Europe Plant Based Eggs Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

366.31 Million

USD

5,594.22 Million

2024

2032

USD

366.31 Million

USD

5,594.22 Million

2024

2032

| 2025 –2032 | |

| USD 366.31 Million | |

| USD 5,594.22 Million | |

|

|

|

|

Segmentación del mercado europeo de huevos vegetales por tipo (huevo entero, clara y yema), presentación (polvo, líquido, etc.), ingrediente base (harina de algas, harina de trigo, harina de soja, semillas de chía, garbanzos, almidón, frijol mungo, guisantes, etc.), función (sustituto parcial de huevo, sustituto completo de huevo, sustituto de huevo batido, etc.), aplicación (para desayuno, panadería casera, etc.), tipo de envase (botellas, bolsas, tetrabriks, etc.) y canal de distribución (tienda física y tienda física). Tendencias del sector y pronóstico hasta 2032.

¿Cuál es el tamaño y la tasa de crecimiento del mercado de huevos de origen vegetal en Europa?

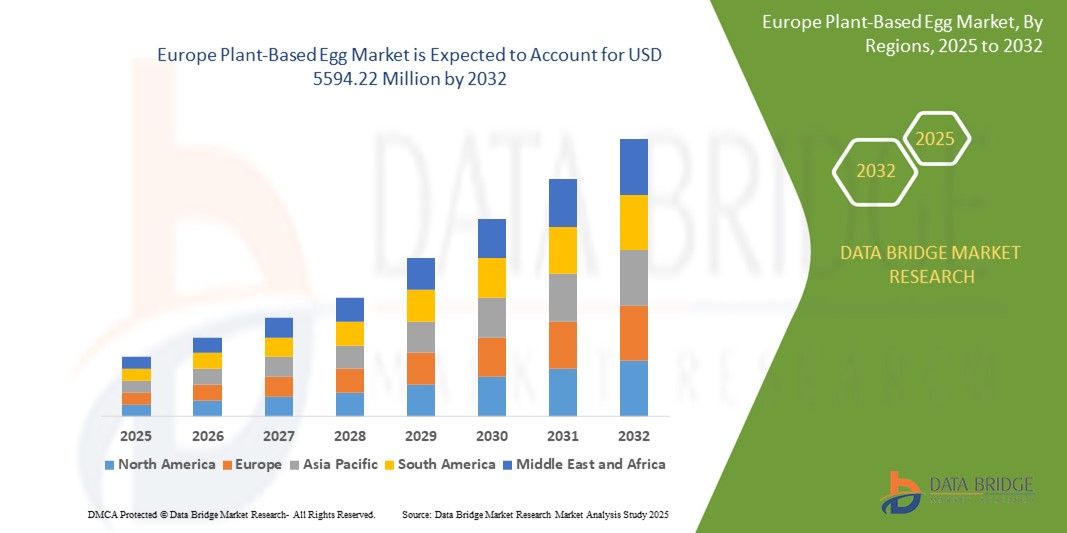

- El tamaño del mercado europeo de huevos de origen vegetal se valoró en USD 366,31 millones en 2024 y se espera que alcance los USD 5594,22 millones para 2032 , con una CAGR del 3,90 % durante el período de pronóstico.

- El mercado de huevos vegetales está en auge, ofreciendo beneficios como un menor impacto ambiental, bienestar animal y ventajas para la salud. Con aplicaciones versátiles en cocina y repostería, los huevos vegetales satisfacen diversas necesidades dietéticas, siendo atractivos para veganos, vegetarianos y consumidores preocupados por su salud que buscan alternativas sostenibles sin comprometer el sabor ni la nutrición.

¿Cuáles son las principales conclusiones del mercado de huevos de origen vegetal?

- Las iniciativas gubernamentales que promueven la producción sostenible de alimentos y reducen la dependencia de la ganadería pueden impulsar el crecimiento del mercado de huevos de origen vegetal. Las políticas y regulaciones favorables incentivan a los fabricantes a invertir en alternativas, ampliando así su presencia. Esto fomenta la innovación y la accesibilidad, alineándose con las preferencias de los consumidores por opciones alimentarias sostenibles, éticas y más saludables.

- A medida que aumenta la conciencia sobre la salud, los consumidores optan por dietas basadas en plantas, buscando alternativas a los productos animales. Los huevos vegetales, sin colesterol y bajos en grasa, responden a esta tendencia, atrayendo a quienes priorizan la salud. Su perfil nutricional se alinea con las preferencias de los consumidores preocupados por su salud, impulsando la demanda de huevos vegetales en el mercado.

- El Reino Unido dominó el mercado europeo de huevos de origen vegetal con una participación del 42,8 % en 2024, liderado por La alta conciencia de los consumidores sobre el consumo ético, el bienestar animal y la sostenibilidad ambiental está impulsando la demanda de alternativas al huevo.

- Se espera que Alemania experimente el mayor crecimiento en el mercado europeo de huevos de origen vegetal, con una sólida base en tecnología alimentaria y sostenibilidad. Una amplia base de consumidores veganos y con conciencia ambiental impulsa una demanda constante en los canales minoristas y de restauración.

- El segmento de huevos enteros dominó el mercado con la mayor participación en los ingresos del 44,1 % en 2024, impulsado por su versatilidad para replicar huevos tradicionales en varias recetas que incluyen horneado, cocinado y revuelto.

Alcance del informe y segmentación del mercado de huevos de origen vegetal

|

Atributos |

Perspectivas clave del mercado de los huevos de origen vegetal |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

¿Cuál es la tendencia clave en el mercado de huevos de origen vegetal?

Etiqueta limpia y personalización basada en IA en ovoproductos de origen vegetal

- Una tendencia líder en el mercado de huevos de origen vegetal es la fusión de fórmulas de etiqueta limpia con personalización basada en IA, lo que ayuda a las marcas a satisfacer las necesidades diversas y preocupadas por la salud de los consumidores.

- Por ejemplo, Eat Just, Inc. y Simply Eggless están invirtiendo en inteligencia artificial y análisis de datos para desarrollar productos que imiten de cerca la textura, el sabor y el rendimiento de cocción de los huevos reales para diversos perfiles dietéticos.

- Las marcas están utilizando IA para predecir las preferencias de los consumidores en función de los hábitos alimentarios regionales, lo que permite recomendaciones de productos personalizadas y marketing dirigido.

- También se están explorando plataformas impulsadas por IA para agilizar la previsión de la cadena de suministro, reducir el desperdicio y mejorar los ciclos de desarrollo de productos.

- Las empresas de huevos de origen vegetal ahora están incorporando ingredientes naturales, como frijoles mungo, proteína de garbanzos y algas, al tiempo que eliminan alérgenos y aditivos sintéticos.

- A medida que crece la demanda de alimentos más saludables y transparentes, la integración de la IA y los estándares de etiqueta limpia está transformando la innovación de productos y la confianza del consumidor en la categoría.

¿Cuáles son los impulsores clave del mercado de huevos de origen vegetal?

- La creciente conciencia sobre el bienestar animal, el cambio climático y los riesgos para la salud relacionados con los productos de origen animal está impulsando el cambio hacia alternativas al huevo.

- Por ejemplo, Follow Your Heart y Vegg están expandiendo su presencia minorista en toda Europa para satisfacer la demanda de fuentes de proteínas éticas y sostenibles.

- Un aumento en las dietas veganas, flexitarianas y libres de alérgenos está impulsando el crecimiento de la categoría en los canales de servicios de alimentación, minoristas y en línea.

- Los gobiernos de regiones como Europa e India están promoviendo activamente la nutrición basada en plantas a través de subsidios, directrices y fondos de innovación.

- Los fabricantes de alimentos se están asociando con marcas alternativas al huevo para formular productos de panadería, mayonesa y pasta sin huevo, ampliando la aplicación comercial de los huevos de origen vegetal.

- El auge de las plataformas de comercio electrónico ha facilitado que las marcas de nicho lleguen directamente a los consumidores preocupados por la salud, acelerando la penetración en el mercado.

¿Qué factor está desafiando el crecimiento del mercado de huevos de origen vegetal?

- Los altos costos de formulación y procesamiento, combinados con la limitada familiaridad de los consumidores en algunas regiones, siguen siendo importantes obstáculos para el crecimiento.

- Según la Iniciativa FAIRR, la producción de huevos de origen vegetal puede costar entre un 20 % y un 40 % más que los huevos convencionales debido a la I+D, los desafíos de escalamiento y los ingredientes de primera calidad.

- Las inconsistencias de sabor y textura entre las marcas reducen las compras repetidas y limitan la aceptación entre los consumidores tradicionales de huevos.

- Por ejemplo, varios usuarios en plataformas como Amazon y Reddit han compartido comentarios mixtos sobre el rendimiento del producto en aplicaciones para hornear y freír.

- La incertidumbre regulatoria sobre el etiquetado (por ejemplo, el uso del término "huevo") también crea barreras legales en mercados como Estados Unidos, Francia y Australia.

- Para superar estos obstáculos, las empresas deben centrarse en la educación del consumidor, la optimización de costos y un cumplimiento normativo más claro para escalar de manera efectiva y sostenible.

¿Cómo está segmentado el mercado de huevos de origen vegetal?

El mercado está segmentado en función de las ofertas, el tipo de producto, el modo de implementación y el uso final.

- Por tipo

Según el tipo, el mercado de huevos vegetales se segmenta en huevo entero, clara y yema. El segmento de huevo entero dominó el mercado con la mayor participación en los ingresos, con un 44,1%, en 2024, gracias a su versatilidad para replicar los huevos tradicionales en diversas recetas, como hornear, cocinar y preparar revueltos. Su amplia aceptación entre los consumidores veganos y su creciente aplicación en la restauración refuerzan aún más su dominio del mercado.

Se espera que el segmento de huevos blancos sea testigo de la CAGR más rápida durante el período de pronóstico debido a su creciente uso en merengues, postres y aplicaciones específicas de proteínas.

- Por formulario

Según su presentación, el mercado se segmenta en polvo, líquido y otros. El segmento de polvos tuvo la mayor participación de mercado, con un 51,7%, en 2024, gracias a su mayor vida útil, facilidad de almacenamiento y transporte, y alta compatibilidad con las industrias de panadería y alimentos envasados.

Se proyecta que el segmento Líquido crecerá a la tasa más alta entre 2025 y 2032, impulsado por la creciente demanda de formatos listos para cocinar y la conveniencia en entornos de cocina domésticos y comerciales.

- Por ingrediente base

Según el ingrediente base, el mercado se segmenta en harina de algas, harina de trigo, harina de soya, semillas de chía, garbanzos, almidón, frijol mungo, guisantes y otros. El segmento de frijol mungo dominó el mercado con una participación del 27,9 % en 2024, gracias a su superior capacidad de emulsión, aglutinante y contenido proteico, que imita con precisión la funcionalidad del huevo.

Se espera que el segmento basado en guisantes crezca rápidamente debido a su perfil hipoalergénico y su atractivo de etiqueta limpia entre los consumidores preocupados por la salud.

- Por función

Según su función, el mercado se segmenta en sustitutos parciales de huevo, sustitutos completos de huevo, sustitutos de baño de huevo y otros. El segmento de sustitutos completos de huevo lideró el mercado con una participación dominante del 59,6 % en 2024, impulsado por el creciente veganismo, la preocupación por la sostenibilidad ambiental y la transición hacia alternativas sin colesterol.

Se proyecta que el segmento de sustitutos de lavado de huevo gane terreno debido al aumento de las aplicaciones de panadería y confitería que necesitan acabados brillantes y agentes aglutinantes.

- Por aplicación

Según su aplicación, el mercado de huevos de origen vegetal se clasifica en: Aplicaciones para el desayuno, Aplicaciones de panadería casera y Otros. El segmento de Aplicaciones de panadería casera dominó el mercado con la mayor participación en los ingresos, un 46,3 %, en 2024, impulsado por el auge de la repostería casera y la demanda de ingredientes de etiqueta limpia.

Se proyecta que el segmento de aplicaciones de desayuno crecerá más rápido, impulsado por innovaciones de productos en mezclas para revueltos, tortillas y quiches que replican las ofertas de desayuno tradicionales.

- Por tipo de embalaje

Según el tipo de envase, el mercado se segmenta en botellas, bolsas, envases Tetra y otros. El segmento de bolsas tuvo la mayor cuota de mercado, con un 39,5%, en 2024, ya que ofrece soluciones ligeras, ecológicas y rentables, ideales tanto para el comercio minorista como para uso institucional.

Se espera que el segmento Tetra Packs sea testigo de un crecimiento significativo debido a su vida útil prolongada y su funcionalidad de fácil vertido para sustitutos líquidos de huevo.

- Por canal de distribución

Según el canal de distribución, el mercado se divide en minoristas con presencia física y minoristas sin presencia física. El segmento de minoristas con presencia física dominó el mercado con una participación en los ingresos del 63,8 % en 2024, gracias a la fuerte preferencia de los consumidores por la compra de comestibles en persona y a la amplia disponibilidad de huevos vegetales en supermercados, hipermercados y tiendas de alimentos saludables.

Se prevé que el segmento minorista sin tiendas físicas (comercio electrónico) crezca más rápido, impulsado por la expansión de las plataformas de comestibles digitales, los kits de comidas por suscripción y las crecientes búsquedas de productos veganos en línea.

¿Qué región posee la mayor participación en el mercado de huevos de origen vegetal?

- El Reino Unido dominó el mercado europeo de huevos de origen vegetal con una participación del 42,8 % en 2024, liderado por La alta conciencia de los consumidores sobre el consumo ético, el bienestar animal y la sostenibilidad ambiental está impulsando la demanda de alternativas al huevo.

- Las colaboraciones entre minoristas y servicios de alimentación, incluidas las principales cadenas de supermercados y establecimientos de comida rápida, están acelerando la accesibilidad y la adopción de productos.

- Un número cada vez mayor de empresas emergentes e incubadoras de tecnología alimentaria están invirtiendo en productos de huevo innovadores de origen vegetal adaptados a las preferencias de sabor locales y aplicaciones de horneado.

Análisis del mercado alemán de huevos de origen vegetal

Se espera que Alemania experimente el mayor crecimiento en el mercado europeo de huevos de origen vegetal, gracias a una sólida base en tecnología alimentaria y sostenibilidad. Una amplia base de consumidores veganos y con conciencia ambiental impulsa una demanda constante en los canales minoristas y de servicios de alimentación. El país alberga una alta concentración de fabricantes de alimentos de origen vegetal y centros de I+D, lo que lo convierte en un foco de desarrollo y lanzamiento de productos. El apoyo gubernamental a sistemas alimentarios de origen vegetal, dietas respetuosas con el medio ambiente y políticas de contratación pública está acelerando la penetración en el mercado. La combinación de consumidores progresistas, innovación de vanguardia y un panorama político proactivo en Alemania la posiciona como un mercado clave para el cultivo de huevos de origen vegetal en Europa.

Análisis del mercado francés de huevos de origen vegetal

El mercado francés de huevos de origen vegetal está ganando terreno de forma constante, impulsado por la innovación culinaria, las tendencias de alimentación limpia y el apoyo político. El creciente interés en la repostería sin huevo, los ingredientes naturales y las dietas flexitarianas está impulsando la demanda de alternativas vegetales, especialmente en centros urbanos como París y Lyon. Las startups alimentarias están experimentando con sustitutos de huevo de calidad culinaria que se adaptan a la cocina francesa, especialmente a pasteles, quiches y salsas. Las estrategias nacionales que promueven la agricultura sostenible, la innovación alimentaria y las comidas escolares vegetales están contribuyendo a una mayor adopción por parte de los consumidores. El énfasis de Francia en la calidad y la tradición alimentaria se está entrelazando con los cambios en la alimentación moderna, creando un mercado nicho, pero en rápida evolución, para las soluciones de huevo de origen vegetal.

¿Cuáles son las principales empresas del mercado de huevos de origen vegetal?

La industria de los huevos de origen vegetal está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Simply Eggless Inc. (EE. UU.)

- Sigue tu corazón (EE. UU.)

- Nabati (Canadá)

- Vegg (EE. UU.)

- Eat Just, Inc. (EE. UU.)

- Eggcitables (Canadá)

- Peggs (Estados Unidos)

- EVO Foods (India)

- ORGRAN (Australia)

- Terra Vegane (Alemania)

- Vezlay Foods Private Limited (India)

- Now Foods (EE. UU.)

- Glanbia PLC (Irlanda)

- Noblegen Inc. (Canadá)

- Grupo Mantiqueira (Brasil)

- Le Papondu (Francia)

¿Cuáles son los últimos avances en el mercado europeo de huevos de origen vegetal?

- En mayo de 2022, Evo Foods se asoció con Ginkgo Bioworks para lanzar ovoproductos de origen animal, con el objetivo de satisfacer la creciente demanda de alternativas vegetales. Esta colaboración busca lanzar sustitutos de proteínas que se adapten a los gustos del consumidor, en línea con el creciente interés en opciones de alimentos de origen animal.

- En abril de 2022, Eat Just obtuvo la aprobación de la Comisión Europea para lanzar su línea de ovoproductos vegetales en Europa, impulsando así el crecimiento del mercado de este tipo de huevos. Al ofrecer opciones versátiles como huevos doblados, revueltos y bocados sous-huevos, Eat Just busca capitalizar la creciente demanda de alternativas vegetales en la región.

- En octubre de 2021, EVO Foods lanzó su huevo líquido vegetal derivado de legumbres, con planes de expandirse al mercado estadounidense para finales de año. Esta iniciativa reforzó la base de clientes de la empresa y contribuyó a su trayectoria de crecimiento.

- En octubre de 2021, Nestlé amplió su portafolio de alimentos vegetales con la introducción de alternativas vegetales al huevo, lo que elevó la competencia en el mercado de este producto. Con la marca Garden Gourmet vEGGie, estos productos ofrecen una opción nutritiva y sostenible.

- En junio de 2020, The Veggletto Company Pty Ltd lanzó el sistema Veggletto, revolucionando la cocina con alternativas al huevo. Esta innovación revolucionaria impulsó las ventas de la empresa, ofreciendo a los consumidores una solución novedosa para incorporar sustitutos del huevo en sus creaciones culinarias.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.