Mercado europeo de fabricación por contrato, por producto (fabricación de productos farmacéuticos y fabricación de dispositivos médicos), por usuario final (empresas farmacéuticas, empresas de biotecnología, empresas biofarmacéuticas, empresas de dispositivos médicos, fabricantes de equipos originales e institutos de investigación), por canal de distribución (ventas minoristas, licitación directa y otros): tendencias de la industria y pronóstico hasta 2030.

Análisis y perspectivas del mercado de fabricación por contrato en Europa

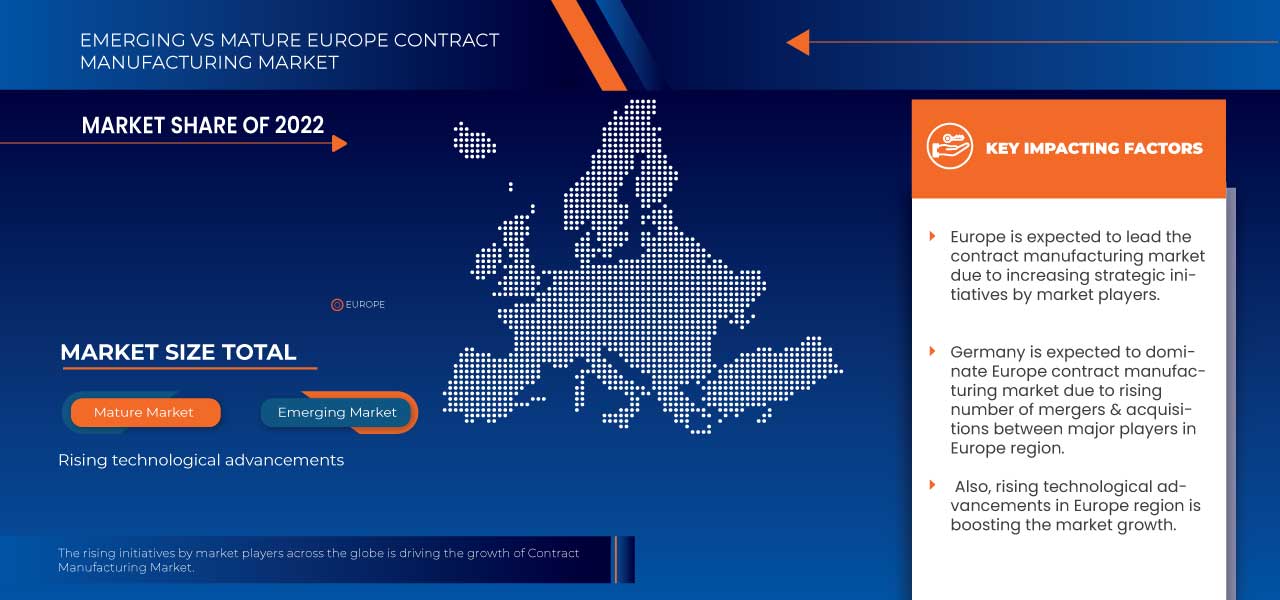

El mercado europeo de fabricación por contrato está impulsado por factores como el aumento de los avances técnicos y la rentabilidad de los productos farmacéuticos y de desarrollo, que aumentan su demanda, y la creciente inversión en investigación y desarrollo que conduce al crecimiento del mercado. Actualmente, el gasto en atención médica ha aumentado en los países desarrollados y emergentes, lo que se espera que cree una ventaja competitiva para que los fabricantes desarrollen productos nuevos e innovadores.

La fabricación por contrato es un contrato entre una empresa y un fabricante para fabricar una cierta cantidad de componentes o productos para la empresa en un período de tiempo específico. Los bienes creados estarán bajo la marca o el sello de la empresa. Esto se denomina fabricación con marca propia. A menudo, también se denomina subcontratación si se realiza a través de las fronteras. Los fabricantes brindan su servicio en función de sus propios diseños, fórmulas y especificaciones, a menos que el cliente proporcione los suyos propios. Ellos crearán estos productos para quienquiera que hayan contratado, incluso empresas de la competencia.

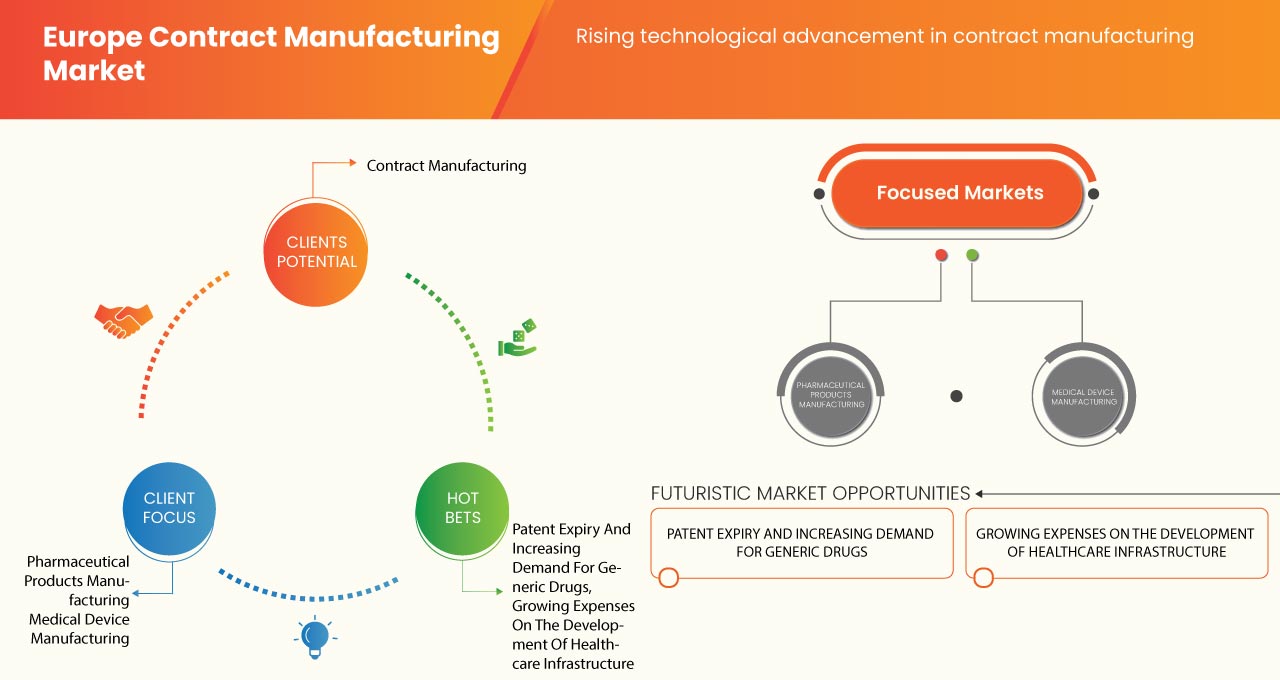

Uno de los principales factores que impulsan el crecimiento del mercado de fabricación por contrato es la creciente demanda en el sector de dispositivos médicos y farmacéuticos. La continua investigación de ensayos clínicos que realizan varias empresas para mejorar el diagnóstico conduce a la expansión del mercado. El mercado también se ve influenciado por los crecientes avances tecnológicos y la rentabilidad. Sin embargo, el riesgo de información confidencial y las estrictas regulaciones pueden actuar como factores restrictivos para el mercado de fabricación por contrato de Europa en el período de pronóstico.

Por otra parte, la expiración de patentes y la creciente demanda de medicamentos genéricos, los crecientes gastos en infraestructura sanitaria y las iniciativas estratégicas de los principales actores del mercado actúan como una oportunidad para el crecimiento del mercado. Sin embargo, el riesgo de la propiedad intelectual y el creciente número de empresas farmacéuticas que establecen sus propias unidades de fabricación pueden crear desafíos para el mercado europeo de fabricación por contrato.

La demanda de fabricación por contrato aumentará en Europa debido a una mayor inclinación hacia los diagnósticos en el punto de atención . Varias empresas están tomando iniciativas que conducen gradualmente al crecimiento del mercado.

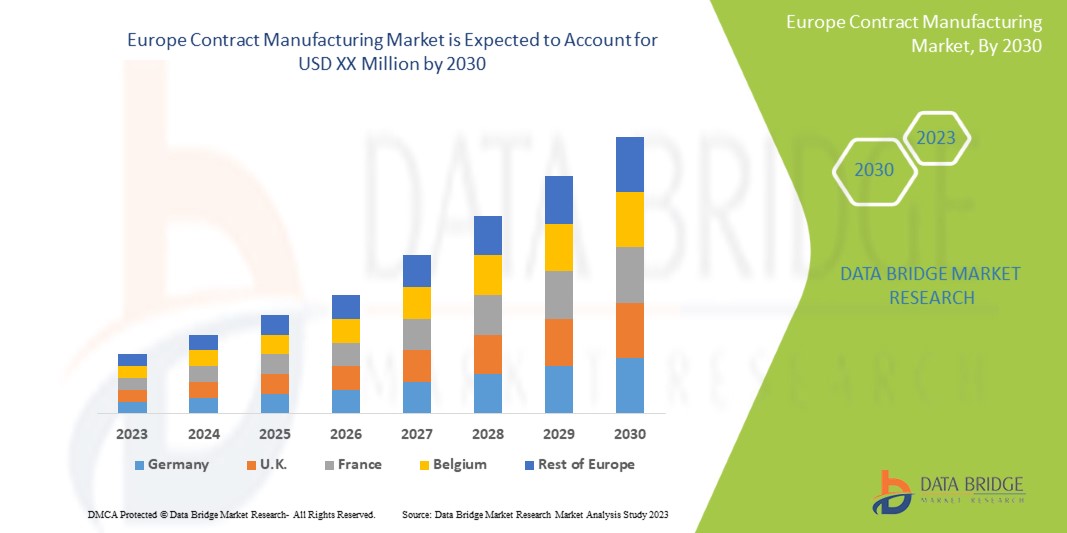

El mercado europeo de fabricación por contrato es favorable y tiene como objetivo reducir los esfuerzos de fabricación de las organizaciones de atención médica. Data Bridge Market Research analiza que el mercado europeo de fabricación por contrato crecerá a una tasa compuesta anual del 6,0 % durante el período de pronóstico de 2023 a 2030.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2023 a 2030 |

|

Año base |

2022 |

|

Años históricos |

2021 (Personalizable para 2015-2020) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por producto (fabricación de productos farmacéuticos y fabricación de dispositivos médicos), por usuario final (empresas farmacéuticas, empresas de biotecnología, empresas biofarmacéuticas, empresas de dispositivos médicos, fabricantes de equipos originales e institutos de investigación), por canal de distribución (ventas minoristas, licitación directa y otros) |

|

Países cubiertos |

Alemania, Francia, Italia, Reino Unido, España, Países Bajos, Rusia, Suiza, Turquía, Austria, Noruega, Hungría, Lituania, Irlanda, Polonia, Luxemburgo, Resto de Europa |

|

Actores del mercado cubiertos |

Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH. y Catalent, Inc, entre otros. |

Dinámica de la fabricación por contrato en Europa

Definición de mercado

La fabricación por contrato en los mercados internacionales se utiliza en situaciones en las que una empresa encarga a otra empresa de un país diferente la fabricación de sus productos; esto también se conoce como subcontratación internacional o externalización internacional. La empresa proporciona al fabricante todas las especificaciones y, si es necesario, también los materiales necesarios para el proceso de producción. Este tipo de contrato establece los requisitos que debe cumplir el fabricante en cuanto a calidad de los productos, certificación, cantidades, condiciones y fechas de entrega, etc. También establece directrices para la inspección y prueba de los productos establecidos por la empresa que subcontrata la fabricación o por sus propios clientes. Además, también describe modificaciones de los pedidos, así como garantías y compensaciones en caso de incumplimiento del contrato. Dado que el proceso consiste básicamente en externalizar la producción en mercados extranjeros a un socio que comercializa el producto final con una marca privada, existen varias empresas e industrias diferentes que pueden hacer uso de este tipo de contrato.

Conductores

- Rentabilidad para las empresas manufactureras

La fabricación intensiva en tiempo y la producción ineficaz de diversos productos y su gestión son grandes cargas para las organizaciones del sector público y privado. También son esenciales para abordar desafíos complejos porque una sola organización es menos eficaz a la hora de impulsar el cambio y, a veces, los resultados requeridos. Las empresas de fabricación por contrato actuarán como oportunidades crecientes tanto para el sector público como para el privado.

La creciente demanda de fabricación por contrato con mayor precisión y menos restricciones de tiempo impulsa a los actores clave a adoptar iniciativas estratégicas. La fabricación por contrato permite ahorrar los gastos generales necesarios para invertir en maquinaria, material y otra mano de obra, lo que simplifica el proceso de producción y agiliza la cadena de suministro al reducir el coste general.

Sin embargo, los principales actores del mercado están invirtiendo grandes cantidades de capital en la fabricación para satisfacer las demandas de sus usuarios finales. Los actores de la fabricación por contrato participan en la elaboración de estrategias y su implementación, reduciendo el coste de producción de estos actores. Los servicios de fabricación por contrato a otras empresas también garantizan la eficiencia y el uso óptimo de los recursos mediante el uso de mano de obra eficaz, inteligencia estratégica o recursos de trabajo necesarios en el ciclo de producción.

- Aumento de los avances tecnológicos en la fabricación por contrato

Introducir un nuevo medicamento en el mercado con rapidez requiere inversiones considerables en la fabricación debido a la creciente demanda en la industria farmacéutica. Se requieren tecnologías y habilidades avanzadas, ya que algunos medicamentos tienen fórmulas complejas y requieren equipos y técnicas específicos para su producción en masa.

Se está considerando el uso de tecnologías innovadoras como el aprendizaje automático, el big data y la inteligencia artificial para desarrollar medicamentos farmacéuticos o fabricar dispositivos médicos con el fin de lograr una producción rápida y veloz. Estos avances técnicos también ayudan a la producción en masa y a la escalabilidad en un corto período de tiempo.

Sin embargo, las empresas farmacéuticas tradicionalmente auditan o supervisan los procesos de producción y entrega de sus organizaciones de fabricación por contrato para monitorear el proceso de fabricación mediante rastreo remoto en tiempo real.

Oportunidades

- Crecientes gastos en el desarrollo de infraestructura sanitaria

La infraestructura es un pilar fundamental que sustenta el objetivo fundamental de promover mejores estándares de atención y bienestar para todos los pacientes, junto con una buena experiencia en el sistema de atención de salud. Al mismo tiempo, el sistema de atención de salud y el personal deben respaldar la promoción de la salud, la prevención y el autocuidado efectivos de toda la población. La infraestructura debe integrar el hospital, como centro de atención aguda y hospitalaria, en el sistema de atención de salud más amplio y debe facilitar los siete dominios de la experiencia de calidad del paciente, la eficacia, la eficiencia, la puntualidad, la seguridad, la equidad y la sostenibilidad. La infraestructura incluye el entorno construido y los elementos de apoyo: equipos, acceso, tecnología de la información (TI), sistemas y procesos, iniciativas de sostenibilidad y personal.

Sin embargo, los crecientes gastos en el desarrollo de infraestructura sanitaria están impulsando el crecimiento del mercado de fabricación por contrato en Europa en el período de pronóstico.

Restricciones/Desafíos

- Aumenta el número de empresas farmacéuticas que instalan sus plantas de fabricación

La mayoría de las compañías farmacéuticas están construyendo plantas de fabricación para producir productos farmacéuticos y reducir costos. Los fabricantes están más centrados en la introducción de tecnologías avanzadas y el proceso de digitalización. La industria farmacéutica también enfrenta disrupciones debido a nuevos modelos de negocios y una población más enfocada en medicamentos y tratamientos personalizados. Por lo tanto, la demanda de atención personalizada es alta. Los perfiles ocupacionales también están cambiando: algunos trabajos están desapareciendo debido a la automatización, mientras que están surgiendo trabajos completamente nuevos.

Por lo tanto, el creciente número de empresas farmacéuticas que establecen sus unidades de fabricación puede desafiar el crecimiento del mercado de fabricación por contrato de Europa en el período de pronóstico.

Acontecimientos recientes

- En octubre de 2021, Boehringer Ingelheim International gmbh. inauguró su moderna planta de producción biofarmacéutica de cultivo celular a gran escala (LSCC) en Viena, Austria, con un volumen de inversión de más de 700 millones de euros, que es la mayor inversión individual en la historia de la empresa.

- En marzo de 2023, Evonik Industries AG anunció la apertura de una nueva planta GMP para fabricar lípidos para aplicaciones avanzadas de administración de fármacos farmacéuticos. La planta de lanzamiento de lípidos está ubicada en la planta de la empresa en Hanau, Alemania, y proporciona a los clientes cantidades de lípidos según sea necesario para la fabricación comercial a pequeña escala y clínica.

Segmentación del mercado de fabricación por contrato en Europa

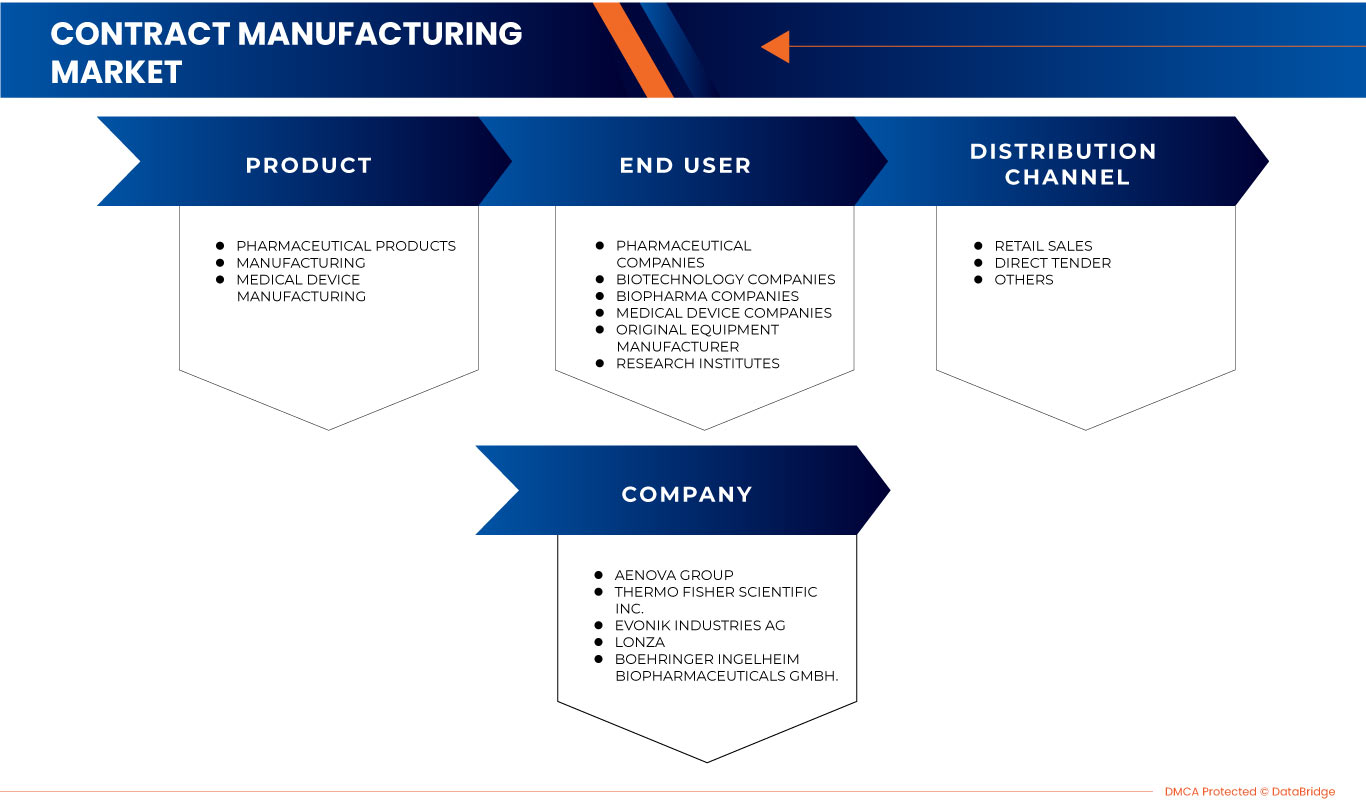

El mercado europeo de fabricación por contrato se clasifica en tres segmentos importantes según el producto, el usuario final y el canal de distribución. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus áreas de aplicación principales y la diferencia en sus mercados objetivo.

Producto

- Fabricación de dispositivos médicos

- Fabricación de productos farmacéuticos

Sobre la base del producto, el mercado europeo de fabricación por contrato está segmentado en fabricación de dispositivos médicos y fabricación de productos farmacéuticos.

Usuario final

- Compañías farmacéuticas

- Empresas de biotecnología

- Empresas biofarmacéuticas

- Empresas de dispositivos médicos

- Fabricante de equipos originales

- Institutos de investigación

Sobre la base del usuario final, el mercado europeo de fabricación por contrato está segmentado en fabricantes de equipos originales, empresas de dispositivos médicos, empresas farmacéuticas, empresas de biotecnología, empresas biofarmacéuticas e institutos de investigación.

Canal de distribución

- Ventas al por menor

- Licitación directa

- Otros

Sobre la base del canal de distribución, el mercado europeo de fabricación por contrato está segmentado en licitaciones directas, ventas minoristas y otros.

Análisis y perspectivas regionales del mercado de fabricación por contrato en Europa

Se analiza el mercado de fabricación por contrato de Europa y se proporcionan información y tendencias del tamaño del mercado por producto, usuario final y canal de distribución como se mencionó anteriormente.

Algunos de los países incluidos en el informe sobre fabricación por contrato en Europa son Alemania, Francia, Italia, Reino Unido, España, Países Bajos, Rusia, Suiza, Turquía, Austria, Noruega, Hungría, Lituania, Irlanda, Polonia, Luxemburgo y el resto de Europa.

Se espera que el Reino Unido domine debido al creciente avance tecnológico en las áreas en desarrollo.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de fabricación por contrato en Europa

El panorama competitivo del mercado europeo de fabricación por contrato ofrece información detallada de los competidores. Se incluyen los siguientes detalles: descripción general de la empresa, datos financieros de la empresa, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia en Europa, sitios e instalaciones de producción, capacidades de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, amplitud y variedad de productos y dominio de aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado europeo de fabricación por contrato.

Algunos actores en el mercado son Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH. y Catalent, Inc entre otros.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE CONTRACT MANUFACTURING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 STRATEGIC INITIATIVES:

5 REGULATORY FRAMEWORK

5.1 REGULATORY SCENARIO BY FDA

5.2 REGULATORY SCENARIO IN AUSTRALIA

5.3 REGULATORY SCENARIO IN EUROPE FOR MEDICINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 COST-EFFECTIVENESS FOR THE MANUFACTURING COMPANIES

6.1.2 RISE OF TECHNOLOGICAL ADVANCEMENTS IN CONTRACT MANUFACTURING

6.1.3 EUROPE PRESENCE AND CONNECTED NETWORK

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS AMONG VARIOUS JURISDICTIONS

6.2.2 RISK OF CONFIDENTIAL INFORMATION

6.3 OPPORTUNITIES

6.3.1 PATENT EXPIRY AND INCREASING DEMAND FOR GENERIC DRUGS

6.3.2 GROWING EXPENSES ON THE DEVELOPMENT OF HEALTHCARE INFRASTRUCTURE

6.3.3 INCREASE IN NUMBER OF STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INTELLECTUAL PROPERTY RISKS

6.4.2 INCREASE IN NUMBER OF PHARMACEUTICAL COMPANIES TO SET UP THEIR MANUFACTURING SITES

7 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PHARMACEUTICAL PRODUCTS MANUFACTURING

7.2.1 TYPES OF PRODUCTS

7.2.1.1 TABLETS

7.2.1.2 CAPSULES

7.2.1.3 BIOLOGICS

7.2.1.4 SMALL MOLECULE

7.2.1.5 CELL & GENES MANUFACTURING

7.2.1.6 NUTRACEUTICALS

7.2.1.7 OTHERS

7.2.2 TYPE OF SERVICES

7.2.2.1 DRUG DEVELOPMENT SERVICES

7.2.2.2 TABLET MANUFACTURING SERVICES

7.2.2.3 BIOLOGICS API MANUFACTURING

7.2.2.4 BIOLOGICS FDF MANUFACTURING SERVICES

7.2.2.5 OTHERS

7.2.3 BY DOSAGE FORM

7.2.3.1 SOLID FORMULATIONS

7.2.3.2 LIQUID FORMULATIONS

7.2.3.2.1 INJECTABLE

7.2.3.2.2 SYRUPS

7.2.3.3 SEMI-SOLID FORMULATIONS

7.2.3.4 TOPICAL DRUG FORMULATIONS

7.2.3.5 OTHERS

7.3 MEDICAL DEVICE MANUFACTURING

7.3.1 TYPE OF DEVICES

7.3.1.1 SYRINGES AND NEEDLES

7.3.1.2 INFUSION DEVICES & ADMINISTRATION SETS

7.3.1.3 MEDICAL ACCESSORIES, COMPONENTS & CONSUMABLES

7.3.1.4 DISPOSABLES

7.3.1.5 IVD DEVICES

7.3.1.6 CARDIOVASCULAR DEVICES

7.3.1.7 DIABETES CARE DEVICES

7.3.1.8 GENERAL SURGERY DEVICES

7.3.1.9 ORTHOPEDIC DEVICES

7.3.1.10 RESPIRATORY DEVICES

7.3.1.11 OPHTHALMIC DEVICES

7.3.1.12 DENTAL DEVICES

7.3.1.13 GYNECOLOGY/UROLOGY DEVICES

7.3.1.14 LABORATORY EQUIPMENT

7.3.2 TYPE OF SERVICES

7.3.2.1 MEDICAL DEVICE DESIGN AND DEVELOPMENT

7.3.2.2 DEVICE ASSEMBLY

7.3.2.3 REGULATORY ASSISTANCE

7.3.2.4 PACKAGING & LABELLING

7.3.2.5 STERILIZATION SERVICES

7.3.2.6 TRAINING AND VALIDATION

7.3.2.7 QUALITY ASSURANCE

7.3.2.8 OTHERS

7.3.3 BY DEVICE CLASS

7.3.3.1 CLASS I MEDICAL DEVICES

7.3.3.2 CLASS IIA MEDICAL DEVICES

7.3.3.3 CLASS IIB MEDICAL DEVICES

7.3.3.4 CLASS III MEDICAL DEVICES

8 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER

8.1 OVERVIEW

8.2 PHARMACEUTICAL COMPANIES

8.3 BIOTECHNOLOGY COMPANIES

8.4 BIOPHARMA COMPANIES

8.5 MEDICAL DEVICES COMPANIES

8.6 ORIGINAL EQUIPMENT MANUFACTURER

8.7 RESEARCH INSTITUTES

9 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL SALES

9.3 DIRECT TENDER

9.4 OTHERS

10 EUROPE CONTRACT MANUFACTURING MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 FRANCE

10.1.3 U.K.

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 TURKEY

10.1.8 BELGIUM

10.1.9 NETHERLANDS

10.1.10 SWITZERLAND

10.1.11 REST OF EUROPE

11 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 AENOVA GROUP

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 THERMO FISHER SCIENTIFIC INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 EVONIK INDUSTRIES AG

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 LONZA

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 BOEHRINGER INGELHEIM INTERNATIONAL GMBH.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABBVIE INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ALMAC GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVID BIOSERVICES, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BAXTER

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 CATALENT, INC

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 FAMAR HEALTH CARE SERVICES

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 JUBILANT PHARMA LIMITED

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 KIMBALL INTERNATIONAL

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 MERCK KGAA

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 NIPR0

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 PFIZER INC

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 RECIPHARM AB.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 SIEGFRIED HOLDING AG

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SUN PHARMACEUTICAL INDUSTRIES LTD

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 TE CONNECTIVITY

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 VETTER PHARMA-FERTIGUNG GMBH & CO. KG

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 EUROPE BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 EUROPE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 EUROPE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 EUROPE MEDICAL DEVICE MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE CONSUMABLES AND ACCESSORIES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 10 EUROPE TYPE OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 EUROPE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 13 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 EUROPE PHARMACEUTICAL COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 EUROPE BIOTECHNOLOGY COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE BIOPHARMA COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 EUROPE AMBULATORY SURGICAL CENTERS IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 EUROPE ORIGINAL EQUIPMENT MANUFACTURER IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE RESEARCH INSTITUTES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 21 EUROPE RETAIL SALES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 EUROPE DIRECT TENDER IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 EUROPE OTHERS IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 EUROPE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 25 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 26 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030, 2021-2030 (UNIT)

TABLE 29 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030, 2021-2030 (ASP)

TABLE 30 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 31 EUROPE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 32 EUROPE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 33 EUROPE MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 EUROPE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 35 EUROPE TYPES OF DEVICES IN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 36 EUROPE TYPES OF DEVICES IN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 37 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 EUROPE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 39 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 40 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 GERMANY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 42 GERMANY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 43 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 44 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 45 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 46 GERMANY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 47 GERMANY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 GERMANY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 GERMANY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 50 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 52 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 53 GERMANY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 54 GERMANY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 55 GERMANY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 56 GERMANY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 57 FRANCE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 58 FRANCE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 59 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 60 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 61 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 62 FRANCE BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 FRANCE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 64 FRANCE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 FRANCE MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 67 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 68 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 69 FRANCE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 70 FRANCE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 71 FRANCE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 FRANCE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 73 U.K. CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 74 U.K. PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 75 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 76 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 77 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 78 U.K. BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 79 U.K. BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 80 U.K. LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 U.K. MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 83 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 84 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 85 U.K. TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 U.K. BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 87 U.K. CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 88 U.K. CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 89 ITALY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 ITALY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 91 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 92 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 93 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 94 ITALY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 95 ITALY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 96 ITALY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 97 ITALY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 98 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 99 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 100 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 101 ITALY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 102 ITALY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 ITALY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 104 ITALY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 105 SPAIN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 106 SPAIN PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 107 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 108 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 109 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 110 SPAIN BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 111 SPAIN BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 112 SPAIN LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 SPAIN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 114 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 115 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 116 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 117 SPAIN TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 118 SPAIN BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 119 SPAIN CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 120 SPAIN CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 121 RUSSIA CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 RUSSIA PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 123 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 124 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 125 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 126 RUSSIA BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 127 RUSSIA BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 128 RUSSIA LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 129 RUSSIA MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 130 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 131 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 132 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 133 RUSSIA TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 134 RUSSIA BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 135 RUSSIA CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 136 RUSSIA CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 137 TURKEY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 138 TURKEY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 139 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 140 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 141 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 142 TURKEY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 143 TURKEY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 144 TURKEY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 145 TURKEY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 146 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 147 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 148 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 149 TURKEY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 150 TURKEY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 151 TURKEY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 152 TURKEY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 153 BELGIUM CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 154 BELGIUM PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 155 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 156 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 157 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 158 BELGIUM BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 159 BELGIUM BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 160 BELGIUM LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 161 BELGIUM MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 162 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 163 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 164 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 165 BELGIUM TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 166 BELGIUM BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 167 BELGIUM CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 168 BELGIUM CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 169 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 170 NETHERLANDS PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 171 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 172 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 173 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 174 NETHERLANDS BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 175 NETHERLANDS BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 176 NETHERLANDS LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 177 NETHERLANDS MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 178 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 179 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 180 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 181 NETHERLANDS TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 182 NETHERLANDS BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 183 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 184 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 185 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 186 SWITZERLAND PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 187 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 188 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 189 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 190 SWITZERLAND BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 191 SWITZERLAND BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 192 SWITZERLAND LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 193 SWITZERLAND MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 194 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 195 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 196 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 197 SWITZERLAND TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 198 SWITZERLAND BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 199 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 200 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 201 REST OF EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 2 EUROPE CONTRACT MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CONTRACT MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CONTRACT MANUFACTURING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CONTRACT MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CONTRACT MANUFACTURING MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 EUROPE CONTRACT MANUFACTURING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE CONTRACT MANUFACTURING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 11 RISING TECHNOLOGICAL ADVANCEMENTS AND COST-EFFECTIVENESS OF PHARMACEUTICAL AND MEDICAL PRODUCTS ARE EXPECTED TO DRIVE THE GROWTH OF THE EUROPE CONTRACT MANUFACTURING MARKET

FIGURE 12 THE PHARMACEUTICAL PRODUCTS MANUFACTURING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CONTRACT MANUFACTURING MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE CONTRACT MANUFACTURING MARKET

FIGURE 14 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, 2022

FIGURE 15 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 16 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, 2022

FIGURE 19 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 20 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 21 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, LIFELINE CURVE

FIGURE 22 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 23 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 24 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 25 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 26 EUROPE CONTRACT MANUFACTURING MARKET: SNAPSHOT (2022)

FIGURE 27 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2022)

FIGURE 28 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT (2023-2030)

FIGURE 31 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.