Europe Octabin Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

529.91 Million

USD

788.90 Million

2024

2032

USD

529.91 Million

USD

788.90 Million

2024

2032

| 2025 –2032 | |

| USD 529.91 Million | |

| USD 788.90 Million | |

|

|

|

|

Segmentación del mercado europeo de octabinas por tipo de producto (octabina de flujo libre, octabina de descarga, octabina autoensamblable, octabina estándar y octabina telescópica), capacidad (personalizada y estándar), usuario final (industria química, alimentaria, bienes de consumo, farmacéutica, etc.): tendencias y pronóstico del sector hasta 2032.

Tamaño del mercado de Octabin

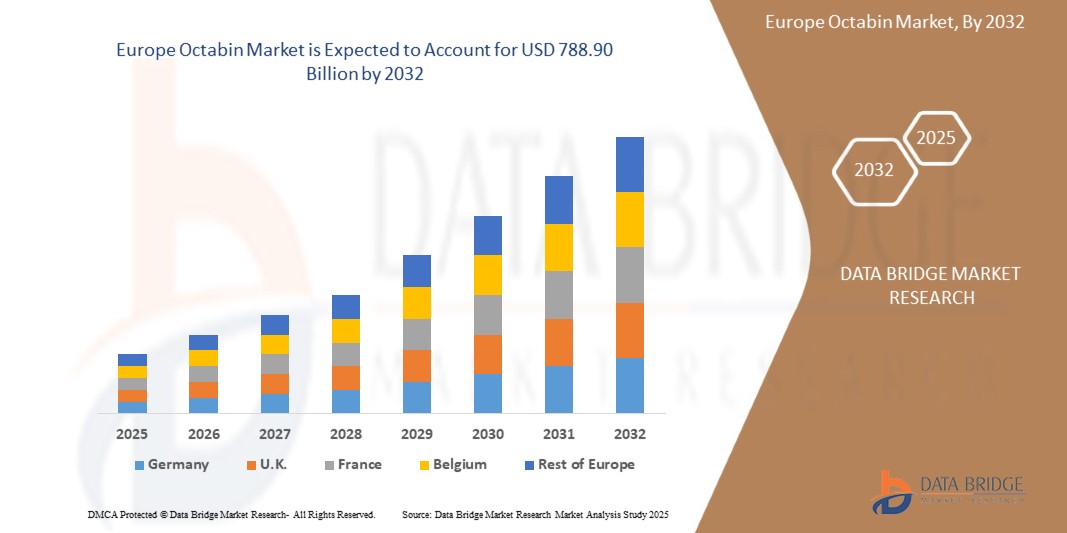

- El tamaño del mercado europeo de octabina se valoró en USD 529,91 millones en 2024 y se espera que alcance los USD 788,90 millones para 2032 , con una CAGR del 5,1% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente demanda de soluciones de embalaje a granel rentables, sostenibles y que ahorren espacio en industrias como la química, la alimentaria y la farmacéutica, lo que lleva a una mayor adopción de octabines para el manejo de materiales de gran volumen y el envío internacional.

- Además, el creciente énfasis en los envases reciclables y ligeros, sumado a las presiones regulatorias para reducir el uso de plástico, está posicionando a los octabins como una alternativa preferida para el transporte a granel. Estos factores convergentes están acelerando la adopción de soluciones de octabins, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de Octabin

- Los octabines son contenedores corrugados multicapa de alta resistencia, diseñados para el envasado y transporte a granel de productos secos fluidos, como resinas, polvos e ingredientes alimentarios. Su integridad estructural, rentabilidad y compatibilidad con sistemas de manipulación automatizados los hacen ideales para uso industrial de gran volumen.

- La creciente demanda de octabines se debe principalmente a la creciente globalización de las cadenas de suministro, el aumento de las exportaciones de materiales granulares y en polvo y la creciente presión para reducir los residuos de envases mediante el uso de soluciones plegables y ecológicas.

- Alemania dominó el mercado de octabina en 2024, debido a su fuerte presencia en las industrias química y automotriz, que requieren soluciones de embalaje duraderas y de alta capacidad para el transporte a granel.

- Se espera que Francia sea la región de más rápido crecimiento en el mercado de octabina durante el período de pronóstico debido a la creciente demanda en los sectores alimentario y farmacéutico de envases higiénicos de gran capacidad que se ajusten a los requisitos de transporte de etiqueta limpia y libre de contaminación.

- El segmento estándar dominó el mercado con una cuota del 58,3 % en 2024, gracias a su consistencia en la capacidad de carga, facilidad de apilado y compatibilidad con los sistemas estandarizados de envío y almacenamiento. Las empresas que gestionan necesidades recurrentes de embalaje a granel, especialmente en los sectores petroquímico y agrícola, suelen optar por tamaños estándar para simplificar la manipulación y reducir los errores operativos.

Alcance del informe y segmentación del mercado de Octabin

|

Atributos |

Perspectivas clave del mercado de Octabin |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de Octabin

Creciente tendencia hacia materiales ecológicos

- El mercado de octavinos se ve cada vez más influenciado por la tendencia hacia materiales ecológicos y sostenibles debido a la creciente conciencia ambiental y a las regulaciones de embalaje más estrictas. Los octavinos de cartón corrugado, conocidos por su reciclabilidad y menor impacto ambiental en comparación con las alternativas de plástico o metal, están ganando protagonismo.

- Por ejemplo, empresas líderes como WestRock Company y Smurfit Kappa Group están expandiendo su producción de octavinos de cartón ondulado, aprovechando la demanda de los sectores de alimentación y bebidas que priorizan las soluciones de envasado sostenibles. Esto coincide con la preferencia de los consumidores por los envases ecológicos y las medidas regulatorias que fomentan la reducción de residuos.

- Las innovaciones incluyen adhesivos y recubrimientos de base biológica que mejoran la durabilidad y mantienen el cumplimiento ecológico.

- El auge del comercio electrónico y los envíos masivos impulsa la adopción de octabines livianos y reciclables que reducen la huella de carbono del transporte.

- Las estrategias de marca ahora enfatizan los principios de la economía circular al ofrecer modelos de octabin reutilizables o retornables.

- Los gobiernos regionales de Europa y Asia-Pacífico están promoviendo estándares de embalaje sostenibles que impulsan aún más el crecimiento del octabin ecológico.

Dinámica del mercado de Octabin

Conductor

“Mayor uso en la agricultura y el procesamiento de alimentos”

- Las industrias de agricultura y procesamiento de alimentos son importantes usuarios finales que impulsan la demanda de octabin debido a la necesidad de envases a granel robustos y rentables que garanticen la seguridad del producto, preserven la calidad y simplifiquen la logística.

- Por ejemplo, empresas como International Paper and Packaging Corporation of America suministran ampliamente octabines a exportadores agrícolas y fabricantes de alimentos para transportar frutas, granos, nueces y polvos de manera segura y eficiente.

- La resistencia y la capacidad de apilado de los octabines reducen el deterioro y las pérdidas en tránsito, algo fundamental para productos perecederos y envíos de gran volumen.

- La creciente demanda mundial de productos frescos y alimentos procesados, junto con el incremento de las exportaciones de frutas (especialmente manzanas y cítricos) de regiones como China, India y Estados Unidos, acelera aún más el crecimiento del mercado.

- La creciente necesidad del sector farmacéutico de envasado a granel de ingredientes secos y productos químicos también impulsa la expansión del mercado de octabina. La expansión de la logística de la cadena de frío y las plataformas de comercio electrónico impulsa su adopción, ya que las empresas requieren contenedores flexibles y seguros para las distintas etapas de la cadena de suministro.

Restricción/Desafío

Cumplimiento normativo y normas de embalaje

- Los estrictos y cambiantes requisitos de cumplimiento normativo y los estándares de envasado plantean desafíos para los fabricantes y usuarios de octabin en todas las industrias, lo que afecta los procesos de selección, diseño y certificación de materiales.

- Por ejemplo, las regulaciones que garantizan la seguridad en el contacto con alimentos, la contención de materiales peligrosos y las certificaciones de sostenibilidad requieren que los productores de octabina como International Paper y WestRock inviertan fuertemente en pruebas, garantía de calidad y documentación, lo que aumenta los costos y los plazos de entrega.

- Los estándares regionales divergentes complican las cadenas de suministro globales al requerir soluciones de embalaje personalizadas para diferentes mercados, lo que agrega complejidad y gastos operativos.

- El cumplimiento de las directivas de sostenibilidad, como la Directiva sobre envases y residuos de envases de la UE, a menudo exige el uso de materiales reciclables y límites en ciertos plásticos o productos químicos, lo que restringe algunas opciones de materiales.

- El incumplimiento conlleva el riesgo de sanciones legales, retiradas de productos y daños a la reputación de la marca, lo que lleva a una adopción cautelosa en algunos sectores. Se están llevando a cabo esfuerzos continuos de armonización e inversiones en programas de certificación, pero esto aumenta las barreras de entrada y los desafíos operativos para nuevos actores y fabricantes más pequeños.

Alcance del mercado de Octabin

El mercado está segmentado según el tipo de producto, la capacidad y el usuario final.

• Por tipo de producto

Según el tipo de producto, el mercado de octabines se segmenta en octabines de base de flujo libre, octabines de descarga de base, octabines autoensamblables, octabines estándar y octabines telescópicos. El segmento de octabines estándar representó la mayor participación en los ingresos en 2024 debido a su amplia aplicación en diversas industrias, como la química, la alimentaria y la de bienes de consumo. Su simplicidad estructural, su rentabilidad y su formato listo para usar lo convierten en la opción preferida para el envasado a granel de gránulos, resinas y polvos. Además, su compatibilidad con palés estándar y la eficiente utilización del espacio durante el transporte aumentan aún más su demanda entre los envasadores industriales.

Se proyecta que el segmento de octabines autoensamblables registre el mayor crecimiento entre 2025 y 2032, impulsado por su construcción ligera, menores costos de almacenamiento y facilidad de ensamblaje in situ. A medida que las empresas buscan minimizar los gastos logísticos y optimizar el almacenamiento, la demanda de soluciones de empaquetado plano y fáciles de usar, como los octabines autoensamblables, está aumentando significativamente. Su adaptabilidad a marcas personalizadas y variaciones estructurales también los hace ideales para exportadores y empresas enfocadas en empaques sostenibles y escalables.

• Por capacidad

En función de la capacidad, el mercado de octabines se segmenta en personalizado y estándar. El segmento de capacidad estándar lideró el mercado con una participación del 58,3 % en 2024, favorecido por su consistencia en la capacidad de carga, facilidad de apilado y compatibilidad con los sistemas estandarizados de envío y almacenamiento. Las empresas que atienden necesidades recurrentes de embalaje a granel, especialmente en los sectores petroquímico y agrícola, suelen optar por tamaños estándar para simplificar la manipulación y reducir errores operativos.

Se prevé que el segmento de capacidad personalizada experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente preferencia por envases a medida que se ajusten a restricciones logísticas o volúmenes de producto específicos. Industrias como la farmacéutica y la química especializada, donde la sensibilidad del material o la optimización del volumen son cruciales, optan cada vez más por octabines personalizados. La personalización también permite a las empresas abordar con mayor eficacia los requisitos de marca, cumplimiento de seguridad y sostenibilidad.

• Por el usuario final

Según el usuario final, el mercado de octabines se segmenta en las industrias química, alimentaria, de bienes de consumo y farmacéutica, entre otras. El segmento de la industria química dominó la cuota de mercado en 2024 gracias al amplio uso de octabines para transportar polímeros, gránulos de plástico y productos químicos en polvo de forma segura y sin contaminación. Su estructura rígida, estabilidad de carga y resistencia a derrames los hacen ideales para la manipulación de materiales peligrosos y de gran volumen.

Se prevé que el segmento de la industria alimentaria experimente su mayor crecimiento entre 2025 y 2032, impulsado por el aumento de las exportaciones mundiales de alimentos y la creciente demanda de opciones de envasado higiénicas, ecológicas y a granel. Los octavinos están ganando terreno en este sector para el almacenamiento y el envío de ingredientes alimentarios secos, como cereales, legumbres y mezclas en polvo. Su reciclabilidad y su cumplimiento de las normas de seguridad alimentaria los posicionan como una opción sostenible para el envasado de alimentos.

Análisis regional del mercado de Octabin

- Alemania dominó el mercado de octabina con la mayor participación en los ingresos en 2024, impulsada por su fuerte presencia en las industrias química y automotriz, que requieren soluciones de embalaje duraderas y de alta capacidad para el transporte a granel.

- El liderazgo del país está respaldado por una infraestructura de fabricación bien establecida, estrictos estándares de seguridad de embalaje y una creciente demanda de contenedores a granel sostenibles y reciclables en logística y almacenamiento.

- La posición de Alemania se ve fortalecida aún más por la integración de la automatización en las líneas de envasado, los avances continuos en la tecnología de embalaje de cartón corrugado y la creciente exportación de resinas plásticas y productos químicos en polvo que dependen de los octabines para un tránsito seguro.

Análisis del mercado de Octabin en el Reino Unido

Se prevé que el mercado británico de octavinos experimente un crecimiento sostenido entre 2025 y 2032, impulsado por la mayor demanda de envases a granel sostenibles y plegables en los sectores de procesamiento de alimentos, distribución minorista y bienes de consumo. A medida que las empresas responden a la presión regulatoria para reducir los residuos de envases y adoptar soluciones reciclables, los octavinos se vuelven cada vez más atractivos gracias a su diseño ligero y su eficiencia de apilamiento. Además, la transición del país hacia la automatización de almacenes y logística externa está impulsando una mayor adopción de formatos de envases que ofrecen flexibilidad operativa y ahorro de espacio. El sólido ecosistema de comercio electrónico del Reino Unido y el énfasis en la optimización de la cadena de suministro también impulsan la adopción de soluciones de envasado de alto rendimiento que equilibran durabilidad, rentabilidad y sostenibilidad.

Análisis del mercado de Octabin en Francia

Se proyecta que Francia registre la CAGR más rápida en el mercado europeo de octabines durante el período de pronóstico de 2025 a 2032. El crecimiento está respaldado por la creciente demanda en los sectores alimentario y farmacéutico de envases higiénicos de gran capacidad que se alineen con los requisitos de transporte de etiqueta limpia y libre de contaminación. Las iniciativas de sostenibilidad impulsadas por el gobierno y las regulaciones sobre la reducción de plástico están acelerando la transición hacia alternativas de cartón corrugado como los octabines, especialmente en industrias que manejan polvos, resinas e ingredientes de grado alimenticio. Además, la creciente base de fabricantes locales de envases y startups de Francia enfocadas en la eco-innovación está impulsando la disponibilidad de formatos de octabines biodegradables y personalizables. El aumento de la inversión en logística verde e infraestructura de almacenamiento urbano también está creando oportunidades para soluciones de embalaje a granel compactas y plegables que facilitan la entrega y el almacenamiento de última milla en entornos con limitaciones de espacio.

Cuota de mercado de Octabin

La industria del octabin está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- DS Smith (Reino Unido)

- Smurfit Kappa (Irlanda)

- Grupo VPK (Bélgica)

- Mondi (Reino Unido)

- International Paper (EE. UU.)

- Quadwall (Reino Unido)

- WestRock Company (EE. UU.)

- Klingele Paper & Packaging SE & Co. KG (Alemania)

- Rondo Ganahl AG (Austria)

- WEBER Paletten & Verpackung (Alemania)

- S Lester Packing Materials Ltd. (Reino Unido)

- TRICOR AG (Alemania)

- Tape and Go Europe (Países Bajos)

Últimos avances en el mercado europeo de octabina

- En febrero de 2024, TRICOR AG celebró la ceremonia de inauguración de la moderna planta de Weeze-Goch, lo que representó una importante inversión de 170 millones de euros. La planta, construida con los más altos estándares de eficiencia energética, empleó a más de 200 personas y contó con un sistema fotovoltaico de 3,3 megavatios. La empresa prioriza un entorno de trabajo sostenible y moderno. Su ubicación estratégica cerca de la frontera con los Países Bajos posiciona a TRICOR AG como un proveedor líder europeo de embalajes industriales. La planta, equipada con tecnología innovadora, estableció nuevos estándares en la fabricación y el procesamiento de cartón ondulado grueso.

- En octubre de 2023, el Grupo VPK adquirió una participación mayoritaria en Zetacarton, empresa italiana de cartón ondulado, lo que marcó su entrada en Italia. Zetacarton se especializa en embalajes plegables y de caja grande, complementando la oferta de embalajes "fit-2size" del Grupo VPK. Esta operación amplía la cobertura geográfica de VPK para el embalaje plegable, atendiendo a centros de distribución logística de comercio electrónico en toda Europa. La reciente inversión de Zetacarton en una nueva impresora digital de una sola pasada amplía su gama de productos, contribuyendo a su crecimiento sostenible. La adquisición se alinea con la estrategia a largo plazo del Grupo VPK de expansión sostenible en el mercado europeo.

- En diciembre de 2023, Klingele Paper & Packaging SE & Co. KG finalizó los planes para introducir un Heatcube del Grupo Kioto en su planta de Werne. El Heatcube, una innovadora tecnología de almacenamiento de energía térmica con sales fundidas, pretende sustituir el gas natural en la planta de Werne y reducir las emisiones de CO2 en más de 3400 toneladas anuales. La firma de un pliego de condiciones detalló los detalles del proyecto, con un estudio de ingeniería que comenzará en enero de 2024 y un contrato de compraventa previsto para el Heatcube para abril de 2024. Esta iniciativa ayuda a la empresa a implementar prácticas respetuosas con el medio ambiente en la industria del papel y el cartón ondulado, lo que le permitirá posicionarse entre los actores del mercado en términos de sostenibilidad.

- En mayo de 2023, Rondo Ganahl AG celebró su 52.º aniversario con la inauguración de un nuevo centro de impresión en St. Ruprecht. Con una inversión de 37,5 millones de dólares estadounidenses, la planta aspira a aumentar la producción hasta un 30 % anual, satisfaciendo así la creciente demanda de embalajes de cartón ondulado ecológicos, especialmente en la industria alimentaria. El nuevo centro de impresión, equipado con tecnología avanzada, contribuye al compromiso de la empresa con la reducción del impacto ambiental, el uso de energía solar para la producción y la generación de 2,5 millones de kilovatios hora de energía limpia al año en St. Ruprecht.

- En abril de 2023, Mondi invirtió en nueva tecnología para aumentar la capacidad de producción de su gama de papel barrera funcional. Esta inversión incluye una nueva extrusora, la reconstrucción de la máquina de recubrimiento, mejoras y la optimización de la eficiencia de la maquinaria. Esta expansión ayudará a la empresa a satisfacer la demanda y a mejorar sus ingresos en el mercado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.