Europe Safety Systems Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.38 Billion

USD

2.25 Billion

2024

2032

USD

1.38 Billion

USD

2.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Segmentación del mercado europeo de sistemas de seguridad por tipo (controladores y relés de seguridad, visión artificial de seguridad, sensores de seguridad e interruptores de seguridad), tecnología (sensores digitales, inteligentes y analógicos), función (protección de máquinas, monitorización de procesos, gestión energética, asistencia al aparcamiento, prevención de colisiones, sistemas de monitorización de vibraciones, sistemas de parada de emergencia, etc.), tamaño de la organización (grandes y medianas empresas), usuario final (automoción, aeroespacial y defensa, sanidad, petróleo y gas, transporte y logística, electrónica de consumo, alimentación y bebidas, construcción, etc.), canal de distribución (ventas directas e indirectas): tendencias y previsiones del sector hasta 2032.

Tamaño del mercado de sistemas de seguridad en Europa

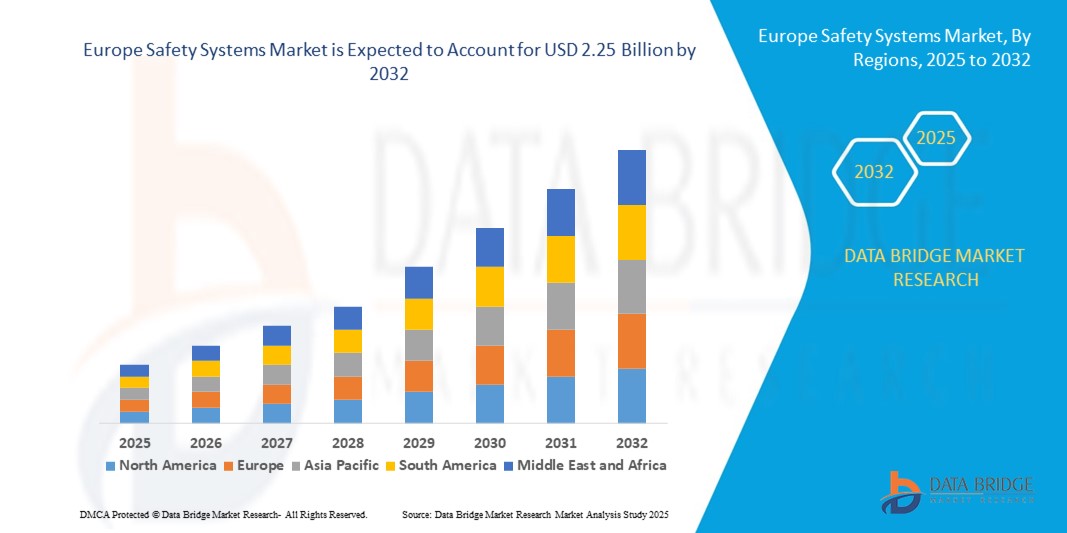

- El tamaño del mercado de sistemas de seguridad de Europa se valoró en USD 1.380 millones en 2024 y se espera que alcance los USD 2.250 millones en 2032 , con una CAGR del 6,3 % durante el período de pronóstico.

- El crecimiento del mercado se ve impulsado en gran medida por la creciente implementación de la automatización y las estrictas regulaciones de seguridad en el lugar de trabajo en todas las industrias, lo que impulsa la demanda de sistemas de seguridad avanzados para proteger la maquinaria, los trabajadores y las operaciones.

- Además, la creciente adopción de sensores inteligentes, visión artificial y soluciones de monitoreo habilitadas para IoT está permitiendo la gestión de seguridad en tiempo real, el mantenimiento predictivo y el cumplimiento, acelerando así la adopción de sistemas de seguridad e impulsando significativamente la expansión del mercado.

Análisis del mercado de sistemas de seguridad en Europa

- Los sistemas de seguridad son soluciones integradas que incluyen sensores, controladores, relés y dispositivos de monitoreo diseñados para proteger equipos, procesos y operadores humanos de condiciones peligrosas en industrias como la automotriz, el petróleo y el gas, la manufactura y la atención médica.

- La creciente demanda de sistemas de seguridad está impulsada principalmente por marcos regulatorios más estrictos, un enfoque creciente en la eficiencia operativa y la creciente necesidad de minimizar el tiempo de inactividad y los accidentes en el lugar de trabajo a través de tecnologías de seguridad inteligentes y automatizadas.

- El Reino Unido dominó el mercado de sistemas de seguridad en 2024, debido a su sólida base industrial, su sector manufacturero avanzado y sus estrictas regulaciones de seguridad en el lugar de trabajo en industrias como la automotriz, la aeroespacial y la del petróleo y el gas.

- Se espera que Alemania sea el país de más rápido crecimiento en el mercado de sistemas de seguridad durante el período de pronóstico debido a la rápida expansión de las prácticas de la Industria 4.0, la adopción de robótica avanzada y la creciente dependencia de la maquinaria automatizada en sus centros de fabricación.

- El segmento de sensores inteligentes dominó el mercado con una cuota del 42% en 2024, gracias a su capacidad para proporcionar datos precisos, su conectividad con plataformas IoT y sus capacidades de monitorización en tiempo real. Estos sensores son ampliamente utilizados para el mantenimiento predictivo y la mejora de la eficiencia operativa en sectores como el aeroespacial, el sanitario y el automotriz. Su adaptabilidad a sistemas de automatización avanzados y su integración con análisis basados en la nube garantizan una protección fiable y procesos optimizados. La creciente demanda de interpretación inteligente de datos y autodiagnóstico en los sistemas de seguridad refuerza aún más su liderazgo.

Alcance del informe y segmentación del mercado de sistemas de seguridad

|

Atributos |

Perspectivas clave del mercado de sistemas de seguridad |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda. |

Tendencias del mercado de sistemas de seguridad en Europa

Creciente adopción de máquinas inteligentes e Industria 4.0

- El mercado de sistemas de seguridad está experimentando un crecimiento significativo gracias a la creciente adopción de la Industria 4.0 y las tecnologías de máquinas inteligentes. La automatización y la digitalización avanzadas requieren mecanismos de seguridad integrados para garantizar un funcionamiento fluido en entornos industriales cada vez más complejos.

- Por ejemplo, Rockwell Automation ha incorporado tecnologías de seguridad inteligente a sus soluciones de automatización industrial. Sus sistemas están diseñados para integrar la seguridad con las operaciones digitales, proporcionando análisis predictivos que mejoran la protección de los trabajadores y reducen el tiempo de inactividad en las plantas de fabricación.

- La combinación de sensores inteligentes, conectividad IoT y aprendizaje automático está mejorando los sistemas de seguridad, haciéndolos más proactivos. Estos avances permiten la monitorización en tiempo real, el mantenimiento predictivo y las paradas automatizadas en entornos peligrosos, lo que mejora significativamente la seguridad en el trabajo.

- Además, la demanda de robótica colaborativa y equipos industriales autónomos exige una integración avanzada de la seguridad. Los sistemas de seguridad son fundamentales para que las máquinas y los humanos trabajen en conjunto sin accidentes, lo que fomenta la productividad y la resiliencia operativa.

- La creciente importancia de la toma de decisiones basada en datos en las fábricas pone de relieve la necesidad de sistemas de seguridad que se conecten con plataformas centralizadas. Estos sistemas proporcionan informes de incidentes y datos de cumplimiento en tiempo real, alineando la seguridad industrial con las estrategias de transformación digital.

- En conjunto, la adopción de la Industria 4.0 está colocando los sistemas de seguridad a la vanguardia de la fabricación y las operaciones modernas. Su integración con la tecnología inteligente garantiza que el avance industrial se equilibre con una mayor protección de los activos, los procesos y el capital humano.

Dinámica del mercado de sistemas de seguridad en Europa

Conductor

Avances en la tecnología de sistemas de seguridad

- Los avances tecnológicos en sistemas de seguridad impulsan significativamente el crecimiento del mercado, a medida que los fabricantes incorporan soluciones innovadoras para adaptarse a las necesidades industriales modernas. La mayor eficiencia, la conectividad digital y la automatización inteligente se están convirtiendo en características definitorias de las soluciones de seguridad de próxima generación.

- Por ejemplo, Siemens ha desarrollado sistemas de automatización con seguridad integrada que combinan productividad con niveles de seguridad avanzados. Estas plataformas permiten a las empresas cumplir con estándares estrictos, a la vez que mejoran la flexibilidad y reducen el tiempo de comercialización de nuevos productos.

- Las nuevas tecnologías de sistemas de seguridad, como los controladores de seguridad programables, la visión artificial avanzada y las redes de comunicación a prueba de fallos, garantizan una mayor capacidad de respuesta y precisión. Estas innovaciones minimizan los riesgos y proporcionan seguridad personalizada para diferentes operaciones industriales.

- Además, la integración con plataformas IIoT mejora las capacidades de análisis de datos, lo que permite a las empresas detectar riesgos de forma proactiva. Los sistemas de seguridad ahora funcionan no solo como medidas reactivas, sino como herramientas predictivas y preventivas, lo que los convierte en un elemento central para la excelencia operativa.

- Estos avances tecnológicos demuestran la innovación continua del sector. Al alinear la seguridad con la modernización digital, las organizaciones garantizan mayor confiabilidad, cumplimiento normativo y eficiencia en entornos industriales, reforzando los sistemas de seguridad como motor de crecimiento a largo plazo.

Restricción/Desafío

Aumento de los requisitos regulatorios y estándares de cumplimiento

- El mercado de sistemas de seguridad se enfrenta a los desafíos de los marcos regulatorios en constante evolución y los estrictos requisitos de cumplimiento normativo en todos los sectores. Las empresas deben actualizar periódicamente sus sistemas para cumplir con las diversas normas regionales, lo que incrementa los costos y la complejidad operativa.

- Por ejemplo, empresas como ABB y Honeywell se enfrentan a una presión constante para alinear sus soluciones de seguridad con diversas directivas de seguridad, como la ISO 13849 y las regulaciones de OSHA. El cumplimiento de estas normas internacionales y nacionales suele requerir una inversión sustancial en el diseño y la certificación de sistemas.

- El ritmo de la evolución regulatoria supera la capacidad de adaptación de las empresas más pequeñas, lo que genera disparidades en la adopción por parte del sector. Para muchas empresas, los costos asociados a las actualizaciones continuas dificultan la implementación generalizada de tecnologías de seguridad avanzadas.

- Además, la fragmentación de las regulaciones de seguridad en los mercados globales genera complicaciones en el desarrollo y la implementación de productos. Las empresas deben gestionar requisitos superpuestos, lo que prolonga los lanzamientos de productos y ralentiza las tasas de adopción en ciertas regiones.

- Abordar estos desafíos de cumplimiento exige una colaboración más estrecha entre empresas y organismos reguladores, así como la inversión en soluciones de seguridad flexibles y escalables. Desarrollar sistemas adaptables a diversas condiciones regulatorias será esencial para sostener el crecimiento del mercado de sistemas de seguridad.

Alcance del mercado de sistemas de seguridad en Europa

El mercado está segmentado según el tipo, la tecnología, la función, el tamaño de la organización, el usuario final y el canal de distribución.

- Por tipo

Según el tipo, el mercado de sistemas de seguridad se segmenta en controladores y relés de seguridad, visión artificial de seguridad, sensores de seguridad e interruptores de seguridad. El segmento de controladores y relés de seguridad dominó la mayor cuota de mercado en 2024, impulsado por su papel central en la gestión y coordinación de las operaciones de seguridad en maquinaria industrial y líneas de producción. Estos dispositivos garantizan el cumplimiento de las estrictas normas internacionales de seguridad, especialmente en sectores como la fabricación de automóviles y la ingeniería pesada. Su fácil integración en la infraestructura de automatización existente, junto con su probada fiabilidad para minimizar los riesgos laborales, refuerza su dominio. La creciente demanda de certificaciones de seguridad funcional y el creciente enfoque en la protección de los operadores humanos impulsan aún más su adopción.

Se prevé que el segmento de visión artificial de seguridad experimente el mayor crecimiento entre 2025 y 2032, impulsado por los rápidos avances en el reconocimiento de imágenes y la automatización basados en IA. Los sistemas de visión artificial se utilizan cada vez más para la monitorización en tiempo real, la detección de defectos y la inspección automatizada, con el fin de prevenir fallos de funcionamiento y accidentes en los equipos. La creciente adopción de prácticas de la Industria 4.0 y fábricas inteligentes impulsa el uso de la visión artificial de seguridad para el análisis predictivo y la optimización de procesos. Además, su escalabilidad en diversas aplicaciones, como la farmacéutica, el procesamiento de alimentos y el ensamblaje de productos electrónicos, posiciona a este segmento para un crecimiento acelerado.

- Por tecnología

En términos de tecnología, el mercado de sistemas de seguridad se segmenta en sensores digitales, inteligentes y analógicos. El segmento de sensores inteligentes dominó el mercado con una participación del 42 % en 2024, gracias a su capacidad para proporcionar datos precisos, su conectividad con plataformas IoT y sus capacidades de monitorización en tiempo real. Estos sensores son ampliamente utilizados para el mantenimiento predictivo y la mejora de la eficiencia operativa en sectores como el aeroespacial, el sanitario y el automotriz. Su adaptabilidad a sistemas de automatización avanzados y su integración con análisis en la nube garantizan una protección fiable y procesos optimizados. La creciente demanda de interpretación inteligente de datos y autodiagnóstico en los sistemas de seguridad refuerza aún más su liderazgo.

Se prevé que el segmento de sensores digitales experimente la tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, gracias a su rentabilidad, diseño compacto y funcionamiento energéticamente eficiente. Los sensores digitales se utilizan cada vez más para monitorizar la temperatura, la vibración y la presión en entornos industriales, donde la rapidez de respuesta es crucial para prevenir fallos. Su fácil integración en sistemas de control automatizados y su compatibilidad con tecnologías integradas los hacen muy atractivos para las pymes. La creciente adopción de gemelos digitales y simulación en tiempo real impulsa aún más la demanda de sensores digitales en los sistemas de seguridad modernos.

- Por función

Según su función, el mercado se segmenta en protección de máquinas, monitorización de procesos, gestión energética, asistencia al aparcamiento, prevención de colisiones, sistemas de monitorización de vibraciones, sistemas de parada de emergencia, entre otros. El segmento de protección de máquinas dominó el mercado en 2024, gracias a su papel fundamental en la protección de maquinaria industrial de alto valor contra fallos mecánicos y errores humanos. Los fabricantes priorizan los sistemas de protección de máquinas por su capacidad para reducir el tiempo de inactividad, mejorar la eficiencia operativa y prolongar la vida útil de los equipos. Su adopción es sólida en las industrias automotriz, aeroespacial y pesada, donde la fiabilidad de los equipos influye directamente en la productividad. La aplicación de las normativas internacionales de seguridad y el aumento del coste de los accidentes laborales impulsan aún más la demanda.

Se proyecta que el segmento de prevención de colisiones crecerá a su ritmo más rápido entre 2025 y 2032, impulsado por el creciente despliegue en vehículos autónomos, robótica de almacén y aplicaciones de aviación. Los sistemas de prevención de colisiones utilizan sensores avanzados, LiDAR y algoritmos de IA para detectar posibles peligros y prevenir accidentes en tiempo real. La creciente adopción de sistemas de asistencia al conductor en las industrias automotriz y logística contribuye significativamente a su crecimiento. Con la exigencia de funciones de seguridad avanzadas en los vehículos por parte de los gobiernos y la adopción de la automatización por parte de las industrias, los sistemas de prevención de colisiones se están convirtiendo en un componente esencial para reducir los riesgos operativos.

- Por tamaño de la organización

Según el tamaño de la organización, el mercado se segmenta en pequeñas y medianas empresas y grandes organizaciones. Las grandes organizaciones dominaron el mercado en 2024, impulsadas por su mayor capacidad de inversión, la amplia adopción de la automatización y el estricto cumplimiento de las normas de seguridad. Empresas de sectores como el petróleo y el gas, la automoción y la aeroespacial priorizan sistemas de seguridad avanzados para proteger activos y empleados, y garantizar operaciones ininterrumpidas. Su implementación a gran escala de robótica y maquinaria conectada requiere soluciones de seguridad sofisticadas e integradas, lo que fortalece la cuota de mercado de este segmento.

Se proyecta que el segmento de pequeñas y medianas empresas registrará el mayor crecimiento entre 2025 y 2032, impulsado por una mayor concienciación sobre la seguridad en el trabajo, soluciones rentables y el cumplimiento normativo. Las pymes adoptan cada vez más sistemas de seguridad modulares y escalables que se ajustan a sus presupuestos y permiten actualizaciones graduales. Los incentivos gubernamentales para la adopción de soluciones de seguridad y la disponibilidad de tecnologías asequibles y fáciles de instalar fomentan aún más su adopción. Este cambio es especialmente visible en las economías emergentes, donde las pymes constituyen la columna vertebral de la actividad industrial.

- Por el usuario final

Según el usuario final, el mercado se segmenta en automoción, aeroespacial y defensa, salud, petróleo y gas, transporte y logística, electrónica de consumo, alimentación y bebidas, construcción, entre otros. El segmento automotriz dominó el mercado en 2024, gracias al creciente énfasis en la seguridad del conductor y los pasajeros, junto con la creciente adopción de sistemas avanzados de asistencia al conductor (ADAS). Los fabricantes de automóviles están invirtiendo fuertemente en la integración de sensores de seguridad, visión artificial y sistemas anticolisión para cumplir con las normativas de seguridad y mejorar la fiabilidad de los vehículos. El creciente sector de los vehículos eléctricos impulsa aún más la demanda de sistemas de seguridad avanzados.

Se prevé que el sector sanitario experimente el mayor crecimiento entre 2025 y 2032, impulsado por la necesidad de precisión, monitorización en tiempo real y seguridad del paciente en entornos de cuidados críticos. Los sistemas de seguridad en entornos sanitarios son vitales para garantizar diagnósticos precisos, monitorizar el estado de los equipos y proteger al personal médico de exposiciones peligrosas. La rápida digitalización de los hospitales, la adopción de sistemas de monitorización basados en el IoT y la creciente inversión en infraestructura sanitaria inteligente impulsan el crecimiento. La demanda se ve respaldada además por el enfoque regulatorio en la seguridad de los dispositivos médicos y la prevención de errores.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en ventas directas e indirectas. El segmento de ventas directas dominó el mercado en 2024, impulsado por la preferencia de los fabricantes por la interacción directa con los clientes para ofrecer soluciones a medida, servicios posventa y contratos a largo plazo. Los canales de ventas directas son especialmente importantes en sectores como el aeroespacial, el automotriz y el de petróleo y gas, donde se implementan soluciones de seguridad personalizadas de alto valor. La fortaleza de este canal reside en construir relaciones sólidas con los clientes y ofrecer experiencia técnica integral.

Se prevé que el segmento de ventas indirectas experimente su mayor crecimiento entre 2025 y 2032, impulsado por el creciente papel de distribuidores, integradores de sistemas y plataformas de comercio electrónico. Los canales indirectos ofrecen un mayor alcance de mercado, especialmente para pymes y mercados emergentes, donde los clientes recurren a proveedores externos para obtener soluciones rentables. La creciente demanda de dispositivos de seguridad modulares listos para usar y la expansión de las plataformas de distribución digital impulsan aún más el potencial de crecimiento del canal de ventas indirectas.

Análisis regional del mercado de sistemas de seguridad en Europa

- El Reino Unido dominó el mercado de sistemas de seguridad con la mayor participación en los ingresos en 2024, impulsado por su sólida base industrial, su sector de fabricación avanzado y sus estrictas regulaciones de seguridad en el lugar de trabajo en industrias como la automotriz, la aeroespacial y la del petróleo y el gas.

- El liderazgo del país se ve reforzado por la adopción generalizada de la automatización, la integración de sensores inteligentes y tecnologías de visión artificial y las inversiones continuas en la mejora de la infraestructura de seguridad industrial.

- El creciente enfoque en el cumplimiento de las normas internacionales de seguridad, junto con la creciente demanda de soluciones de mantenimiento predictivo y protección de los trabajadores, fortalece aún más la posición del Reino Unido.

Perspectivas del mercado de sistemas de seguridad en Alemania

Se proyecta que Alemania registrará la tasa de crecimiento anual compuesta (TCAC) más rápida de Europa entre 2025 y 2032, impulsada por la rápida expansión de las prácticas de la Industria 4.0, la adopción de robótica avanzada y la creciente dependencia de la maquinaria automatizada en sus centros de fabricación. El crecimiento se sustenta en iniciativas gubernamentales que promueven la seguridad industrial, fuertes inversiones en fábricas inteligentes y una fuerte demanda de sistemas de monitorización basados en el IoT. El liderazgo del país en los sectores de la automoción, la ingeniería y la automatización industrial genera importantes oportunidades para las tecnologías de seguridad de última generación. El énfasis de Alemania en la integración de la visión artificial basada en IA, los sistemas anticolisión y los sensores digitales en los procesos industriales está acelerando su adopción e impulsando una sólida expansión del mercado.

Perspectivas del mercado de sistemas de seguridad en Francia

Se prevé que Francia experimente un crecimiento sostenido durante el período 2025-2032, impulsado por su consolidado sector industrial, la creciente adopción de la automatización en la construcción y el transporte, y la creciente atención al cumplimiento normativo en materia de seguridad laboral. La creciente demanda de sensores de seguridad, sistemas de parada de emergencia y tecnologías de protección de máquinas en los sectores de alimentación y bebidas y electrónica de consumo está impulsando su adopción. La colaboración entre empresas nacionales y fabricantes internacionales de sistemas de seguridad mejora la accesibilidad, la innovación de productos y la penetración en el mercado. El enfoque del país en las operaciones sostenibles, la armonización regulatoria y la adopción de tecnologías de seguridad digital continúa fortaleciendo las perspectivas de mercado de Francia.

Cuota de mercado de sistemas de seguridad en Europa

La industria de sistemas de seguridad está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Siemens (Alemania)

- Panasonic Corporation (Japón)

- ABB (Suiza)

- Honeywell International Inc. (EE. UU.)

- Rockwell Automation (EE. UU.)

- Festo SE & Co. KG (Alemania)

- Schneider Electric (Francia)

- SICK AG (Alemania)

- KEYENCE CORPORATION (Japón)

- Corporación OMRON (Japón)

- Sensata Technologies, Inc. (EE. UU.)

- Pepperl+Fuchs SE (Alemania)

- Balluff GmbH (Alemania)

- TankScan (EE. UU.)

- Autonics Corporation (Corea del Sur)

- Hans Turck GmbH & Co. KG (Alemania)

Últimos avances en el mercado europeo de sistemas de seguridad

- En agosto de 2024, Siemens Smart Infrastructure presentó el sensor de red mejorado (EGS) SICAM, lo que impulsó significativamente la digitalización de las redes de distribución. Al proporcionar monitorización continua y prevenir sobrecargas, esta solución lista para usar permite a los operadores de red maximizar el uso de la infraestructura existente, garantizando al mismo tiempo una mayor eficiencia y estabilidad. Esta innovación impulsa la integración de fuentes de energía renovables en la red, una necesidad creciente en la transición energética global. Este lanzamiento ha consolidado el liderazgo de Siemens en el mercado de soluciones energéticas inteligentes, posicionándola como un socio preferente para las empresas de servicios públicos que buscan la transformación digital y una infraestructura resiliente.

- En diciembre de 2023, Panasonic Holdings Corporation presentó un sensor inercial 6 en 1 diseñado para mejorar la seguridad y el rendimiento automotriz. Al combinar múltiples funciones de detección en una sola unidad compacta, esta innovación mejora la estabilidad del vehículo y los sistemas de asistencia al conductor, satisfaciendo así la creciente demanda de tecnologías avanzadas de seguridad automotriz. Este desarrollo ha consolidado la posición de Panasonic en el mercado de sensores automotrices, lo que le ha permitido ampliar su cuota de mercado y fortalecer las colaboraciones con fabricantes de automóviles especializados en soluciones de movilidad inteligente.

- En mayo de 2023, ABB completó la adquisición del negocio de motores NEMA de baja tensión de Siemens, una decisión estratégica que amplió su cartera de motores industriales. Con esta adquisición, ABB reforzó sus capacidades de fabricación y mejoró su alcance de servicio para clientes globales en sectores como la automatización, la energía y la fabricación. Este desarrollo reforzó el liderazgo de ABB en el mercado de motores industriales, lo que le permitió abordar la creciente demanda de soluciones de motores energéticamente eficientes y fiables tanto en mercados desarrollados como emergentes.

- En enero de 2023, Honeywell International Inc. profundizó su colaboración con Nexceris para ofrecer soluciones de seguridad mejoradas para vehículos eléctricos. Al integrar la tecnología de sensores de batería de Honeywell con el sistema de detección de gases Li-Ion Tamer de Nexceris, la colaboración se centró en mitigar los riesgos de fugas térmicas que provocan incendios en las baterías de los vehículos eléctricos. Esto fortaleció la posición de Honeywell en el mercado de soluciones de seguridad automotriz, especialmente en el sector de los vehículos eléctricos, en rápido crecimiento, y demostró su capacidad para ofrecer tecnologías innovadoras que salvan vidas y satisfacen las crecientes demandas de seguridad del sector.

- En agosto de 2022, Rockwell Automation lanzó sus sensores fotoeléctricos Allen-Bradley 42EA RightSight S18 y 42JA VisiSight M20A, dirigidos a industrias que requieren soluciones de detección compactas, fiables y versátiles. Estos sensores económicos simplifican la instalación y el mantenimiento, a la vez que ofrecen un alto rendimiento en entornos con limitaciones de espacio. El lanzamiento reforzó la posición de Rockwell en los mercados de automatización industrial y sensores al satisfacer la demanda de tecnologías de detección rentables y avanzadas, ampliando así su cartera de clientes en diversas aplicaciones industriales.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.