Mercado europeo de envases de papel y plástico biodegradables, por tipo de envase (plástico y papel), producto (bolsas, bandejas para hornear, platos de papel, recipientes tipo almeja para sándwiches, vasos para porciones, bandejas, cubiertos, cuencos, bolsas y bolsitas, con tapa y otros), uso (de un solo uso y reutilizable), canal de distribución (comercio electrónico, supermercados/hipermercados, tiendas de conveniencia, tiendas especializadas y otros), aplicación (envases de alimentos, envases de bebidas, envases de productos farmacéuticos, envases de cuidado personal y del hogar, envases de electrodomésticos y otros), capa de envasado (envases primarios, envases secundarios y envases terciarios), usuario final (restaurantes, hoteles, teterías y cafeterías, tiendas de dulces y aperitivos, cafeterías y otros), país (Alemania, Reino Unido, Italia, Francia, España, Suiza, Rusia, Turquía, Bélgica, Países Bajos y resto de Europa), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado : mercado europeo de envases de plástico y papel biodegradables

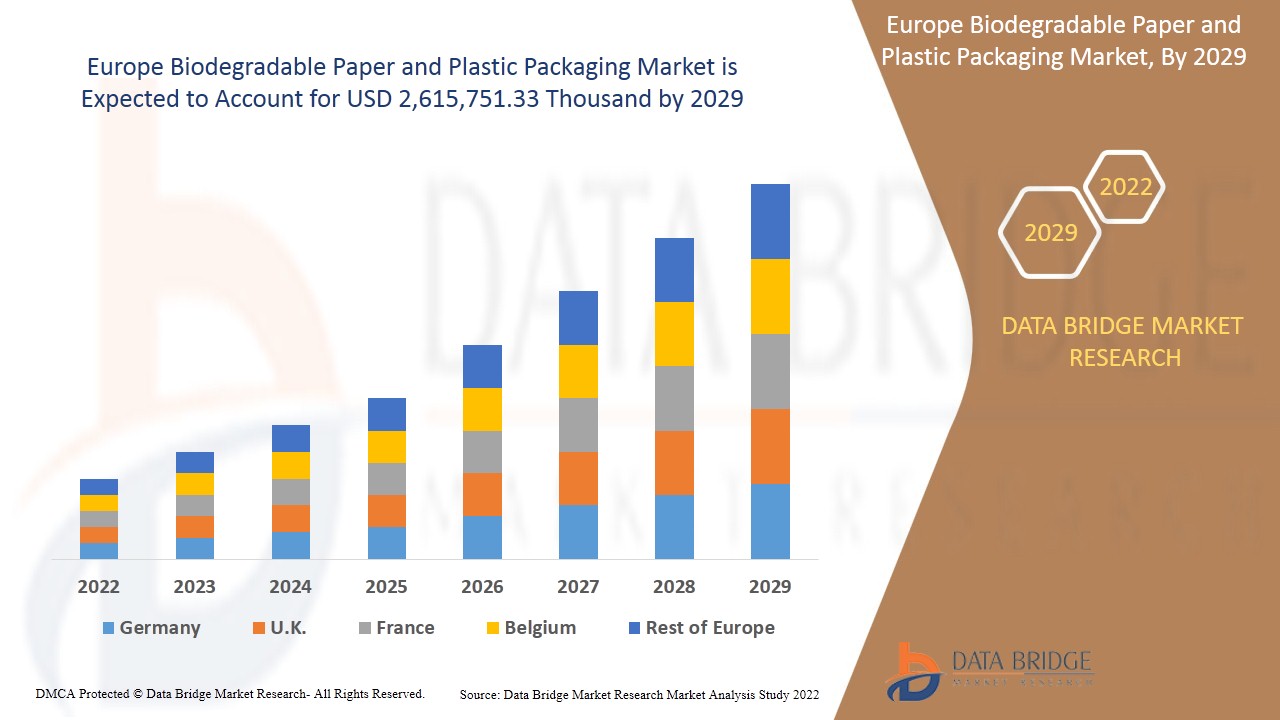

Se espera que el mercado europeo de envases de papel y plástico biodegradables gane crecimiento de mercado en el período de pronóstico de 2022 a 2029. Data Bridge Market Research analiza que el mercado está creciendo a una CAGR del 7,8% en el período de pronóstico de 2022 a 2029 y se espera que alcance los USD 2.615.751,33 mil para 2029. Uno de los impulsores importantes asociados con el mercado europeo de envases de papel y plástico biodegradables podría ser el fortalecimiento de las regulaciones gubernamentales relacionadas con los envases.

Los envases de papel y plástico biodegradables son productos ecológicos que no emiten carbono durante el proceso de producción. Debido a la creciente concienciación de la población sobre los envases ecológicos, la demanda de envases de papel y plástico biodegradables ha aumentado. Esto se aplica a varias industrias, como la farmacéutica, la alimentaria, la sanitaria y la medioambiental. Con varios tipos de plásticos, la industria alimentaria y de bebidas depende en gran medida de los materiales de envasado.

Se espera que la creciente conciencia de los consumidores en relación con los envases ecológicos impulse el crecimiento del mercado. La necesidad de materiales con una huella de carbono más baja puede actuar como un potencial impulsor del mercado. Además, la eliminación gradual de los plásticos de un solo uso aumentará las ventas y las ganancias de los actores que operan en el mercado.

La principal limitación que afecta al mercado europeo de envases de plástico y papel biodegradables es la inversión limitada en la producción de plástico biodegradable. Además, un gran enfoque en la producción de plástico reciclable y de origen biológico no biodegradable también puede limitar el crecimiento del mercado. Se espera que la producción de ácido poliláctico (PLA) a partir de caña de azúcar y maíz cree oportunidades para el mercado europeo de envases de plástico y papel biodegradables. Es probable que la disponibilidad limitada de máquinas y equipos para materiales de origen biológico actúe como un desafío para el crecimiento del mercado.

Este informe sobre el mercado de envases de plástico y papel biodegradables de Europa proporciona detalles sobre la participación de mercado, los nuevos desarrollos y el análisis de la cartera de productos, el impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsas de ingresos emergentes, cambios en las regulaciones del mercado, aprobaciones de productos, decisiones estratégicas, lanzamientos de productos, expansiones geográficas e innovaciones tecnológicas en el mercado. Para comprender el análisis y el escenario del mercado, contáctenos para obtener un resumen analítico; nuestro equipo lo ayudará a crear una solución de impacto en los ingresos para lograr su objetivo deseado.

Alcance y tamaño del mercado de envases de plástico y papel biodegradables en Europa

El mercado europeo de envases de papel y plástico biodegradables está segmentado en función del tipo de envase, el producto, el uso, el canal de distribución, la aplicación, la capa de envasado y el usuario final. El crecimiento entre segmentos le ayuda a analizar nichos de crecimiento y estrategias para abordar el mercado y determinar sus principales áreas de aplicación y la diferencia en sus mercados objetivo.

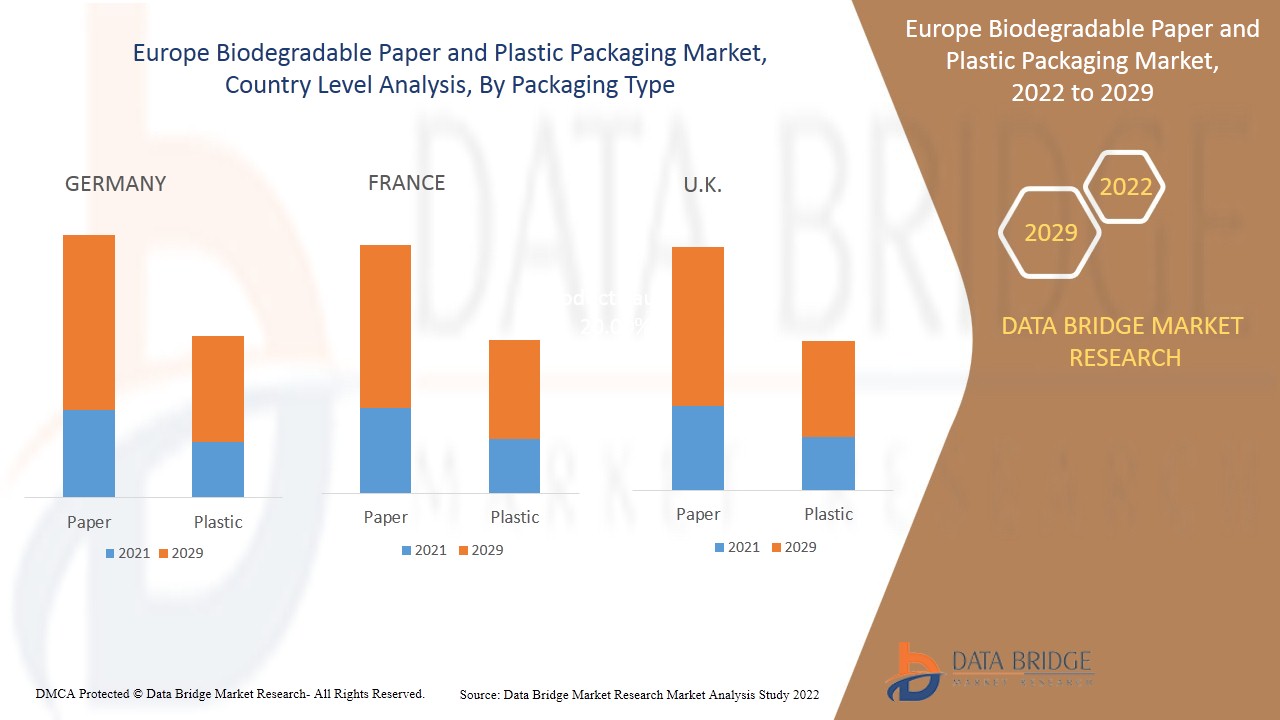

- En función del tipo de embalaje, el mercado europeo de embalajes de papel y plástico biodegradables se segmenta en papel y plástico. En 2022, se espera que el segmento del papel domine el mercado europeo de embalajes de papel y plástico biodegradables, ya que el proceso de fabricación del papel requiere menos trabajadores cualificados y una fácil disponibilidad de recursos o materias primas, lo que aumenta su demanda.

- En función del producto, el mercado europeo de envases de papel y plástico biodegradables se segmenta en pajitas, bolsas, bandejas para hornear, platos de papel, recipientes tipo concha para sándwiches, vasos para porciones, bandejas, cubiertos, cuencos, bolsas y sobres, con tapa y otros. En 2022, se espera que el segmento de las bolsas domine el mercado europeo de envases de papel y plástico biodegradables, ya que son duraderos y se pueden utilizar para múltiples usos, lo que aumenta su demanda.

- En función del uso, el mercado europeo de envases de papel y plástico biodegradables se segmenta en envases de un solo uso y reutilizables. En 2022, se espera que el segmento reutilizable domine el mercado europeo de envases de papel y plástico biodegradables, ya que evita la explotación innecesaria de los recursos y evita la basura, lo que aumenta su demanda en el período de pronóstico.

- Según el canal de distribución, el mercado europeo de envases de papel y plástico biodegradables se segmenta en comercio electrónico , supermercados/hipermercados, tiendas de conveniencia, tiendas especializadas y otros. En 2022, se espera que el segmento de supermercados/hipermercados domine el mercado europeo de envases de papel y plástico biodegradables, ya que los clientes pueden disfrutar de total libertad de selección, lo que aumenta su demanda en el período de pronóstico.

- On the basis of application, the Europe biodegradable paper and plastic packaging market is segmented into food packaging, beverage packaging, pharmaceuticals packaging, personal & home care packaging, electronic appliance packaging, and others. In 2022, the food packaging segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it makes food safer and less vulnerable to contamination which increases its demand.

- On the basis of packaging layer, the Europe biodegradable paper and plastic packaging market is segmented into primary packaging, secondary packaging, and tertiary packaging. In 2022, the primary packaging segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it is low cost and designed for end-users who have printed information of the product, thus increasing its demand in the forecast period.

- On the basis of end-user, the Europe biodegradable paper and plastic packaging market is segmented into restaurants, hotels, tea and coffee shops, sweets & snacks stores, cafeteria and others. In 2022, the restaurants segment is expected to dominate the Europe biodegradable paper and plastic packaging market as it introduces diners to different cultures through food and its packaging, which increases its demand in the forecast period.

Europe Biodegradable Paper and Plastic Packaging Market, Country Level Analysis

Europe biodegradable paper and plastic packaging market is segmented based on packaging type, product, usage, distribution channel, application, packaging layer and end-user.

The countries covered in the Europe biodegradable paper and plastic packaging market report are Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, and the Rest of Europe.

Germany is expected to dominate the Europe biodegradable paper and plastic packaging market due to the increasing need for lower carbon footprint materials. In France, growing consumer awareness related to eco-friendly packaging is proven to boost the demand for biodegradable paper and plastic packaging in every sector. Whereas in the U.K., strengthening government regulations related to packaging is expected to boost the biodegradable paper and plastic packaging demand among end-users.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of European brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Crecimiento de la industria de envases de plástico y papel biodegradables

El mercado europeo de envases de papel y plástico biodegradables también le ofrece un análisis detallado del mercado para cada país, el crecimiento de una base instalada de diferentes tipos de productos para el mercado de envases de papel y plástico biodegradables, el impacto de la tecnología mediante curvas de línea de vida y los cambios en los escenarios regulatorios de las fórmulas infantiles y su impacto en el mercado europeo de envases de papel y plástico biodegradables. Los datos están disponibles para el período histórico de 2012 a 2020.

Análisis del panorama competitivo y de la cuota de mercado de los envases de plástico y papel biodegradables en Europa

El panorama competitivo del mercado europeo de envases de plástico y papel biodegradables proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, los procesos de ensayos clínicos, el análisis de la marca, las aprobaciones de productos, las patentes, la amplitud y la extensión de los productos, el dominio de las aplicaciones y la curva de la línea de vida de la tecnología. Los puntos de datos anteriores solo están relacionados con el enfoque de la empresa en el mercado europeo de envases de plástico y papel biodegradables.

Algunos de los principales actores incluidos en el informe son Smurfit Kappa, DS Smith, Tetra Pak, Mondi, International Paper, VPK Group, Sonoco Products Company, STOROPACK HANS REICHENECKER GMBH, WestRock Company, Stora Enso, Eurocell srl, Novamont SpA, OSQ, BIO-LUTIONS International AG, TIPA LTD, Robert Cullen Ltd., BioApply, CPS Paper Products, The Biodegradable Bag Company Ltd., Hosgör Plastik, entre otros actores nacionales y regionales. Los analistas de DBMR comprenden las fortalezas competitivas y brindan un análisis competitivo para cada competidor por separado.

Por ejemplo,

- En octubre de 2021, el Grupo VPK convirtió el complejo industrial DA Alizay, situado en la región de Normandía, en un polo de desarrollo sostenible en el ámbito de la economía circular. El Grupo VPK anuncia la realización de la reconstrucción de la máquina de papel con Valmet Oyj

- En noviembre de 2021, Mondi invirtió 20 millones de euros para mejorar la sostenibilidad de su producción de pulpa en la planta de Frantschach en Austria. Este nuevo equipamiento de la planta hará que la producción de pulpa de Mondi sea aún más eficiente y sostenible. Esto ayudará a ganar más clientes

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 USAGE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 CUSTOMER BARGAINING POWER

4.1.4 SUPPLIER BARGAINING POWER

4.1.5 INTERNAL COMPETITION (RIVALRY)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 NEED FOR LOWER CARBON FOOTPRINT MATERIALS

5.1.2 GROWING CONSUMER AWARENESS RELATED TO ECO-FRIENDLY PACKAGING

5.1.3 STRENGHTHENING OF GOVERNMENT REGULATIONS RELATED TO PACKAGING

5.1.4 PHASE OUT OF SINGLE USE PLASTICS

5.2 RESTRAINTS

5.2.1 HIGH COST OF BIODEGRADABLE PACKAGING PRODUCTS

5.2.2 LOW PRODUCTION OF POLYHYDROXYBUTYRATE ACID (PHB)

5.2.3 LIMITED INVESTMENT IN BIODEGRADABLE PLASTIC PRODUCTION

5.2.4 HIGH FOCUS ON RECYCLABLE AND BIO-BASED NON-BIODEGRADABLE PLASTIC PRODUCTION

5.3 OPPORTUNITIES

5.3.1 PRODUCTION OF COST-EFFECTIVE BIODEGRADABLE PACKAGING PRODUCTS

5.3.2 PRODUCTION OF POLYLACTIC ACID (PLA) FROM SUGARCANE AND CORN

5.3.3 BIODEGRADABLE PACKAGING PRODUCTION FOR HEALTHCARE INDUSTRY

5.4 CHALLENGES

5.4.1 HIGH FLUCTUATION IN RAW MATERIAL PRICES

5.4.2 LIMITED AVAILABILITY OF MACHINES AND EQUIPMENT FOR PRODUCTION OF BIO-BASED MATERIALS

5.4.3 LOW YIELD IN PRODUCTION OF BIO-BASED PLASTIC RESINS

6 IMPACT OF COVID-19 ON EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE BIODEGRADABLE PLASTIC & PAPER PACKAGING MARKET

6.2 STRATERGIC DECISIONS BY MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 PRICE IMPACT

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 BAGS

7.2.1 STANDARD CARRY BAGS

7.2.2 STAND UP BAGS

7.2.2.1 ROUND BOTTOM GUSSET TYPE

7.2.2.2 SEAL BOTTOM TYPE

7.2.2.3 PLOW BOTTOM TYPE

7.2.2.4 SIDE GUSSET TYPE

7.2.2.5 THREE SIDE SEALED

7.2.2.6 FOUR SIDE SEALED

7.2.2.7 OTHERS

7.2.3 T-SHIRT PLASTIC BAGS

7.2.4 SELF-OPENING STYLE BAGS

7.2.5 ZIPPER BAGS

7.2.6 FOOD SAFE BARRIER BAGS

7.2.7 SMELL PROOF BAGS

7.2.8 PINCH BOTTOM BAGS

7.2.9 OTHERS

7.3 TRAYS

7.4 PAPER PLATES

7.5 BOWLS

7.6 CLAMSHELL SANDWICH CONTAINERS

7.7 POUCHES AND SACHETS

7.8 PORTION CUPS

7.9 STRAWS

7.1 CUTLERY

7.11 LIDDED

7.12 BAKING SHEETS

7.13 OTHERS

8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE

8.1 OVERVIEW

8.2 PAPER

8.2.1 CORRUGATED BOARD

8.2.2 BOXBOARD

8.2.3 FLEXIBLE PAPER

8.2.4 OTHERS

8.3 PLASTIC

8.3.1 PLA

8.3.2 STARCH BASED PLASTIC

8.3.3 PBS

8.3.4 PHA

8.3.5 PCL

8.3.6 OTHERS

9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE

9.1 OVERVIEW

9.2 REUSABLE

9.3 SINGLE-USE

10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 SUPERMARKETS/HYPERMARKETS

10.3 CONVENIENCE STORES

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER

11.1 OVERVIEW

11.2 PRIMARY PACKAGING

11.3 SECONDARY PACKAGING

11.4 TERTIARY PACKAGING

12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD PACKAGING

12.2.1 FOOD PACKAGING, BY APPLICATION

12.2.1.1 FRUITS

12.2.1.2 VEGETABLE

12.2.1.3 BAKERY PRODUCTS

12.2.1.3.1 CAKES

12.2.1.3.2 PASTRIES

12.2.1.3.3 BISCUITS

12.2.1.3.4 BREAD

12.2.1.3.5 OTHERS

12.2.1.4 COOKED FOOD

12.2.1.4.1 PIZZA

12.2.1.4.2 SANDWICH

12.2.1.4.3 BURGER

12.2.1.4.4 OTHERS

12.2.1.5 MEAT, SEAFOOD AND POULTRY

12.2.1.6 DAIRY PRODUCTS

12.2.1.6.1 EGGS

12.2.1.6.2 CHEESE

12.2.1.6.3 OTHERS

12.2.1.7 OTHERS

12.3 BEVERAGE PACKAGING

12.4 ELECTRONIC APPLIANCE PACKAGING

12.5 PERSONAL & HOME CARE PACKAGING

12.6 PHARMACEUTICALS PACKAGING

12.7 OTHERS

13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESTAURANTS

13.2.1 RESTAURANTS, BY PRODUCT

13.2.1.1 BAGS

13.2.1.2 TRAYS

13.2.1.3 PAPER PLATES

13.2.1.4 BOWLS

13.2.1.5 CLAMSHELL SANDWICH CONTAINERS

13.2.1.6 POUCHES AND SACHETS

13.2.1.7 PORTION CUPS

13.2.1.8 STRAWS

13.2.1.9 CUTLERY

13.2.1.10 LIDDED

13.2.1.11 BAKING SHEETS

13.2.1.12 OTHERS

13.3 SWEETS & SNACKS STORES

13.3.1 SWEETS & SNACKS STORES, BY PRODUCT

13.3.1.1 BAGS

13.3.1.2 TRAYS

13.3.1.3 PAPER PLATES

13.3.1.4 BOWLS

13.3.1.5 CLAMSHELL SANDWICH CONTAINERS

13.3.1.6 POUCHES AND SACHETS

13.3.1.7 PORTION CUPS

13.3.1.8 STRAWS

13.3.1.9 CUTLERY

13.3.1.10 LIDDED

13.3.1.11 BAKING SHEETS

13.3.1.12 OTHERS

13.4 CAFETERIA

13.4.1 CAFETERIA, BY PRODUCT

13.4.1.1 BAGS

13.4.1.2 TRAYS

13.4.1.3 PAPER PLATES

13.4.1.4 BOWLS

13.4.1.5 CLAMSHELL SANDWICH CONTAINERS

13.4.1.6 POUCHES AND SACHETS

13.4.1.7 PORTION CUPS

13.4.1.8 STRAWS

13.4.1.9 CUTLERY

13.4.1.10 LIDDED

13.4.1.11 BAKING SHEETS

13.4.1.12 OTHERS

13.5 TEA AND COFFEE SHOPS

13.5.1 TEA AND COFFEE SHOPS, BY PRODUCT

13.5.1.1 BAGS

13.5.1.2 TRAYS

13.5.1.3 PAPER PLATES

13.5.1.4 BOWLS

13.5.1.5 CLAMSHELL SANDWICH CONTAINERS

13.5.1.6 POUCHES AND SACHETS

13.5.1.7 PORTION CUPS

13.5.1.8 STRAWS

13.5.1.9 CUTLERY

13.5.1.10 LIDDED

13.5.1.11 BAKING SHEETS

13.5.1.12 OTHERS

13.6 HOTELS

13.6.1 HOTELS, BY PRODUCT

13.6.1.1 BAGS

13.6.1.2 TRAYS

13.6.1.3 PAPER PLATES

13.6.1.4 BOWLS

13.6.1.5 CLAMSHELL SANDWICH CONTAINERS

13.6.1.6 POUCHES AND SACHETS

13.6.1.7 PORTION CUPS

13.6.1.8 STRAWS

13.6.1.9 CUTLERY

13.6.1.10 LIDDED

13.6.1.11 BAKING SHEETS

13.6.1.12 OTHERS

13.7 OTHERS

13.7.1 OTHERS, BY PRODUCT

13.7.1.1 BAGS

13.7.1.2 TRAYS

13.7.1.3 PAPER PLATES

13.7.1.4 BOWLS

13.7.1.5 CLAMSHELL SANDWICH CONTAINERS

13.7.1.6 POUCHES AND SACHETS

13.7.1.7 PORTION CUPS

13.7.1.8 STRAWS

13.7.1.9 CUTLERY

13.7.1.10 LIDDED

13.7.1.11 BAKING SHEETS

13.7.1.12 OTHERS

14 EUROPE

14.1 GERMANY

14.2 FRANCE

14.3 U.K.

14.4 ITALY

14.5 SPAIN

14.6 RUSSIA

14.7 BELGIUM

14.8 NETHERLANDS

14.9 SWITZERLAND

14.1 TURKEY

14.11 REST OF EUROPE

15 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

15.2 MERGERS & ACQUISITIONS

15.3 EXPANSIONS

15.4 NEW PRODUCT DEVELOPMENT

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SMURFIT KAPPA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 DS SMITH

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 TETRA PAK

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT UPDATES

17.4 MONDI

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT UPDATES

17.5 INTERNATIONAL PAPER

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT UPDATES

17.6 VPK GROUP

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 SONOCO PRODUCTS COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT UPDATE

17.8 STOROPACK HANS REICHENECKER GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATES

17.9 BIOAPPLY

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATE

17.1 BIO-LUTIONS INTERNATIONAL AG

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATES

17.11 CPS PAPER PRODUCTS

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 EUROCELL SRL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT UPDATE

17.13 HOŞGÖR PLASTIK

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 NOVAMONT S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATE

17.15 OSQ

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT UPDATE

17.16 ROBERT CULLEN LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT UPDATE

17.17 STORA ENZO

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATE

17.18 THE BIODEGRADABLE BAG COMPANY LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT UPDATE

17.19 TIPA LTD

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT UPDATES

17.2 WEST ROCK COMPANY

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT UPDATES

18 QUESTIONNAIRES

19 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS.; HS CODE - 3923 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES FOR CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS AND OTHER CLOSURE OF PLASTICS .; HS CODE - 3923 (USD THOUSAND)

TABLE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 EUROPE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 EUROPE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND )

TABLE 13 EUROPE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE DAIRY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 26 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 27 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 28 GERMANY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 29 GERMANY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 30 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 GERMANY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 32 GERMANY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 34 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 35 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 36 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 GERMANY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 38 GERMANY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 GERMANY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 GERMANY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 GERMANY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 42 GERMANY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 GERMANY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 44 GERMANY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 GERMANY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 46 GERMANY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 47 GERMANY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 49 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 50 FRANCE BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 FRANCE STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 52 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 FRANCE PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 FRANCE PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 56 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 57 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 58 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 FRANCE FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 60 FRANCE BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 FRANCE COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 FRANCE DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 66 FRANCE CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 FRANCE TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 FRANCE HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 69 FRANCE OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 71 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 72 U.K. BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.K. STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 74 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.K. PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 U.K. PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 78 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 79 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 80 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 U.K. FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 82 U.K. BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 83 U.K. COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 U.K. DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.K. BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 86 U.K. RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 U.K. SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 88 U.K. CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 U.K. TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 90 U.K. HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 91 U.K. OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 93 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 94 ITALY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 95 ITALY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 96 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 ITALY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 ITALY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 100 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 101 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 102 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 103 ITALY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 104 ITALY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 105 ITALY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 106 ITALY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 107 ITALY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 108 ITALY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 109 ITALY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 ITALY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 ITALY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 112 ITALY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 113 ITALY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 114 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 115 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 116 SPAIN BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 117 SPAIN STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 119 SPAIN PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 SPAIN PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 122 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 123 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 124 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 SPAIN FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 126 SPAIN BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 127 SPAIN COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 128 SPAIN DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 129 SPAIN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 130 SPAIN RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 131 SPAIN SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 132 SPAIN CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 133 SPAIN TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 134 SPAIN HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 135 SPAIN OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 136 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 137 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 138 RUSSIA BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 139 RUSSIA STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 140 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 RUSSIA PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 RUSSIA PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 144 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 145 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 146 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 RUSSIA FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 148 RUSSIA BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 149 RUSSIA COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 150 RUSSIA DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 RUSSIA BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 152 RUSSIA RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 153 RUSSIA SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 154 RUSSIA CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 155 RUSSIA TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 156 RUSSIA HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 157 RUSSIA OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 158 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 159 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 160 BELGIUM BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 161 BELGIUM STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 162 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 BELGIUM PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 BELGIUM PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 166 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 167 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 168 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 169 BELGIUM FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 170 BELGIUM BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 BELGIUM COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 172 BELGIUM DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 173 BELGIUM BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 174 BELGIUM RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 175 BELGIUM SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 176 BELGIUM CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 177 BELGIUM TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 178 BELGIUM HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 179 BELGIUM OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 180 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 181 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 182 NETHERLANDS BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 183 NETHERLANDS STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 184 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 NETHERLANDS PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 NETHERLANDS PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 188 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 189 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 190 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 191 NETHERLANDS FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 192 NETHERLANDS BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 NETHERLANDS COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 NETHERLANDS DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 NETHERLANDS BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 196 NETHERLANDS RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 197 NETHERLANDS SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 198 NETHERLANDS CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 199 NETHERLANDS TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 200 NETHERLANDS HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 201 NETHERLANDS OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 202 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 203 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 204 SWITZERLAND BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 205 SWITZERLAND STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 206 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 SWITZERLAND PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 SWITZERLAND PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 210 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 211 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 212 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 213 SWITZERLAND FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 214 SWITZERLAND BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 SWITZERLAND COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 216 SWITZERLAND DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 217 SWITZERLAND BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 218 SWITZERLAND RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 219 SWITZERLAND SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 220 SWITZERLAND CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 221 SWITZERLAND TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 222 SWITZERLAND HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 223 SWITZERLAND OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 224 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 225 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

TABLE 226 TURKEY BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 227 TURKEY STAND UP BAGS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 228 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 229 TURKEY PAPER IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 230 TURKEY PLASTIC IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 231 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2020-2029 (USD THOUSAND)

TABLE 232 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 233 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2020-2029 (USD THOUSAND)

TABLE 234 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 235 TURKEY FOOD PACKAGING IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPICATION, 2020-2029 (USD THOUSAND)

TABLE 236 TURKEY BAKERY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 237 TURKEY COOKED FOOD IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 238 TURKEY DIARY PRODUCTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 239 TURKEY BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 240 TURKEY RESTAURANTS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 241 TURKEY SWEETS & SNACKS STORES IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 242 TURKEY CAFETERIA IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 243 TURKEY TEA AND COFFEE SHOPS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 244 TURKEY HOTELS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 245 TURKEY OTHERS IN BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 246 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 247 REST OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2020-2029 (UNITS)

Lista de figuras

FIGURE 1 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 2 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE USAGE LIFE LINE CURVE

FIGURE 7 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SEGMENTATION

FIGURE 14 GROWING CONSUMER AWARENESS RELATED TO ECOFRIENDLY PACKAGING IS DRIVING THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET IN 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET

FIGURE 17 VOLUME OF PLASTIC POLYMERS USE IN THE EUROPEAN UNION (MILLION TONS), 2018

FIGURE 18 EUROPE BIOPLASTICS MARKET, BY TYPE (IN EUROPE), 2018

FIGURE 19 PRODUCTION CAPACITY OF BIOPLASTICS, BY MATERIAL TYPE, 2019

FIGURE 20 TYPES OF NATIONAL RESTRICTIONS OR BANS IN THE WORLD (%)

FIGURE 21 BANS ON SPECIFIC PRODUCTS (N) ASSOCIATED WITH FOOD SERVICE AND DELIVERY

FIGURE 22 PRODUCTION COST OF PLA, BY OPERATING EXPENDITURE (%)

FIGURE 23 FEEDSTOCK EFFICIENCY SCORE, 2016

FIGURE 24 LAND USE PER TON OF BIOBASED PLA, BIOBASED PE AND BIOETHANOL

FIGURE 25 PRODUCER PRICE INDEX BY INDUSTRY: PLASTICS MATERIAL AND RESINS MANUFACTURING

FIGURE 26 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PRODUCT, 2021

FIGURE 27 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING TYPE, 2021

FIGURE 28 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY USAGE, 2021

FIGURE 29 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 30 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY PACKAGING LAYER, 2021

FIGURE 31 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 32 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET, BY END-USER, 2021

FIGURE 33 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 38 EUROPE BIODEGRADABLE PAPER AND PLASTIC PACKAGING MARKET: COMPANY SHARE 2021(%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.