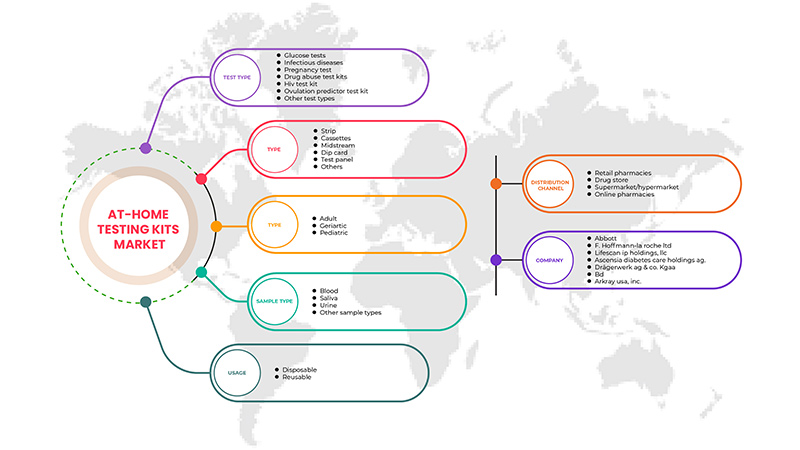

Mercado europeo de kits de prueba para el hogar, por tipo de prueba (prueba de embarazo, kit de prueba de VIH, diabetes, enfermedades infecciosas, pruebas de glucosa, kit de prueba de predicción de ovulación, kit de prueba de abuso de drogas y otros), tipo (casete, tira, midstream, panel de prueba, tarjeta de inmersión y otros), edad (pediátrica, adulta y geriátrica), tipo de muestra (orina, sangre, saliva y otros tipos de muestra), uso (desechable y reutilizable), canales de distribución (farmacias minoristas, droguerías, supermercados/hipermercados y farmacias en línea), tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas sobre los kits de prueba para el hogar en Europa

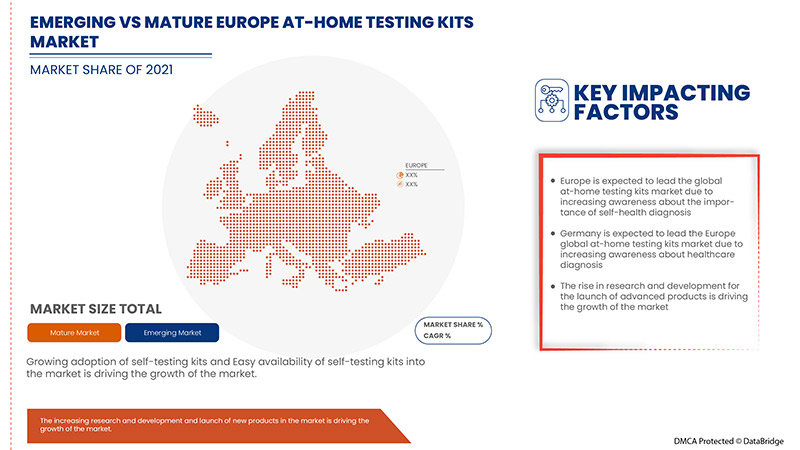

Se espera que el mercado europeo de kits de prueba para el hogar crezca, ya que antes la gente solía visitar los hospitales con frecuencia, incluso para problemas básicos, pero debido a la creciente conciencia sobre varios productos, este comportamiento ha cambiado y ha cambiado la tendencia. Los kits de prueba para el hogar o para el autodiagnóstico están fácilmente disponibles en las farmacias y se ha vuelto extremadamente fácil adquirirlos. Varias empresas médicas se están aventurando en este espacio, ya que fabrican rápidamente kits de prueba para el autodiagnóstico.

Esta amplia disponibilidad también se puede atribuir a las empresas de farmacias online que han empezado a lanzar productos médicos, que facilitan la disponibilidad con solo pulsar un botón. Además, estos kits de autodiagnóstico están disponibles sin receta médica, lo que puede impulsar fácilmente el mercado europeo de kits de prueba para el hogar. Los kits de prueba para el hogar permiten a los usuarios finales recoger su muestra en casa y luego realizar las pruebas en casa o enviar esa muestra al laboratorio para su análisis. Los kits de prueba para el hogar sin duda han facilitado el proceso de confirmación de la preocupación de la persona, ya sea una prueba de embarazo casera o de VIH, o cualquier otra prueba de enfermedades infecciosas.

Estos kits de prueba para el hogar son fáciles de usar y también asequibles. Sin embargo, siempre existe una duda sobre la precisión de los resultados que se ha convertido en una limitación para el mercado europeo de kits de prueba para el hogar. Sin embargo, un resultado falso positivo de una prueba puede causar ansiedad y estrés a la persona, incluso si no lo tiene. Es muy molesto y perturbador para la persona recibir resultados falsos positivos o negativos. Hoy en día, muchas empresas producen kits de prueba de diagnóstico rápido para COVID-19, que se pueden realizar en casa. Pero hay varios problemas relacionados con la precisión debido a los cuales se ha suspendido la distribución de esos kits de prueba para el hogar que se han verificado para su fiabilidad.

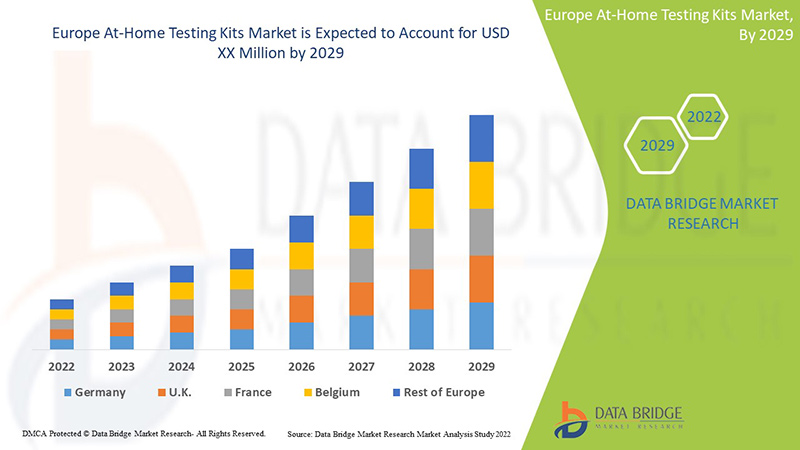

Data Bridge Market Research analiza que el mercado europeo de kits de prueba para el hogar crecerá a una CAGR del 5,9 % durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2019-2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de prueba (prueba de embarazo, kit de prueba de VIH, diabetes, enfermedades infecciosas , pruebas de glucosa, kit de prueba de predicción de ovulación, kit de prueba de abuso de drogas y otros), tipo (casete, tira, prueba de flujo medio, panel de prueba, tarjeta de inmersión y otros), edad (pediátrica, adulta y geriátrica), tipo de muestra (orina, sangre, saliva y otros tipos de muestras), uso (desechable y reutilizable), canales de distribución (farmacias minoristas, droguerías, supermercados/hipermercados y farmacias en línea) |

|

Países cubiertos |

Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Suiza, Rusia, Turquía, Bélgica y resto de Europa |

|

Actores del mercado cubiertos |

Abbott, Siemens Healthcare GmbH, F. Hoffmann-La Roche Ltd, BD, Drägerwerk AG & Co. KGaA, LifeScan IP Holdings, LLC, Ascensia Diabetes Care Holdings AG, Nectar Lifesciences Ltd. (Rapikit), ACON Laboratories, Inc., Quidel Corporation, ARKRAY USA, Inc., BTNX INC., Atomo Diagnostics, Eurofins Scientific, Piramal Enterprises Ltd., Bionime Corporation, Nova Biomedical, Cardinal Health, OraSure Technologies, Biolytical Laboratories Inc., Everlywell, Inc., SA Scientific Ltd., Clearblue (una subsidiaria de Swiss Precision Diagnostics GmbH), Biosynex, PRIMA Lab SA, MP BIOMEDICALS, Sterilab Services, Chembio Diagnostics, Inc., BioSure, Selfdiagnostics OU, entre otros. |

Definición del mercado europeo de kits de prueba para el hogar

Los kits de prueba para el hogar son instrumentos de prueba que ayudan a las personas a realizar pruebas en casa y les dan resultados rápidos en un minuto. También incluyen equipos de monitoreo de salud para verificar y controlar continuamente la salud del paciente diabético. Las pruebas para el hogar son muy convenientes para realizar con comodidad en el hogar y están disponibles a un precio muy asequible. Las pruebas de auto-prueba suelen ser las versiones avanzadas de los kits de prueba rápida en el punto de atención que fueron diseñados originalmente para profesionales de la salud y pueden ser realizados por una persona común. Sus procesos, empaques e instrucciones se han simplificado para guiar a la persona a través de los pasos para realizar una prueba. Hay varios kits de prueba para el hogar disponibles, incluidas pruebas de VIH, prueba de embarazo, diabetes, prueba de ovulación y enfermedades infecciosas como malaria, COVID-19 y otras. Para realizar estas pruebas rápidas en el hogar, se puede tomar sangre, orina y fluido oral como muestra.

Dinámica del mercado de kits de prueba para el hogar en Europa

Conductores

- Creciente adopción de kits de autodiagnóstico

Antes, la gente solía acudir a menudo a los hospitales, incluso para problemas básicos. Sin embargo, a medida que ha aumentado la conciencia sobre varios productos, este comportamiento ha cambiado y se ha convertido en una tendencia. Hoy en día, la gente prefiere hacerse las pruebas básicas con kits de prueba en casa antes de visitar a un médico.

Esto se ha vuelto aún más evidente debido a esta pandemia, ya que las personas están adoptando más kits de prueba de autoayuda debido a varias restricciones vigentes. Ha resultado ser una bendición disfrazada tanto para los hospitales como para los pacientes, ya que los hospitales ya están sobrecargados y pueden concentrarse completamente en los pacientes con COVID-19, y los pacientes pueden ahorrar grandes costos de visitas al médico y honorarios por medicamentos. Se ha vuelto muy conveniente para los consumidores, ya que pueden saber rápidamente los resultados de sus pruebas con solo un clic.

- Fácil disponibilidad de kits de autodiagnóstico en farmacias

Los kits de autodiagnóstico o para realizar en casa están disponibles en las farmacias y se han vuelto muy fáciles de conseguir. Varias empresas médicas se están aventurando en este espacio, ya que fabrican rápidamente kits de autodiagnóstico.

Esta amplia disponibilidad también se puede atribuir a las empresas emergentes de farmacias en línea, que facilitan la disponibilidad con solo hacer clic en un botón. Además, estos kits de autodiagnóstico están disponibles sin receta médica.

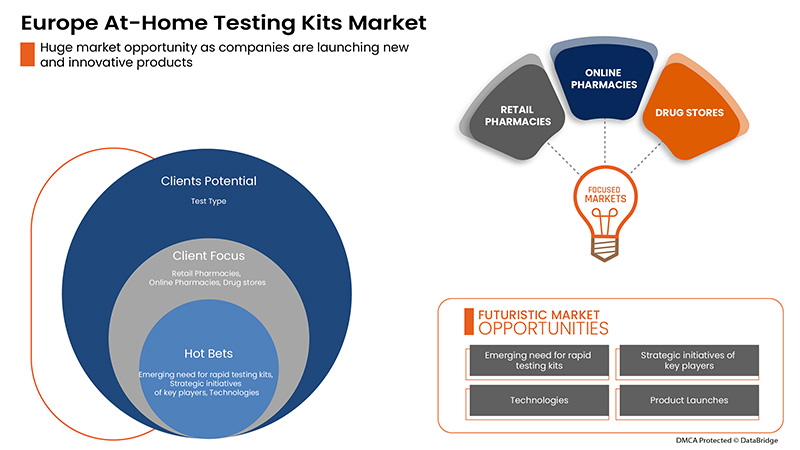

Oportunidad

- Advenimiento de tecnologías avanzadas

Las últimas tecnologías son fundamentales para que los productos médicos sean muy avanzados y fiables. En diferentes dispositivos médicos, la inteligencia artificial (IA) y el aprendizaje automático (ML) son aspectos importantes del sector de la atención sanitaria, ya que tienen la capacidad de mejorar la seguridad de los pacientes y los procesos administrativos mediante la automatización del trabajo y un rendimiento más rápido.

Es seguro que, por defecto, los instrumentos de diagnóstico basados en IA seguirán desarrollándose. La IA solo ha dado pasos modestos hacia una oportunidad enorme y multidimensional en el sector de la atención sanitaria.

Restricción/Desafío

- Inexactitud de los resultados de los kits de autodiagnóstico

Los kits de prueba para el hogar permiten a los usuarios finales recolectar su muestra en casa y realizar las pruebas en casa o enviar esa muestra al laboratorio para su análisis. Los kits de prueba para el hogar sin duda han facilitado el proceso de confirmar la preocupación de la persona, ya sea una prueba de embarazo casera, una prueba de VIH o cualquier otra prueba de enfermedades infecciosas.

Estos kits de prueba para el hogar son fáciles de usar y también asequibles. Sin embargo, siempre existe la duda sobre la precisión de los resultados. El seguimiento de la COVID-19 en el hogar puede ser más cómodo que ir a un hospital o al consultorio médico. También ayudará a reducir el riesgo de propagación o contagio del coronavirus cuando se realice la prueba.

Sin embargo, un resultado falso positivo en una prueba puede causar ansiedad y estrés a la persona, incluso si no la tiene. Es muy molesto y perturbador para la persona recibir resultados falsos positivos o negativos. Hoy en día, muchas empresas producen kits de prueba de diagnóstico rápido para COVID-19 que se pueden realizar en casa, pero existen varios problemas relacionados con la precisión debido a los cuales se ha suspendido la distribución de esos kits de prueba para el hogar para verificar su confiabilidad.

Impacto de la COVID-19 en el mercado europeo de kits de prueba para el hogar

La COVID-19 ha tenido un gran impacto en el mercado europeo de kits de pruebas para el hogar. El mercado de los kits de pruebas para el hogar se está expandiendo como consecuencia de la creciente popularidad de los kits de pruebas de autoayuda y de bricolaje (DIY) debido a su conveniencia y resultados rápidos. Los consumidores están preocupados por la confiabilidad de los kits de pruebas rápidas para el hogar, lo que podría impedir la expansión del mercado de los kits de pruebas para el hogar. Las empresas necesitan urgentemente kits de pruebas rápidas para la COVID-19 para reducir las muertes de pacientes y aumentar las tasas de recuperación de los pacientes, así como para aumentar la tasa del mercado de kits de pruebas para el hogar para pacientes diabéticos y pacientes con problemas cardíacos. Esto está creando una importante oportunidad de mercado para los kits de pruebas para el hogar.

Desarrollo reciente

- En abril de 2022, Ascensia Diabetes Care, una empresa global de atención a la diabetes, anuncia que ha lanzado el sistema de monitorización continua de glucosa (MCG) Eversense E3 de próxima generación para pacientes en EE. UU., junto con el nuevo programa de ahorro Eversense PASS. Eversense E3, desarrollado por Senseonics Holdings, Inc., fue aprobado para su uso hasta por 6 meses por la Administración de Alimentos y Medicamentos de EE. UU. (FDA) a principios de este año, lo que lo convierte en el sensor CGM de mayor duración disponible en EE. UU. Esto ha ayudado a la empresa a ampliar su cartera de productos en el mercado.

Alcance del mercado de kits de prueba para el hogar en Europa

El mercado europeo de kits de prueba para el hogar se clasifica en seis segmentos notables según el tipo de prueba, el tipo, la edad, el tipo de muestra, el uso y los canales de distribución. El crecimiento entre estos segmentos lo ayudará a analizar los segmentos de crecimiento del mercado en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Tipo de prueba

- Prueba de embarazo

- Kit de prueba del VIH

- Diabetes

- Enfermedades infecciosas

- Pruebas de glucosa

- Kit de prueba de predicción de la ovulación

- Kit de prueba de abuso de drogas

- Otros

Según el tipo de prueba, el mercado europeo de kits de prueba para el hogar está segmentado en prueba de embarazo, kit de prueba de VIH, diabetes, enfermedades infecciosas, pruebas de glucosa, kit de prueba de predicción de ovulación, kit de prueba de abuso de drogas y otros.

Tipo

- Casete

- Banda

- Centro de la corriente

- Panel de prueba

- Tarjeta de inmersión

- Otros

Según el tipo, el mercado europeo de kits de prueba para el hogar está segmentado en casete, tira, prueba intermedia, panel de prueba, tarjeta de inmersión y otros.

Edad

- Pediátrico

- Adulto

- Geriátrico

Según la edad, el mercado europeo de kits de prueba para el hogar está segmentado en pediátrico, adulto y geriátrico.

Tipo de muestra

- Orina

- Sangre

- Saliva

- Otros

Según el tipo de muestra, el mercado europeo de kits de prueba para el hogar está segmentado en orina, sangre, saliva y otros.

Uso

- Desechable

- Reutilizable

Según el uso, el mercado europeo de kits de prueba para el hogar está segmentado en desechables y reutilizables.

Canales de distribución

- Farmacias minoristas

- Farmacia

- Supermercado/Hipermercado

- Farmacias en línea

Según los canales de distribución, el mercado europeo de kits de prueba para el hogar está segmentado en farmacias minoristas, droguerías, supermercados/hipermercados y farmacias en línea.

Análisis y perspectivas regionales del mercado de kits de prueba para el hogar en Europa

Europe at-home testing kits market is analyzed and market size insights and trends are provided based on test type, type, age, sample type, usage, and distribution channels.

The regions covered in the Europe at-home testing kits market report are Germany, U.K., France, Italy, Spain, Netherlands, Switzerland, Russia, Turkey, Belgium and Rest of Europe.

Germany dominates the Europe at-home testing kits market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the country's high healthcare expenditure and the increasing awareness about the Europe at-home testing kits market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe At-Home Testing Kits Market Share Analysis

Europe at-home testing kits market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Europe at-home testing kits market.

Some of the major players operating in the Europe at-home testing kits market are Abbott, ACON Laboratories, Inc., Rapikit, BD, Cardinal Health, B. Braun Melsungen AG, Piramal Enterprises Ltd., Siemens Healthcare GmbH, Quidel Corporation, Bionime Corporation, SA Scientific, ARKRAY USA, Inc., Nova Biomedical, AdvaCare Pharma, AccuBioTech Co., Ltd., Atlas Medical UK, TaiDoc Technology Corporation, Drägerwerk AG & Co. KGaA, F. Hoffmann-La Roche Ltd, Sensing Self, PTE. Ltd, Atomo Diagnostics, RUNBIO BIOTECH CO.,LTD., Mylan N.V. (a subsidiary of Viatris, Inc.), MP BIOMEDICALS, VedaLab, Shanghai Chemtron Biotech Co.Ltd., and Ascensia Diabetes Care Holdings AG among other domestic players.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of EUROPE At-Home Testing Kits MARKET

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- test type LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Increasing health consciousness and awareness amongst customers

- Growing adoption of self-testing kits

- Easy availability of self-testing kit at pharmacies

- Ease to use and low costs of rapid self-test kits

- Increase in awareness about importance of HIV diagnosis

- RESTRAINTS

- Inaccuracy of results by self-testing kits

- Stringent government regulations for manufacturing and distribution of testing kits

- OPPoRTUNITIES

- Advent of advanced technologies

- Emerging need of rapid testing kits for COVID-19 pandemic

- Rise in the adaption of self-testing kits

- increase in Strategic decision amongst companies

- cHALLENGES

- High competition in medical technology industry

- reduction in research & development budgets

- COVID-19 IMPACT ON EUROPE AT-HOME TESTING KITS MARKET

- AFTERMATH OF THE NETWORK INDUSTRY AND GOVERNMENT ROLE

- STRATEGIC DECISIONS FOR market players AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON DEMAND & supply chain

- CONCLUSION

- Europe at-home testing kits market, BY test type

- overview

- Glucose Tests

- Infectious Diseases

- Drug Abuse Test Kits

- Pregnancy Test

- HIV Test Kit

- Ovulation Predictor Test Kit

- Others

- Europe at-home testing kits market, BY type

- overview

- Cassettes

- Retail Pharmacies

- Online Pharmacies

- Drug Store

- Supermarket/Hypermarket

- Strip

- Retail Pharmacies

- Online Pharmacies

- Drug Store

- Supermarket/Hypermarket

- Midstream

- Retail Pharmacies

- Online Pharmacies

- Drug Store

- Supermarket/Hypermarket

- Dip Card

- Retail Pharmacies

- Online Pharmacies

- Drug Store

- Supermarket/Hypermarket

- Test Panel

- Retail Pharmacies

- Online Pharmacies

- Drug Store

- Supermarket/Hypermarket

- Others

- Europe at-home testing kits market, BY age

- overview

- Adult

- Geriatric

- Pediatric

- Europe at-home testing kits market, BY Sample Type

- overview

- Urine

- Blood

- Saliva

- Others

- Europe at-home testing kits market, BY Usage

- overview

- Disposable

- Reusable

- Europe at-home testing kits market, BY Distribution Channels

- overview

- Retail Pharmacies

- Online Pharmacies

- Drug Store

- Supermarket/Hypermarket

- Europe At-Home Testing Kits Market, by geography

- EUROPE

- Germany

- U.K.

- France

- Italy

- Spain

- The Netherlands

- Switzerland

- Russia

- Turkey & ireland

- Belgium

- Rest of Europe

- Europe At-Home Testing Kits Market: COMPANY landscape

- company share analysis: Europe

- swot analysis

- company profile

- abbott

- COMPANY snapshot

- revenue analysis

- company share analysis

- product PORTFOLIO

- recent DEVELOPMENT

- Ascensia Diabetes Care Holdings AG

- COMPANY snapshot

- company share analysis

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- bd

- COMPANY snapshot

- REVENUE ANALYSIS

- company share analysis

- product PORTFOLIO

- recent DEVELOPMENTS

- F. hoffmann-la roche ltd

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- b. braun melsungen ag

- COMPANY snapshot

- company share analysis

- product PORTFOLIO

- recent DEVELOPMENT

- Drägerwerk AG & Co. KGaA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AccuBiotech co., ltd.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Acon laboratories, inc.

- COMPANY snapshot

- product PORTFOLIO

- recent DEVELOPMENTS

- advacare pharma

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ARKRAY USA, Inc.

- COMPANY snapshot

- product PORTFOLIO

- recent DEVELOPMENTS

- atlas medical UK

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Atomo diagnostics

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- biolytical laboratories inc.

- COMPANY snapshot

- Product PORTFOLIO

- recent DEVELOPMENTS

- bionime corporation

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENT

- Biosure UK

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Biosynex

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BTNX inc.

- COMPANY snapshot

- Product PORTFOLIO

- recent DEVELOPMENT

- cardinal health

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENT

- chembio diagnostics, inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Clearblue (A Subsidiary of Clear Blue Technologies Inc.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Eurofins Viracor, Inc. (a subsidiary of EUROFINS SCIENTIFIC)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Everlywell, inc.

- COMPANY snapshot

- product PORTFOLIO

- recent DEVELOPMENTS

- lifescan ip holdings, llc

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- MP BIOMEDICALS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- MYLAN N.V. (A SUBSIDIARY OF VIATRIS INC.)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- NOVa biomedical

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Orasure technologies, inc.

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENTS

- Piramal enterprises ltd.

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENTS

- prima lab sa

- COMPANY snapshot

- product PORTFOLIO

- recent DEVELOPMENT

- quidel corporation

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENTS

- rapikit

- COMPANY snapshot

- revenue analysis

- product PORTFOLIo

- recent DEVELOPMENT

- RUNBIO BIOTECH CO.,LTD.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SA scientific

- COMPANY snapshot

- product PORTFOLIO

- recent DEVELOPMENT

- SelfDiagnostics

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Sensing self, pte. ltd

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Shanghai Chemtron Biotech Co.Ltd.

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- siemens healthcare gmbh

- COMPANY snapshot

- REVENUE ANALYSIS

- product PORTFOLIO

- recent DEVELOPMENT

- STERILAB SERVICES

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- taidoc technology corporation

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- vedalab

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENT

- questionnaire

- related reports

Lista de Tablas

TABLE 1 Europe At-Home Testing Kits Market, By Test Type, 2019-2028 (USD Million)

TABLE 2 Europe Glucose Tests in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 3 Europe Infectious Diseases in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 4 Europe Drug Abuse Test Kits in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 5 Europe Pregnancy Test in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 6 Europe HIV Test Kit in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 7 Europe Ovulation Predictor Test Kit in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 8 Europe Others in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 9 Europe At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 10 Europe Cassettes in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 11 Europe Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 12 Europe Strip in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 13 Europe Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 14 Europe Midstreamin At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 15 Europe Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 16 Europe Dip Card in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 17 Europe Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 18 Europe Test Panel in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 19 Europe Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 20 Europe Other in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 21 Europe At-Home Testing Kits Market, By age, 2019-2028 (USD Million)

TABLE 22 Europe Adult in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 23 Europe Geriatric in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 24 Europe Pediatric in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 25 Europe At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 26 Europe Urine in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 27 Europe Blood in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 28 Europe Saliva in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 29 Europe Others in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 30 Europe At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 31 Europe Disposable in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 32 Europe Reusable in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 33 Europe At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 34 Europe Retail Pharmacies in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 35 Europe Online Pharmacies in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 36 Europe Drug Store in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 37 Europe Supermarket/Hypermarket in At-Home Testing Kits Market, By Region,2019-2028, (USD Million)

TABLE 38 Europe At-Home Testing Kits Market, By Country, 2019-2028 (USD Million)

TABLE 39 Europe At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 40 Europe At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 41 Europe Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 42 Europe Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 43 Europe Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 44 Europe Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 45 Europe Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 46 Europe At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 47 Europe At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 48 Europe At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 49 Europe At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 50 Germany At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 51 Germany At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 52 Germany Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 53 Germany Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 54 Germany Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 55 Germany Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 56 Germany Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 57 Germany At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 58 Germany At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 59 Germany At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 60 Germany At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 61 U.K. At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 62 U.K. At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 63 U.K. Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 64 U.K. Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 65 U.K. Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 66 U.K. Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 67 U.K. Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 68 U.K. At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 69 U.K. At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 70 U.K. At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 71 U.K. At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 72 France At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 73 France At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 74 France Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 75 France Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 76 france Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 77 France Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 78 France Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 79 France At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 80 France At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 81 France At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 82 France At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 83 Italy At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 84 Italy At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 85 Italy Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 86 Italy Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 87 Italy Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 88 Italy Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 89 Italy Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 90 Italy At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 91 Italy At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 92 Italy At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 93 Italy At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 94 Spain At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 95 Spain At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 96 Spain Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 97 Spain Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 98 Spain Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 99 Spain Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 100 Spain Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 101 Spain At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 102 Spain At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 103 Spain At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 104 Spain At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 105 The Netherlands At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 106 The Netherlands At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 107 The Netherlands Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 108 The Netherlands Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 109 The Netherlands Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 110 The Netherlands Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 111 The Netherlands Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 112 The Netherlands At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 113 The Netherlands At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 114 The Netherlands At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 115 The Netherlands At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 116 Switzerland At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 117 Switzerland At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 118 Switzerland Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 119 Switzerland Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 120 Switzerland Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 121 Switzerland Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 122 Switzerland Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 123 Switzerland At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 124 Switzerland At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 125 Switzerland At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 126 Switzerland At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 127 Russia At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 128 Russia At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 129 Russia Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 130 Russia Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 131 Russia Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 132 Russia Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 133 Russia Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 134 Russia At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 135 Russia At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 136 Russia At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 137 Russia At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 138 Turkey & Ireland At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 139 turkey & Ireland At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 140 Turkey & Ireland Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 141 Turkey & Ireland Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 142 Turkey & Ireland Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 143 Turkey & Ireland Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 144 Turkey & Ireland Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 145 Turkey & Ireland At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 146 Turkey & Ireland At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 147 Turkey & Ireland At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 148 Turkey & Ireland At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 149 Belgium At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

TABLE 150 Belgium At-Home Testing Kits Market, By Type, 2019-2028 (USD Million)

TABLE 151 Belgium Cassettes in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 152 Belgium Strip in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 153 Belgium Midstream in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 154 Belgium Dip Card in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 155 Belgium Test Panel in At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 156 Belgium At-Home Testing Kits Market, By Age, 2019-2028 (USD Million)

TABLE 157 Belgium At-Home Testing Kits Market, By Sample Type, 2019-2028 (USD Million)

TABLE 158 Belgium At-Home Testing Kits Market, By Usage, 2019-2028 (USD Million)

TABLE 159 Belgium At-Home Testing Kits Market, By Distribution Channels, 2019-2028 (USD Million)

TABLE 160 Rest of Europe At-Home Testing Kits Market, By test Type, 2019-2028 (USD Million)

Lista de figuras

FIGURE 1 Europe At-Home Testing Kits market: segmentation

FIGURE 2 EUROPE At-Home Testing Kits MARKET: data triangulation

FIGURE 3 Europe At-Home Testing Kits market: DROC ANALYSIS

FIGURE 4 Europe At-Home Testing Kits market: Europe vs regional MARKET ANALYSIS

FIGURE 5 EUROPE At-Home Testing Kits MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE At-Home Testing Kits MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe At-Home Testing Kits market: DBMR MARKET POSITION GRID

FIGURE 8 Europe At-Home Testing Kits market: VENDOR SHARE ANALYSIS

FIGURE 9 Europe At-Home Testing Kits market: SEGMENTATION

FIGURE 10 Growing Adoption of self-testing kits is expected to DRIVe Europe At-Home Testing Kits MARKET IN THE FORECAST PERIOD of 2021 to 2028

FIGURE 11 glucose tests segment is expected to account for the largest share of Europe At-Home Testing Kits market in 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE AT-HOME TESTING KITS MARKET

FIGURE 13 Europe at-home testing kits MARKET: BY test type, 2020

FIGURE 14 Europe at-home testing kits MARKET: BY type, 2020

FIGURE 15 Europe at-home testing kits MARKET: BY age, 2020

FIGURE 16 Europe at-home testing kits MARKET: BY Sample Type, 2020

FIGURE 17 Europe at-home testing kits MARKET: BY Usage, 2020

FIGURE 18 Europe at-home testing kits MARKET: BY Distribution Channels, 2020

FIGURE 19 EUROPE At-Home Testing Kits MARKET: SNAPSHOT (2020)

FIGURE 20 EUROPE At-Home Testing Kits MARKET: by Country (2020)

FIGURE 21 EUROPE At-Home Testing Kits MARKET: by Country (2021 & 2028)

FIGURE 22 EUROPE At-Home Testing Kits MARKET: by Country (2020 & 2028)

FIGURE 23 EUROPE At-Home Testing Kits MARKET: by test Type (2021-2028)

FIGURE 24 Europe at-home testing kits market: company share 2020 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.