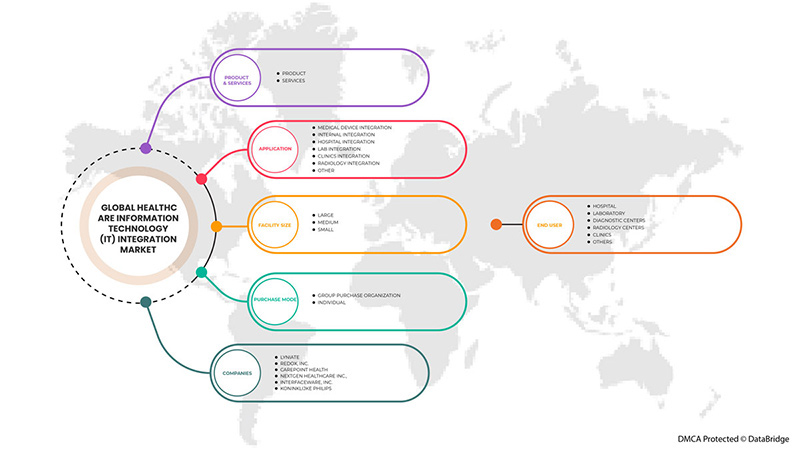

Europe Healthcare Information Technology (IT) Integration Market, By Product & Services (Product, and Services), Application (Medical Device Integration, Internal Integration, Hospital Integration, Lab Integration, Clinics Integration, and Radiology Integration), Facility Size (Large, Medium, and Small), Purchase Mode (Group Purchase Organization, and Individual), End User (Hospitals, Laboratory, Diagnostic Centers, Radiology Centers, and Clinics), Industry Trends and Forecast to 2029.

Europe Healthcare Information Technology (IT) Integration Market Analysis and Size

Healthcare IT integration enables it for healthcare systems to gather data, exchange it with the cloud, and communicate with one another, allowing for the rapid and correct analysis of that data. The Internet of Things (IoT) combines sensor output with communications to provide tasks that were until recently thought of as notional, from monitoring and diagnosis to delivery methods. The sensors can be incorporated into a device, cloud-based, or wearable. With the developments of such sensors and ICT, the healthcare sector now possesses a dynamic collection of patient data that can be used to support diagnostics and preventive care and to assess the likely success of preventive treatment.

In addition, Integration initiatives are often limited in scope. They integrate only a small portion of patient data available because it is difficult to move information among disparate clinical and business software applications within and beyond healthcare enterprise borders. It requires a thorough understanding of data governance, expert knowledge of health messaging standards, access to sophisticated technology, and expertise in systems integration, including service-oriented architecture (SOA) and enterprise architecture management (EAM). CGI’s HIIF defines and describes all the parameters necessary to achieve the integration that healthcare organizations require.

However, the higher costs associated with integrated IT solutions and issues associated with interoperability are anticipated to restrain the market growth.

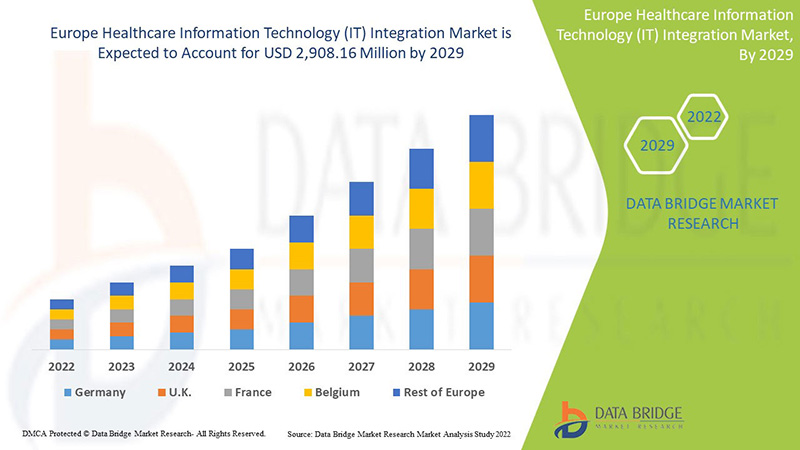

Data Bridge Market Research analyzes that the Europe healthcare information technology (IT) integration market is expected to reach a value of USD 2,908.16 million by 2029, at a CAGR of 12.7% during the forecast period. Product and services account for the largest type segment in the market due to the rapid demand for IT solutions and services in Europe. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Por producto y servicios (producto y servicios), aplicación (integración de dispositivos médicos, integración interna, integración de hospitales, integración de laboratorios, integración de clínicas e integración de radiología), tamaño de la instalación (grande, mediana y pequeña), modo de compra (organización de compra grupal e individual), usuario final (hospitales, laboratorios, centros de diagnóstico, centros de radiología y clínicas). |

|

Países cubiertos |

Alemania, Francia, Reino Unido, Italia, España, Rusia, Turquía, Bélgica, Países Bajos, Suiza y el resto de Europa. |

|

Actores del mercado cubiertos |

Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc. Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions, Inc., Epic systems corporation, Qualcomm life Inc., Capsule Technologies Inc., Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, Infor Inc., GE Healthcare, MCKESSON Corporation y Meditech, entre otros. |

Definición del mercado de integración de tecnologías de la información (TI) sanitarias en Europa

La integración de TI sanitaria (tecnología de la información sanitaria) es el área de TI que implica el diseño, desarrollo, creación, uso y mantenimiento de sistemas de información para la industria de la atención médica. Los sistemas de información sanitaria automatizados e interoperables seguirán mejorando la atención médica y la salud pública, reducirán los costos, aumentarán la eficiencia, reducirán los errores y mejorarán la satisfacción del paciente, y optimizarán el reembolso para los proveedores de atención médica ambulatoria y hospitalaria. La importancia de la TI sanitaria resulta de la combinación de la evolución de la tecnología y el cambio de las políticas gubernamentales que influyen en la calidad de la atención al paciente. Algunos de los productos de integración de la tecnología de la información sanitaria (TI) son motores de interfaz/integración, software de integración de dispositivos médicos y soluciones de integración de medios, y los servicios son implementación e integración, soporte y mantenimiento, capacitación y educación, y consultoría. La TI sanitaria permite a los proveedores de atención médica gestionar mejor la atención al paciente mediante el uso y el intercambio seguros de información sanitaria. Al desarrollar registros médicos electrónicos seguros y privados para la mayoría de los estadounidenses y hacer que la información sanitaria esté disponible electrónicamente cuando y donde se la necesite, la TI sanitaria puede mejorar la calidad de la atención, al mismo tiempo que hace que la atención sanitaria sea más rentable. Con la ayuda de la tecnología de la información para la salud, los proveedores de atención médica tendrán: información precisa y completa sobre la salud de un paciente. De esa manera, los proveedores pueden brindar la mejor atención posible, ya sea durante una visita de rutina o una emergencia médica, la capacidad de coordinar mejor la atención brindada. Esto es especialmente importante si un paciente tiene una condición médica grave. Es una forma de compartir información de manera segura con los pacientes y sus cuidadores familiares a través de Internet, para los pacientes que optan por esta comodidad.

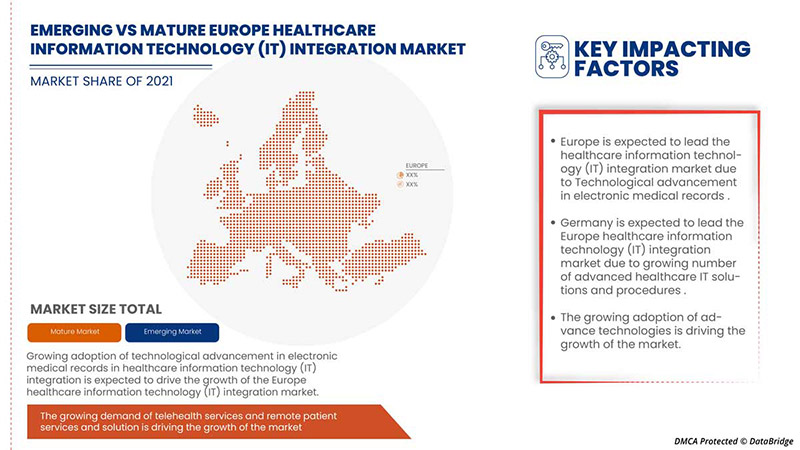

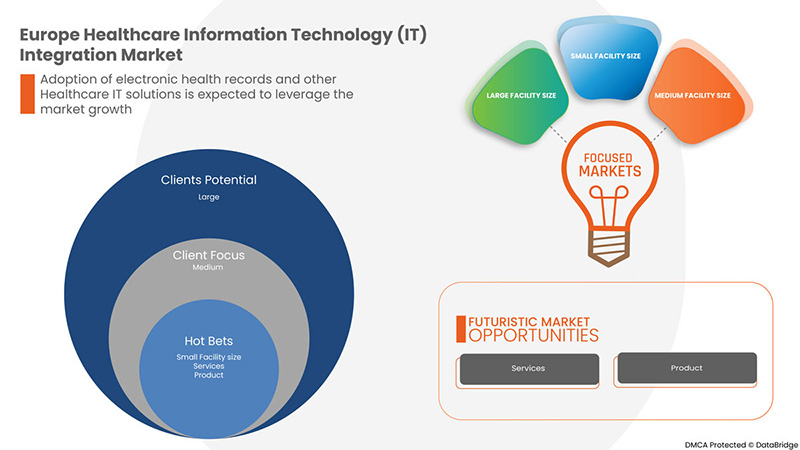

Además, la rápida adopción de registros médicos electrónicos y otras soluciones de TI para el cuidado de la salud es uno de los impulsores de alto impacto del mercado. Además, la necesidad urgente de integrar los datos de los pacientes en los sistemas de atención de la salud y las políticas gubernamentales favorables, los programas de financiación y las iniciativas para implementar soluciones de integración de TI para el cuidado de la salud son los principales impulsores del crecimiento del mercado.

Dinámica del mercado de integración de tecnologías de la información (TI) en el sector sanitario en Europa

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Adopción rápida de registros médicos electrónicos y otras soluciones de TI para el cuidado de la salud

Los datos de los pacientes son complejos, confidenciales y, a menudo, no están estructurados. Incorporar esta información al proceso de prestación de servicios de salud es un desafío que se debe afrontar para aprovechar la oportunidad de mejorar la atención al paciente. Si bien el historial clínico electrónico (HER, por sus siglas en inglés) se ha utilizado durante más de una década, el mercado se ha acelerado recientemente debido a las iniciativas gubernamentales en diferentes países para mejorar la seguridad de los datos de los pacientes.

Los requisitos normativos impuestos por HITECH han estimulado la adopción de EHR y EMR. Otro factor importante que está impulsando el crecimiento del mercado es el creciente número de Organizaciones de Atención Responsable (ACO), lo que aumenta la demanda de EHR y EMR.

Las iniciativas gubernamentales en otros países, como Dinamarca, Suecia, Francia y Canadá, también están fomentando la adopción de HCE y exigiendo su uso significativo para controlar los costos de la atención médica.

Además, los servicios de TI ayudan a integrar a varios usuarios finales en todo el sistema de atención médica, incluidos hospitales, unidades de enfermería, farmacias y compañías de seguros de salud. Sin embargo, la integración de estos datos y su disponibilidad en tiempo real es esencial para que los profesionales de la salud aseguren una toma de decisiones eficaz. Por lo tanto, con el crecimiento previsto de los sistemas de EHR en los próximos años, los hospitales se centrarán fuertemente en mejorar su capacidad mediante la integración de diferentes sistemas hospitalarios con EHR, creando así oportunidades de desarrollo para el mercado de integración de tecnología de la información (TI) en el ámbito de la atención médica.

- Demanda creciente de servicios de telesalud y soluciones de monitoreo remoto de pacientes

En la actualidad, los servicios de telesalud se solicitan para fines de monitoreo y consultoría. Los avances en las soluciones de atención médica han ayudado a ofrecer contenido educativo y garantizar una comunicación ininterrumpida entre pacientes y proveedores de atención médica. El funcionamiento exitoso de las soluciones de monitoreo remoto de pacientes depende de la integración exitosa de dispositivos médicos y de Tecnologías de la Información y las Comunicaciones (TIC) que permitan la prestación de servicios médicos a largas distancias.

Dado que los médicos y enfermeros pasan la mayor parte de su tiempo trabajando sin computadoras en los hospitales, les resulta difícil llevar consigo los historiales clínicos de los pacientes cuando están de viaje. Como resultado, muchos actores del mercado han comenzado a ofrecer plataformas móviles, como aplicaciones móviles, para soluciones de TI para el sector sanitario.

Los avances en informática han proporcionado una gama cada vez mayor de opciones, como banda ancha avanzada, telefonía móvil y redes, monitoreo remoto de pacientes, videoconferencias de alta definición y registros médicos electrónicos. Esto ha creado oportunidades significativas para que los proveedores de soluciones integren la tecnología de la información sanitaria. A través de una red sanitaria de IoT que consta de dispositivos médicos conectados, los pacientes que se encuentran en sus casas pueden ser monitoreados de forma remota para conocer sus signos vitales, como niveles de presión arterial, peso, nivel de glucosa en sangre, electrocardiograma y temperatura corporal, ya que los datos del paciente se envían automáticamente a la enfermera o al médico.

Un entorno de atención médica conectado permite a los médicos controlar y ajustar de forma remota el estado de un paciente. Las tecnologías de atención médica conectadas implican tecnología de sensores inteligentes, conectividad avanzada, mejoras de interfaz y análisis de datos. Estos avances ayudan a reducir los costos de atención médica al mejorar la aceptación del paciente y reducir las visitas a la clínica. Además, si bien los costos de implementación pueden ser altos, estas tecnologías están ayudando a acelerar las operaciones de muchas empresas.

Con los avances tecnológicos, estas soluciones desempeñan un papel importante en la mejora de la monitorización remota y el cumplimiento del tratamiento por parte de los pacientes y, en consecuencia, de su calidad de vida. Por lo tanto, se espera que la creciente demanda de soluciones de monitorización remota y de dispositivos remotos impulse el crecimiento de los proveedores de soluciones de integración de tecnología de la información (TI) sanitaria en Europa en los próximos años.

Restricción

- Cuestiones asociadas a la interoperabilidad

La heterogeneidad de los sistemas de información sanitaria plantea importantes desafíos para la implementación y el uso exitosos de soluciones informáticas sanitarias. Muchos países no cuentan con estándares de TI específicos para almacenar e intercambiar datos, lo que genera problemas de interoperabilidad. Si bien existen muchos estándares diferentes de almacenamiento, transporte y seguridad de datos, la implementación e integración de estos estándares de interoperabilidad presenta un desafío importante para los proveedores de atención médica y los proveedores de soluciones de TI médicas y sanitarias. Debido a la falta de un sistema de información sanitaria único que satisfaga todos los requisitos administrativos, clínicos, técnicos y de laboratorio de los principales proveedores de atención médica, los requisitos de interoperabilidad y los estándares de interoperabilidad se han vuelto importantes. Los proveedores también siguen diferentes formatos y estándares de datos debido al escaso o la falta de conocimiento técnico de los estándares definidos, lo que dificulta compartir datos en tiempo real con sistemas asociados, lo que aumenta el costo de la integración de TI sanitaria. Los problemas con la calidad e integridad de los datos, el incumplimiento de los estándares establecidos, la falta de profesionales calificados y la variación en el tiempo de funcionamiento entre los proveedores de atención médica se encuentran entre los problemas que actúan como obstáculos principales para la implementación de una infraestructura de TI sanitaria totalmente interoperable. Se espera que estos factores limiten el crecimiento del mercado.

Oportunidades/Desafíos

- Desafíos relacionados con la integración de datos

La información relacionada con los pacientes se ha generado desde diferentes departamentos en todos los puntos de tratamiento dentro de la organización de atención médica, lo que la convierte en una industria con un uso intensivo de la información y registros de pacientes más confiables. Sin embargo, es esencial brindar información confiable mediante la combinación de grandes cantidades de datos para producir registros de pacientes completos y confiables porque se utilizan una variedad de equipos médicos e instrumentos de diagnóstico en los sistemas de atención médica y existe una creciente necesidad de conectar todos estos sistemas para ayudar a los profesionales de la salud a responder rápidamente en varios puntos de prestación de atención.

Numerosas organizaciones de atención sanitaria han invertido en diversas aplicaciones de gestión de la información, incluidos sistemas de gestión de activos, sistemas de imágenes, sistemas de gestión de correo electrónico, sistemas de gestión de formularios, sistemas de información clínica, sistemas de gestión de personal, sistemas de gestión de bases de datos, sistemas de gestión de contenido, sistemas de gestión del ciclo de ingresos, sistemas de flujo de trabajo clínico y no clínico y sistemas de gestión de relaciones con los clientes. A medida que las organizaciones de atención sanitaria adoptan cada vez más diversos sistemas de TI de atención sanitaria, existe una mayor necesidad de integrar diferentes tipos de sistemas de TI en la arquitectura de TI de la organización para garantizar la utilización óptima de estos sistemas y ayudar a la toma de decisiones precisa. La combinación exitosa de los sistemas de TI de atención sanitaria con otros sistemas es un foco de atención de los proyectos de desarrollo de infraestructura de TI en las organizaciones de atención sanitaria.

Por lo tanto, cada organización en el área de la salud utiliza sistemas diferentes y existe una alta probabilidad de diagnóstico erróneo y examen inadecuado del informe debido a la integración de datos que destruye el uso de la tecnología de información en el área de la salud, lo que puede actuar como un desafío para el crecimiento del mercado.

Impacto post COVID-19 en el mercado de integración de tecnologías de la información (TI) sanitarias en Europa

El brote de COVID-19 ha tenido efectos drásticos en la atención sanitaria en Europa, siendo el Reino Unido uno de los países más gravemente afectados. Debido al brote de COVID-19, todos los centros sanitarios están bajo una enorme presión y los centros sanitarios de todo el mundo se han visto abarrotados por las visitas diarias de numerosos pacientes. La creciente prevalencia de la enfermedad por coronavirus ha impulsado la demanda de dispositivos de diagnóstico y tratamiento precisos en varios países del mundo. En este sentido, las tecnologías de atención conectada han demostrado ser muy útiles. Permiten a los proveedores de atención sanitaria controlar a los pacientes mediante dispositivos no invasivos conectados digitalmente, como tensiómetros domésticos y oxímetros de pulso. Además, la rápida propagación de esta enfermedad en Europa ha provocado una escasez de camas de hospital y de personal sanitario. Como resultado, se han adoptado cada vez más dispositivos médicos conectados para controlar los signos vitales, y es probable que se observe una tendencia similar en los próximos años.

Los fabricantes están tomando diversas decisiones estratégicas para recuperarse tras la COVID-19. Los actores están llevando a cabo múltiples actividades de I+D y lanzamientos de productos, y alianzas estratégicas para mejorar la tecnología y los resultados de las pruebas involucradas en el mercado de pruebas farmacogenéticas.

Acontecimientos recientes

- En agosto de 2022, Cognizant anunció que AXA UK & Ireland lo había seleccionado como socio tecnológico para ayudar a consolidar, modernizar y gestionar parte de sus operaciones de TI. AXA UK & Ireland está transformando su ecosistema tecnológico para crear un entorno de TI más digital, moderno y ágil que sea rico en datos, seguro y sostenible con un menor costo general. Cognizant brindará servicios de TI integrados que abarcan soporte y mantenimiento de mesas de ayuda, informática para el usuario final, desarrollo y mantenimiento de aplicaciones, operaciones en la nube y gestión de infraestructura de TI. Esto ha ayudado a la empresa a expandir su negocio.

- En julio de 2022, NXGN Management, LLC, presentó su galardonado NextGen Office, el único registro médico electrónico (EHR) integrado en el registro de la Asociación Médica Podológica Estadounidense (APMA), en la conferencia anual del grupo celebrada del 28 al 31 de julio en Orlando. NextGen Healthcare es socio fundador del registro de la APMA, que proporcionó información clínicamente relevante a los clientes de NextGen Healthcare. Esto ha ayudado a la empresa a mostrar sus productos en la APMA y obtener reconocimiento.

Alcance del mercado de integración de tecnologías de la información (TI) en el sector sanitario en Europa

El mercado de integración de tecnología de la información (TI) para el sector sanitario en Europa está segmentado en productos y servicios, aplicaciones, tamaño de las instalaciones, modo de compra y usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Por producto y servicios

- Producto

- Servicios

Sobre la base de productos y servicios, el mercado de integración de tecnología de la información (TI) sanitaria de Europa está segmentado en productos y servicios.

Por aplicaciones

- Integración de dispositivos médicos

- Integración interna

- Integración hospitalaria

- Integración de laboratorio

- Integración de Clínicas

- Integración de radiología

- Otro

Sobre la base de la aplicación, el mercado de integración de tecnología de la información (TI) sanitaria de Europa está segmentado en integración de dispositivos médicos, integración interna, integración hospitalaria, integración de laboratorio, integración clínica, integración de radiología y otros.

Por tamaño de la instalación

- Grande

- Medio

- Pequeño

En función del tamaño de las instalaciones, el mercado de integración de tecnología de la información (TI) sanitaria en Europa se segmenta en grande, mediano y pequeño.

Por modo de compra

- Organización de compras grupales

- Individual

Sobre la base del modo de compra, el mercado de integración de tecnología de la información (TI) sanitaria en Europa se segmenta en compras grupales y compras individuales.

Por el usuario final

- Hospital

- Laboratorio

- Centros de diagnóstico

- Centros de radiología

- Clínicas

- Otros

Sobre la base de los usuarios finales, el mercado de integración de tecnología de la información (TI) sanitaria de Europa está segmentado en hospitales, laboratorios, centros de diagnóstico, centros de radiología, clínicas y otros.

Análisis y perspectivas regionales del mercado de integración de tecnologías de la información (TI) en el sector sanitario en Europa

Se analiza el mercado de integración de tecnología de la información (TI) de atención médica de Europa y se proporciona información sobre el tamaño del mercado por producto y servicios, aplicación, tamaño de la instalación, modo de compra y usuario final.

Los países cubiertos en este informe de mercado son Alemania, Francia, Reino Unido, Italia, España, Rusia, Turquía, Bélgica, Países Bajos, Suiza y el resto de Europa.

En 2022, Europa ocupará el segundo lugar en cuanto a programas de financiación e iniciativas para aplicar soluciones de integración de TI en el ámbito sanitario. Se espera que Alemania crezca debido a la creciente inversión en I+D y la rápida adopción de registros sanitarios electrónicos y otras soluciones de TI en el ámbito sanitario.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Healthcare Information Technology (IT) Integration Market Share Analysis

Europe healthcare information technology (IT) integration market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the Europe healthcare information technology (IT) integration market.

Some of the major players operating in the Europe healthcare information technology (IT) integration market are Lyniate, Redox, Inc., carepoint health, Nextgen Healthcare Inc., Interfaceware, Inc., Koninklijke Philips, Oracle, AVI-SPL, INC., Allscripts Healthcare solutions, Inc., Epic systems corporation, Qualcomm life Inc., Capsule technologies Inc., Orion health, Quality syetems, Inc., Cerner corporation, Intersystems corporation, Infor Inc., GE Healthcare, MCKESSON Corporation, and Meditech, among others.

Research Methodology: Europe Healthcare Information Technology (IT) Integration Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include the Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT AND SERVICES LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 POTENTIAL HEALTHCARE IT TECHNOLOGIES

4.1.1 EHR

4.1.2 EMR

4.1.3 ARTIFICIAL INTELLIGENCE

4.1.4 TELEMEDICINE

5 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET SHARE ANALYSIS-

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID ADOPTION OF ELECTRONIC HEALTH RECORDS AND OTHER HEALTHCARE IT SOLUTIONS

7.1.2 GROWING DEMAND FOR TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS

7.1.3 GROWING REQUIREMENT OF TELEHEALTH SERVICES ACROSS HEALTHCARE SECTOR

7.2 RESTRAINS

7.2.1 ISSUES ASSOCIATED WITH INTEROPERABILITY

7.2.2 HIGH COSTS ASSOCIATED WITH INTEGRATED IT SOLUTIONS

7.3 OPPORTUNITIES

7.3.1 EARLY MEDICAL DECISIONS AND CLINICAL DECISION SUPPORT

7.3.2 DATA UNIFORMITY AND STANDARDIZED DATA EXCHANGE

7.3.3 INCREASING AWARENESS AMONG PEOPLE

7.4 CHALLENGES

7.4.1 DATA INTEGRATION RELATED CHALLENGES

7.4.2 RISING HEALTHCARE FRAUDS

8 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT AND SERVICES

8.1 OVERVIEW

8.2 SERVICES

8.2.1 SUPPORT & MAINTENANCE

8.2.2 IMPLEMENTATION & INTEGRATION

8.2.3 TRAINING & EDUCATION

8.2.4 CONSULTING

8.3 PRODUCT

8.3.1 INTERFACE/INTEGRATION ENGINES

8.3.1.1 GROUP PURCHASE ORGANIZATION

8.3.1.2 INDIVIDUAL

8.3.2 MEDICAL DEVICE INTEGRATION SOFTWARE

8.3.2.1 GROUP PURCHASE ORGANIZATION

8.3.2.2 INDIVIDUAL

8.3.3 MEDIA INTEGRATION SOLUTIONS

8.3.3.1 GROUP PURCHASE ORGANIZATION

8.3.3.2 INDIVIDUAL

8.3.4 OTHER INTEGRATION TOOLS

9 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MEDICAL DEVICE INTEGRATION

9.3 HOSPITAL INTEGRATION

9.4 INTERNAL INTEGRATION

9.5 RADIOLOGY INTEGRATION

9.6 LAB INTEGRATION

9.7 CLINICS INTEGRATION

9.8 OTHERS

10 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE

10.1 OVERVIEW

10.2 LARGE

10.3 MEDIUM

10.4 SMALL

11 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE

11.1 OVERVIEW

11.2 GROUP PURCHASE ORGANIZATION

11.3 INDIVIDUAL

12 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 DIAGNOSTIC CENTERS

12.4 RADIOLOGY CENTERS

12.5 LABORATORY

12.6 CLINICS

12.7 OTHERS

13 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K.

13.1.4 ITALY

13.1.5 RUSSIA

13.1.6 SPAIN

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 BELGIUM

13.1.11 REST OF EUROPE

14 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 EMR PROVIDERS

16.2 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 NXGN MANAGEMENT, LLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 EPIC SYSTEMS CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 MEDICAL INFORMATION TECHNOLOGY, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 TEGRATION PROVIDERS

16.7 INFOR.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 LYNIATE

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 QVERA

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 INTERSYSTEM CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL ELECTRIC HEALTHCARE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 COMPANY SHARE ANALYSIS

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 INTERFACEWARE INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 ORION HEALTH GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 IBM (2021)

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 COMPANY SHARE ANALYSIS

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 SUMMIT HEALTHCARE SERVICES, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 MASIMO (2021)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 MDI SOLUTIONS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 COGNIZANT

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 SIEMENS HEALTHCARE GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 COMPANY SHARE ANALYSIS

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 REDOX, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

16.21 BOTH PROVIDERS

16.22 ORACLE (2021)

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 COMPANY SHARE ANALYSIS

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 KONNKLIJKE PHILIPS N.V. (2021)

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 2 EUROPE SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 4 EUROPE PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 6 EUROPE INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 8 EUROPE MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 9 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MEDICAL DEVICE INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE HOSPITAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE INTERNAL INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE RADIOLOGY INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE LAB INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE CLINICS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OTHERS INTEGRATION IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE LARGE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE MEDIUM IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SMALL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE GROUP PURCHASE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE INDIVIDUAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 25 EUROPE HOSPITAL IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE DIAGNOSTIC CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE RADIOLOGY CENTRES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE LABORATORY IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE CLINICS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE OTHERS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 33 EUROPE SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 34 EUROPE PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 35 EUROPE INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 36 EUROPE MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 37 EUROPE MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 38 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 43 GERMANY SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 44 GERMANY PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 45 GERMANY INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 46 GERMANY MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 47 GERMANY MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 48 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 50 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 51 GERMANY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 53 FRANCE SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 54 FRANCE PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 55 FRANCE INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 56 FRANCE MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 57 FRANCE MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 58 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 59 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 60 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 63 U.K. SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 64 U.K. PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 65 U.K. INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 66 U.K. MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 67 U.K. MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 68 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 71 U.K. HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 72 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 73 ITALY SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 74 ITALY PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 75 ITALY INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 76 ITALY MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 77 ITALY MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 78 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 80 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 81 ITALY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 85 RUSSIA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 88 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 90 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 93 SPAIN SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 94 SPAIN PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 95 SPA INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 96 SPAIN MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 97 SPAIN MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 98 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 100 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 101 SPAIN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 103 TURKEY SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 104 TURKEY PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 105 TURKEY INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 106 TURKEY MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 107 TURKEY MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 108 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 113 NETHERLANDS SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 114 NETHERLANDS PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 115 NETHERLANDS INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 116 NETHERLANDS MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 117 NETHERLANDS MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 118 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 121 NETHERLANDS HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 131 SWITZERLAND HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 133 BELGIUM SERVICES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 134 BELGIUM PRODUCT IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 135 BELGIUM INTERFACE/INTEGRATION ENGINES IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM MEDICAL DEVICE INTEGRATION SOFTWARE IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 137 BELGIUM MEDIA INTEGRATION SOLUTIONS IN HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 139 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY FACILITY SIZE, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PURCHASE MODE, 2020-2029 (USD MILLION)

TABLE 141 BELGIUM HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 142 REST OF EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET, BY PRODUCT & SERVICES, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR HEALTHCARE IT SOLUTION, TELEHEALTH SERVICES AND REMOTE PATIENT MONITORING SOLUTIONS ARE EXPECTED TO DRIVE THE EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET

FIGURE 14 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2021

FIGURE 15 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, CAGR (2022-2029)

FIGURE 17 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT AND SERVICES, LIFELINE CURVE

FIGURE 18 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2021

FIGURE 19 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 21 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2021

FIGURE 23 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, CAGR (2022-2029)

FIGURE 25 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY FACILITY SIZE, LIFELINE CURVE

FIGURE 26 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2021

FIGURE 27 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, 2022-2029 (USD MILLION)

FIGURE 28 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, CAGR (2022-2029)

FIGURE 29 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY PURCHASE MODE, LIFELINE CURVE

FIGURE 30 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2021

FIGURE 31 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: SNAPSHOT (2021)

FIGURE 35 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021)

FIGURE 36 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: BY PRODUCT & SERVICES (2022-2029)

FIGURE 39 EUROPE HEALTHCARE INFORMATION TECHNOLOGY (IT) INTEGRATION MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.