>Mercado europeo de embalajes ecológicos por tipo (embalajes con contenido reciclado, embalajes reutilizables y embalajes degradables), tipo de material (papel y cartón, plástico, metal, vidrio, materiales a base de almidón y otros), tipo de producto (bolsas, sobres y bolsitas, cajas, contenedores, películas, bandejas, tubos, botellas y tarros, latas y otros), técnica (embalaje activo, embalaje moldeado, embalaje de fibra alternativa y otros), capa (embalaje primario, embalaje secundario y embalaje terciario), aplicación (alimentos, bebidas, productos farmacéuticos, cuidado personal, cuidado del hogar y otros), país (Alemania, Reino Unido, Italia, Francia, España, Rusia, Suiza, Turquía, Bélgica, Países Bajos, Luxemburgo y resto de Europa), tendencias de la industria y pronóstico hasta 2029

Análisis y perspectivas del mercado : mercado europeo de envases ecológicos

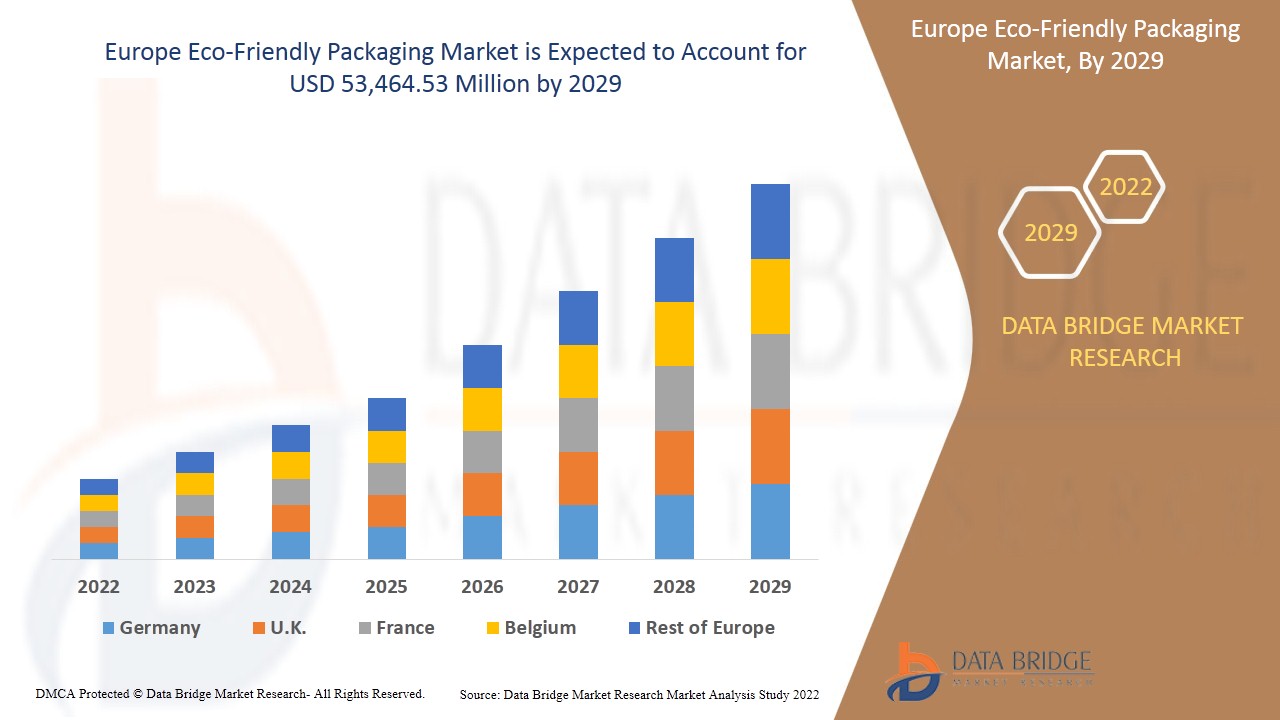

Se espera que el mercado europeo de envases ecológicos gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 4,2% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 53.464,53 millones para 2029.

Los envases ecológicos son fáciles de reciclar, seguros para las personas y el medio ambiente y están fabricados con materiales reciclados. Utilizan materiales y prácticas de fabricación que tienen un impacto mínimo en el consumo de energía y los recursos naturales. Los consumidores están cada vez más preocupados por las consecuencias ambientales de los envases. Los consumidores y los gobiernos presionan a las empresas para que utilicen envases ecológicos para sus productos.

Las soluciones de embalaje ecológico tienen como objetivo: reducir la cantidad de embalaje del producto, promover el uso de materiales renovables/reutilizables, reducir los gastos relacionados con el embalaje, eliminar el uso de materiales tóxicos en la producción de embalajes y brindar opciones para reciclar los embalajes fácilmente.

El cambio de las preferencias de los consumidores hacia los alimentos envasados y de conveniencia puede impulsar el mercado. Se espera que las importantes iniciativas gubernamentales para promover los envases ecológicos creen oportunidades en el mercado. La limitación de las capacidades de producción se considera un problema para los fabricantes en el mercado. El alto coste del reciclaje se considera un desafío en el mercado europeo de envases ecológicos.

Este informe sobre envases ecológicos en Europa proporciona detalles sobre la cuota de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y local, analiza las oportunidades en términos de nuevas áreas de ingresos, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de envases ecológicos en Europa

The Europe eco-friendly packaging market is segmented based on type, material type, product type, technique, layer, and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target market.

- On the basis of type, the Europe eco-friendly packaging market is segmented into recycled content packaging, reusable packaging, and degradable packaging. In 2022, the reusable packaging segment is expected to dominate because reusable packaging is designed for repeated use; it is stronger and more durable than single-use packaging.

- On the basis of material type, the Europe eco-friendly packaging market is segmented into paper & paper board, plastic, metal, glass, starch-based materials, and others. In 2022, the paper & paper board segment is expected to dominate owing to the advantage of being, in most cases, the least expensive structural material for packaging and a renewable source.

- On the basis of product type, the Europe eco-friendly packaging market is segmented into bags, pouches & sachets, boxes, containers, films, trays, tubes, bottles & jars, cans, and others. In 2022, the boxes segment is expected to dominate as boxes have a good strength-to-weight ratio and do a great job of protecting their contents.

- On the basis of technique, the Europe eco-friendly packaging market is segmented into active packaging, molded packaging, alternate fiber packaging, and others. In 2022, the alternate fiber packaging segment is expected to dominate as it provides a much-needed alternative to polystyrene, which is detrimental to the environment and human health.

- On the basis of layer, the Europe eco-friendly packaging market is segmented into primary packaging, secondary packaging, and tertiary packaging. In 2022, the primary packaging segment is expected to dominate as it keeps the product sealed off from external environmental damage.

- On the basis of application, the Europe eco-friendly packaging market is segmented into food, beverages, pharmaceutical, personal care, home care, and others. In 2022, the food segment is expected to dominate as packaging is widely used in the food industry to prevent or reduce product damage and food spoilage, therefore saving energy, vital nutrients, and costs and protecting the consumers' health.

Europe Eco-Friendly Packaging Market Country Level Analysis

The Europe eco-friendly packaging market is analyzed, and market size information is provided by country, type, material type, product type, technique, layer, and application.

The countries covered in the Europe eco-friendly packaging market report are Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Luxemburg, and the Rest of Europe. Germany is expected to dominate in the European region due to increasing growth of food sector. Germany is followed by the U.K. as it is second growing country in the region due to the growing awareness regarding environmental conservation. France is projected to grow due to the increasing consumer preferences towards convenience foods.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of European brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Growth Potential in the Europe Eco-Friendly Packaging Market

The Europe eco-friendly packaging market also provides you with detailed market analysis for every country's growth in an installed base of different kinds of products for the eco-friendly packaging market, impact of technology using lifeline curves, changes in infant formula regulatory scenarios, and their impact on the Europe eco-friendly packaging market. The data is available for the historical period 2011 to 2019.

Competitive Landscape and Europe Eco-Friendly Packaging Market Share Analysis

The Europe eco-friendly packaging market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus related to the Europe eco-friendly packaging market.

Some of the major players covered in the Europe eco-friendly packaging market are Crown Holdings, Inc., Berry Global Inc., Smurfit Kappa, Amcor plc, Tetra Pak, Ardagh Group S.A., Mondi, DS Smith, Ball Corporation, Sonoco Products Company, WestRock Company, Plastipak Holdings, Inc., Sealed Air, Nampak Ltd., Huhtamaki, Pactiv Evergreen Inc., Elopak, UFlex Limited, other players domestic and global. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

For instance,

- En noviembre de 2021, Smurfit Kappa Bag-in-Box lanza una nueva película termolaminada. La planta de Smurfit Kappa Bag-in-Box Ibi en España ha iniciado la producción de bolsas con una nueva película metalizada termolaminada más sostenible: M-Compact 77. Esto ampliará la cartera de productos de la empresa.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ECO-FRIENDLY PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SINGLE-USE PLASTIC BAN HAS HEIGHTENED DEMAND FOR ECO-FRIENDLY PACKAGING

5.1.2 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS

5.1.3 RISE IN AWARENESS REGARDING ENVIRONMENTAL CONSERVATION AND SUSTAINABLE LIVING

5.1.4 STRINGENT GOVERNMENT REGULATIONS REGARDING ENVIRONMENTAL SUSTAINABILITY

5.2 RESTRAINTS

5.2.1 PRICE VOLATILITY OF RAW MATERIALS

5.2.2 CONSTRAINT IN PRODUCTION CAPACITIES

5.2.3 LACK OF KNOWLEDGE AND LOW ACCEPTANCE FOR SUSTAINABLE PACKAGING IN DEVELOPING ECONOMIES

5.3 OPPORTUNITIES

5.3.1 CONSIDERABLE INNOVATIONS IN PACKAGING PRODUCTS

5.3.2 SIGNIFICANT GOVERNMENT INITIATIVES TO PROMOTE USE OF ECO-FRIENDLY PACKAGING

5.3.3 INCREASE IN GROWTH POTENTIAL IN PACKAGING MARKET AND RISING R&D ACTIVITIES

5.4 CHALLENGES

5.4.1 HIGH COST OF ECO-FRIENDLY PACKAGING AS COMPARED TO CONVENTIONAL PRODUCTS

5.4.2 HIGH COST AND POOR INFRASTRUCTURE FOR RECYCLING PROCESSES

6 COVID 19 IMPACT ON THE EUROPE ECO-FRIENDLY PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE ECO-FRIENDLY PACKAGING MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 REUSABLE PACKAGING

7.3 RECYCLED CONTENT PACKAGING

7.4 DEGRADABLE PACKAGING

8 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 PAPER & PAPER BOARD

8.2.1 PAPER & PAPER BOARD, BY MATERIAL TYPE

8.2.1.1 RECYCLED (COATED AND UNCOATED)

8.2.1.2 SOLID BLEACH SULFATE (SBS)

8.2.1.3 COATED UNBLEACHED KRAFT (CUK)

8.2.1.4 OTHERS

8.3 PLASTIC

8.3.1 PLASTIC, BY MATERIAL TYPE

8.3.1.1 BIO-BASED PLASTIC

8.3.1.2 BIODEGRADABLE PLASTIC

8.3.1.3 OTHERS

8.4 GLASS

8.4.1 GLASS, BY MATERIAL TYPE

8.4.1.1 SODA ASH

8.4.1.2 SAND

8.4.1.3 LIMESTONE

8.5 METAL

8.5.1 METAL, BY MATERIAL TYPE

8.5.1.1 ALUMINIUM

8.5.1.2 STEEL

8.5.1.3 OTHER

8.6 STARCH-BASED MATERIALS

8.7 OTHERS

9 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 BOXES

9.3 BAGS

9.4 POUCHES & SACHETS

9.5 CONTAINERS

9.6 BOTTLES & JARS

9.7 CANS

9.8 FILMS

9.9 TUBES

9.1 TRAYS

9.11 OTHERS

10 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE

10.1 OVERVIEW

10.2 ALTERNATE FIBER PACKAGING

10.2.1 ALTERNATE FIBER PACKAGING, BY TECHNIQUE

10.2.1.1 BAMBOO FIBER

10.2.1.2 MUSHROOM PACKAGING

10.2.1.3 OTHERS

10.3 MOLDED PACKAGING

10.3.1 MOLDED PACKAGING, BY TECHNIQUE

10.3.1.1 TRANSFER MOLDED PULP PACKAGING

10.3.1.2 THICK WALL PULP PACKAGING

10.3.1.3 THERMOFORMED PULP PACKAGING

10.3.1.4 PROCESSED PULP PACKAGING

10.4 ACTIVE PACKAGING

10.4.1 ACTIVE PACKAGING, BY TECHNIQUE

10.4.1.1 MODIFIED ATMOSPHERE PACKAGING (MAP)

10.4.1.2 ANTIMICROBIAL PACKAGING

10.4.1.3 BARRIER PACKAGING

10.5 OTHERS

11 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD

12.2.1 FOOD, BY APPLICATION

12.2.1.1 BAKERY & CONFECTIONARY

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 READY TO EAT FOOD

12.2.1.4 FROZEN FOOD

12.2.1.5 FRUITS & VEGETABLES

12.2.1.6 MEAT PRODUCTS

12.2.1.7 OTHERS

12.2.2 FOOD, BY TYPE

12.2.2.1 REUSABLE PACKAGING

12.2.2.2 RECYCLED CONTENT PACKAGING

12.2.2.3 DEGRADABLE PACKAGING

12.3 BEVERAGES

12.3.1 BEVERAGES, BY APPLICATION

12.3.1.1 NON-ALCOHOLIC

12.3.1.2 ALCOHOLIC

12.3.2 BEVERAGES, BY TYPE

12.3.2.1 REUSABLE PACKAGING

12.3.2.2 RECYCLED CONTENT PACKAGING

12.3.2.3 DEGRADABLE PACKAGING

12.4 PHARMACEUTICALS

12.4.1 PHARMACEUTICALS, BY TYPE

12.4.1.1 REUSABLE PACKAGING

12.4.1.2 RECYCLED CONTENT PACKAGING

12.4.1.3 DEGRADABLE PACKAGING

12.5 PERSONAL CARE

12.5.1 PERSONAL CARE, BY TYPE

12.5.1.1 REUSABLE PACKAGING

12.5.1.2 RECYCLED CONTENT PACKAGING

12.5.1.3 DEGRADABLE PACKAGING

12.6 HOME CARE

12.6.1 HOME CARE, BY TYPE

12.6.1.1 REUSABLE PACKAGING

12.6.1.2 RECYCLED CONTENT PACKAGING

12.6.1.3 DEGRADABLE PACKAGING

12.7 OTHERS

12.7.1 OTHERS, BY TYPE

12.7.1.1 REUSABLE PACKAGING

12.7.1.2 RECYCLED CONTENT PACKAGING

12.7.1.3 DEGRADABLE PACKAGING

13 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 U.K.

13.1.3 FRANCE

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 NETHERLANDS

13.1.7 BELGIUM

13.1.8 RUSSIA

13.1.9 TURKEY

13.1.10 SWITZERLAND

13.1.11 LUXEMBOURG

13.1.12 REST OF EUROPE

14 EUROPE ECO-FRIENDLY PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 AWARD

14.6 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 WEST ROCK COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT UPDATES

16.2 CROWN HOLDING, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 AMCOR PLC

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 TETRA PAK

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 BERRY EUROPE INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT UPDATES

16.6 SMUFIT KAPPA

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 DS SMITH

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 MONDI

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 ARDAGH GROUP S.A.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 BALL CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

16.11 ELOPAK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATES

16.12 EMERALD PACKAGING

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATES

16.13 HUHTAMAKI

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATES

16.14 NAMPAK LTD.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 PACTIV EVERGREEN INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT UPDATES

16.16 PLASTIPAK HOLDINGS, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATES

16.17 PRINTPACK

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 SEALED AIR

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT UPDATES

16.19 SONOCO PRODUCTS COMPANY

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT UPDATES

16.2 UFLEX LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE - 4819 (USD THOUSAND)

TABLE 2 EXPORT DATA OF CARTONS, BOXES, CASES, BAGS AND OTHER PACKING CONTAINERS, OF PAPER, PAPERBOARD, CELLULOSE WADDING; HS CODE – 4819 (USD THOUSAND)

TABLE 3 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 5 EUROPE REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE REUSABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 7 EUROPE RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE RECYCLED CONTENT PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 9 EUROPE DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE DEGRADABLE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 11 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE METAL IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE STARCH-BASED MATERIALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE BOXES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE BAGS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE POUCHES & SACHETS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE CONTAINERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE BOTTLES & JARS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE CANS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE FILMS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE TUBES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TRAYS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 34 EUROPE ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 42 EUROPE PRIMARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 EUROPE SECONDARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE TERTIARY PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 EUROPE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 EUROPE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 EUROPE PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 EUROPE PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 EUROPE HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 EUROPE HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 EUROPE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 EUROPE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 PLASTIC WASTE GENERATED BY EUROPEAN COUNTRIES, 2021

TABLE 61 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 62 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 63 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 65 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 66 EUROPE PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 67 EUROPE PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 68 EUROPE METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 69 EUROPE GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 73 EUROPE MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 74 EUROPE ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 75 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 76 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 EUROPE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 EUROPE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 EUROPE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 EUROPE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 EUROPE PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 EUROPE PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 EUROPE HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 EUROPE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 GERMANY ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 87 GERMANY ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 89 GERMANY PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 90 GERMANY METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 91 GERMANY GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 92 GERMANY ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 GERMANY ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 94 GERMANY ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 95 GERMANY MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 96 GERMANY ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 97 GERMANY ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 98 GERMANY ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 GERMANY FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 GERMANY FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 GERMANY BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 GERMANY BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 GERMANY PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 GERMANY PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 GERMANY HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 GERMANY OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.K. ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.K. ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 109 U.K. ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.K. PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.K. PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.K. METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.K. GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.K. ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.K. ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 116 U.K. ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 117 U.K. MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 118 U.K. ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 119 U.K. ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 120 U.K. ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 121 U.K. FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 U.K. FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 U.K. BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 U.K. BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 U.K. PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 U.K. PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 U.K. HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 U.K. OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 FRANCE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 FRANCE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 131 FRANCE ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 132 FRANCE PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 133 FRANCE PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 134 FRANCE METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 135 FRANCE GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 136 FRANCE ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 FRANCE ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 138 FRANCE ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 139 FRANCE MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 140 FRANCE ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 141 FRANCE ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 142 FRANCE ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 FRANCE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 FRANCE FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 FRANCE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 FRANCE BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 FRANCE PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 FRANCE PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 FRANCE HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 FRANCE OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 ITALY ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 ITALY ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 153 ITALY ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 154 ITALY PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 155 ITALY PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 156 ITALY METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 157 ITALY GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 158 ITALY ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 ITALY ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 160 ITALY ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 161 ITALY MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 162 ITALY ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 163 ITALY ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 164 ITALY ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 ITALY FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 ITALY FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 ITALY BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 ITALY BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 ITALY PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 ITALY PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 ITALY HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 ITALY OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 SPAIN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 SPAIN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 175 SPAIN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 176 SPAIN PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 177 SPAIN PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 178 SPAIN METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 179 SPAIN GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 180 SPAIN ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 181 SPAIN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 182 SPAIN ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 183 SPAIN MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 184 SPAIN ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 185 SPAIN ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 186 SPAIN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 187 SPAIN FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 SPAIN FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 SPAIN BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 SPAIN BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 SPAIN PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 SPAIN PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 SPAIN HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 SPAIN OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 NETHERLANDS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 196 NETHERLANDS ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 197 NETHERLANDS ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 198 NETHERLANDS PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 199 NETHERLANDS PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 200 NETHERLANDS METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 201 NETHERLANDS GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 202 NETHERLANDS ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 203 NETHERLANDS ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 204 NETHERLANDS ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 205 NETHERLANDS MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 206 NETHERLANDS ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 207 NETHERLANDS ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 208 NETHERLANDS ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 209 NETHERLANDS FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 210 NETHERLANDS FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 NETHERLANDS BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 212 NETHERLANDS BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 213 NETHERLANDS PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 214 NETHERLANDS PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 215 NETHERLANDS HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 216 NETHERLANDS OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 217 BELGIUM ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 BELGIUM ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 219 BELGIUM ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 220 BELGIUM PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 221 BELGIUM PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 222 BELGIUM METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 223 BELGIUM GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 224 BELGIUM ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 225 BELGIUM ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 226 BELGIUM ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 227 BELGIUM MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 228 BELGIUM ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 229 BELGIUM ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 230 BELGIUM ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 231 BELGIUM FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 232 BELGIUM FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 BELGIUM BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 234 BELGIUM BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 BELGIUM PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 236 BELGIUM PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 BELGIUM HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 238 BELGIUM OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 RUSSIA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 RUSSIA ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 241 RUSSIA ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 242 RUSSIA PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 243 RUSSIA PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 244 RUSSIA METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 245 RUSSIA GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 246 RUSSIA ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 247 RUSSIA ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 248 RUSSIA ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 249 RUSSIA MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 250 RUSSIA ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 251 RUSSIA ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 252 RUSSIA ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 253 RUSSIA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 254 RUSSIA FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 RUSSIA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 256 RUSSIA BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 RUSSIA PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 RUSSIA PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 RUSSIA HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 RUSSIA OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 261 TURKEY ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 262 TURKEY ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 263 TURKEY ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 264 TURKEY PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 265 TURKEY PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 266 TURKEY METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 267 TURKEY GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 268 TURKEY ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 269 TURKEY ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 270 TURKEY ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 271 TURKEY MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 272 TURKEY ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 273 TURKEY ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 274 TURKEY ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 275 TURKEY FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 276 TURKEY FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 TURKEY BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 278 TURKEY BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 TURKEY PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 TURKEY PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 TURKEY HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 TURKEY OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 SWITZERLAND ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 284 SWITZERLAND ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 285 SWITZERLAND ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 286 SWITZERLAND PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 287 SWITZERLAND PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 288 SWITZERLAND METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 289 SWITZERLAND GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 290 SWITZERLAND ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 291 SWITZERLAND ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 292 SWITZERLAND ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 293 SWITZERLAND MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 294 SWITZERLAND ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 295 SWITZERLAND ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 296 SWITZERLAND ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 297 SWITZERLAND FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 298 SWITZERLAND FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 SWITZERLAND BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 300 SWITZERLAND BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 SWITZERLAND PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 SWITZERLAND PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 303 SWITZERLAND HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 SWITZERLAND OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 LUXEMBURG ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 LUXEMBOURG ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

TABLE 307 LUXEMBOURG ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 308 LUXEMBOURG PAPER & PAPER BOARD IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 309 LUXEMBOURG PLASTIC IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 310 LUXEMBOURG METAL IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 311 LUXEMBOURG GLASS IN ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 312 LUXEMBOURG ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 313 LUXEMBOURG ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 314 LUXEMBOURG ACTIVE PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 315 LUXEMBOURG MOLDED PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 316 LUXEMBOURG ALTERNATE FIBER PACKAGING IN ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 317 LUXEMBOURG ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2020-2029 (USD MILLION)

TABLE 318 LUXEMBOURG ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 319 LUXEMBOURG FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 320 LUXEMBOURG FOOD IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 321 LUXEMBOURG BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 322 LUXEMBOURG BEVERAGES IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 323 LUXEMBOURG PHARMACEUTICALS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 324 LUXEMBOURG PERSONAL CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 325 LUXEMBOURG HOME CARE IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 326 LUXEMBOURG OTHERS IN ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 327 REST OF EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 328 REST OF EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2020-2029 (MILLION UNITS)

Lista de figuras

FIGURE 1 EUROPE ECO-FRIENDLY PACKAGING MARKET

FIGURE 2 EUROPE ECO-FRIENDLY PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ECO-FRIENDLY PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ECO-FRIENDLY PACKAGING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ECO-FRIENDLY PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ECO-FRIENDLY PACKAGING MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 EUROPE ECO-FRIENDLY PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE ECO-FRIENDLY PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE ECO-FRIENDLY PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE ECO-FRIENDLY PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE ECO-FRIENDLY PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE ECO-FRIENDLY PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE ECO-FRIENDLY PACKAGING MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE EUROPE ECO-FRIENDLY PACKAGING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 CHANGING CONSUMER PREFERENCES TOWARDS CONVENIENCE AND PACKAGED FOODS IS DRIVING EUROPE ECO-FRIENDLY PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 REUSABLE PACKAGING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ECO-FRIENDLY PACKAGING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE ECO-FRIENDLY PACKAGING MARKET

FIGURE 18 PLASTIC WASTE GENERATED BY KEY COUNTRIES, 2021

FIGURE 19 CARDBOARD COSTS IN MONTH OF MAY 2020 & 2021

FIGURE 20 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TYPE, 2021

FIGURE 21 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY MATERIAL TYPE, 2021

FIGURE 22 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY PRODUCT TYPE, 2021

FIGURE 23 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY TECHNIQUE, 2021

FIGURE 24 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY LAYER, 2021

FIGURE 25 EUROPE ECO-FRIENDLY PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 26 EUROPE ECO-FRIENDLY PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 27 EUROPE ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 28 EUROPE ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 EUROPE ECO-FRIENDLY PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 EUROPE ECO-FRIENDLY PACKAGING MARKET: BY TYPE (2022-2029)

FIGURE 31 EUROPE ECO-FRIENDLY PACKAGING MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.