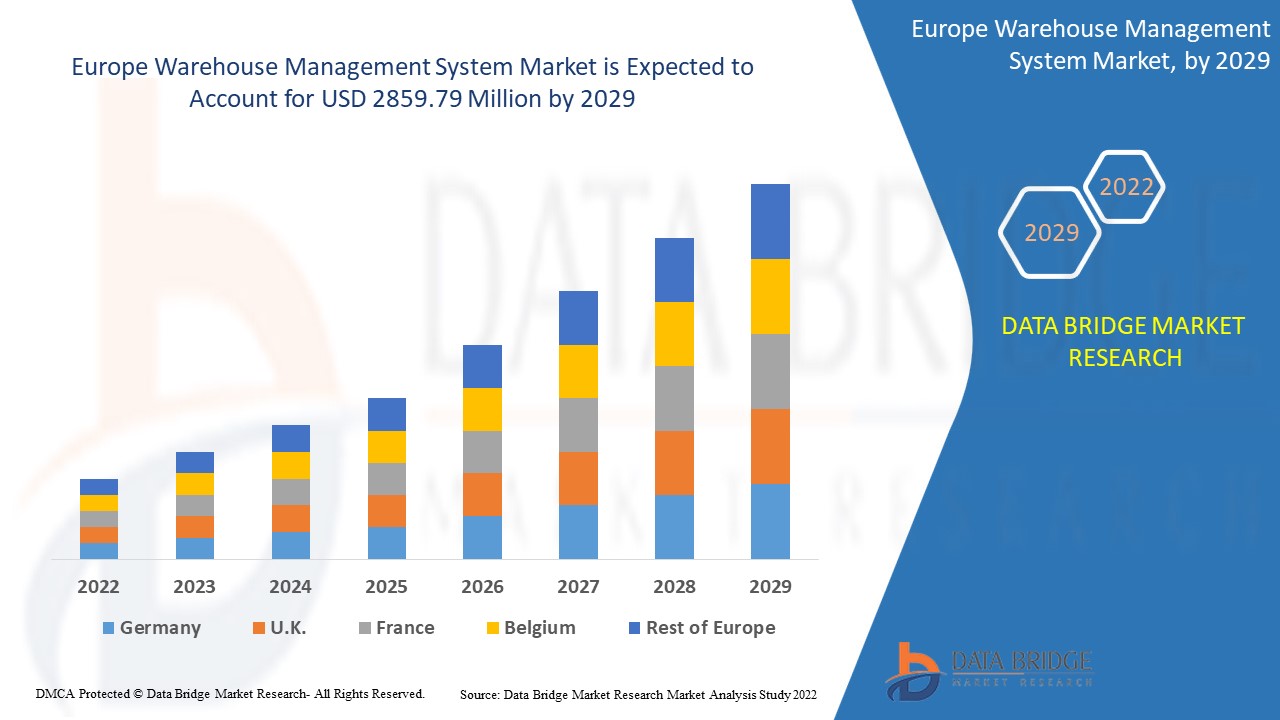

El mercado europeo de sistemas de gestión de almacenes se valoró en 854,47 millones de dólares en 2021 y se espera que alcance los 2859,79 millones de dólares en 2029, registrando una CAGR del 16,30% durante el período de pronóstico de 2022 a 2029. El "software" representa el segmento de componentes más grande en el mercado de sistemas de gestión de almacenes dentro del período previsto debido a la creciente conciencia sobre el software WMS entre las pequeñas y medianas empresas (PYME) y la creciente participación de soluciones de software WMS basadas en la nube. El informe de mercado curado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis PESTLE.

Definición de mercado

El sistema de gestión de almacenes es un sistema que funciona para simplificar la red, junto con su administración, al trasladarse a una red que pueda ser manejada por cualquier servidor de productos básicos que esté bajo el control del operador de red. El funcionamiento de la red es adaptable, lo que puede resultar en varias ventajas para el público objetivo que adopte sus nuevos servicios. El uso de v-CPE a gran escala por parte de los proveedores de red puede resultar en la simplificación y aceleración de la entrega de servicios y la configuración y administración de dispositivos desde ubicaciones remotas.

Alcance y segmentación del mercado de sistemas de gestión de almacenes en Europa

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2014 - 2019) |

|

Unidades cuantitativas |

Ingresos en millones de USD, volúmenes en unidades, precios en USD |

|

Segmentos cubiertos |

Componente (hardware, software, servicios), implementación (basada en la nube, local), tipo de nivel (avanzado, intermedio, básico), función (sistema de gestión de mano de obra, análisis y optimización, facturación y gestión de patios, integración y mantenimiento de sistemas, servicios de consultoría), canal de distribución (en línea, fuera de línea), usuario final (alimentos y bebidas, comercio electrónico, automoción, logística de terceros, atención médica, electricidad y electrónica, metales y maquinaria, productos químicos, otros) |

|

Países cubiertos |

Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza, Resto de Europa |

|

Actores del mercado cubiertos |

Manhattan Associates, (EE. UU.), Blue Yonder Group, Inc. (EE. UU.), HighJump (EE. UU.), Oracle (EE. UU.), IBM (EE. UU.), SAP SE (Alemania), ACL Digital (EE. UU.), VMWare Inc. (EE. UU.), Ericsson Inc (Suecia), Hewlett Packard Enterprise Development LP (EE. UU.), Softeon (EE. UU.), Telco Systems (EE. UU.), NEC Corporation (Japón), Juniper Networks Inc. (EE. UU.), Infor (EE. UU.), Versa Networks Inc. (EE. UU.) y Cisco Systems Inc. (EE. UU.) |

|

Oportunidades de mercado |

|

Dinámica del mercado de sistemas de gestión de almacenes

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- La digitalización y su uso en el comercio electrónico

El mercado de los sistemas de gestión de almacenes está en alza debido al rápido aumento de la digitalización y al uso más amplio de la misma por parte de los consumidores en los sectores del comercio electrónico en sus actividades cotidianas, así como a los requisitos de cumplimiento omnicanal. Se prevé que este factor sea el factor más importante que impulse el crecimiento de este mercado.

También se estima que la necesidad de un software versátil para abordar los códigos de barras, las básculas inteligentes y el traslado de mercancías de un lugar a otro con la misma habilidad y trabajando en colaboración impulsará el crecimiento general del mercado. Además, las ventajas de venta, eficiencia laboral y costos de propiedad del módulo adicional WMS también impulsan el crecimiento del mercado. La aparición de demandas de tráfico variables también amortigua el crecimiento del mercado dentro del período previsto. La disponibilidad de una variedad de sabores también actúa como un impulsor del mercado.

Oportunidades

- Digitalización y demanda de soluciones virtuales

Se estima que la digitalización de la cadena de suministro contribuye a crear un ecosistema completamente integrado que generará oportunidades lucrativas para el mercado, lo que ampliará aún más la tasa de crecimiento del mercado de sistemas de gestión de almacenes en el futuro. Además, el aumento de la demanda de soluciones y servicios virtuales en el área de la red también ofrecerá numerosas oportunidades de crecimiento dentro del mercado.

Restricciones/Desafíos

- Menor conciencia

Se espera que la falta de conciencia sobre WMS en las pequeñas y medianas empresas obstaculice el crecimiento del mercado.

- Costos elevados

Los WMS locales presentan una desventaja significativa en cuanto a actualizaciones de hardware y costos de mantenimiento, ya que las soluciones WMS locales de gama alta tienen un alto costo de implementación, lo que impide que las pymes las adopten. Además, un sistema de almacenamiento requiere una gran inversión inicial que pueda soportar el crecimiento del mercado, lo que se prevé que sea un desafío para el mercado de sistemas de gestión de almacenes durante el período de pronóstico.

Este informe de mercado de sistemas de gestión de almacenes proporciona detalles de nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado de categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado de sistemas de gestión de almacenes, comuníquese con Data Bridge Market Research para obtener un informe de analista, nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Impacto de Covid-19 en el mercado de sistemas de gestión de almacenes

La pandemia mundial de COVID-19 ha afectado a 215 países y ha afectado a una amplia gama de industrias. El mercado de sistemas de gestión de almacenes se ha visto enormemente afectado por el brote de COVID-19 , ya que los consumidores están migrando rápidamente a las plataformas de Internet. La demanda en línea de alimentos y bebidas, productos básicos y recetas, todos ellos proporcionados mediante métodos únicos sin contacto, ha aumentado. La mayor demanda en línea de diversos productos también ha aumentado la necesidad de almacenamiento. Varias empresas importantes están abriendo nuevos almacenes en varios países para dar cabida a la creciente demanda. Como resultado, los sistemas de gestión de almacenes se están volviendo más populares en las empresas de comercio electrónico y logística de terceros. Se prevé que los gigantes del comercio electrónico como Amazon, Alibaba y eBay sigan impulsando la demanda de sistemas de gestión de almacenes a medida que establezcan nuevas instalaciones en todo el mundo.

Además, la situación está mejorando debido a la disminución de los casos de COVID-19 en todo el mundo y el mercado está ganando velocidad y se expandirá durante el período de proyección. Por lo tanto, se estima que el mercado crecerá a un ritmo sustancial después de la COVID-19.

Acontecimientos recientes

- En mayo de 2020, Manhattan Associates Inc., un proveedor líder de software de gestión de almacenes, presentó la solución Manhattan Active Warehouse Management, el primer sistema de gestión de almacenes (WMS) de clase empresarial nativo en la nube del mundo que combina todos los aspectos de la distribución y nunca requiere actualizaciones. Manhattan Active WM, compuesto completamente por microservicios y extremadamente elástico, aporta un nuevo nivel de velocidad, adaptabilidad y facilidad de uso en la gestión de la distribución.

Alcance del mercado de sistemas de gestión de almacenes en Europa

El mercado de sistemas de gestión de almacenes está segmentado en función de los componentes, la implementación, el tipo de nivel, la función, el canal de distribución y el usuario final. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Componente

- Hardware

- Software

- Servicios

Despliegue

- Basado en la nube

- En las instalaciones

Tipo de nivel

- Avanzado

- Intermedio

- Básico

Función

- Sistema de Gestión Laboral

- Analítica y optimización

- Facturación y gestión de patios

- Integración y mantenimiento de sistemas

- Servicios de Consultoría

Canal de distribución

- En línea

- Desconectado

Usuario final

- Alimentos y bebidas

- Comercio electrónico

- Automotor

- Logística de terceros

- Cuidado de la salud

- Electricidad y electrónica

- Metales y maquinaria

- Productos químicos

- Otros

Análisis y perspectivas regionales del mercado de sistemas de gestión de almacenes

Se analiza el mercado del sistema de gestión de almacenes y se proporcionan información y tendencias del tamaño del mercado por país, componente, implementación, tipo de nivel, función, canal de distribución y usuario final como se menciona anteriormente.

Los países cubiertos en el informe de mercado del sistema de gestión de almacenes son Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía y el resto de Europa en Europa.

Alemania lidera el mercado de sistemas de gestión de almacenes gracias al creciente uso de sistemas de gestión de almacenes multicanal, que aumentan la demanda al proporcionar datos en tiempo real sobre el inventario mediante códigos de barras, números de serie y etiquetado RFID. Además, debido al crecimiento del negocio del comercio electrónico, el Reino Unido está dominando. El sistema de gestión de almacenes multicanal se utiliza más ampliamente, por lo que Francia domina.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Puntos de datos como análisis de la cadena de valor aguas abajo y aguas arriba, tendencias técnicas y análisis de las cinco fuerzas de Porter, estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los sistemas de gestión de almacenes

El panorama competitivo del mercado de sistemas de gestión de almacenes proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de sistemas de gestión de almacenes.

Algunos de los principales actores que operan en el mercado de sistemas de gestión de almacenes son

- Manhattan Associates, (Estados Unidos)

- Blue Yonder Group, Inc. (Estados Unidos)

- HighJump (Estados Unidos)

- Oracle (Estados Unidos)

- IBM (Estados Unidos)

- SAP SE (Alemania)

- ACL Digital (Estados Unidos)

- VMWare Inc. (Estados Unidos)

- Ericsson Inc., (Suecia)

- Hewlett Packard Enterprise Development LP (Estados Unidos)

- Softeon (Estados Unidos)

- Sistemas de telecomunicaciones (EE. UU.)

- Corporación NEC (Japón)

- Juniper Networks Inc., (Estados Unidos)

- Infor (Estados Unidos)

- Versa Networks Inc., (Estados Unidos)

- Cisco Systems Inc. (Estados Unidos)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Europe warehouse management system Market

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- Product timeline curve

- secondary sourcEs

- assumptions

- Executive SUMMARY

- premium insights

- Market Overview

- Europe WAREHOUSE MANAGEMENT SYSTEM MARKET, BY component

- overview

- software

- Billing & Yard Management

- Analytics & Optimization

- Labor Management System

- hardware

- crane

- Automated Storage and Retrieval System (ASRS)

- robot

- Conveyor and Sortation System

- Automated Guided Vehicle (AGV)

- services

- Support and Maintenance

- Integration and Migration

- Training and Education

- Consulting

- Europe WAREHOUSE MANAGEMENT SYSTEM MARKET, By Deployment

- overview

- On-Premise

- Cloud-Based

- Europe WAREHOUSE MANAGEMENT SYSTEM MARKET, BY Type of Tier

- overview

- Advanced

- Intermediate

- basic

- Europe WAREHOUSE MANAGEMENT SYSTEM MARKET, BY Distribution Channel

- overview

- Offline

- Online

- Europe WAREHOUSE MANAGEMENT SYSTEM MARKET, BY End-USER

- overview

- Food & Beverages

- E-COMMERCE

- automotive

- Third-Party Logistics

- Healthcare

- Electrical & Electronics

- Metals and Machinery

- Chemicals

- Others

- Europe

- GERMANY

- U.K.

- FRANCE

- ITALY

- RUSSIA

- SPAIN

- SWITZERLAND

- BELGIUM

- NETHERLANDS

- TURKEY

- REST OF EUROPE

- company share analysis: EUROPE

- SAP SE

- COMPANY SNAPSHOT

- REVENUE analysis

- PRODUCT PORTFOLIO

- RECENT Update

- Oracle

- COMPANY SNAPSHOT

- REVENUE analysis

- PRODUCT PORTFOLIO

- RECENT Update

- IBM Corporation

- COMPANY SNAPSHOT

- REVENUE analysis

- PRODUCT PORTFOLIO

- RECENT Update

- PSI Logistics GmbH (a subsidiary of PSI Software AG)

- COMPANY SNAPSHOT

- REVENUE analysis

- solution PORTFOLIO

- RECENT Update

- Manhattan Associates

- COMPANY SNAPSHOT

- REVENUE analysis

- PRODUCT PORTFOLIO

- RECENT Update

- Blue Yonder Group, Inc.

- COMPANY SNAPSHOT

- solution PORTFOLIO

- RECENT Updates

- Epicor Software Corporation

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT Updates

- Infor

- COMPANY SNAPSHOT

- product Portfolio

- RECENT UPDATE

- dasault systemes (IQMS)

- COMPANY SNAPSHOT

- revenue analysis

- product Portfolio

- RECENT Update

- PRIMA SOLUTIONS LTD.

- COMPANY SNAPSHOT

- solution Portfolio

- RECENT Update

- PTC

- COMPANY SNAPSHOT

- REVENUE analysis

- PRODUCT PORTFOLIO

- RECENT Update

- softeon

- COMPANY SNAPSHOT

- Solution Portfolio

- RECENT Updates

- Synergy Ltd

- COMPANY SNAPSHOT

- product Portfolio

- RECENT Updates

- Tecsys inc.

- COMPANY SNAPSHOT

- REVENUE analysis

- solution PORTFOLIO

- RECENT Updates

Lista de Tablas

TABLE 1 Europe Warehouse management system Market, By component, 2018-2027 (USD MILLION)

TABLE 2 Europe software In Warehouse management system Market, By software Component, 2018-2027 (USD million)

TABLE 3 Europe hardware In Warehouse management system Market, By hardware Component, 2018-2027 (USD million)

TABLE 4 Europe Services In Warehouse management system Market, By Services Component, 2018-2027 (USD million)

TABLE 5 Europe warehouse management system Market, By Deployment, 2018-2027 (USD MILLION)

TABLE 6 Europe warehouse management system Market, By Type of Tier, 2018-2027 (USD MILLION)

TABLE 7 Europe warehouse management system Market, By Distribution Channel, 2018-2027 (USD MILLION)

TABLE 8 europe warehouse management system Market, By End-user, 2018-2027 (USD MILLION)

TABLE 9 EUROPE Warehouse Management System MARKET, By Country, 2018-2027 (usd million)

TABLE 10 EUROPE Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 11 Europe Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 12 Europe Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 13 Europe Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 14 Europe Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 15 Europe WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 16 Europe Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 17 Europe Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 18 GERMANY Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 19 GERMANY Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 20 GERMANY Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 21 GERMANY Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 22 GERMANY Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 23 GERMANY WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 24 GERMANY Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 25 GERMANY Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 26 U.K. Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 27 U.K. Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 28 U.K. Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 29 U.K. Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 30 U.K. Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 31 U.K. WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 32 U.K. Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 33 U.K. Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 34 FRANCE Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 35 FRANCE Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 36 FRANCE Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 37 FRANCE Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 38 FRANCE Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 39 FRANCE WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 40 FRANCE Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 41 FRANCE Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 42 ITALY Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 43 ITALY Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 44 ITALY Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 45 ITALY Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 46 ITALY Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 47 ITALY WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 48 ITALY Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 49 ITALY Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 50 RUSSIA Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 51 RUSSIA Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 52 RUSSIA Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 53 RUSSIA Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 54 RUSSIA Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 55 RUSSIA WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 56 RUSSIA Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 57 RUSSIA Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 58 SPAIN Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 59 SPAIN Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 60 SPAIN Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 61 SPAIN Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 62 SPAIN Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 63 SPAIN WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 64 SPAIN Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 65 SPAIN Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 66 SWITZERLAND Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 67 SWITZERLAND Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 68 SWITZERLAND Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 69 SWITZERLAND Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 70 SWITZERLAND Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 71 SWITZERLAND WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 72 SWITZERLAND Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 73 SWITZERLAND Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 74 BELGIUM Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 75 BELGIUM Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 76 BELGIUM Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 77 BELGIUM Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 78 BELGIUM Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 79 BELGIUM WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 80 BELGIUM Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 81 BELGIUM Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 82 NETHERLANDS Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 83 NETHERLANDS Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 84 NETHERLANDS Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 85 NETHERLANDS Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 86 NETHERLANDS Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 87 NETHERLANDS WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 88 NETHERLANDS Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 89 NETHERLANDS Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 90 TURKEY Warehouse Management System MARKET, By component, 2018-2027 (usd million)

TABLE 91 TURKEY Software In Warehouse Management System Market, By Software Component, 2018-2027 (USD million)

TABLE 92 TURKEY Hardware In Warehouse Management System Market, By Hardware Component, 2018-2027 (USD million)

TABLE 93 TURKEY Services In Warehouse Management System Market, By Services Component, 2018-2027 (USD million)

TABLE 94 TURKEY Warehouse Management System Market, By Deployment, 2018-2027 (USD million)

TABLE 95 TURKEY WAREHOUSE MANAGEMENT SYSTEM MARKET, BY TYPE OF TIER, 2018-2027 (USD MILLION)

TABLE 96 TURKEY Warehouse Management System Market, By Distribution Channel, 2018-2027 (USD million)

TABLE 97 TURKEY Warehouse Management System Market, By End-User, 2018-2027 (USD million)

TABLE 98 REST OF EUROPE Warehouse Management System MARKET, By component, 2018-2027 (usd million)

Lista de figuras

FIGURE 1 Europe WAREHOUSE MANAGEMENT SYSTEM MARKET: segmentation

FIGURE 2 Europe warehouse management system Market: data triangulation

FIGURE 3 Europe warehouse management system Market: DROC ANALYSIS

FIGURE 4 Europe warehouse management system Market: REGIONAL vs country MARKET ANALYSIS

FIGURE 5 Europe warehouse management system Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe warehouse management system Market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe warehouse management system Market: DBMR MARKET POSITION GRID

FIGURE 8 Europe warehouse management system market: vendor share analysis

FIGURE 9 Europe warehouse management system Market: SEGMENTATION

FIGURE 10 Globalization of the distribution and supply chain network is EXPECTED TO DRIVE the Europe WAREHOUSE MANAGEMENT SYSTEM MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 11 Software is expected to account for the largest share of Europe warehouse management system Market in 2020 & 2027

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF Europe warehouse management systems MARKET

FIGURE 13 Europe WAREHOUSE MANAGEMENT SYSTEM MARKET: BY Component, 2019

FIGURE 14 Europe WAREHOUSE MANAGEMENT SYSTEM MARKET: BY deployment, 2019

FIGURE 15 Europe WAREHOUSE MANAGEMENT SYSTEM MARKET: BY type of tier, 2019

FIGURE 16 europe WAREHOUSE MANAGEMENT SYSTEM MARKET: BY distribution channel, 2019

FIGURE 17 Europe WAREHOUSE MANAGEMENT SYSTEM MARKET: BY end-user, 2019

FIGURE 18 europe Warehouse management system market: COMPANY SHARE 2019 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.