Europe Eclinical Solutions Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

2.85 Billion

USD

7.75 Billion

2024

2032

USD

2.85 Billion

USD

7.75 Billion

2024

2032

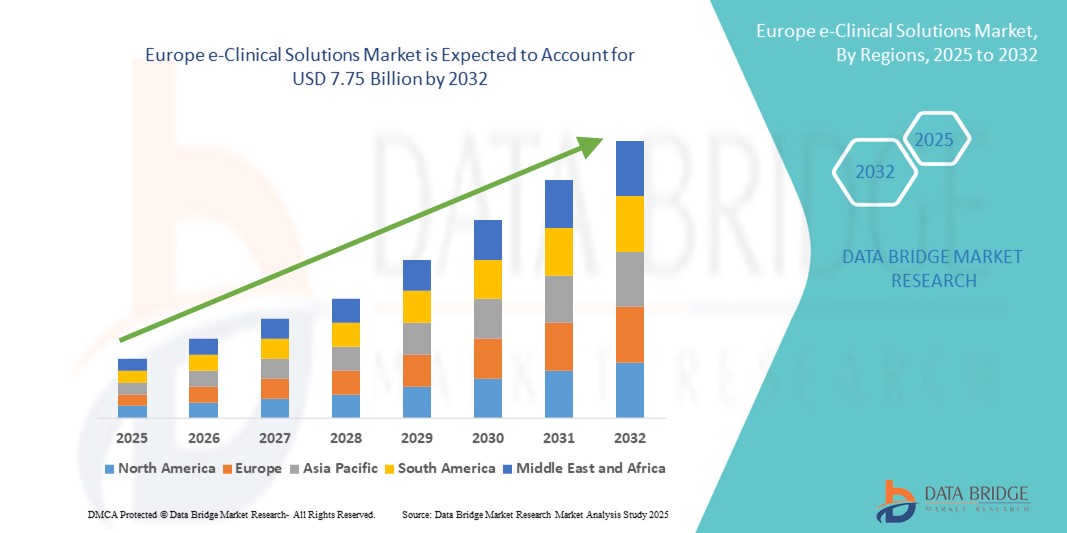

| 2025 –2032 | |

| USD 2.85 Billion | |

| USD 7.75 Billion | |

|

|

|

|

Segmentación del mercado europeo de soluciones clínicas electrónicas por producto (sistemas de captura electrónica de datos y gestión de datos de ensayos clínicos, sistemas de gestión de ensayos clínicos, plataformas de análisis clínico, registros médicos de coordinación de atención [CCMR], gestión de aleatorización y suministro de ensayos, plataformas de integración de datos clínicos, soluciones de evaluación electrónica de resultados clínicos, soluciones de seguridad, sistemas de archivos maestros de ensayos electrónicos, soluciones de gestión de información regulatoria, entre otros), modo de entrega (soluciones alojadas en la web (bajo demanda), soluciones empresariales con licencia (locales) y soluciones basadas en la nube (SAAS)), fase del ensayo clínico (fase I, fase II, fase III y fase IV), tamaño de la organización (pequeña, mediana y grande), dispositivo del usuario (ordenador de escritorio, tableta, dispositivo PDA portátil, teléfono inteligente, entre otros), usuario final (empresas farmacéuticas y biofarmacéuticas, organizaciones de investigación por contrato, empresas de servicios de consultoría, fabricantes de dispositivos médicos, hospitales e institutos de investigación académica): tendencias de la industria y pronóstico hasta 2032.

Tamaño del mercado europeo de soluciones clínicas electrónicas

- El tamaño del mercado de soluciones clínicas electrónicas de Europa se valoró en USD 2.850 millones en 2024 y se espera que alcance los USD 7.750 millones para 2032 , con una CAGR del 13,3 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de tecnologías de ensayos clínicos digitales, el creciente volumen de ensayos clínicos y los estrictos requisitos regulatorios que impulsan una gestión eficiente de datos en las compañías farmacéuticas y las organizaciones de investigación por contrato (CRO).

- Además, los avances tecnológicos como la computación en la nube, la inteligencia artificial y los modelos de ensayos descentralizados, combinados con el apoyo regulatorio como el Espacio Europeo de Datos Sanitarios (EHDS), están mejorando la eficiencia de los ensayos y la accesibilidad a los datos, impulsando así significativamente la adopción de soluciones clínicas electrónicas en toda Europa.

Análisis del mercado europeo de soluciones clínicas electrónicas

- Las soluciones e-Clinical, que abarcan la captura electrónica de datos (EDC), los sistemas de gestión de ensayos clínicos (CTMS) y otras plataformas digitales, son cada vez más fundamentales para agilizar los ensayos clínicos y garantizar el cumplimiento normativo en toda Europa debido a su eficiencia, acceso a datos en tiempo real y capacidades de integración con modelos de ensayos descentralizados.

- La creciente demanda de soluciones clínicas electrónicas se debe principalmente al creciente número de ensayos clínicos, el enfoque cada vez mayor en la investigación centrada en el paciente, los estrictos requisitos regulatorios y la creciente adopción de tecnologías de salud digital entre las compañías farmacéuticas y las organizaciones de investigación por contrato (CRO).

- Alemania dominó el mercado de soluciones e-Clinical con la mayor participación en los ingresos del 28,5 % en 2024, caracterizada por una industria farmacéutica madura, una adopción temprana de soluciones digitales y un fuerte apoyo regulatorio, con empresas líderes que implementan plataformas de gestión de ensayos basadas en la nube e impulsadas por IA.

- Se espera que Francia sea el país de más rápido crecimiento durante el período de pronóstico debido a la expansión de las actividades de ensayos clínicos, el aumento de las inversiones en atención médica y una mayor participación en estudios de investigación multinacionales.

- El segmento de sistemas de gestión de ensayos clínicos (CTMS) dominó el mercado europeo de soluciones e-Clinical con una participación de mercado del 38,5 % en 2024, impulsado por su capacidad para planificar, rastrear y gestionar de manera eficiente ensayos complejos, garantizando al mismo tiempo el cumplimiento de los estándares regulatorios en evolución.

Alcance del informe y segmentación del mercado de soluciones clínicas electrónicas en Europa

|

Atributos |

Perspectivas clave del mercado de soluciones e-Clinical en Europa |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Europa

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de soluciones clínicas electrónicas en Europa

Transformación digital y ensayos clínicos impulsados por IA

- Una tendencia significativa y en auge en el mercado europeo de soluciones e-Clínicas es la creciente adopción de la inteligencia artificial (IA) y el aprendizaje automático en la gestión de ensayos clínicos, el reclutamiento de pacientes y el análisis de datos. Estas tecnologías están mejorando significativamente la eficiencia, la precisión y la información predictiva de los ensayos.

- Por ejemplo, plataformas como Medidata Rave y EDC de Oracle Health Sciences integran IA para identificar la elegibilidad de los pacientes, monitorear el cumplimiento del protocolo y marcar anomalías en tiempo real, lo que reduce errores y acelera los plazos de los ensayos.

- El análisis basado en IA en las soluciones e-Clinical permite el modelado predictivo, la monitorización basada en riesgos y el apoyo a la toma de decisiones en tiempo real. Por ejemplo, algunos sistemas Medidata y Veeva utilizan IA para optimizar la selección de centros y pronosticar las tasas de abandono de pacientes, lo que mejora las tasas de éxito de los ensayos. Además, las plataformas avanzadas en la nube permiten un intercambio fluido de datos entre centros de estudio, patrocinadores y organismos reguladores, lo que garantiza una ejecución de ensayos más rápida y conforme a las normativas.

- La integración de soluciones e-Clinical con modelos de ensayos descentralizados e híbridos facilita la monitorización remota de pacientes, el consentimiento electrónico y los seguimientos basados en telemedicina, creando una experiencia de ensayo digital unificada.

- Esta tendencia hacia ensayos clínicos inteligentes, interconectados y centrados en el paciente está cambiando las expectativas de gestión de ensayos, con empresas como Veeva Systems y Oracle Health Sciences expandiendo las ofertas habilitadas para IA para mejorar la eficiencia operativa y el cumplimiento normativo.

- La demanda de plataformas e-Clinical mejoradas con IA y totalmente integradas está creciendo rápidamente en toda Europa, impulsada por empresas farmacéuticas, compañías de biotecnología y organizaciones de investigación por contrato (CRO) que buscan operaciones de ensayos clínicos más rápidas, precisas y compatibles.

Dinámica del mercado de soluciones e-Clínicas en Europa

Conductor

Aumento de los ensayos clínicos y la presión regulatoria

- El creciente número de ensayos clínicos en toda Europa, junto con los estrictos requisitos regulatorios, como las directrices de la Agencia Europea de Medicamentos (EMA) y el cumplimiento del RGPD, es un impulsor importante para la adopción de soluciones clínicas electrónicas.

- Por ejemplo, en marzo de 2025, la iniciativa del Espacio Europeo de Datos Sanitarios (EHDS) hizo hincapié en el uso estandarizado de datos sanitarios electrónicos, lo que impulsó a las compañías farmacéuticas a adoptar plataformas clínicas electrónicas integradas para una gestión eficiente de los ensayos y la presentación de informes regulatorios.

- A medida que las organizaciones buscan ensayos más rápidos, seguros y rentables, las soluciones e-Clinical brindan funciones como monitoreo en tiempo real, administración de sitios basada en riesgos y verificación electrónica de datos de origen, lo que ofrece claras ventajas sobre los procesos manuales tradicionales.

- Además, la adopción de modelos de ensayo descentralizados e híbridos hace que las soluciones e-Clinical sean esenciales para permitir el monitoreo remoto de pacientes, visitas virtuales y seguimiento del cumplimiento en tiempo real.

- La combinación de presión regulatoria, avances tecnológicos y la necesidad de eficiencia operativa está acelerando la adopción de plataformas e-Clinical basadas en la nube, habilitadas para IA y totalmente integradas en los sectores farmacéutico y biotecnológico europeos.

Restricción/Desafío

Preocupaciones sobre la privacidad de los datos y altos costos de implementación

- Las preocupaciones sobre la privacidad de los datos de los pacientes, el cumplimiento del RGPD y las vulnerabilidades de ciberseguridad en las plataformas de ensayos clínicos digitales suponen un reto importante para su adopción en el mercado. Dado que las soluciones clínicas electrónicas implican el manejo de datos sanitarios sensibles, las empresas deben implementar un cifrado robusto, protocolos de acceso seguro y auditorías periódicas.

- Por ejemplo, los incidentes de alto perfil sobre violaciones de datos de salud en Europa han hecho que algunas organizaciones duden en digitalizar por completo la gestión de ensayos, en particular para estudios multinacionales.

- Abordar estas preocupaciones sobre la privacidad y seguridad de los datos mediante cifrado avanzado, almacenamiento seguro en la nube y capacitación del personal es crucial para generar confianza entre patrocinadores y organismos reguladores. Además, el costo inicial relativamente alto de las sofisticadas plataformas clínicas electrónicas puede ser un obstáculo para las pequeñas empresas biotecnológicas y las CRO con presupuestos limitados.

- Si bien las soluciones escalables basadas en la nube están reduciendo gradualmente las barreras, las funciones premium como el análisis predictivo impulsado por IA, el monitoreo integrado de pacientes o las herramientas de resultados informados electrónicamente por el paciente (ePRO) a menudo tienen un precio más alto.

- Superar estos desafíos mediante medidas mejoradas de ciberseguridad, apoyo al cumplimiento y modelos de plataforma rentables será vital para el crecimiento sostenido en el mercado europeo de soluciones e-Clinical.

Alcance del mercado de soluciones e-Clínicas en Europa

El mercado está segmentado en función del producto, el modo de entrega, la fase del ensayo clínico, el tamaño de la organización, el dispositivo del usuario y el usuario final.

- Por producto

En función del producto, el mercado europeo de soluciones e-Clinical se segmenta en sistemas de captura electrónica de datos y gestión de datos de ensayos clínicos, sistemas de gestión de ensayos clínicos (CTMS), plataformas de análisis clínico, registros médicos de coordinación de atención (CCMR), gestión de aleatorización y suministro de ensayos, plataformas de integración de datos clínicos, soluciones de evaluación electrónica de resultados clínicos, soluciones de seguridad, sistemas de archivo maestro de ensayos electrónicos, soluciones de gestión de información regulatoria, entre otros. El segmento de sistemas de gestión de ensayos clínicos (CTMS) dominó el mercado con la mayor cuota de ingresos, un 38,5 %, en 2024, gracias a su capacidad para planificar, supervisar y gestionar eficientemente ensayos complejos, garantizando al mismo tiempo el cumplimiento normativo. Las compañías farmacéuticas y las CRO suelen priorizar los CTMS por su supervisión integral de ensayos, la gestión centralizada de datos y la integración con otros sistemas e-Clinical. El segmento también se beneficia de la creciente adopción en ensayos multinacionales a gran escala, donde la automatización robusta del flujo de trabajo y la monitorización basada en riesgos son fundamentales.

Se prevé que el segmento de plataformas de análisis clínico experimente la tasa de crecimiento anual compuesta (TCAC) más rápida, del 17,5 %, entre 2025 y 2032, impulsada por la creciente demanda de información basada en IA, análisis predictivo y soporte para la toma de decisiones en tiempo real en ensayos clínicos. La capacidad de analizar grandes conjuntos de datos, identificar tendencias y optimizar el rendimiento de los ensayos hace que estas plataformas sean muy atractivas para los patrocinadores que buscan una mayor eficiencia operativa y tasas de éxito. Con la creciente complejidad de los ensayos clínicos y el enorme volumen de datos generados, las soluciones de análisis clínico se están volviendo indispensables para mejorar los resultados de los ensayos y la eficiencia operativa.

- Por modo de entrega

Según el modo de entrega, el mercado europeo de soluciones e-Clinical se segmenta en soluciones alojadas en web (bajo demanda), soluciones empresariales con licencia (locales) y soluciones en la nube (SaaS). Las soluciones en la nube (SaaS) obtuvieron la mayor cuota de mercado, con un 42 %, en 2024 gracias a su escalabilidad, menores costes iniciales, accesibilidad remota e integración fluida con las operaciones de ensayos clínicos descentralizados. Estas soluciones son especialmente populares entre las CRO y las empresas farmacéuticas medianas que buscan una implementación rápida y modelos de suscripción flexibles.

Se prevé que las soluciones alojadas en la web (bajo demanda) experimenten el mayor crecimiento entre 2025 y 2032, impulsadas por la necesidad de una implementación ágil y rentable, y la creciente adopción de modelos de ensayos clínicos híbridos y descentralizados en toda Europa. Estas soluciones permiten a las partes interesadas, como patrocinadores, investigadores y pacientes, acceder a los datos de los ensayos de forma segura desde cualquier lugar, lo que mejora la eficiencia de los ensayos y reduce los retrasos operativos.

- Por fase de ensayo clínico

Según la fase de los ensayos clínicos, el mercado europeo de soluciones e-Clinical se segmenta en ensayos de fase I, II, III y IV. Los ensayos de fase III dominaron el mercado con una cuota del 40 % en 2024, debido a su mayor escala, la complejidad de la gestión de datos y un mayor escrutinio regulatorio. Las soluciones e-Clinical eficientes son cruciales en los ensayos de fase III para garantizar la monitorización en tiempo real, la calidad de los datos y el cumplimiento de las regulaciones de la EMA. Las soluciones e-Clinical facilitan una sólida garantía de calidad de los datos, el cumplimiento de las regulaciones de la EMA y locales, y la generación de informes optimizados, todos ellos esenciales para la ejecución exitosa de los ensayos clínicos en fase avanzada.

Se prevé que los ensayos de fase II alcancen su tasa de crecimiento anual compuesta (TCAC) más rápida entre 2025 y 2032, impulsados por el creciente número de ensayos en fase inicial y la creciente adopción de plataformas digitales para el reclutamiento de pacientes, la adherencia al protocolo y el análisis de resultados. Estas intervenciones digitales reducen la duración de los ciclos de ensayo, mejoran la precisión y permiten a los patrocinadores tomar decisiones más rápidas sobre la aprobación o no de los programas de desarrollo de fármacos.

- Por tamaño de la organización

En función del tamaño de las organizaciones, el mercado europeo de soluciones e-Clinical se segmenta en pequeñas, medianas y grandes organizaciones. Las grandes organizaciones dominaron el mercado con una participación del 55 % en 2024, beneficiándose de mayores presupuestos para plataformas e-Clinical avanzadas, amplias carteras de ensayos clínicos y mayores requisitos de cumplimiento normativo. Estas organizaciones tienen la capacidad de invertir en plataformas integradas, basadas en IA, basadas en la nube y multifuncionales para garantizar la eficiencia de los ensayos clínicos, cumplir con los estándares regulatorios y gestionar grandes volúmenes de datos.

Se prevé que las pequeñas y medianas organizaciones experimenten el mayor crecimiento durante el período de pronóstico, impulsado por soluciones en la nube y SaaS que reducen los costos iniciales y permiten una implementación flexible para ensayos a menor escala. El auge de las soluciones en la nube y SaaS ha reducido las barreras de entrada para las pymes, permitiéndoles implementar plataformas clínicas electrónicas con una inversión inicial mínima, acceder a herramientas de análisis avanzadas y realizar ensayos descentralizados o híbridos de manera eficiente.

- Por dispositivo del usuario

En función del dispositivo del usuario, el mercado europeo de soluciones e-Clínicas se segmenta en ordenadores de escritorio, tabletas, dispositivos PDA portátiles, teléfonos inteligentes y otros. Las soluciones de escritorio representaron la mayor cuota de mercado, con un 45 % en 2024, gracias a su fiabilidad, acceso a todas las funciones e idoneidad para la gestión integral de ensayos clínicos en centros de investigación y oficinas de patrocinadores. Los ordenadores de escritorio siguen siendo esenciales para tareas como el diseño de protocolos, la configuración de ensayos clínicos, la elaboración de informes regulatorios y la analítica avanzada.

Se prevé que los teléfonos inteligentes y las tabletas experimenten el mayor crecimiento entre 2025 y 2032, impulsado por modelos de ensayos descentralizados, la monitorización remota, la recopilación de datos ePRO y la necesidad de comunicación en tiempo real entre pacientes, investigadores y patrocinadores. Las soluciones clínicas electrónicas móviles mejoran la participación del paciente, la adherencia a los protocolos de los ensayos y permiten una toma de decisiones más rápida.

- Por el usuario final

En función del usuario final, el mercado europeo de soluciones e-Clinic se segmenta en empresas farmacéuticas y biofarmacéuticas, organizaciones de investigación por contrato (CRO), empresas de servicios de consultoría, fabricantes de dispositivos médicos, hospitales e institutos de investigación académica. Las empresas farmacéuticas y biofarmacéuticas dominaron el mercado con una participación del 50 % en 2024, debido a las extensas carteras de ensayos clínicos, las obligaciones regulatorias y la necesidad de plataformas e-Clinic robustas e integradas.

Se prevé que las organizaciones de investigación por contrato (CRO) alcancen su tasa de crecimiento anual compuesta (TCAC) más alta entre 2025 y 2032, impulsada por la creciente externalización de las operaciones de ensayos clínicos, la demanda de una gestión centralizada de ensayos y la adopción de soluciones basadas en la nube e habilitadas con IA para optimizar la eficiencia y la rentabilidad de los ensayos. Las CRO recurren cada vez más a soluciones clínicas electrónicas para gestionar ensayos para múltiples patrocinadores simultáneamente, optimizar los flujos de trabajo y garantizar el cumplimiento de las normas regulatorias europeas.

Análisis regional del mercado europeo de soluciones clínicas electrónicas

- Alemania dominó el mercado de soluciones e-Clinical con la mayor participación en los ingresos del 28,5 % en 2024, caracterizada por una industria farmacéutica madura, una adopción temprana de soluciones digitales y un fuerte apoyo regulatorio, con empresas líderes que implementan plataformas de gestión de ensayos basadas en la nube e impulsadas por IA.

- Las organizaciones del país valoran mucho la eficiencia, el monitoreo en tiempo real y el cumplimiento normativo que ofrecen las soluciones e-Clinical, lo que permite una gestión más rápida y precisa de ensayos clínicos complejos en múltiples sitios.

- Esta adopción generalizada está respaldada además por una infraestructura tecnológica avanzada, una alta concentración de Organizaciones de Investigación por Contrato (CRO) y una creciente inversión en ensayos clínicos descentralizados e híbridos, lo que establece las soluciones e-Clinical como una opción preferida para las instituciones de investigación farmacéutica, biotecnológica y académica en toda Alemania.

Análisis del mercado alemán de soluciones clínicas electrónicas

Alemania dominó el mercado europeo de soluciones clínicas electrónicas, con la mayor cuota de ingresos, un 28,5 %, en 2024. Esto se debe a un sólido sector farmacéutico y biotecnológico, una infraestructura sanitaria avanzada y la adopción temprana de plataformas clínicas electrónicas basadas en la nube e impulsadas por IA. Las organizaciones alemanas valoran enormemente las soluciones seguras y que respetan la privacidad, así como la integración de modelos de ensayo descentralizados e híbridos, que respaldan los ensayos clínicos de fase II y III. El énfasis en la innovación y el cumplimiento normativo sigue convirtiendo a Alemania en un actor clave en el mercado europeo.

Análisis del mercado de soluciones clínicas electrónicas en Francia

Se prevé que Francia sea el país con mayor crecimiento en el mercado europeo de soluciones e-Clinic durante el período de pronóstico, impulsado por el aumento de la actividad de ensayos clínicos, las iniciativas regulatorias de apoyo y la mayor adopción de plataformas de gestión y análisis de ensayos basadas en IA. Las compañías farmacéuticas y las CRO francesas están aprovechando cada vez más las soluciones e-Clinic para optimizar el reclutamiento de pacientes, la adherencia al protocolo y la generación de informes en tiempo real. El creciente enfoque en la digitalización y la toma de decisiones basada en datos está impulsando una rápida expansión del mercado en Francia.

Perspectivas del mercado de soluciones clínicas electrónicas del Reino Unido

Se prevé que el mercado británico de soluciones clínicas electrónicas crezca a una tasa de crecimiento anual compuesta (TCAC) notable durante el período de pronóstico, impulsado por la adopción de ensayos descentralizados, un sólido ecosistema de ciencias de la vida y el cumplimiento de las regulaciones de la MHRA y la EMA. Las compañías farmacéuticas y las CRO del Reino Unido utilizan cada vez más la IA, el análisis en tiempo real y la monitorización remota para optimizar la eficiencia de los ensayos y reducir los costes operativos.

Análisis del mercado de soluciones clínicas electrónicas en Italia

Se prevé que el mercado italiano de soluciones e-Clínicas crezca de forma sostenida durante el período de pronóstico, impulsado por la expansión de las actividades de ensayos clínicos, el aumento de la inversión en tecnologías de salud digital y la participación en estudios multinacionales. Las plataformas en la nube, EDC y las soluciones de análisis clínico están mejorando la eficiencia operativa de las compañías farmacéuticas, las CRO y los institutos de investigación académica.

Análisis del mercado de soluciones e-Clínicas en España

El mercado español de soluciones e-Clínicas está experimentando un crecimiento gracias a la creciente adopción de plataformas integradas de gestión de ensayos, análisis basados en IA y el énfasis regulatorio en la seguridad de los datos de los pacientes. El enfoque en la eficiencia de las operaciones clínicas y la colaboración transfronteriza dentro de la UE está impulsando la demanda del mercado, especialmente en ensayos de fase II y fase III.

Cuota de mercado de soluciones e-Clínicas en Europa

La industria europea de soluciones e-Clínicas está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- eClinical Solutions LLC (EE. UU.)

- Oracle Corporation (EE. UU.)

- Anju Software, Inc. (EE. UU.)

- Castor EDC (Países Bajos)

- Signant Health (EE. UU.)

- Dassault Systèmes SE (Francia)

- Medidata Solutions, Inc. (EE. UU.)

- Parexel International (MA) Corporation (EE. UU.)

- IQVIA (EE. UU.)

- Veeva Systems (EE. UU.)

- RealTime Software Solutions, LLC (EE. UU.)

- Bioclínica (EE. UU.)

- CRF Health (EE. UU.)

- eClinicalWorks (EE. UU.)

- Maxisit (Alemania)

- Clario (EE. UU.)

- Fountayn (EE. UU.)

- ICON plc (Irlanda)

- Medrio (Estados Unidos)

¿Cuáles son los desarrollos recientes en el mercado de soluciones e-clínicas en Europa?

- En abril de 2025, Veeva Systems anunció el próximo lanzamiento de su nuevo Veeva SiteVault CTMS, un sistema de gestión de ensayos clínicos diseñado específicamente para centros de investigación. El lanzamiento inicial está previsto para agosto de 2025. Este avance es significativo, ya que proporciona a los centros de investigación un sistema dedicado e integrado para gestionar ensayos, agilizando los flujos de trabajo específicos de cada centro y mejorando la colaboración con los patrocinadores.

- En diciembre de 2024, eClinical Solutions anunció una nueva colaboración con Snowflake, una empresa de IA en la nube de datos. Esta alianza establece una integración bidireccional entre elluminate Clinical Data Cloud de eClinical y la plataforma Snowflake. Esta colaboración está diseñada para optimizar el intercambio de datos para las organizaciones de ciencias de la vida, ayudándolas a gestionar y analizar el creciente volumen de datos complejos de ensayos clínicos de forma más eficiente. Esta alianza pone de relieve el creciente interés en la creación de ecosistemas de datos integrados en diferentes plataformas.

- En septiembre de 2024, eClinical Solutions, proveedor líder de software y servicios clínicos digitales, anunció una inversión mayoritaria de GI Partners, una firma de inversión privada. Esta estrategia busca acelerar el crecimiento de la compañía y mejorar sus productos de datos basados en IA y servicios biométricos. Esta inversión pone de manifiesto una tendencia más amplia en el sector: las firmas de capital privado están invirtiendo fuertemente en empresas de tecnología clínica electrónica para capitalizar la creciente demanda de ensayos clínicos eficientes y basados en datos.

- En junio de 2024, Medidata, una empresa de Dassault Systèmes, anunció el lanzamiento de Clinical Data Studio. Esta nueva plataforma de software basada en IA está diseñada para optimizar la gestión de datos de ensayos clínicos. Al aprovechar la IA y la automatización, el estudio centraliza los datos de ensayos de diversas fuentes, lo que ayuda a reducir los ciclos de revisión hasta en un 80 % y a mejorar la calidad de los datos. Este lanzamiento representa un paso significativo en la transición de la industria hacia el uso de la IA para modernizar y acelerar los procesos relacionados con los datos en los ensayos clínicos.

- En febrero de 2021, eClinical Solutions presentó elluminate CTMS, una plataforma en la nube diseñada para acelerar el desarrollo de fármacos mediante la optimización de los procesos de ensayos clínicos. El sistema ofrece acceso a datos en tiempo real, análisis avanzados y una mejor colaboración entre los equipos clínicos.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.