Mercado europeo de reciclaje de baterías de iones de litio , por componente (material activo, material no activo), química (litio-níquel-manganeso-cobalto (Li-NMC), óxido de litio-cobalto (LCO), óxido de litio-manganeso (LMO), fosfato de litio-hierro (LFP), óxido de litio-níquel-cobalto-aluminio (NCA), óxido de litio-titanato (LTO)), proceso de reciclaje (proceso hidrometalúrgico, proceso pirometalúrgico, proceso físico/mecánico): tendencias de la industria y pronóstico hasta 2029.

Análisis y tamaño del mercado

La batería de iones de litio se compone de iones de litio que se mueven del electrodo negativo al electrodo positivo a través del electrolito durante la carga y se mueven hacia atrás en el momento de la carga. Estas baterías son recargables y se utilizan comúnmente en productos electrónicos de consumo y automóviles. Consta de cuatro componentes: cátodo, ánodo, separador y electrolito. El ánodo ayuda a almacenar y liberar iones de litio del cátodo, lo que permite el paso de corriente a través de un circuito externo. El cátodo actúa como una fuente de iones de litio que determina la capacidad y el voltaje promedio de la batería. El electrolito es básicamente el medio que ayuda en el movimiento de los iones. El separador básicamente ayuda a prevenir el contacto entre el cátodo y el ánodo. Las láminas de aluminio se utilizan como colector de corriente para los cátodos y las láminas de cobre se utilizan como colector de corriente para los ánodos. La combinación de los cuatro componentes forma una celda que se utiliza para alimentar varias aplicaciones. Con un grupo de celdas se forma un módulo y con un grupo de módulos se forma un paquete. Las baterías de iones de litio ofrecen alta densidad de energía, capacidad de voltaje y menor tasa de autodescarga que otras baterías recargables. Esto los hace muy adecuados para una amplia gama de aplicaciones.

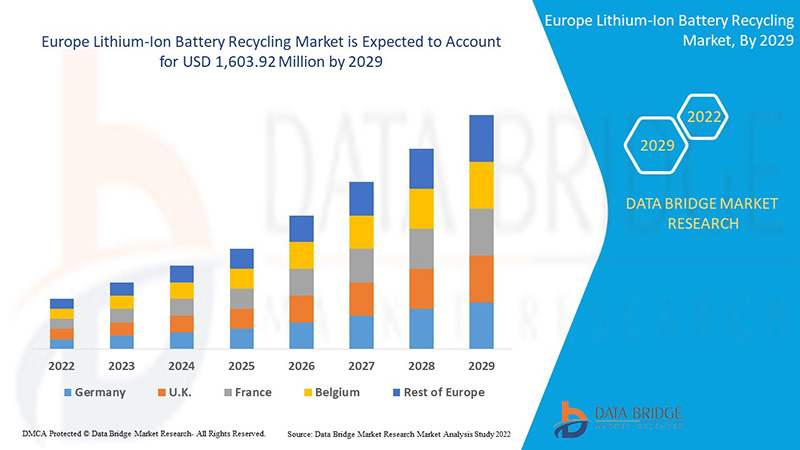

Data Bridge Market Research analiza que se espera que el mercado europeo de reciclaje de baterías de iones de litio alcance un valor de 1.603,92 millones de dólares en 2029, con una tasa compuesta anual del 20,8 % durante el período de pronóstico. El informe del mercado de reciclaje de baterías de iones de litio también cubre en profundidad el análisis de precios, el análisis de patentes y los avances tecnológicos.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por componente (material activo, material no activo), química (litio-níquel-manganeso-cobalto (Li-NMC), óxido de litio-cobalto (LCO), óxido de litio-manganeso (LMO), fosfato de litio-hierro (LFP), óxido de litio-níquel-cobalto-aluminio (NCA), óxido de litio-titanato (LTO)), proceso de reciclaje (proceso hidrometalúrgico, proceso pirometalúrgico, proceso físico/mecánico) |

|

Países cubiertos |

Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa en Europa |

|

Actores del mercado cubiertos |

Glencore, Umicore, Saubermacher Dienstleistungs AG, Akkuser Oy, TES, Fortum, Contemporary Amperex Technology Co., Limited, Ganfeng Lithium Co.,Ltd., Attero, ACCUREC-Recycling GmbH, Duesenfeld GmbH, ECOBAT, Cawleys, Veolia Environnement SA, Batrec Industria, Nickelhütte Aue GmbH, Neometals Ltd. |

Dinámica del mercado de reciclaje de baterías de iones de litio

En esta sección se aborda la comprensión de los factores impulsores del mercado, las ventajas, las oportunidades, las limitaciones y los desafíos. Todo esto se analiza en detalle a continuación:

Conductores

- Creciente demanda de teléfonos inteligentes y productos electrónicos de consumo

Las demandas y requisitos de los productos electrónicos de consumo han seguido aumentando a un ritmo exponencial. Las baterías de iones de litio son comunes en los productos electrónicos de consumo. Son uno de los tipos de baterías recargables más populares para dispositivos electrónicos portátiles, con relaciones adecuadas de energía a peso, alto voltaje de circuito abierto y baja tasa de autodescarga. El avance en las tecnologías ha compactado el tamaño de los dispositivos electrónicos, haciéndolos más delgados y livianos, lo que aumenta la demanda de baterías de iones de litio. Las baterías de iones de litio duran más, se cargan más rápido y tienen una mayor densidad de potencia para una mayor vida útil de la batería en un paquete más liviano.

- Penetración de flota de transporte de generación baja en carbono

Las emisiones del transporte por carretera representan casi el 75% de todas las emisiones de GEI (gases de efecto invernadero) del transporte y el 11% de las emisiones globales de GEI. La electrificación es la palanca clave de descarburación para el transporte por carretera. En contraste, los vehículos eléctricos actualmente emiten entre un 30 y un 60% menos de emisiones que los motores de combustión, dependiendo de la combinación de energía. Si no se toman medidas, las emisiones globales del transporte por carretera seguirán creciendo como resultado del aumento de las necesidades de transporte satisfechas con combustibles fósiles. Sin embargo, la electrificación ayuda a reducir las emisiones de CO2 y a mejorar la calidad del aire al evitar la mezcla de gases tóxicos. Para mitigar el cambio climático y crear una economía libre de combustibles fósiles, la comunidad mundial ha acordado que las emisiones de GEI deben reducirse rápida y significativamente. Por lo tanto, las baterías de iones de litio se consideran la tecnología limpia prometedora para reemplazar los dispositivos convencionales alimentados por combustibles fósiles. En comparación con otras tecnologías de baterías recargables de alta calidad, las baterías de iones de litio tienen las densidades de energía más altas de cualquier tecnología de baterías actual (100-265 Wh/kg o 250-670 Wh/L). Las baterías de iones de litio también se utilizan para alimentar sistemas eléctricos para algunas aplicaciones aeroespaciales; su principal factor, entre otros, es su ligereza y respeto por el medio ambiente.

Oportunidades

- Creciente número de iniciativas de I+D e instalaciones gubernamentales para el reciclaje

Las baterías de iones de litio tienen una amplia gama de aplicaciones y, con más esfuerzos dedicados a la investigación y el desarrollo, se están desarrollando características más avanzadas. Las empresas están construyendo nuevas instalaciones de fabricación para satisfacer las crecientes demandas de baterías de iones de litio en aplicaciones para vehículos eléctricos, dispositivos médicos y comunicación de datos. Las nuevas instalaciones y la creciente investigación y desarrollo están creando nuevas oportunidades para el crecimiento del mercado mundial de baterías de iones de litio.

Restricciones/Desafíos

- Cuestiones de seguridad relacionadas con el almacenamiento y transporte de baterías usadas

Los iones de litio se utilizan ampliamente en diversas aplicaciones, como la electrónica de consumo, las aplicaciones industriales, los dispositivos médicos y los automóviles. Las baterías de iones de litio son ligeras y ahora están diseñadas para ser flexibles y tener formas variables. Sin embargo, pueden ser extremadamente peligrosas si están defectuosas o sobrecargadas, si se empaquetan incorrectamente o si se usan o manipulan incorrectamente. El litio es altamente reactivo e inflamable y, por lo tanto, puede causar graves daños a la vida y a la propiedad. Estas características pueden causar daños durante el almacenamiento, el uso y el transporte de las baterías de iones de litio.

- Problemas relacionados con el sobrecalentamiento de la batería de iones de litio

A pesar de su potencial tecnológico, las baterías de iones de litio aún presentan una serie de deficiencias, en particular en lo que respecta a la seguridad. Las baterías de iones de litio tienen tendencia a sobrecalentarse y pueden dañarse a altos voltajes. En algunos casos, esto puede provocar una fuga térmica y combustión. Estas baterías requieren mecanismos de seguridad para limitar el voltaje y las presiones internas, lo que puede aumentar el peso y limitar el rendimiento en algunos casos. Las baterías de iones de litio también están sujetas al envejecimiento, lo que significa que pueden perder capacidad y fallar con frecuencia después de varios años. Otro factor que limita su adopción generalizada es su costo, que es aproximadamente un 40% más alto que el de las baterías de níquel-cadmio.

Impacto posterior al COVID-19 en el mercado de reciclaje de baterías de iones de litio

La COVID-19 ha tenido un gran impacto en el mercado de reciclaje de baterías de iones de litio, ya que casi todos los países han optado por cerrar todas las instalaciones de producción, excepto las que se dedican a producir bienes esenciales.

Después de la pandemia, el crecimiento del mercado de reciclaje de baterías de iones de litio se atribuye a la creciente adopción de la electrificación de la industria automotriz en todas las regiones y países. Aunque la industria automotriz enfrentó grandes problemas durante la pandemia, las ventas de vehículos eléctricos aumentaron a niveles más altos en el escenario posterior a la pandemia. Además, la demanda de productos electrónicos de consumo que funcionan con baterías ha aumentado durante el período de tiempo, lo que actúa como un impulsor del crecimiento de este mercado.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de investigación y desarrollo para mejorar la tecnología involucrada en el reciclaje de baterías de iones de litio. Con esto, las empresas traerán tecnologías avanzadas al mercado. Además, las iniciativas gubernamentales para el uso de vehículos eléctricos han llevado al crecimiento del mercado.

Desarrollo reciente

- En febrero de 2022, Glencore firmó una asociación estratégica con Britishvolt para desarrollar un ecosistema líder a nivel mundial para el reciclaje de baterías en el Reino Unido. Con esto, la empresa tiende a desarrollar otras actividades de reciclaje, como la refinación de masa negra para convertirla en materias primas aptas para baterías en todo el mercado.

- En febrero de 2022, Neometals Ltd. anunció una empresa conjunta con una empresa alemana llamada SMS Group para comercializar el proceso de reciclaje de baterías de iones de litio. Ambas empresas han unido sus fuerzas para establecer la empresa Primobius, centrada en el reciclaje de baterías. Junto con la formación de la nueva empresa, la empresa conjunta también incluye otros tres proyectos principales, exploración minera y actividades de I+D. Esto mejorará el alcance geográfico y la cartera de Neometals Ltd. en un futuro próximo.

Alcance del mercado de reciclaje de baterías de iones de litio en Europa

El mercado de reciclaje de baterías de iones de litio está segmentado en función de los componentes, la química y el proceso de reciclaje. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducidos en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Componente

- Material activo

- Material no activo

Según el componente, el mercado de reciclaje de baterías de iones de litio se segmenta en material activo y material no activo.

Química

- Litio-níquel-manganeso-cobalto (Li-NMC)

- Óxido de litio y cobalto (LCO)

- Óxido de litio y manganeso (LMO)

- Fosfato de hierro y litio (LFP)

- Óxido de litio, níquel, cobalto y aluminio (NCA)

- Óxido de titanato de litio (LTO)

Sobre la base de la química, el mercado de reciclaje de baterías de iones de litio se ha segmentado en litio-níquel, manganeso y cobalto (Li-NMC), óxido de litio y cobalto (LCO), óxido de litio y manganeso (LMO), fosfato de litio y hierro (LFP), óxido de litio-níquel y cobalto y aluminio (NCA) y óxido de litio y titanato (LTO).

Proceso de reciclaje

- Proceso hidrometalúrgico

- Proceso de pirometalurgia

- Proceso físico/mecánico

Sobre la base del proceso de reciclaje, el mercado de reciclaje de baterías de iones de litio se ha segmentado en proceso hidrometalúrgico, proceso pirometalúrgico y proceso físico/mecánico.

Análisis y perspectivas regionales del mercado de reciclaje de baterías de iones de litio

Se analiza el mercado de reciclaje de baterías de iones de litio y se proporcionan información y tendencias sobre el tamaño del mercado por país, componente, proceso de reciclaje y química como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de reciclaje de baterías de iones de litio son Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía y el resto de Europa.

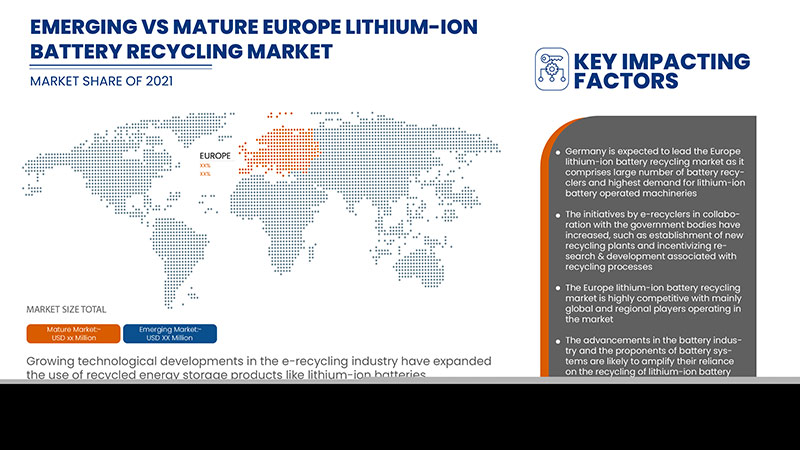

Alemania domina en la región europea debido al aumento de los esfuerzos de investigación y desarrollo en procesos de reciclaje de baterías de iones de litio para promover un modelo energético sostenible.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del reciclaje de baterías de iones de litio

El panorama competitivo del mercado de reciclaje de baterías de iones de litio proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado de reciclaje de baterías de iones de litio.

Algunos de los principales actores que operan en el mercado del reciclaje de baterías de iones de litio son Glencore, Umicore, Saubermacher Dienstleistungs AG, Akkuser Oy, TES, Fortum, Contemporary Amperex Technology Co., Limited, Ganfeng Lithium Co., Ltd., Attero, ACCUREC-Recycling GmbH, Duesenfeld GmbH, ECOBAT, Cawleys, Veolia Environnement SA, Batrec Industrie, Nickelhütte Aue GmbH, Neometals Ltd.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Lista de Tablas

TABLE 1 LIST OF THE COMPANIES WITH THEIR RECYCLING PROCESS AND APPROXIMATE CAPACITY

TABLE 2 STANDARDS RELATED TO LITHIUM-ION BATTERIES

TABLE 3 POLICIES RELEVANT TO LIB RECYCLING PUBLISHED IN CHINA

TABLE 4 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ACTIVE MATERIAL IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE NON-ACTIVE MATERIAL IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 8 EUROPE LITHIUM-NICKEL MANGANESE COBALT (LI-NMC) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE LITHIUM COBALT OXIDE (LCO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE LITHIUM-MANGANESE OXIDE (LMO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE LITHIUM-IRON PHOSPHATE (LFP) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE LITHIUM-NICKEL COBALT ALUMINUM OXIDE (NCA) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE LITHIUM-TITANATE OXIDE (LTO) IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 15 EUROPE HYDROMETALLURGICAL PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PYROMETALLURGY PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE PHYSICAL/ MECHANICAL PROCESS IN LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 19 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 20 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 21 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 22 GERMANY LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 23 GERMANY LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 24 GERMANY LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 25 U.K. LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 26 U.K. LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 27 U.K. LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 28 FRANCE LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 29 FRANCE LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 30 FRANCE LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 31 ITALY LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 32 ITALY LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 33 ITALY LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 34 SPAIN LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 SPAIN LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 36 SPAIN LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 37 RUSSIA LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 38 RUSSIA LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 39 RUSSIA LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 40 BELGIUM LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 41 BELGIUM LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 42 BELGIUM LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 43 NETHERLANDS LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 44 NETHERLANDS LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 45 NETHERLANDS LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 46 SWITZERLAND LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 47 SWITZERLAND LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 48 SWITZERLAND LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 49 TURKEY LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 50 TURKEY LITHIUM-ION BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2029 (USD MILLION)

TABLE 51 TURKEY LITHIUM-ION BATTERY RECYCLING MARKET, BY RECYCLING PROCESS, 2020-2029 (USD MILLION)

TABLE 52 REST OF EUROPE LITHIUM-ION BATTERY RECYCLING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: SEGMENTATION

FIGURE 2 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: EUROPE VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE EUROPE LITHIUM-ION BATTERY RECYCLING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE LITHIUM-ION BATTERY RECYCLING MARKET IN 2022 & 2029

FIGURE 12 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE EUROPE LITHIUM-ION BATTERY RECYCLING MARKET IN THE FORECAST PERIOD OF 2020 TO 2029

FIGURE 13 HISTORICAL DATA FOR ANNUAL EUROPE LITHIUM-ION BATTERY DEPLOYMENT FOR ALL MARKETS

FIGURE 14 REGION WITH LITHIUM ION BATTERY RECYCLING CAPACITY FOR ALL APPLICATIONS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE LITHIUM-ION BATTERY RECYCLING MARKET

FIGURE 16 PROJECTION OF STEADY GROWTH FOR DEMAND FOR CONSUMER ELECTRONICS (2015-2025)

FIGURE 17 NUMBER OF PLUG-IN ELECTRIC PASSENGER CAR SALES IN 2020 IN UNITS

FIGURE 18 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: BY COMPONENT, 2021

FIGURE 19 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: BY CHEMISTRY, 2021

FIGURE 20 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: BY RECYCLING PROCESS, 2021

FIGURE 21 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: SNAPSHOT (2021)

FIGURE 22 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2021)

FIGURE 23 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 24 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 25 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: BY COMPONENT (2022-2029)

FIGURE 26 EUROPE LITHIUM-ION BATTERY RECYCLING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.