Mercado de tratamiento de gas en Europa, por tipo ( amina terciaria , amina primaria, amina secundaria, no aminas), tipo de gas (gas ácido, gas de síntesis), tratamiento ( eliminación de gas ácido , deshidratación, otros), tecnología (OASE (BASF SE), Flexsorb (Exxon Mobil Corporation), ADIP (Royal Dutch Shell Plc), UOP (Honeywell International Inc.), SPREX (Axens), otros), industria (centrales eléctricas, refinerías, metal y minería, petróleo y gas, pulpa y papel, alimentos y bebidas, otros), país (Alemania, Francia, Italia, Reino Unido, Bélgica, España, Rusia, Turquía, Países Bajos, Suiza y resto de Europa), tendencias de la industria y pronóstico hasta 2028

Análisis y perspectivas del mercado: mercado de tratamiento de gas en Europa

Análisis y perspectivas del mercado: mercado de tratamiento de gas en Europa

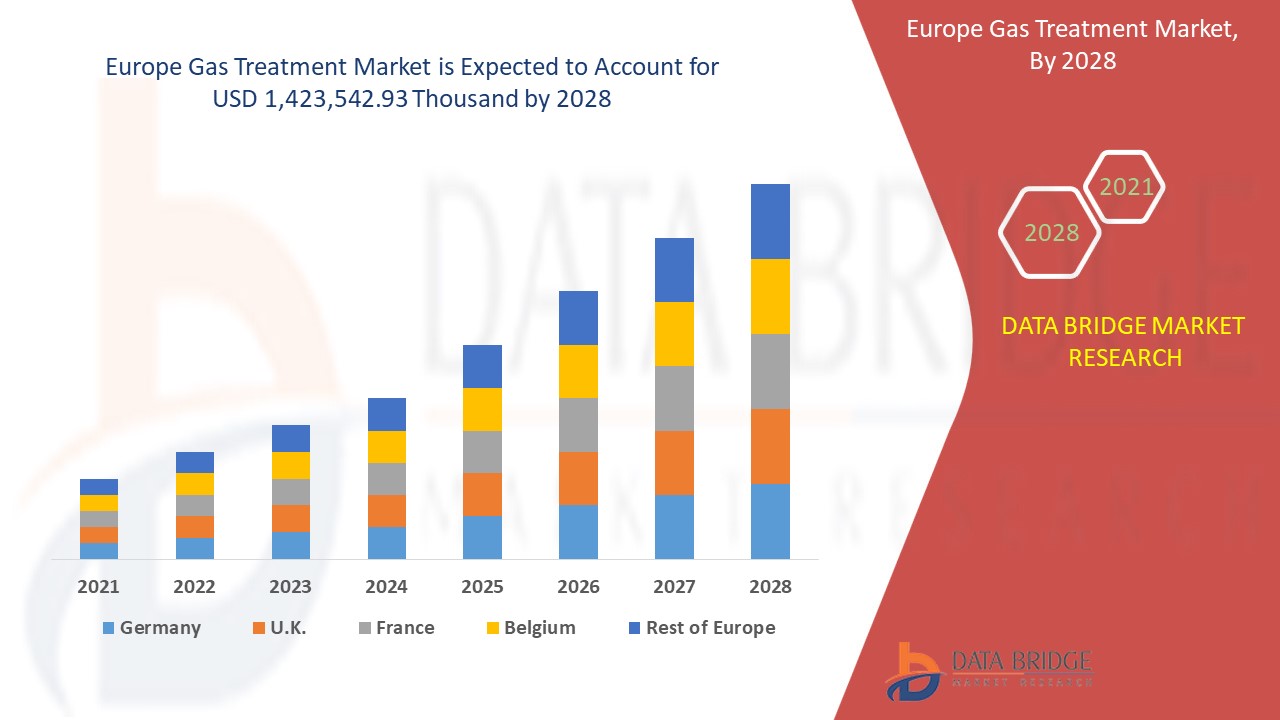

Se espera que el mercado de tratamiento de gas de Europa gane un crecimiento significativo en el período de pronóstico de 2021 a 2028. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 4,6% en el período de pronóstico de 2021 a 2028 y se espera que alcance los USD 1.423.542,93 mil para 2028.

El tratamiento de gases es el proceso de mejora de la calidad de los gases mediante el cual se eliminan los componentes no deseados de los gases. La necesidad de tratamiento de gases está aumentando debido al aumento del consumo de gases naturales como fuente de energía en diversas aplicaciones/industrias. Elimina el sulfuro de hidrógeno y el dióxido de carbono, lo que hace que su uso sea seguro como fuente de energía limpia y cumple con los reguladores ambientales.

La creciente demanda de gas natural debido a su bajo impacto ambiental está impulsando el crecimiento del mercado. El creciente uso de filtros industriales y precipitadores electrostáticos está actuando como un potencial impulsor del mercado. Además, las crecientes y estrictas regulaciones de control de la contaminación del aire están aumentando las ventas y las ganancias de los actores que operan en el mercado.

La principal limitación que afecta al mercado es el alto costo de las materias primas especializadas para la extracción de gas. Además, diversas complicaciones asociadas con el proceso de extracción de gas también limitarán el crecimiento del mercado. Las oportunidades para el mercado son el avance en la tecnología de tratamiento en la industria del petróleo y el gas. Uno de los impulsores significativos asociados con el mercado de tratamiento de gas es el creciente uso de gases naturales como una fuente más limpia para la generación de electricidad. Sin embargo, las estrictas regulaciones gubernamentales con respecto al tratamiento de gas pueden desafiar el crecimiento del mercado.

Este informe sobre el mercado de tratamiento de gases proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de nuevos segmentos de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen de analistas. Nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de tratamiento de gas en Europa

Alcance y tamaño del mercado de tratamiento de gas en Europa

El mercado europeo de tratamiento de gas está segmentado en función del tipo, el tipo de gas, el tratamiento, la tecnología y la industria. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

- Según el tipo, el mercado europeo de tratamiento de gases se segmenta en aminas primarias, aminas secundarias, aminas terciarias y no aminas. En 2021, se espera que las aminas terciarias dominen el mercado debido al aumento de las preocupaciones por la sostenibilidad ambiental y la salud pública, lo que ayuda a impulsar su demanda en el año de pronóstico.

- Según el tipo de gas, el mercado de tratamiento de gas de Europa se segmenta en gas ácido y gas de síntesis. En 2021, se espera que el segmento de gas ácido domine el mercado de tratamiento de gas de Europa debido al cambio de la energía del carbón al gas natural, lo que aumenta su demanda en el año de pronóstico.

- En función del tratamiento, el mercado de tratamiento de gases de Europa se segmenta en deshidratación, eliminación de gases ácidos y otros. En 2021, se espera que la eliminación de gases ácidos domine el mercado de tratamiento de gases de Europa, ya que el tratamiento de eliminación de gases ácidos se utiliza para eliminar los componentes ácidos para cumplir con las especificaciones de CO2, lo que aumenta su demanda en el año de pronóstico.

- En función de la tecnología, el mercado europeo de tratamiento de gases está segmentado en SPREX (Axens), ADIP (Royal Dutch Shell plc), UOP (Honeywell International inc.), OASE (BASF SE), Flexsorb (Exxon Mobil Corporation) y otros. En 2021, se espera que OASE (BASF SE) domine el mercado, ya que ayuda a las refinerías y procesadores de gas a cumplir con las políticas regulatorias sobre emisiones de gases nocivos, lo que impulsa su demanda en el año de pronóstico.

- En función de la industria, el mercado de tratamiento de gas de Europa está segmentado en refinerías, plantas de energía, pulpa y papel, metales y minería, alimentos y bebidas, petróleo y gas, y otros. En 2021, se espera que el segmento de las plantas de energía domine el mercado debido al aumento de la urbanización, los ingresos de las personas y la demanda de electricidad en toda la región, lo que impulsa su demanda en el año de pronóstico.

Análisis a nivel de país del mercado de tratamiento de gas en Europa

Se analiza el mercado de tratamiento de gas de Europa y se proporciona información sobre el tamaño del mercado por país, tipo, tipo de gas, tratamiento, tecnología e industria.

Los países cubiertos en el informe del mercado de tratamiento de gases de Europa son Alemania, Reino Unido, Francia, Rusia, Italia, España, Países Bajos, Suiza, Bélgica, Turquía y el resto de Europa.

Se espera que Alemania domine el mercado europeo de tratamiento de gas debido al cambio de la energía del carbón al gas natural, que contribuye en gran medida al crecimiento de dicho mercado.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta se consideran al proporcionar un análisis de pronóstico de los datos del país.

Crecimiento en la industria de tratamiento de gases

El mercado de tratamiento de gases de Europa también le proporciona un análisis detallado del mercado para cada país, el crecimiento de la base instalada de diferentes tipos de productos para el mercado de tratamiento de gases, el impacto de la tecnología mediante curvas de línea de vida y los cambios en los escenarios regulatorios de las fórmulas infantiles, y su impacto en el mercado de tratamiento de gases. Los datos están disponibles para el período histórico de 2011 a 2019.

Análisis del panorama competitivo y de la cuota de mercado del tratamiento de gas

El panorama competitivo del mercado de tratamiento de gases de Europa ofrece detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción , las fortalezas y debilidades de la empresa, el lanzamiento de productos, los proyectos de ensayos clínicos , el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa en relación con el mercado de tratamiento de gases de Europa.

Algunos de los principales actores incluidos en el informe son INEOS, BASF SE, Royal Dutch Shell plc, Dow, Honeywell International Inc., Clariant, Eastman Chemical Company, Ecolab, Exxon Mobil Corporation, Cabot Corporation, Huntsman International LLC, Lhoist, Axens, Eunisell Chemicals, entre otros. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Por ejemplo,

- En junio de 2021, Axens y Sulzer Chemtech formaron una alianza para obtener la licencia de un proceso avanzado para el procesamiento de nafta mediante craqueo catalítico fluido (FCC). Con este desarrollo, la empresa espera aumentar su cartera de productos y fortalecer su marca en el mercado.

- En octubre de 2021, Clariant presentó 'Licosperse', una preparación de pigmentos más ecológica para aplicaciones de pulido. La empresa implementó el lanzamiento de este producto con el fin de ampliar su contribución a la gestión de la sostenibilidad.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE GAS TREATMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE OF GAS LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET INDUSTRY COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 EUROPE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR NATURAL GAS OWING TO ITS LOW ENVIRONMENTAL FOOTPRINT

5.1.2 GROWING USAGE OF INDUSTRIAL FILTERS AND ELECTROSTATIC PRECIPITATORS

5.1.3 RISING STRINGENT AIR POLLUTION CONTROL REGULATIONS

5.1.4 GROWING USAGES OF NATURAL GASSES AS A CLEANER SOURCE FOR ELECTRICITY GENERATION

5.2 RESTRAINTS

5.2.1 HIGH COST OF SPECIALIZED RAW MATERIALS FOR GAS EXTRACTION SUCH AS RAPID EVAPORATION SPEED MATERIAL AND FILTRATION PIPES

5.2.2 VARIOUS COMPLICATION ASSOCIATED WITH GAS EXTRACTION PROCESS

5.2.3 HUGE INSTALLATION AND INITIAL COST FOR GAS TREATMENT

5.3 OPPORTUNITIES

5.3.1 INCREASING GOVERNMENT INITIATIVES FOR GAS TREATMENT

5.3.2 DISCOVERY OF NEW GAS RESERVES ACROSS THE WORLD

5.3.3 ADVANCEMENT IN TREATMENT TECHNOLOGY IN OIL & GAS INDUSTRY

5.4 CHALLENGES

5.4.1 STRINGENT GOVERNMENT REGULATIONS REGARDING GAS TREATMENT

5.4.2 INCREASING HEALTH ISSUE AMONG THE WORKERS OF GAS INDUSTRY

6 ANALYSIS ON IMPACT OF COVID-19 ON THE GAS TREATMENT MARKET

6.1 AFTERMATH OF COVID-19 GOVERNMENT INITIATIVES TO BOOST GAS TREATMENT MARKET

6.2 STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID-19 TO GET COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE GAS TREATMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 TERTIARY AMINE

7.2.1 TRIETHANOLAMINE

7.2.2 METHYLDIETHANOLAMINE

7.3 PRIMARY AMINE

7.3.1 MONOETHANOLAMINE

7.3.2 DIGLYCOLAMINE

7.4 SECONDARY AMINE

7.4.1 DIETHANOLAMINE

7.4.2 DIISOPROPANOLAMINE

7.5 NON-AMINES

7.5.1 GLYCOLS

7.5.2 TRIAZINE

7.5.3 OTHERS

8 EUROPE GAS TREATMENT MARKET, BY TYPE OF GAS

8.1 OVERVIEW

8.2 ACID GAS

8.3 SYNTHESIS GAS

9 EUROPE GAS TREATMENT MARKET, BY TREATMENT

9.1 OVERVIEW

9.2 ACID GAS REMOVAL

9.3 DEHYDRATION

9.4 OTHERS

10 EUROPE GAS TREATMENT MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 OASE (BASF SE)

10.3 FLEXSORB (EXXON MOBIL CORPORATION)

10.4 ADIP (ROYAL DUTCH SHELL PLC)

10.5 UOP (HONEYWELL INTERNATIONAL INC.)

10.6 SPREX (AXENS)

10.7 OTHERS

11 EUROPE GAS TREATMENT MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 POWER PLANTS

11.3 REFINERIES

11.4 METAL & MINING

11.5 OIL & GAS

11.6 PULP & PAPER

11.7 FOOD & BEVERAGES

11.8 OTHERS

12 EUROPE GAS TREATMENT MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K.

12.1.3 FRANCE

12.1.4 RUSSIA

12.1.5 TURKEY

12.1.6 ITALY

12.1.7 SPAIN

12.1.8 NETHERLANDS

12.1.9 BELGIUM

12.1.10 SWITZERLAND

12.1.11 REST OF EUROPE

13 EUROPE GAS TREATMENT MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

13.2 PARTNERSHIPS & ACQUISITIONS

13.3 EXPANSIONS

13.4 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 DOW

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 EXXON MOBIL CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 ROYAL DUTCH SHELL PLC

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 HONEYWELL INTERNATIONAL INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 INEOS

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATE

15.7 EASTMAN CHEMICAL COMPANY

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 CLARIANT

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 ECOLAB

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 AXENS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 BERRYMAN CHEMICAL

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

15.12 CABOT CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATE

15.13 EUNISELL CHEMICALS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATES

15.14 HUNTSMAN INTERNATIONAL LLC

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 LHOIST

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING GASES; HS CODE: 842139 (USD THOUSAND)

TABLE 2 EXPORT DATA OF MACHINERY AND APPARATUS FOR FILTERING OR PURIFYING GASES; HS CODE: 842139 (USD THOUSAND)

TABLE 3 AIR POLLUTION CONTROL REGULATIONS IN EUROPE & U.S.

TABLE 4 EUROPE GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 5 EUROPE GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 6 EUROPE TERTIARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 7 EUROPE TERTIARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (TONS)

TABLE 8 EUROPE TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 9 EUROPE PRIMARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 10 EUROPE PRIMARY AMINE TYPE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (TONS )

TABLE 11 EUROPE PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 12 EUROPE SECONDARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 13 EUROPE SECONDARY AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (TONS)

TABLE 14 EUROPE SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 15 EUROPE NON-AMINES IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 16 EUROPE NON-AMINE IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (TONS )

TABLE 17 EUROPE NON-AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 18 EUROPE GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 19 EUROPE ACID GAS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 20 EUROPE SYNTHESIS GAS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 21 EUROPE GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 22 EUROPE ACID GAS REMOVAL IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 EUROPE DEHYDRATION IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 EUROPE OTHERS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 25 EUROPE GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 26 EUROPE OASE (BASF SE) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 EUROPE FLEXSORB (EXXON MOBIL CORPORATION) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 EUROPE ADIP (ROYAL DUTCH SHELL PLC) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 29 EUROPE UOP (HONEYWELL INTERNATIONAL INC.) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 EUROPE SPREX (AXENS) IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 31 EUROPE OTHERS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 32 EUROPE GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 33 EUROPE POWER PLANTS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 34 EUROPE REFINERIES IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 35 EUROPE METAL & MINING IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 36 EUROPE OIL & GAS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 EUROPE PULP & PAPER IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 38 EUROPE FOOD & BEVERAGES IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 EUROPE OTHERS IN GAS TREATMENT MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 40 EUROPE GAS TREATMENT MARKET, BY COUNTRY, 2019-2028 (USD THOUSAND)

TABLE 41 EUROPE GAS TREATMENT MARKET, BY COUNTRY, 2019-2028 (TONS)

TABLE 42 EUROPE GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 43 EUROPE GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 44 EUROPE PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 45 EUROPE SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 46 EUROPE TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 47 EUROPE NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 48 EUROPE GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 49 EUROPE GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 50 EUROPE GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 51 EUROPE GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 52 GERMANY GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 53 GERMANY GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 54 GERMANY PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 55 GERMANY SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 56 GERMANY TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 57 GERMANY NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 58 GERMANY GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 59 GERMANY GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 60 GERMANY GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 61 GERMANY GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 62 U.K. GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 63 U.K. GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 64 U.K. PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 65 U.K. SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 66 U.K. TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 67 U.K. NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 68 U.K. GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 69 U.K. GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 70 U.K. GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 71 U.K. GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 72 FRANCE GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 73 FRANCE GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 74 FRANCE PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 75 FRANCE SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 76 FRANCE TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 77 FRANCE NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 78 FRANCE GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 79 FRANCE GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 80 FRANCE GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 81 FRANCE GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 82 RUSSIA GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 83 RUSSIA GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 84 RUSSIA PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 85 RUSSIA SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 86 RUSSIA TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 87 RUSSIA NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 88 RUSSIA GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 89 RUSSIA GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 90 RUSSIA GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 91 RUSSIA GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 92 TURKEY GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 93 TURKEY GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 94 TURKEY PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 95 TURKEY SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 96 TURKEY TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 97 TURKEY NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 98 TURKEY GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 99 TURKEY GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 100 TURKEY GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 101 TURKEY GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 102 ITALY GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 103 ITALY GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 104 ITALY PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 105 ITALY SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 106 ITALY TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 107 ITALY NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 108 ITALY GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 109 ITALY GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 110 ITALY GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 111 ITALY GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 112 SPAIN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 113 SPAIN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 114 SPAIN PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 115 SPAIN SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 116 SPAIN TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 117 SPAIN NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 118 SPAIN GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 119 SPAIN GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 120 SPAIN GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 121 SPAIN GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 122 NETHERLANDS GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 123 NETHERLANDS GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 124 NETHERLANDS PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 125 NETHERLANDS SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 126 NETHERLANDS TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 127 NETHERLANDS NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 128 NETHERLANDS GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 129 NETHERLANDS GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 130 NETHERLANDS GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 131 NETHERLANDS GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 132 BELGIUM GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 133 BELGIUM GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 134 BELGIUM PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 135 BELGIUM SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 136 BELGIUM TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 137 BELGIUM NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 138 BELGIUM GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 139 BELGIUM GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 140 BELGIUM GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 141 BELGIUM GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 142 SWITZERLAND GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 143 SWITZERLAND GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

TABLE 144 SWITZERLAND PRIMARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 145 SWITZERLAND SECONDARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 146 SWITZERLAND TERTIARY AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 147 SWITZERLAND NON-AMINES AMINE IN GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 148 SWITZERLAND GAS TREATMENT MARKET, BY TYPE OF GAS, 2019-2028 (USD THOUSAND)

TABLE 149 SWITZERLAND GAS TREATMENT MARKET, BY TREATMENT, 2019-2028 (USD THOUSAND)

TABLE 150 SWITZERLAND GAS TREATMENT MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 151 SWITZERLAND GAS TREATMENT MARKET, BY INDUSTRY, 2019-2028 (USD THOUSAND)

TABLE 152 REST OF EUROPE GAS TREATMENT MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 153 REST OF EUROPE GAS TREATMENT MARKET, BY TYPE, 2019-2028 (TONS)

Lista de figuras

FIGURE 1 EUROPE GAS TREATMENT MARKET: SEGMENTATION

FIGURE 2 EUROPE GAS TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE GAS TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GAS TREATMENT MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE GAS TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE GAS TREATMENT MARKET: THE TYPE OF GAS LIFE LINE CURVE

FIGURE 7 EUROPE GAS TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE GAS TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE GAS TREATMENT MARKET: MARKET INDUSTRY COVERAGE GRID

FIGURE 10 EUROPE GAS TREATMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 EUROPE GAS TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE GAS TREATMENT MARKET: SEGMENTATION

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE GAS TREATMENT MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 INCREASING DEMAND FOR NATURAL GAS OWING TO ITS LOW ENVIRONMENTAL FOOTPRINT IS DRIVING THE EUROPE GAS TREATMENT MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 TERTIARY AMINE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE GAS TREATMENT MARKET IN 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE GAS TREATMENT MARKET

FIGURE 17 EUROPE NATURAL GAS CONSUMPTION, TERA JOULE, (1990-2019)

FIGURE 18 NATURAL GAS CONSUMPTION IN U.S., 2019

FIGURE 19 PERCENTAGE BREAKDOWN OF COST SHARES FOR ONSHORE OIL AND NATURAL GAS DRILLING AND COMPLETION

FIGURE 20 NATURAL GAS RESERVES BY COUNTRY (MMCF) IN 2017

FIGURE 21 EUROPE GAS TREATMENT MARKET: BY TYPE, 2020

FIGURE 22 EUROPE GAS TREATMENT MARKET: BY TYPE OF GAS, 2020

FIGURE 23 EUROPE GAS TREATMENT MARKET: BY TREATMENT, 2020

FIGURE 24 EUROPE GAS TREATMENT MARKET: BY TECHNOLOGY, 2020

FIGURE 25 EUROPE GAS TREATMENT MARKET: BY INDUSTRY, 2020

FIGURE 26 EUROPE GAS TREATMENT MARKET: SNAPSHOT (2020)

FIGURE 27 EUROPE GAS TREATMENT MARKET: BY COUNTRY (2020)

FIGURE 28 EUROPE GAS TREATMENT MARKET: BY COUNTRY (2021 & 2028)

FIGURE 29 EUROPE GAS TREATMENT MARKET: BY COUNTRY (2020 & 2028)

FIGURE 30 EUROPE GAS TREATMENT MARKET: BY TYPE (2021-2028)

FIGURE 31 EUROPE GAS TREATMENT MARKET: COMPANY SHARE 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.