Europe Refractive Surgery Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

422.98 Million

USD

746.40 Million

2021

2029

USD

422.98 Million

USD

746.40 Million

2021

2029

| 2022 –2029 | |

| USD 422.98 Million | |

| USD 746.40 Million | |

|

|

|

Mercado europeo de dispositivos de cirugía refractiva , por tipo de producto (láser, lente intraocular fáquica (IOL), aberrómetro/aberrometría de frente de onda, instrumentos y accesorios quirúrgicos, kits de cirugía refractiva, medidores de diámetro pupilar, epiqueratomos, microqueratomos, termoqueratoplastia, kits de incisión relajante limbar y otros), tipo de cirugía (LASIK (queratomileusis in situ con láser, queratectomía fotorrefractiva (PRK), lentes intraoculares fáquicas (IOL), queratotomía astigmática (AK), queratoplastia lamelar automatizada (ALK), anillo intracorneal (INTACS), queratoplastia térmica láser (LTK), queratoplastia conductiva (CK), queratotomía radial (RK) y otros), aplicación (miopía, hipermetropía, astigmatismo y presbicia), usuario final (hospitales, especialidades) Clínicas, Centros Quirúrgicos Ambulatorios y Otros), Canal de Distribución (Licitación Directa, Distribuidores de Terceros y Otros), Tendencias de la Industria y Pronóstico hasta 2029.

Definición y perspectivas del mercado

Los dispositivos de cirugía refractiva se utilizan para mejorar o corregir errores refractivos como la miopía, la hipermetropía, la presbicia o el astigmatismo. Estos dispositivos incluyen láseres excimer, láseres YAG, microqueratomos y láseres femtosegundos. Las cirugías refractivas reducen en gran medida la dependencia de anteojos o lentes de contacto. En el mercado se utilizan varios dispositivos refractivos para tratar defectos de la visión.

Los errores refractivos se producen debido a la forma incorrecta de la córnea o de los globos oculares. El procedimiento de cirugía refractiva incluye la remodelación de los globos oculares o de la córnea mediante diversos dispositivos de cirugía refractiva, como láseres avanzados, tratamientos LASIK, queratectomía fotorrefractiva y diversas lentes, como lentes intraoculares fáquicas y lentes intraoculares tóricas.

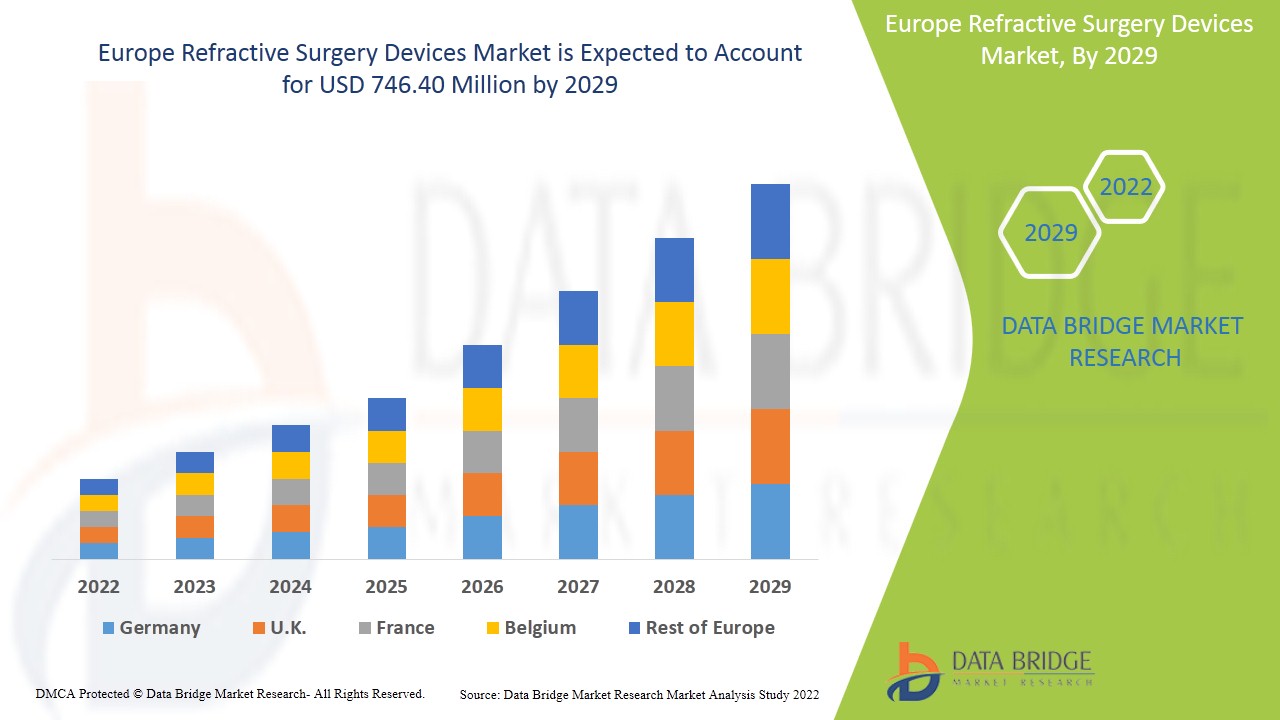

Se espera que el mercado de dispositivos de cirugía refractiva gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 7,6% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 746,40 millones para 2029 desde USD 422,98 millones en 2021.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo de producto (láser, lente intraocular fáquica (IOL), aberrómetros/aberrometría de frente de onda, instrumentos y accesorios quirúrgicos, kits de cirugía refractiva, medidores de diámetro pupilar, epiqueratomos, microqueratomos, termoqueratoplastia, kits de incisión relajante limbar y otros), tipo de cirugía (LASIK (queratomileusis in situ con láser, queratectomía fotorrefractiva (PRK), lentes intraoculares fáquicas (IOL), queratotomía astigmática (AK), queratoplastia lamelar automatizada (ALK), anillo intracorneal (INTACS), queratoplastia térmica láser (LTK), queratoplastia conductiva (CK), queratotomía radial (RK) y otros), aplicación (miopía, hipermetropía, astigmatismo y presbicia), usuario final (hospitales, clínicas especializadas, centros quirúrgicos ambulatorios) Centros y Otros), Canal de Distribución (Licitación Directa, Distribuidores de Terceros y Otros) |

|

Países cubiertos |

Alemania, Francia, Reino Unido, Italia, España, Países Bajos, Rusia, Suiza, Bélgica, Turquía, Austria, Noruega, Hungría, Lituania, Irlanda, Polonia Resto de Europa |

|

Actores del mercado cubiertos |

Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (una subsidiaria de Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, entre otros. |

La dinámica del mercado de dispositivos de cirugía refractiva incluye

Conductores

- Aumento del avance tecnológico

En los últimos años, el desarrollo tecnológico en el sector sanitario ha aumentado enormemente. Los avances en la tecnología de los dispositivos de cirugía refractiva permiten un tratamiento indoloro y sin complicaciones durante el tratamiento de una enfermedad. Además, la innovación y la mejora de los distintos dispositivos de cirugía refractiva contribuyen a obtener un resultado rápido y preciso en el diagnóstico de enfermedades. La innovación en los dispositivos de cirugía refractiva también proporciona la rentabilidad de las herramientas terapéuticas basadas en la tecnología durante el tratamiento de enfermedades.

Por ejemplo,

- Según Contoura Vision India, la cirugía de la vista Contoura es la última cirugía ocular avanzada en la eliminación de anteojos. Es uno de los avances tecnológicos más seguros en cirugía ocular, que no solo corrige la graduación de los anteojos, sino que también funciona para las irregularidades de la córnea.

- Según la Organización del Centro de Oftalmología y Láser, en mayo de 2017, se descubrió que la tecnología del láser de femtosegundo Visumax es uno de los tratamientos quirúrgicos refractivos más avanzados. Es capaz de corregir defectos visuales de los ojos.

Se espera que los avances tecnológicos en diversos dispositivos de cirugía refractiva, como los avances en el escaneo de puntos variables con láser, impulsen el mercado de dispositivos de cirugía refractiva. Por lo tanto, se espera que la creciente innovación y el avance tecnológico en dispositivos de cirugía refractiva impulsen el crecimiento del mercado durante el período de pronóstico.

- Aumento del gasto sanitario

En la última década, el gasto sanitario ha aumentado drásticamente para mejorar el servicio de atención sanitaria a los pacientes. Estados Unidos es el mayor mercado sanitario, donde el gasto sanitario total ha aumentado drásticamente en los últimos años. El objetivo fundamental detrás del aumento del gasto es proporcionar dispositivos de cirugía refractiva adecuados, asequibles y de alta calidad. Para promover una población más sana y abordar las emergencias sanitarias en los países desarrollados y en desarrollo, los respectivos organismos gubernamentales y las organizaciones sanitarias están tomando la iniciativa de acelerar el gasto sanitario.

Por ejemplo,

- Según la Organización de Asuntos de Salud, el gasto sanitario de Estados Unidos aumentó un 9,7% hasta alcanzar los 4,1 billones de dólares en 2020, un ritmo mucho más rápido que el observado en 2019.

- Según el gobierno del Reino Unido, en 2020, el gobierno ha destinado casi 250 millones de libras esterlinas, lo que equivale a unos 300 millones de dólares estadounidenses, para digitalizar y mejorar la atención diagnóstica en todo el NHS (Servicio Nacional de Salud) utilizando la última tecnología. Esta financiación se ha asignado específicamente a mejoras tecnológicas en los servicios de diagnóstico del NHS para detectar y comenzar a tratar las enfermedades lo antes posible.

- El Gobierno de la India ha puesto en marcha la Iniciativa Nacional de Servicios de Diagnóstico Gratuitos como parte de la Misión Nacional de Salud. Esta iniciativa era importante para proporcionar atención médica integral y de calidad gratuita en un solo lugar. Con esta iniciativa del Gobierno de la India, varios estados han probado varios modelos para garantizar la disponibilidad de diagnósticos en los centros de salud públicos.

El aumento del gasto sanitario también es beneficioso para el crecimiento económico y del sector sanitario, ya que afecta significativamente al desarrollo de nuevas pruebas diagnósticas y nuevas herramientas quirúrgicas. Por lo tanto, el enorme gasto sanitario es un factor favorable para el crecimiento del mercado.

Oportunidad

- Logros en cirugías LASIK

La tasa de éxito de la cirugía LASIK o los resultados de la misma son bien conocidos, ya que se han realizado miles de estudios clínicos que analizan la agudeza visual y la satisfacción del paciente. Investigaciones recientes indican que el 99 por ciento de los pacientes logran una visión superior a 20/40, y más del 90 por ciento logra una visión de 20/20 o superior. Además, la cirugía LASIK tiene una tasa de satisfacción del paciente sin precedentes del 96 por ciento, la más alta de cualquier procedimiento electivo.

Por ejemplo,

- Un estudio de 2016 en el Journal of Cataract & Refractive Surgery descubrió que la cirugía LASIK tiene una tasa de satisfacción del paciente del 96 %.

Según el artículo "LASIK: conozca las ventajas y los riesgos", 2018

- Eric Donnenfeld, MD, expresidente de la Sociedad Estadounidense de Cirugía Refractiva y de Cataratas, completó alrededor de 85.000 procedimientos a lo largo de sus 28 años de carrera.

- Según Market Scope, alrededor de 10 millones de estadounidenses se han sometido a cirugía LASIK desde que la FDA la aprobó por primera vez en 1999. Se realizan alrededor de 700.000 cirugías LASIK cada año, pero esa cifra es inferior al pico de 1,4 millones en 2000.

En adelante, el creciente número de cirugías LASIK exitosas en todo el mundo se asocia positivamente con el desarrollo, registro y lanzamiento de productos. Por lo tanto, se espera que esto impulse el mercado de dispositivos de cirugía refractiva en los próximos años.

- Iniciativas estratégicas de los actores del mercado

El aumento de la incidencia de errores refractivos en todo el mundo ha generado una mayor demanda del mercado de dispositivos de cirugía refractiva. El objetivo principal es mejorar la gestión de la salud con el desarrollo de productos innovadores y tipos de cirugía para una atención de calidad con una aplicación conveniente. Los actores clave en el mercado de dispositivos de cirugía refractiva han tomado iniciativas estratégicas, que incluyen lanzamientos de productos, adquisiciones y mucho más, y se espera que lideren y creen más oportunidades en el mercado de dispositivos de cirugía refractiva.

Por ejemplo,

- En junio de 2021, Glaukos Corporation recibió la aprobación regulatoria de la Administración de Productos Terapéuticos (TGA) de Australia para PRESERFLO MicroShunt. PRESERFLO MicroShunt tenía como objetivo reducir la presión intraocular (PIO) en los ojos de los pacientes con glaucoma primario de ángulo abierto en los que la PIO permanecería incontrolable además de ser la terapia médica máxima tolerada y/o en los que la progresión del glaucoma requiere cirugía.

- En junio de 2021, Bausch & Lomb Incorporated firmó un acuerdo con Lochan, una empresa del sector de servicios de tecnología de la información. Estas empresas tenían como objetivo desarrollar la próxima generación del software de apoyo a la toma de decisiones clínicas eyeTELLIGENCE de Bausch & Lomb Incorporated. Al utilizar la infraestructura basada en la nube de eyeTELLIGENCE, este software se desarrollaría para permitir a los cirujanos combinar sin esfuerzo todos los factores de los procedimientos de cirugía de cataratas, retina y refractiva para aumentar la eficiencia total de su práctica.

- En marzo de 2021, NIDEK presentó el RT-6100 CB para Windows, un software de control opcional para el refractor inteligente RT-6100 y el sistema de refracción de sobremesa TS-610. Este software se adapta a los distintos requisitos de los pacientes y los operadores. Además, el software permite realizar refracciones que cumplen con los requisitos de distanciamiento social.

Estos numerosos productos estratégicos lanzados y adquisiciones por parte de importantes empresas del mercado de dispositivos de cirugía refractiva han abierto una oportunidad para las empresas de todo el mundo. Estas estrategias están permitiendo a las empresas fortalecer su presencia en el mercado. Por lo tanto, se prevé que la iniciativa estratégica sea la oportunidad de oro para que los actores del mercado aceleren el crecimiento de sus ingresos en el mercado.

Desafíos/Restricciones

- Falta de conciencia y confianza de la gente respecto a los beneficios del procedimiento.

En muchos países, la población en general desconoce la cirugía refractiva ni sus diversos beneficios para los errores refractivos, como la miopía, el astigmatismo, la presbicia y otros. La gente tiene miedo de las cirugías, ya que pueden provocar efectos secundarios graves que se espera que supongan un gran desafío para el mercado.

Por ejemplo,

- Según el estudio del Instituto Nacional de Salud (NIH) de 2021, se afirmó que las personas se negaban a someterse a una cirugía porque les preocupaban sus complicaciones y carecían de información sobre el procedimiento. Además, el estudio mostró que el 82,5% de los participantes desconocían que la cirugía refractiva podría mejorar su agudeza visual debido a la falta de conocimiento.

- Según el estudio realizado por la Revista Internacional de Medicina en Países en Desarrollo en 2019, se afirmó que:

- El 32,2% del total de participantes pensó que la cirugía refractiva era peligrosa y el 9,5% pensó que causa complicaciones avanzadas.

- Además, el estudio de la India mostró que el 64% de los participantes no sabía que la cirugía refractiva podía mejorar su visión.

Se espera que la falta de conciencia sobre los beneficios de la cirugía refractiva y el miedo de las personas a las complicaciones de la cirugía creen un gran desafío para el crecimiento del mercado.

- Falta de instalaciones sanitarias para el tratamiento ocular

La población pobre de los países de ingresos bajos y medios sufre más ceguera y trastornos oftálmicos que la población más rica. Los planes de desarrollo y estratégicos adoptados en los países desarrollados no se aplican de la misma manera en los países de ingresos bajos. Muchos de estos países suelen depender de trabajadores sanitarios comunitarios, asistentes médicos y cirujanos de cataratas para la atención oftalmológica primaria inicial. La oftalmología en los países de ingresos bajos (LIC) es un gran desafío debido a sus complejidades, como los climas tropicales, las redes eléctricas frágiles, la infraestructura vial y de agua deficiente, la capacidad de diagnóstico limitada y las opciones de tratamiento limitadas.

Por ejemplo,

- Según el artículo "Herramientas de diagnóstico innovadoras para la oftalmología en países de bajos ingresos", el informe de 2020 afirma que la prevalencia de ceguera y trastornos oculares en los países de altos ingresos es de 0,3 por 1.000 personas, pero en los países de bajos ingresos, la estimación es de 1,5 por 1.000. Esto muestra la necesidad insatisfecha de atención oftalmológica en los países de bajos ingresos.

Otro problema importante en los países de bajos ingresos es la falta de concienciación de la población sobre el dolor ocular y otros trastornos. Muchos estudios de investigación informan de la gran demanda de atención de la salud ocular en los países de bajos ingresos, y sus necesidades insatisfechas siguen llamando la atención de muchas organizaciones de atención sanitaria.

Por ejemplo,

- En 2014, el British Journal of Ophthalmology informó que el plan Visión 2020 iniciado por el gobierno aún está lejos de lograrse debido a la falta de iniciativas dirigidas a los países de ingresos medios y bajos.

Por lo tanto, la deficiente instalación de atención sanitaria para tratamientos oculares en los países de ingresos bajos y medios se considera el mayor desafío para el crecimiento del mercado de dispositivos de cirugía refractiva.

Impacto posterior al COVID-19 en el mercado de dispositivos de cirugía refractiva

El COVID-19 ha afectado al mercado. Los confinamientos y el aislamiento durante la pandemia restringieron el movimiento de las masas. Como resultado, las fechas y los horarios de las cirugías se retrasaron. Por lo tanto, la pandemia ha afectado negativamente a este mercado.

Desarrollo reciente

- En julio de 2021, Johnson & Johnson Vision lanzó el sistema VERITAS Vision, un sistema de facoemulsificación (faco) de última generación. Este sistema está desarrollado para cuidar tres áreas importantes: la eficiencia del cirujano, la seguridad del paciente y la comodidad. Esto ha aumentado la cartera de productos de la empresa.

Alcance del mercado de dispositivos de cirugía refractiva

El mercado de dispositivos de cirugía refractiva está segmentado por tipo de producto, tipo de cirugía, aplicación, usuario final y canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de producto

- Láser

- Lente intraocular fáquica (LIO)

- Aberrómetros / Aberrometría de frente de onda

- Instrumentos y accesorios quirúrgicos

- Kits de cirugía refractiva

- Medidores de diámetro pupilar

- Epiqueratomos

- Microqueratomos

- Termoqueratoplastia

- Kits de incisión relajante limbar

- Otros

Sobre la base del tipo de producto, el mercado de dispositivos de cirugía refractiva se segmenta en láser, lente intraocular fáquica (LIO), aberrómetro/aberrometría de frente de onda, instrumentos y accesorios quirúrgicos, kits de cirugía refractiva, medidores de diámetro pupilar, epiqueratomos, microqueratomos, termoqueratoplastia, kits de incisión relajante limbar y otros.

Tipo de cirugía

- Lasik (queratomileusis in situ con láser)

- Queratectomía fotorrefractiva (PRK)

- Lentes intraoculares fáquicas (LIO)

- Queratotomía astigmática (QA)

- Queratoplastia lamelar automatizada (ALK)

- Anillo intracorneal (INTACS)

- Queratoplastia térmica con láser (LTK)

- Queratoplastia conductiva (CK)

- Queratotomía radial (RK)

- Otros

Según el tipo de cirugía, el mercado de dispositivos de cirugía refractiva se segmenta en LASIK (queratomileusis in situ con láser), queratectomía fotorrefractiva (PRK), lentes intraoculares fáquicas (IOL), queratotomía astigmática (AK), queratoplastia lamelar automatizada (ALK), anillo intracorneal (INTACS), queratoplastia térmica láser (LTK), queratoplastia conductiva (CK), queratotomía radial (RK) y otras.

Solicitud

- Miopía (miopía)

- Hipermetropía (presbicia)

- Astigmatismo

- Presbicia

Sobre la base de la aplicación, el mercado de dispositivos de cirugía refractiva está segmentado en miopía, hipermetropía, astigmatismo y presbicia.

Usuario final

- Hospitales

- Clínicas especializadas

- Centros de cirugía ambulatoria

- Otros

Según el usuario final, el mercado de dispositivos de cirugía refractiva se segmenta en hospitales, clínicas especializadas, centros quirúrgicos ambulatorios y otros.

Canal de distribución

- Licitación directa

- Distribuidores de terceros

- Otros

Sobre la base del canal de distribución, el mercado de dispositivos de cirugía refractiva se segmenta en licitación directa, distribuidores externos y otros.

Análisis y perspectivas regionales del mercado de dispositivos para cirugía refractiva

Se analiza el mercado de dispositivos de cirugía refractiva y se proporcionan información y tendencias del tamaño del mercado por país, tipo de producto, tipo de cirugía, aplicación, usuario final y canal de distribución como se menciona anteriormente.

Los países cubiertos en el informe del mercado de dispositivos de cirugía refractiva son Alemania, Francia, Reino Unido, Italia, España, Países Bajos, Rusia, Suiza, Bélgica, Turquía, Austria, Noruega, Hungría, Lituania, Irlanda, Polonia y el resto de Europa.

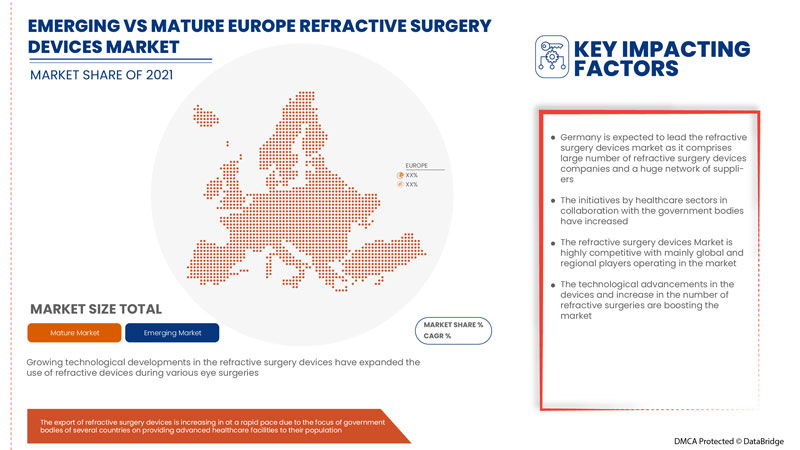

Se espera que Alemania domine el mercado debido a la creciente adopción de cirugías mínimamente invasivas.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas nuevas y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la alta competencia de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de los dispositivos de cirugía refractiva

El panorama competitivo del mercado de dispositivos de cirugía refractiva proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y la variedad de productos y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de dispositivos de cirugía refractiva.

Algunas de las principales empresas que operan en el mercado de dispositivos para cirugía refractiva son Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (una subsidiaria de Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, entre otras.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, el análisis global frente a regional y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar a nuestros clientes existentes y nuevos datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (Factbook) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE REFRACTIVE SURGERY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 EUROPE REFRACTIVE SURGERY DEVICES MARKET: REGULATIONS

4.3.1 REGULATION IN THE U.S.

4.3.2 REGULATIONS IN EUROPE

4.3.3 REGULATIONS IN SINGAPORE

4.3.4 REGULATIONS IN AUSTRALIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TECHNOLOGICAL ADVANCEMENT

5.1.2 RISE IN HEALTHCARE EXPENDITURE

5.1.3 INCREASE IN POPULATION WITH MACULAR DEGENERATION

5.1.4 RISE IN ADOPTION OF MINIMALLY INVASIVE SURGERIES

5.2 RESTRAINTS

5.2.1 STRINGENT RULES AND REGULATIONS

5.2.2 HIGH COST ASSOCIATED WITH REFRACTIVE SURGERY DEVICES

5.2.3 SIDE EFFECTS OF SURGERY

5.3 OPPORTUNITIES

5.3.1 ACHIEVEMENTS IN LASIK SURGERIES

5.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.3 INCREASING GERIATRIC POPULATION

5.3.4 EXCESSIVE USAGE OF DIGITAL DEVICES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 LACK OF HEALTHCARE FACILITIES FOR EYE TREATMENT

6 COVID-19 IMPACT ON EUROPE REFRACTIVE SURGERY DEVICES MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY

6.4 STRATEGIC DECISIONS BY MANUFACTURERS

6.5 CONCLUSION

7 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LASER

7.2.1 EXCIMER LASERS

7.2.2 FEMTOSECOND LASER/ULTRASHORT PULSE LASER

7.2.3 OTHERS

7.3 PHAKIC INTRAOCULAR LENS (IOL)

7.4 ABERROMETERS / WAVEFRONT ABERROMETRY

7.5 SURGICAL INSTRUMENTS & ACCESSORIES

7.6 REFRACTIVE SURGERY KITS

7.7 PUPILLARY DIAMETER METERS

7.8 EPIKERATOMES

7.9 MICROKERATOMES

7.1 THERMOKERATOPLASTY

7.11 LIMBAL RELAXING INCISION KITS

7.12 OTHERS

8 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 LASIK (LASER IN-SITU KERATOMILEUSIS)

8.3 PHOTOREFRACTIVE KERATECTOMY (PRK)

8.4 PHAKIC INTRAOCULAR LENSES (IOL)

8.5 ASTIGMATIC KERATOTOMY (AK)

8.6 AUTOMATED LAMELLAR KERATOPLASTY (ALK)

8.7 INTRACORNEAL RING (INTACS)

8.8 LASER THERMAL KERATOPLASTY (LTK)

8.9 CONDUCTIVE KERATOPLASTY (CK)

8.1 RADIAL KERATOTOMY (RK)

8.11 OTHERS

9 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEARSIGHTEDNESS (MYOPIA)

9.3 FARSIGHTEDNESS (HYPEROPIA)

9.4 PRESBYOPIA

9.5 ASTIGMATISM

10 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 NETHERLANDS

12.1.7 RUSSIA

12.1.8 SWITZERLAND

12.1.9 BELGIUM

12.1.10 TURKEY

12.1.11 AUSTRIA

12.1.12 NORWAY

12.1.13 HUNGARY

12.1.14 LITHUANIA

12.1.15 IRELAND

12.1.16 POLAND

12.1.17 REST OF EUROPE

13 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 JOHNSON AND JOHNSON SERVICES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.1.5.1 PRODUCT LAUNCH

15.2 ALCON INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.5.1 ACQUISITION

15.2.5.2 PRODUCT LAUNCH

15.3 STAAR SURGICAL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAUSCH + LOMB INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 ACQUISITION

15.4.5.2 CE APPROVAL

15.5 TOPCON CANADA INC., (A SUBSIDIARY OF TOPCON CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PARTNERSHIP

15.5.5.2 ACQUISITION

15.6 AAREN SCIENTIFIC INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMPLITUDE LASER

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 PARTNERSHIP

15.8 BD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.8.4.1 CONFERENCE

15.8.4.2 PRODUCT LAUNCH

15.9 GLAUKOS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 PRODUCT LAUNCH

15.9.4.2 ACQUISITION

15.1 HOYA SURGICAL OPTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 CONFERENCE

15.11 IVIS TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LENSAR INC. (A SUBSDIARY OF PDL BIOPHARMA, INC.)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MORIA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NIDEK CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 WEBSITE LAUNCH

15.15 OPHTEC BV

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 PRODUCT LAUNCH

15.16 RAYNER INTRAOCULAR LENSES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.16.3.1 NEW DISTRIBUTION UNIT

15.16.3.2 ACQUISITION

15.16.3.3 ACQUISITION

15.17 REICHERT, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 CONFERENCE

15.18 ROWIAK GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 R&D FACILITY

15.19 SCHWIND EYE-TECH-SOLUTIONS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRACEY TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 R&D FACILITY

15.21 ZIEMER OPHTHALMIC SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 AGREEMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE PHAKIC INTRAOCULAR LENS (IOL) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ABBEROMETERS/WAFEFRONT ABERROMETRY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SURGICAL INSTRUMENT & ACCESSORIES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE REFRACTIVE SURGERY KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PUPILLARY DIAMETER METERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE EPIKERATOMES IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MICROKERATOMES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE THERMOKERATOPLASTY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE LIMBAL RELAXING INCISION KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE LASIK (LASER IN-SITU KERATOMILEUSIS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PHOTOREFRACTIVE KERATECTOMY (PRK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE PHAKIC INTRAOCULAR LENSES (IOL) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ASTIGMATIC KERATOTOMY (AK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE AUTOMATED LAMELLAR KERATOPLASTY (ALK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE INTRACORNEAL RING (INTACS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE LASER THERMAL KERATOPLASTY (LTK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE CONDUCTIVE KERATOPLASTY (CK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE RADIAL KERATOTOMY (RK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE NEARSIGHTEDNESS (MYOPIA) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE FARSIGHTEDNESS (HYPEROPIA) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE PRESBYOPIA IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ASTIGMATISM IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HOSPITALS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE SPECIALTY CLINICS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE AMBULATORY SURGICAL CENTERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 EUROPE DIRECT TENDER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE THIRD PARTY DISTRIBUTORS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 49 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 FRANCE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 ITALY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 67 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SPAIN LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 NETHERLANDS LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 SWITZERLAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 91 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 BELGIUM LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 97 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 TURKEY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 103 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 109 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORWAY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 115 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 HUNGARY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 121 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 LITHUANIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 127 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 IRELAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 133 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 POLAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 139 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 REST OF EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REFRACTIVE SURGERY DEVICES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REFRACTIVE SURGERY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE REFRACTIVE SURGERY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE REFRACTIVE SURGERY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN THE REFRACTIVE SURGERY DEVICES ARE EXPECTED TO DRIVE THE EUROPE REFRACTIVE SURGERY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE REFRACTIVE SURGERY DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE REFRACTIVE SURGERY DEVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR EUROPE REFRACTIVE SURGERY DEVICES MARKET

FIGURE 15 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 17 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2021

FIGURE 20 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2021

FIGURE 24 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2021

FIGURE 28 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.