Mercado europeo de secuenciación de próxima generación (NGS), por producto (instrumentos, consumibles y servicios), aplicaciones (diagnóstico, descubrimiento de biomarcadores, medicina de precisión , descubrimiento de fármacos, agricultura e investigación animal y otros), usuario final (empresas farmacéuticas y biotecnológicas, centros de investigación e institutos académicos y gubernamentales y hospitales y clínicas), país (Alemania, Reino Unido, Italia, Francia, España, Suiza, Rusia, Turquía, Bélgica, Países Bajos y resto de Europa), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado europeo de secuenciación de próxima generación (NGS)

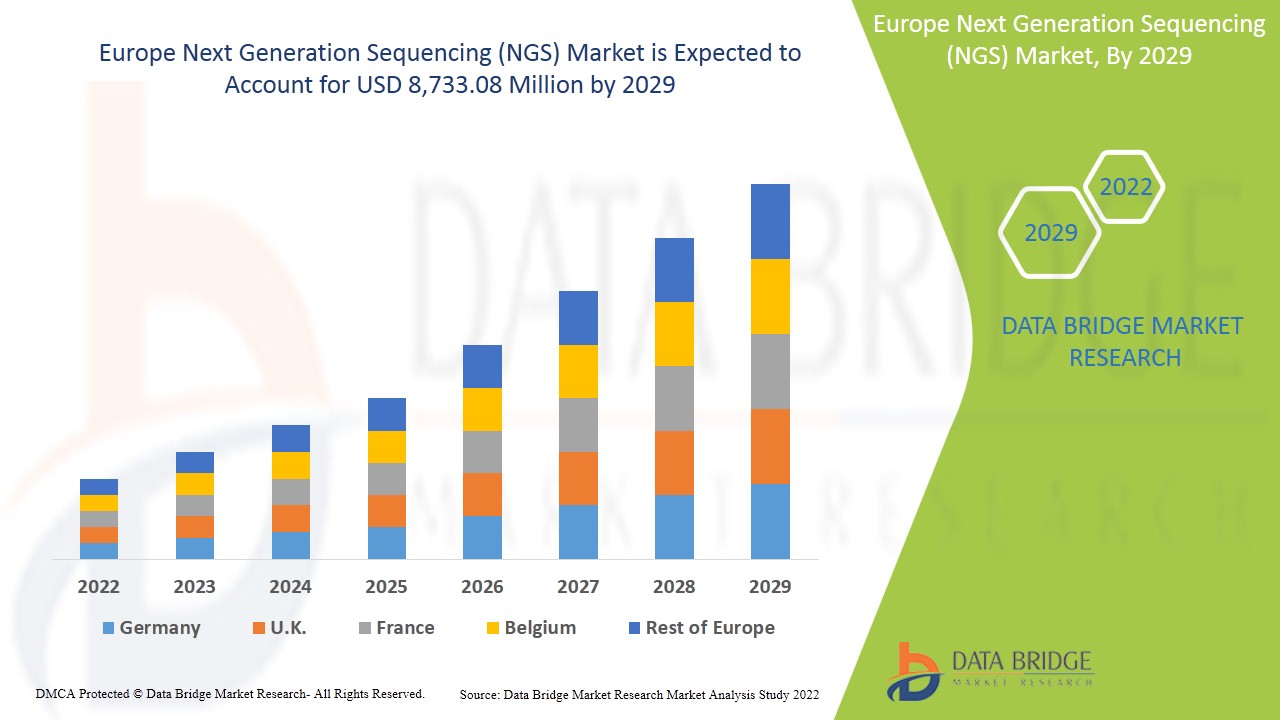

Se espera que el mercado europeo de secuenciación de próxima generación (NGS) gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 15,7% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 8.733,08 millones para 2029. El aumento de las actividades de investigación sobre la secuenciación de próxima generación actúa como impulsor del crecimiento del mercado de secuenciación de próxima generación (NGS).

La secuenciación de alto rendimiento, considerada más ampliamente como la secuenciación de "próxima generación" (NGS), ahora está integrada en la práctica clínica habitual debido a los numerosos avances técnicos y funcionales, mientras que los primeros protocolos dependían de muestras extraídas fuera de los flujos de trabajo típicos en patología clínica, especímenes estándar fijados con formalina e incluidos en parafina que se pueden usar con más regularidad como material de partida para la NGS. Además, se están acumulando protocolos para el análisis e interpretación de datos de NGS, así como bases de conocimiento, lo que permite a los médicos actuar más fácilmente sobre la información genómica en el punto de atención al paciente. La presencia de una amplia gama de productos de la secuenciación de próxima generación utilizados en el diagnóstico de enfermedades crónicas está satisfaciendo la necesidad de los centros de atención médica. El aumento del avance tecnológico conduce al desarrollo de una secuenciación de próxima generación (NGS) altamente eficiente en el mercado.

Los principales factores que impulsan el crecimiento del mercado de secuenciación de próxima generación (NGS) son el uso de la secuenciación de próxima generación en el desarrollo de fármacos y la amplia cartera ofrecida por los principales actores, y el factor que obstaculiza el crecimiento del mercado de secuenciación de próxima generación (NGS) incluye el alto costo de los productos de secuenciación de próxima generación y el retiro de productos.

El informe de mercado de secuenciación de próxima generación (NGS) proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de secuenciación de próxima generación (NGS), comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de secuenciación de próxima generación (NGS)

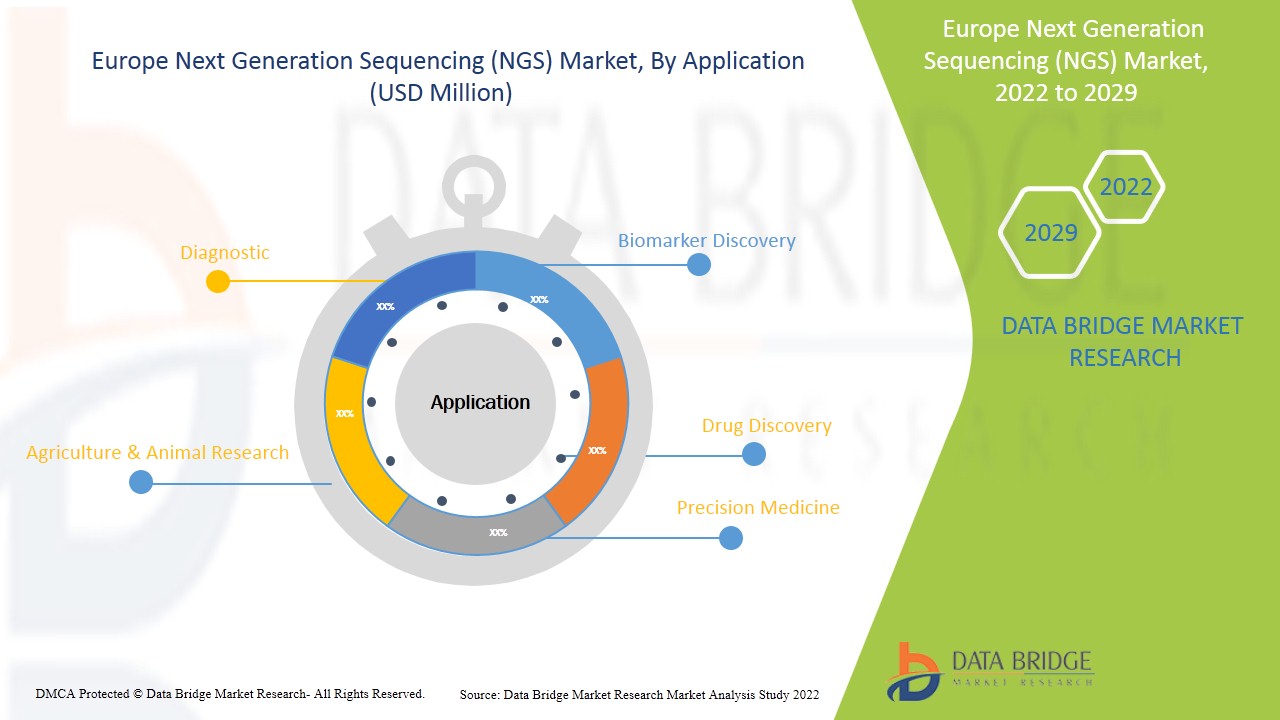

El mercado de secuenciación de próxima generación (NGS) está segmentado en función del producto, la aplicación y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- En función del producto, el mercado europeo de secuenciación de próxima generación (NGS) se segmenta en instrumentos, consumibles y servicios. En 2022, se espera que el segmento de instrumentos domine el mercado europeo de secuenciación de próxima generación (NGS), ya que los instrumentos cuentan con una amplia cartera de instrumentos disponibles para los países europeos y este es también el segmento principal que contribuye a los ingresos.

- En función de la aplicación, el mercado europeo de secuenciación de próxima generación (NGS) se segmenta en diagnóstico, descubrimiento de fármacos, descubrimiento de biomarcadores, medicina de precisión, agricultura e investigación animal. En 2022, se espera que el segmento de diagnóstico domine el mercado europeo de secuenciación de próxima generación (NGS) debido al hecho de que los laboratorios clínicos y los laboratorios están utilizando NGS para el diagnóstico rutinario de diversas enfermedades porque tiene el potencial de ofrecer resultados de pruebas precisos y proporcionar un excelente régimen de tratamiento.

- En función del usuario final, el mercado europeo de secuenciación de próxima generación (NGS) está segmentado en hospitales y clínicas, centros de investigación e institutos académicos y gubernamentales, empresas farmacéuticas y de biotecnología. En 2022, se espera que los centros de investigación y los institutos académicos y gubernamentales dominen el mercado europeo de secuenciación de próxima generación (NGS), ya que se sabe que los países europeos tienen institutos de investigación avanzados que trabajan constantemente en NGS en colaboración con empresas farmacéuticas.

Análisis a nivel de país del mercado de secuenciación de próxima generación (NGS)

Se analiza el mercado de secuenciación de próxima generación (NGS) y se proporciona información sobre el tamaño del mercado por país, producto, aplicación y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de secuenciación de próxima generación (NGS) son el Reino Unido, Alemania, Francia, España, Italia, Países Bajos, Suiza, Rusia, Turquía, Austria, Irlanda y el resto de Europa.

Se espera que el segmento de centros de investigación e institutos académicos y gubernamentales en Alemania de la región europea crezca con la tasa de crecimiento más alta en el período de pronóstico de 2022 a 2029 debido al aumento del uso de NGS en estos centros donde se realiza la investigación a nivel del suelo.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Las crecientes actividades estratégicas de los principales actores del mercado para mejorar el conocimiento sobre el tratamiento de secuenciación de próxima generación (NGS) están impulsando el crecimiento del mercado de secuenciación de próxima generación (NGS)

El mercado de secuenciación de próxima generación (NGS) también le proporciona un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2011 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de la secuenciación de próxima generación (NGS)

El panorama competitivo del mercado de secuenciación de próxima generación (NGS) proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de secuenciación inducida de próxima generación (NGS).

Algunas de las principales empresas que se dedican a la secuenciación de próxima generación (NGS) son Agilent Technologies, Inc., ThermoFisher Scientific, Inc., QIAGEN, Illumina, Inc., Bio-Rad Laboratories, Inc., BGI (una subsidiaria de BGI Group), Oxford Nanopore Technologies plc, entre otros actores nacionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Numerosas empresas de todo el mundo también han iniciado contratos y acuerdos que están acelerando el mercado de secuenciación de próxima generación (NGS).

Por ejemplo,

- En febrero de 2021, Thermo Fisher Scientific Inc. anunció que había ganado seis premios en los premios anuales CMO Leadership Awards. Los premios, presentados por Life Science Leader y Outsourced Pharma, reconocen a los principales socios de fabricación por contrato según la evaluación de las empresas biofarmacéuticas y biotecnológicas. Se estima que este reconocimiento fortalecerá la presencia de la empresa en el mercado europeo y conducirá a un aumento del crecimiento de la empresa en los próximos años.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de la empresa en el mercado de secuenciación de próxima generación (NGS), lo que también brinda beneficios para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL'S ANALYSIS

3.2 PORTER'S FIVE FORCES MODEL

4 REGULATIONS OF EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 DECREASE IN THE COST OF GENETIC SEQUENCING PER BASE

5.1.2 INCREASE IN THE ADOPTION OF GENOME-FOCUSED PHARMACOLOGY

5.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY MAJOR PLAYER

5.1.4 USE OF NEXT GENERATION SEQUENCING IN DRUG DEVELOPMENT

5.1.5 INCREASED TREND TOWARDS PERSONALIZED MEDICATION

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTRUMENT

5.2.2 DIFFICULTY IN CLINICAL NGS DATA ANALYSIS

5.2.3 CYBER SECURITY CONCERN IN GENOMICS

5.3 OPPORTUNITIES

5.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

5.3.2 PRODUCT APPROVAL IN RECENT YEARS

5.3.3 ADVANCEMENT IN NGS TECHNOLOGY

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM NGS

5.4.2 CHALLENGES FOR IMPLEMENTING NGS IN THE CLINICAL LAB

6 IMPACT OF COVID-19 ON EUROPE NEXT GENERATION SEQUENCING (NGS) HEALTHCARE INDUSTRY

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY CHAIN

6.4 KEY INITIATIVES BY MARKET PLAYERS DURING COVID-19

6.5 CONCLUSION

7 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 INSTRUMENTS

7.2.1 HISEQ SERIES

7.2.2 MISEQ SERIES

7.2.3 ION TORRENT

7.2.4 PACBIO RS II

7.2.5 SEQUEL SYSTEM

7.2.6 SOLID

7.2.7 OTHERS

7.3 CONSUMABLE

7.3.1 LIBRARY PREPARATION & TARGET ENRICHMENT

7.3.2 SAMPLE PREPARATION CONSUMABLES

7.3.3 OTHERS

7.4 SERVICES

7.4.1 SEQUENCING SERVICES

7.4.2 DATA MANAGEMENT

8 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 DIAGNOSTICS

8.3 BIOMARKER DISCOVERY

8.4 PRECISION MEDICINE

8.5 DRUG DISCOVERY

8.6 AGRICULTURE & ANIMAL RESEARCH

9 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER

9.1 OVERVIEW

9.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

9.3 RESEARCH CENTERS & ACADEMIC AND GOVERNMENT INSTITUTES

9.4 HOSPITAL & CLINICS

10 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 FRANCE

10.1.3 U.K.

10.1.4 ITALY

10.1.5 RUSSIA

10.1.6 SPAIN

10.1.7 SWITZERLAND

10.1.8 NETHERLANDS

10.1.9 BELGIUM

10.1.10 TURKEY

10.1.11 REST OF EUROPE

11 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 COMPANY PROFILING

12.1 ILLUMINA, INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT ANALYSIS

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT DEVELOPMENTS

12.2 BGI (A SUBSIDIAIRY OF BGI GROUP) (2021)

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT ANALYSIS

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT DEVELOPMENT

12.3 THERMO FISHER SCIENTIFIC INC.

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 SWOT ANALYSIS

12.3.5 PRODUCT PORTFOLIO

12.3.6 RECENT DEVELOPMENTS

12.4 QIAGEN

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 SWOT ANALYSIS

12.4.5 PRODUCT PORTFOLIO

12.4.6 RECENT DEVELOPMENTS

12.5 AGILENT TECHNOLOGIES, INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 SWOT ANALYSIS

12.5.5 PRODUCT PORTFOLIO

12.5.6 RECENT DEVELOPMENT

12.6 OXFORD NANOPORE TECHNOLOGIES

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 BIO-RAD LABORATORIES, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8X GENOMICS

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENTS

12.9 BIOMÉRIEUX SA

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

12.1 DNASTAR

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 GENEIOUS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS

12.12 GENEWIZ, FROM AZENTA LIFE SCIENCES

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 HAMILTON COMPANY

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 MACROGEN, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 NEW ENGLAND BIOLABS

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 PACIFIC BIOSCIENCES OF CALIFORNIA, INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 REVENUE ANALYSIS

12.16.3 PRODUCT PORTFOLIO

12.16.4 RECENT DEVELOPMENTS

12.17 PARTEK, INCORPORATED

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 PERKIN ELMER INC. (2021)

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 ROCHE SEQUENCING (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS (PARENT COMPANY)

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENTS

12.2 TAKARA BIO INC.

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Lista de Tablas

TABLE 1 NEXT GENERATION SEQUENCING COST PER SAMPLE

TABLE 2 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 EUROPE INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 EUROPE CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 EUROPE SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE DIAGNOSTICS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE BIOMARKER DISCOVERY IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PRECISION MEDICINE IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE DRUG DISCOVERY IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE AGRICULTURE & ANIMAL RESEARCH IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE RESEARCH CENTERS & ACADEMIC AND GOVERNMENT INSTITUTES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE HOSPITAL & CLINICS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 20 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 21 EUROPE INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 22 EUROPE CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 23 EUROPE SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 24 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 GERMANY NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 27 GERMANY INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 28 GERMANY CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 29 GERMANY SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 30 GERMANY NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 GERMANY NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 FRANCE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 33 FRANCE INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 34 FRANCE CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 35 FRANCE SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 36 FRANCE NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 FRANCE NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 38 U.K. NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 39 U.K. INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 40 U.K. CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 U.K. SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 U.K. NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 U.K. NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 ITALY NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 ITALY INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 46 ITALY CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 ITALY SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 48 ITALY NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ITALY NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 RUSSIA NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 RUSSIA INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 52 RUSSIA CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 RUSSIA SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 54 RUSSIA NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 RUSSIA NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 SPAIN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 57 SPAINSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 SPAIN CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 SPAIN SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 SPAIN NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 SPAIN NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 SWITZERLAND NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 SWITZERLAND INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 SWITZERLAND CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 SWITZERLAND SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 SWITZERLAND NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 SWITZERLAND NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 NETHERLANDS NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 NETHERLANDS INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 NETHERLANDS CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 NETHERLANDS SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 NETHERLANDS NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 NETHERLANDS NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 BELGIUM NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 75 BELGIUM INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 BELGIUM SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 78 BELGIUM NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 BRLGIUM NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 TURKEY NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 81 TURKEY INSTRUMENTS IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 TURKEY CONSUMABLES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 TURKEY SERVICES IN NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 TURKEY NEXT GENERATION SEQUENCING (NGS) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 TURKEY NEXT GENERATION SEQUENCING (NGS) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 REST OF EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: SEGMENTATION

FIGURE 2 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: DROC ANALYSIS

FIGURE 4 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: SEGMENTATION

FIGURE 11 WISE PORTFOLIO OFFERED BY MAJOR PLAYERS AND USE OF NEXT GENERATION SEQUENCING IN DRUG DEVELOPMENT IS EXPECTED TO DRIVE THE EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET IN 2021 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET

FIGURE 14 DECREASE IN COST OF PER BASE SEQUENCING

FIGURE 15 USE OF NSG IN DRUG DEVELOPMENT

FIGURE 16 REVENUE OF THE COMPANY AGILENT TECHNOLOGIES, INC.

FIGURE 17 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT, 2021

FIGURE 18 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT, 2020-2029 (USD MILLION)

FIGURE 19 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 20 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 21 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 23 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 24 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 25 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY END USER, 2021

FIGURE 26 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 27 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 28 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: SNAPSHOT (2021)

FIGURE 30 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY COUNTRY (2021)

FIGURE 31 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: BY PRODUCT (2022-2029)

FIGURE 34 EUROPE NEXT GENERATION SEQUENCING (NGS) MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.