Europe Drinking Chocolate Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

13.27 Billion

USD

18.30 Billion

2024

2032

USD

13.27 Billion

USD

18.30 Billion

2024

2032

| 2025 –2032 | |

| USD 13.27 Billion | |

| USD 18.30 Billion | |

|

|

|

Segmentación del mercado de chocolate para beber en Europa, por tipo (negro, con leche, blanco), contenido de cacao (60-90 %, 40-60 %, 30-40 %, otros), aplicación (bebidas de chocolate, batidos de proteínas, bebidas energéticas, mezclas de café), sabor (vainilla, caramelo, miel, avellana), forma (polvo, líquido), consumidores objetivo (adultos, niños), usuario final (proveedores de servicios de alimentación, hogares/domésticos, empresas, aerolíneas): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado del chocolate para beber

El deseo constante de crear, presentar y comercializar nuevas exquisiteces sustenta las perspectivas de crecimiento del mercado del chocolate para beber. El sabor y la exquisitez son dos factores clave que impulsan el desarrollo de productos en el mercado del chocolate para beber.

Tamaño del mercado del chocolate para beber

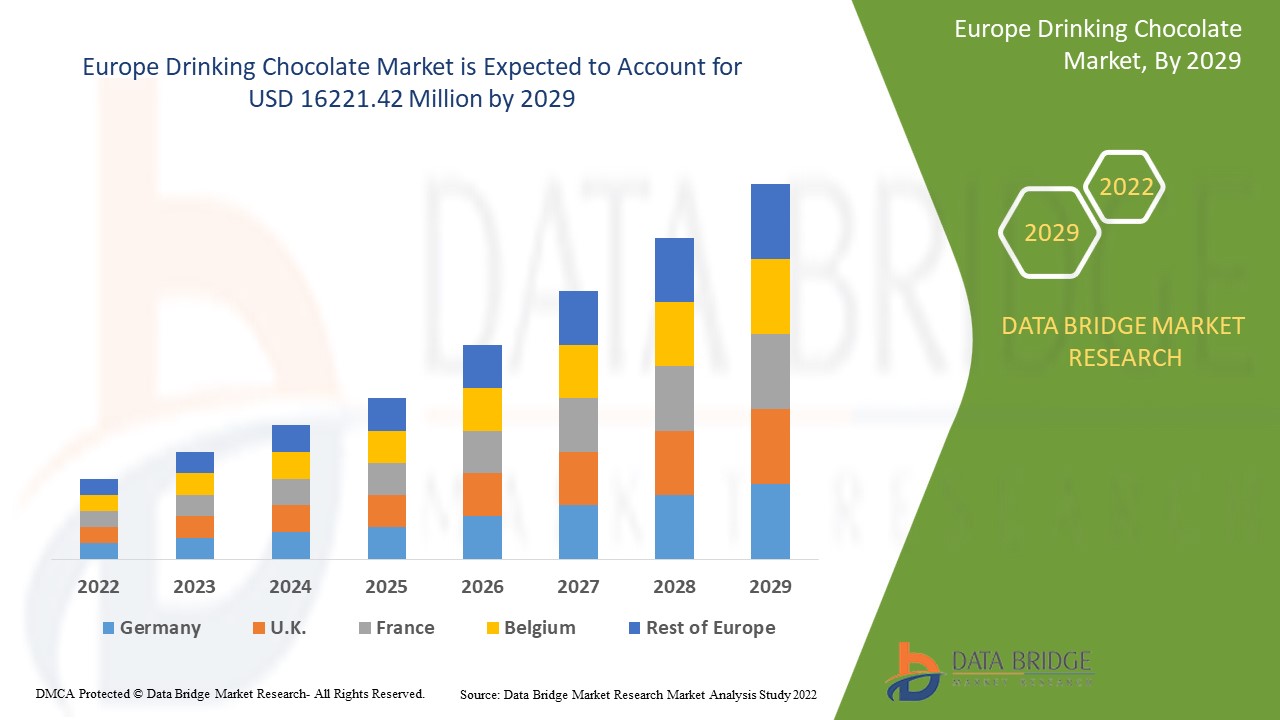

El tamaño del mercado europeo de chocolate para beber se valoró en USD 13,27 mil millones en 2024 y se proyecta que alcance los USD 18,30 mil millones para 2032, con una CAGR del 4,1% durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Perspectivas clave del mercado del chocolate para beber |

|

Segmentación |

|

|

Países cubiertos |

Alemania, Reino Unido, Francia, Italia, Suiza, Países Bajos, España, Bélgica, Turquía, Rusia, Suecia, Dinamarca, Polonia, Luxemburgo, Resto de Europa |

|

Actores clave del mercado |

Barry Callebaut (Suiza), The Hershey Company (EE. UU.), Nestle SA (Suiza), Ingredion (EE. UU.), Mars, Incorporated (EE. UU.), DSM (Países Bajos), Kerry Group plc (Irlanda), Tate & Lyle (Reino Unido), Godiva (EE. UU.), LUIGI LAVAZZA SPA (Italia), Starbucks Coffee Company (EE. UU.), PepsiCo (EE. UU.), Mondelez International (EE. UU.), The Simply Good Foods Company (EE. UU.) |

|

Oportunidades de mercado |

|

Definición del mercado del chocolate para beber

El chocolate caliente es otro nombre para el chocolate para beber. En algunas partes del mundo, el chocolate para beber se conoce como té de chocolate. Como bebida, el chocolate para beber se elabora a partir de pequeños trozos de chocolate que se derriten lentamente y se mezclan con leche y agua. Se elabora con chocolate derretido, chocolate calentado, chocolate en polvo o cacao en polvo . Para elaborar chocolate para beber, las formas en polvo se disuelven en agua o leche. El contenido de cacao de los chocolates para beber determina si están endulzados o no. Una variedad de chocolates para beber se elaboran a partir de chocolate con leche o chocolate blanco.

Dinámica del mercado del chocolate para beber

Conductores

- Aumento de las ventas minoristas en línea y expansión de las cadenas de suministro

Una de las tendencias clave que impulsa la evolución del mercado del chocolate para beber son los avances en el comercio minorista en línea. Las tiendas de conveniencia, las tiendas especializadas, los supermercados, las farmacias y los hipermercados son grandes canales de distribución de productos. Los esfuerzos continuos de los minoristas y los fabricantes por ampliar su cadena de suministro y distribución han desempeñado un papel esencial en el aumento del acceso a los productos en el mercado del chocolate para beber.

- Diversificación de productos según las necesidades

El deseo constante de probar nuevos sabores y gustos étnicos es una fuerza impulsora importante en el mercado del chocolate para beber. Con el paso de los años, la industria del chocolate ha cambiado su enfoque hacia la producción de productos más saludables. La creciente población consciente de la salud está impulsando esta tendencia, en particular en las economías emergentes. La evolución del mercado del chocolate para beber ha sido impulsada por los avances en la venta minorista organizada en las regiones en desarrollo.

Oportunidad

La facilidad de pago de productos a través de canales online y la amplia gama de sabores y texturas de chocolate son factores esenciales que impulsan la popularidad del comercio electrónico en el mercado del chocolate a la taza. Además, el chocolate a la taza se utiliza cada vez más en la formulación de una amplia variedad de bebidas y productos de confitería, como pasteles, batidos, croissants y chocolate caliente, lo que contribuye al crecimiento del mercado europeo del chocolate a la taza.

Restricciones

Sin embargo, la fácil disponibilidad de productos sustitutos, las estrictas regulaciones gubernamentales relacionadas con la estandarización de la calidad y las interrupciones en la cadena de suministro causadas por la pandemia limitarán el alcance del crecimiento del mercado de chocolate para beber. El alto costo de las actividades de I+D y la volatilidad de los precios de las materias primas obstaculizarán la tasa de crecimiento del mercado de chocolate para beber. Otras limitaciones del crecimiento del mercado incluyen la creciente prevalencia de la obesidad, los altos niveles de azúcar en los pacientes y una creciente tasa de incidencia de la diabetes.

Este informe sobre el mercado del chocolate para beber proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado del chocolate para beber, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado del chocolate para beber

El mercado del chocolate para beber está segmentado en función del tipo, el contenido de cacao, la aplicación, el sabor, la forma, los consumidores objetivo, el tipo de envase, el material de envasado, el usuario final y el canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los escasos segmentos de crecimiento de las industrias y proporcionará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo

- Chocolate oscuro

- Chocolate con leche

- Blanco

Contenido de cacao

- 60-90%

- 40-60%

- 30-40%

- Otros

Canal de distribución

- Hipermercados/supermercados

- Tienda especializada

- Tiendas de conveniencia

- Tienda online

- Otro

Solicitud

- Bebidas de chocolate

- Batidos de proteínas

- Bebidas energéticas

- Mezclas de café

- Otros

Sabor

- Vainilla

- Caramelo

- Miel

- Avellana

Forma

- Polvo

- Líquido

Clientes objetivo

- Adultos

- Niños

Usuarios finales

- Proveedores de servicios de alimentación

- Hogar/Doméstico

- Corporaciones

- Aerolíneas

Análisis regional del mercado del chocolate para beber

Se analiza el mercado del chocolate para beber y se proporcionan información y tendencias del tamaño del mercado por país, tipo, contenido de cacao, aplicación, sabor, forma, consumidores objetivo, tipo de empaque, material de empaque, usuario final y canal de distribución como se mencionó anteriormente.

Los países cubiertos en el informe del mercado de chocolate para beber son Alemania, Reino Unido, Francia, Italia, Suiza, Países Bajos, España, Bélgica, Turquía, Rusia, Suecia, Dinamarca, Polonia, Luxemburgo y el resto de Europa.

La región de Asia y el Pacífico domina el mercado de chocolate para beber y continuará haciéndolo durante el período de pronóstico debido a la tremenda popularidad de la región y el consumo sustancial de chocolate, el creciente consumo de waffles y pitas preparados con cremas de chocolate, la creciente adopción de la cultura occidental y los alimentos que han reemplazado los alimentos tradicionales con pan y tostadas, el crecimiento de la población y los crecientes cambios en el estilo de vida.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la gran o escasa competencia de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado del chocolate para beber

El panorama competitivo del mercado del chocolate para beber proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado del chocolate para beber.

Los líderes del mercado del chocolate para beber que operan en el mercado son:

- Barry Callebaut (Suiza)

- La Compañía Hershey (Estados Unidos)

- Nestlé SA (Suiza)

- Ingredion (Estados Unidos)

- Mars, Incorporated (Estados Unidos)

- DSM (Países Bajos)

- Kerry Group plc (Irlanda)

- Tate & Lyle (Reino Unido)

- Godiva (Estados Unidos)

- LUIGI LAVAZZA SPA, (Italia)

- Compañía de café Starbucks (Estados Unidos)

- PepsiCo (Estados Unidos)

- Mondelez Internacional (Estados Unidos)

- La empresa Simply Good Foods (Estados Unidos)

Últimos avances en el mercado del chocolate para beber

- Nestlé lanzará una bebida Nesquik de origen vegetal en Europa en septiembre de 2020, ampliando así su gama de alternativas lácteas. La nueva bebida lista para beber se introdujo primero en España, Portugal y Hungría, y luego se expandió a otros países europeos. Está hecha con avena, guisantes y cacao de origen sostenible, y contiene menos azúcar que la versión normal de Nesquik a base de leche.

- La marca de leche aromatizada de FrieslandCampina, Yazoo, anunció el lanzamiento de un nuevo sabor, Choco-Hazelicious, en marzo de 2020. La bebida estaría disponible en cuatro formatos diferentes, lo que permitiría consumirla tanto en movimiento como en casa. Ferrero planea prelanzar las nuevas tabletas Ferrero Rocher en el canal de venta minorista de viajes en septiembre de 2021 en colaboración con Lagardère. Ferrero ingresa al mercado de tabletas de chocolate con el nuevo producto disponible en tres sabores: para beber, cacao oscuro al 55 por ciento y chocolate blanco.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.