Mercado europeo de tecnología de teledetección, por tipo (pasivo y activo), tipo de sistema (sistema de teledetección visual, teledetección por infrarrojos , teledetección óptica, teledetección por microondas, teledetección por radar, teledetección aérea, teledetección por satélite y teledetección acústica y casi acústica), resolución de imagen (fuentes de baja resolución espacial ( 30 metros), satélite de resolución media (5-30 metros), industria de alta resolución (1-5 metros) e industria de muy alta resolución (silvicultura , cartografía de llanuras aluviales y gestión de emergencias, atención sanitaria, geología y exploración mineral, oceanografía, agricultura y otros), país (Alemania, Italia, Reino Unido, Francia, España, Países Bajos, Bélgica, Suiza, Turquía, Rusia y resto de Europa), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado europeo de tecnología de teledetección

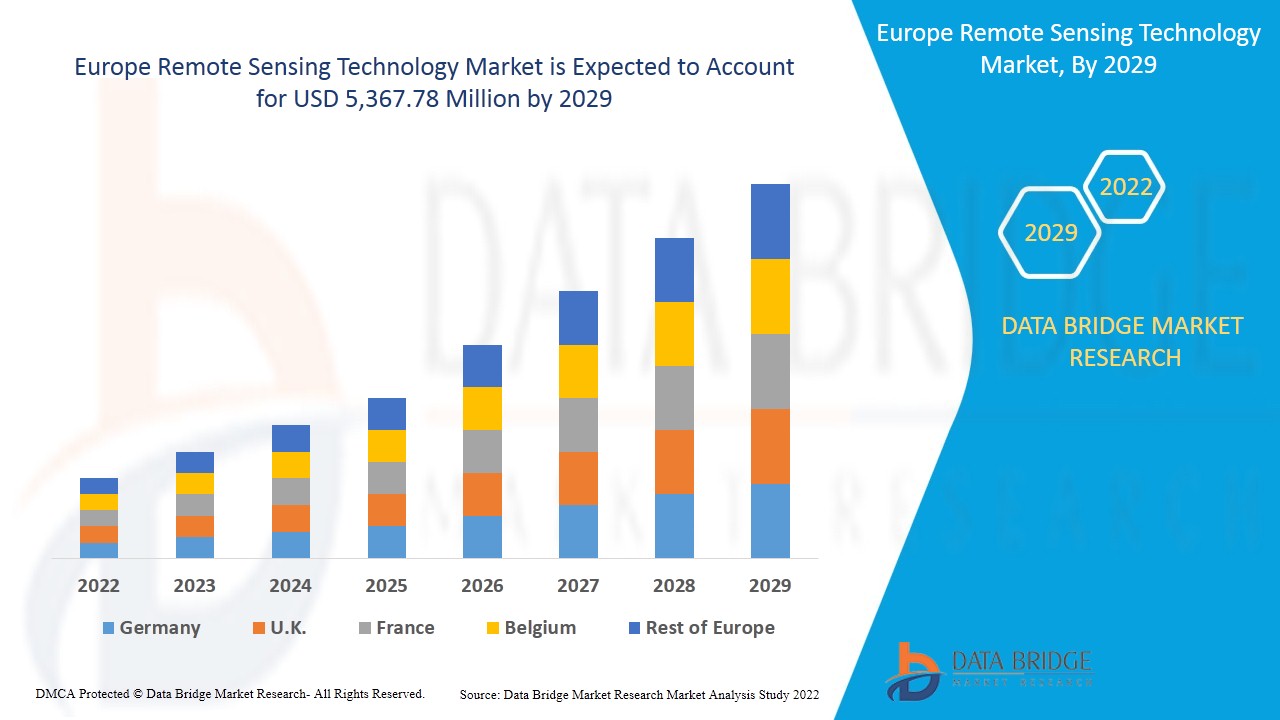

Se espera que el mercado de tecnología de teledetección gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 8,9% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 5.367,78 millones para 2029. Se espera que la creciente adopción de la innovación de Internet de las cosas (IoT) en el sector agrícola impulse el crecimiento del mercado.

La teledetección es un tipo de tecnología geoespacial que emite y refleja la radiación electromagnética (EM) de los ecosistemas terrestres, atmosféricos y acuáticos de la Tierra para detectar y monitorear las características físicas de un área sin hacer contacto físico. Esta técnica de recopilación de datos generalmente involucra tecnologías de sensores basados en aeronaves y satélites que se clasifican como sensores pasivos y sensores activos. Los sensores pasivos responden a estímulos externos y recopilan la radiación que se refleja o emite por un objeto o el espacio circundante. La fuente de radiación más común medida a través de la teledetección pasiva es la luz solar reflejada. Los sensores activos utilizan estímulos internos para recopilar datos y emiten energía que escaneará objetos y áreas, con lo que un sensor medirá la energía reflejada desde el objetivo.

El Internet de las cosas (IoT) en la agricultura utiliza sensores remotos, robots, drones e imágenes de PC para visualizar los cultivos y proporcionar información a los agricultores para una gestión eficiente de la explotación. Los sensores del Internet de las cosas (IoT) se utilizan para recopilar datos que se transmiten con fines de análisis. Los agricultores pueden visualizar la calidad de la cosecha desde un panel sistemático.

La necesidad de realizar elevadas inversiones iniciales para ensamblar numerosos componentes está bloqueando el desarrollo del mercado de la tecnología de teledetección. Los actores del mercado quieren fabricar elementos y codificar contenido de datos que cumpla con las normas establecidas por las organizaciones gubernamentales. Esto limita las posibilidades de desarrollo de las organizaciones en el mercado. Sin embargo, se espera que la creciente adopción en aplicaciones de investigación y exploración impulse el mercado en los próximos años.

Se espera que la creciente demanda de proyectos de observación de la Tierra entre los países desarrollados y en desarrollo impulse el crecimiento del mercado. Se espera que la falta de alerta y los problemas de interoperabilidad desafíen el crecimiento del mercado, sin embargo, se espera que la creciente adopción de la teledetección en la investigación y la exploración entre diferentes sectores cree una oportunidad para el crecimiento del mercado. El alto costo de establecimiento de la infraestructura puede restringir el crecimiento del mercado.

El informe de mercado de tecnología de detección remota proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de tecnología de detección remota, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de la tecnología de teledetección

El mercado de la tecnología de teledetección se divide en cuatro segmentos importantes que se basan en el tipo, el tipo de sistema, la resolución de la imagen y la aplicación. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

- Según el tipo, el mercado de la tecnología de teledetección se segmenta en activo y pasivo. En 2022, se espera que el segmento pasivo domine el mercado, ya que la tecnología de teledetección pasiva proporciona imágenes satelitales de alta calidad y se utiliza ampliamente para la observación de la Tierra.

- Según el tipo de sistema, el mercado de la tecnología de teledetección se segmenta en sistemas de teledetección visual, teledetección infrarroja, teledetección óptica, teledetección por microondas, teledetección por radar, teledetección aérea, teledetección por satélite y teledetección acústica y casi acústica. En 2022, se espera que el segmento de la teledetección por radar domine el mercado, ya que facilita la propagación y la comunicación de señales de radio claras y sin ruido.

- En función de la resolución de la imagen, el mercado de la tecnología de teledetección se segmenta en fuentes de baja resolución espacial (> 30 metros), satélites de resolución media (5-30 metros), industria de alta resolución (1-5 metros) e industria de muy alta resolución (< 1 metro). En 2022, se espera que las fuentes de baja resolución espacial (> 30 metros) dominen el mercado, ya que son altamente ignífugas y se pueden utilizar en una amplia gama de aplicaciones industriales.

- En función de la aplicación, el mercado de la tecnología de teledetección se segmenta en evaluación del paisaje, seguridad, calidad del aire, hidrología, silvicultura, cartografía de llanuras aluviales y gestión de emergencias, atención sanitaria, geología y exploración minera, oceanografía, agricultura y otros. En 2022, se espera que el segmento de evaluación del paisaje domine el mercado, ya que garantiza que los paisajes se gestionen y desarrollen de forma sostenible.

Análisis a nivel de país del mercado de tecnología de teledetección

El mercado de tecnología de teledetección está segmentado en cuatro segmentos notables que se basan en el tipo, tipo de sistema, resolución de imagen y aplicación.

Los países cubiertos en el informe del mercado de tecnología de teledetección son Alemania, Francia, Reino Unido, Italia, España, Suiza, Países Bajos, Rusia, Turquía, Bélgica y el resto de Europa.

Se espera que el Reino Unido domine el mercado debido al creciente número de proyectos de observación de la Tierra por parte de numerosas agencias espaciales.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Se espera que el aumento de la utilidad en el sector militar y de defensa impulse el crecimiento del mercado

El mercado de tecnología de teledetección también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico 2011-2020.

Análisis del panorama competitivo y de la cuota de mercado de la tecnología de teledetección

El panorama competitivo del mercado de tecnología de teledetección proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de tecnología de teledetección.

Algunos de los principales actores que operan en el mercado de tecnología de teledetección son Northrop Grumman, The Airborne Sensing Corporation, ITT INC., Leica Geosystems AG - Parte de Hexagon, Lockheed Martin Corporation., Honeywell International Inc., Thales Group, Orbital Insight, Ceres Imaging, Satellite Imaging Corporation, Descartes Labs, Inc, Astro Digital US, SlantRange, Inc., Droplet Measurement Technologies, Airbus, Farmers Edge Inc., SCANEX Group., SpaceKnow, Raytheon Technologies Corporation, Terra Remote Sensing, PrecisionHawk y entre otros.

Numerosos contratos y acuerdos son iniciados también por empresas de todo el mundo, lo que también está acelerando el mercado de la tecnología de teledetección.

Por ejemplo,

- En diciembre de 2021, Airbus completó su segundo satélite de vigilancia oceánica, Sentinel-6B. El satélite fue construido para medir la distancia a la superficie del mar con una precisión de unos pocos centímetros. El objetivo principal del satélite es medir la altura de la superficie del mar, las variaciones en el nivel del mar y analizar y observar las corrientes oceánicas.

- En enero de 2022, Northrop Grumman Corporation completó con éxito una prueba estática del motor de cohete de un misil de ataque de precisión. La prueba del motor de cohete era un requisito necesario para validar el diseño del motor de la empresa para la producción. La inversión de la empresa en tecnologías digitales impulsa la asequibilidad de instalaciones de producción de motores de cohetes sólidos tácticos modernas y eficientes.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE REMOTE SENSING TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IN-DEPTH ANALYSIS ON HYPERSPECTRAL REMOTE SENSING: PREMIUM INSIGHTS

4.1.1 INTRODUCTION

4.1.2 HISTORY

4.1.3 LIST OF HYPERSPECTRAL SENSORS:

4.1.4 APPLICATION OF HYPERSPECTRAL IMAGE ANALYSIS:

4.1.5 PRICING ANALYSIS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 MIDDLE EAST AND AFRICA

5.5 SOUTH AMERICAN

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING FOCUS TOWARDS EARTH OBSERVATION PROJECTS BETWEEN DEVELOPED AND DEVELOPING COUNTRIES

6.1.2 SURGING UTILITY IN MILITARY AND DEFENCE SECTOR

6.1.3 GROWING ADOPTION OF PRECISION FARMING TECHNOLOGY

6.2 RESTRAINT

6.2.1 HIGH INFRASTRUCTURE ESTABLISHMENT COST

6.3 OPPORTUNITIES

6.3.1 RISING ADOPTION OF REMOTE SENSING IN RESEARCH AND EXPLORATION AMONG DIFFERENT SECTORS

6.3.2 RISE IN ADOPTION OF INTERNET OF THING (IOT) IN REMOTE SENSING TECHNOLOGY

6.4 CHALLENGE

6.4.1 ABSENCE OF ALERTNESS AND INTEROPERABILITY ISSUE

7 IMPACT OF COVID-19 ON THE EUROPE REMOTE SENSING TECHNOLOGY MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 STRATEGIC DECISION BY MANUFACTURERS AFTER COVID-19

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND AND SUPPLY CHAIN

7.5 CONCLUSION

8 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY TYPE

8.1 OVERVIEW

8.2 PASSIVE

8.2.1 NEAR INFRARED

8.2.2 THERMAL INFRARED ENERGY

8.2.3 VISIBLE

8.3 ACTIVE

8.3.1 RADAR

8.3.2 LASER

8.3.3 SONAR

9 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE

9.1 OVERVIEW

9.2 RADAR REMOTE SENSING

9.3 AIRBORNE REMOTE SENSING

9.4 SATELLITE REMOTE SENSING

9.5 MICROWAVE REMOTE SENSING

9.6 INFRARED REMOTE SENSING

9.7 ACOUSTIC AND NEAR ACOUSTIC REMOTE SENSING

9.8 OPTICAL REMOTE SENSING

9.9 VISUAL REMOTE SENSING

10 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION

10.1 OVERVIEW

10.2 LOW SPATIAL RESOLUTION RESOURCE (>30 METERS)

10.3 MEDIUM RESOLUTION SATELLITE (5-30 METERS)

10.4 HIGH RESOLUTION INDUSTRY (1-5 METERS)

10.5 VERY HIGH RESOLUTION INDUSTRY (< 1 METER)

11 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 LANDSCAPE ASSESSMENT

11.2.1 RURAL/URBAN CHANGE

11.2.2 BIOMASS MAPPING

11.3 SECURITY

11.4 GEOLOGY AND MINERAL EXPLORATION

11.5 HYDROLOGY

11.5.1 FLOOD DELINEATION AND MAPPING

11.5.2 SOIL MOISTURE

11.6 FORESTRY

11.6.1 COASTAL PROTECTION

11.6.2 BIOMASS ESTIMATION

11.6.3 AGROFORESTRY MAPPING

11.6.4 BURN DELINEATION

11.6.5 DEPLETION MONITORING

11.7 HEALTHCARE

11.8 AIR QUALITY

11.9 FLOOD PLAIN MAPPING AND EMERGENCY MANAGEMENT

11.1 AGRICULTURE

11.10.1 CROP MONITORING & DAMAGE ASSESSMENT

11.10.2 CROP TYPE MAPPING

11.11 OCEANOGRAPHY

11.12 OTHERS

12 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY REGION

12.1 EUROPE

12.1.1 U.K.

12.1.2 FRANCE

12.1.3 RUSSIA

12.1.4 GERMANY

12.1.5 ITALY

12.1.6 SPAIN

12.1.7 TURKEY

12.1.8 NETHERLANDS

12.1.9 SWITZERLAND

12.1.10 BELGIUM

12.1.11 REST OF EUROPE

13 EUROPE REMOTE SENSING TECHNOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS.

15 COMPANY PROFILE

15.1 NORTHROP GRUMMAN

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 RAYTHEON TECHNOLOGIES CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 LOCKHEED MARTIN CORPORATION.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 THALES GROUP

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 AIRBUS

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ASTRO DIGITAL US

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 CERES IMAGING

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DESCARTES LABS, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DROPLET MEASUREMENT TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 FARMERS EDGE INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 HONEYWELL INTERNATIONAL INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 ITT INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LEICA GEOSYSTEMS AG - PART OF HEXAGON

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 MALLON TECHNOLOGY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MAXAR TECHNOLOGIES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ORBITAL INSIGHT

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PRECISIONHAWK

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SATELLITE IMAGING CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SLANTRANGE, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 SCANEX GROUP.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SPACEKNOW

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 THE AIRBORNE SENSING CORPORATION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 TERRA REMOTE SENSING

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORT

Lista de Tablas

TABLE 1 WAVELENGTH RANGES APPLIED IN HYPERSPECTRAL REMOTE SENSING

TABLE 2 THE COSTS OF VARIOUS OPTICAL AND MICROWAVE SATELLITE DATA USED FOR CROP AREA ESTIMATION

TABLE 3 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE RADAR REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE AIRBORNE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE SATELLITE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE MICROWAVE REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE INFRARED REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE ACOUSTIC AND NEAR ACOUSTIC REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE OPTICAL REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE VISUAL REMOTE SENSING IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE LOW SPATIAL RESOLUTION RESOURCES (> 30 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE MEDIUM RESOLUTION SATELLITE (5-30 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE HIGH RESOLUTION INDUSTRY (1-5 METERS) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE VERY HIGH RESOLUTION INDUSTRY (< 1 METER) IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 EUROPE SECURITY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE GEOLOGY AND MINERAL EXPLORATION IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HEALTHCARE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE AIR QUALITY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE FLOOD PLAIN MAPPING AND EMERGENCY MANAGEMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE OCEANOGRAPHY IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN REMOTE SENSING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 EUROPE HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 EUROPE AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.K. REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.K. PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.K. ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.K. REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 54 U.K. REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 U.K. LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.K. HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.K. AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 FRANCE REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 FRANCE PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 FRANCE REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 63 FRANCE REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 64 FRANCE REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 FRANCE LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 FRANCE HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 FRANCE AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 RUSSIA REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 RUSSIA PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 RUSSIA ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 RUSSIA REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 73 RUSSIA REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 74 RUSSIA REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 RUSSIA LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 RUSSIA HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 RUSSIA FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 RUSSIA AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 GERMANY REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 GERMANY PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 GERMANY REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 83 GERMANY REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 84 GERMANY REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 GERMANY LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 GERMANY FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ITALY REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 ITALY PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 ITALY ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 ITALY REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 93 ITALY REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 94 ITALY REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 ITALY LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 ITALY HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 ITALY FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 ITALY AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SPAIN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SPAIN REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 103 SPAIN REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 104 SPAIN REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 SPAIN LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SPAIN HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SPAIN FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SPAIN AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 TURKEY REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 TURKEY REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 113 TURKEY REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 114 TURKEY REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 TURKEY LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 TURKEY HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 TURKEY FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 TURKEY AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 NETHERLANDS REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 NETHERLANDS ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 NETHERLANDS REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 123 NETHERLANDS REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 124 NETHERLANDS REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 NETHERLANDS LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 NETHERLANDS HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 NETHERLANDS FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 NETHERLANDS AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 SWITZERLAND REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 133 SWITZERLAND REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 134 SWITZERLAND REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 SWITZERLAND LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 SWITZERLAND HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 SWITZERLAND FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 SWITZERLAND AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM PASSIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 141 BELGIUM ACTIVE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 142 BELGIUM REMOTE SENSING TECHNOLOGY MARKET, BY SYSTEM TYPE, 2020-2029 (USD MILLION)

TABLE 143 BELGIUM REMOTE SENSING TECHNOLOGY MARKET, BY IMAGE RESOLUTION, 2020-2029 (USD MILLION)

TABLE 144 BELGIUM REMOTE SENSING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 145 BELGIUM LANDSCAPE ASSESSMENT IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 BELGIUM HYDROLOGY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 BELGIUM FORESTRY IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 BELGIUM AGRICULTURE IN REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 REST OF EUROPE REMOTE SENSING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE REMOTE SENSING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 EUROPE REMOTE SENSING TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REMOTE SENSING TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REMOTE SENSING TECHNOLOGY MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REMOTE SENSING TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REMOTE SENSING TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE REMOTE SENSING TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE REMOTE SENSING TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE REMOTE SENSING TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE REMOTE SENSING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE EUROPE REMOTE SENSING TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PASSIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE REMOTE SENSING TECHNOLOGY MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE EUROPE REMOTE SENSING TECHNOLOGY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGE OF EUROPE REMOTE SENSING TECHNOLOGY MARKET

FIGURE 15 EUROPE REMOTE SENSING TECHNOLOGY MARKET: BY TYPE, 2021

FIGURE 16 EUROPE REMOTE SENSING TECHNOLOGY MARKET: BY SYSTEM TYPE, 2021

FIGURE 17 EUROPE REMOTE SENSING TECHNOLOGY MARKET: BY IMAGE RESOLUTION, 2021

FIGURE 18 EUROPE REMOTE SENSING TECHNOLOGY MARKET: BY APPLICATION, 2021

FIGURE 19 EUROPE REMOTE SENSING TECHNOLOGY MARKET: SNAPSHOT (2021)

FIGURE 20 EUROPE REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2021)

FIGURE 21 EUROPE REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 EUROPE REMOTE SENSING TECHNOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 EUROPE REMOTE SENSING TECHNOLOGY MARKET: BY TYPE (2022-2029)

FIGURE 24 EUROPE REMOTE SENSING TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.