Europe Health Insurance Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

EURO

481,427.01 million

EURO

706,497.32 million

2022

2030

EURO

481,427.01 million

EURO

706,497.32 million

2022

2030

| 2023 –2030 | |

| EURO 481,427.01 million | |

| EURO 706,497.32 million | |

|

|

|

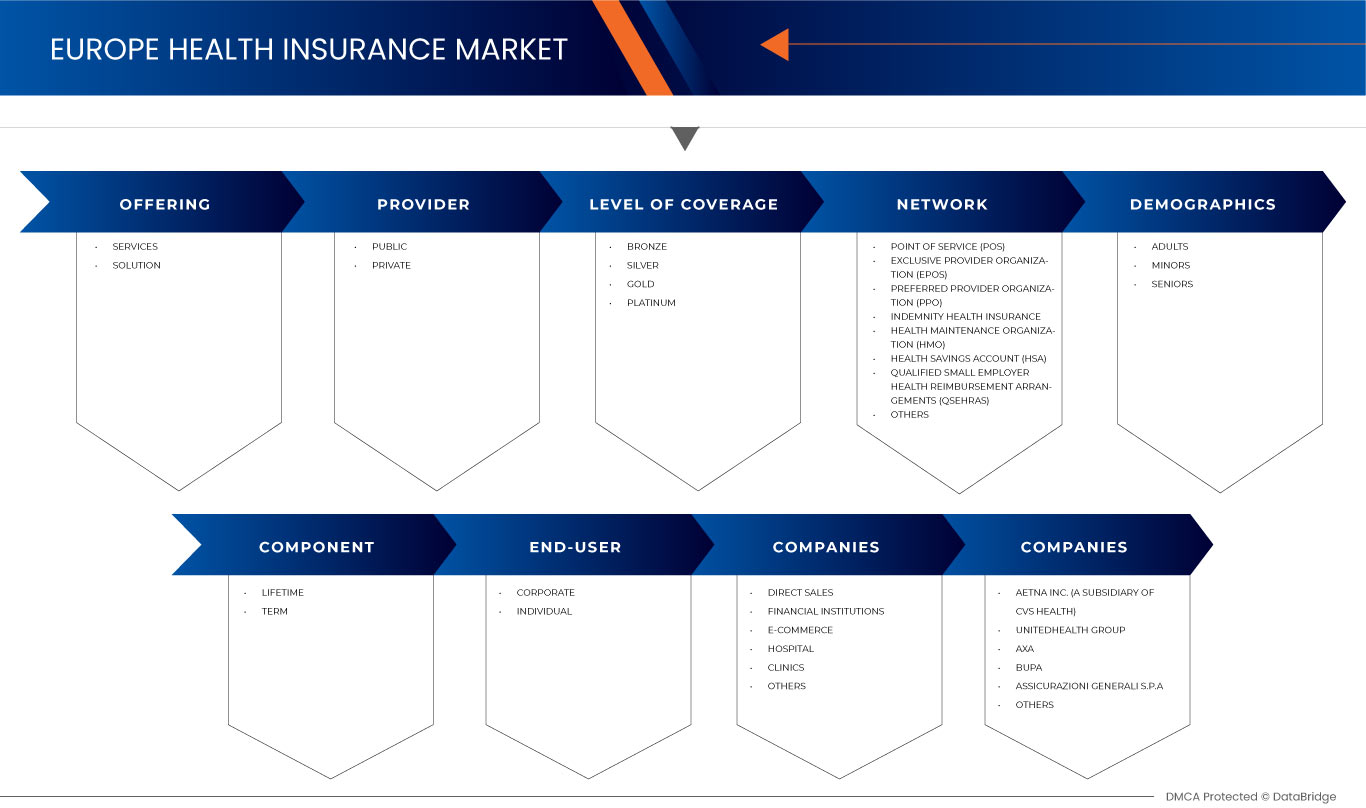

Mercado de seguros de salud en Europa, por oferta (servicios y soluciones), proveedor (público y privado), nivel de cobertura (bronce, plata, oro y platino), red (punto de servicio (POS), organización de proveedores exclusivos (EPOS), seguro de salud de indemnización, cuenta de ahorros para gastos médicos (HSA), acuerdos de reembolso de gastos médicos para pequeños empleadores calificados (QSEHRAS), organización de proveedores preferidos (PPO), organización de mantenimiento de la salud (HMO) y otros), datos demográficos (adultos, menores y personas mayores), tipo de cobertura (de por vida y a término), usuario final (corporativo e individual), canal de distribución (ventas directas, instituciones financieras, comercio electrónico, hospitales, clínicas y otros): tendencias de la industria y pronóstico hasta 2030.

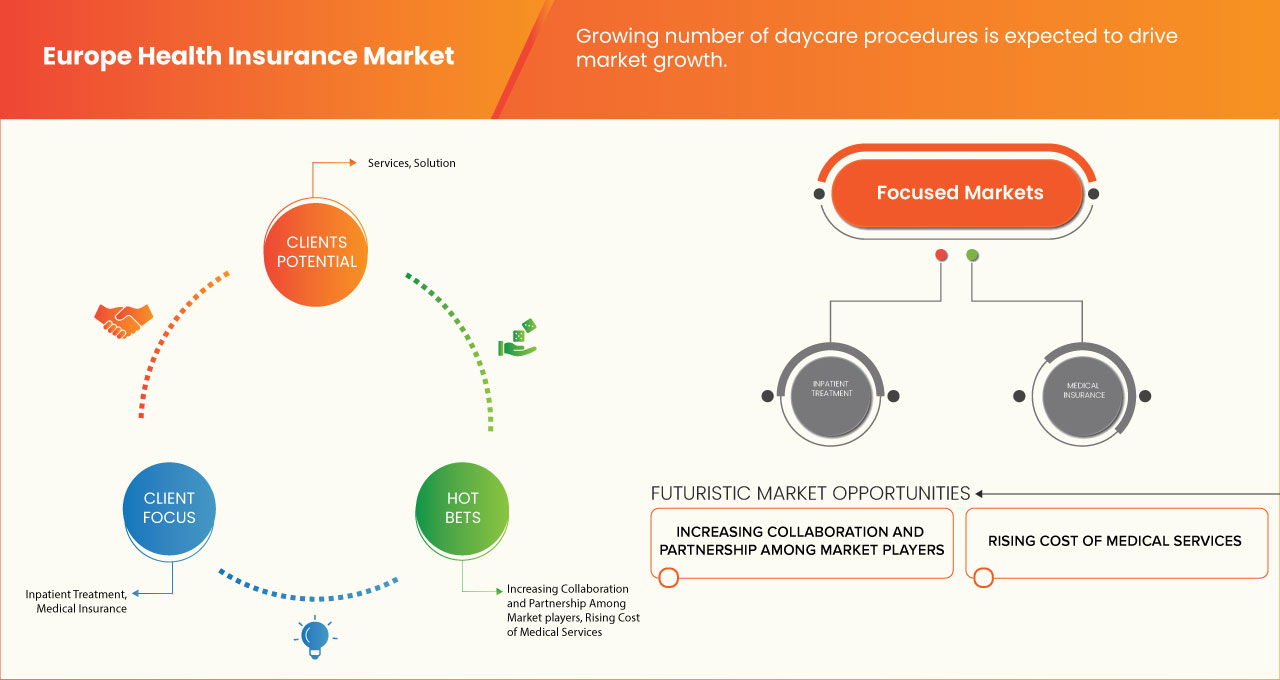

Análisis y perspectivas del mercado de seguros de salud en Europa

Se espera que el creciente número de procedimientos de guardería impulse el crecimiento del mercado. Sin embargo, se espera que el alto costo de las primas de seguro limite el crecimiento del mercado. Se espera que las ventajas de las pólizas de seguro de salud actúen como oportunidades para el crecimiento del mercado. Sin embargo, se espera que la falta de conocimiento sobre los beneficios del seguro de salud represente un desafío para el crecimiento del mercado.

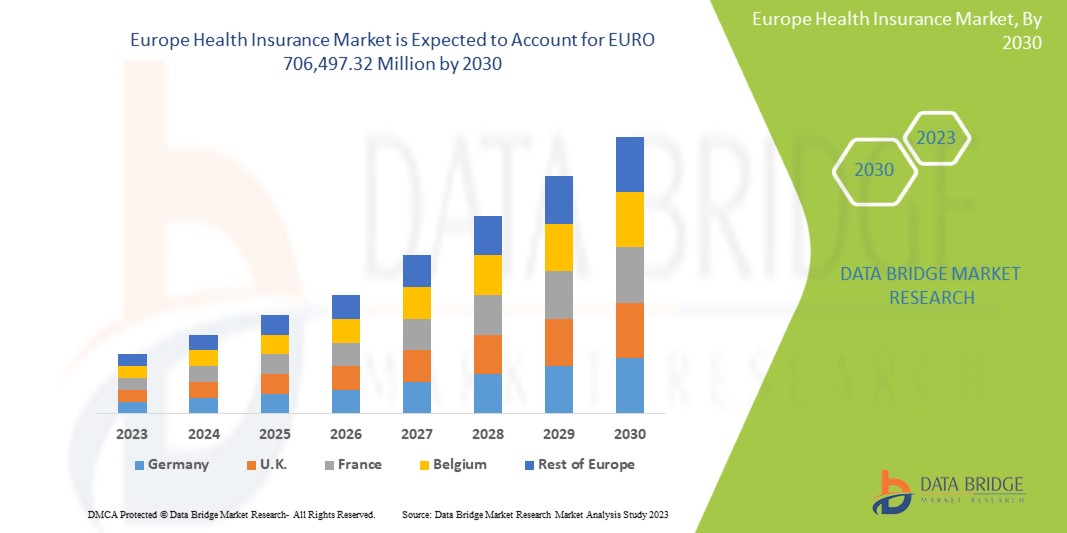

Data Bridge Market Research analiza que se espera que el mercado de seguros de salud en Europa alcance los 706.497,32 millones de euros en 2030 desde los 481.427,01 millones de euros en 2022, creciendo con una CAGR sustancial del 5,1% en el período de pronóstico de 2023 a 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de euros |

|

Segmentos cubiertos |

Oferta (servicios y soluciones), proveedor (público y privado), nivel de cobertura ( bronce , plata, oro y platino), red (punto de servicio (POS), organización de proveedores exclusivos (EPOS), seguro médico de indemnización, cuenta de ahorros para gastos médicos (HSA), acuerdos de reembolso de gastos médicos para pequeños empleadores calificados (QSEHRAS), organización de proveedores preferidos (PPO), organización de mantenimiento de la salud (HMO) y otros), datos demográficos (adultos, menores y adultos mayores), tipo de cobertura (de por vida y a término), usuario final (corporativo e individual), canal de distribución (ventas directas, instituciones financieras, comercio electrónico , hospitales, clínicas y otros) |

|

Países cubiertos |

Reino Unido, Alemania, Francia, Rusia, Italia, España, Países Bajos, Polonia, Suiza, Bélgica, Suecia, Turquía, Dinamarca, Noruega, Finlandia y resto de Europa |

|

Actores del mercado cubiertos |

Aetna Inc. (una subsidiaria de CVS Health) (EE. UU.), UNITEDHEALTH GROUP (EE. UU.), AXA (Francia), Bupa (Reino Unido), ASSICURAZIONI GENERALI SPA (Italia), Allianz Care (una subsidiaria de Allianz) (Francia), Cigna (EE. UU.), Aviva (Reino Unido), VHI Group (Irlanda), Vitality (Reino Unido), Oracle (EE. UU.), MAPFRE (España), Saga (Reino Unido), International Medical Group Inc. (EE. UU.), Broadstone Corporate Benefits Limited (Reino Unido), General and Medical Finance Ltd (Reino Unido), Healthcare International Global Network Ltd. (Reino Unido), Now Health International (Hong Kong), Freedom Health Insurance (Reino Unido) y, entre otros. |

Definición de mercado

El seguro de salud es un tipo de seguro que brinda cobertura para todo tipo de gastos quirúrgicos, así como para tratamientos médicos derivados de una enfermedad o lesión. Se aplica a una gama integral o limitada de servicios médicos que brinda cobertura total o parcial de los costos de servicios específicos. Brinda apoyo financiero al asegurado, ya que cubre todos los gastos médicos cuando el asegurado está hospitalizado para recibir tratamiento. También cubre los gastos previos y posteriores a la hospitalización.

En el plan de seguro médico hay varios tipos de cobertura disponibles, que son sin efectivo o con solicitud de reembolso. Un beneficio sin efectivo está disponible cuando el asegurado recibe tratamiento en los hospitales de la red de la compañía de seguros. Si el asegurado recibe tratamiento en hospitales que no están en la red de la lista, en ese caso, el asegurado cubre todos los gastos médicos y luego solicita el reembolso a la compañía de seguros presentando todas las facturas médicas.

Dinámica del mercado de seguros de salud en Europa

En esta sección se aborda la comprensión de los factores impulsores, las oportunidades, las limitaciones y los desafíos del mercado. Todo esto se analiza en detalle a continuación:

Conductores

- Aumento del coste de los servicios médicos

El aumento de los gastos asociados a las cirugías, las hospitalizaciones y los servicios médicos ha provocado una crisis financiera mundial. En caso de enfermedad grave o accidente, el seguro médico ofrece una ayuda financiera crucial. El coste de los servicios médicos abarca diversos elementos, como los gastos quirúrgicos, los honorarios médicos, los costes de hospitalización, los gastos de urgencias y los costes de pruebas diagnósticas. Esta tendencia al alza de los costes de los servicios médicos ha impulsado la expansión del mercado de los seguros médicos.

- Aumento del número de procedimientos de guardería

Los procedimientos ambulatorios se refieren a procedimientos médicos o cirugías que implican una estancia hospitalaria más corta. Los pacientes que se someten a procedimientos ambulatorios solo necesitan permanecer en el hospital durante un breve período. En los últimos tiempos, muchas compañías de seguros de salud han comenzado a incluir los procedimientos ambulatorios en sus planes de seguro. A diferencia de las reclamaciones de seguros tradicionales que requieren una estancia hospitalaria mínima de 24 horas, los asegurados ahora pueden reclamar el seguro por procedimientos ambulatorios sin cumplir con este requisito. Esta inclusión de los procedimientos ambulatorios en las pólizas de seguro de salud ha aumentado la demanda de dicha cobertura y ha contribuido al crecimiento del mercado.

Oportunidades

- Ventajas de las pólizas de seguro de salud

Los planes de seguro de salud brindan a los asegurados el reembolso de diversos gastos médicos, incluyendo hospitalización, cirugías y tratamientos relacionados con lesiones o enfermedades. Una póliza de seguro de salud representa un acuerdo entre el asegurado y la compañía de seguros. En virtud de este acuerdo, la compañía de seguros se compromete a cubrir los costos de futuros problemas médicos, mientras que el asegurado acepta pagar primas regulares de acuerdo con el plan de seguro elegido. Las ventajas que ofrecen las pólizas de seguro de salud crean condiciones favorables para la expansión del mercado mundial de seguros de salud, ya que las personas reconocen el valor y los beneficios de obtener dicha cobertura.

- Aumento del gasto sanitario

El gasto sanitario en todo el mundo está experimentando un rápido crecimiento. Según un informe de la Organización Mundial de la Salud (OMS), el gasto mundial en salud ha mostrado una tendencia ascendente constante. En las últimas dos décadas, el gasto sanitario se ha más que duplicado, alcanzando los 8,5 billones de dólares en 2019, equivalente al 9,8% del PIB mundial. Sin embargo, la distribución del gasto sanitario es desigual: los países de altos ingresos representan aproximadamente el 80% del gasto total. En los países de bajos ingresos, la atención sanitaria se financia principalmente mediante gastos directos (44%) y ayuda externa (29%), mientras que el gasto público tiene prioridad en los países de altos ingresos (70%). Este aumento del gasto sanitario presenta oportunidades para que el mercado europeo de seguros de salud se expanda y satisfaga la creciente demanda de cobertura integral.

- Restricciones/ Desafíos

Desconocimiento de los beneficios del seguro de salud

Una parte importante de la población mundial desconoce las ventajas de las pólizas de seguro médico en el sector de la salud. A medida que aumentan los gastos médicos debido a los avances en el campo, la industria de la salud está experimentando un crecimiento sustancial. Sin embargo, la adopción de pólizas de seguro médico sigue siendo limitada debido a la falta de conocimiento sobre sus beneficios. A pesar del crecimiento y los avances en la tecnología de la atención médica, existe la necesidad de aumentar la conciencia y la comprensión entre las personas sobre el valor y las ventajas de la cobertura de seguro médico.

- Altos costos de las primas de seguros

El seguro de salud está diseñado para cubrir una amplia gama de costos de tratamiento médico, brindando un apoyo financiero crucial a los asegurados cuando requieren hospitalización. Amplía la cobertura tanto a los gastos previos como posteriores a la hospitalización, lo que garantiza un apoyo integral durante todo el tratamiento. Para mantener una póliza de seguro de salud activa, los asegurados deben pagar primas de seguro regulares. Sin embargo, en muchos casos, el costo de las primas de seguro puede ser alto, lo que representa un desafío para el crecimiento del mercado. La asequibilidad y el precio de los planes de seguro son factores importantes a considerar para abordar esta barrera y fomentar la expansión del mercado.

Acontecimientos recientes

- En agosto de 2020, International Medical Group, Inc. (IMG) presentó una oferta ampliada de productos para ayudar a las organizaciones a planificar e investigar viajes internacionales seguros. La empresa presentó servicios de asistencia exclusivos destinados a apoyar a los clientes en sus planes de viaje tanto para el presente como para el futuro. Este desarrollo estratégico permitió a IMG afrontar con éxito los desafíos planteados por la pandemia y mantener su crecimiento y éxito.

- En junio de 2021, Vitality anunció una colaboración con Samsung UK, mediante la cual Samsung Health se integrará en el Programa Vitality. Esta integración tiene como objetivo ofrecer a los miembros opciones adicionales para realizar un seguimiento de su actividad y mejorar su salud general. Al vincular su perfil de Samsung Health a su cuenta de Vitality Member Zone, los usuarios de Android ahora pueden disfrutar de todas las ventajas del Programa Vitality. La asociación permite el registro automático de los pasos diarios y la actividad de frecuencia cardíaca a través de Samsung Health, lo que permite a los miembros ganar puntos de actividad Vitality sin problemas.

Alcance del mercado de seguros de salud en Europa

El seguro de salud en Europa se divide en ocho segmentos importantes según la oferta, el proveedor, el nivel de cobertura, la red, la demografía, el tipo de cobertura, el usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y las diferencias en sus mercados objetivo.

Ofrenda

- servicios

- solución

Sobre la base de la oferta, el mercado europeo de seguros de salud está segmentado en servicios y soluciones.

Proveedor

- Público

- Privado

Según el proveedor, el mercado europeo de seguros de salud está segmentado en público y privado.

Nivel de cobertura

- Bronce

- Plata

- Oro

- Platino

Según el nivel de cobertura, el mercado de seguros de salud europeo está segmentado en bronce, plata, oro y platino.

Red

- Punto de servicio (POS)

- Organización de proveedores exclusivos (EPOS)

- Seguro de salud de indemnización

- Cuenta de ahorros para gastos médicos (HSA)

- Acuerdos de reembolso de gastos de salud para pequeños empleadores calificados (QSEHRAS)

- Organización de proveedores preferidos (PPO)

- Organización para el mantenimiento de la salud (HMO)

- Otros

Sobre la base de la red, el mercado de seguros de salud de Europa está segmentado en punto de servicio (POS), organización de proveedores exclusivos (EPOS), seguro de salud de indemnización, cuenta de ahorros para salud (HSA), acuerdos de reembolso de salud para pequeños empleadores calificados (QSEHRAS), organización de proveedores preferidos (PPO), organización de mantenimiento de la salud (HMO) y otros.

Demografía

- Adultos

- Menores de edad

- Personas mayores

Sobre la base de la demografía, el mercado de seguros de salud en Europa está segmentado en adultos, menores y personas mayores.

Tipo de cobertura

- Vida

- Término

Según el tipo de cobertura, el mercado de seguros de salud europeo se segmenta en de por vida y a término.

Uso final

- Corporaciones

- Individual

En función del uso final, el mercado europeo de seguros de salud está segmentado en corporativos e individuales.

Canal de distribución

- Ventas directas

- Instituciones financieras

- Comercio electrónico

- Hospitales

- Clínicas

- Otros

Sobre la base del canal de distribución, el mercado de seguros de salud de Europa está segmentado en ventas directas, instituciones financieras, comercio electrónico, hospitales, clínicas y otros.

Análisis y perspectivas regionales del mercado de seguros de salud en Europa

El seguro de salud en Europa está segmentado en ocho segmentos notables según la oferta, el proveedor, el nivel de cobertura, la red, la demografía, el tipo de cobertura, el uso final y el canal de distribución.

Los países cubiertos en el informe del mercado de seguros de salud de Europa son Reino Unido, Alemania, Francia, Rusia, Italia, España, Países Bajos, Polonia, Suiza, Bélgica, Suecia, Turquía, Dinamarca, Noruega, Finlandia y el resto de Europa.

Se espera que el Reino Unido domine el mercado debido a la creciente demanda de seguros de salud por parte del sector corporativo en la región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, y el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado del seguro de salud en Europa

El panorama competitivo del mercado de seguros de salud en Europa proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en I+D, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, las aprobaciones de productos, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de supervivencia del tipo de producto. Los puntos de datos proporcionados anteriormente solo están relacionados con el enfoque de la empresa en el mercado.

Algunos de los principales actores del mercado que operan en el mercado de seguros de salud de Europa son Aetna Inc. (una subsidiaria de CVS Health) (EE. UU.), UNITEDHEALTH GROUP (EE. UU.), AXA (Francia), Bupa (Reino Unido), ASSICURAZIONI GENERALI SPA (Italia), Allianz Care (una subsidiaria de Allianz) (Francia), Cigna (EE. UU.), Aviva (Reino Unido), VHI Group (Irlanda), Vitality (Reino Unido), Oracle (EE. UU.), MAPFRE (España), Saga (Reino Unido), International Medical Group Inc. (EE. UU.), Broadstone Corporate Benefits Limited (Reino Unido), General and Medical Finance Ltd (Reino Unido), Healthcare International Global Network Ltd. (Reino Unido), Now Health International (Hong Kong), Freedom Health Insurance (Reino Unido), entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTH INSURANCE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PREMIUM INSIGHT- GLOBAL OVERVIEW

4.2 MIGRATION TRENDS IN EUROPE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING COST OF MEDICAL SERVICES

5.1.2 GROWING NUMBER OF DAYCARE PROCEDURES

5.1.3 MANDATORY PROVISION OF HEALTHCARE INSURANCE IN PUBLIC AND PRIVATE SECTORS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSURANCE PREMIUMS

5.2.2 STRICT DOCUMENTATION PROCESS FOR REIMBURSEMENT CLAIM

5.3 OPPORTUNITIES

5.3.1 ADVANTAGES OF HEALTH INSURANCE POLICIES

5.3.2 INCREASING HEALTHCARE EXPENDITURE

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS REGARDING THE BENEFITS OF HEALTH INSURANCE

6 EUROPE HEALTH INSURANCE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SERVICES

6.2.1 INPATIENT TREATMENT

6.2.2 OUTPATIENT TREATMENT

6.2.3 MEDICAL ASSURANCE

6.2.4 OTHERS

6.3 SOLUTION

6.3.1 MEDICAL ASSURANCE

6.3.2 DISEASES INSURANCE

6.3.3 INCOME PROTECTION INSURANCE

7 EUROPE HEALTH INSURANCE MARKET, BY PROVIDER

7.1 OVERVIEW

7.2 PUBLIC

7.3 PRIVATE

8 EUROPE HEALTH INSURANCE MARKET, BY COVERAGE TYPE

8.1 OVERVIEW

8.2 LIFETIME

8.3 TERM

9 EUROPE HEALTH INSURANCE MARKET, BY END USE

9.1 OVERVIEW

9.2 CORPORATE

9.2.1 SERVICES

9.2.1 SOLUTION

9.3 INDIVIDUAL

9.3.1 SERVICES

9.3.2 SOLUTION

10 EUROPE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 FINANCIAL INSTITUTIONS

10.4 E-COMMERCE

10.5 HOSPITALS

10.6 CLINICS

10.7 OTHERS

11 EUROPE HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE

11.1 OVERVIEW

11.2 BRONZE

11.3 SILVER

11.4 GOLD

11.5 PLATINUM

12 EUROPE HEALTH INSURANCE MARKET, BY NETWORK

12.1 OVERVIEW

12.2 POINT OF SERVICE (POS)

12.3 EXCLUSIVE PROVIDER ORGANIZATION (EPOS)

12.4 PREFERRED PROVIDER ORGANIZATION (PPO)

12.5 INDEMNITY HEALTH INSURANCE

12.6 HEALTH MAINTENANCE ORGANIZATION (HMO)

12.7 HEALTH SAVINGS ACCOUNT (HSA)

12.8 QUALIFIED SMALL EMPLOYER HEALTH REIMBURSEMENT ARRANGEMENTS (QSEHRAS)

12.9 OTHERS

13 EUROPE HEALTH INSURANCE MARKET, BY DEMOGRAPHICS

13.1 OVERVIEW

13.2 ADULTS

13.3 MINORS

13.4 SENIORS

14 EUROPE

14.1 U.K.

14.2 GERMANY

14.3 FRANCE

14.4 RUSSIA

14.5 ITALY

14.6 SPAIN

14.7 NETHERLANDS

14.8 POLAND

14.9 SWITZERLAND

14.1 BELGIUM

14.11 SWEDEN

14.12 TURKEY

14.13 DENMARK

14.14 NORWAY

14.15 FINLAND

14.16 REST OF EUROPE

15 EUROPE HEALTH INSURANCE MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 UNITEDHEALTH GROUP

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 AXA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 BUPA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 ASSICURANZIONI GENERALI S.P.A.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 ALLIANZ CARE (A SUBSIDIARY OF ALLIANZ)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 AVIVA

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 BROADSTONE CORPORATE BENEFITS LIMITED

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CIGNA

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 FREEDOM HEALTH INSURANCE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 GENERAL AND MEDICAL FINANCE LTD

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HEALTHCARE INTERNATIONAL GLOBAL NETWORK LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 INTERNATIONAL MEDICAL GROUP, INC.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 MAPFRE

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 NOW HEALTH INTERNATIONAL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEEVLOPMENTS

17.16 ORACLE

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 SAGA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 VHI GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 VITALITY (A SUBSIDIARY OF DISCOVERY LTD)

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tablas

TABLE 1 AVERAGE COSTS FOR COMMON SURGERIES

TABLE 2 LIST OF DAY CARE PROCEDURES

TABLE 3 EUROPE HEALTH INSURANCE MARKET, BY OFFERING, 2021-2030 (EURO MILLION)

TABLE 4 EUROPE SERVICES IN HEALTH INSURANCE MARKET, BY TYPE, 2021-2030 (EURO MILLION)

TABLE 5 EUROPE SOLUTION IN HEALTH INSURANCE MARKET, BY TYPE, 2021-2030 (EURO MILLION)

TABLE 6 EUROPE HEALTH INSURANCE MARKET, BY PROVIDER, 2021-2030 (EURO MILLION)

TABLE 7 EUROPE HEALTH INSURANCE MARKET, BY COVERAGE TYPE, 2021-2030 (EURO MILLION)

TABLE 8 EUROPE HEALTH INSURANCE MARKET, BY END USE, 2021-2030 (EURO MILLION)

TABLE 9 EUROPE CORPORATE IN HEALTH INSURANCE MARKET, BY OFFERING, 2021-2030 (EURO MILLION)

TABLE 10 EUROPE INDIVIDUAL IN HEALTH INSURANCE MARKET, BY OFFERING, 2021-2030 (EURO MILLION)

TABLE 11 EUROPE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (EURO MILLION)

TABLE 12 EUROPE HEALTH INSURANCE MARKET, BY LEVEL OF COVERAGE, 2021-2030 (EURO MILLION)

TABLE 13 EUROPE HEALTH INSURANCE MARKET, BY NETWORK, 2021-2030 (EURO MILLION)

TABLE 14 EUROPE HEALTH INSURANCE MARKET, BY DEMOGRAPHICS, 2021-2030 (EURO MILLION)

Lista de figuras

FIGURE 1 EUROPE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTH INSURANCE MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE HEALTH INSURANCE MARKET: END-USER COVERAGE GRID

FIGURE 10 EUROPE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 11 INCREASING COST FOR MEDICAL SERVICES IS EXPECTED TO DRIVE THE GROWTH OF THE EUROPE HEALTH INSURANCE MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEALTH INSURANCE MARKET IN 2023 AND 2030

FIGURE 13 MIGRANT POPULATION STATISTICS IN EUROPEAN COUNTRIES (2021)

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF EUROPE HEALTH INSURANCE MARKET

FIGURE 15 INCREASE IN HEALTH CARE EXPENDITURE BY ALL FINANCING SCHEMES (2019-2020)

FIGURE 16 EUROPE PRIVATE HEALTH INSURANCE COVERAGE, 2020

FIGURE 17 PERCENTAGE OF OUT-OF-POCKET EXPENDITURE ON HEALTH (2019)

FIGURE 18 HEALTH INSURANCE COVERAGE

FIGURE 19 EUROPE HEALTH INSURANCE MARKET: BY OFFERING, 2022

FIGURE 20 EUROPE HEALTH INSURANCE MARKET: BY PROVIDER, 2022

FIGURE 21 EUROPE HEALTH INSURANCE MARKET: BY COVERAGE TYPE, 2022

FIGURE 22 EUROPE HEALTH INSURANCE MARKET: BY END USE, 2022

FIGURE 23 EUROPE HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 24 EUROPE HEALTH INSURANCE MARKET: BY LEVEL OF COVERAGE, 2022

FIGURE 25 EUROPE HEALTH INSURANCE MARKET: BY NETWORK, 2022

FIGURE 26 EUROPE HEALTH INSURANCE MARKET: BY DEMOGRAPHICS, 2022

FIGURE 27 EUROPE HEALTH INSURANCE MARKET: SNAPSHOT (2022)

FIGURE 28 EUROPE HEALTH INSURANCE MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.