Mercado europeo de carne procesada, por tipo de producto ( rescerdo , cabra, cordero, pollo , pavo, pato, pescado ), tipo (carne procesada fresca, carne congelada, carne refrigerada , carne enlatada, carne seca/semiseca, carne fermentada, otras), categoría (curada, sin curar), naturaleza (convencional, orgánica ), tipo de embalaje (bandejas, bolsas, cajas, botes, otros), material de embalaje (plástico, vidrio , papel/cartón, metal, otros), usuario final (sector de servicios alimentarios, hogar), canal de distribución (minoristas con tienda, minoristas sin tienda), país (Alemania, Francia, Reino Unido, Italia, España, Austria, Rusia, Turquía, Bélgica, Dinamarca, Países Bajos, Suecia, Polonia, Suiza y resto de Europa), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado europeo de carne procesada

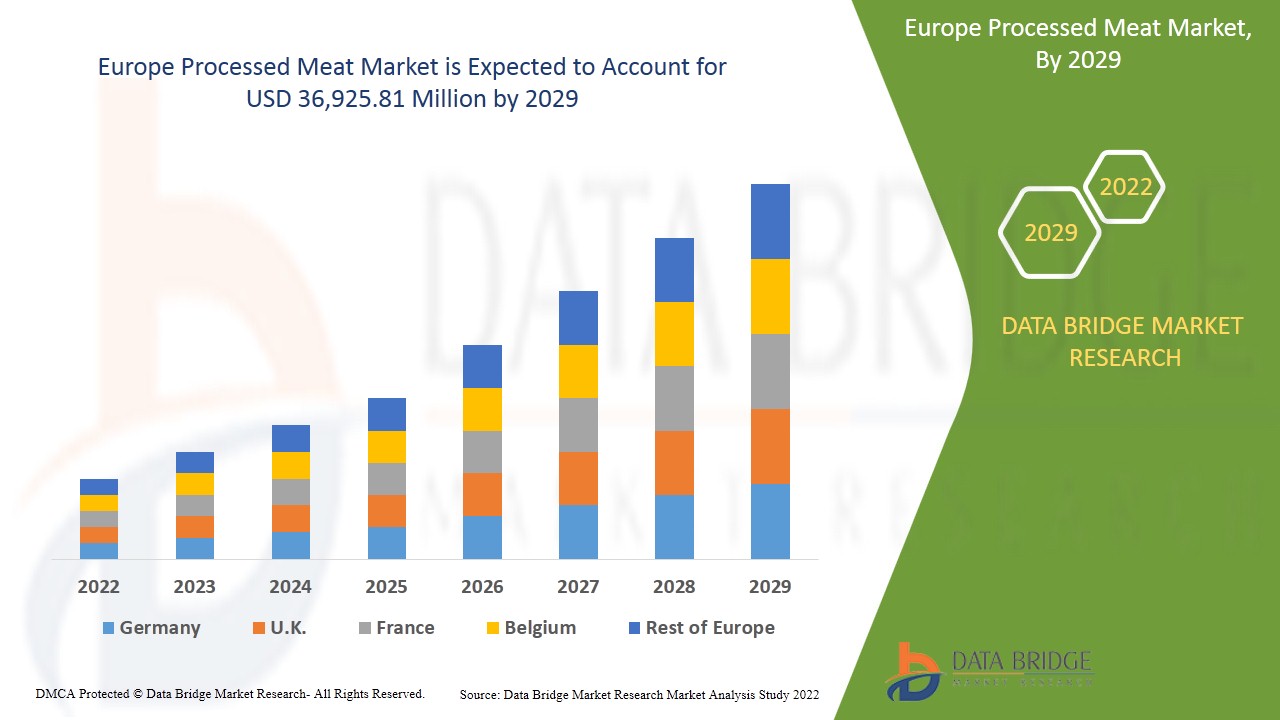

Se espera que el mercado europeo de carne procesada crezca en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,9% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 36.925,81 millones para 2029. El aumento de la demanda de carne procesada en las industrias alimentaria y farmacéutica puede impulsar el crecimiento del mercado europeo de carne procesada.

La carne procesada se puede definir como carne suplementada con varios aditivos y conservantes, como acidificantes, minerales, sales y otros condimentos y agentes aromatizantes. La carne se procesa principalmente para mejorar su calidad, evitar la degeneración y agregar sabores a su composición original. Puede ser carne roja o carne blanca de cerdo, aves, ganado o carne de animales marinos.

Carnes como la de res, cerdo, pavo, pollo y cordero se utilizan habitualmente para producir carne procesada. Entre los productos cárnicos procesados se encuentran el pepperoni, la cecina, los hot dogs y las salchichas. Se añaden ciertos conservantes a la carne para evitar que las bacterias y otros organismos la echen a perder.

Los principales factores que se espera que impulsen el crecimiento del mercado europeo de carne procesada en el período de pronóstico son el aumento de los ingresos disponibles. Además, se estima que la disminución del tiempo que se tarda en cocinar carne en casa debido al estilo de vida agitado complementará aún más el crecimiento del mercado europeo de carne procesada.

- Por otra parte, se prevé que el aumento de la incidencia de la obesidad debido al elevado consumo de productos cárnicos procesados impida el crecimiento del mercado europeo de carnes procesadas en el período de referencia. Además, el crecimiento de las cadenas de restaurantes y de comida rápida puede ofrecer otras oportunidades potenciales para el crecimiento del mercado europeo de carnes procesadas en los próximos años. Sin embargo, las estrictas regulaciones gubernamentales podrían suponer un reto adicional para el crecimiento de este mercado.

El informe sobre el mercado de carne procesada en Europa proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de nuevos segmentos de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de carne procesada en Europa, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de carne procesada en Europa

El mercado europeo de carne procesada se divide en ocho segmentos importantes según el tipo, el tipo de producto, la categoría, la naturaleza, el tipo de embalaje, el material de embalaje, el usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

- Según el tipo de procesamiento, el mercado europeo de carne procesada se segmenta en carne procesada fresca, carne congelada, carne refrigerada, carne enlatada, carne seca/semi seca, carne fermentada y otras. En 2022, se espera que el segmento de carne procesada fresca domine el mercado debido a la creciente preferencia de los consumidores por la carne procesada fresca debido a su contenido nutricional mantenido.

- Según el tipo de producto, el mercado europeo de carne procesada se segmenta en carne de res, cerdo, cabra, cordero, pollo, pavo, pato y pescado. En 2022, se espera que el segmento del pollo domine el mercado debido al aumento de las importaciones y exportaciones de carne de ave.

- Según la categoría, el mercado europeo de carne procesada se segmenta en curada y sin curar. En 2022, se espera que el segmento de carne curada domine el mercado debido a la disponibilidad de carne curada con diferentes sabores.

- En función de la naturaleza, el mercado europeo de carne procesada se segmenta en orgánica y convencional. En 2022, se espera que el segmento convencional domine el mercado debido a la disponibilidad de carne convencional y a su mejor sabor, junto con una mayor asequibilidad que la carne orgánica.

- Según el tipo de envase, el mercado europeo de carne procesada se segmenta en bandejas, bolsas, cajas, botes y otros. En 2022, se espera que el segmento de las bolsas domine el mercado debido a su facilidad de transporte y resellado, lo que las hace más versátiles que las bolsas de un solo uso y otros tipos de envases.

- En función del material de envasado, el mercado europeo de carne procesada se segmenta en plástico, vidrio, papel/cartón, metal y otros. En 2022, se espera que el segmento del plástico domine el mercado debido a sus propiedades, como la durabilidad y otras.

- En función del usuario final, el mercado de carne procesada se segmenta en el sector doméstico y de servicios de alimentación. En 2022, se espera que el segmento del sector de servicios de alimentación domine el mercado de carne procesada debido a la rápida expansión del sector alimentario en varias economías desarrolladas y en desarrollo.

- En función del canal de distribución, el mercado europeo de carne procesada se segmenta en minoristas con presencia física y minoristas sin presencia física. En 2022, se espera que el segmento de minoristas con presencia física domine el mercado debido a la disponibilidad de representantes capacitados de la empresa en supermercados e hipermercados.

Análisis a nivel de país del mercado de carne procesada en Europa

El mercado europeo de carne procesada está segmentado en ocho segmentos notables según el tipo, el tipo de producto, la categoría, la naturaleza, el tipo de embalaje, el material de embalaje, el usuario final y el canal de distribución.

Los países cubiertos en el informe del mercado de carne procesada de Europa son Alemania, Francia, Reino Unido, Italia, España, Austria, Rusia, Turquía, Bélgica, Dinamarca, Países Bajos, Suecia, Polonia, Suiza y el resto de Europa.

Se espera que el segmento de tipo de procesamiento en la región de Europa crezca con la tasa de crecimiento más alta en el período de pronóstico de 2022 a 2029 debido al crecimiento de las inversiones y colaboraciones en el negocio de procesamiento de carne. Se espera que Alemania lidere el crecimiento del mercado europeo, y se espera que el segmento de tipo de producto domine en este país debido a la creciente urbanización y la mayor adopción de un estilo de vida saludable.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento sobre la carne procesada están impulsando el crecimiento del mercado de carne procesada en Europa

El mercado europeo de carne procesada también le ofrece un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de la carne procesada en Europa

El panorama competitivo del mercado de carne procesada en Europa ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la variedad de productos, el dominio de las aplicaciones y la curva de supervivencia de la tecnología. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado de carne procesada en Europa.

Algunos de los principales actores que operan en el mercado europeo de carne procesada son Cargill, Incorporated,

JBS Foods, Tyson Foods, Inc., Smithfield Foods, Inc., Hormel Foods Corporation, Groupe Bigard, NH Foods Ltd., Louis Dreyfus Company, Tönnies Group, Gausepohl Fleisch Deutschland GmbH, HKScan, Gruppo Veronesi, TERRENA, Müller Gruppe, OSI Group, Charoen Pokphand Foods PCL., Sanderson Farms, Incorporated., Westfleisch SCE mbH, Marfrig, Vion Food Group, Danish Crown AMBA, The Kraft Heinz Company, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Muchos lanzamientos de productos también son iniciados por empresas en todo el mundo, lo que acelera el mercado de carne procesada en Europa.

Por ejemplo,

- En noviembre de 2021, JBS Foods anunció que comercializaría carne cultivada hasta 2024. La empresa está lanzando este producto con BioTech Foods. Esto ayudará a la empresa a atraer una mayor base de clientes y a ampliar su cartera de productos.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias del actor del mercado mejoran la presencia de la empresa en el mercado de carne procesada de Europa, lo que también beneficia el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Lista de Tablas

FIGURE 1 EUROPE PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 2 EUROPE PROCESSED MEAT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PROCESSED MEAT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PROCESSED MEAT MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE PROCESSED MEAT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PROCESSED MEAT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE PROCESSED MEAT MARKET: DBMR POSITION GRID

FIGURE 8 EUROPE PROCESSED MEAT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE PROCESSED MEAT MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC REGION IS EXPECTED TO DOMINATE THE EUROPE PROCESSED MEAT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS IS DRIVING THE GROWTH OF EUROPE PROCESSED MEAT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PROCESSED MEAT MARKET IN 2022 & 2029

FIGURE 13 EUROPE PROCESSED MEAT MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE PROCESSED MEAT MARKET

FIGURE 15 EUROPE PROCESSED MEAT MARKET, BY TYPE (2021)

FIGURE 16 EUROPE PROCESSED MEAT MARKET, BY PRODUCT TYPE (2021)

FIGURE 17 EUROPE PROCESSED MEAT MARKET, BY PACKAGING TYPE (2021)

FIGURE 18 EUROPE PROCESSED MEAT MARKET, BY END-USER (2021)

FIGURE 19 EUROPE PROCESSED MEAT MARKET, BY CATEGORY

FIGURE 20 EUROPE PROCESSED MEAT MARKET, BY NATURE (2021)

FIGURE 21 EUROPE PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL (2021)

FIGURE 22 EUROPE SNAPSHOT, 2021

FIGURE 23 EUROPE SUMMARY, 2021

FIGURE 24 EUROPE SUMMARY, 2022 & 2029

FIGURE 25 EUROPE SUMMARY, 2021 & 2029

FIGURE 26 EUROPE SUMMARY BY PRODUCT, 2022 - 2029

FIGURE 27 EUROPE PROCESSED MEAT MARKET: COMPANY SHARE 2021 (VOLUME %)

Lista de figuras

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PROCESSED MEAT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS (VOLUME %)

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 EUROPE PROCESSED MEAT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.2.1 GROWING UTILIZATION OF NEW TECHNOLOGIES IN MEAT PROCESSING

4.2.2 GROWING COLLABORATIONS AND PARTNERSHIPS

4.2.3 CONSUMER OPTING FOR HEALTHEIR MEAT PRODUCTS WITH DECREASED FAT LEVEL, CHOLESTEROL,

5 EUROPE PROCESSED MEAT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN INVESTMENTS & COLLABORATIONS IN MEAT PROCESSING BUSINESS

6.1.2 PREFERENCE FOR ANIMAL-BASED PROTEINS OVER PLANT-BASED PROTEINS

6.1.3 GROWING URBANIZATION AND INCREASED ADOPTION OF HEALTHY LIFESTYLE

6.1.4 GROWING POPULARITY OF CANNED AND FROZEN MEAT FOOD

6.2 RESTRAINTS

6.2.1 HIGH INVESTMENT COST IN POULTRY BUSINESS

6.2.2 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT ALTERNATIVES

6.3 OPPORTUNITIES

6.3.1 GROWING FAST FOOD AND RESTAURANT CHAINS

6.3.2 INCREASING AUTOMATION IN MEAT PROCESSING INDUSTRY

6.3.3 GROWING PREFERENCE FOR ORGANIC MEAT

6.4 CHALLENGES

6.4.1 STRINGENT GOVERNMENT REGULATIONS

6.4.2 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7 COVID-19 IMPACT ON EUROPE PROCESSED MEAT MARKET

7.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST EUROPE PROCESSED MEAT MARKET

7.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.3 IMPACT ON PRICE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON SUPPLY CHAIN

7.6 CONCLUSION

8 EUROPE PROCESSED MEAT MARKET, BY TYPE

8.1 FRESH PROCESSED MEAT

8.2 FROZEN MEAT

8.3 CHILLED MEAT

8.4 CANNED MEAT

8.5 DRIED/SEMI DRIED MEAT

8.6 FERMENTED MEAT

9 EUROPE PROCESSED MEAT MARKET, BY PRODUCT TYPE:

9.1 OVERVIEW:

9.2 BEEF

9.3 PORK

9.4 GOAT

9.5 LAMB

9.6 CHICKEN

9.7 TURKEY

9.8 DUCK

9.9 FISH

10 EUROPE PROCESSED MEAT MARKET, BY PACKAGING TYPE

10.1 TRAYS

10.2 POUCHES

10.3 BOXES

10.4 CANNISTERS

10.5 OTHERS

11 EUROPE PROCESSED MEAT MARKET, BY END USER:

11.1 OVERVIEW:

11.2 HOUSEHOLD

11.3 FOOD SERVICE SECTOR

12 EUROPE PROCESSED MEAT MARKET, BY CATEGORY:

12.1 OVERVIEW:

12.2 CURED

12.3 UNCURED

13 EUROPE PROCESSED MEAT MARKET, BY NATURE:

13.1 OVERVIEW:

13.2 ORGANIC

13.3 CONVENTIONAL

14 EUROPE PROCESSED MEAT MARKET, BY DISTRIBUTION CHANNEL

14.1 STORE BASED RETAILER

14.2 NON-STORE BASED RETAILER

15 EUROPE PROCESSED MEAT MARKET, BY REGION

15.1 EUROPE

15.1.1 GERMANY

15.1.2 U.K

15.1.3 FRANCE

15.1.4 ITALY

15.1.5 SPAIN

15.1.6 SWITZERLAND

15.1.7 NETHERLANDS

15.1.8 AUSTRIA

15.1.9 RUSSIA

15.1.10 BELGIUM

15.1.11 DENMARK

15.1.12 SWEDEN

15.1.13 POLAND

15.1.14 TURKEY

15.1.15 REST OF EUROPE

16 EUROPE PROCESSED MEAT MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 JBS FOODS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUS ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 TYSON FOODS, INC.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 VION FOOD GROUP

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 CARGILL, INCORPORATED

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 DANISH CROWN A.M.B.A

18.5.1 COMPANY SNAPSHOT

18.5.2 COMPANY SHARE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENTS

18.6 CHAROEN POKPHAND FOODS PUBLIC CO. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 SMITHFIELD FOODS, INC

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 TÖNNIES GROUP

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 HORMEL FOODS CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUS ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 NATIONAL BEEF PACKING COMPANY L.L.C.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 GAUSEPOHL FLEISCH DEUTSCHLAND GMBH

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.12 GROUPE BIGARD

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 GRUPPO VERONESI

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUS ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 HKSCAN

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUS ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 KOCH FOODS.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 LOUIS DREYFUS COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MARFRIG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 MÜLLER GRUPPE

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENT

18.19 NH FOODS LTD.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUS ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENT

18.2 OSI GROUP

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENTS

18.21 PERDUE FARMS INC.

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 SANDERSON FARMS, INCORPORATED.

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENT

18.23 TERRENA

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 THE KRAFT HEINZ COMPANY

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENT

18.25 WESTFLEISCH SCE MBH

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

LIST OF TABLES

TABLE 1 ALLERGIES CAUSED BY DIFFERENT PLANT-BASED PROTEINS

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.