Mercado de tarjetas de combustible para flotas comerciales en Europa, por tipo de tarjeta (tarjetas de combustible universales, tarjetas de combustible de marca, tarjetas de combustible para comerciantes), características (informes de vehículos, compatibilidad con EMV, tokenización, actualizaciones en tiempo real, pagos móviles y transacciones sin tarjeta, otros), tipo de suscripción (tarjeta registrada, tarjeta al portador), utilidad (tarifas de estacionamiento de vehículos, pago de tarifas de petróleo, mantenimiento de flotas, pago de tarifas de peaje, otros), usuario final (flotas de reparto, flotas de taxis, flotas de alquiler de automóviles, flotas de servicios públicos, otros), país (Reino Unido, Alemania, Francia, Italia, España, Rusia, Países Bajos, Bélgica, Suiza, Turquía y resto de Europa), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado: mercado europeo de tarjetas de combustible para flotas comerciales

Análisis y perspectivas del mercado: mercado europeo de tarjetas de combustible para flotas comerciales

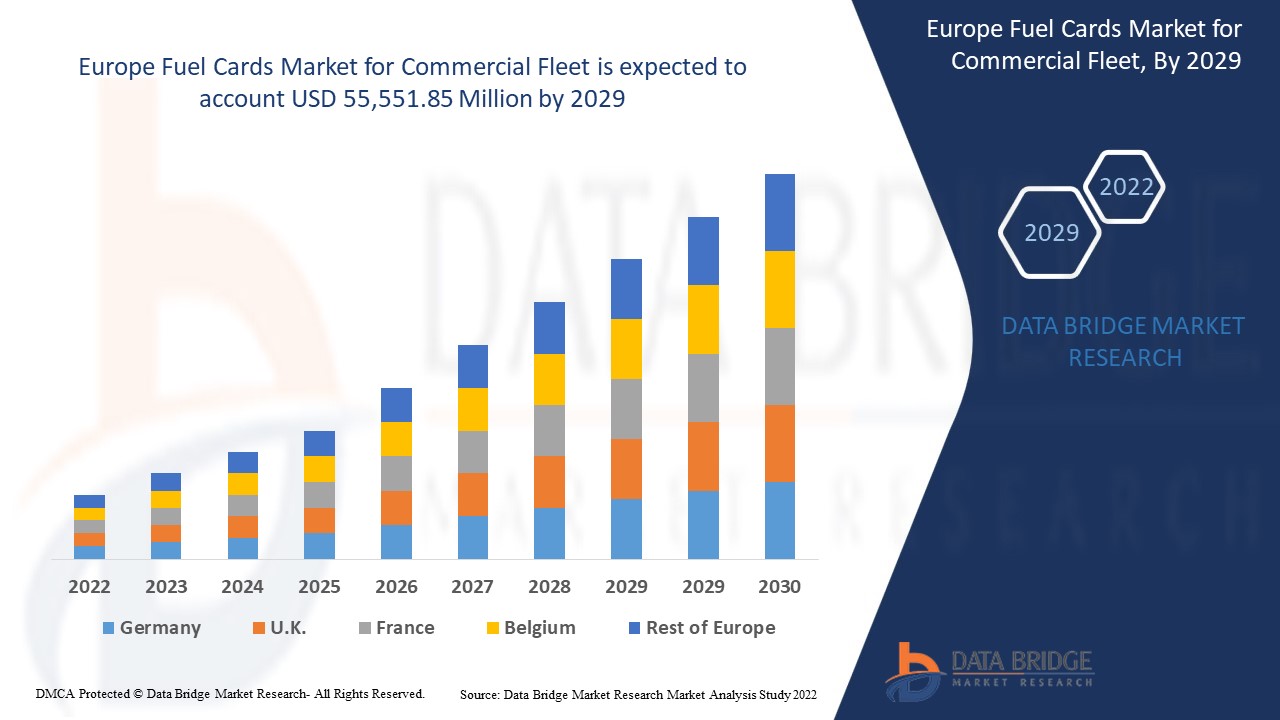

Se espera que el mercado europeo de tarjetas de combustible para flotas comerciales gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo con una CAGR del 6,3% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 55.551,85 millones para 2029. El aumento de la demanda de dispositivos relacionados con la automatización del hogar inteligente está impulsando el mercado.

Una tarjeta de combustible es una forma cómoda de pagar la gasolina, el diésel y otros combustibles en las estaciones de servicio. En lugar de pagar con efectivo, tarjeta de crédito o cheque, el conductor entrega la tarjeta de combustible . Proporcionan diversos beneficios a los proveedores de flotas al capturar datos de bajo nivel sobre el kilometraje de los vehículos, los galones de combustible cargados y la necesidad de mantenimiento del vehículo. Además, sus proveedores de servicios han comenzado a integrar una interfaz telemática y sólidas instalaciones de informes como ofertas de productos estándar para mejorar la productividad de la gestión de flotas. Además, un aumento en la preferencia por la digitalización de los pagos y la influencia de la Internet de las cosas (IoT) están complementando significativamente el crecimiento del mercado de tarjetas de combustible.

La creciente demanda de un control de la compra de vehículos y del consumo de combustible es el principal factor impulsor del mercado. El creciente uso de escáneres de códigos de barras para camuflar las compras y robar combustible puede resultar un desafío, pero la disponibilidad de descuentos lucrativos en las tarjetas de combustible puede ser una oportunidad. La mayor tasa de interés de la tarjeta sobre la compra de combustible puede ser un obstáculo para la adopción de las persianas exteriores.

El informe del mercado de tarjetas de combustible para flotas comerciales proporciona detalles de la participación de mercado, nuevos desarrollos y análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado de tarjetas de combustible para flotas comerciales, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Mercado europeo de tarjetas de combustible para flotas comerciales: alcance y tamaño del mercado

Mercado europeo de tarjetas de combustible para flotas comerciales: alcance y tamaño del mercado

El mercado europeo de tarjetas de combustible para flotas comerciales está segmentado en cinco segmentos notables que son tipo de tarjeta, características, tipo de suscripción, utilidad y usuario final.

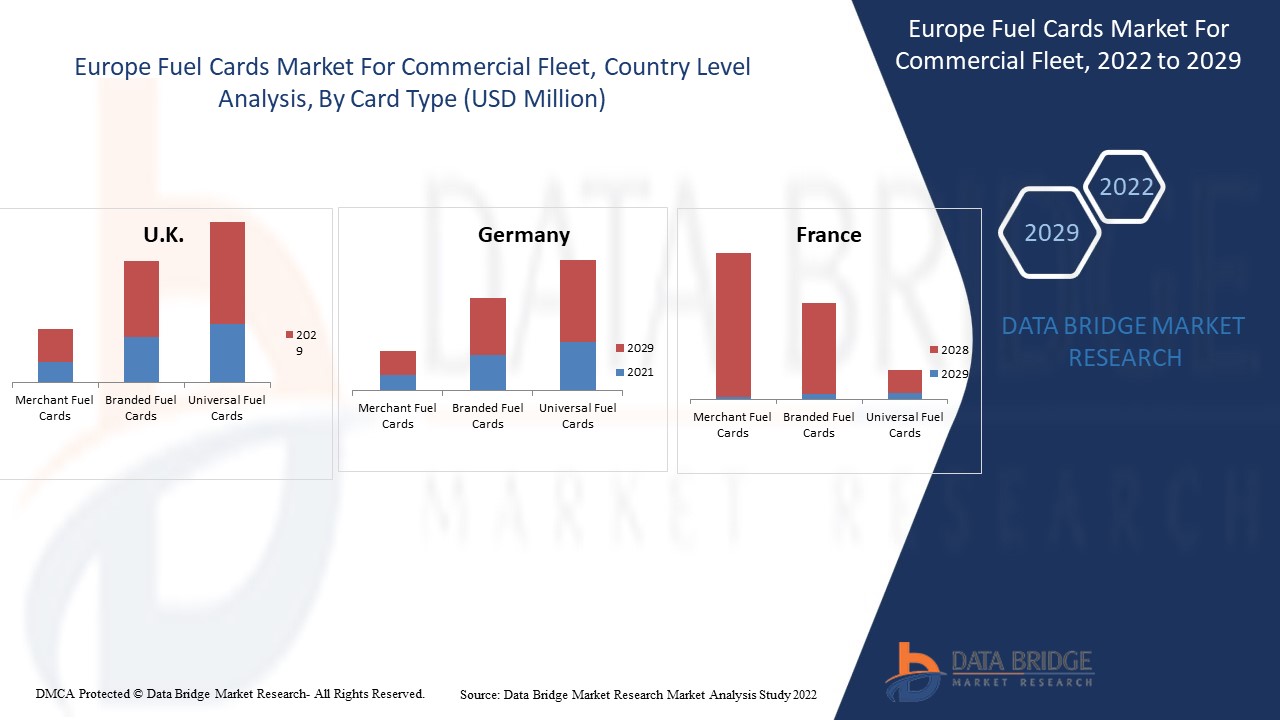

- En función del tipo de tarjeta, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en tarjetas de combustible universales, tarjetas de marca y tarjetas comerciales. En 2022, las tarjetas de combustible universales ocupan el segmento más alto, ya que ofrecen flexibilidad, control y conveniencia para todas las necesidades de compra de las empresas, lo que permite un control más estricto de los gastos comerciales.

- En función de sus características, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en informes de vehículos, compatibilidad con EMV, tokenización, actualizaciones en tiempo real, pagos móviles y transacciones sin tarjeta, entre otros. En 2022, los pagos móviles y las transacciones sin tarjeta ocupan el segmento más alto, ya que ofrecen una capa adicional de seguridad para todo tipo de empresas.

- Según el tipo de suscripción, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en tarjetas registradas y tarjetas al portador. En 2022, las tarjetas registradas ocupan el segmento más alto, ya que ayudan a los propietarios de empresas a realizar un seguimiento de todos los gastos y ofrecen más flexibilidad para monitorear los vehículos.

- En función de la utilidad, el mercado europeo de tarjetas de combustible para flotas comerciales está segmentado en tarifas de estacionamiento de vehículos, pago de tarifas de combustible, mantenimiento de flotas, pago de tarifas de peaje, entre otros. En 2022, el pago de tarifas de combustible ocupa el segmento más alto, ya que la aplicación de las tarjetas de combustible es mayor en las estaciones de servicio y los usuarios obtienen una serie de beneficios como reembolsos de efectivo, recompensas de puntos y más.

- En función del usuario final, el mercado europeo de tarjetas de combustible para flotas comerciales se segmenta en flotas de reparto, flotas de alquiler de coches, flotas de servicios públicos, flotas de taxis y otras. En 2022, las flotas de reparto ocupan el segmento más alto, ya que ayudan a mejorar los servicios al cliente con una interfaz telemática para una gestión adecuada de la flota.

Análisis a nivel de país del mercado europeo de tarjetas de combustible para flotas comerciales

Análisis a nivel de país del mercado europeo de tarjetas de combustible para flotas comerciales

Se analiza el mercado de tarjetas de combustible para flotas comerciales y se proporciona información sobre el tamaño del mercado por país, tipo de tarjeta, características, tipo de suscripción, utilidad y usuario final como se menciona anteriormente.

Los países incluidos en el informe sobre el mercado europeo de tarjetas de combustible para flotas comerciales son Alemania, Francia, Italia, Reino Unido, España, Rusia, Países Bajos, Suiza, Bélgica, Turquía y el resto de Europa.

El Reino Unido domina el mercado gracias a los avances en investigación y desarrollo relacionados con la calidad y el diseño de las persianas exteriores. Alemania ocupa el segundo puesto debido a la creciente demanda de viviendas energéticamente eficientes en el país. Francia ocupa el tercer puesto debido a la creciente concienciación sobre la protección contra los dañinos rayos UV en espacios residenciales y comerciales.

La sección de países del informe también proporciona factores de impacto individuales en el mercado y cambios en la regulación en el mercado a nivel nacional que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como nuevas ventas, ventas de reemplazo, demografía del país, leyes regulatorias y aranceles de importación y exportación son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se considera la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

La creciente inclinación hacia la banca digital está impulsando el crecimiento del mercado europeo de tarjetas de combustible para flotas comerciales.

El mercado europeo de tarjetas de combustible para flotas comerciales también le ofrece un análisis detallado del mercado para el crecimiento de cada país en un mercado en particular. Además, proporciona información detallada sobre la estrategia de los actores del mercado y su presencia geográfica. Los datos están disponibles para el período histórico de 2012 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de tarjetas de combustible para flotas comerciales en Europa

El panorama competitivo del mercado de tarjetas de combustible para flotas comerciales proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de prueba de productos, las aprobaciones de productos, las patentes, la amplitud y la profundidad de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de la empresa relacionado con el mercado de tarjetas de combustible para flotas comerciales.

Algunos de los principales actores que operan en el mercado europeo de tarjetas de combustible para flotas comerciales son Exxon Mobil Corporation, Shell, UK Fuels Limited, WAG payment solutions, as, bp plc, DKV EURO SERVICE Gmbh + Co. KG, Wex Europe Services, UTA (una empresa de Edenred), OMV Aktiengesellschaft y TotalEnergies, entre otros.

Numerosos desarrollos, contratos, acuerdos y ampliaciones son también iniciados por empresas de todo el mundo que también están acelerando el mercado de tarjetas de combustible para flotas comerciales.

Por ejemplo,

- En julio de 2021, UK Fuels Limited amplió su negocio aumentando su red a más de 3500 estaciones de servicio. Esta expansión ha ayudado a la empresa a aumentar su base de clientes al adquirir el 97 % del mercado europeo, lo que se traduce en un crecimiento de los ingresos y las ganancias de la empresa.

- En septiembre de 2021, WAG Payment Solutions, como ha ampliado su negocio en Alemania. Esta ampliación permitirá a los clientes de la empresa utilizar sus tarjetas Eurowag en las estaciones de servicio TANKPOOL24 de toda Alemania. Esto ayudará a la empresa a incluir nuevos clientes comerciales a su cartera de clientes y también contribuirá a diversificar la cartera de productos de la empresa.

La colaboración, el lanzamiento de productos, la expansión comercial, los premios y reconocimientos, las empresas conjuntas y otras estrategias de los actores del mercado están mejorando la presencia de la empresa en el mercado de tarjetas de combustible para flotas comerciales, lo que también brinda beneficios para el crecimiento de las ganancias de la organización.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE FUEL CARDS FOR COMMERCIAL FLEET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 CARD TYPE TIMELINE CURVE

2.1 MARKET UTILITY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CASE STUDIES

4.1.1 INTEGRAL

4.1.1.1 IDENTIFYING THE PROBLEM

4.1.1.2 SOLUTION

4.1.2 TOTAL PRODUCE

4.1.2.1 IDENTIFYING THE PROBLEM

4.1.2.2 SOLUTION

4.2 REGULATORY FRAMEWORK

4.2.1 PSD (PAYMENT SERVICE DIRECTIVE)

4.2.2 DIRECTIVE (EU) 2015/2366

4.3 TECHNOLOGICAL TRENDS

4.3.1 MOBILE & CONNECTED PAYMENTS

4.3.2 TELEMATICS INTERFACE

4.3.3 HOST CARD EMULATION

4.4 PRICING ANALYSIS

4.5 SUPPLY CHAIN ANALYSIS

4.6 TOP FLEET LEASING COMPANIES IN EUROPE

4.6.1 TOTAL COST OF OWNERSHIP (TCO) FOR A HEAVY DUTY FLEET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN DEMAND OF MONITORING VEHICLE PURCHASE & FUEL ECONOMY

5.1.2 THE GROWTH IN INCLINATION TOWARDS THE DIGITAL BANKING

5.1.3 INCREASE IN DEMAND FOR SECURE CASHLESS FUEL TRANSACTIONS ACROSS THE REGION

5.2 RESTRAINTS

5.2.1 HIGHER FUEL SURCHARGE (FSC) FEE BY A CARRIER

5.2.2 FUEL CARD ACCOUNTS CAN ONLY BE SET UP FOR BUSINESSES PURPOSES

5.3 OPPORTUNITIES

5.3.1 RISING IN THE STRATEGIC ACQUISITIONS AND PARTNERSHIPS AMONG VARIOUS ORGANIZATIONS

5.3.2 AVAILABILITY OF LUCRATIVE DISCOUNTS OVER THE FUEL CARDS

5.3.3 EFFICIENT FLEET ADMINISTRATION WITH THE HELP OF ENHANCED DATA CAPTURE

5.4 CHALLENGES

5.4.1 RISE IN NUMBER OF SKIMMERS TO DISGUISE PURCHASES TO STEAL FUEL

5.4.2 INCREASE IN CONCERN OF THE SECURITY ISSUES WITH THE FUEL CARD PAYMENT

6 ANALYSIS ON IMPACT OF COVID 19 ON THE EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET

6.1 AFTERMATH OF THE EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE

7.1 OVERVIEW

7.2 UNIVERSAL FUEL CARDS

7.2.1 FUEL CREDIT CARDS

7.2.2 OVER THE ROAD FUEL CARD

7.2.3 NETWORK CARDS

7.3 BRANDED FUEL CARDS

7.4 MERCHANT FUEL CARDS

8 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY FEATURES

8.1 OVERVIEW

8.2 MOBILE PAYMENT & CARDLESS TRANSACTIONS

8.3 VEHICLE REPORTING

8.4 REAL TIME UPDATES

8.5 EMV COMPLIANT

8.6 TOKENIZATION

8.7 OTHERS

9 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE

9.1 OVERVIEW

9.2 REGISTERED CARD

9.3 BEARER CARD

10 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY UTILITY

10.1 OVERVIEW

10.2 OIL FEE PAYMENT

10.3 FLEET MAINTENANCE

10.4 VEHICLE PARKING FEES

10.5 TOLL FEE PAYMENT

10.6 OTHERS

11 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY END-USER

11.1 OVERVIEW

11.2 DELIVERY FLEETS

11.2.1 MEDIUM/HEAVY DUTY FLEET

11.2.2 LIGHT DUTY FLEET

11.2.3 UNIVERSAL FUEL CARDS

11.2.4 BRANDED FUEL CARDS

11.2.5 MERCHANT FUEL CARDS

11.3 TAXI CAB FLEETS

11.3.1 UNIVERSAL FUEL CARDS

11.3.2 BRANDED FUEL CARDS

11.3.3 MERCHANT FUEL CARDS

11.4 CAR RENTAL FLEETS

11.4.1 UNIVERSAL FUEL CARDS

11.4.2 BRANDED FUEL CARDS

11.4.3 MERCHANT FUEL CARDS

11.5 PUBLIC UTILITY FLEETS

11.5.1 UNIVERSAL FUEL CARDS

11.5.2 BRANDED FUEL CARDS

11.5.3 MERCHANT FUEL CARDS

11.6 OTHERS

11.6.1 UNIVERSAL FUEL CARDS

11.6.2 BRANDED FUEL CARDS

11.6.3 MERCHANT FUEL CARDS

12 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY

12.1 EUROPE

12.1.1 U.K.

12.1.2 GERMANY

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 RUSSIA

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 SWITZERLAND

12.1.10 TURKEY

12.1.11 REST OF EUROPE

13 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 COMPANY PROFILE

14.1 BP P.L.C.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 SWOT ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.1.6 DBMR ANALYSIS

14.2 OMV AKTIENGESELLSCHAFT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 SWOT ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.2.6 DBMR ANALYSIS

14.3 EXXON MOBIL CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 SWOT ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.3.6 DBMR ANALYSIS

14.4 VALERO MARKETING AND SUPPLY COMPANY

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 SWOT ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.4.6 DBMR ANALYSIS

14.5 UK FUELS LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 SWOT ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.5.5 DBMR ANALYSIS

14.6 DKV EURO SERVICE GMBH + CO. KG

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 MORGAN FUELS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 TOTALENERGIES

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 SHELL

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 UTA (AN EDENRED COMPANY)

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 W.A.G. PAYMENT SOLUTIONS, A.S.

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 WEX EUROPE SERVICES

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tablas

TABLE 1 LIST OF TOP LEASING COMPANIES AND THE FUEL CARDS USED BY THEM

TABLE 2 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE UNIVERSAL FUEL CARDS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 5 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 7 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 8 EUROPE DELIVERY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE DELIVERY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TAXI CAB FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE CAR RENTAL FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN FUEL CARD MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 15 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 16 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 18 EUROPE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 19 EUROPE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 20 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 21 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 23 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 25 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 26 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 28 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 30 EUROPE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 32 EUROPE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 34 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 EUROPE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 38 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 40 U.K. UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.K. UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 42 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 43 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 45 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 46 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 47 U.K. FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 48 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 50 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 51 U.K. DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 52 U.K. TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.K. TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 54 U.K. CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.K. CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 U.K. PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 58 U.K. OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 60 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 62 GERMANY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 63 GERMANY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 64 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 65 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 66 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 67 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 68 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 69 GERMANY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 70 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 71 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 72 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 73 GERMANY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 74 GERMANY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 75 GERMANY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 76 GERMANY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 77 GERMANY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 78 GERMANY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 79 GERMANY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 80 GERMANY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 82 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 84 FRANCE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 86 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 87 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 88 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 89 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 90 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 91 FRANCE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 92 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 93 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 94 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 95 FRANCE DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 96 FRANCE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 97 FRANCE TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 98 FRANCE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 99 FRANCE CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 100 FRANCE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 101 FRANCE PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 102 FRANCE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 103 FRANCE OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 104 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 105 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 106 ITALY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 108 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 109 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 110 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 111 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 112 TALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 ITALY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 114 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 116 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 117 ITALY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 118 ITALY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 119 ITALY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 120 ITALY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 121 ITALY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 122 ITALY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 123 ITALY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 124 ITALY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 125 ITALY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 126 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 127 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 128 SPAIN UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 129 SPAIN UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 130 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 131 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 132 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 133 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 134 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 135 SPAIN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 136 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 137 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 138 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 139 SPAIN DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 140 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 141 SPAIN TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 142 SPAIN CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 143 SPAIN CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 144 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 145 SPAIN PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 146 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 147 SPAIN OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 148 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 149 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 150 RUSSIA UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 151 RUSSIA UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 152 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 153 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 154 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 155 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 157 RUSSIA FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 158 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 159 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 160 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 161 RUSSIA DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 162 RUSSIA TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 163 RUSSIA TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 164 RUSSIA CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 165 RUSSIA CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 166 RUSSIA PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 167 RUSSIA PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 168 RUSSIA OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 169 RUSSIA OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 170 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 171 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 172 NETHERLANDS UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 173 NETHERLANDS UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 174 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 175 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 176 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 177 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 178 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 179 NETHERLANDS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 180 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 181 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 182 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 183 NETHERLANDS DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 184 NETHERLANDS TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 185 NETHERLANDS TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 186 NETHERLANDS CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 187 NETHERLANDS CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 188 NETHERLANDS PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 189 NETHERLANDS PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 190 NETHERLANDS OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 191 NETHERLANDS OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 192 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 193 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 194 BELGIUM UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 195 BELGIUM UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 196 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 197 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 198 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 199 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 200 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 201 BELGIUM FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 202 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 204 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 205 BELGIUM DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 206 BELGIUM TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 208 BELGIUM CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 210 BELGIUM PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 212 BELGIUM OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 214 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 215 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 216 SWITZERLAND UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 217 SWITZERLAND UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 218 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 219 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 220 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 221 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 222 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 223 SWITZERLAND FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 224 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 226 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 227 SWITZERLAND DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 228 SWITZERLAND TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWITZERLAND TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 230 SWITZERLAND CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 231 SWITZERLAND CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 232 SWITZERLAND PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWITZERLAND PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 234 SWITZERLAND OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 235 SWITZERLAND OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 236 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 237 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 238 TURKEY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 239 TURKEY UNIVERSAL FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 240 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY FEATURES, 2020-2029 (USD MILLION)

TABLE 241 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (USD MILLION)

TABLE 242 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY SUBSCRIPTION TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 243 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY UTILITY, 2020-2029 (USD MILLION)

TABLE 244 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 245 TURKEY FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY END-USER, 2020-2029 (THOUSAND UNITS)

TABLE 246 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 247 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY VEHICLE TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 248 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 249 TURKEY DELIVERY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 250 TURKEY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 251 TURKEY TAXI CAB FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 252 TURKEY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 253 TURKEY CAR RENTAL IN FLEETS FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 254 TURKEY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 255 TURKEY PUBLIC UTILITY FLEETS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 256 TURKEY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

TABLE 257 TURKEY OTHERS IN FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 258 REST OF EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET, BY CARD TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE FUEL CARDS FOR COMMERCIAL FLEET MARKET: SEGMENTATION

FIGURE 2 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: DATA TRIANGULATION

FIGURE 3 EUROPE FUEL CARDS FOR COMMERCIAL FLEET MARKET: DROC ANALYSIS

FIGURE 4 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: SEGMENTATION

FIGURE 10 INCREASING IN DEMAND FOR MONITORING VEHICLE PURCHASE & FUEL ECONOMY IS EXPECTED TO DRIVE EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 11 CARD TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET IN 2022 & 2029

FIGURE 12 ANNUAL CHARGES ON FUEL CARDS OFFERED BY VARIOUS COMPANIES

FIGURE 13 AVERAGE COST OF OWNERSHIP FOR HEAVY DUTY FLEET (IN %)

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET

FIGURE 15 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY CARD TYPE, 2021

FIGURE 16 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY FEATURES, 2021

FIGURE 17 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY SUBSCRIPTION TYPE, 2021

FIGURE 18 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY UTILITY, 2021

FIGURE 19 EUROPE FUEL CARD MARKET FOR COMMERCIAL FLEET: BY END-USER, 2021

FIGURE 20 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: SNAPSHOT (2021)

FIGURE 21 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2021)

FIGURE 22 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2022 & 2029)

FIGURE 23 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY COUNTRY (2021 & 2029)

FIGURE 24 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: BY CARD TYPE (2022-2029)

FIGURE 25 EUROPE FUEL CARDS MARKET FOR COMMERCIAL FLEET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.