Mercado europeo de aislamiento de tuberías, por tipo de producto (productos de aislamiento rígido, cubiertas de aislamiento de lana de roca, material de revestimiento, películas delgadas , envolturas, láminas y otros), tipo de material (lana de roca, fibra de vidrio, poliuretano, poliestireno, poliolefina, polipropileno, policarbonato, cloruro de polivinilo, urea formaldehído , espuma fenólica, espuma elastomérica y otros), temperatura (aislamiento en caliente y aislamiento en frío), aplicación (construcción y edificación, electrónica, industria química, energía y electricidad, petróleo y gas, automoción, transporte, alimentos y bebidas y otros) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado europeo de aislamiento de tuberías

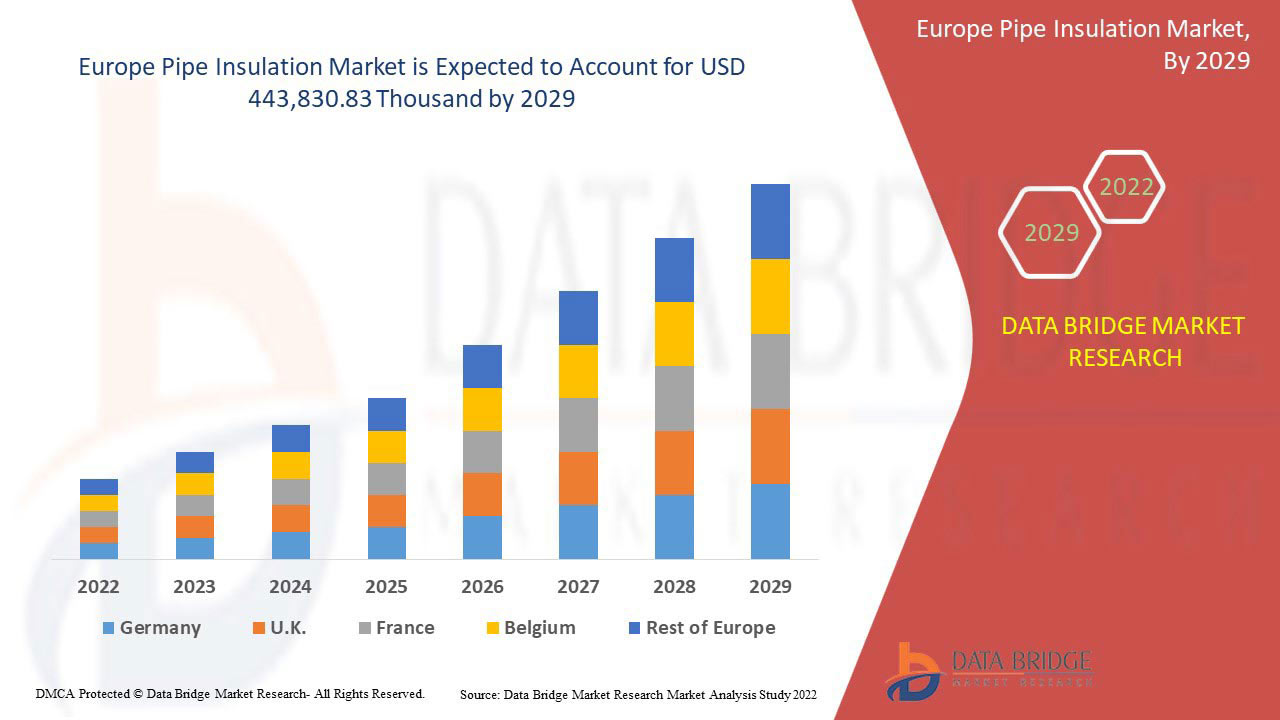

Se espera que el mercado europeo de aislamiento de tuberías alcance los USD 443.830,83 mil para 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 4,7% en el período de pronóstico de 2022 a 2029.

El informe sobre el mercado de aislamiento de tuberías en Europa proporciona detalles de los principales factores que influyen en el progreso del mercado (impulsores, restricciones, oportunidades y desafíos específicos de la industria) con respecto a las tendencias de crecimiento específicas, las perspectivas futuras y las contribuciones al mercado general para pronosticar el tamaño de los segmentos del mercado con respecto a la región de Europa. Aparte de eso, también nos brinda información sobre cómo perfilar estratégicamente a los principales actores y cómo se pueden analizar ampliamente sus cuotas de mercado y competencias básicas para diferentes países de Europa, para rastrear y analizar desarrollos competitivos como empresas conjuntas, fusiones y adquisiciones, desarrollo de nuevos productos, expansiones y actividades de investigación y desarrollo en el mercado de aislamiento de tuberías de Europa.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019 – 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD |

|

Segmentos cubiertos |

Por tipo de producto (productos de aislamiento rígido, cubiertas de aislamiento de lana de roca, material de revestimiento, películas delgadas , envolturas, láminas y otros), tipo de material (lana de roca, fibra de vidrio, poliuretano, poliestireno, poliolefina, polipropileno, policarbonato, cloruro de polivinilo , formaldehído de urea, espuma fenólica, espuma elastomérica y otros), temperatura (aislamiento térmico y aislamiento térmico), aplicación (construcción, electrónica, industria química, energía y electricidad, petróleo y gas, automoción, transporte, alimentos y bebidas y otros) |

|

Países cubiertos |

Alemania, Francia, Reino Unido, Rusia, Italia, España, Bélgica, Países Bajos, Suiza, Turquía y resto de Europa |

|

Actores del mercado cubiertos |

Kingspan Group, Saint-Gobain, Covestro AG, Knauf Insulation, BASF SE, Dow Izolan (una filial de DOW), Huntsman International LLC, Owens Corning, Johns Manville, Cellofoam GmbH & Co. KG, L'ISOLANTE K-FLEX SPA, 3M, NMC SA, ROCKWOOL International A/S, DUNMORE, ARMACELL y Röchling SE & Co. KG, entre otros. |

Definición de mercado

Un aislamiento adecuado de las tuberías limita el movimiento del calor a través de ellas y ofrece una barrera contra la humedad, lo que mejora la eficiencia térmica de los edificios y otras industrias y les proporciona protección de por vida contra la intemperie y la corrosión. Las tuberías mal aisladas permiten que el agua se consolide, lo que las deja indefensas frente al agua estancada que puede congelarse en un clima frío.

Películas delgadas: Los materiales de película delgada tienen baja conductividad térmica y se utilizan ampliamente en el aislamiento de tuberías para evitar el riesgo de corrosión debajo del aislamiento.

Láminas: el aislamiento de tuberías con láminas se utiliza para evitar la pérdida de calor de la superficie de las tuberías de agua caliente y fría. Puede ayudar a amortiguar los ruidos y las vibraciones en las industrias.

Envolturas: Las envolturas se utilizan para cubrir las tuberías y protegerlas de la temperatura y el calor exteriores.

Productos de aislamiento rígido: Los productos de aislamiento rígido consisten en productos de fibra de vidrio o lana mineral utilizados para aislar las tuberías en un rango más amplio para minimizar la pérdida de calor de la superficie de la tubería.

Material de recubrimiento: Los materiales de recubrimiento tienen alta densidad y baja conductividad térmica y se utilizan para controlar la transferencia de calor a través de la superficie de la tubería.

Dinámica del mercado de aislamiento de tuberías en Europa

Conductores

- El aislamiento de tuberías industriales ayuda a minimizar las pérdidas de calor en las plantas de fabricación.

El aislamiento mecánico evitará la pérdida y ganancia de calor al mantener la temperatura general del sistema y también previene la proporción de accidentes y lesiones como quemaduras si alguien toca la tubería sin saberlo. El aislamiento de tuberías se puede utilizar en interiores y exteriores en sistemas mecánicos. También se utiliza en las paredes exteriores e interiores de un edificio para proporcionar resistencia a las pérdidas de calor al transferir las paredes exteriores de un edificio y mantener la temperatura interior de todo el edificio. De la información anterior, se puede concluir que una cantidad sustancial de calor se desperdicia diariamente en los sectores industriales debido a superficies calentadas y refrigeradas con mantenimiento deficiente, aislamiento insuficiente y sin aislamiento. El aislamiento adecuado de diferentes sistemas de tuberías térmicas reducirá la pérdida de calor de diferentes subsistemas, como tuberías de conexión y superficies de equipos de recuperación de calor, lo que puede hacer que el entorno de trabajo sea más cómodo y seguro.

- Aumento del suministro de petróleo a través de oleoductos debido al aumento de la contaminación marina causada por los barcos

La contaminación del agua de mar debido al vertido de petróleo en los mares, que causa daños a todo el entorno vivo y no vivo, se denomina derrame de petróleo. El petróleo es una de las fuentes de energía más importantes del mundo. El transporte de petróleo a través de barcos de un país a otro es un sector comercial importante. Sin embargo, la transferencia de petróleo a través de barcos ha provocado varios accidentes en el pasado durante el traslado del petróleo a los buques, durante el transporte, la rotura de tuberías y al perforar en la corteza terrestre.

Oportunidades

- Alta demanda de aislamiento de tuberías debido a la creciente industria química y petroquímica

La demanda de productos de las industrias petroquímicas, como la química, la textil, la automoción, el embalaje y la construcción, está aumentando considerablemente. Los petroquímicos son los componentes derivados del petróleo y el gas que se utilizan en todo tipo de productos de uso diario, como plásticos, fertilizantes, embalajes, ropa, dispositivos digitales, equipos médicos, detergentes y neumáticos. Los plásticos son el producto más utilizado en todo el mundo. Al ser parte de la industria química, estos materiales poliméricos se utilizan en las industrias de la construcción, la electrónica, la aeroespacial y el transporte.

- Utilización de aislamientos de tuberías en la gestión mecánica de la industria alimentaria y farmacéutica

Las industrias farmacéuticas requieren una amplia gama de actividades de infraestructura. El calentamiento y enfriamiento de materiales a través del proceso de destilación y cristalización requiere una gran cantidad de energía. El aislamiento de tuberías industriales ayuda a minimizar la pérdida de energía y brinda beneficios generales a largo plazo al ahorrar el costo de la pérdida de calor y beneficiar otros requisitos del sistema.

El sistema de tuberías desempeña un papel fundamental en todo el proceso de fabricación de la industria alimentaria y farmacéutica, ya que en el transporte por tuberías se transportan todos los líquidos, gases y otras materias primas calientes y frías, como pesticidas, productos farmacéuticos o elementos para la mezcla de productos químicos. Los productos químicos más comunes que se utilizan en las industrias farmacéutica y alimentaria son el ácido bórico, el ácido sulfúrico, el ácido fosfórico, el ácido cítrico, el nitrato de amonio y los ácidos grasos. Todos estos sistemas de tuberías necesitan un aislamiento adecuado porque ayuda a reducir la pérdida de calor y, al mismo tiempo, garantiza la estabilidad de la temperatura.

Restricciones/Desafíos

- Incendio y explosión debido a la reacción de productos químicos con material aislante en tuberías

El tipo de material aislante utilizado debe depender del tipo de material que se esté transfiriendo a través de las tuberías. A veces, los productos químicos y los aceites que se transfieren a través de las tuberías forman una reacción química con el material aislante y pueden provocar incendios y explosiones. Cuando se transfieren materiales inflamables a través de las tuberías, debe haber bucles de incendios, detectores de incendios automáticos con hidrantes y monitores conectados en el área de almacenamiento para superar la protección contra cargas electrostáticas que pueden causar ignición.

El material aislante, como la espuma de poliuretano, puede incendiarse fácilmente y hacer explotar los productos químicos presentes en las tuberías. El material de celulosa se incendia cuando se aplica en las tuberías para proporcionar aislamiento. El incendio provocado debido a la reacción entre la celulosa y los productos químicos presentes en las tuberías no se puede extinguir por completo.

- La disponibilidad de sustitutos como la calefacción por trazado eléctrico

El calentamiento eléctrico por trazado es un sistema de calefacción que se utiliza para mantener adecuadamente el flujo de calor de los sistemas de tuberías en forma de soldadura eléctrica, que funciona mediante el contacto físico entre la tubería y el arco eléctrico. El calentamiento eléctrico por trazado también se conoce como aislamiento térmico, en el que una gran cantidad de calor generado por el elemento mantiene la temperatura de la tubería.

El calentamiento por trazado se utiliza ampliamente para proteger las tuberías de la congelación, mantener todo el sistema a una temperatura constante y para la transferencia segura de productos químicos o sustancias que se solidifican a determinadas temperaturas ambiente. El cable calefactor eléctrico por trazado se puede dividir en cuatro clasificaciones de productos distintas:

- Circuito en serie, cables con aislamiento mineral (MI) (salida de potencia constante)

- Cables calefactores de circuito paralelo (potencia de salida constante)

- Cables calefactores autorregulables (potencia variable)

Alto costo y alto consumo de tiempo en reemplazo de material aislante para tuberías instaladas en el mar y subterráneas

Hoy en día, el aislamiento de tuberías es una medida de ahorro de energía que se utiliza para mantener el flujo de calor dentro de las tuberías y mantener la temperatura general de las mismas. Ya sea que el aislamiento de tuberías esté bajo tierra o sobre la superficie, su instalación es el mayor desafío para los consumidores porque requiere un alto rango de costos de inversión para su correcto funcionamiento.

Según un estudio publicado por la Oficina Federal Suiza de Energía (evaluación económica basada en la construcción de un gasoducto), la contribución de una anualidad del 5,1 % anual revela que el costo total de distribución de calor de un gasoducto es de 2,16 céntimos de euro por kWh. El calor suministrado a los consumidores a través de él se obtiene mediante tuberías de diámetro optimizado, cuyo costo es el doble. Los costos totales de construcción de gasoductos están claramente dominados por los costos de capital que representan una participación del 62 %, mientras que el costo del combustible es de 4,0 céntimos de euro por kWh.

Durante la construcción de tuberías, es necesario realizar una vigilancia adecuada, ya que una vez finalizada la construcción y si se detecta algún fallo posteriormente, la reconstrucción requiere mucho tiempo e incluso más inversión. A partir de la información anterior, queda claro que la inversión en el aislamiento de tuberías es una tarea difícil y se tomaron medidas precisas durante la instalación de las tuberías, ya que la reinstalación supondrá el doble de gastos, lo que resulta difícil de pagar para los consumidores.

Desarrollo reciente

- En julio de 2022, Oleon firmó un acuerdo de adquisición de terrenos con Central Spectrum. Fue un hito importante para el crecimiento continuo de Oleon en Malasia. Esto permitirá a la empresa crecer y expandir sus instalaciones.

Mercado europeo de aislamiento de tuberías

El mercado europeo de aislamiento de tuberías se clasifica en cuatro segmentos notables, que se basan en el tipo de producto, tipo de material, temperatura y aplicación.

Por tipo de material

- Poliuretano

- Lana de roca

- Fibra de vidrio

- Poliestireno

- Expandido

- Extruido

- Poliolefina

- Polipropileno

- Policarbonato

- Cloruro de polivinilo

- Urea-formaldehído

- Espuma fenólica

- Espuma elastomérica

- Otros

Según el tipo de material, el mercado está segmentado en lana de roca, fibra de vidrio, poliuretano, poliestireno, poliolefina, polipropileno, policarbonato, cloruro de polivinilo, urea formaldehído, espuma fenólica, espuma elastomérica y otros.

Por tipo de producto

- Productos de aislamiento rígido

- Cubiertas aislantes de lana de roca

- Material de revestimiento

- Películas delgadas

- Envolturas

- Láminas

- Otros

Sobre la base del tipo de producto, el mercado está segmentado en películas delgadas, láminas, envolturas, productos aislantes rígidos, cubiertas aislantes de lana de roca, material de revestimiento y otros.

Por aplicación

- Petróleo y gas

- Industria química

- Alimentos y bebidas

- Construcción y edificación

- Energía y potencia

- Electrónica

- Automotor

- Transporte

- Otros

Sobre la base de la aplicación, el mercado está segmentado en construcción y edificación, electrónica, industria química, energía y electricidad, petróleo y gas, automotriz, transporte, alimentos y bebidas y otros.

Por temperatura

- Aislamiento térmico

- Aislamiento del frío

En función de la temperatura, el mercado está segmentado en aislamiento térmico y térmico.

Análisis y perspectivas regionales del mercado de aislamiento de tuberías en Europa

El mercado europeo de aislamiento de tuberías está segmentado según el tipo de producto, el tipo de material, la temperatura y la aplicación.

Los países del mercado europeo de aislamiento de tuberías son Alemania, Francia, Reino Unido, Rusia, Italia, España, Bélgica, Países Bajos, Suiza, Turquía y el resto de Europa.

Se espera que en 2022, Alemania domine el mercado europeo de aislamiento de tuberías, ya que la demanda de productos químicos y petróleo y gas es muy alta porque se requieren grandes tuberías subterráneas para exportar las sustancias de un lugar a otro para satisfacer la creciente demanda de los consumidores.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales al proporcionar un análisis de pronóstico de los datos del país.

Panorama competitivo y mercado europeo del aislamiento de tuberías

El panorama competitivo del mercado de aislamiento de tuberías en Europa ofrece información detallada por competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las líneas de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de aislamiento de tuberías en Europa.

Algunos de los participantes destacados que operan en el mercado europeo de aislamiento de tuberías son Kingspan Group, Saint-Gobain, Covestro AG, Knauf Insulation, BASF SE, Dow Izolan (una subsidiaria de DOW), Huntsman International LLC, Owens Corning, Johns Manville, Cellofoam GmbH & Co. KG, L'ISOLANTE K-FLEX SPA, 3M, NMC SA, ROCKWOOL International A/S, DUNMORE, ARMACELL y Röchling SE & Co. KG, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con tamaños de muestra grandes. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen cuadrículas de posicionamiento de proveedores, análisis de la línea de tiempo del mercado, descripción general y guía del mercado, cuadrículas de posicionamiento de la empresa, análisis de la participación de mercado de la empresa, estándares de medición, Europa vs. análisis regional y de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PIPE INSULATION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 PESTLE ANALYSIS

4.2.1 ENVIRONMENTAL FACTOR

4.2.2 LEGAL FACTOR

4.2.3 POLITICAL FACTOR

4.2.4 SOCIAL FACTOR

4.2.5 ECONOMIC FACTOR

4.2.6 TECHNOLOGICAL FACTOR

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 IMPACT OF THE WAR IN UKRAINE:

4.5 PRODUCTION CONSUMPTION ANALYSIS - EUROPE PIPE INSULATION MARKET

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 SUPPLY CHAIN ANALYSIS- EUROPE PIPE INSULATION MARKET

4.8 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING BUILDING CONSTRUCTION INDUSTRY

5.1.2 INDUSTRIAL PIPE INSULATION HELPS IN MINIMIZING HEAT LOSSES IN MANUFACTURING SITES

5.1.3 INCREASING SUPPLY OF OIL THROUGH PIPELINES OWING TO INCREASED MARINE POLLUTION CAUSED BY SHIPS

5.2 RESTRAINT

5.2.1 THE DAMAGES CAUSED TO THE ENVIRONMENT DUE TO CONSTRUCTION OF PIPES AND ITS INSULATION

5.2.2 CHANGE OF CHEMICAL STRUCTURE DUE TO ADULTERATION THROUGH INSULATING MATERIAL IN OIL & PETROCHEMICALS AND CHEMICALS

5.2.3 ADVERSE EFFECTS ON MARINE LIFE OWING TO GROWING PIPE INSTALLATIONS IN SEA

5.3 OPPORTUNITY

5.3.1 HIGH DEMAND FOR PIPE INSULATION DUE TO GROWING CHEMICALS AND PETROCHEMICALS INDUSTRY

5.3.2 UTILIZATION OF PIPE INSULATION IN THE MECHANICAL MANAGEMENT OF THE FOOD AS WELL AS PHARMACEUTICAL INDUSTRY

5.4 CHALLENGES

5.4.1 FIRE AND EXPLOSION DUE TO CHEMICALS REACTION WITH INSULATING MATERIAL IN PIPES

5.4.2 THE AVAILABILITY OF SUBSTITUTES LIKE ELECTRIC TRACE HEATING

5.4.3 HIGH COST AND HIGH TIME CONSUMPTION IN REPLACEMENT OF INSULATING MATERIAL FOR PIPES INSTALLED IN SEA AND UNDERGROUND

6 EUROPE PIPE INSULATION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 RIGID INSULATION PRODUCTS

6.2.1 RIGID INSULATION PRODUCTS, BY TYPE

6.2.1.1 RIGID FOAM

6.2.1.2 FIBER GLASS COVER

6.2.1.3 WOOD

6.2.1.4 OTHERS

6.3 STONE WOOL INSULATION COVERS

6.4 COATING MATERIAL

6.5 THIN FILMS

6.6 WRAPS

6.7 FOILS

6.8 OTHERS

7 EUROPE PIPE INSULATION MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 POLYURETHANE

7.3 ROCKWOOL

7.4 FIBERGLASS

7.5 POLYSTYRENE

7.5.1 POLYSTYRENE MATERIAL, BY TYPE

7.5.1.1 EXPANDED POLYSTYRENE

7.5.1.2 EXTRUDED POLYSTYRENE

7.6 POLYOLEFIN

7.7 POLYPROPYLENE

7.8 POLYCARBONATE

7.9 POLYVINYL CHLORIDE

7.1 UREA FORMALDEHYDE

7.11 PHENOLIC FOAM

7.12 ELASTOMERIC FOAM

7.13 OTHERS

8 EUROPE PIPE INSULATION MARKET, BY TEMPERATURE TYPE

8.1 OVERVIEW

8.2 COLD INSULATION

8.3 HOT INSULATION

9 EUROPE PIPE INSULATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 OIL AND GAS

9.2.1 OIL AND GAS, BY END-USER

9.3 OIL

9.3.1 OIL, BY END-USER

9.3.1.1 CRUDE OIL

9.3.1.2 PETROCHEMICAL

9.3.1.3 OTHER CRUDE OIL DERIVATIVES

9.4 GAS

9.4.1 GAS, BY END-USER

9.4.1.1 NATURAL GAS

9.4.1.2 SYNTHETIC GAS

9.4.2 OIL AND GAS, BY PRODUCT TYPE

9.4.2.1 RIGID INSULATION PRODUCTS

9.4.2.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.4.2.2 RIGID FOAM

9.4.2.3 FIBER GLASS COVER

9.4.2.4 WOOD

9.4.2.5 OTHERS

9.5 STONE WOOL INSULATION COVERS

9.6 COATING MATERIAL

9.7 THIN FILMS

9.8 WRAPS

9.9 FOILS

9.1 OTHERS

9.11 FOOD AND BEVERAGE

9.11.1 FOOD AND BEVERAGE, BY END-USER

9.12 BEVERAGE

9.12.1 BEVERAGE, BY END-USER

9.12.1.1 ALCOHOLIC BEVERAGE

9.12.1.2 DAIRY

9.12.1.3 AERATED DRINKS

9.12.1.4 JUICES AND FLAVORED WATER

9.12.1.5 OTHERS

9.13 FOOD

9.13.1 FOOD AND BEVERAGE, BY PRODUCT TYPE

9.13.1.1 RIGID INSULATION PRODUCTS

9.13.1.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.13.1.2 RIGID FOAM

9.13.1.3 FIBER GLASS COVER

9.13.1.4 WOOD

9.13.1.5 OTHERS

9.14 STONE WOOL INSULATION COVERS

9.15 COATING MATERIAL

9.16 THIN FILMS

9.17 WRAPS

9.18 FOILS

9.19 OTHERS

9.2 ENERGY & POWER

9.20.1 ENERGY & POWER, BY PRODUCT TYPE

9.20.1.1 RIGID INSULATION PRODUCTS

9.20.1.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.20.1.2 RIGID FOAM

9.20.1.3 FIBER GLASS COVER

9.20.1.4 WOOD

9.20.1.5 OTHERS

9.21 STONE WOOL INSULATION COVERS

9.22 COATING MATERIAL

9.23 THIN FILMS

9.24 WRAPS

9.25 FOILS

9.26 OTHERS

9.27 ELECTRONICS

9.27.1 ELECTRONICS, BY PRODUCT TYPE

9.27.1.1 RIGID INSULATION PRODUCTS

9.27.1.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.27.1.2 RIGID FOAM

9.27.1.3 FIBER GLASS COVER

9.27.1.4 WOOD

9.27.1.5 OTHERS

9.28 STONE WOOL INSULATION COVERS

9.29 COATING MATERIAL

9.3 THIN FILMS

9.31 WRAPS

9.32 FOILS

9.33 OTHERS

9.34 CHEMICAL INDUSTRY

9.34.1 CHEMICAL INDUSTRY, BY PRODUCT TYPE

9.34.1.1 RIGID INSULATION PRODUCTS

9.34.1.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.34.1.2 RIGID FOAM

9.34.1.3 FIBER GLASS COVER

9.34.1.4 WOOD

9.34.1.5 OTHERS

9.35 STONE WOOL INSULATION COVERS

9.36 COATING MATERIAL

9.37 THIN FILMS

9.38 WRAPS

9.39 FOILS

9.4 OTHERS

9.41 BUILDING AND CONSTRUCTION

9.41.1 BUILDING AND CONSTRUCTION, BY END-USER

9.41.1.1 COMMERCIAL

9.41.1.2 RESIDENTIAL

9.41.1.3 INSTITUTIONAL

9.41.1.4 INFRASTRUCTURE

9.41.2 BUILDING AND CONSTRUCTION, BY PRODUCT TYPE

9.41.2.1 RIGID INSULATION PRODUCTS

9.41.2.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.41.2.2 RIGID FOAM

9.41.2.3 FIBER GLASS COVER

9.41.2.4 WOOD

9.41.2.5 OTHERS

9.42 STONE WOOL INSULATION COVERS

9.43 COATING MATERIAL

9.44 THIN FILMS

9.45 WRAPS

9.46 FOILS

9.47 OTHERS

9.48 AUTOMOTIVE

9.48.1 AUTOMOTIVE, BY END USER

9.48.1.1 PASSENGERS CARS

9.48.1.2 COMMERCIAL VEHICLES

9.48.1.3 AGRICULTURE VEHICLES

9.48.1.4 OTHERS

9.48.2 AUTOMOTIVE, BY PRODUCT TYPE

9.48.2.1 RIGID INSULATION PRODUCTS

9.48.2.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.48.2.2 RIGID FOAM

9.48.2.3 FIBER GLASS COVER

9.48.2.4 WOOD

9.48.2.5 OTHERS

9.49 STONE WOOL INSULATION

9.5 COATING MATERIAL

9.51 THIN FILMS

9.52 WRAPS

9.53 FOILS

9.54 OTHERS

9.55 TRANSPORTATION

9.55.1 TRANSPORTATION, BY END USER

9.55.1.1 RAILWAYS

9.55.1.2 MARINE

9.55.1.3 OTHERS

9.55.2 TRANSPORTATION, BY PRODUCT TYPE

9.55.2.1 RIGID INSULATION PRODUCTS

9.55.2.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.55.2.2 RIGID FOAM

9.55.2.3 FIBER GLASS COVER

9.55.2.4 WOOD

9.55.2.5 OTHERS

9.56 STONE WOOL INSULATION

9.57 COATING MATERIAL

9.58 THIN FILMS

9.59 WRAPS

9.6 FOILS

9.61 OTHERS

9.62 OTHERS

9.62.1 OTHERS, BY PRODUCT TYPE

9.62.1.1 RIGID INSULATION PRODUCTS

9.62.1.1.1 RIGID INSULATION PRODUCTS, BY TYPE

9.62.1.2 RIGID FOAM

9.62.1.3 FIBER GLASS COVER

9.62.1.4 WOOD

9.62.1.5 OTHERS

9.63 STONE WOOL INSULATION

9.64 COATING MATERIAL

9.65 THIN FILMS

9.66 WRAPS

9.67 FOILS

9.68 OTHERS

10 EUROPE PIPE INSULATION MARKET, BY COUNTRY

10.1 GERMANY

10.2 FRANCE

10.3 U.K.

10.4 RUSSIA

10.5 ITALY

10.6 SWITZERLAND

10.7 SPAIN

10.8 BELGIUM

10.9 NETHERLANDS

10.1 TURKEY

10.11 REST OF EUROPE

11 EUROPE PIPE INSULATION MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.1.1 MERGER & ACQUISITION

11.1.2 NEW PRODUCT DEVELOPMENTS

11.1.3 PARTNERSHIPS

11.1.4 EXPANSION

11.1.5 EXHIBITION, CERTIFICATION AND AWARDS

12 SWOT ANALYSIS

12.1 STRENGTH: - STRONG GEOGRAHICAL PRESENCE

12.2 WEAKNESS: - LIMITED CONSUMPTION OF STANDARD PRODUCTS

12.3 OPPORTUNITIES: - PRODUCT EXPANSIONS INCREASES MARKET SHARE OF MANUFACTURERS

12.4 THREATS: - STRENGTHENING OF REGULATIONS AGAINST FOAM PRODUCTS

13 COMPANY PROFILES

13.1 SAINT GOBAIN

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 BASF SE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 ROCKWOOL INTERNATIONAL A/S

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 KINGSPAN GROUP

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 HUNTSMAN INTERNATIONAL LLC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 OWENS CORNING

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 COVESTRO AG

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 3M

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 ARMACELL

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 CELLOFOAM FMBH & CO. KG

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.11 DOW CHEMICAL COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 DUNMORE

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 JOHNS MANVILLE

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 KNAUF INSULATION

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 L'ISOLANTE K-FLEX S.P.A

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.16 NMC SA

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.17 RÖCHLING

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 CONCLUSION

16 RELATED REPORTS

Lista de Tablas

TABLE 1 INSULATION IMPORT GROWTH RATE, 2014-2015 (%)

TABLE 2 EUROPE PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029, USD THOUSAND

TABLE 4 EUROPE PIPE INSULATION MARKET, BY MATERIAL TYPE , 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029, USD THOUSAND

TABLE 6 EUROPE PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE ELECTRONICS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END USER, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCTS TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE PIPE INSULATION MARKET, BY COUNTRY, 2022-2029 (USD THOUSAND)

TABLE 35 GERMANY PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 GERMANY PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 GERMANY POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 GERMANY PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 40 GERMANY PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 GERMANY BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 42 GERMANY BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 GERMANY CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 GERMANY ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 GERMANY OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 51 GERMANY OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 52 GERMANY GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 53 GERMANY OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 GERMANY AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 56 GERMANY AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 GERMANY TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 59 GERMANY TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 GERMANY FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 62 GERMANY BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 63 GERMANY FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 GERMANY OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 GERMANY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 FRANCE POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 FRANCE PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 72 FRANCE PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 73 FRANCE BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 74 FRANCE BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 FRANCE ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 FRANCE CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 FRANCE ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 FRANCE OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 83 FRANCE OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 84 FRANCE GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 85 FRANCE OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 FRANCE AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 88 FRANCE AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 FRANCE TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 91 FRANCE TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 FRANCE FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 94 FRANCE BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 95 FRANCE FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 FRANCE OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 FRANCE RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 U.K. PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 U.K. PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 U.K. POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 U.K. PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 104 U.K. PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 U.K. BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 106 U.K. BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 U.K. ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 U.K. CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 U.K. ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 U.K. OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 115 U.K. OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 116 U.K. GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 117 U.K. OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 U.K. AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 120 U.K. AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 122 U.K. TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 123 U.K. TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 U.K. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 126 U.K. BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 127 U.K. FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 U.K. OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 U.K. RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 RUSSIA PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 RUSSIA PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 RUSSIA POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 RUSSIA PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 137 RUSSIA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 138 RUSSIA BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 RUSSIA ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 RUSSIA CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 RUSSIA ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 RUSSIA OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 147 RUSSIA OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 148 RUSSIA GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 149 RUSSIA OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 150 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 151 RUSSIA AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 152 RUSSIA AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 153 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 154 RUSSIA TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 155 RUSSIA TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 157 RUSSIA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 158 RUSSIA BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 159 RUSSIA FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 160 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 RUSSIA OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 RUSSIA RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 ITALY PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 ITALY PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 ITALY POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 ITALY PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 168 ITALY PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 ITALY BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 170 ITALY BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 171 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 ITALY ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 ITALY CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 176 ITALY ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 177 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 178 ITALY OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 179 ITALY OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 180 ITALY GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 181 ITALY OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 182 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 ITALY AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 184 ITALY AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 ITALY TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 187 ITALY TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 188 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 ITALY FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 190 ITALY BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 191 ITALY FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 192 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 193 ITALY OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 194 ITALY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 195 SWITZERLAND PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 196 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 SWITZERLAND PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 198 SWITZERLAND POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 199 SWITZERLAND PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 200 SWITZERLAND PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 201 SWITZERLAND BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 202 SWITZERLAND BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 203 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 204 SWITZERLAND ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 206 SWITZERLAND CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 SWITZERLAND ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 210 SWITZERLAND OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 211 SWITZERLAND OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 212 SWITZERLAND GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 213 SWITZERLAND OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 214 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 215 SWITZERLAND AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 216 SWITZERLAND AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 217 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 218 SWITZERLAND TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 219 SWITZERLAND TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 220 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 221 SWITZERLAND FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 222 SWITZERLAND BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 223 SWITZERLAND FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 224 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 225 SWITZERLAND OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 226 SWITZERLAND RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 227 SPAIN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 228 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 SPAIN PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 230 SPAIN POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 SPAIN PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 232 SPAIN PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 233 SPAIN BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 234 SPAIN BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 235 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 236 SPAIN ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 237 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 238 SPAIN CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 239 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 240 SPAIN ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 241 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 242 SPAIN OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 243 SPAIN OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 244 SPAIN GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 245 SPAIN OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 246 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 247 SPAIN AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 248 SPAIN AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 249 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 250 SPAIN TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 251 SPAIN TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 252 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 253 SPAIN FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 254 SPAIN BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 255 SPAIN FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 256 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 257 SPAIN OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 258 SPAIN RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 259 BELGIUM PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 260 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 261 BELGIUM PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 262 BELGIUM POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 263 BELGIUM PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 264 BELGIUM PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 265 BELGIUM BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 266 BELGIUM BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 267 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 268 BELGIUM ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 269 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 270 BELGIUM CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 271 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 272 BELGIUM ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 273 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 274 BELGIUM OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 275 BELGIUM OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 276 BELGIUM GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 277 BELGIUM OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 278 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 279 BELGIUM AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 280 BELGIUM AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 281 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 282 BELGIUM TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 283 BELGIUM TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 284 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 285 BELGIUM FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 286 BELGIUM BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 287 BELGIUM FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 288 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 289 BELGIUM OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 290 BELGIUM RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 291 NETHERLANDS PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 292 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 293 NETHERLANDS PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 294 NETHERLANDS POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 295 NETHERLANDS PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 296 NETHERLANDS PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 297 NETHERLANDS BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 298 NETHERLANDS BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 299 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 300 NETHERLANDS ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 301 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 302 NETHERLANDS CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 303 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 304 NETHERLANDS ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 305 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 306 NETHERLANDS OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 307 NETHERLANDS OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 308 NETHERLANDS GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 309 NETHERLANDS OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 310 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 311 NETHERLANDS AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 312 NETHERLANDS AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 313 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 314 NETHERLANDS TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 315 NETHERLANDS TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 316 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 317 NETHERLANDS FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 318 NETHERLANDS BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 319 NETHERLANDS FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 320 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 321 NETHERLANDS OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 322 NETHERLANDS RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 323 TURKEY PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 324 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 325 TURKEY PIPE INSULATION MARKET, BY MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 326 TURKEY POLYSTYRENE IN PIPE INSULATION MARKET, BY POLYSTYRENE MATERIAL TYPE, 2020-2029 (USD THOUSAND)

TABLE 327 TURKEY PIPE INSULATION MARKET, BY TEMPERATURE, 2020-2029 (USD THOUSAND)

TABLE 328 TURKEY PIPE INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 329 TURKEY BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY BUILDING AND CONSTRUCTION END-USER, 2020-2029 (USD THOUSAND)

TABLE 330 TURKEY BUILDING AND CONSTRUCTION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 331 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 332 TURKEY ELECTRONIC IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 333 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 334 TURKEY CHEMICAL INDUSTRY IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 335 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 336 TURKEY ENERGY & POWER IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 337 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 338 TURKEY OIL & GAS IN PIPE INSULATION MARKET, BY OIL & GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 339 TURKEY OIL IN PIPE INSULATION MARKET, BY OIL END-USER, 2020-2029 (USD THOUSAND)

TABLE 340 TURKEY GAS IN PIPE INSULATION MARKET, BY GAS END-USER, 2020-2029 (USD THOUSAND)

TABLE 341 TURKEY OIL & GAS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 342 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 343 TURKEY AUTOMOTIVE IN PIPE INSULATION MARKET, BY AUTOMOTIVE END-USER, 2020-2029 (USD THOUSAND)

TABLE 344 TURKEY AUTOMOTIVE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 345 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 346 TURKEY TRANSPORTATION IN PIPE INSULATION MARKET, BY TRANSPORTATION END-USER, 2020-2029 (USD THOUSAND)

TABLE 347 TURKEY TRANSPORTATION IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 348 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 349 TURKEY FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY FOOD AND BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 350 TURKEY BEVERAGE IN PIPE INSULATION MARKET, BY BEVERAGE END-USER, 2020-2029 (USD THOUSAND)

TABLE 351 TURKEY FOOD AND BEVERAGE IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 352 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 353 TURKEY OTHERS IN PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 354 TURKEY RIGID INSULATION PRODUCTS IN PIPE INSULATION MARKET, BY RIGID INSULATION PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 355 REST OF EUROPE PIPE INSULATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

Lista de figuras

FIGURE 1 EUROPE PIPE INSULATION MARKET: SEGMENTATION

FIGURE 2 EUROPE PIPE INSULATION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PIPE INSULATION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PIPE INSUALTION MARKET: EUROPE VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE PIPE INSUALTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PIPE INSULATION MARKET: PRODUCT LIFE LINE CURVE

FIGURE 7 EUROPE PIPE INSULATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE PIPE INSULATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE PIPE INSULATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE PIPE INSULATION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 EUROPE PIPE INSULATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE PIPE INSULATION MARKET: SEGMENTATION

FIGURE 13 GERMANY IS EXPECTED TO DOMINATE THE MARKET FOR PIPE INSULATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 STRONG AWARENESS TOWARDS PREVENTIVE MAINTENANCE IN THE MANUFACTURING INDUSTRY IS DRIVING THE EUROPE PIPE INSULATION MARKET IN THE FORECAST PERIOD FROM 2022 TO 2029

FIGURE 15 RIGID INSULATION PRODUCTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PIPE INSULATION MARKET IN 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF GLOBAL PIPE INSULATION MARKET

FIGURE 17 EUROPE PIPE INSULATION MARKET, BY PRODUCT TYPE, 2021

FIGURE 18 EUROPE PIPE INSULATION MARKET, BY MATERIAL TYPE, 2021

FIGURE 19 EUROPE PIPE INSULATION MARKET, BY TEMPERATURE, 2021

FIGURE 20 EUROPE PIPE INSULATION MARKET, BY APPLICATION, 2021

FIGURE 21 EUROPE PIPE INSULATION MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE PIPE INSULATION MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE PIPE INSULATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE PIPE INSULATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE PIPE INSULATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 26 EUROPE PIPE INSULATION MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.