Europe Ultrasound Imaging Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

164.89 Million

USD

241.77 Million

2024

2032

USD

164.89 Million

USD

241.77 Million

2024

2032

| 2025 –2032 | |

| USD 164.89 Million | |

| USD 241.77 Million | |

|

|

|

|

Segmentación del mercado europeo de imágenes por ultrasonido por producto (en carrito, compacto/portátil), tecnología (2D, 3D/4D, Doppler, ultrasonido focalizado de alta intensidad (HIFU), otros), aplicación (radiología/imagen general, cardiología, obstetricia/ginecología, urología, musculoesquelético, otros), usuario final (hospitales, centros de diagnóstico, centros de cirugía ambulatoria, clínicas, otros): tendencias del sector y pronóstico hasta 2032

Tamaño del mercado de imágenes por ultrasonido

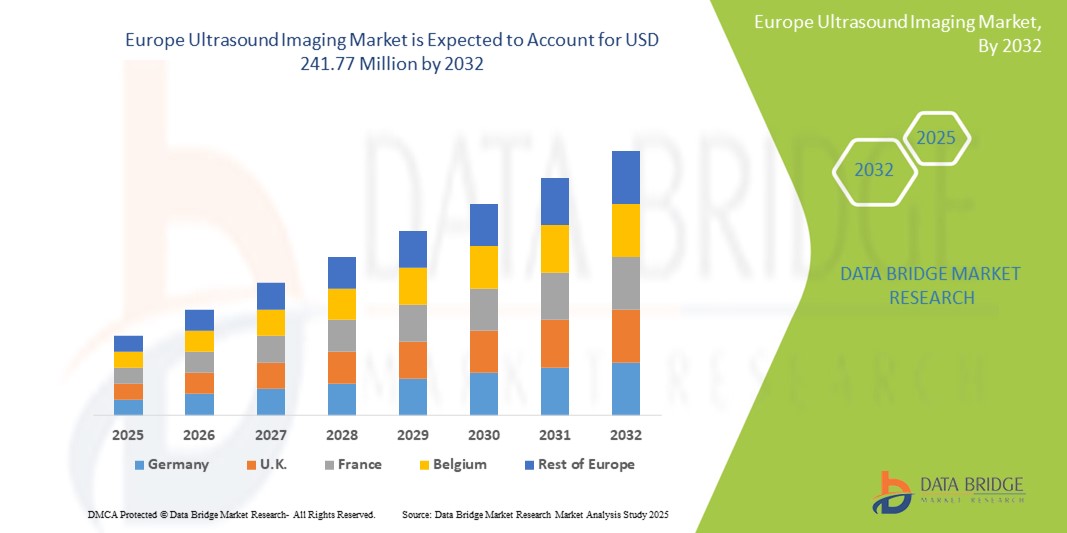

- El mercado europeo de imágenes por ultrasonido se valoró en USD 164,89 millones en 2024 y se espera que alcance los USD 241,77 millones para 2032 , con una CAGR del 5,5 % durante el período de pronóstico.

- La creciente incidencia de enfermedades crónicas, la creciente demanda de técnicas de diagnóstico mínimamente invasivas y el crecimiento de la población geriátrica en Europa. Además, la preferencia por la imagenología sin radiación y los avances tecnológicos en ecógrafos portátiles y de punto de atención siguen impulsando su adopción en el mercado.

Análisis del mercado europeo de imágenes por ultrasonido

- Los dispositivos de ecografía son esenciales para diversos procedimientos diagnósticos y terapéuticos, ya que proporcionan imágenes de alta resolución de los órganos internos. Se utilizan ampliamente en aplicaciones como obstetricia, cardiología y diagnóstico musculoesquelético.

- La demanda de imágenes por ultrasonido está impulsada principalmente por la creciente prevalencia de enfermedades crónicas y los avances en la tecnología de imágenes.

- Se espera que Alemania domine el mercado de imágenes por ultrasonido debido a su avanzada infraestructura de atención médica, su elevado gasto sanitario y la adopción temprana de innovaciones médicas.

- Se espera que el Reino Unido sea el mercado de más rápido crecimiento durante el período de pronóstico, impulsado por la expansión del acceso a la atención médica y una mayor concienciación.

- Se espera que el segmento basado en carritos/carritos lidere el mercado con una participación del 40,22%, impulsado por el creciente uso de la ecografía en la atención prenatal y el monitoreo fetal.

Alcance del informe Segmentación del mercado de imágenes por ultrasonido

|

Atributos |

Perspectivas clave del mercado de imágenes por ultrasonido |

|

Segmentos cubiertos |

Por producto: Basado en carrito, compacto/portátil |

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de imágenes por ultrasonido

Integración de tecnología inteligente y conocimientos de salud basados en IA

- Una tendencia clave es la creciente adopción de ecógrafos portátiles, especialmente en urgencias y centros de atención rurales. Estos dispositivos permiten diagnósticos más rápidos y una mayor movilidad.

Por ejemplo,

Los hospitales del Reino Unido han adoptado cada vez más ecógrafos portátiles para mejorar la eficiencia diagnóstica. Estos dispositivos reducen los tiempos de espera en urgencias y permiten evaluaciones rápidas a pie de cama. Su portabilidad permite a los profesionales sanitarios obtener imágenes en tiempo real en entornos de cuidados críticos, lo que mejora los resultados de los pacientes y agiliza los flujos de trabajo en diversos departamentos, como urgencias y unidades de cuidados intensivos.

- La integración de inteligencia artificial en los sistemas de ultrasonido permite la optimización de imágenes en tiempo real, mediciones automáticas y una mayor precisión diagnóstica, mejorando los resultados de los pacientes y los flujos de trabajo clínicos.

Dinámica del mercado de imágenes por ultrasonido

Conductor

“Avances tecnológicos del ultrasonido”

- Los algoritmos de IA permiten que los dispositivos de ultrasonido analicen imágenes rápidamente y con mayor precisión, lo que reduce el tiempo que los proveedores de atención médica dedican al diagnóstico.

- Los sistemas de ultrasonido compactos y portátiles permiten a los proveedores de atención médica realizar imágenes de diagnóstico en una variedad de entornos, incluidas salas de emergencia, áreas remotas y entornos de atención domiciliaria.

- Por ejemplo, los ecógrafos portátiles con imágenes basadas en IA, como los desarrollados por Butterfly Network, permiten diagnósticos rápidos y de alta calidad en urgencias y entornos remotos. Estos dispositivos ofrecen conectividad en la nube para un intercambio de datos fluido, lo que mejora la colaboración entre profesionales sanitarios y optimiza la atención al paciente mediante diagnósticos más precisos y accesibles.

- Los dispositivos de ultrasonido con conectividad en la nube permiten el almacenamiento remoto de datos y el intercambio fácil de información del paciente, lo que mejora la colaboración entre los profesionales de la salud y optimiza los resultados de la atención al paciente.

- Las mejoras tecnológicas en los sensores de imágenes y el software están mejorando significativamente la resolución y la claridad de las imágenes de ultrasonido, lo que conduce a mejores diagnósticos y planificación del tratamiento.

Oportunidad

“Dispositivos de ultrasonido portátiles”

- La creciente necesidad de dispositivos de ultrasonido portátiles en los servicios médicos de emergencia (SME) permite a los fabricantes ingresar a mercados que requieren equipos compactos y de alto rendimiento para diagnósticos en el sitio en áreas remotas o rurales.

- Los servicios de atención médica a domicilio se están expandiendo, lo que crea una demanda de dispositivos de ultrasonido portátiles que permiten a los pacientes recibir atención fuera de los entornos clínicos, ofreciendo comodidad y reduciendo las visitas al hospital.

- En zonas rurales con acceso limitado a centros de salud tradicionales, los equipos de emergencias médicas (SME) utilizan cada vez más ecógrafos portátiles para diagnósticos rápidos. Estos dispositivos permiten la detección temprana de afecciones como anomalías cardíacas o complicaciones del embarazo, mejorando la evolución de los pacientes y reduciendo la necesidad de visitas al hospital.

- La creciente prevalencia de enfermedades crónicas, como las complicaciones cardiovasculares y relacionadas con la diabetes, está impulsando la necesidad de dispositivos de ultrasonido accesibles en la atención primaria y en aplicaciones de monitoreo remoto.

- La aprobación regulatoria de los dispositivos de ultrasonido portátiles está mejorando, lo que crea oportunidades para que los fabricantes amplíen sus líneas de productos con dispositivos que cumplen con los estándares de salud y atienden diversas necesidades de los pacientes.

Restricción/Desafío

“ El alto costo de los sistemas avanzados”

- Las clínicas más pequeñas y los hospitales rurales pueden tener dificultades para justificar el alto costo inicial de los sistemas de ultrasonido avanzados, lo que limita su capacidad de ofrecer capacidades de diagnóstico de vanguardia.

- Las limitaciones presupuestarias en los entornos de atención sanitaria de bajos ingresos dan lugar a retrasos en la actualización de los equipos, lo que limita el acceso a tecnología de ultrasonido más nueva y eficiente para los pacientes que necesitan atención oportuna.

- En clínicas rurales y hospitales pequeños, el alto costo de los sistemas de ultrasonido avanzados puede restringir el acceso a la tecnología más avanzada. Por ejemplo, una clínica en una zona remota puede tener dificultades para afrontar el costo inicial de equipos de ultrasonido de vanguardia, lo que afecta su capacidad para ofrecer diagnósticos precisos y oportunos a los pacientes.

- Los altos costos de mantenimiento y operación asociados con los sistemas avanzados pueden desalentar aún más su adopción en centros de salud no urbanos y más pequeños, que priorizan soluciones más rentables.

- El elevado precio puede crear barreras para los proveedores de atención médica en los mercados emergentes, donde la asequibilidad es una consideración importante en la adquisición de equipos médicos.

Alcance del mercado de imágenes por ultrasonido

El mercado está segmentado en base a tres segmentos notables: por producto, tecnología y usuario final de la aplicación.

|

Segmentación |

Subsegmentación |

|

Producto |

|

|

Tecnología |

|

|

Solicitud |

|

|

Usuario final |

|

Se proyecta que en 2025, los productos basados en carritos/carritos dominarán el mercado con la mayor participación en el segmento de productos.

Se prevé que el segmento de dispositivos con carritos lidere el mercado europeo de dispositivos de ecografía, con la mayor cuota de mercado (41,42 %) en 2025. Este predominio se atribuye a sus avanzadas capacidades de imagen, mayor potencia de procesamiento y su idoneidad para diagnósticos integrales en hospitales. Se utilizan ampliamente en cardiología, radiología y obstetricia.

Se espera que la radiología/salud por imágenes generales represente la mayor participación durante el período de pronóstico en el mercado de aplicaciones.

En 2025, se prevé que el segmento de Radiología/Imagen General domine el mercado europeo de dispositivos de ecografía, con la mayor cuota de mercado, un 41,11 %, impulsado por la creciente demanda de imágenes diagnósticas no invasivas en diversas aplicaciones clínicas. Este segmento se beneficia de los avances tecnológicos en imágenes 3D/4D, su amplia adopción en entornos ambulatorios y su mayor uso en la detección temprana de enfermedades. Además, el aumento de la población geriátrica y la prevalencia de enfermedades crónicas impulsan aún más su utilización en los centros sanitarios.

Análisis regional del mercado de imágenes por ultrasonido

El Reino Unido es el país dominante en el mercado de la ecografía.

- El Reino Unido domina el mercado europeo de imágenes por ultrasonido y representa la mayor participación debido a su infraestructura de atención médica avanzada, su elevado gasto en atención médica y la adopción temprana de innovaciones médicas, en particular en tecnologías de monitoreo de la salud.

- La creciente prevalencia de enfermedades crónicas como diabetes, enfermedades cardiovasculares e hipertensión, junto con una gran población que envejece, está impulsando la demanda de dispositivos de salud digitales que permitan el monitoreo remoto y el diagnóstico temprano en entornos clínicos y de atención domiciliaria.

- Los principales actores como Fitbit, Apple y Medtronic tienen su sede en el Reino Unido y ofrecen una amplia gama de dispositivos portátiles aprobados por la FDA y soluciones de seguimiento de la salud diseñadas para satisfacer las necesidades de diversos grupos de pacientes.

- Las iniciativas gubernamentales dirigidas a mejorar el acceso a la atención médica, promover la atención preventiva e implementar políticas de reembolso favorables consolidan aún más el liderazgo del Reino Unido en el mercado europeo de imágenes por ultrasonido.

Se proyecta que Alemania registre la mayor tasa de crecimiento.

- Se espera que Alemania registre el crecimiento más rápido en el mercado de imágenes por ultrasonido de Europa, impulsado por su sistema de salud financiado con fondos públicos y un enfoque creciente en la prevención de enfermedades crónicas y soluciones de monitoreo remoto de pacientes.

- El aumento de las inversiones gubernamentales en el manejo de enfermedades crónicas como la diabetes, la hipertensión y la obesidad, junto con el envejecimiento de la población, está impulsando la demanda de imágenes ecográficas domiciliarias.

- La expansión de clínicas de atención médica multidisciplinarias, centros de rehabilitación y servicios de atención médica domiciliaria está impulsando aún más la necesidad de soluciones de monitoreo de salud accesibles y rentables adaptadas a las diversas necesidades de los pacientes.

- Los esfuerzos de colaboración entre las autoridades sanitarias provinciales, los grupos de defensa de los pacientes y las instituciones de investigación están fomentando la innovación y ampliando la disponibilidad de tecnologías avanzadas de monitoreo de salud digital en toda Alemania.

Cuota de mercado de las imágenes por ultrasonido

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Europa, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- GE HealthCare (EE. UU.)

- Siemens Healthineers (Alemania)

- Philips Healthcare (Países Bajos)

- Canon Medical Systems Corporation (Japón)

- Samsung Medison Co., Ltd. (Corea del Sur)

- Fujifilm Holdings Corporation (Japón)

- Mindray Medical International Limited (China)

- Hitachi Ltd. (Japón)

- Esaote SpA (Italia)

- Butterfly Network, Inc. (EE. UU.)

Últimos avances en el mercado europeo de imágenes por ultrasonido

- Sistema de ultrasonidos A20 en el Congreso Europeo de Radiología (ECR) 2025. Este avanzado sistema incorpora la Tecnología de Inteligencia Acústica , que mejora la claridad de imagen y la precisión diagnóstica. El Resona A20 está diseñado para optimizar el flujo de trabajo y ser compatible con una amplia gama de aplicaciones clínicas, como obstetricia, cardiología e imagenología general, satisfaciendo así la creciente demanda de soluciones de ultrasonidos de alto rendimiento en los centros sanitarios europeos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.